January 2026

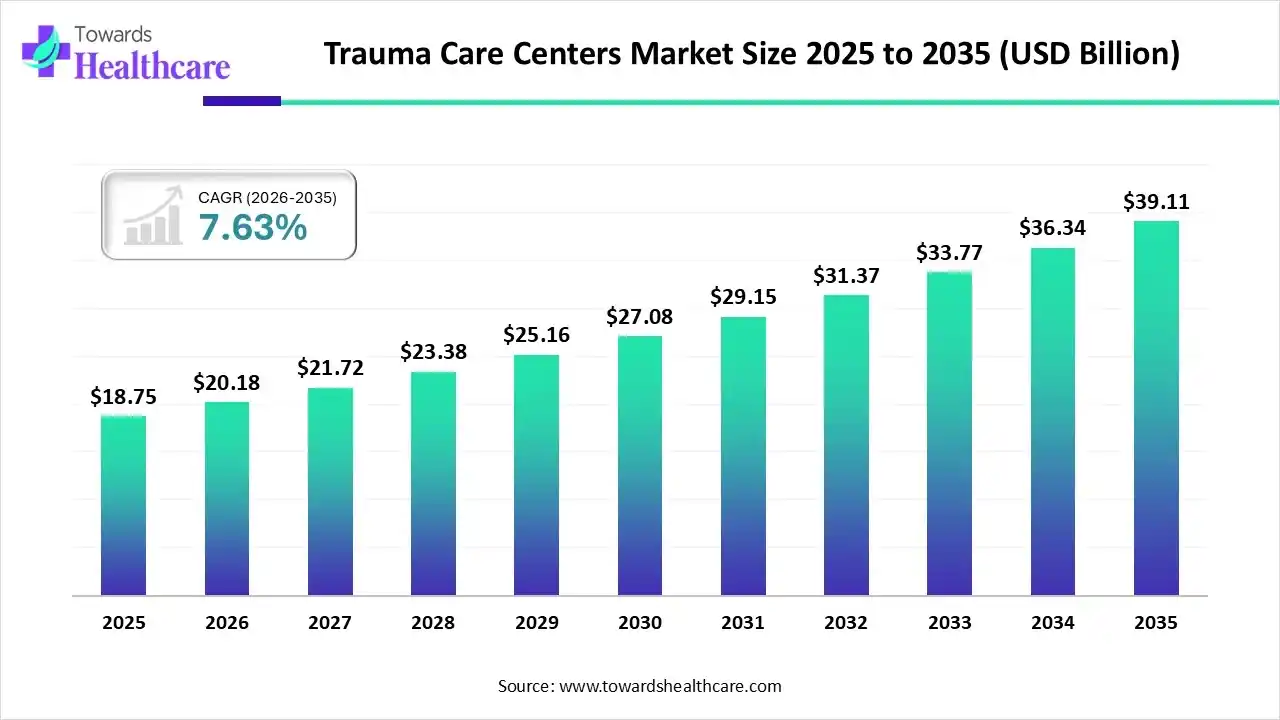

The global trauma care centers market size was estimated at USD 18.75 billion in 2025 and is predicted to increase from USD 20.18 billion in 2026 to approximately USD 39.11 billion by 2035, expanding at a CAGR of 7.63% from 2026 to 2035.

The Government of India introduced the national program for prevention and management of trauma and burn injuries, which is ideal to reduce mortality and morbidity due to accidents. The technological innovations like robotics, AI, and telemedicine services are driving the trauma care centers market. Furthermore, public-private partnerships, global data collaboration, and advanced technology integration are the emerging trends in trauma care.

| Key Elements | Scope |

| Market Size in 2026 | USD 20.18 Billion |

| Projected Market Size in 2035 | USD 39.11 Billion |

| CAGR (2026 - 2035) | 7.63% |

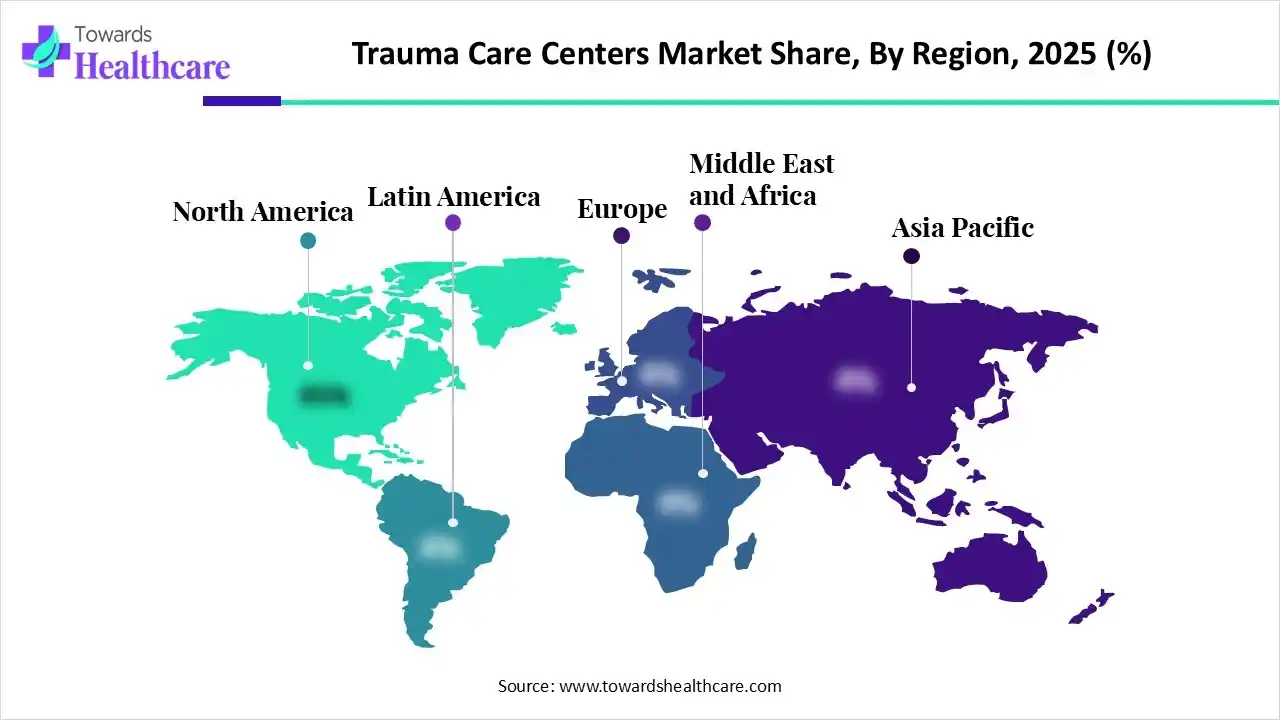

| Leading Region | North America |

| Market Segmentation | By Facility Type, By Trauma Type, By Service Type, By Region |

| Top Key Players | Banner Health, Ascension Health, Northwell Health, Commonspirit Health, Johns Hopkins Hospital, Cleveland Clinic, Mayo Clinic, HCA Healthcare, Inc., Community Health Systems, Inc., Tenet Healthcare Corporation |

The trauma care centers pay immediate attention to patients needing urgent surgical intervention, accident survivors, and polytrauma cases. They hold a good reputation due to their collaborative environment across various departments such as neurosurgery, anaesthesiology, surgery, orthopaedics, and critical care. These departments are dedicated to delivering holistic treatment for complex injuries, further expanding the trauma care centers market. These centers engage in research, education, and foster skill development in areas like trauma and emergency medicine. Some of the specific services provided by them are integrated ICU care for surgical support, monitoring, and resuscitation. They stay in coordination with the blood bank and laboratory services to rapidly deliver blood products.

AI is advantageous in clinical practice in traumatic orthopedics, where it improves practical ability, enables early diagnosis and personalized treatment, reduces training costs, and supports clinical decision-making. AI improves the efficiency and accuracy of injury surveillance systems by automating manual tasks. AI models strengthen decisions of early trauma care for seriously injured patients, driving the trauma care centers market.

How does the in-House Segment Dominate the Trauma Care Centers Market in 2025?

The in-house segment dominated the market in 2025, owing to the immediate availability of expertise, detailed diagnostics, and immediate surgical intervention offered by in-house facilities. The in-house rehabilitation services and intensive care are crucial to save patients’ lives. A specialty coverage is provided to address complex injuries, orthopedic surgery, neurosurgery, plastic surgery, and critical care.

The standalone facility type segment is expected to grow at the fastest CAGR in the trauma care centers market during the forecast period due to its importance in emergency intervention, community access, and initial assessment. This facility serves as the first point of contact for trauma patients, providing them with immediate emergency care. It is well-equipped to perform immediate surgical interventions for severe health conditions.

What made Falls the Dominant Segment in the Trauma Care Centers Market in 2025?

The falls segment dominated the market in 2025, owing to its primary form of traumatic injury managed by trauma care centers. The management and intervention for fall victims include immediate care, diagnosis and definitive treatment, rehabilitation, and long-term recovery. The medical care addresses psychosocial effects and focuses on injury prevention and public health.

The traffic-related injuries segment is estimated to grow at ta notable rate in the trauma care centers market during the predicted timeframe due to its prominent role in trauma care centers. They influence resources, medical care, and patient outcomes within these centers. The majority of admissions in trauma care centers in many regions are due to polytrauma cases.

How did the Outpatient Segment Dominate the Trauma Care Centers Market in 2025?

The outpatient segment dominated the market in 2025, owing to the major role of outpatient services in follow-up care, monitoring, rehabilitation services, and mental and behavioral health support. These services are important in care coordination, case management, preventive care, and education. They bring cost-effective solutions and manage resources efficiently.

The inpatient segment is anticipated to grow at the fastest rate in the trauma care centers market during the upcoming period due to the potential impact of inpatient services in continuous monitoring, intensive care, surgical and specialty interventions, and patient and family support. These services focus on education, research, and quality improvement. They are expanding due to multidisciplinary team coordination.

North America dominated the market in 2025 owing to improved emergency medical services systems, an aging population, and continuous advancements in medical technology. The Trauma Center Association of America prioritizes advocacy, operations, finance, and education. In March 2024, the HHS Administration for Strategic Preparedness & Response (ASPR) introduced specific budget proposals to fund the National Disaster Medical System (NDMS) at $65.9 million. The North American trauma care centers market is majorly driven by the ongoing government support, smaller-scale initiatives, current regional networks, and technological advancements across this region. In January 2025, Trump announced the private sector investment of $500 billion in AI infrastructure.

The Centers for Medicare & Medicaid Services (CMS) launched the $50 billion Rural Health Transformation Program, aiming to make rural America healthy again, promote sustainable access, boost workforce development, and drive innovative care and tech innovation. Additionally, the World Health Organization (WHO) launched a health emergency appeal of US$1.5 billion to tackle the global health crisis.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period, driven by rising awareness and demand for quality care. In February 2025, Nepal strengthened emergency care systems through the World Health Organization (WHO) 's global emergency and trauma care initiative. Recently, on World Trauma Day in October 2025, JP Nadda, the Health Minister, reaffirmed his commitment to strengthening trauma care, further encouraging growth in the trauma care centers market in this region. The Trauma Centre at the Institute of Medical Sciences (IMS), Banaras Hindu University, was honored with a global award for advancing in digital health innovation. In January 2024, the Asian Development Bank (ADB) signed an agreement of 1.5 billion Indian rupees for Cygnus Medicare Private Limited to promote affordable healthcare in India.

In March 2024, Nitin Gadkari, the Ministry of Road Transport and Highways in Chandigarh, announced a nationwide cashless treatment scheme for road accident victims. Prashanthi Balamandira Trust, a non-profit organization in Karnataka, launched India’s largest social stock exchange issue with INR 18 Crore SSE to fund and support emergency care near Bengaluru.

Europe is expected to grow at a notable rate in the market in 2025. This regional growth is attributed to the innovative surgical techniques, demand for specialized care, and focus on quality improvement. EU-funded projects support mental health assistance for displaced Ukrainians and vulnerable groups across Europe, where EU-funded modular clinics benefit 50,000 Ukrainians. In March 2025, the World Health Organization (WHO) reported a new health investment platform to improve primary healthcare. The European Investment Bank stated that this platform holds the potential to fill the health financing gap and drive sustainable investments.

France planned to co-host with the African Union and Gavi to boost sustainable immunization and innovation for equitable health by 2030. France is moving towards flexible financing and innovative health solutions, surging the expansion of the trauma care centers market across European countries. France holds a strong presence of WHO collaborative centers, which share a vision for health for all.

| Sr. No. | Name of the Company | Headquarters | Latest Update |

| 1 | Banner Health | Phoenix, Arizona, U.S. | In February 2025, Banner Health Community Hospital, situated in Torrington, was recognized for its outstanding trauma care. |

| 2 | Ascension Health | St. Louis, Missouri, U.S. | In October 2025, Ascension Sacred Heart celebrated trauma survivors due to the level I impact of the trauma center. |

| 3 | Northwell Health | New Hyde Park, New York, U.S. | In June 2025, Northwell Health attracted 400 registrants at the East and raised over $170,000. |

| 4 | Commonspirit Health | Chicago, Illinois, U.S. | In October 2025, CommonSpirit Health announced a new initiative to address mounting headwinds, lagging finances. |

| 5 | Johns Hopkins Hospital | Baltimore, Maryland, U.S. | In October 2024, Johns Hopkins All Children’s Hospital was honored with first rank in Florida. |

| 6 | Cleveland Clinic | Cleveland, Ohio | In December 2025, a new survey of Cleveland Clinic patients suggested the high prevalence and under-addressed impact of trauma in chronic pain care. |

| 7 | Mayo Clinic | Rochester, Minnesota, U.S. | In March 2025, the Mayo Clinic Trauma and Acute Care Surgery Symposium was organized in Texas, U.S. |

| 8 | HCA Healthcare, Inc. | Nashville, Tennessee, U.S. |

In October 2025, Michael Cuffe, MD, MBA, Executive Vice President. The CEO of HCA Healthcare Inc. reported that the company holds an expensive healthcare network. |

| 9 | Community Health Systems, Inc. | Franklin, Tennessee, U.S. | Community Health Systems, Inc. is leading in 36 distinct markets across 14 states and is one of the major healthcare providers in the nation. |

| 10 | Tenet Healthcare Corporation | Dallas, Texas, U.S. | In July 2025, Tenet Healthcare Corporation raised its guidance for the year 2025 by $400 million based on its outlook on Q2 overperformance. |

The R&D process in trauma care centers involves problem identification and topic selection, evidence synthesis and research design, development and innovation, implementation and testing, and dissemination and continuous improvement.

Key Players: Stryker Corporation, Smith & Nephew, Zimmer Biomet, Medtronic, and Integra LifeSciences.

The major strategies for distribution include the use of specialized distributors, enhanced supply chain resilience, adoption of lean inventory management, the use of technology and automation, ensuring regulatory compliance, boosting collaboration, and investing in human resources.

Key Players: McKesson Corporation, Cardinal Health, Cencora, Owens & Minor, Medline Industries, Zimmer Biomet, Johnson & Johnson, and Medtronic plc.

These services include emergency medical services, stabilization, intensive and acute care, surgical and diagnostic capabilities, rehabilitation services, psychological and social support, and pain management.

Key Players: Stryker, Medtronic, IQVIA, Cleveland Clinic, and Mayo Clinic.

By Facility Type

By Trauma Type

By Service Type

By Region

North America

South America

Europe

Asia Pacific

MEA

January 2026

December 2025

December 2025

December 2025