December 2025

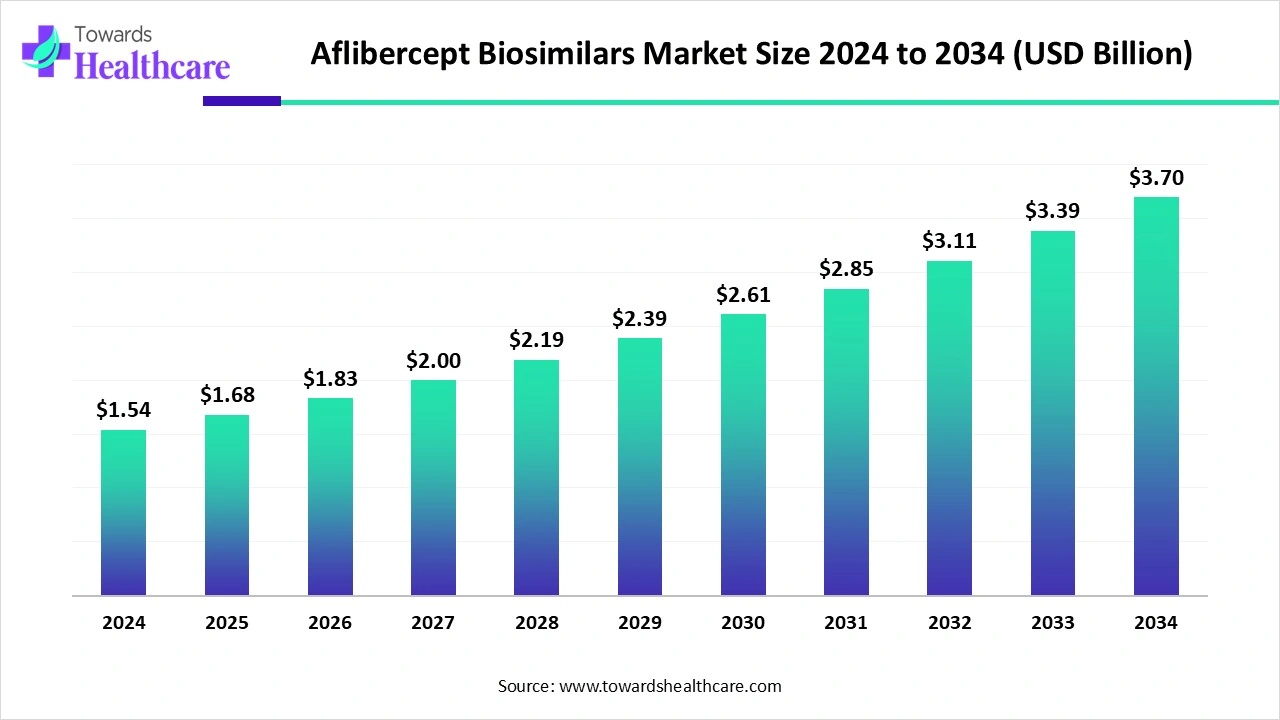

The global aflibercept biosimilars market size stood at US$ 1.54 billion in 2024, grew to US$ 1.68 billion in 2025, and is forecast to reach US$ 3.7 billion by 2034, expanding at a CAGR of 9.14% from 2025 to 2034.

The aflibercept biosimilars market is witnessing strong momentum, with Europe emerging as the dominant region due to its supportive regulatory framework, cost-driven healthcare systems, and established biosimilar adoption culture. The European Medicines Agency has approved multiple aflibercept biosimilars, creating a competitive environment that accelerates market penetration. National health systems, relying on tender-based procurement, encourage rapid uptake of cost-effective alternatives, while clinicians and payers show high confidence given long experience with biosimilars in Europe. Rising prevalence of retinal disorders, particularly age-related macular degeneration and diabetic macular edema, alongside an aging population, further fuels demand. Collectively, these factors solidify the leadership of Europe.

| Table | Scope |

| Market Size in 2025 | USD 1.68 Billion |

| Projected Market Size in 2034 | USD 3.7 Billion |

| CAGR (2025 - 2034) | 9.14% |

| Leading Region | Europe |

| Market Segmentation | By Development Type, By Therapeutic Indication, By Route of Administration, By End-User, By Distribution Channel, By Region |

| Top Key Players | Formycon/Klinge Biopharma, Samsung Bioepis, Amgen, Alteogen, Sandoz, Biogen, Teva Pharmaceuticals, Pfizer, Novartis, Roche, Bayer, Mylan / Viatris, Celltrion, STADA, Fresenius Kabi, Biocon, Apotex, Lupin, Cipla |

The aflibercept biosimilars market refers to the segment of biologics focused on developing and commercializing biosimilar versions of aflibercept, a recombinant fusion protein that inhibits vascular endothelial growth factor (VEGF) and placental growth factor (PlGF). The reference product, widely used under the brand name Eylea, is a standard treatment for retinal vascular disorders such as age-related macular degeneration (AMD), diabetic macular edema (DME), diabetic retinopathy (DR), and retinal vein occlusion (RVO)

Biosimilars of aflibercept are designed to provide clinically equivalent safety, efficacy, and quality at lower costs, addressing the high treatment burden and improving patient access to advanced ophthalmic care. The market encompasses multiple stages of development—from preclinical and clinical trials through regulatory approval and commercialization—and spans regions where patent expiry of the originator has created opportunities for entry. As healthcare systems and pa yers push for affordable biologic alternatives, aflibercept biosimilars are gaining strategic importance, particularly in ophthalmology practices, hospitals, and specialty clinics.

In July 2025, A SAMSUNG BIOEPIS agreement (DCA) for licensing, development, and commercialization was signed by Samsung Bioepis and Harrow. The deal will give Harrow the sole U.S. commercial rights to the ophthalmology biosimilar portfolio of Samsung, including aflibercept-yszy 0.05 mL injection (OPUVIZ), an FDA-approved biosimilar referencing EYLEA (aflibercept), and HARROW Bioepis-_ranibizumab-nuna 0.05 mL injection (BYOOVIZ), an FDA-approved biosimilar referencing LUCENTIS (ranibizumab).

In May 2025, while two other companies extend their biosimilar partnership to include additional products, the FDA designates two biosimilars as interchangeable, improving access to treatments for multiple sclerosis and inflammatory diseases. Alvotech and Advanz Pharma have extended their European biosimilar collaboration to include new candidates aiming at high-value markets since the FDA granted interchangeable status to two biosimilar biologicals.

AI integration can significantly improve the market by enhancing efficiency, accessibility, and adoption across the value chain. In drug development and manufacturing, AI can optimize formulation, predict stability, and streamline quality control, reducing costs and time to market. In regulatory and clinical phases, AI-driven analytics can accelerate trial design, identify suitable patient cohorts, and generate real-world evidence to demonstrate biosimilar equivalence.

For market access and adoption, AI tools can help payers and providers forecast demand, manage supply chains, and support pricing strategies. Clinically, AI-assisted diagnostic platforms can detect retinal diseases earlier and guide personalized treatment regimens, boosting confidence in biosimilar use. Together, these advances improve affordability, patient outcomes, and market penetration for aflibercept biosimilars.

Rise in Prevalence of Retinal Disorders

The rise in the prevalence of retinal disorders is a major driver for the growth of the aflibercept biosimilars market. Conditions such as age-related macular degeneration, diabetic macular edema, and retinal vein occlusion are increasing globally due to aging populations and the growing burden of diabetes. These diseases often require long-term, frequent intravitreal injections with anti-VEGF therapies like aflibercept, creating substantial treatment costs for healthcare systems and patients. As demand for affordable yet equally effective therapies grows, biosimilars provide a cost-saving alternative without compromising efficacy or safety. This rising patient pool, combined with cost pressures, accelerates biosimilar adoption.

For instance, according to the data published by the World Health Organization, approximately 195.6 million people aged 30 to 97 years were affected by and in 2020, with projections indicating an increase to 300 million by 2040 due to aging populations and lifestyle factors.

Patent Litigations and Exclusivity & Physician Hesitancy and Clinical Inertia

The aflibercept biosimilars market faces growth constraints from physician hesitancy, complex regulatory requirements, and ongoing patent protections, which can delay market entry. High development and manufacturing costs, limited patient and payer awareness, and variable pricing and reimbursement policies further restrict adoption. Collectively, these factors moderate the uptake of aflibercept biosimilars despite increasing demand for affordable retinal therapies.

Regulatory advancements and streamlined approval processes are pivotal in accelerating the growth of the aflibercept biosimilars market. The expiration of regulatory exclusivity for Eylea of Regeneron on May 18, 2024, paved the way for the approval of interchangeable biosimilars. Just two days later, the U.S. Food and Drug Administration (FDA) approved Mylan Pharmaceuticals and Yesafili (aflibercept-jbvf) of Biocon Biologics and Opuviz (aflibercept-yszy) of Samsung Bioepis as interchangeable biosimilars to Eylea, marking a significant milestone in ophthalmic biosimilars. Similarly, in Europe, the European Medicines Agency (EMA) has expedited the approval of aflibercept biosimilars.

The SB15 (Samsung Bioepis) segment by Samsung Bioepis is emerging as a dominant force in the market due to several strategic advantages. Firstly, SB15 has demonstrated clinical equivalence to the reference product, Eylea, in pivotal Phase 3 trials, ensuring comparable efficacy and safety profiles. This robust clinical data enhances physician confidence and supports regulatory approvals. Additionally, Samsung Bioepis has secured regulatory approvals in key markets, including the European Union and South Korea, facilitating early market access. The partnership of the company with Biogen further strengthens its commercial reach and distribution capabilities. These factors collectively position SB15 as a leading bios.

The FYB 203 (Formycon/Klinge Biopharma) segment is estimated to be the fastest-growing in the aflibercept biosimilars market due to several key factors. Robust Phase 3 clinical data demonstrated comparable efficacy and safety to the reference product, Eylea, boosting physician confidence. Regulatory approvals in major markets, including the EU and the U.S., have enabled broad market access. Strategic partnerships with companies like Teva, Klinge Biopharma, and Valorum Biologics strengthen commercialization and distribution, while rising demand for cost-effective retinal therapies positions FYB203 to rapidly capture market share in the growing biosimilars segment.

The age-related macular degeneration (AMD) segment is the dominant segment in the aflibercept biosimilars market due to the high global prevalence of AMD, particularly among the aging population. AMD is a leading cause of vision loss, creating significant demand for effective and affordable treatments. Aflibercept biosimilars provide a cost-effective alternative to branded biologics, making them highly attractive to healthcare providers and patients. Strong clinical evidence supporting efficacy in AMD, along with widespread physician adoption, reinforces its position as the largest application segment in this market.

The diabetic macular edema (DME) segment is estimated to be the fastest-growing in the market due to the rising global prevalence of diabetes and the associated risk of vision-threatening complications. With diabetes rates increasing worldwide, more patients are being diagnosed with DME, creating a significant demand for effective and affordable therapies. Aflibercept biosimilars address this need by offering cost-effective alternatives with comparable safety and efficacy to branded products. Moreover, improved screening programs, patient awareness, and early diagnosis are boosting treatment uptake. Favorable reimbursement policies and clinical adoption further support the rapid growth of DME within the biosimilars market.

The intravitreal injection segment is the dominant route of administration in the market because it is the standard and most effective method for delivering therapy directly to the retina. This route ensures high drug concentration at the target site, improving treatment outcomes for conditions like age-related macular degeneration, diabetic macular edema, and retinal vein occlusion. Hospitals and ophthalmic clinics are well-equipped for intravitreal administration, reinforcing its widespread use. Moreover, strong clinical evidence, physician expertise, and regulatory approvals support its adoption. Patient reliance on proven treatment protocols further consolidates intravitreal injections as the leading administration route in this market.

The other delivery methods segment is estimated to be the fastest-growing in the aflibercept biosimilars market due to ongoing innovations aimed at improving patient comfort, adherence, and convenience. Alternative approaches, such as sustained-release implants, ocular inserts, and topical or systemic formulations, are gaining attention for reducing the frequency of invasive injections. These methods appeal to patients seeking less burdensome treatment options and healthcare providers aiming to enhance outcomes. Additionally, rising R&D investments and clinical trials in novel delivery platforms are accelerating adoption, positioning this segment for rapid growth in the coming years.

The hospitals segment dominates the market due to its role as the primary site for administering intravitreal injections for retinal disorders. Hospitals have the necessary infrastructure, trained ophthalmologists, and sterile environments required for safe biologic administration, ensuring patient safety and treatment efficacy. They also benefit from bulk procurement and tender-based purchasing, enabling cost-effective access to biosimilars. Strong reimbursement coverage in hospital settings further encourages adoption. Additionally, hospitals often serve as centers for clinical trials and physician training, reinforcing their position as the leading distribution and administration channel for aflibercept biosimilars.

The ambulatory surgical centers segment is anticipated to be the fastest-growing in the aflibercept biosimilars market due to its convenience, efficiency, and lower treatment costs compared with hospitals. ASCs offer shorter wait times, streamlined procedures, and patient-friendly environments, which attract both physicians and patients for intravitreal injections. The rise in outpatient care trends and preference for minimally invasive, office-based treatments further fuels adoption. Additionally, ASCs benefit from flexible procurement policies and faster decision-making, allowing quicker integration of biosimilars, positioning this segment for rapid growth in the ophthalmology market.

The direct sales segment dominates the market because it enables manufacturers to build stronger relationships with hospitals, clinics, and healthcare providers, ensuring trust and loyalty. This channel allows companies to control pricing, negotiate contracts, and manage bulk procurement more effectively, which is vital in cost-sensitive markets. Direct sales also support better product education, training, and after-sales services, improving physician confidence and patient outcomes. By minimizing intermediaries, manufacturers achieve greater market penetration and efficiency, solidifying direct sales as the leading distribution channel in this market.

The specialty pharmacies segment is anticipated to be the fastest-growing in the market due to its focus on complex, high-cost therapies that require patient support and monitoring. Specialty pharmacies provide personalized services, including medication counseling, adherence programs, and coordination with healthcare providers, which enhance patient outcomes. Their ability to manage insurance, reimbursement, and prior authorizations makes access to biosimilars easier. Additionally, the growing demand for cost-effective treatment options and the shift toward outpatient care models are driving rapid adoption of specialty pharmacies as a preferred distribution channel.

Europe is the dominant region in the aflibercept biosimilars market due to its early regulatory approvals, strong healthcare infrastructure, and well-established biosimilar adoption policies. The European Medicines Agency (EMA) has created a robust framework that accelerates approvals and builds physician confidence in biosimilars. Additionally, favorable reimbursement systems and tender-based procurement promote cost-effective adoption across hospitals and clinics. The aging population and high prevalence of retinal disorders further fuel demand in the region, while strategic partnerships with European pharmaceutical companies enhance market penetration and sustained dominance.

The U.K. benefits from strong NHS-driven cost-containment policies and early adoption of biosimilars. National procurement frameworks ensure wide access, and growing demand for cost-effective ophthalmology treatments accelerates uptake.

Germany leads in biosimilar penetration, supported by a competitive healthcare system, rapid EMA-to-market transition, and strong insurance reimbursement. Physicians and patients show high trust in biosimilars.

The regionalized healthcare system and government-driven price control policies support biosimilar adoption in Spain. Hospitals prioritize affordability, boosting demand for aflibercept biosimilars.

France emphasizes cost savings and tender-based purchasing in public hospitals. Supportive reimbursement policies and physician education programs strengthen adoption, making France a key growth contributor.

The Asia-Pacific region is the fastest-growing in the aflibercept biosimilars market due to its rapidly expanding patient population, particularly with rising cases of diabetes and age-related eye disorders. Governments across countries like China, India, Japan, and South Korea are promoting cost-effective biosimilar adoption through supportive policies and faster regulatory pathways. Increasing healthcare spending, coupled with investments in local biosimilar manufacturing and R&D, is fueling growth. Additionally, expanding healthcare access in developing economies and strategic partnerships between global and regional pharmaceutical companies enhance distribution. These factors collectively position Asia-Pacific as the most dynamic and rapidly advancing market for aflibercept biosimilars.

China leads growth with its large diabetic and aging population, driving high demand for retinal disorder treatments. The government supports biosimilars through price reforms, fast-track approvals, and inclusion in reimbursement lists, making aflibercept biosimilars highly attractive.

India benefits from a rising diabetes burden and growing retinal disease cases. Affordable biosimilars align with the cost-sensitive healthcare system in the country, while increasing local manufacturing and R&D capacity drives adoption.

Advanced healthcare systems and an aging population fuel demand for effective biosimilars in Japan. Strong regulatory frameworks and physician trust accelerate uptake of aflibercept biosimilars.

South Korea is a biosimilar innovation hub, with companies like Samsung Bioepis leading global developments. Government support, strong export potential, and rising domestic demand position the country as a key growth contributor.

Target Identification & Preclinical Studies: Scientists identify therapeutic targets for retinal disorders and test biosimilar candidates in cell cultures and animal models.

Process & Formulation Development: Optimization of cell lines, protein expression, purification, and formulation to match the reference biologic.

Key Players & Organizations: Samsung Bioepis, Sandoz, Amgen, Biocon Biologics, universities, and CROs (Contract Research Organizations).

Phase 1 Trials: Initial human testing for safety, dosage, pharmacokinetics, and immunogenicity.

Phase 2 Trials: Expanded testing to evaluate efficacy, safety, and comparative studies versus reference products.

Phase 3 Trials: Large-scale trials to confirm efficacy, monitor adverse events, and gather comprehensive data for submission.

Regulatory Approvals: Submission to authorities like EMA, FDA, PMDA, or CDSCO for marketing authorization and post-approval compliance.

Education & Counseling: Training patients on intravitreal injections and retinal disorder management.

Adherence Programs: Follow-ups, reminders, and home care services to ensure consistent treatment.

Insurance & Reimbursement Assistance: Guidance for coverage and cost management.

Post-Market Surveillance: Monitoring long-term safety and efficacy in real-world use to inform improvements.

In June 2025, according to Shreehas Tambe, CEO and Managing Director of Biocon Biologics Ltd., Biocon Biologics is proud that Health Canada approved YESAFILI, the first biosimilar to EYLEA in the country. As the tenth biosimilar to be commercialized globally, the company is thrilled to announce that YESAFILI will be introduced in Canada as the first country in July. Biocon Biologics Ltd. is driven by science, with a strength in global commercialization and an ongoing commitment to increasing access to high-quality, reasonably priced biologics, all of which are reflected in this milestone.

By Development Type

By Therapeutic Indication

By Route of Administration

By End-User

By Distribution Channel

By Region

December 2025

November 2025

November 2025

October 2025