February 2026

The global skincare market size is calculated at USD 123.64 billion in 2025, grew to USD 132.13 billion in 2026, and is projected to reach around USD 240.28 billion by 2035. The market is expanding at a CAGR of 6.87% between 2026 and 2035.

| Metric | Details |

| Market Size in 2026 | USD 132.13 Billion |

| Projected Market Size in 2035 | USD 240.28 Billion |

| CAGR (2026 - 2035) | 6.87% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Product, By Packaging Type, By Gender, By Distribution Channel and By Region |

| Top Key Players | L’Oréal Professional (France), Unilever (U.K.), Procter & Gamble (U.S.), Estée Lauder Inc. (U.S.), Beiersdorf AG (Germany), Shiseido Co., Ltd. (Japan), Coty Inc. (U.S.), Natura & Co. (Brazil), Kao Corporation (Japan), Johnson & Johnson Services, Inc. (U.S.), Avon Products Inc. (U.K.) |

The skincare industry provides a wide range of skin care products to maintain our skin in "good condition" by cleaning, soothing, restoring, strengthening, protecting, and treating it. Numerous skin care products with a wide variety of claims and suggested uses are available on the market. Skin care products are widely accessible, and advertisements for them that make fantastical promises are commonplace.

The development of skincare products is being revolutionized by AI technology, which enables more individualized and efficient solutions. AI is making it possible to create customized skincare compositions that meet each person's requirements and preferences by analyzing enormous volumes of data and finding trends. AI can assist skincare firms in utilizing predictive analytics to foresee customer needs and create solutions that target certain issues. To maximize the efficacy of skincare formulations, AI can process a variety of data sets, including skin types, environmental factors, and ingredient efficacy, by utilizing machine learning algorithms. This creative method guarantees that the final product is more in line with the changing demands of customers while also expediting the product development process.

Rising Interest in Natural and Organic Products

These days, there is a growing demand for natural and organic skin care products as a result of growing consumer knowledge of synthetic chemicals and their detrimental consequences. For customers who care about the environment, they are becoming more and more significant. This has prompted innovation and created new pathways to safer, more ecologically friendly skin care products, as firms are introducing clean-label skin care products tailored for this market.

Regulatory Restrictions

The intricate and ever-changing requirements in many regions provide major obstacles for the skincare industry when it comes to regulatory compliance. Concerns about health and the environment led California to prohibit six cosmetic chemicals under its Toxic-Free Cosmetics Act in January 2024.

Personalized Skincare Solutions

By altering how customers interact with and perceive skincare products, advanced customized skincare solutions have completely transformed the industry. Brands may use advanced technology to offer highly tailored products and services. As the need for individualized experiences grows, skincare businesses have a chance to differentiate themselves, foster brand loyalty, and meet the evolving needs of consumers who appreciate high-performing, tailored skincare products.

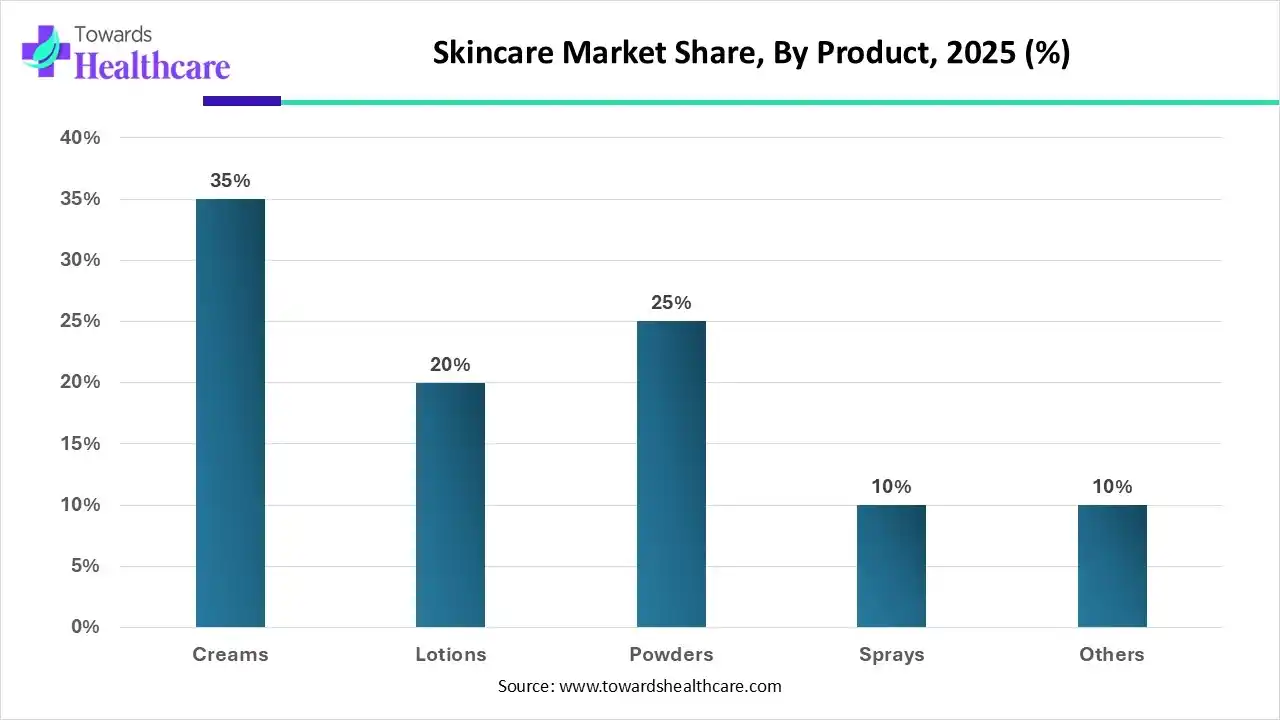

Which Product Segment Dominated the Skincare Market in 2025?

By product, the creams segment dominated the skincare market by 35% in 2025. Creams and topical treatments have long been regarded as essential components of cosmetics. Since even cosmetic creams are based on pharmacy-developed procedures and unmedicated creams are widely utilized for a range of skin disorders, creams may be classified as pharmaceutical items. As technology has advanced, cream formulation has shifted to innovative techniques. The public and society can employ these semisolid preparations with elegance. They exhibit adaptability in their roles. It is easy to apply creams to any portion of the body. Everyone of all ages may use the cream with ease.

The Powders Segment: Significant CAGR

By product, the powders segment is estimated to grow significantly in the skincare market during the forecast period. The use of powdered skin care products is growing in popularity. Powdered skin care products are a particularly environmentally friendly choice. For this reason, makers of cosmetics in particular have created powder products. Preservatives are not necessary for powders. Cosmetics in powder form are extremely light. It is simple to store and move. Temperature-controlled transportation is not necessary for powder cosmetics.

Why Did the Tubes Segment Dominate the Skincare Market in 2025?

By packaging type, the tubes segment led the skincare market by 40% in 2025. Compared to more conventional packaging choices like glass jars and plastic bottles, tube packaging has a number of advantages. They are inexpensive, environmentally safe, and offer protection for active ingredients in addition to being practical and adaptable. A range of heads included with the tube packing makes dispensing clean and simple. The user may effortlessly regulate the quantity of substance dispensed without causing any mess, thanks to this function.

The Bottles Segment: Significantly Growing

By packaging type, the bottles segment is estimated to witness lucrative growth in the skincare market during the forecast period. In addition to being non-toxic and tasteless, the glass container has high stability and barrier qualities, is resistant to heat, light, and solvents, and does not readily react or degrade with skin care products. Therefore, the most comforting material from the standpoint of "safety and stability" is glass bottles. Because these compounds are very active and rapidly impacted by light, cosmetics are packaged in glass bottles, which is better for preserving skin care products with anti-aging, whitening, and antioxidant properties.

How the Female Segment Dominated the Skincare Market in 2025?

By gender, the female segment held the largest share of the skincare market by 60% in 2025. The average yearly discretionary income for women in the Asia-Pacific area is around $30,000. According to a Euromonitor survey, this economic empowerment has increased the demand for anti-aging goods among women in their 30s and 40s. Additionally, women's growing employment in nations like Malaysia, where the World Bank reports that women make up 46.8% of the workforce, raises income and, consequently, levels of discretionary money. As a result, these factors contribute to the expansion of the Asia Pacific cosmetic skin care market.

The Male Segment is Growing Significantly

By gender, the male segment is estimated to grow at a significant rate in the skincare market during 2025-2034. The change in societal perceptions of masculinity and self-care is one of the main causes of the surge in men's skincare. The emergence of social media, where skincare and beauty influencers—many of whom are men—share their routines and promote improved skincare habits, is another factor contributing to this change. Furthermore, males are now more aware of the significance of caring for their skin as part of a larger commitment to their health and well-being, demonstrating how the idea of self-care has transcended conventional gender norms.

| Segment | Share 2025 (%) |

| Cosmetic Stores | 40% |

| Online Channel | 30% |

| Supermarkets/Hypermarkets | 20% |

| Others | 10% |

Which Distribution Channel Segment Dominated the Skincare Market in 2025?

By distribution channel, the cosmetic stores segment led the skincare market by 40% in 2025. A trip to a cosmetics store offers professional advice and first-rate service. Getting expert assistance is essential while choosing the right cosmetics for oneself. Professionals in skincare and cosmetics may be found in these high-end cosmetics boutiques.

The Online Segment: Fastest Growing

By distribution channel, the online segment is estimated to grow at the fastest CAGR in the skincare market during the predicted time frame. Online marketplaces eliminate the necessity for in-person store visits by enabling convenient shopping from any location at any time. For people who are busy or may not have easy access to physical stores, this is very helpful. Comparing online marketplaces to physical storefronts, the former frequently provide a far wider selection of goods. The ability to quickly compare costs, brands, and seller evaluations enables customers to locate the precise things they want without any restrictions.

Asia Pacific dominated the skincare market in 2024. Growing populations, fast urbanization, and rising per capita expenditure on personal care products are all factors driving the skincare industry in rapidly expanding economies like China, South Korea, India, and Indonesia. Additionally, the market for skincare products is expanding due to the increasing availability of reasonably priced skincare products. As a result, the main methods used by major firms to consolidate the market in question are mergers and acquisitions, and product innovation.

One of the most alluring and well-liked locations for international businesses looking to develop their operations is China, where the cosmetics sector is the second largest in the world. In fact, Chinese consumers increasingly use cosmetics on a regular basis. Chinese customers are becoming increasingly astute and informed about the components, formulas, and concepts of skincare. They expect professional, efficacious outcomes supported by clinical and scientific evidence.

South Korea, which is renowned for its inventiveness, use of natural ingredients, and attractive packaging, is in the top ten beauty markets globally in terms of market share. After the US and France, South Korea was the third-largest exporter of cosmetics. The nation with the fastest average internet speed and the greatest rates of smartphone ownership and broadband penetration is South Korea. Resulting in a significant volume of internet purchases. The majority of the major consumer trends in Korea are associated with eco-friendly, climate-conscious, and sustainable lifestyles.

North America is estimated to host the fastest-growing skincare market during the forecast period. Because Americans spend a lot of money on skin care and personal care products and are willing to try new ones, especially those that make clean-label and free-from promises, the market for these goods is booming. The U.S. is the key market that most enterprises choose because of this aspect. Additionally, as more people become aware of the benefits of skincare products, the nation is witnessing an increase in the usage of these products, especially in the luxury category. Because of the substantial sales of skin-lightening products, face oils, serums, and anti-aging creams, the United States is the main source of income in North America.

The skincare market in the US is expanding at a rate never seen before because to rising e-commerce, improved product formulas, and more consumer knowledge. The demand for premium skincare products is still rising as more individuals place a higher priority on the health of their skin. Customers' decisions to buy are greatly influenced by social media. When researching new items, consumers consult brand websites, social media platforms, and online reviews before making a buy.

For American cosmetic firms wishing to enter or grow in the cosmetics sector, Canada's robust and dynamic economy provides a stable market. The biggest manufacturers of skin care and cosmetics in Canada are found in the provinces of Ontario and Quebec, which also have the busiest consumer markets for these goods. Organic and ethically produced products currently account for almost 40% of the Canadian skin care industry due to these shifting customer preferences.

Europe is expected to grow significantly in the skincare market during the forecast period. With strong demand for high-end, cruelty-free, and organic cosmetic products, Europe is a major skincare industry. Due to their developed beauty markets and growing demand for ethical and ecological product lines, France, Germany, the UK, and Italy are becoming more powerful countries. Probiotics, plant-based retinol, and fermented compounds are among the biotech-based skincare formulas that are becoming more and more popular in the region. Furthermore, it is claimed that legislative actions like those that encourage the use of environmentally friendly packaging, prohibit dangerous chemicals, or encourage the use of raw materials that have undergone dermatological testing, among others, have an impact on the industry's landscape. Additionally, rising interest in minimalist skincare regimens and the appeal of European premium skincare companies are driving demand.

Taking care of oneself on the inside and exterior is "synonymous with pleasure" for 67% of French customers. It involves setting aside time for self-care and pursuing general well-being on a regular basis. 72% of French customers integrate sports, good habits, and nutrition into their daily routines, so fusing beauty and lifestyle. According to the report, while choosing products, French customers are cautious and look for confidence. Significantly, 43% of respondents accept the professional judgment of medical or aesthetic experts, 36% take into account customer evaluations, and 24% believe referrals from friends and family. With 44% continuously examining product formulae and components, pharmacies play a crucial role as trustworthy counselors.

The UK is setting the worldwide standard for face skincare products that target the skin microbiome because it understands the significance of the skin's distinct environment. With more than 1,800 beauty companies in operation, it is evident that the UK is producing some of the most innovative and intriguing ideas that will influence beauty trends worldwide. The UK is at the forefront of the clean beauty trend, which began with skincare and is now swiftly expanding into color cosmetics.

Latin America is expected to grow at a notable rate in the foreseeable future. Several factors contribute to market growth, including growing public awareness, rising disposable incomes, and rapid urbanization. Government initiatives and social media play a vital role in increasing awareness about skincare in Latin America. The presence of advanced healthcare infrastructure and affordable treatments enhances the accessibility to skincare treatments. It is estimated that around 75% of Latin Americans prefer skincare products that address modern lifestyle-related concerns.

Mexico is emerging as a center for cosmetic treatments, especially for Americans and Canadians. Mexico’s proximity to North America makes it suitable for patients to receive high-quality care at an affordable rate. More than 90 cosmetic products are being regulated in Mexico.

According to the International Society of Aesthetic Plastic Surgery (ISAPS), Brazil performed the second-highest cosmetic surgeries, accounting for 3.3 million surgeries in 2023. It is estimated to have the most plastic surgeons. The Brazilian government, through its National Health Surveillance Agency (ANVISA), regulates cosmetics, personal hygiene products, and perfumes in Brazil.

In March 2024, through a combination of main and secondary investment rounds, Pilgrim was able to successfully raise ₹200 crore. Gagandeep Makker, a co-founder of Pilgrim, commented on the milestone, saying that this investment marks a significant turning point in the company's history. We have developed strong customer loyalty and become a category leader in the beauty industry because of our unrelenting dedication to providing creative, ingredient-driven beauty solutions. We are well-positioned to improve our R&D skills and increase our offline presence with this additional funding.

By Product

By Packaging Type

By Gender

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026