January 2026

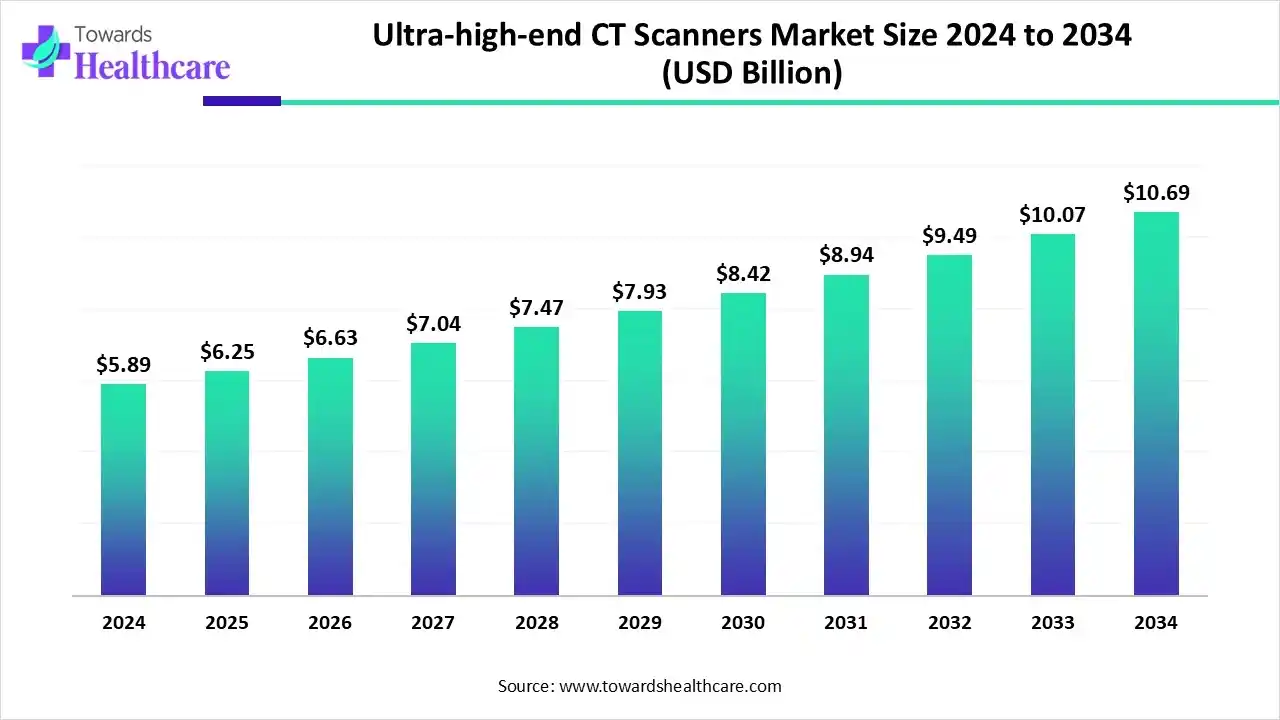

The global ultra-high-end CT scanners market size is calculated at US$ 5.89 billion in 2024, grew to US$ 6.25 billion in 2025, and is projected to reach around US$ 10.69 billion by 2034. The market is expanding at a CAGR of 6.16% between 2025 and 2034.

The growing disease burden globally is increasing the demand for early and accurate diagnosis, which is increasing the adoption of ultra-high-end CT scanners. To improve its features and applications, AI is being used where companies are collaborating and launching advanced scanners. At the same time, the advanced hospitals, expanding healthcare, and robust reimbursement polices are encouraging their use across various regions, promoting the market growth.

| Table | Scope |

| Market Size in 2025 | USD 6.25 Billion |

| Projected Market Size in 2034 | USD 10.69 Billion |

| CAGR (2025 - 2034) | 6.16% |

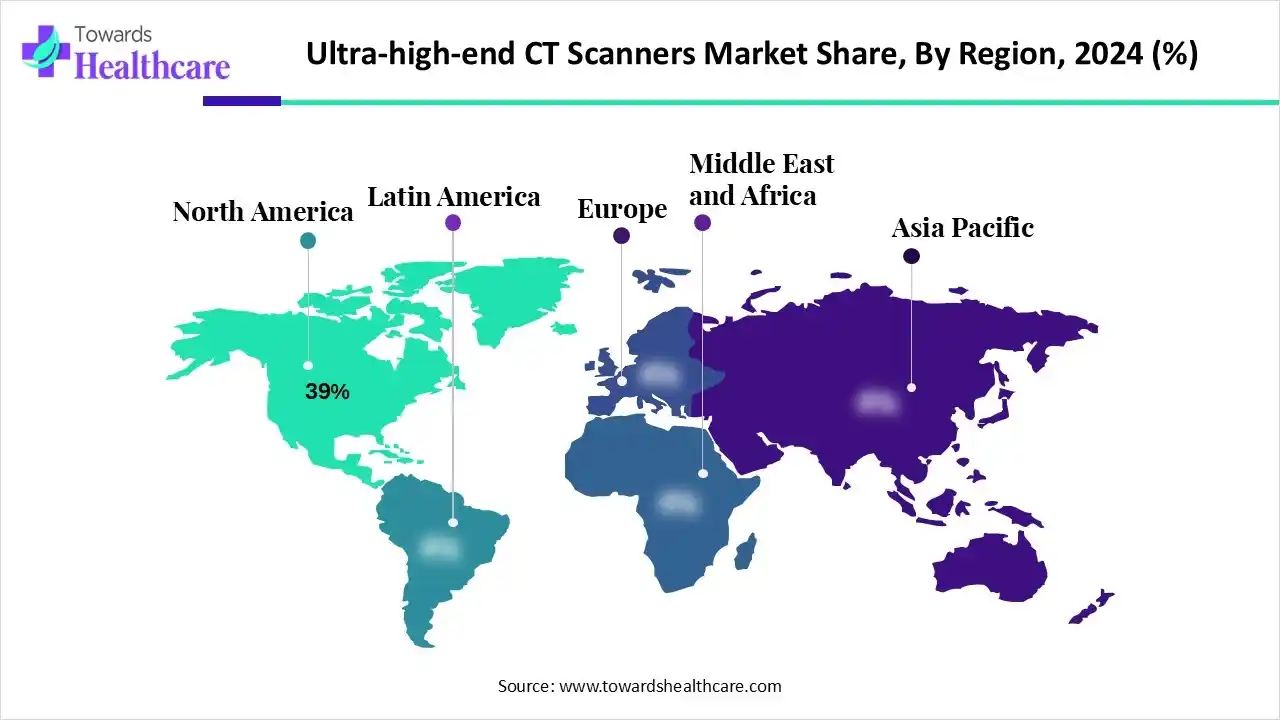

| Leading Region | North America by 39% |

| Market Segmentation | By Technology Type, By Application, By Detector Type, By End User, By Region |

| Top Key Players | Fujifilm Holdings Corporation, Neusoft Medical Systems Co., Ltd., Samsung Medison Co., Ltd., Hitachi Healthcare (Fujifilm Group), Mindray Medical International Ltd., Carestream Health Inc., Medtronic plc, Agfa-Gevaert N.V., Esaote S.p.A., Shimadzu Corporation, Konica Minolta Healthcare Americas, Inc., Planmed Oy, CurveBeam AI Ltd., Micro-X Ltd., Analogic Corporation |

The ultra-high-end CT scanners market is driven by growing technological innovations like dual energy capabilities, artificial intelligence (AI) integration, and photo counting detectors. The ultra-high-end CT scanners encompass the development, production, and commercialization of premium computed tomography (CT) systems offering ultra-fast imaging speeds, high spatial resolution, and advanced spectral or photon-counting capabilities. These systems (typically ≥256-slice and dual-source or spectral detectors) enable ultra-precise cardiac imaging, whole-organ perfusion, oncology staging, neurovascular assessment, and trauma diagnosis.

The use of AI in the ultra-high-end CT scanners market is increasing as it is being used to enhance the image quality. It also helps in the radiation dose adjustments while maintaining the diagnostic quality. At the same time, it is also increasing the accuracy in the treatment planning as it helps in automated disease detection and measurement of tumor size, which is increasing its use in cancer and cardiovascular disease identification. Moreover, it is also enhancing the workflow efficiency.

For instance,

Growing technological innovations: To enhance the imaging resolution and speed of scanning, companies are innovating various platforms, which is driving the ultra-high-end CT scanners market growth. Moreover, they are also enhancing the application of the CT scanners. This, in turn, is leading to new collaborations among the companies.

For instance,

By technology type, the 256–320 slice CT scanners segment held the dominating share of approximately 38% in the ultra-high-end CT scanners market in 2024, due to their optimal balance of image quality, speed, and affordability for tertiary hospitals. It also helped in reducing the radiation dose due to their single scanning approach. Additionally, they were used to scan the heart and brain.

By technology type, the photon-counting CT (spectral CT) segment is expected to show the highest growth during the predicted time. It is a next-generation technology offering ultra-high resolution and lower radiation exposure. Moreover, it also provides accurate tissue quantification, where they are also being used for personalized imaging.

By application type, the cardiovascular imaging segment led the ultra-high-end CT scanners market with approximately a 32% share in 2024, due to growing demand for high temporal resolution and motion-free heart scans. It also helped in the early diagnosis of coronary artery disease. Moreover, their non-invasive approach increased the use.

By application type, the oncology imaging segment is expected to show the fastest growth rate during the predicted time. The ultra-high-end CT scanners are being used for precision imaging for tumor detection and treatment planning. Moreover, their integration with PET is enhancing the spatial accuracy.

By detector type, the conventional energy-integrating detectors (EID) segment held the largest share of approximately 60% in the ultra-high-end CT scanners market in 2024, driven by their standard across premium CT installations globally. Moreover, it also offered consistent image quality, which increased its use. Additionally, their affordability and high resolution increased their use in various applications.

By detector type, the photon-counting detectors (PCD) segment is expected to show the highest growth during the upcoming years. They provide enhanced tissue differentiation and improved soft-tissue contrast. Their higher spatial resolution is providing details and sharp images, which is increasing their adoption rates.

By end user, the hospitals (tertiary & specialty centers) segment led the global ultra-high-end CT scanners market with approximately 55% share in 2024, as they are the primary adopters due to high patient throughput and multidisciplinary diagnostic requirements. Moreover, the presence of various departments increased their use for different types of applications. Additionally, the skilled personnel increased the patient outcomes.

By end user, the diagnostic imaging centers segment is expected to show the fastest growth rate during the upcoming years. They are adopting various high-end scanners for competitive differentiation and premium imaging services. Furthermore, they are also being preferred due to the growing demand for outpatient imaging.

North America dominated the ultra-high-end CT scanners market with 39% in 2024, driven by advanced healthcare infrastructure, which increased their adoption rates. At the same time, the growth in diseases and healthcare investments increased their utilization and use for early and accurate diagnosis. Moreover, the industries are also utilizing advanced technologies to enhance their features, which has contributed to the market growth.

The U.S. consists of advanced healthcare systems, which are driving the ultra-high-end CT scanners market due to their growing utilization in hospitals. The specialized cardiology and cancer institutes are also leveraging them for research purposes. Moreover, the growing outpatient imaging and healthcare investment is also promoting their use.

Asia Pacific is expected to host the fastest-growing ultra-high-end CT scanners market during the forecast period. Asia Pacific is experiencing an expansion in the healthcare sector, which is increasing the adoption of ultra-high-end CT scanners. The growing diseases and awareness are increasing their use for their early detection and preventive care. Moreover, growing diagnostic centers are increasing their adoption rates.

The growing disease burden in China is increasing the use of ultra-high-end CT scanners for their accuracy and early detection, which is enhancing the ultra-high-end CT scanners market growth. The growing screening programs and government investments are increasing their use as well as their innovations. A wide range of hospitals and diagnostic centers are also increasing their utilization.

For instance,

Europe is expected to grow significantly in the ultra-high-end CT scanners market during the forecast period, due to growing focus on preventive care. The presence of well-developed healthcare infrastructure is increasing their use in various applications. Furthermore, the reimbursement policies are supporting the use, where institutions are also contributing to their growing innovations, promoting the market growth.

Germany consists of robust reimbursement systems, which are encouraging the use of ultra-high-end CT scanners. This, in turn, is increasing their adoption by various hospitals and specialty clinics for the diagnosis of diseases like cancer and cardiovascular diseases. Moreover, the companies are using advanced technologies to enhance their applications and features, which is enhancing the ultra-high-end CT scanners market growth.

The R&D of the ultra-high-end CT scanners focuses on utilizing dual energy detectors, AI integration, and next-generation photon counting to enhance he diagnostic workflow, image quality, and reduce radiation dose.

Key Players: Siemens Healthineers, Philips Healthcare, GE HealthCare Technologies Inc., Canon Medical Systems Corporation.

The clinical trials of ultra-high-end CT scanners involve the validation of their novel features, such as photon counting detectors and AI applications, while the regulatory approval focuses on their safety and effectiveness.

Key Players: Siemens Healthineers, Philips Healthcare, GE HealthCare Technologies Inc., Canon Medical Systems Corporation, United Imaging Healthcare Co., Ltd.

The patient support and services of the ultra-high-end CT scanners include the development of a patient-centric environment through features like interactive visual aids, faster scan time, and AI-guided workflows, as well as enhancing their comfort and reducing anxiety and radiation dose.

Key Players: Siemens Healthineers, Philips Healthcare, GE HealthCare Technologies Inc., Canon Medical Systems Corporation, United Imaging Healthcare Co., Ltd.

By Technology Type

By Application

By Detector Type

By End User

By Region

January 2026

January 2026

January 2026

January 2026