January 2026

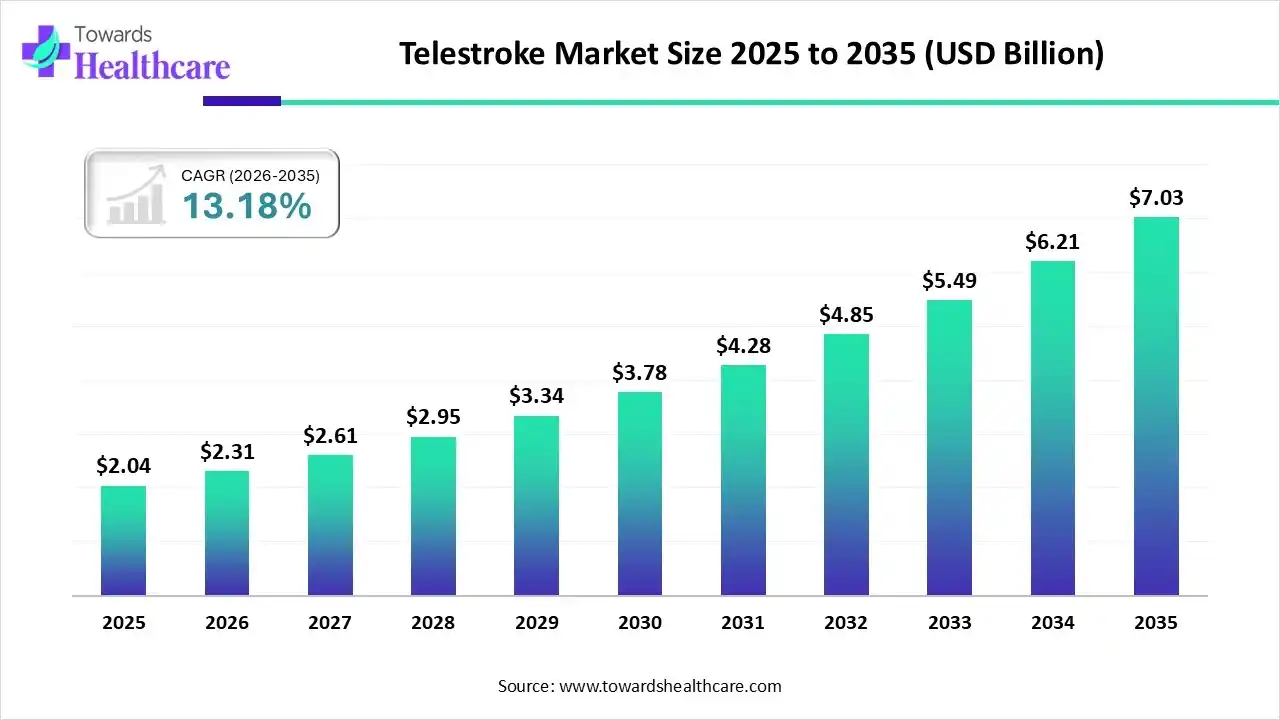

The global telestroke market size was estimated at USD 2.04 billion in 2025 and is predicted to increase from USD 2.31 billion in 2026 to approximately USD 7.03 billion by 2035, expanding at a CAGR of 13.18% from 2026 to 2035.

The telestroke market is primarily driven by the growing need for remote monitoring and increasing awareness of telemedicine. Emerging nations and rural areas witness the expansion of telemedicine infrastructure with advances in internet connectivity, thereby allowing access to specialized experts. Government bodies also support the implementation of telestroke tools in healthcare organizations, serving a larger patient population. The increasing integration of artificial intelligence (AI) improves the diagnosis, treatment, and rehabilitation of stroke.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.31 Billion |

| Projected Market Size in 2035 | USD 7.03 Billion |

| CAGR (2026 - 2035) | 13.18% |

| Leading Region | North America |

| Market Segmentation | By Component/Product Type, By Services Model, By Stroke Type, By Application, By Deployment Mode, By Region |

| Top Key Players | Sevaro Health, Amwell, Eagle Telemedicine, Brainomix, Boehringer Ingelheim, Medtronic, Teladoc Health, ScienceSoft, Blue Sky Telehealth |

Telestroke (also called stroke telemedicine) is the delivery of acute stroke care and related neurology services using real-time telecommunications technology. It connects on-site clinicians at hospitals, emergency departments, or stroke units with remote stroke specialists to enable rapid assessment, imaging review, diagnosis, treatment decisions (including thrombolysis and thrombectomy triage), and follow-up. Telestroke programs combine secure video consultation, PACS/imaging sharing, clinical documentation, and workflow orchestration.

AI plays a vital role in streamlining the diagnosis, treatment, and rehabilitation of stroke, thereby providing personalized care. Natural language processing (NLP) simplifies conversation between patients and chatbots, enabling automatic identification and extraction of information. AI-based sensors detect minor changes in patients, providing real-time updates to healthcare providers. AI and machine learning (ML) algorithms hold immense potential in automating prognosis and calculating precise outcomes. Additionally, AI and ML can help healthcare professionals interpret patient data, suggesting appropriate treatment.

Telestroke aims to provide timely and life-saving care to remote patients. Providers can connect with patients living in rural and underserved areas through a well-established telestroke infrastructure.

Government organizations launch initiatives to integrate telestroke networks into national healthcare strategies, providing quality healthcare to everyone. Initiatives also help recognize the role of telestroke in reducing stroke-related mortality and disability.

AI is increasingly used in telemedicine to improve diagnosis, treatment, and workflow efficiencies in stroke care, leading to better patient outcomes and reduced healthcare costs.

Virtual Reality

Virtual reality is embedded with telestroke to improve neurological evaluations, provide better rehabilitation, and train individuals for enhanced and personalized care.

Blockchain Technology

Blockchain technology is being explored for secure data sharing within telestroke networks, ensuring rapid and private access to critical patient information.

Which Component/Product Type Segment Dominated the Telestroke Market?

The software platforms & telemedicine systems segment held a dominant position in the market in 2025, with a revenue of 46%, due to the growing need for remote care and the integration of advanced technologies. Software platforms enable healthcare providers to communicate and manage care remotely, eliminating the need for patients to visit any healthcare organization. They help patients schedule appointments and request video consultations. Numerous companies develop custom software based on providers’ and patients’ needs.

Imaging & Diagnostics Integration Tools

The imaging & diagnostics integration tools segment is expected to grow at the fastest CAGR in the telestroke market during the forecast period. Advanced imaging tools, such as CT scans and MRI, are used to detect stroke early. AI-based imaging techniques help detect minor changes that are difficult to interpret by humans. Picture Archiving and Communication System (PACS) can store huge amounts of diagnostic reports that are accessible from anywhere.

Why Did the Hub-and-Spoke Telestroke Networks Segment Dominate the Telestroke Market?

The hub-and-spoke telestroke networks segment held the largest revenue share of the market in 2025, with a revenue of 52% due to the increasing demand for remote patient care. Hub-and-spoke telestroke networks connect regional hospitals to a central, advanced stroke center via telemedicine. This serves a larger patient population and reduces the time and costs for patients to visit urban areas for stroke care. These networks delay time-sensitive clinical decision-making and processes.

Managed Telestroke Services

The managed telestroke services segment is expected to grow with the highest CAGR in the telestroke market during the studied years. Managed or outsourced telestroke services refer to contracting an external, specialized provider group to deliver remote neurological expertise. These services connect originating sites (like local hospitals and ambulances) with distant, expert telestroke centers.

How the Ischemic Stroke Management Segment Dominated the Telestroke Market?

The ischemic stroke management segment contributed the biggest revenue share of 72% of the market in 2025, due to the high prevalence of ischemic strokes. Ischemic strokes account for over 80% of all stroke types, leading to permanent brain damage and death. Telestroke approaches are used to identify the need for thrombolysis in patients and the delivery of DTN. They help providers to diagnose stroke through video conferencing and administer ischemic stroke treatments, such as clot-busting medication.

Hemorrhagic Stroke Management

The hemorrhagic stroke management segment is expected to expand rapidly in the telestroke market in the coming years. Hemorrhagic stroke accounts for approximately 15-20% of all stroke types and is comparatively more severe than ischemic stroke. It occurs when a blood vessel in the brain ruptures and bleeds. Hemorrhagic stroke management includes immediate stabilization of vital signs and controlling blood pressure. Telestroke aids in clinical decision-making for accurate treatment and improves post-stroke disability outcomes.

Which Application Segment Led the Telestroke Market?

The acute stroke assessment segment led the market in 2025, with a revenue of 48%, due to the increasing integration of advanced diagnostic tools and the incorporation of electronic medical records (EMRs). Telestroke enables precise assessment of the severity of strokes and suitable treatment planning. Stroke specialists can perform a neurological examination through video conferencing, which includes assessing symptoms, doing neurological tests, and reviewing imaging results.

Rehabilitation & Tele-Recovery

The rehabilitation & tele-recovery segment is expected to witness the fastest growth in the telestroke market over the forecast period. Telerehabilitation provides rehabilitation services to stroke survivors, including movement, cognitive, speech, and language. AI-based sensors are used to track body motion during movement-based therapies. Virtual reality (VR)-based technologies have been found to have better outcomes than traditional rehabilitation for stroke patients.

What Made Cloud-based the Dominant Segment in the Telestroke Market?

The cloud-based segment accounted for the highest revenue share of 55% of the market in 2025, due to the need for high scalability and flexibility. Cloud-based tools enable healthcare professionals and patients to access medical data from anywhere and at any time. They eliminate the need for a specialized infrastructure to install hardware, saving upfront costs. Additionally, there are no capital expenses, data can be backed up regularly, and companies only have to pay for the resources they use.

On-Premise

The on-premise segment is expected to show the fastest growth in the telestroke market over the forecast period. On-premise tools offer complete control over the data and help maintain confidentiality. They are not operated on the internet, reducing the risk of data security breaches. On-premise applications are reliable, secure, and allow enterprises to maintain a level of control. They allow healthcare staff to support and manage potential issues that may arise.

| Total Patients Served | 432 million |

| Providers Onboarded | 230,130 |

| Spokes (Secondary Hospitals) Operationalized | 136,562 |

| Hubs (Specialty Hospitals) Established | 18,176 |

| Specialties | 151 |

| Investment | Rs 105.9 crore (as of November 2025) |

North America dominated the market with a revenue of 34% in 2025. The presence of a robust healthcare infrastructure, growing demand for telemedicine, and favorable regulatory support are major factors that influence market growth in North America. The presence of key players and rising investments is driving the market. The increasing need for personalized care and the rising adoption of advanced technologies propel market growth. Telestroke has become an integral part of acute stroke care delivery in North America, especially in rural and underserved areas.

The U.S. is home to several key players, including Devaro, Eagle Telemedicine, and Access TeleCare, that provide advanced telestroke services. The Centers for Disease Control and Prevention (CDC) reported that telemedicine use increased from 15.4% in 2019 to 86.5% in 2021. Favorable reimbursement policies also encourage people to use telehealth. The Centers for Medicare & Medicaid Services (CMS) is a government body that covers telemedicine for Americans.

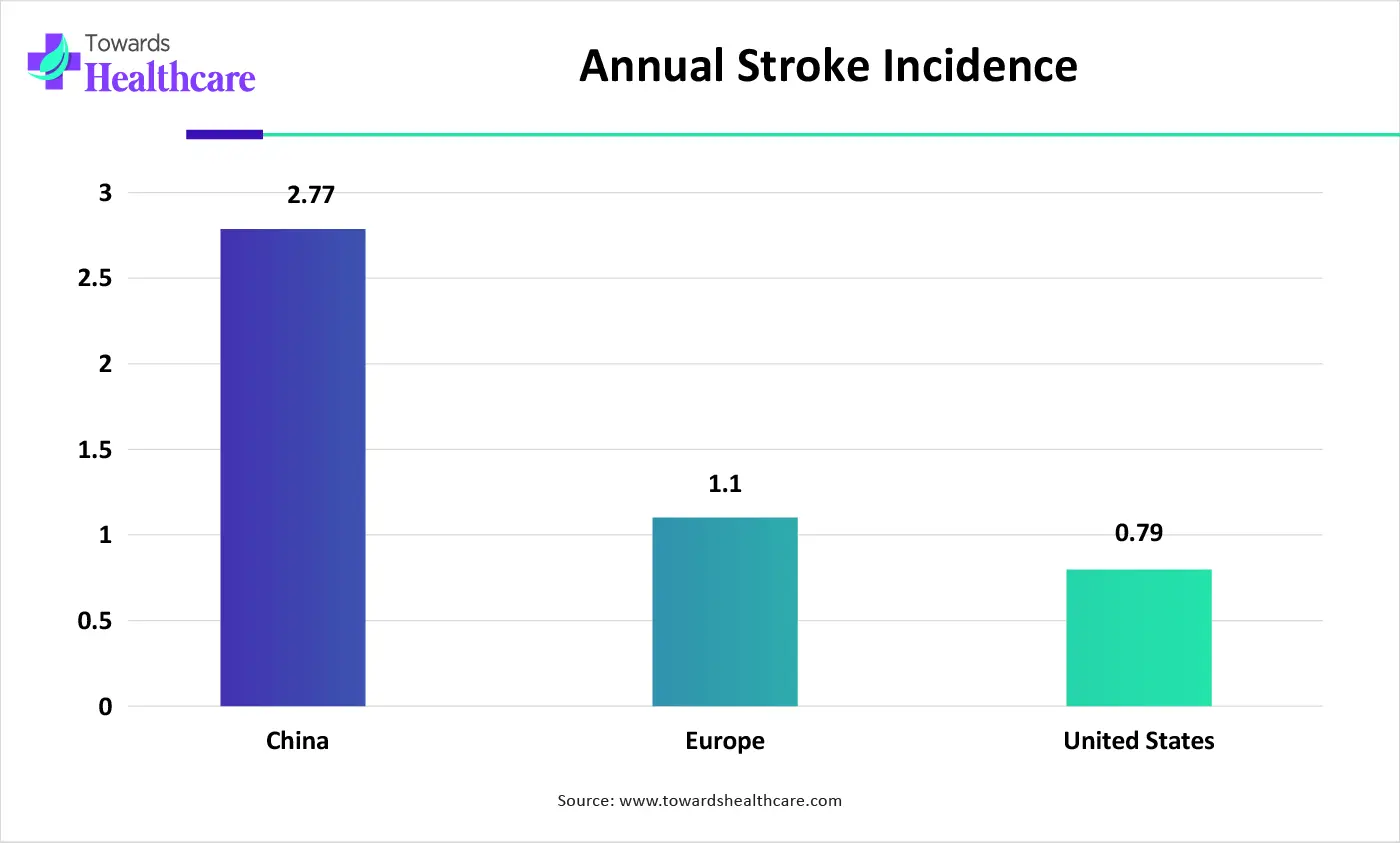

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The rising prevalence of stroke, the growing geriatric population, and the burgeoning healthcare sector boost the market. Government organizations launch initiatives to encourage the general public to screen for and diagnose stroke. People are becoming aware of telemedicine, driven by government initiatives, smartphone adoption, and rising disposable incomes.

China reports the highest number of stroke cases in the world annually, potentiating the need for advanced stroke care. A recent multicenter observational study in Western China found that the proportion of intravenous thrombolysis increased to 7.4% in the post-telestroke phase, and the mean door-to-needle (DTN) time also reduced to 52.66 min. Thus, telestroke is widely used in China during and after the COVID-19 pandemic.

Europe is expected to grow at a notable CAGR in the foreseeable future. The increasing public-private partnerships, collaborations, and mergers & acquisitions promote the development and use of telestroke in Europe. The European Stroke Organization (ESO)’s Telestroke Committee established a 2020-2025 action plan to strengthen and expand telestroke services across the continent. Favorable government support and the growing need for telemedicine bolster market growth. Government bodies make constant efforts to support the implementation of AI in healthcare.

The UK has approximately 1.4 million stroke survivors. It is estimated that over 100,000 people suffer from stroke annually in the UK. Telestroke services are at an initial stage in the UK; however, continuous advancements are promoting telestroke use. The East of England Stroke Telemedicine Partnership, a part of the UK National Health Service England (NHSE), has built an application to deliver remote, expert stroke care.

| Companies | Headquarters | Offerings | Revenue (2025) |

| Sevaro Health | New Jersey, United States | It offers telestroke services and acute neurology coverage with 45-second access to neurologists. | - |

| Amwell | Massachusetts, United States | The telestroke program helps overcome access barriers and drive operational efficiencies for optimal stroke care delivery. | $254.4 million |

| Eagle Telemedicine | Georgia, United States | It offers a top-notch telestroke services program that makes even remote hospitals a center for quality neurological care. | - |

| Brainomix | England, United Kingdom | The Brainomix 360 stroke platform provides AI-enabled decision support for stroke assessment. | - |

| Boehringer Ingelheim | Germany, Europe | It launches telestroke initiatives to connect hospitals with stroke experts, offering immediate specialist care in underserved areas. | EUR 26,796 million |

| Medtronic | Dublin, Ireland | It provides a full range of products and solutions for stroke intervention, post-stroke monitoring, and symptom support. | $32.4 billion |

| Teladoc Health | New York, United States | Its industry-leading telestroke solution can increase care speed for time-critical stroke patients. | $2.57 billion |

| ScienceSoft | Texas, United States | It offers custom telestroke software with tailored functionalities and workflows to initiate real-time remote monitoring, diagnosis, and treatment planning. | - |

| RUSH University System for Health | Illinois, United States | RUSH Telestroke network provides access to 24/7 vascular neurology services for ischemic stroke patients. | $3.65 billion |

| Blue Sky Telehealth | Colorado, United States | The telestroke/emergent neuro program enables physicians to observe and interact with patients to make accurate and timely stroke diagnoses. | - |

By Component/Product Type

By Services Model

By Stroke Type

By Application

By Deployment Mode

By Region

January 2026

January 2026

January 2026

January 2026