February 2026

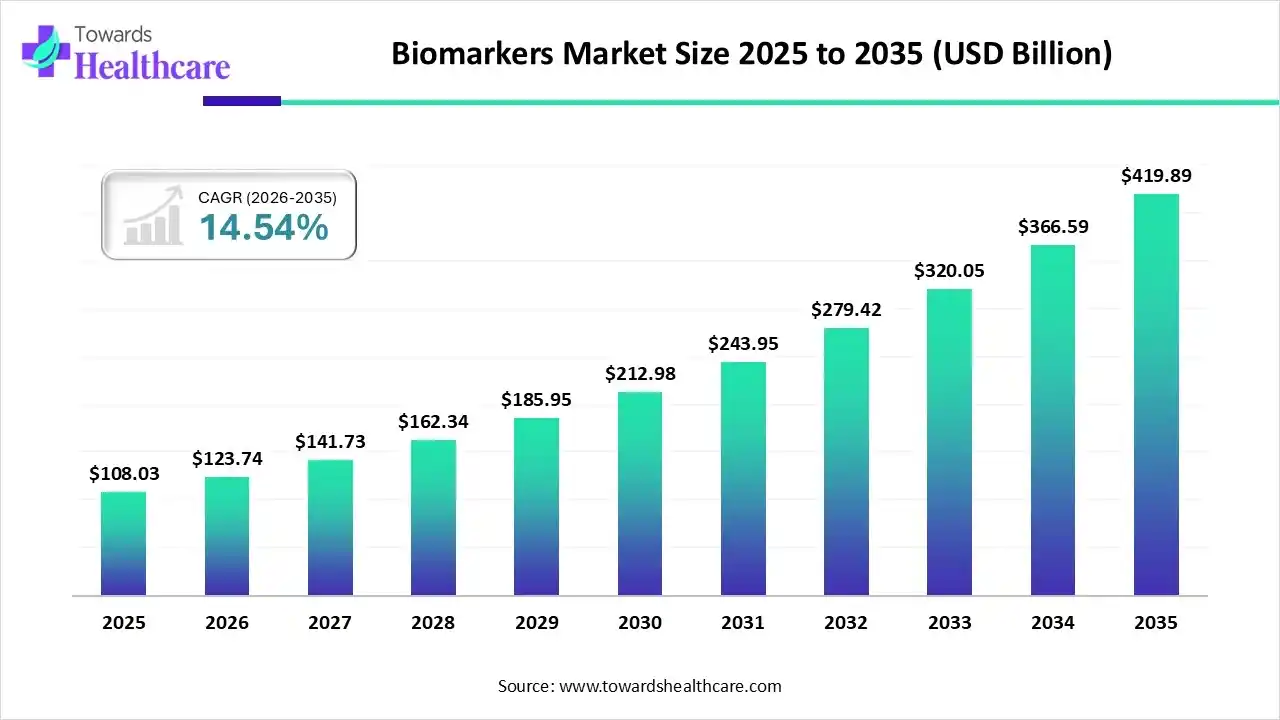

The biomarkers market size to grow from at US$ 123.74 billion in 2026 and is projected to grow to US$ 419.89 billion by 2035, rising at a double digit compound annual growth rate (CAGR) of 14.54% from 2026 to 2035. The rising incidences of chronic disorders, growing research and development, and increasing investments drive the market.

Biomarkers or biological markers are molecules found in blood, body fluids, or tissues that explain what is happening in a cell or organism. They are used to perform clinical assessments and monitor and predict health states in individuals. For instance, high levels of lead in the bloodstream may indicate a need to test for nervous system and cognitive disorders, especially in children. Biomarkers play a crucial role in determining relationships between environmental exposures, human biology, and disease. A biomarker can also act as a diagnostic measure that examines the organ function or other aspects of health when introduced into an organism. Biomarkers can also aid in disease prognosis by providing information about the patient's overall outcome, regardless of any treatment or therapeutic intervention.

The rising incidence and prevalence of chronic disorders potentiates the demand for finding the root cause of the disease and aiding in novel drug discovery and development. The growing research and development boost biomarkers research. The market is also driven by increasing investments from both government and private organizations, and collaborations augment the market.

Artificial intelligence (AI) revolutionizes research and development activities, streamlining the workflow. Biomarkers are an essential part of routine clinical practice, complementing clinical examination and physician expertise to provide accurate disease diagnosis, prediction of complications, personalized treatment guidance, and prognosis. The advent of advanced technologies simplifies the discovery of biomarkers using larger data sets, resulting in improved analysis. Additionally, digital biomarkers offer powerful interpretations of a patient’s digital measurements and correlated medical conditions. Sensors, wearables, and digital platforms are some examples of digital biomarkers that can capture and analyze an array of physiological, behavioral, and environmental data. These measurements are provided by a digital ecosystem that gives people and their healthcare professionals dynamic and individualized health insights. Hence, such advanced technologies can deeply transform healthcare by driving innovations in disease prevention, diagnostics, treatment, and monitoring.

Increasing personalized medications

There is a rise in the demand for the use of personalized medications for various treatments. This, in turn, increases the use of individuals' biomarkers to identify the genetic profile of the patients for their development. At the same time, they are used for the development of targeted therapies. This helps in reducing the side effects and enhances the success rates of the treatment, as well as improves the patient outcomes. Thus, all these advancements drive the biomarkers market growth.

Rising demand for precise diagnostics

As the demand for precise diagnostics is increasing, biomarkers are being used to detect diseases. They also deliver molecular-level insights, which enhance the early diagnosis of diseases. They can also differentiate between the types of diseases effectively. At the same time, they are being used in the development of non-invasive diagnostics. Moreover, further complications can also be detected with the use of the biomarkers. Thus, their use in the development of point-of-care diagnostics for home testing is also increasing. Hence, this is promoting the biomarker market growth.

For instance,

Disease Heterogeneity and Complexity Hinder the Biomarkers Market

The major challenge of the market is disease heterogeneity. A biomarker may be specific to certain types of disease and even within the same type of disease, but it can vary between patients. This limits the clinical applications of biomarkers. Another major challenge is the disease complexity. Biomarkers may not give a complete understanding of the disease due to the full complexity of the disease.

| Key Elements | Scope |

| Market Size in 2026 | USD 123.74 Billion |

| Projected Market Size in 2035 | USD 419.89 Billion |

| CAGR (2026 - 2035) | 14.54% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Type, By Disease, By Application, By Region |

| Top Key Players | Abbott, Alto Neuroscience, Inc., Hanmi Pharmaceutical, Hoffmann-La Roche Ltd., Johnson & Johnson, Labcorp Biopharma, MEDiC Life Sciences, Qiagen, Regeneron, Sanofi, Siemens Healthineers, Thermo Fisher Scientific |

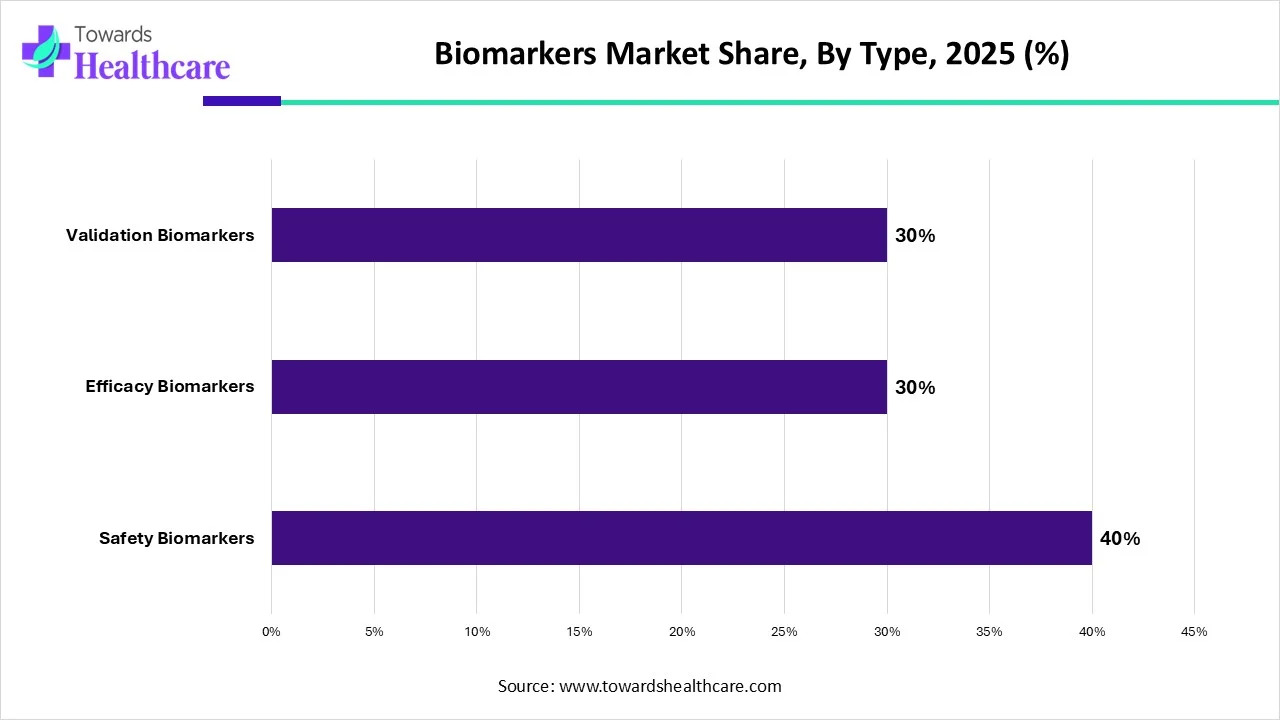

How Safety Biomarkers Segment Dominated the Biomarkers Market in 2025?

By type, the safety biomarkers segment led the global biomarkers market by 40% in 2025. A safety biomarker indicates the possibility, existence, or degree of toxicity as an unfavorable impact that is tested either before or after exposure to a medicinal product or environmental contaminant. The demand is attributed to their implementation in early clinical trials, which plays a key role in decision-making and facilitates the progression of promising therapeutics from preclinical to clinical development.

The efficacy biomarkers segment is expected to grow at the fastest rate in the market during the forecast period. Efficacy biomarkers are indicators of a drug’s therapeutic effects. They refer to early events in disease progression, toxic changes, or pharmacological events.

What Made Cancer the Dominant Segment in the Biomarkers Market in 2025?

By disease, the cancer segment held a dominant presence in the biomarkers market by 45% in 2025. The rising incidences of cancer, cancer complexity, rapid mutations, and demand for personalized medicines augment the segment’s growth. Biomarkers can help in cancer diagnosis, prognosis, or likelihood of disease recurrence independent of treatment.

The neurological diseases segment is anticipated to grow at a significant CAGR in the market during the studied years. The rising geriatric population and increasing incidence and prevalence of neurological disorders like Alzheimer’s disease and Parkinson’s disease drive the segment growth.

| Segment | Share 2025 (%) |

| Drug Discovery & Development | 50% |

| Personalized Medicines | 20% |

| Diagnostics | 20% |

| Others | 10% |

Why Did the Drug Discovery & Development Segment Dominate in the Biomarkers Market in 2025?

By application, the drug discovery & development segment registered its dominance over the global biomarkers market by 50% in 2025. Since biomarkers give a deeper understanding of the disease pathway, they assist in novel drug discovery and development. The increasing awareness and investments & collaborations promote the segment’s growth.

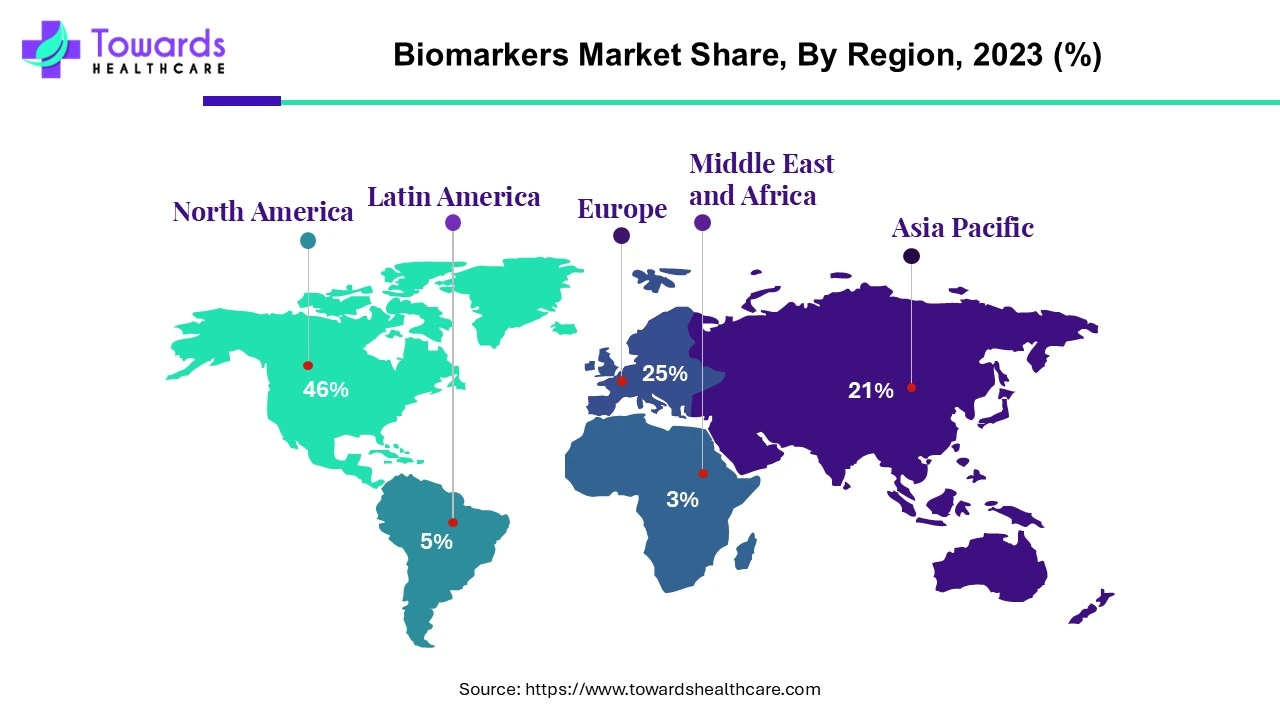

North America held the largest share of the biomarkers market by 46% in 2025. State-of-the-art research and development, favorable government policies, rising incidences of chronic disorders, and the presence of key players drive the market. The US FDA encourages the integration of biomarkers in medical product development and approval, thereby helping to speed the development of promising new therapeutics. The Canadian Health Measures Survey (CHMS) is an ongoing national human biomonitoring survey led by Statistics Canada in collaboration with Health Canada and the Public Health Agency of Canada. The market is also driven by novel drug discovery research in the region.

Asia-Pacific is projected to host the fastest-growing biomarkers market in the coming years. The rising incidence and prevalence of chronic disorders, growing research and development, and increasing investments & collaborations drive the market. The rising incidence of cancer and immunological and neurological disorders potentiates the demand for biomarkers in disease diagnosis and novel drug discovery. It is estimated that China has more than 15 million people over 60 years old living with dementia. India reported 8.8 million cases of dementia in people 60 years or older. At the same time, Japan accounted for approximately 3.9 million cases in 2023. The huge demand for biomarkers research is due to the increasing geriatric population, rapid urbanization, and changing demographics in the region.

Europe is considered to be a significantly growing area in the biomarker market because of the increase in personalized medicine, the presence of major research institutions and companies such as Abbott, Thermo Fisher Scientific, F. Hoffmann-La Roche, and QIAGEN, and the development of innovative technologies like next-generation sequencing, leading to more accurate and less invasive detection methods. This region boasts numerous well-known research institutes and major players in the biomarker industry by encouraging collaborations and innovation.

The Middle East and Africa are expected to grow significantly in the Biomarkers market during the forecast period. The Middle East and Africa are facing a growth in chronic diseases, which in turn is increasing the demand for effective diagnostic and treatment approaches. This increases the demand for biomarkers for their development. Moreover, the growing research and development for the development of personalized medications is also increasing their use. Additionally, the growing government screening programs and campaigns are increasing the awareness among the population, increasing the demand for biomarker-based diagnostics and treatments. Thus, this is promoting the market growth.

Explore further to see how top leaders are reshaping the Biomakers Market at: https://www.towardshealthcare.com/companies/biomarkers-companies

In January 2025, the fourth quarter (Q4) of 2024, reports were released by Sanofi. There was a rise in the net income, which was reported to be €880m ($916m). €1.06bn was noted to be the company's income before joint ventures, tax, and associates. €1.18bn was achieved as operating income, indicating growth, while €7.84bn was the reported gross profit. €2.25bn were the R&D expenses. Moreover, the net sale was noted to be €10.56bn, which indicated growth.

In October 2024, financial results for the third quarter of 2024 were announced by Regeneron Pharmaceuticals, Inc. The revenues showed a growth of 11% to $3.72 billion. The global net sale of Dupixent® was 23% to $3.82 billion, and for Libtayo® were 24% to $289 million, which reflected overall growth. Whereas, the U.S. net sales for EYLEA HD® and EYLEA® increased by 3%. Moreover, the GAAP diluted EPS and non-GAAP diluted EPS(a) increased by 30% to $11.54 and 8% to $12.46, respectively.

Rinol Alaj, Senior Director of Digital Health Technologies at Regeneron, commented that many companies are working independently on building digital biomarkers. Hence, the company organized the Digital Biomarkers Summit in May 2024, which could be a terrific opportunity to bring the industry together and create a mechanism of collaboration to help accelerate overall digital biomarker adoption. He also explained that researching digital biomarkers requires change management, innovative thinking/frameworks, and novel ways of problem-solving.

In January 2024, Angel Alberich-Bayarri, Co-Founder and CEO of Quibim, announced its collaboration with Merck KGaA, Darmstadt, Germany, to develop the next generation of precision medicine technology targeting a wide range of cancers. Also commented on the partnership that the partnership is poised to be a game-changer in the field of oncology by utilizing their innovative imaging-based methodologies.

By Type

By Disease

By Application

By Region

February 2026

February 2026

February 2026

February 2026