October 2025

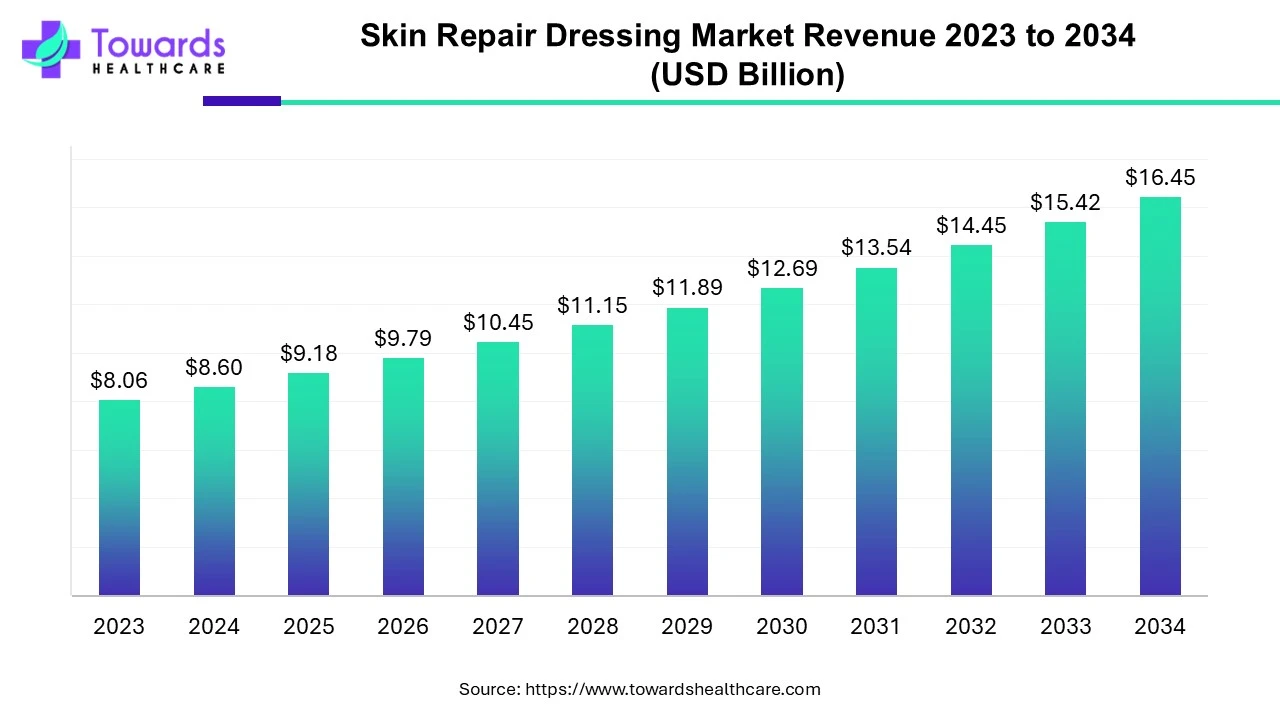

The global skin repair dressing market was estimated at US$ 8.06 billion in 2023 and is projected to grow to US$ 16.45 billion by 2034, rising at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2034.

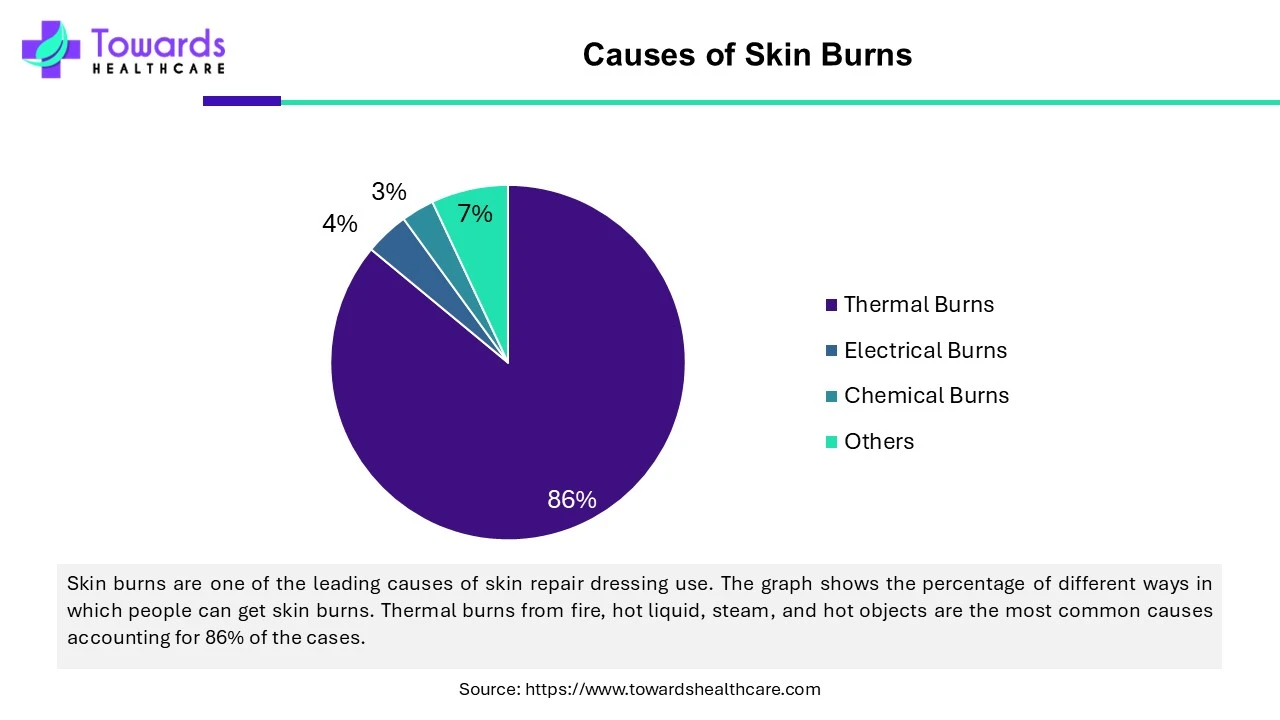

The skin repair dressing market encompasses products, procedures, research & development, and any other aspect associated with skin repair. Skin damage can occur in various circumstances, like accidents, burns, surgeries, diabetes, and skin-damaging infections. Depending on the type of wound and its severity, it is essential to choose the correct wound dressing to reduce treatment costs, accelerate healing, and improve the overall well-being of the patient. The market is growing due to the growing cases of burn wounds. Depending upon the severity of the nuns, the need for skin repair dressing increases.

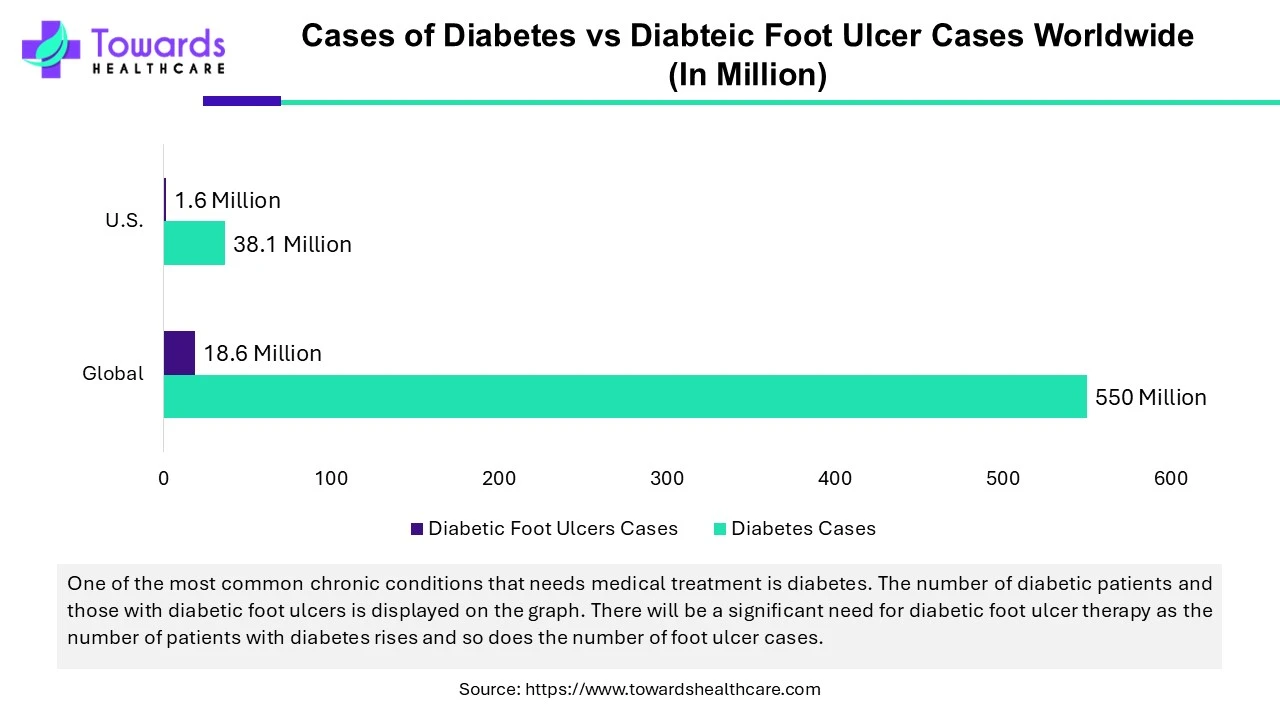

Chronic wounds are a side effect of diabetes because impairment in wound healing slows the healing process. It is estimated that the number of people with diabetes is going to increase to 784 million by 2045. Diabetes leads to diabetic foot ulcers, which are difficult to heal and need continuous monitoring and treatment. It may take weeks to several months to heal the ulcers. During this period, skin repair dressings are used in large amounts. These dressings not only help in healing but also prevent the wounds from getting infected. Some common dressings used in diabetic wounds include hydrogel dressings, alginate dressings, and foam dressings.

The skin repair dressing market provides different types of dressing. The resulting factor for the market is that these dressings have other issues that can limit their use. For instance, gauze & transparent film dressings can stick to a wound, and some dressings can cause irritation & pain. During the process of dressing removal, they can cause harm to the healing/healed wound.

North America Dominated the skin repair dressing market in 2023. Because of its developed healthcare system, growing public awareness, and the existence of significant industry participants, North America has a dominant market. Moreover, a projected rise in the number of operations performed in North America is expected to fuel the market's expansion in the area.

In 2023, the U.S. accounted for the greatest portion of the North American skin repair dressing market. A strong healthcare infrastructure, growing consumer awareness of innovative wound care products, and the existence of many major industry players are some of the reasons propelling the market's expansion. Furthermore, the market is anticipated to be further propelled by the increase in orthopedic operations brought on by the increased rate of sports injuries. Also, 10.5 million Medicare enrollees in the US suffer from chronic wounds.

The quality of life for around 2.5 percent of Americans is impacted by chronic wounds. Individuals with diabetes have a lifetime 25% chance of getting a foot ulcer, of which 15% end up needing to be amputated. In the US, pressure injuries cost between $9.1 and $11.6 billion annually. Inpatient stays connected to burns are still around twice as long and expensive ($24,000 versus $10,700) as stays unrelated to burns. Each year, burn injuries result in around $1.5 billion in medical expenses and $5 billion in missed workdays.

Asia Pacific is expected to grow at the fastest rate during the forecast period. The skin repair dressing market is rapidly growing in Asia Pacific due to the growing incidences of diabetes. The region has the largest pool of patients suffering from diabetes. Apart from this, investments by government and various organizations are growing in Asia Pacific. India, China, South Korea, and Japan majorly contribute to the market’s growth.

India is significantly contributing to the growth of the market. Chronic wounds caused by diabetes are the leading factor in their growth. India has the greatest number of people with diabetes. It is estimated that the number of diabetic patients will rise from 74.9 million in 2021 to 124.9 million by 2045. The Indian government and other organizations are making efforts to improve the quality of care and skin repair through research and development.

For instance,

Europe is expected to grow significantly in the skin repair dressing market during the forecast period. The industries in Europe, along with the institutes, are developing new approaches for skin repair dressing, which is promoting the market growth. Here, the industries are adopting various technologies, due to which different new skin repair dressings are being developed. This is further increasing the number of collaborations as well. The increasing research and development are increasing the new wound healing dressing options. This, in turn, is supported by the government investments.

By type, the collagen-based dressings segment dominated the skin repair dressing market in 2023. Materials based on collagen have the potential to heal wounds because of their inherent affinity for the body. Problems such as poor mechanical qualities have prompted the creation of better collagen dressings. The potential of various collagen dressings to speed up wound healing has been investigated.

By type, the alginate dressings segment is expected to grow at the fastest rate in the skin repair dressing market during the forecast period. The segment is growing due to the growing number of surgeries, and alginate dressings are frequently used to cover surgical wounds. The growing geriatric population will further promote the growth of the segment.

By application, the wound healing segment held the largest share of the market and is expected to grow at a faster rate during the forecast period. Wound healing can be needed after surgeries, chronic wounds, burn wounds, or any type of wound. Without dressings, wounds get exposed to pollution, pathogens, chemicals, and other things that can infect the wounded areas and increase the recovery time.

By end-user, the hospitals segment held the dominant share of the skin repair dressing market in 2023 and is estimated to remain dominant during the predicted period. Hospitals are the most common place where patients with all sorts of injuries are admitted. Apart from this, numerous surgeries are conducted in the hospital that require wound dressings for healing.

By type

By Application

By End User

By Region

October 2025

November 2025

November 2025

January 2026