November 2025

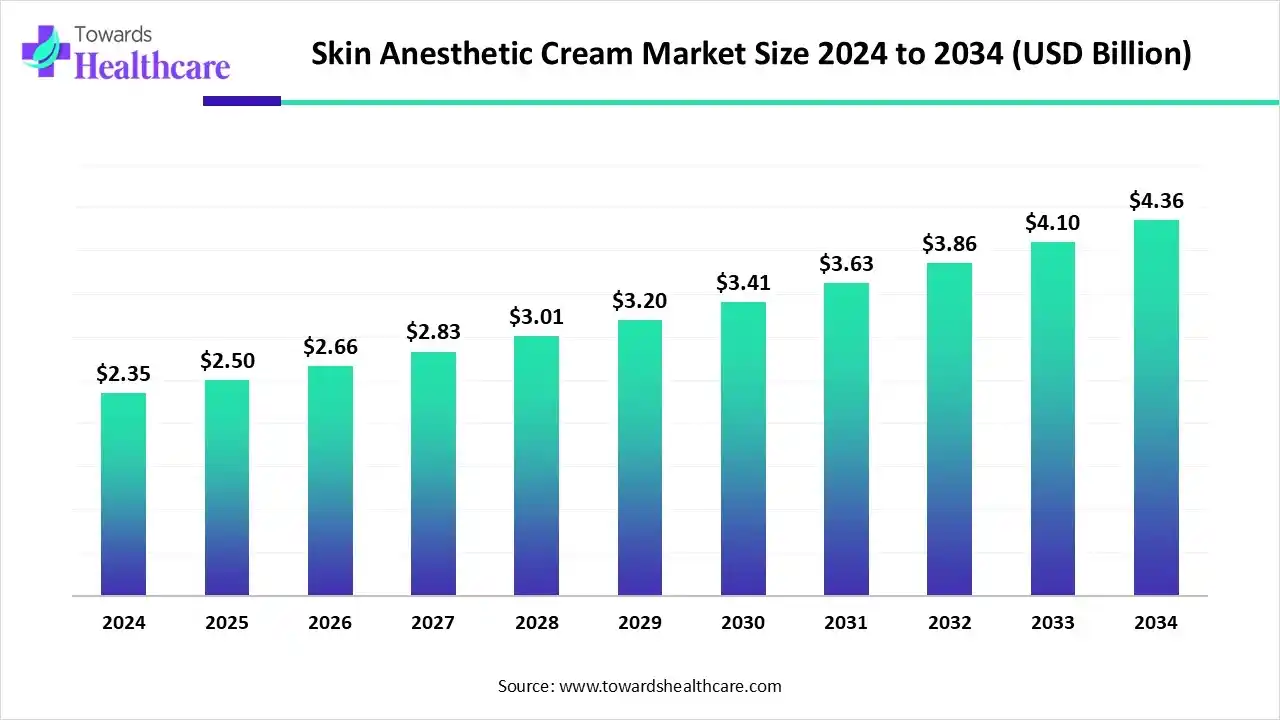

The global skin anesthetic cream market size is calculated at US$ 2.35 billion in 2024, grew to US$ 2.5 billion in 2025, and is projected to reach around US$ 4.36 billion by 2034. The market is expanding at a CAGR of 6.36% between 2025 and 2034.

The growing cosmetic and dermatological procedures are increasing the demand for skin anesthetic creams. For the optimization and personalized treatment development, AI is also being used. Moreover, growing clinics, expanding healthcare, and robust healthcare infrastructures are increasing their use in different regions, where companies are investing and launching new products, promoting market growth.

| Table | Scope |

| Market Size in 2025 | USD 2.5 Billion |

| Projected Market Size in 2034 | USD 4.36 Billion |

| CAGR (2025 - 2034) | 6.36% |

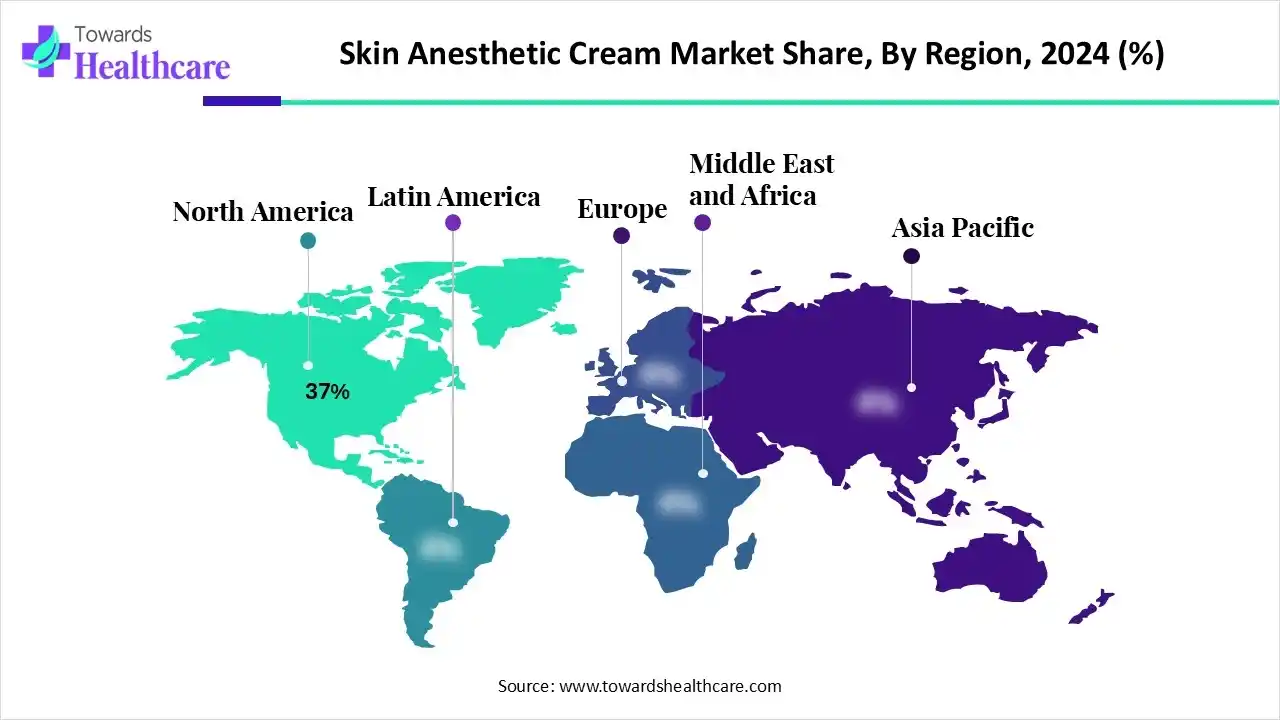

| Leading Region | North America by 37% |

| Market Segmentation | By Product Type, By Application, By Distribution Channel, By End User, By Region |

| Top Key Players | Reckitt Benckiser Group plc, Crown Laboratories, Inc., Glenmark Pharmaceuticals Ltd., Teva Pharmaceutical Industries Ltd., Zydus Lifesciences Ltd., Mylan N.V. (Viatris Inc.), Septodont Healthcare India Pvt. Ltd., Dr. Reddy’s Laboratories Ltd., LidaSkin/TKTX, Church & Dwight Co., Inc., Laboratoires Pierre Fabre, Galderma S.A., Himax Technologies Ltd., Numb Master, Ebanel Laboratories, Inc., Topicaine/Tetracaine Global Brands |

The skin anesthetic cream market is driven by growing advancements in topical anesthetic formulation, the popularity of cosmetic procedures, and a rise in chronic pain. The skin anesthetic cream refers to the topical anesthetic formulations used to numb the skin or mucous membranes before minor surgical, dermatological, cosmetic, or diagnostic procedures. These creams contain active ingredients such as lidocaine, prilocaine, benzocaine, or tetracaine, often in single or combination forms. They are used across medical, cosmetic, and home-care settings to minimize pain, itching, or discomfort during injections, tattooing, laser hair removal, and minor skin treatments.

The use of AI is transforming the cosmetic dermatology field by optimizing the skin aesthetic cream formulation. It is also being used to develop personalized formulations depending on the skin type, sensitivity, and thickness. At the same time, it also predicts the toxic effect and allergic reactions of the formulation, promoting the development of safe anesthetic creams. Moreover, robotics or AI-powered treatment systems are also being developed for various cosmetic surgeries.

For instance,

By product type, the lidocaine-based creams segment held the largest share of approximately 48% in the market in 2024, driven by broad clinical acceptance. At the same time, it was widely used for safety and efficacy. Moreover, their low risk profile increased their use in minor surgeries and laser treatments.

By product type, the combination formulations segment is expected to show the highest growth during the predicted time. Their use is increasing due to their faster onset and stronger anesthetic effect in aesthetic and tattoo procedures. Furthermore, they are providing a longer duration of action with reduced side effects, which is increasing their acceptance rates.

By application type, the aesthetic/cosmetic treatments segment led the market with approximately a 40% share in 2024, due to their rising demand in dermatology clinics and medical spas. They were used for different types of cosmetic procedures, which increased their repeated use. Additionally, their low pain tolerance enhanced their use in clinics.

By application type, the home & OTC pain relief segment is expected to show the fastest growth rate during the predicted time. Their use is increasing due to the growing aging population and their self-use application. At the same time, the increasing availability of regulated non-prescription numbing creams is also contributing to their increased use.

By distribution channel type, the retail pharmacies/drugstores segment held the dominating share of approximately 35% share in the market in 2024, driven by OTC availability and brand recognition. Their availability in various regions increased access to the skin anesthetic creams. Moreover, they also provided guidance to the patients, which enhanced the patient outcomes.

By distribution channel type, the online pharmacies & e-commerce segment is expected to show the highest growth during the upcoming years. These platforms provide a wide range of products along with discounts and home deliveries. This is increasing their use, especially for cosmetic, tattooing, and personal-care applications.

By end user, the dermatology & aesthetic clinics segment led the global skin anesthetic cream market with an approximate 38% share in 2024, due to high procedural volumes. The presence of advanced technologies and skilled personnel ensured the safety and effectiveness while using the creams. Furthermore, the growth in minimally invasive procedures has also increased their use.

By end user, the home consumers/OTC users segment is expected to show the fastest growth rate during the upcoming years. The increasing awareness and preference for pain-free grooming or minor treatments are increasing the use by these consumers. Additionally, their increasing access and non-systemic pain relief creams are also attracting consumers.

North America dominated the skin anesthetic cream market with 37% in 2024, due to the presence of a strong base of dermatology and medspa clinics, which in turn is increasing the use of these creams in various surgical procedures. The growth in awareness also increased their use, along with the growing demand for minimally invasive dermatologic procedures. Moreover, new formulations were also developed by the industries, which contributed to the market growth.

The growing cosmetics and dermatological procedures in the U.S. are driving the market. At the same time, a growing shift towards the use of minimally invasive and pain-free skin treatments is also increasing the demand for these creams. This, in turn, is increasing the development of fast-acting, longer-duration anesthetic creams.

For instance,

Asia Pacific is expected to host the fastest-growing skin anesthetic cream market during the forecast period due to expanding aesthetic treatment centers and the affordability of OTC topical anesthetics. Moreover, increasing aesthetic and cosmetic surgeries, along with growing medical tourism, are also increasing their demand. Therefore, all these factors, along with the growing self-care trends, are promoting the market growth.

The Indian skin anesthetic cream market is experiencing growth due to expanding healthcare, which in turn is increasing the number of clinics, R&D, and adoption of advanced technologies. The growing laser hair removal treatment and microneedling are also increasing their use. Moreover, the companies are also contributing to the development of self-care cream.

For instance,

Europe is expected to grow significantly in the skin anesthetic cream market during the forecast period, due to the presence of a robust healthcare infrastructure. This, in turn, increased the adoption and development of different types of topical anesthetic creams. At the same time, the growing aging population is increasing the use of home care skin anesthetic creams, enhancing the market growth.

The presence of robust industries in the UK is driving the skin anesthetic cream market. At the same time, a growing number of clinics and patient volumes are increasing their demand. Moreover, the presence of stringent regulatory standards ensures the use of safe and effective skin anesthetic cream, enhancing patient outcomes.

For instance,

The R&D of skin anesthetic cream focuses on enhancing formulation and drug delivery systems to achieve better safety profiles, faster onset, and longer duration of action with the use of advanced technologies and natural compounds.

Key Players: AstraZeneca, Novartis AG, Pfizer Inc., Johnson & Johnson, GSK, Galderma S.A., Aspen Pharmaceutical Holdings Limited.

The clinical trial and regulatory approval of the skin aesthetic cream involve the demonstration of the safety, efficacy, and quality of the product.

Key Players: AstraZeneca, AbbVie Inc., Novartis AG, Pfizer Inc., Johnson & Johnson, GSK, Galderma S.A., Cipla.

The formulation of the skin anesthetic cream includes the development of a stable emulsion of active pharmaceutical ingredients with excipients and penetration enhancers, where the final dosage preparation consists of the manufacturing of creams with homogenized consistency, which are packed in tubes with precise dosing guidelines.

Key Players: AstraZeneca, AbbVie Inc., Pfizer Inc., Johnson & Johnson, GSK, Galderma S.A., Aspen Pharmaceutical Holdings Limited.

Information on proper product use, customer service hotlines for addressing user inquiries, safe storage, and potential side effects are provided in the patient support and services for skin anesthetic cream.

Key Players: AstraZeneca, AbbVie Inc., Novartis AG, Pfizer Inc., Johnson & Johnson, Galderma S.A., Aspen Pharmaceutical Holdings Limited.

By Product Type

By Application

By Distribution Channel

By End User

By Region

November 2025

January 2026

November 2025

November 2025