November 2025

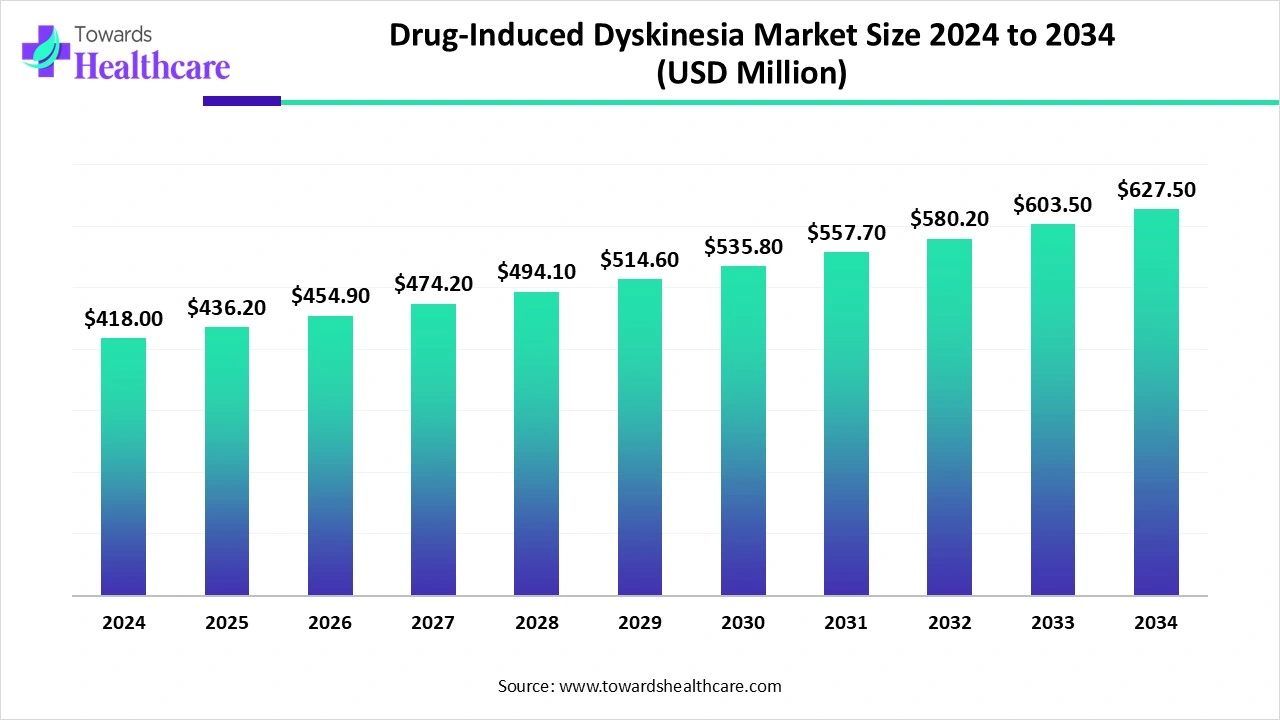

The drug-induced dyskinesia market size is calculated at US$ 418 million in 2024, grew to US$ 436.2 million in 2025, and is projected to reach around US$ 627.5 million by 2034. The market is expanding at a CAGR of 4.34% between 2025 and 2034.

The drug-induced dyskinesia market is gaining momentum as pharmaceutical innovation and neuroscience research converge to deliver more targeted therapies. Beyond traditional dopaminergic methods, new developments in the modulation of glutamatergic and serotonergic pathways, as well as innovative small molecule and gene-based therapies, are creating new opportunities. Clinical development is being accelerated by expanding strategic partnerships between biotech companies and research institutions, and treatment accessibility is being enhanced by patient awareness campaigns. This changing environment is changing the competitive market dynamics and emphasizing a move toward long-term dyskinesia management strategies and precision medicine.

| Table | Scope |

| Market Size in 2025 | USD 436.2 Million |

| Projected Market Size in 2034 | USD 627.5 Million |

| CAGR (2025 - 2034) | 4.34% |

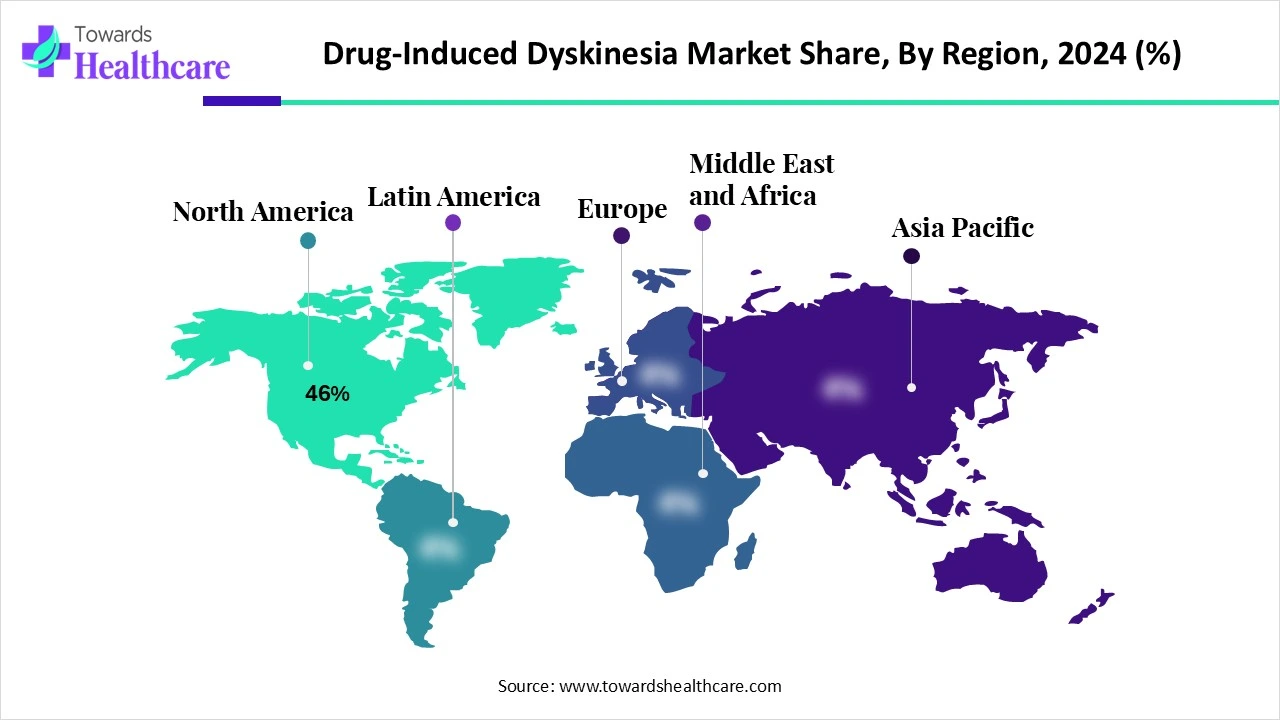

| Leading Region | North America 46% |

| Market Segmentation | By Drug Class, By Indication, By End User, By Region |

| Top Key Players | Adamas Pharmaceuticals (Supernus), Neurocrine Biosciences, Teva Pharmaceutical Industries, Amneal Pharmaceuticals, Sunovion Pharmaceuticals, Novartis AG, UCB Pharma, Lundbeck A/S, Ipsen Biopharmaceuticals, Biogen Inc., AbbVie Inc., GlaxoSmithKline (GSK), Roche Holding AG, Zydus Lifesciences, Kyowa Kirin, Medtronic (for device-assisted therapies), Acorda Therapeutics, Voyager Therapeutics, Intra-Cellular Therapies, Cure Parkinson’s (Research-focused) |

The drug-induced dyskinesia market is witnessing steady growth, driven by the growing number of patients receiving Parkinsons disease and other neurological conditions long term treatment. Dyskinesia, which frequently results from long-term dopaminergic treatment which levodopa has grown to be a significant clinical problem, driving a high need for efficient treatment options. The market is expanding because of supportive regulatory initiatives, improvements in drug development aimed at motor complications, and growing patient and healthcare awareness of providers. Furthermore, it is anticipated that better diagnostic tools and the aging population across the globe will encourage the use of innovative therapies and spur market expansion in the years to come.

The standard treatment for tardive and drug-induced dyskinesia is now VMAT 2 inhibitors because of their demonstrated effectiveness, good safety record, and numerous regional regulatory approvals. Their use is growing; these medications efficiently lessen involuntary movements and control dopamine release. Sales growth is being driven by the increasing acceptance among psychiatrists and neurologists. To increase treatment options, businesses are also spending money on next-generation VMAT 2 inhibitors.

Increasing focus on non-dopaminergic pathways like glutamatergic and serotonergic modulation

Motor complications are frequently made worse over time by conventional dopaminergic medications. The focus of research is therefore shifting to other neurotransmitter systems like glutamate and serotonin. These medications try to lessen dyskinesia without interfering with the mainstay of Parkinsons treatment. Biotech companies and pharmaceutical behemoths are investing in R&D because of this strategy. Treatment guidelines may change in the upcoming ten years because of such therapies.

AI is transforming the drug-induced dyskinesia market by streamlining diagnosis, enabling predictive modeling, and supporting drug discovery. While wearable sensors and AI-powered video tools are enhancing the early detection and ongoing monitoring of involuntary movements, machine learning algorithms are assisting doctors in more accurately predicting patient risk profiles and customizing treatment regimens. Additionally, pharmaceutical companies are using AI to speed up R&D are repurposing drugs, resulting in a hybrid market ecosystem where precision medicine and digital health enhance conventional treatments. Globally, this integration is changing patient-centered care, expanding the market, and enhancing access via telehealth platforms.

Rising Disease Prevalence

The global incidence of Parkinsons disease and tardive dyskinesia is escalating primarily due to aging populations and prolonged use of antipsychotic medications. This surge necessitates innovative solutions for early detection and continuous monitoring. AI technologies, such as advanced video analysis and wearable sensors are being leveraged to provide scalable, objective assessments enabling timely interventions and personalized treatment plans.

Limited Treatment Options

Few FDA-approved therapies are available specifically for DI, leaving patients with suboptimal management. Many existing treatments are repurposed from other neurological conditions and may not fully address dyskinesia symptoms. Companies are focusing on novel VMAT 2 inhibitors, long-acting formulations, and combination therapies to expand treatment choices. In addition, clinical development for new therapies is slow due to stringent efficacy and safety requirements, limiting rapid market expansion. Novel VMAT 2 inhibitors, long-acting formulations, and combination therapies are in development to broaden patient options and improve treatment outcomes.

Growing Focus on Novel Therapies

Pharmaceutical companies have a great chance to create next-generation therapies like serotonin receptor modulators, gene therapies, and VMAT2 inhibitors. These developments seek to increase safety and efficacy while providing patients who dont react well to current treatments with alternatives. Further speeding up drug discovery are partnerships with biotech startups and increased R&D funding.

Rising Awareness and Early Diagnosis

There are now chances to diagnose levodopa-induced dyskinesia and tardive dyskinesia earlier, thanks to patient and healthcare provider education campaigns. Early detection increases the number of patients who can receive new treatments and enhances treatment results. Businesses that fund awareness campaigns can increase brand recognition and patient engagement.

The dopamine modulators segment is currently dominating the market because they are frequently used to treat tardive dyskinesia and motor complications in Parkinsons disease. They are the most popular therapeutic option due to their proven effectiveness, wide clinical use, and widespread physician acceptance. By lowering involuntary movements and enhancing the quality of life of the patients, these medications aid in the stabilization of dopamine levels in the brain. Their dominance on a global scale is also influenced by established safety profiles and the availability of multiple formulations.

The serotonin receptor modulators segment is the fastest-growing segment in the drug-induced dyskinesia market, driven by continuing studies and growing interest in focusing on different neurotransmitter pathways to more effectively treat dyskinesia adverse effects. New compounds in this class are being investigated in clinical trials which could lead to better tolerability. Growing patient and clinician awareness of alternative therapeutic approaches is helping the segment. The development of drugs based on serotonin is receiving more funding from biotech companies, which further supports growth.

The Parkinsons disease segment dominates the drug-induced dyskinesia market, accounting for the largest share of patients receiving treatment. This can be attributed to the high global incidence of Parkinsons disease and the critical need to treat levodopa-induced dyskinesia. Long-term ongoing therapy is frequent necessary for Parkinsons patients, which fuels a consistent demand for supportive therapies and pharmaceuticals. Parkinsons disease treatment protocols have been integrated by hospitals and specialty centers, further solidifying market dominance in this indication.

The tardive dyskinesia segment is the fastest-growing indication, fueled by a rise in awareness, early diagnosis, and the introduction of innovative treatments that target TD symptoms in particular. Access to treatment has increased since new VMAT2 inhibitors were approved by regulators. Initiatives to inform caregivers and healthcare professionals about early detection and treatment of TD are another factor propelling market expansion. It is anticipated that growing mental health and psychiatric medication use worldwide will increase the patient base.

The oral segment dominated the drug-induced dyskinesia market because it provides improved patient adherence for long-term management convenience and ease of use. For at-home treatment, patients prefer oral formulations, which eliminates the need for frequent hospital stays. Better oral dosage forms with lower side effects and higher bioavailability have been purchased by pharmaceutical companies. Globally recognized manufacturing and distribution networks also support the segment.

The injectable segment is the fastest-growing segment, reinforced by developments in long-acting injectables and depot formulations that offer long-lasting therapeutic effects. With injectables, patient compliance is improved, dosage accuracy is increased, and symptom fluctuations are better managed. The focus of emerging research is on novel delivery methods like subcutaneous or extended-release injections. Growth is further accelerated by growing adoption in neurology centers and specialty clinics.

The hospitals segment dominates the market as most patients with severe dyskinesia or complications related to Parkinsons are treated in inpatient or specialized hospital settings where monitoring and management of complex therapies are feasible. Hospitals also serve as primary sites for clinical trials and treatment initiation. Access to multidisciplinary care teams ensures optimized therapy and follow-up. High patient volume and advanced infrastructure in hospitals reinforce their dominant position in the market.

The specialty neurology centers segment is the fastest-growing segment, driven by the growth of movement disorder treatment centers, the availability of specialized treatments, and the extension of outpatient care. These facilities employ cutting-edge diagnostic equipment to evaluate patients and offer individualized treatment programs. The segment is growing due to patient preference for specialized, localized care. Clinical programs in partnership with pharmaceutical companies also contribute to the rapid growth.

North America dominated the drug-induced dyskinesia market share 46% in 2024 due to the early adoption of new treatments, high healthcare spending, and the existence of a well-established healthcare infrastructure. The U.S. strong R&D pipeline, broad patient and physician awareness, and sound reimbursement practices that make cutting-edge treatment options more accessible are all advantages for the market. To further solidify their market dominance, the region is also home to significant pharmaceutical companies that are aggressively introducing novel treatments, including new VMAT2 inhibitors.

The U.S. drug-induced dyskinesia market is characterized by high by the widespread use of dopamine modulates and newly developed serotonin receptor modulates, with hospitals continuing to serve as the main treatment location. Consistent demand is driven by the rising prevalence of Parkinsons disease and tardive dyskinesia, as well as increased awareness among neurologists and providers. To enhance patient compliance and treatment results, new formulations are being introduced, such as injectable and extended-release oral therapies.

The Asia Pacific drug-induced dyskinesia market is the fastest-growing globally, driven by growing patient awareness, a growing healthcare infrastructure, and the rising incidence of tardive dyskinesia and Parkinsons disease. Growing disposable incomes, the adoption of new treatments in emerging economies, and government programs to increase access to neurological care all contribute to growth. Clinical trials and educational initiatives aimed at patients and doctors are also helping the market.

The India drug-induced dyskinesia market is witnessing rapid growth because of advancements in healthcare access, as well as growing awareness of Parkinsons disease and tardive dyskinesia. The main treatment settings are hospitals and specialty neurology centers, and oral formulations continue to be the most widely used. Government programs increasing disposable income and the growing use of innovative treatments are all contributing factors to the growth of the market.

The goal of R&D is to lessen the involuntary movements brought on by chronic drug use by creating innovative treatments like gene therapies , VMAT2 inhibitors, and alternative formulations. New developments include customized treatment plans and clinical trial designs aided by AI. Enhancing medication tolerability and minimizing adverse effects for long-term patient use are further goals of research.

Key Players: Neurocrine Biosciences, Teva Pharmaceuticals, Acadia Pharmaceuticals, Ipsen Pharma.

Clinical trials are conducted on treatments to evaluate their safety, effectiveness, and potential to improve quality of life. VMAT2 inhibitors, off-label medications, and new gene therapies are subject to medical standards that are enforced by regulatory bodies such as the FDA, EMA, and CDSCO. To track treatment outcomes and safety in the real world, post-marketing surveillance is also carried out.

Key Players: Neurocrine Biosciences, Teva Pharmaceuticals, Acadia Pharmaceuticals, Ipsen Pharma.

Patient support includes education programs, symptom tracking tools, counseling for medication adherence, and outreach initiatives to improve awareness and access in underserved regions. Companies also provide digital platforms and mobile apps to facilitate communication between patients and healthcare providers.

Key Players: Neurocrine Biosciences, Teva Pharmaceuticals, Acadia Pharmaceuticals, Ipsen Pharma.

In April 2024, Neurocrine Biosciences announced that the U.S. FDA approved the Ingrezza Sprinkle (valbenazine) granule formulation, an alternative for patients who experience trouble swallowing capsules, particularly those with movement disorders linked to Huntingtons disease. CEO of Neurocrine, Kevin C. Gorman, stated, “We are proud to bring Ingrezza to people living with HD and their caregivers who now have the option of a one-capsule, once-daily treatment that has demonstrated significant improvement in HD chorea in clinical studies.”

By Drug Class

By Indication

By Route of Administration

By End User

By Region

November 2025

November 2025

December 2025

November 2025