March 2026

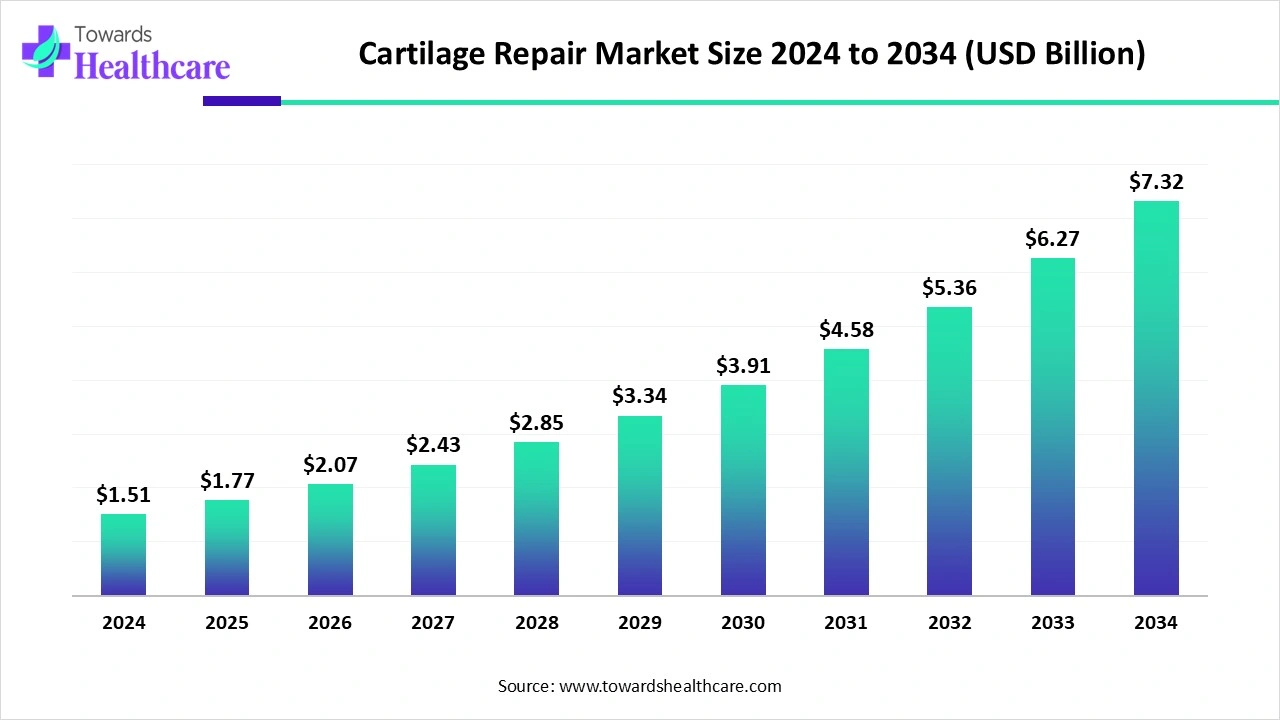

The global cartilage repair market size is calculated at US$ 1.51 billion in 2024, grew to US$ 1.77 billion in 2025, and is projected to reach around US$ 7.32 billion by 2034. The market is expanding at a CAGR of 17.14% between 2025 and 2034.

The market is being driven by compelling factors. The factors have increased demand for novel treatments that might relieve pain and restore joint function. The growing prevalence of joint conditions, such as osteoarthritis and sports injuries, is one of the main factors propelling the market and has raised need for efficient treatment solutions. The ageing population and rising awareness of the value of joint health are two further factors propelling the market. Because of this, the industry is expanding remarkably, opening the door for developments in regenerative medicine and providing hope for better patient outcomes.

| Table | Scope |

| Market Size in 2025 | USD 1.77 Billion |

| Projected Market Size in 2034 | USD 7.32 Billion |

| CAGR (2025 - 2034) | 17.14% |

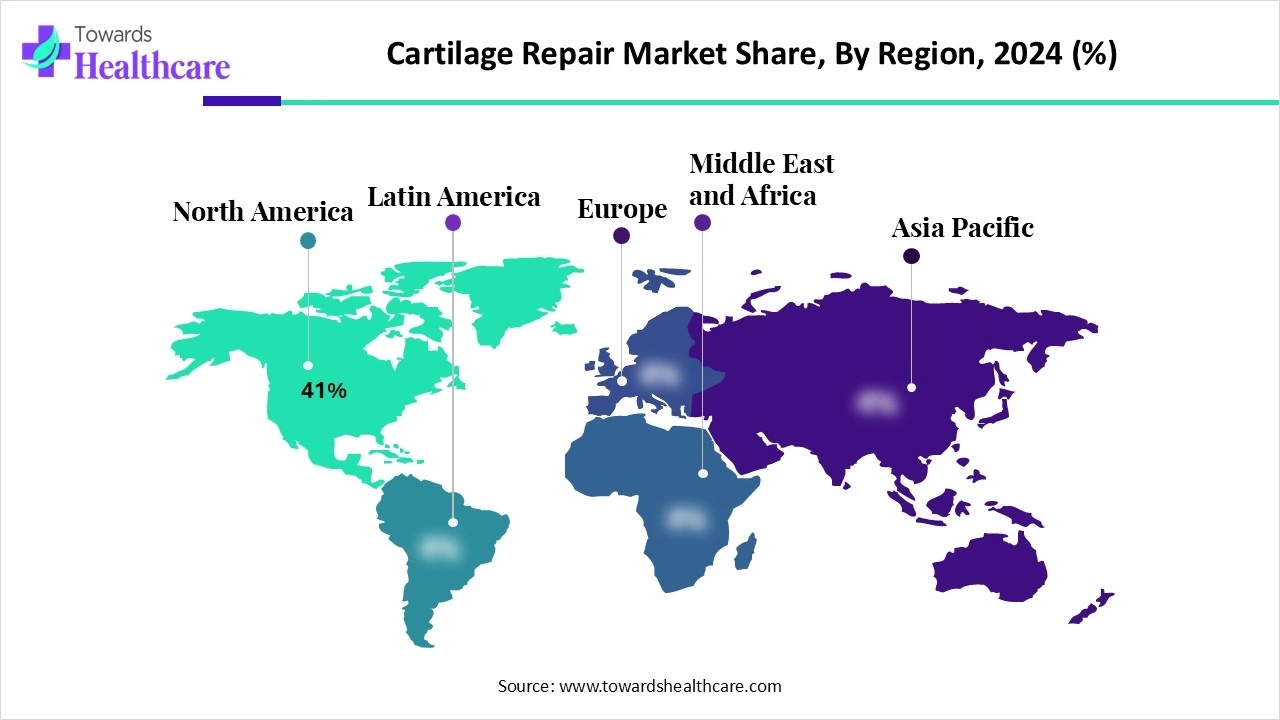

| Leading Region | North America 41% |

| Market Segmentation | By Procedure/Technique, By Biomaterial/Implant Type, By Indication/Lesion Profile, By Care Setting, By Patient Profile, By Revenue Stream, By Region |

| Top Key Players | Vericel, Zimmer Biomet, Arthrex, Stryker, Smith+Nephew, DePuy Mitek (Johnson & Johnson), CONMED, Geistlich Pharma, Anika Therapeutics, CartiHeal, Bioventus, MTF Biologics, AlloSource, RTI Surgical, Medipost, CO.DON, Ocugen, Exactech, B. Braun Aesculap, Organogenesis/Integra |

The cartilage repair market encompasses products and procedures designed to restore or replace damaged articular cartilage in synovial joints, most commonly the knee, followed by the ankle, hip, and shoulder. It spans marrow-stimulation techniques (e.g., microfracture), osteochondral autograft/allograft transfers (OATS/OCA), autologous and allogeneic cell-based therapies (e.g., ACI/MACI, MSCs), biomaterial scaffolds and matrices (collagen, HA, synthetic polymers), off-the-shelf osteochondral implants, adjunct biologics (PRP, adhesives), fixation hardware, and surgical instruments. Growth is driven by rising sports injuries, earlier return-to-activity expectations, expanding clinical evidence (matrix-induced ACI, fresh OCA), and availability of off-the-shelf implants and reimbursed cell-based options.

Rising Investment by Market Players: Cartilage damage is growing, especially in women. This has developed the interest of key players, and they are investing in the market, leading to the growth of the market.

Machine learning is at the vanguard of revolutionising joint health and cartilage healing in the quickly developing field of medical technology. More precise cartilage injury diagnosis is now possible thanks to machine learning techniques. These algorithms help determine the level of injury and provide individualised treatment strategies by examining patterns in medical imagery. The ongoing advancement of machine learning is closely related to the future of joint health. Further revolutionary developments in cartilage healing are anticipated as a result of its integration with other technologies, including as biotechnology and 3D printing.

Driver

Rising Cases of Osteoporosis

The most prevalent bone disease and a significant non-communicable illness, osteoporosis affects one in five men and one in three women over 50 globally. In Europe, the U.S., and Japan, osteoporosis is thought to afflict 75 million individuals. According to estimates, 200 million women worldwide suffer from osteoporosis, which affects around 10% of women in their 60s, 5% of women in their 70s, 2% of women in their 80s, and 2/3 of women in their 90s.

Complex Biomechanics Restrain the Cartilage Repair Market

The biomechanical forces acting on the knee joint are intricate and substantial. It bears a large portion of the body's weight and withstands repeated strain from exercises like sprinting, leaping, and walking. Any repair procedure is hampered by this continuous load-bearing and movement. Severe biomechanical dysfunction might result from even small flaws in the healed cartilage.

What are the Future Opportunities in the Cartilage Repair Market?

One of the most significant aspects of the transition from current to future treatment techniques for arthritis is seen to be the move to nonsurgical approaches. In order to get the best results, nonsurgical therapy options for cartilage abnormalities should comprise a customised strategy to treatment that takes into account the objectives of each patient as well as any adoption hurdles.

By procedure/technique, the cell-based cartilage repair segment held the major share of the cartilage repair market in 2024. For the treatment of localised, traumatic chondral lesions of the knee, cell-based regenerative treatments for cartilage regeneration have become the norm. Stem cells have great potential for treating osteoarthritis by repairing damaged cartilage. Apart from their multipotency, stem cells have immunomodulatory properties that can improve cartilage regeneration and reduce inflammation.

By procedure/technique, the off-the-shelf implants/synthetic & biphasic plugs segment is estimated to be the fastest-growing during the predicted period. In addition to supporting proper cell development and differentiation and replicating local cell niches, off-the-shelf biological scaffolds also offer mechanical support and function in load-bearing joints from the moment of implantation.

By biomaterial/implant type, the collagen-based & HA-based scaffolds/membranes segment held the major share of the cartilage repair market in 2024. These two elements have excellent osteoconductivity, bone-bonding properties, and biocompatibility. For bone tissue engineering scaffolds, the collagen/HA composite biomaterial scaffolds have thus been thoroughly studied and employed.

By biomaterial/implant type, the synthetic polymers segment is estimated to be the fastest-growing during the predicted period. The variety and potential of synthetic polymers are greater. The FDA has given some of these materials approval for clinical use in humans. Because they are more resistant to physicochemical characteristics than natural membranes, these scaffolds may be produced in a variety of ways and are distinguished by their biocompatibility, biodegradability, and superior mechanical qualities.

By indication/lesion profile, the focal chondral defects of the knee segment held the major share of the cartilage repair market in 2024. Knee focal chondral abnormalities are frequent. A number of surgical methods have been put forth to treat chondral defects. One of the biggest problems orthopaedic surgeons face is chondral abnormalities. Athletes had 20% more knee chondral abnormalities, and those who have had ACL reconstructive surgery may have up to 50% more.

By indication/lesion profile, the hip and shoulder focal defects segment is estimated to be the fastest-growing during the predicted period. Age-related discomfort and impairment are frequently caused by arthritic cartilage degradation, which can range from localised lesions to a complete loss of cartilage. They frequently develop as a result of trauma, ongoing shoulder instability, and previous surgery. Additionally, there have been significant attempts to create efficient surgical cartilage repair techniques as a result of chondral defects and the ensuing development of OA.

By care setting, the hospitals & academic medical centers segment held the major share of the cartilage repair market in 2024. As the main locations for healthcare in the majority of communities, community hospitals provide a crucial and complementary role, handling around 80% of all hospital admissions annually. In the healthcare system, academic medical centres, or AMCs, have been essential. In addition to provide clinical treatment, they also support product development, research, and innovation; they find and validate new care pathways; and they teach and educate the next generation of healthcare professionals. They act as a safety nett for hospitals as well. The growth of alliances or mergers between AMCs and community hospitals has been a subset of the trend towards the consolidation of health system services.

By care setting, the ambulatory surgery centers (ASCs) segment is estimated to be the fastest-growing during the predicted period. Along with the potential to increase the value of treatment, total joint replacement (TJR) surgery performed in ambulatory surgical centres (ASCs) has increased dramatically in recent years. The effectiveness of a TJR ASC programme depends critically on the standardisation of high-quality perioperative care.

By patient profile, the active adults 18-45 segment held the major share of the cartilage repair market in 2024. With studies indicating prevalences as high as 24% in general adult populations and a greater prevalence in those over 40 compared to younger persons, the prevalence of knee cartilage degradation in active adults varies but is considerable. Injury, repeated stress, and ageing are some of the reasons of osteoarthritis, and some of these faults are present in athletes who do not exhibit any symptoms.

By patient profile, the middle-aged patients segment is estimated to be the fastest-growing during the predicted period. Pain, stiffness, and dysfunction are frequent symptoms of cartilage loss in middle-aged people, which can be brought on by trauma, age-related degeneration, or diseases like osteoarthritis. Pain, stiffness, and dysfunction are frequent symptoms of cartilage loss in middle-aged people, which can be brought on by trauma, age-related degeneration, or diseases like osteoarthritis.

By revenue stream, the implants/scaffolds & cell constructs segment held the major share of the cartilage repair market in 2024. A 3D scaffold offers structural support, while implanted cells (such as chondrocytes or mesenchymal stem cells, or MSCs) produce new cartilage tissue in the injured location. Implants, scaffolds, and cell constructions are a potential method for cartilage repair.

By indication/lesion profile, the allograft tissue supply segment is estimated to be the fastest-growing during the predicted period. In light of the shortcomings of the existing methods, the best course of action would be to repair the defect with hyaline cartilage and viable cells in a single step, remodelling it over time without causing damage to the subchondral bone plate. These characteristics are provided by the innovative allograft solution known as viable cartilage allograft (VCA, MTF Biologics, Edison, NJ/ConMed).

North America dominated the cartilage repair market share 41% in 2024. Early acceptance of innovative regenerative treatments, extensive knowledge, and well-established healthcare infrastructures. The market is supported by a strong demand for minimally invasive treatments, continuous research investments, and well-established leading players. The availability of top orthopaedic doctors and transparent reimbursement rules and services have further strengthened demand.

Fractures in elderly men and postmenopausal women are frequently caused by osteoporosis. Women are more affected than males. Over 8 million (80%) of the estimated 10 million Americans who suffer from osteoporosis are female. Although osteoporosis can strike younger women, it affects one in four women in the United States who are 65 years of age or older.

Over 2.5 million people in Canada suffer from osteoporosis. About 150 out of every 100,000 Canadians get a hip fracture each year, which is one of the most dangerous fractures linked to osteoporosis.

Asia Pacific is estimated to host the fastest-growing cartilage repair market during the forecast period. Among the most common operations in the area are hip and knee replacements and surgery. Due to the rising incidence of knee problems and the expanding senior population, the market for knees is expected to expand. The market is expanding due to factors such the increased risk of accidents and fractures caused by osteoporosis. Initiatives to introduce cutting-edge items in the area also contribute to the market's expansion. Since osteoarthritis frequently results in cartilage injury and the degeneration of articular cartilage, it is the main reason for these operations. Additionally, due to patient and provider desire, the area is seeing a rise in the frequency of sports-related knee injuries as well as an expansion in indications for total knee replacement.

The identification and amplification of stem/progenitor cells, the development of growth factor cocktails to promote differentiation, the production of efficient biomaterial scaffolds for cell delivery, the management of inflammation, and the development of strategies to improve cell integration and retention within the injured tissue are important research areas.

Determining clinical needs, performing preclinical research and regulatory interactions (such as pre-IND meetings), conducting phased human clinical trials with precisely defined patient populations, endpoints, and comparator groups, and then submitting all data for regulatory review and market approval by organisations such as the FDA are the steps involved in cartilage repair clinical trials and regulatory approval.

Accurate diagnosis through imaging and physical examinations is the first step in providing patient support and services for cartilage repair. Next comes a customised treatment plan that may include conservative measures like medication and physical therapy or more invasive procedures like cell-based therapies and cartilage/bone grafts.

In January 2024, as previously revealed, Smith+Nephew paid $180 million upon completion, with an additional $150 million depending on future financial success. Agili-C has the potential to revolutionise cartilage repair results due to its demonstrated superiority over the existing standard of care, according to Scott Schaffner, President, Sports Medicine, Smith+Nephew. I am really certain that this will significantly add value for Smith+Nephew because of our leadership in knee repair and our proficiency in regenerative treatment.

By Procedure/Technique

By Biomaterial/Implant Type

By Indication/Lesion Profile

By Care Setting

By Patient Profile

By Revenue Stream

By Region

March 2026

March 2026

March 2026

March 2026