January 2026

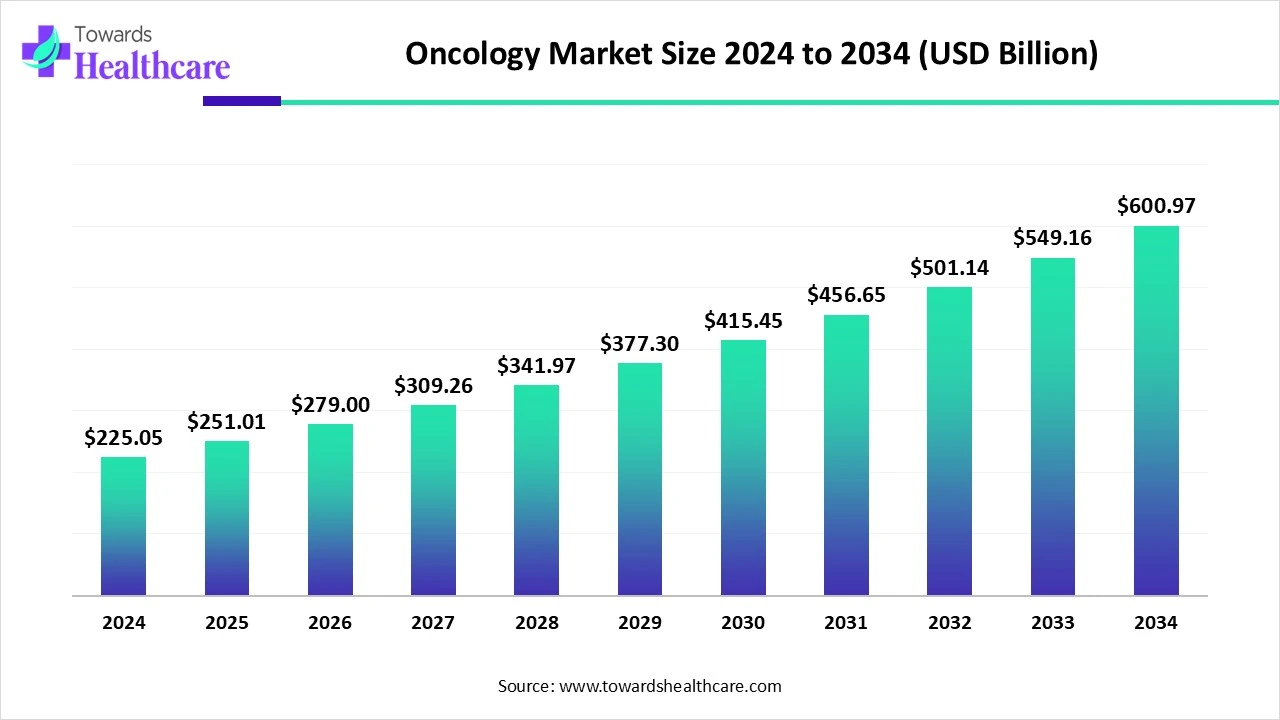

The global oncology market size is calculated at US$ 279.98 billion in 2026, grew to US$ 251.01 billion in 2025, and is projected to reach around US$ 748.17 billion by 2035. The market is expanding at a CAGR of 11.54% between 2026 and 2035.

The growing occurrences of different types of cancer globally are increasing reliance on diagnostic, treatment, and supportive care solutions. The companies are also developing and launching various such approaches. They are also collaborating and investing to enhance cancer care. With the use of AI, the accuracy and effectiveness of the diagnostic and treatment approaches are being improved. Thus, all these developments, along with the government support, are increasing their use and utilization in various regions. This, in turn, is promoting the market growth.

| Metric | Details |

| Market Size in 2026 | USD 279.98 Billion |

| Projected Market Size in 2035 | USD 748.17 Billion |

| CAGR (2026 - 2035) | 11.54% |

| Leading Region | North America share by 43% |

| Market Segmentation | By Therapy Type, By Cancer Type, By Modality, By End User, By Technology, By Region |

| Top Key Players | Roche Holding AG (Genentech), Merck & Co., Inc., Bristol-Myers Squibb (BMS), Pfizer Inc., Novartis AG, AstraZeneca plc, Johnson & Johnson (Janssen Oncology), Amgen Inc., Gilead Sciences (incl. Kite Pharma), Eli Lilly and Company, Sanofi, Takeda Oncology, BeiGene, Ltd., Seagen Inc. (Pfizer), AbbVie Inc., Daiichi Sankyo Company, Limited, Regeneron Pharmaceuticals, Illumina, Inc. (Oncology Diagnostics), F. Hoffmann-La Roche (Foundation Medicine), GE HealthCare / Siemens Healthineers (Oncology Imaging Solutions) |

The oncology market encompasses diagnostics, treatments, and supportive care solutions for cancer prevention, detection, management, and treatment. It encompasses pharmaceuticals (chemotherapy, immunotherapy, targeted therapy, hormonal therapy), radiation therapy, surgical oncology, and diagnostic tools such as imaging, tumor markers, and biopsy technologies. The market is expanding due to the global rise in cancer incidence, advancements in personalized and precision medicine, early detection technologies, and the growing pipeline of novel immunotherapies and companion diagnostics. Moreover, various innovative technologies are being researched for clinical trials.

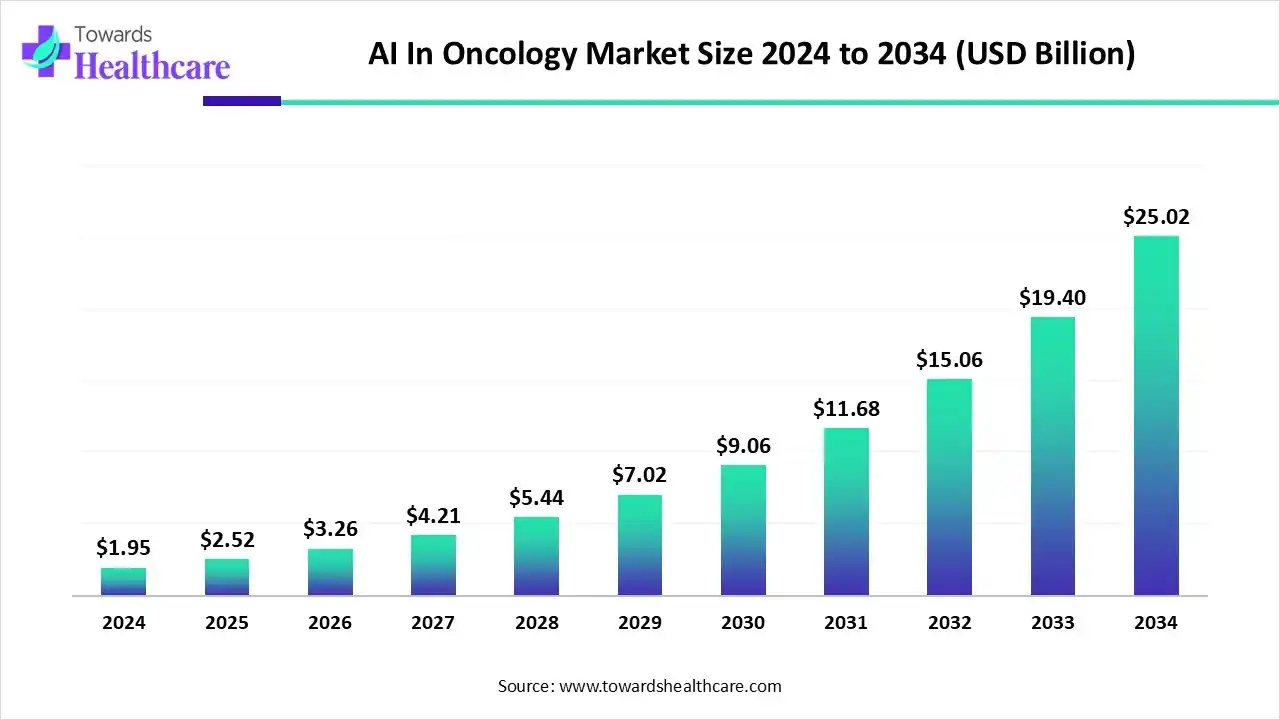

The use of AI in oncology for proteomics, imaging modalities (CT, MRI, PET, ultrasound), genomics, histopathology, etc, is increasing. The high-accuracy clinical decisions can be provided by AI. With the use of AI algorithms, the diagnosis is being improved as it enhances the precision, speed, and reproducibility. It also helps in the discovery of novel therapeutic targets, personalized treatment planning, robot-assisted surgeries, and radiation dosing. Real-time remote monitoring, detection of complications, and treatment adherence can be achieved with the virtual and wearables assistants powered by AI.

The global AI in oncology market size is estimated at US$ 1.95 billion in 2024 and is projected to grow to US$ 2.52 billion in 2025, reaching around US$ 25.02 billion by 2034. The market is projected to expand at a CAGR of 29.36% between 2025 and 2034.

The AI in oncology market refers to the integration of artificial intelligence technologies, such as machine learning, deep learning, and natural language processing, into the field of oncology. These technologies are utilized to enhance various aspects of cancer care, including early detection, diagnosis, treatment planning, and personalized therapy. AI applications in oncology aim to improve clinical outcomes, reduce human error, and optimize healthcare resources by analyzing complex medical data, such as medical imaging, genomic data, and electronic health records.

Increasing Cancer Incidence

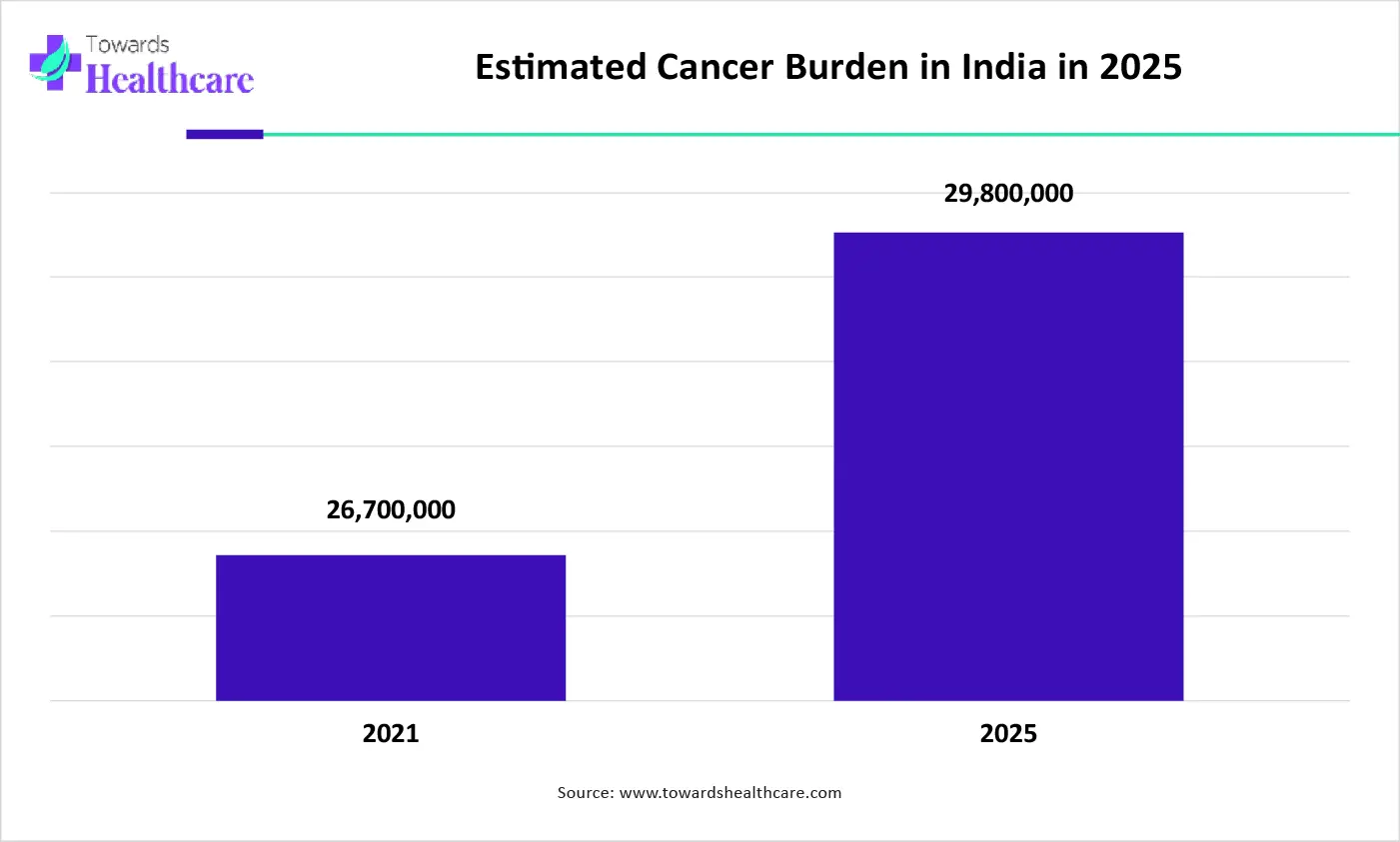

There is a rise in the occurrence of cancer, which in turn is increasing the demand for early diagnosis and effective treatment approaches. At the same time, growing awareness and changing lifestyles are also contributing to the same. This, in turn, is increasing the research and development to formulate new drugs, biosimilars, or diagnostic tools. Additionally, various screening programs are also being conducted. Moreover, the development of new therapies is also increasing. Thus, all these developments are driving the oncology market growth.

The graph represents the estimated cancer burden in India for 2025. It indicates that there will be a rise in cancer cases. Hence, it increases the demand for new diagnostic, treatment, and supportive care options for its effective management. Thus, this in turn will ultimately promote the market growth.

High Cost and Complex Development Procedures

The cost associated with the treatment is high, which decreases the patient acceptance rates. The presence of improper reimbursement policies also reduces their use. Their development process is complicated, which makes it time-consuming and delays the clinical trials. Furthermore, the limited infrastructure also affects their development.

Growing Use of Precision Medications

The demand for the use of precision medicines is increasing as they provide target-specific action. They can target the genetic mutations as well as the molecular pathways of the cancer cells. Moreover, with the use of advanced diagnostic tools, the biomarkers can be identified, which are then used in the development of these medications. Thus, various precision medications are being developed to treat complex cancer cases, as they reduce the cancer complications and enhance the effectiveness. Thus, this promotes the oncology market growth.

For instance,

By therapy type, the pharmacological/drug-based therapy segment led the market with approximately 68% share in 2024. They were used in different stages of cancer. Their non-invasive approach increased patient compliance. Moreover, the presence of a wide range of options increased their use, contributing to the market growth.

In the pharmacological/drug-based therapy segment, the immunotherapy (ICIs, CAR-T) sub-segment is expected to show the fastest growth rate at a notable CAGR during the predicted time. They are being used in the treatment of different types of cancer. They are also used in complex cancer cases. This is advancing their new innovations as well.

By cancer type, the breast cancer segment held the largest share of approximately 15% share in the market in 2024. There was a rise in the cases of breast cancer. This increased the early diagnosis as well as the demand for effective treatment options. Furthermore, various screening programs were also conducted.

By cancer type, the liver cancer segment is expected to show the fastest growth rate during the upcoming years. Due to changing lifestyles, the occurrences of liver cancer are increasing. This is driving the demand for its diagnostic and treatment approaches. Thus, new drugs are being developed and launched to meet these rising demands.

By modality type, the therapeutic oncology segment led the market with approximately 72% share in 2024. They are used in the treatment of a wide range of cancer types. They were also used in combination therapies. This, in turn, increased their research and development. Thus, this enhanced the market growth.

By modality type, the diagnostic oncology segment is expected to show the highest growth during the forthcoming years. For early and accurate detection, the demand for diagnostic solutions is increasing. Thus, various next-generation diagnostic approaches are being developed.

In the diagnostic oncology segment, the liquid biopsy subsegment is the fastest-growing. Its use is increasing as it effectively detects cancer in early stages. Its non-invasive method is increasing the adoption rates. It is also useful in the development of drugs and the detection of their responses.

By end user, the hospitals & cancer institutes segment held the largest share of approximately 60% in the global market in 2024. A wide range of diagnostic, treatment, and supportive care approaches was provided by them. Moreover, different types of cancer patients were effectively treated. This enhanced the patient outcomes.

By end user, the specialty oncology clinics segment is expected to show the highest growth during the upcoming years. They consist of advanced infrastructure and expertise. The use of advanced therapies and affordable treatment approaches is attracting patients. Moreover, their supportive care and faster scheduling are also contributing to the same.

By technology type, the monoclonal antibodies & targeted biologics segment held the dominating share of approximately 36% in the market in 2024. They show targeted action, which reduces the chances of side effects. They were also combined with other therapies to treat different types of cancers. This promoted the market growth.

By technology type, the immune checkpoint inhibitors (PD-1/PD-L1, CTLA-4) segment is expected to show the fastest growth rate during the predicted time. They show long-term response with targeted action. This decreases their side effects and increases their use. This, in turn, is increasing their production rates.

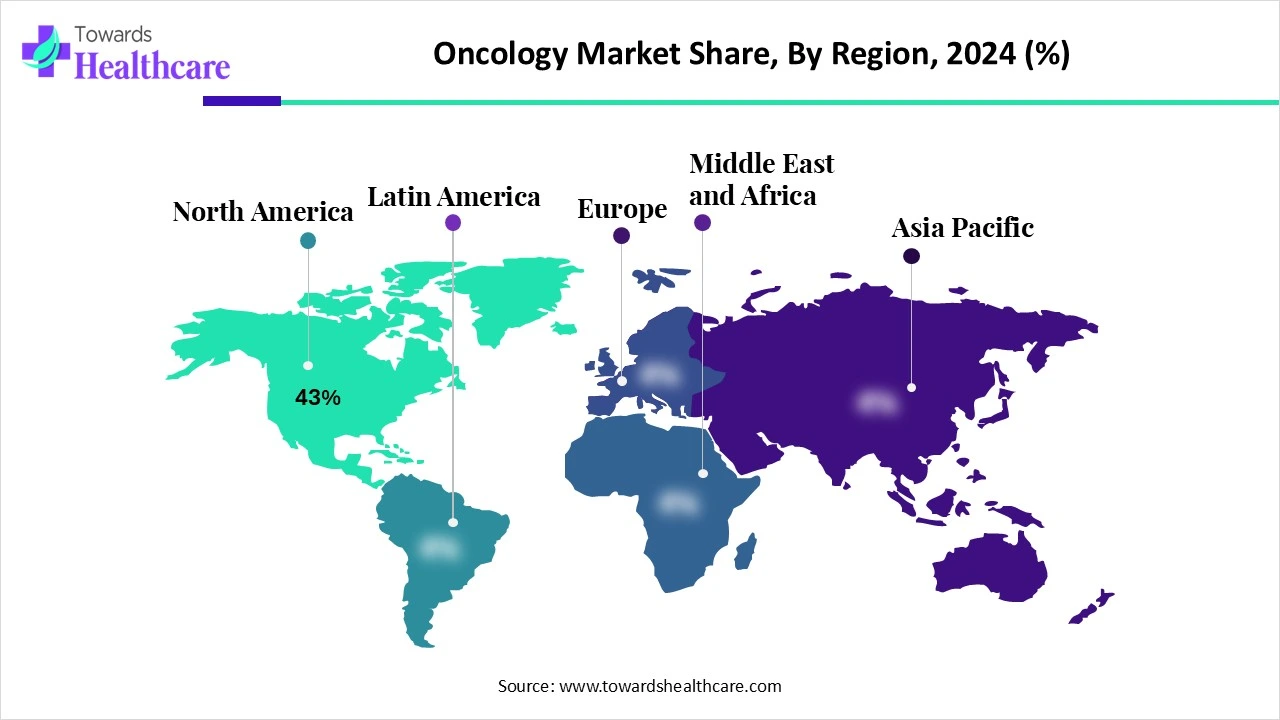

North America dominated the oncology market share by 43% in 2024. North America consisted of a well-developed healthcare sector, which heavily invested in cancer diagnostic and treatment approaches. Moreover, the growing R&D also enhanced their development. Thus, this promoted the market growth.

The U.S. Oncology Market Trends

The U.S. oncology market size is calculated at US$ 72.79 billion in 2024, grew to US$ 81.34 billion in 2025, and is projected to reach around US$ 211.78 billion by 2034. The market is expanding at a CAGR of 11.75% between 2025 and 2034.

The healthcare sector of the U.S is advanced, leveraging various cancer diagnostic and treatment approaches. Moreover, it is significantly investing in the development of advanced therapies and precision medicines. Additionally, the presence of advanced technologies is accelerating these developments.

The Canada Oncology Market Trends

The growing research and development in Canada are increasing the cancer drug pipeline. At the same time, the industries are adopting new technologies to enhance the diagnostic and treatment strategies. Furthermore, the fast-track approval is enhancing their launches.

Asia Pacific is expected to host the fastest-growing oncology market during the forecast period. The presence of a large population in the Asia Pacific is increasing the risk of cancer. This, in turn, is increasing the use of various cancer diagnostics, treatment, and support care options. Thus, this enhances the market growth.

The China Oncology Market Trends

The cancer burden in China is increasing due to the presence of a large population. Thus, to tackle this rise, new diagnostic tools and methods are being developed by the industries for their early and accurate detection. Additionally, regulatory support is also being provided to accelerate their approval.

The India Oncology Market Trends

To deal with the growing cancer cases in India, the healthcare sector infrastructure investments are increasing. This is establishing new diagnostic, surgical centers, and labs. The industries are also enhancing innovations. Moreover, various initiatives are also being introduced by the government.

Europe is expected to grow significantly in the oncology market during the forecast period. The demand for the use of therapies for the treatment of cancer is increasing in Europe. Additionally, the new targeted therapies are also being researched. This is promoting the market growth.

The Germany Oncology Market Trends

The incidence of various types of cancer is increasing in Germany. This, in turn, is increasing the use of immunotherapies along with other targeted therapies. The demand for the use of precision medications is also increasing. Thus, their growing demand is increasing their production.

The UK Oncology Market Trends

The growing research and development in the UK is increasing the clinical trials as well. Moreover, new collaborations among the companies are also being formed to enhance their drug development. They are also focusing on the development of new biosimilars. Furthermore, funding and investments are also being provided by the government.

Latin America is considered to be a significantly growing area, due to the increasing prevalence of cancer and the growing awareness of screening and early diagnosis. Government bodies launch initiatives to support the development of novel products for managing cancer and train individuals. Countries like Argentina, Brazil, Chile, Mexico, and Peru have more than 5 active medical oncology fellowship programs, encouraging more oncologists.

The Brazil Oncology Market Trends

Brazil reported approximately 17,010 new cancer cases in 2023. As cervical cancer is the third-leading cause of morbidity among Brazilian women, the Brazilian government offers free access to cervical cancer screening. According to a recent survey, 67.1% of vaccinated Brazilian women underwent a screening test for cervical cancer. In addition, ANVISA, a Brazilian regulatory authority, approved 68 novel oncology drugs from 2008 to 2023.

The Middle East & Africa are expected to grow at a notable CAGR in the foreseeable future. The burgeoning healthcare sector, increasing R&D investments, and favorable government support drive the market. The increasing collaboration among key players helps access advanced technologies and develop proprietary products. The region also has a suitable clinical trial infrastructure, allowing global researchers to test and launch their products for the local population.

The UAE Oncology Market Trends

The UAE government is at the forefront of managing cancer patients. It fully covers the cost of cancer treatments, including oncology medications for the UAE nationals. Its Vision 2031 initiative aims to build a resilient oncology ecosystem that reduces mortality, optimizes patient outcomes, and establishes a regional standard for equitable, high-quality cancer care.

Some of the government initiatives for oncology include:

| Medicine Name | Core Benefits | Net Sales (USD millions, 2024) |

| Entresto | Oral medicine for heart failure and hypertension | 7,822 |

| Cosentyx | Injectable treatment for inflammatory and immune conditions | 6,141 |

| Kesimpta | Injectable treatment for relapsing multiple sclerosis | 3,224 |

| Kisqali | Oral treatment for a type of breast cancer | 3,033 |

| Promacta / Revolade | Oral treatment for certain blood disorders | 2,216 |

| Tafinlar + Mekinist | Oral combination targeted therapy for a certain type of cancer | 2,058 |

| Jakavi | Oral treatment for certain rare blood disorders | 1,936 |

| Tasigna | Oral treatment for a type of chronic myeloid leukemia | 1,671 |

| Xolair* | Injectable medicine for certain respiratory and immunological conditions (severe asthma) | 1,643 |

| Ilaris | Injectable medicine for certain rare autoinflammatory disorders | 1,509 |

By Therapy Type

By Cancer Type

By Modality

By End User

By Technology

By Region

January 2026

January 2026

January 2026

January 2026