January 2026

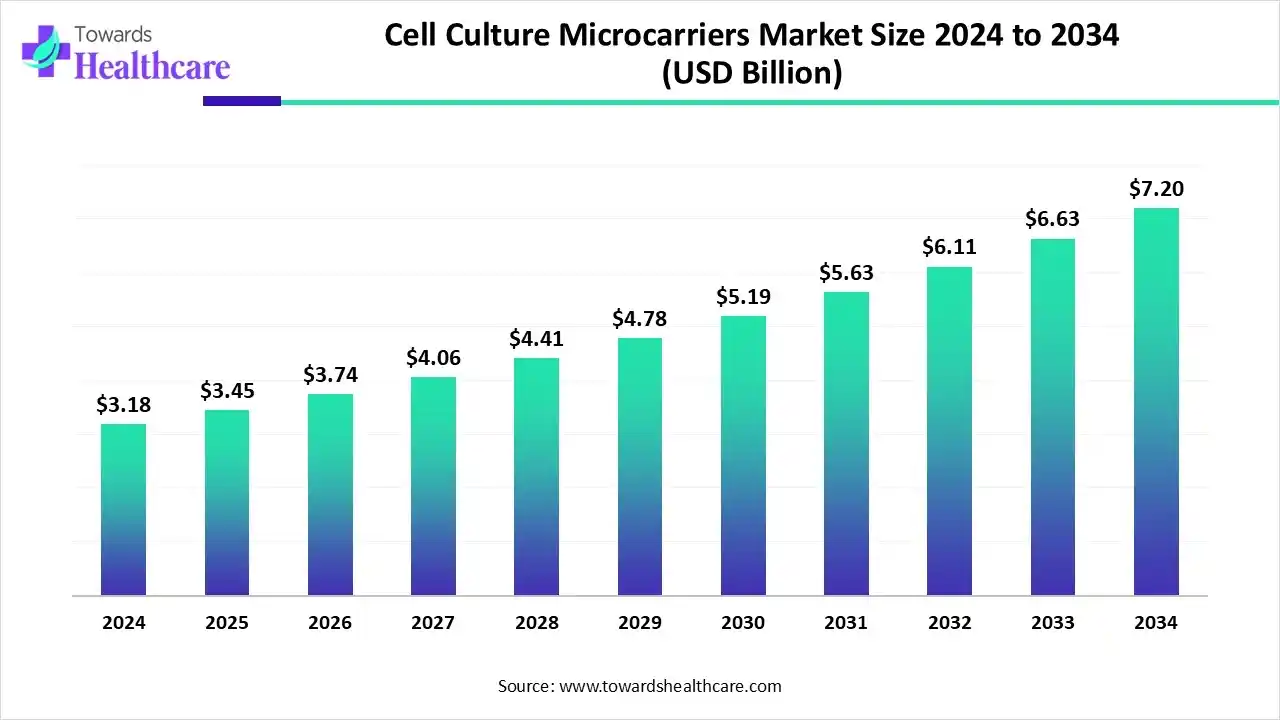

The global cell culture microcarriers market size is calculated at USD 3.18 billion in 2024, grew to USD 3.45 billion in 2025, and is projected to reach around USD 7.2 billion by 2034. The market is expanding at a CAGR of 8.54% between 2025 and 2034.

The cell culture microcarriers market is primarily driven by the increasing development of personalized medicines and the growing use of single-use technology. The rising prevalence of chronic disorders necessitates researchers to develop precision medicines on a large scale. Cell culture microcarriers facilitate the large-scale production of cell culture. Artificial intelligence (AI) automates and monitors the manufacturing process, enabling manufacturers to modify vital parameters.

| Table | Scope |

| Market Size in 2025 | USD 3.45 Billion |

| Projected Market Size in 2034 | USD 7.2 Billion |

| CAGR (2025 - 2034) | 8.54% |

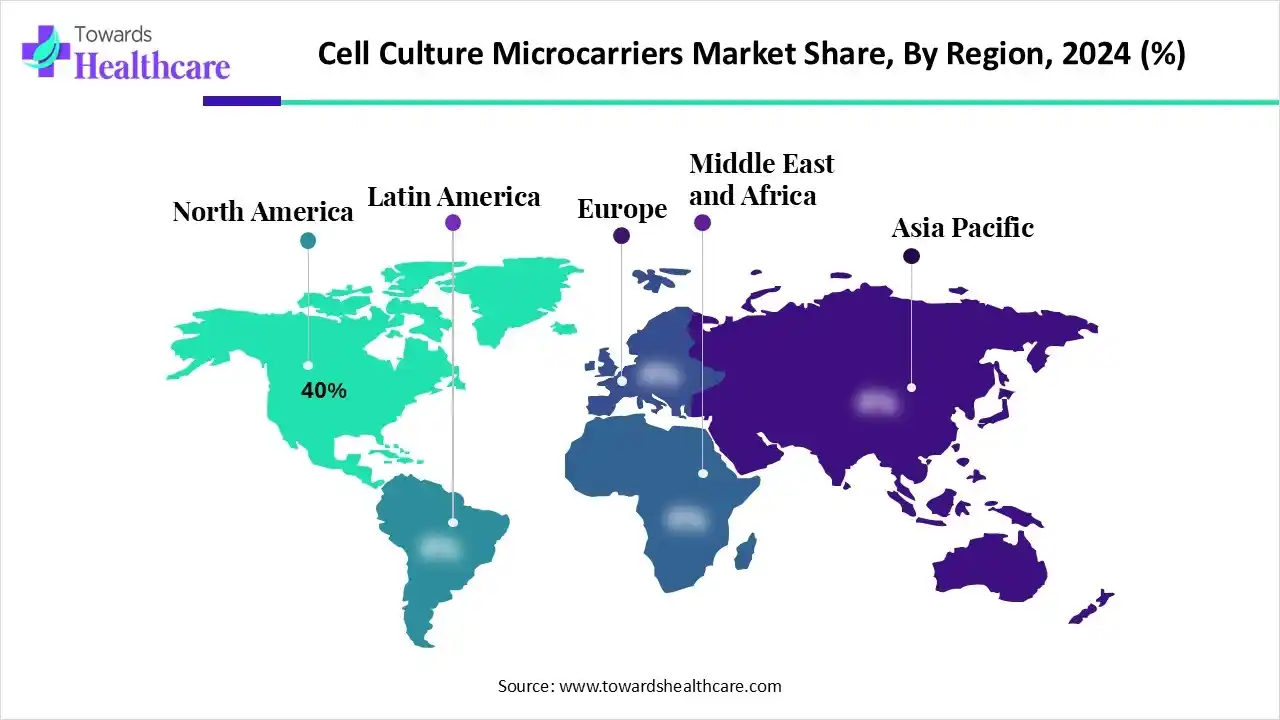

| Leading Region | North America by 40% |

| Market Segmentation | By Product, By Cell Type, By Application, By Technology, By End-User, By Region |

| Top Key Players | Rousselot, Inc., Twist Bioscience, Sartorius AG, Kuraray Co., Ltd., Esco VacciXcell, Ritai Bioreactor, Cytocarrier Systems (CCS) Ltd., Merck KGaA, 3D Biotek |

The cell culture microcarriers market is experiencing robust growth, driven by the rising prevalence of chronic disorders, the growing demand for biopharmaceuticals, and advancements in stem cell research. It encompasses small beads or particles that support the growth of adherent cells in bioreactors and other cell culture systems. They provide a high surface area for cell attachment, enabling scalable cell expansion for applications in regenerative medicine, vaccines, biopharmaceutical production, and research.

AI improves the market by enabling researchers to develop biodegradable microcarriers for cell culture. It automates the cell culture process, providing complete control over feeding and passaging schedules. It saves a lot of time and cost for researchers. AI and machine learning (ML) algorithms can analyze vast amounts of data and maximize productivity for growing and scaling stem cells. They can also suggest the type of microcarriers for cell culture based on research requirements.

By product, the synthetic microcarriers segment held a dominant presence in the market with a share of 50% in 2024, due to the ability to modify the desired properties of microcarriers. Polymer-based microcarriers, such as polystyrene and polyurethane, provide the desired strength to the cell culture medium. They are biodegradable in nature and allow cell adhesion over a large surface area. They are also used as cellularized building blocks for bottom-up tissue engineering scaffolds and as cell carriers in cell therapy applications.

By product, the functionalized/coated microcarriers segment is expected to grow at the fastest CAGR of 10.0% in the market during the forecast period. Functionalized microcarriers, such as ECM-coated and peptide-coated, improve cell attachment, growth, and differentiation. They allow for higher cell yields and the generation of robust cultures. Coated microcarriers retain the standard benefits of existing microcarrier technology, including scalability, consistency in size, and the ability to culture stem cells.

By cell type, the stem cells segment held the largest revenue share of 45% in the market in 2024, due to the growing demand for stem cell-based therapeutics and the ability of stem cells to replicate into different specialized cell types. Stem cell culture refers to the process of culturing stem cells derived from living organisms in a controlled environment. They can be derived from the umbilical cord or the embryo.

By cell type, the mammalian cells segment is expected to grow with the highest CAGR of 8.5% in the market during the studied years. Mammalian cell culture is the process of growing cells obtained from mammals. Mammalian cells can be derived from endoderm, ectoderm, and mesoderm. They are widely preferred due to their widespread applications, such as antibodies, viral vaccines, synthetic hormones, and enzymes.

By application, the regenerative medicine segment contributed the biggest revenue share of 40% in the market in 2024, due to the increasing demand for personalized medicines and the need to cure from its root cause. Regenerative medicines, such as stem cells, gene therapy, and tissue engineering products, repair, rejuvenate, and replace damaged body parts that cause a disease. They provide targeted treatment and boost the healing power of a degenerative disease. As of July 2025, the U.S. Food and Drug Administration (FDA) approved a total of 43 cell and gene therapy products.

By application, the vaccine production segment is expected to expand rapidly in the market with a CAGR of 9.0% in the coming years. Vaccines derived from cell culture methods result in high purity, reduced contamination, and suitability for large-scale production. Different cell types used for vaccine production include primary cells, diploid cell lines, continuous cell lines, and stem cells. Moreover, the cell culture-based method is cost-effective and suitable for large-scale production. Microcarriers can be used for large-scale cell culture, and tiny particles can be used as delivery systems for vaccines.

By technology, the microcarrier suspension culture segment led the market with a share of 60% in 2024, due to its superior advantages compared to fixed-bed cell culture. Suspension cells grow free-floating as single cells or as multicell clumps or clusters. They can be grown in culture bags on a rocking-motion bioreactor platform. Suspension culture requires a careful balance between sufficient agitation to provide media aeration and prevent culture settling, and minimizing the shear stress on cells.

By technology, the fixed-bed/scaffold-based culture segment is expected to witness the fastest CAGR of 8.0% in the market over the forecast period. Fixed-bed cell culture requires physical attachment to a substrate or extracellular matrix (ECM) for proliferation and survival. Adherent platforms enable visualization of cells to monitor cultures. They provide a more natural environment as they can recapitulate cell-cell and cell-matrix interactions. They are in demand, especially in applications requiring closely controlled cell physiology and function.

By end-user, the biopharmaceutical companies segment accounted for the highest revenue share of 45% in the market in 2024, due to the availability of favorable infrastructure and the presence of skilled professionals. Biopharma companies face competition from different companies, encouraging them to develop innovative therapeutics. They expand their product pipeline, strengthening their market position. They receive funding from the government or private organizations, enabling them to adopt advanced technologies.

By end-user, the contract manufacturing organizations (CMOs) segment is expected to show the fastest CAGR of 9.0% over the forecast period. The increasing number of startups potentiates the need for CMOs. Biopharma startups lack suitable infrastructure, necessitating them to collaborate with CMOs. CMOs provide access to advanced technologies and possess skilled professionals to provide relevant expertise. Large companies also collaborate with CMOs as they focus on multiple projects simultaneously.

North America dominated the global market with a share of 40% in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and the rising adoption of advanced technologies are the major growth factors of the market in North America. The growing demand for personalized medicines and favorable regulatory policies contribute to market growth. The increasing R&D investment and collaboration among key players foster the development of biotech products.

Key players, such as Thermo Fisher Scientific, Cytiva Life Sciences, and Corning, Inc., are the major contributors to the market in the U.S. The U.S. FDA had approved 16 new personalized medicines in 2023, and about 18 in 2024. This rising trend of new product approvals drives the market. Biopharma companies have doubled their R&D investment in personalized medicines. For instance, in July 2025, AstraZeneca announced $50 billion in the U.S. by 2030.

Asia-Pacific is expected to grow at the fastest CAGR of 9.5% in the market during the forecast period. The rapidly expanding biopharmaceutical sector and the presence of robust biotech manufacturing facilities augment the market. Government organizations launch initiatives and provide funding to support the indigenous manufacturing of biotech products. This enables foreign companies to set up their manufacturing facilities in the Asia-Pacific countries.

In July 2025, CytoNiche Biotech launched its 3D FloTrix Experience Hub in Singapore, marking a pivotal step in the company’s international expansion and showcasing the core technology. The company offers a 3D FloTrix platform, which is an automated, scalable 3D cell production system built on GMP-grade dissolvable microcarriers. The Health Sciences Authority (HSA) regulates the approval of cell, tissue, and gene therapy products in Singapore.

The Middle East & Africa are expected to grow at a considerable CAGR of 9.0% in the cell culture microcarriers market in the upcoming period. Government bodies are constantly making efforts to expand their manufacturing infrastructure, promoting the development of personalized medicines. The rising prevalence of chronic disorders and rapidly changing demographics propel the market. Global companies set up their facilities in MEA to serve a larger patient population. The increasing focus on R&D in the region and the presence of some local players facilitate market growth.

Non-communicable diseases (NCDs) pose a major public and economic burden on people, accounting for 152,854 deaths caused by 9 NCDs. The Saudi Arabian government’s Breakthrough Medicines Program aims to bring advanced therapeutics to a region where the prevalence of genetic disorders is significantly higher than in the West. Middle East countries are eager to move into the cell and gene therapy space to fulfill unmet patient needs.

By Product

By Cell Type

By Application

By Technology

By End-User

By Region

January 2026

January 2026

January 2026

January 2026