December 2025

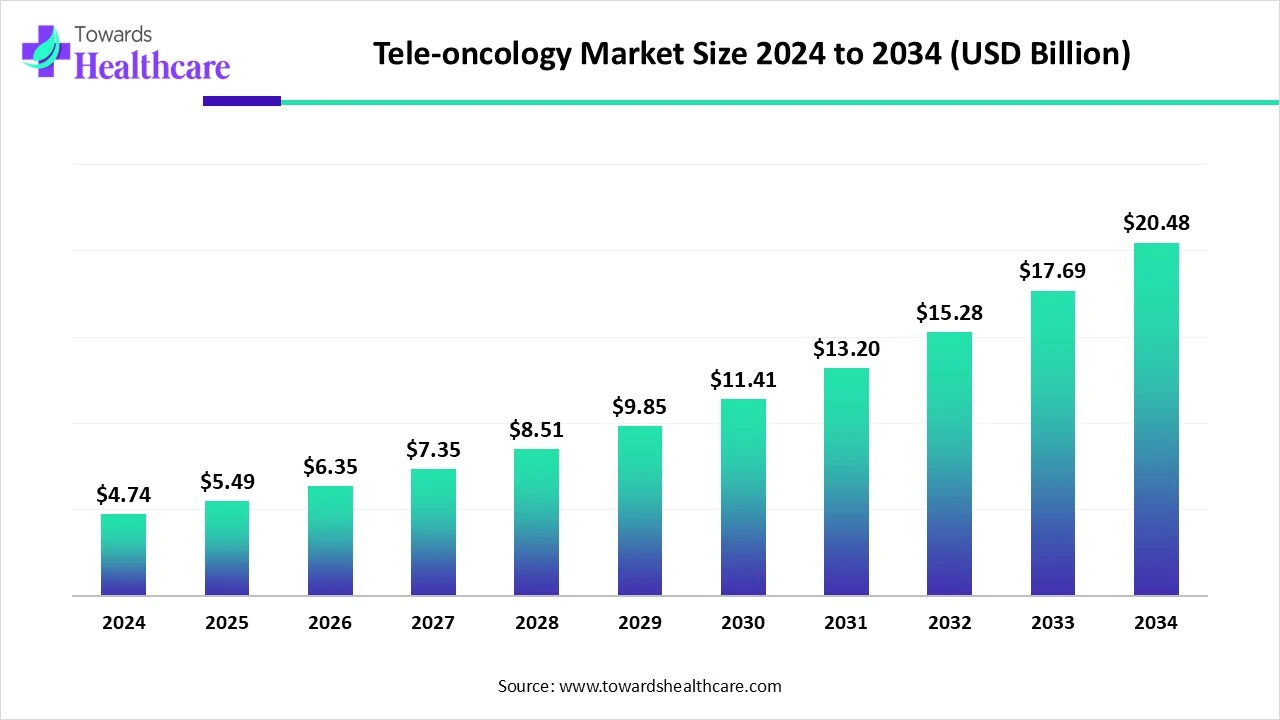

The global tele-oncology market size is calculated at US$ 4.74 in 2024, grew to US$ 5.49 billion in 2025, and is projected to reach around US$ 20.48 billion by 2034. The market is expanding at a CAGR of 15.76% between 2025 and 2034.

Due to ongoing technological advancements in the healthcare sector by different regions like the US, China, Japan, and India are driving the overall development of the global tele-oncology market. As well as enhanced efforts into empowerment of remote patient monitoring technologies and telehealth, are also impacting the utilization of digital technologies in the rising cancer cases. Telepathology and teleradiology are expanding areas in the tele-oncology area, where results are achieved with high-resolution methods. These modifications in oncology are fostering digital transformation across the world in the healthcare sector.

| Table | Scope |

| Market Size in 2025 | USD 5.49 Billion |

| Projected Market Size in 2034 | USD 20.48 Billion |

| CAGR (2025 - 2034) | 15.76% |

| Leading Region | North America |

| Market Segmentation | By Component, By Application, By Cancer Type, By Region |

| Top Key Players | Teladoc Health, Amwell, GE Healthcare, Philips Healthcare, Siemens Healthineers, Roche Diagnostics, McKesson Corporation, IBM Watson Health, BMS, OncoKB, Accenture, HealthTap, Varian Medical Systems, Flatiron Health, Virtual Oncology platforms, Regional teleoncology specialists, AI-powered cancer care startups, Remote diagnostics solution providers, Oncology data analytics firms, Teleimaging technology vendors |

The global tele-oncology market involves the remote delivery of cancer-related healthcare services, such as virtual consultations, remote monitoring, telepathology, and tele-training, leveraging telehealth platforms, software, and hardware to enhance access, efficiency, and continuity of oncology care worldwide. Primarily, in rural areas, various hospitals and NGOs are promoting tele-oncology camps and mobile health units having diagnostic tools with accelerated accessibility. Besides this, tele-oncology initiatives, like the one by the KCDO, are assisting clinical assistants to help oncologists and simplify workflows.

The widespread emergence of the increasing emphasis on patient-centric care and expanding adoption of telemedicine has contributed to the overall market growth.

To expand excellent patient outcomes, particularly in underserved areas where access to specialized oncology care is restricted are widely utilizing AI-powered technologies in cancer care. Moreover, AI-driven tools assist in the analysis of medical images, such as CT scans, MRIs, etc., with improved tumor detection, greater accuracy, and identification of abnormalities. A few examples are increasingly incorporated in the market expansion, including Rology, Intixel, Neuralabs Africa, Massive Bio for radiologists, to enhance diagnosis capabilities with annotating abnormalities in scans, and also automatically drafting reports.

Stepping Towards Healthcare and Telemedicine

The global tele-oncology market is mainly driven by the increasing shift towards healthcare, such as the emergence of value-based care models and patient-centric care. This ultimately supports progressive virtual communication among healthcare professionals and patients with affordable and highly effective approaches. Moreover, patients are widely adopting telemedicine solutions that provide remote consultations, consistent monitoring, and access to specialized care. Along with this, widespread internet penetration and research and development are boosting the expansion of digital therapeutics for cancer care.

Unequal Digital Segregation

Arising challenges in the market are the protection of sensitive patient data, particularly regarding genomic is a major concern, and breaches can lead to serious consequences. Apart from this, unequal distribution of technology and reliable internet connectivity pose a hurdle to tele-oncology adoption in older adults and patients who belong to rural areas.

Ongoing R&D and Integration with Wearable Devices

In 2025-2034, the global tele-oncology market will encompass diverse opportunities for enhancing cancer care, such as continuous R&D approaches. This will assist in the validation of clinical efficacy of tele-oncology technologies, to understand issues regarding data security, and confirm equal access for all demographics. Moreover, the market is emphasizing integration with wearable devices and remote patient monitoring technologies, which makes it feasible to track critical signs and other health parameters. As well as big data analytics and AI will have an immense contribution to the progression of personalized treatment facilities.

In 2024, the software segment captured the biggest revenue share of the global tele-oncology market. Increasing technological advances and the adoption of telemedicine are propelling the broad application of software. Moreover, the inclusion of videoconferencing platforms, mobile applications, and web-based portals facilitates remote consultations, patient monitoring, and access to educational resources, enhancing care accessibility and potentially minimizing treatment burdens. Alongside, certain telemedicine software can be coupled with electronic health records (EHRs), which enables seamless access to patient data and provides more efficient care coordination.

Whereas, the wearable devices segment is predicted to grow rapidly in the predicted timeframe. This segment mainly comprises various smartwatches and fitness trackers, which give consistent monitoring of critical signs, activity levels, and other health data. This data is further employed to achieve personalized treatment plans and identify concerns as soon as possible. As well as these devices also offer remote patient monitoring, minimizing often clinic visits, which fosters advantages for patients with mobility problems or those living in remote areas.

The teleconsultation segment dominated the market in 2024. Primarily, accelerating the need for accessible and affordable care is fueling the adoption of virtual oncology services. This application possesses remote connection among patients and healthcare providers with decreased unnecessary visits. This also further supports in reducing risks and financial stress on the patient. Apart from this, teleconsultation technologies assist tailored, data-driven cancer care, with allowance for rapid response time to complications, and optimize access to specialized care for cancer patients.

On the other hand, the telepathology segment is estimated to show rapid growth. This application has many benefits over in-person pathology, like it is inexpensive, reducing physical traveling, and also allowing remote consultations with enhanced healthcare accessibility. Additionally, they encompass the Zoomify system, in which Whole Slide Imaging is coupled with a Telepathology conferencing Tool. This emerges multiple simultaneous visualizations of the slide in session, becoming a virtual multi-headed microscope.

By cancer type, the breast cancer segment held a major revenue share of the market in 2024. A surge in the adoption of telehealth solutions among the growing instances of breast cancer is driving overall segment expansion. Also, the telehealth segment is experiencing expansion in radiology and oncology, with remote treatment strategies, virtual interactions, and remote supervision of radiation therapy delivery. Ultimately, this resolves geographical hurdles, improves patient convenience, and potentially enhances quality of life.

However, the brain cancer segment will grow at the fastest CAGR during 2025-2034. The presence of multidisciplinary care by tele-neuro-oncology provides comprehensive treatment plans for different specialists together. Moreover, the adoption of telemedicine supports clinical trials to expand the development of novel therapies. The emergence of telemedicine in psychological cases assisted by using services like Cognitive Behavioural Therapy for Insomnia (CBT-I), which plays a major role in psychological challenges related to brain cancer.

In 2024, North America held the biggest revenue share of the market. The COVID-19 pandemic played a crucial role in North America’s market expansion, as it fostered the greater adoption of virtual home healthcare platforms to achieve remote cancer care services in this region. By using remote patient monitoring technologies, it is easy to track patient symptoms and treatment progress in real-time by clinicians. Also, North America is focusing on the high emergence of wearable devices and other sensors in the oncology area.

In the US, a growing prevalence of diverse cancers is a major driver of the respective market growth. Alongside, the expansion of technologies advantages from innovations in AI, big data analytics, and remote monitoring techniques in the US is boosting the diagnosis process, with enhanced treatment strategies, and patient management.

For instance,

In Canada, facilitation of telemedicine in the oncology sector mainly acts as a driver for market development. Whereas, the Ontario Telemedicine Network (OTN) is an eminent example of a large-scale telemedicine network that offers tele-oncology services, with increased connectivity among patients in remote areas with specialists.

For this market,

In the upcoming years, the Asia Pacific will witness the fastest growth in the oncology market due to advancing healthcare infrastructure, mainly in rural and underserved areas. These areas are accelerating the adoption of remote cancer care services. As well as rising disposable incomes are supporting the population to access highly sophisticated healthcare technologies, including wearable devices, etc. Additionally, the ASAP’s expanding medical tourism industry is also contributing to the enhancement of virtual oncology services, as patients looking for specialized cancer care from other countries.

For instance,

Japan’s escalating geriatric population, which is highly prone to cancer, is demanding easy-to-access and convenient healthcare approaches, like telemedicine etc. Moreover, the emerging digital revolution in several areas, such as healthcare, is fueling the broad adoption of telehealth and telemedicine solutions.

China’s vast cancer-based population is driving the demand for robust and accessible telehealth approaches. Whereas, the Chinese government is strongly encouraging the progression of digital health and telemedicine, with enhanced healthcare effectiveness. However, the fastest development of technologies like AI, 5G, and big data is offering advanced and accessible telemedicine services, including tele-oncology.

For instance,

The tele-oncology market in Europe is experiencing significant expansion, with wider adoption of teleconsultation. This further enables the convenience and effectiveness of remote solutions for both patients and healthcare providers in Europe. Alongside, Europe is a key region of investments in digital oncology measures, with the presence of major companies, such as Siemens Healthineers, Owkin, and LetsGetChecked, securing significant funding.

For this market,

The UK’s market widely emphasizes that technological breakthroughs, including AI and big data analytics, are boosting early detection, robust treatment planning, and drug discovery in the oncology domain.

For instance,

Germany has a wide range of focus on the adoption of integrated AI, machine learning, and cloud computing into oncology information systems is revolutionizing data management, analysis, and application in cancer care, resulting in more efficient treatment strategies. Also, this region is fostering the development of personalized cancer care at an affordable price.

By Component

By Application

By Cancer Type

By Region

December 2025

November 2025

November 2025

November 2025