January 2026

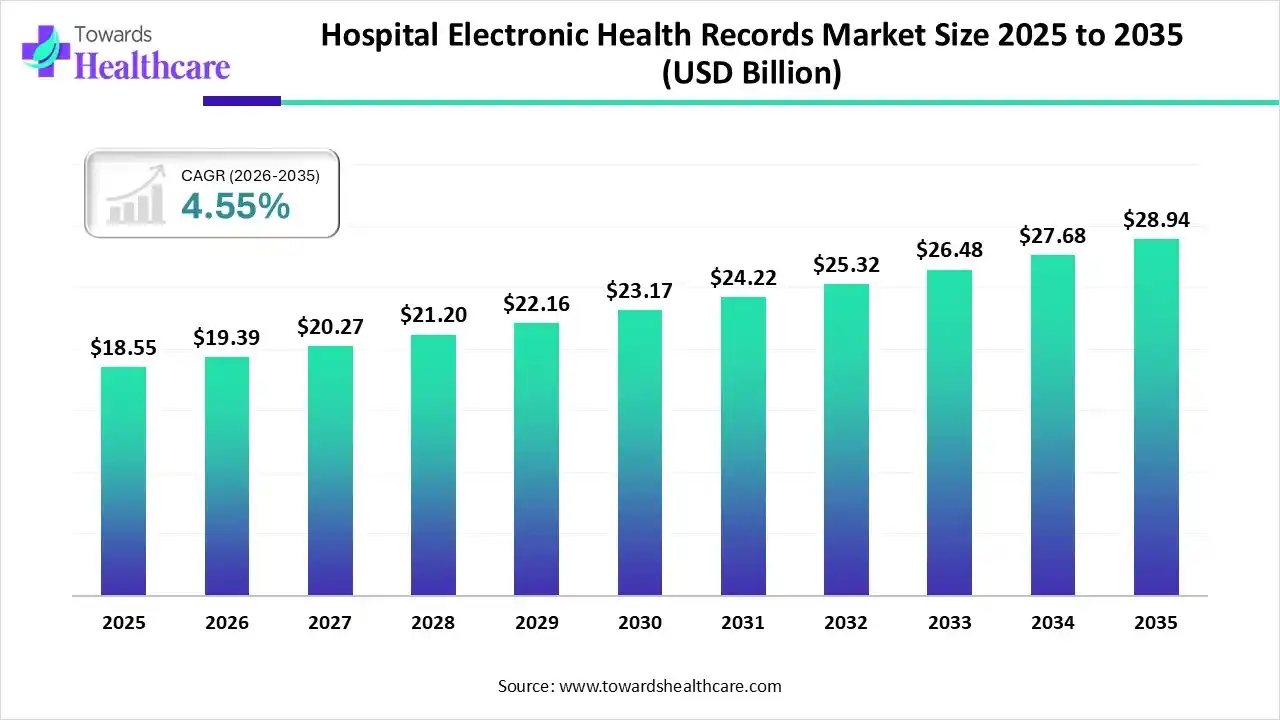

The global hospital electronic health records market size was estimated at USD 18.55 billion in 2025 and is predicted to increase from USD 19.39 billion in 2026 to approximately USD 28.94 billion by 2035, expanding at a CAGR of 4.55% from 2026 to 2035.

The hospital electronic health records (EHR) market is growing steadily as hospitals shift from paper-based systems to digital platforms to improve patient care, data accuracy, and workflow efficiency. Rising demand for cloud-based EHRs, government incentives for digital healthcare, and the need for real-time patient data support market expansion. Increasing hospital digitalization, interoperability needs, and focus on patient-centric care continue to drive global EHR adoption.

| Key Elements | Scope |

| Market Size in 2026 | USD 19.39 Billion |

| Projected Market Size in 2035 | USD 28.94 Billion |

| CAGR (2026 - 2035) | 4.55% |

| Leading Region | North America |

| Market Segmentation | By Deployment, By Type, By Business Model, By Product, By Hospital, By Application, By Region |

| Top Key Players | Epic Systems Corporation, Allscripts Healthcare Solutions, Inc., McKesson Corporation, MEDITECH, Athernahealth Inc., eClinicalWorks, NextGen Health, Inc., GE Healthcare, Siemens Healthineers |

Hospital electronic health records are the digital systems used by hospitals to store, manage, and access patients' medical information, including diagnoses, treatments, lab results, medications, and clinical history, in a secure, centralized format to support better decision-making and care delivery.

The hospital electronic health records market is growing due to the rising need for efficient patient data management, improved clinical workflows, and faster decision-making. Hospitals are increasingly adopting digital systems to replace paper records, reduce errors, and enhance patient safety. Government incentives, regulatory requirements, and the shift toward cloud-based solutions further boost adoption. Additionally, the demand for interoperability, telehealth integration, and streamlined hospital operations continues to strengthen market expansion.

AI is transforming the market by improving data accuracy, reducing administrative workload, and enabling faster clinical decision-making. It helps automate documentation, identify patterns in patient data, and support predictive analytics for better treatment outcomes. AI-driven tools also enhance interoperability, streamline workflows, and strengthen cybersecurity. As hospitals prioritize efficiency and smarter care delivery, AI integration is becoming a key driver of EHR system adoption and innovation.

Hospitals are increasingly shifting to cloud-based EHR systems, enabling secure, scalable, and remote access to patient data while reducing IT infrastructure costs and improving interoperability across facilities.

Integration of AI and advanced analytics in EHRs allows predictive insights, automated documentation, and improved clinical decision-making, enhancing patient care and operational efficiency.

EHRs now focus on patient engagement through portals, mobile apps, and telehealth integration, providing easier access to medical records, appointment management, and personalized care guidance.

Future EHRs will focus on seamless data sharing across hospitals, clinics, and labs, improving care coordination, reducing errors, and supporting nationwide healthcare data integration initiatives.

AI and machine learning will increasingly be integrated into EHRs to provide predictive analytics, early diagnosis support, and personalized treatment recommendations, enhancing patient outcomes and hospital efficiency.

EHR systems will continue shifting to cloud and mobile platforms, offering secure, remote access to patient data, supporting telemedicine, and enabling flexible, scalable healthcare solutions for providers.

| Year | Population | % of EHR Adoption |

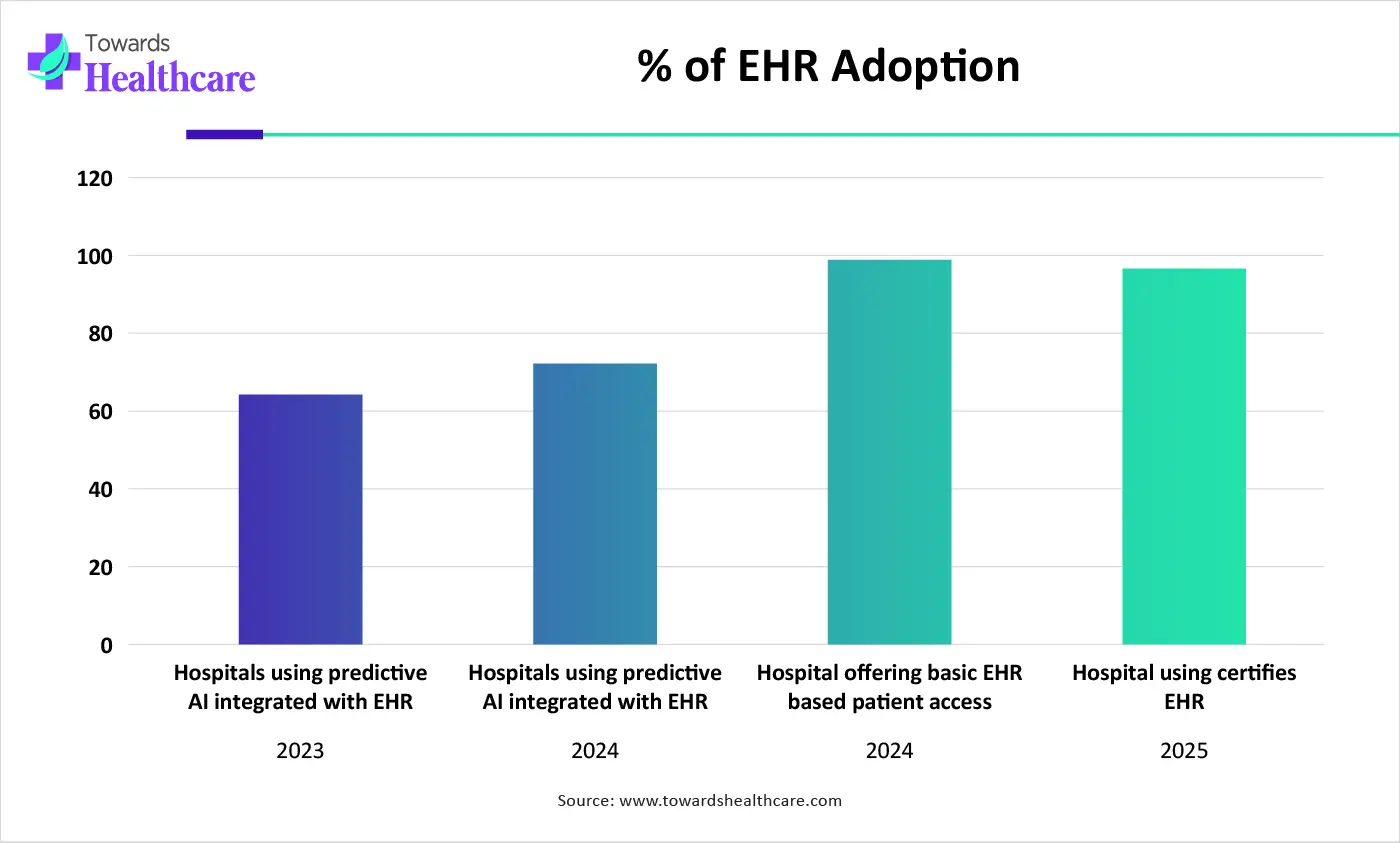

| 2023 | Hospitals using predictive AI integrated with EHR | 66% |

| 2024 | Hospitals using predictive AI integrated with EHR | 71% |

| 2024 | Hospital offering basic EHR-based patient access | 99% |

| 2025 | Hospital using certified EHR | 96% |

How Does the Cloud-based Segment Dominate the Market in 2025?

The cloud-based segment dominates the hospital electronic health records market due to its scalability, lower upfront costs, and ease of maintenance compared to on-premise systems. Cloud EHRs enable secure remote access, seamless data sharing, and real-time updates across multiple departments and facilities. Growing demand for interoperability, telehealth integration, and efficient data management further drives adoption, making cloud-based solutions the preferred choice for hospitals aiming to enhance operational efficiency and patient care.

Web-Based

The web-based segment is expected to grow significantly in the market due to its accessibility, ease of use, and ability to provide real-time patient data across multiple devices. Hospitals favor web-based EHRs for streamlined workflow, reduced IT maintenance, and seamless integration with other healthcare applications. Increasing adoption of digital healthcare solutions, telemedicine, and remote patient monitoring further drives the growth of web-based deployment during the forecast period.

What Made the Acute Segment Dominant in the Market in 2025?

The acute care segment led the hospital electronic health records market in 2025 due to the high demand for efficient management of critical and time-sensitive patient data. Acute care hospitals prioritize real-time access to patient records, rapid clinical decision-making, and interoperability across departments. Additionally, government incentives, rising patient volumes, and the need to improve care quality and reduce errors have driven EHR adoption in acute care settings more than in other hospital types.

Post-acute

The post-acute care segment is expected to grow at the fastest CAGR in the market during the forecast period due to increasing demand for coordinated care after hospitalization. EHRs help post-acute facilities manage patient transitions, monitor recovery, and share data with hospitals and physicians. Rising home healthcare services, rehabilitation centers, and government initiatives promoting continuity of care further drive rapid adoption in this segment.

How will the Professional Services Segment dominate the Market in 2025?

The professional services segment held the highest market share in the hospital electronic health records market in 2025 due to the growing need for implementation, training, and support services. Hospitals and healthcare providers rely on these services to ensure smooth EHR deployment, optimize workflows, maintain compliance, and enhance staff proficiency. The increasing complexity of EHR systems and the demand for customized solutions further drive the dominance of professional services in the market.

Subscription

The subscription segment is expected to grow at the highest CAGR in the market during the forecast period due to its cost-effectiveness, flexibility, and predictable pricing model. Hospitals prefer subscription-based EHRs for easy scalability, reduced upfront investment, and continuous software updates. Additionally, increasing adoption of cloud-based solutions and demand for remote access, interoperability, and efficient data management are driving the rapid growth of the subscription model.

Why Did the Integrated Segment Dominate the Market in 2025?

The integration segment dominated the hospital electronic health records market in 2025 because hospitals increasingly require seamless connectivity between EHR systems and other healthcare applications. Integration solutions enable real-time data sharing, improve interoperability, streamline clinical workflows, and support coordinated patient care across departments. Growing demand for connected healthcare ecosystems, compliance with regulatory standards, and the need for efficient data management have further strengthened the dominance of the integration segment in the market.

Standalone

The standalone segment is expected to grow at the fastest CAGR in the market during the forecast period due to its affordability, ease of implementation, and suitability for small to mid-sized healthcare facilities. Standalone EHRs offer focused functionality without complex integrations, enabling quicker deployment and lower maintenance costs. Rising demand from clinics, specialty centers, and remote healthcare providers further drives the rapid adoption of standalone solutions.

How Does the Medium Hospitals Segment Dominate the Market in 2025?

The medium hospitals segment held the largest share of the hospital electronic health records market in 2024 due to their balanced scale, which allows significant investment in EHR systems without the complexity of large hospitals. Medium-sized hospitals increasingly adopt EHRs to improve patient care, streamline workflows, ensure regulatory compliance, and enhance data management. Growing patient volumes and the need for efficient clinical and administrative operations further drive market dominance in this segment.

Large Hospitals

The large hospitals segment is expected to grow at the fastest CAGR in the market during the forecast period due to increasing patient volumes, complex operations, and the need for advanced data management. Large hospitals invest in comprehensive EHR systems to enhance interoperability, support multi-department workflows, comply with regulations, and integrate advanced technologies like AI and analytics, driving rapid adoption and market growth in this segment.

What Made the Cardiology Segment Dominant in the Market in 2025?

The cardiology segment led the hospital electronic health records market due to the high demand for accurate, real-time patient data to manage cardiovascular conditions. EHR systems in cardiology facilitate monitoring of patient history, diagnostics, treatment plans, and follow-ups. Increasing prevalence of heart diseases, rising hospitalizations, and the need for efficient data sharing among cardiologists, specialists, and care teams further drive the dominance of the cardiology application segment in the market.

Ophthalmology

The ophthalmology segment is expected to grow at the fastest CAGR in the market during the forecast period due to increasing demand for specialized eye care and advanced diagnostic management. EHRs help ophthalmologists track patient history, imaging results, and treatment plans efficiently. Rising prevalence of vision disorders, growing adoption of digital health tools in eye care clinics, and the need for streamlined patient management are driving rapid growth in this segment.

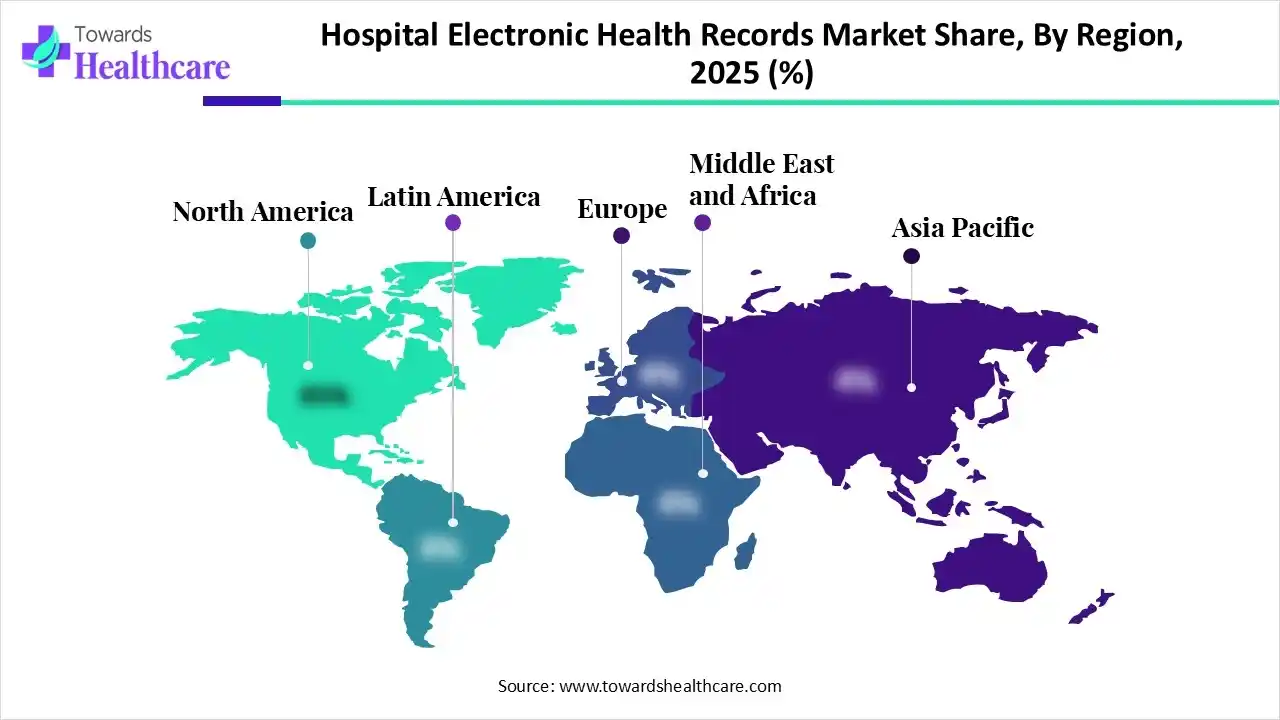

North America dominates the hospital electronic health records market due to widespread EHR adoption, advanced healthcare infrastructure, and strong government initiatives like the HITECH Act promoting meaningful use of certified EHR systems. High digital literacy, significant investments in health, IT, and the presence of major EHR vendors further drive market growth. Additionally, increasing demand for improved patient care, data management, and interoperability strengthens the region's leadership in the EHR market.

The U.S. market is expanding due to strong federal support, including interoperability regulations and modernization initiatives led by HHS and ONC. Hospitals are increasingly investing in advanced digital systems to improve care coordination, reduce medical errors, and enhance patient access to health information. Rising adoption of AI-driven tools, growing demand for data analytics, and continuous upgrades to meet compliance standards further accelerate EHR growth across U.S. hospitals.

Asia Pacific is anticipated to grow at the fastest CAGR in the hospital electronic health records market due to rapid healthcare digitization, expanding hospital infrastructure, and strong government initiatives promoting electronic records adoption. Rising patient volumes, increasing investments in health IT, and growing awareness of digital workflow are driving demand. Additionally, the region’s fast-developing economies, improving internet connectivity, and adoption of cloud-based solutions support accelerating EHR implementation across hospitals.

China’s market is increasing due to strong government-led digital health initiatives, including the Healthy China 2030 plan and nationwide hospital informatization programs. Rapid hospital expansion, growing patient volumes, and the need for efficient data management are driving adoption. Additionally, advancements in AI, cloud computing, and interoperability, along with rising investments in smart hospitals, are accelerating the demand for modern EHR systems across China’s healthcare landscape.

Europe is expected to grow at a significant rate in the hospital electronic health records market due to strong government policies supporting digital health, rising adoption of interoperable systems, and increasing investments in healthcare modernization. The EU’s focus on cross-border data exchange, expanding eHealth infrastructure, and growing demand for integrated patient care are key drivers. Additionally, advancements in AI, telehealth, and cloud-based solutions further accelerate HER adoption across European hospitals.

The UK market is increasing due to the strong government commitment to digital transformation under the NHS Long Term Plan. Hospitals are adopting advanced EHR systems to improve care coordination, reduce administrative burden, and enhance patient safety. Growing demand for integrated data sharing, rising investments in health IT infrastructure, and expanding use of AI and analytics further accelerate HER adoption across UK healthcare facilities.

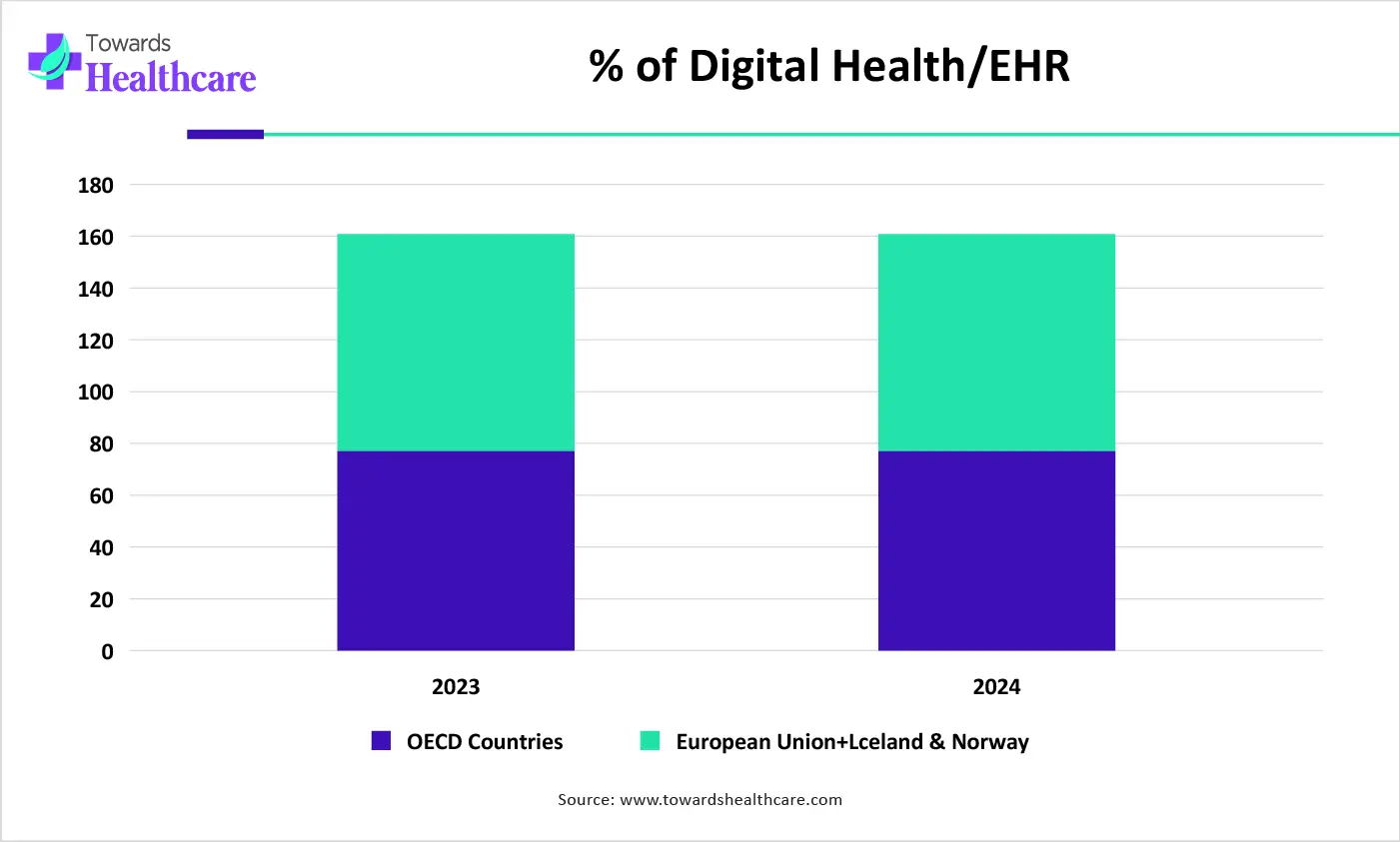

| Region | Year | % of Digital Health/EHR |

| OECD Countries | 2023 | 79% |

| OECD Countries | 2024 | 82% |

| European Union+ Iceland & Norway | 2023 | 79% |

| European Union+ Iceland & Norway | 2024 | 83% |

| Companies | Headquarters | Offerings |

| Epic Systems Corporation | Wisconsin, USA | Comprehensive hospital EHR with integrated clinical workflows, interoperability, analytics, and strong patient-engagement tools. |

| Allscripts Healthcare Solutions, Inc. | Chicago, Illinois | Flexible EHR for inpatient and outpatient care with population-health, care-coordination, and customizable workflows. |

| McKesson Corporation | Texas, USA | Hospital EHR and clinical-management solutions supporting documentation, workflow automation, and administrative efficiency. |

| MEDITECH | Canton, USA | Scalable EHR platform for hospitals offering unified clinical documentation, patient data exchange, and interoperability support. |

| Athernahealth, Inc. | Massachusetts, USA | Cloud-based EHR with revenue-cycle management, patient-engagement tools, and seamless care-coordination for hospitals. |

| eClinicalWorks | Massachusetts, USA | Cloud EHR for hospitals/clinics with telehealth, patient portals, and specialty-specific templates. |

| NextGen Health, Inc. | Atlanta, Georgia | Specialty-driven EHR for hospitals offering clinical documentation, scheduling, and practice-management tools. |

| GE Healthcare | Chicago, Illinois | EHR integrated with imaging, diagnostics, and clinical workflows for hospitals needing unified data systems. |

| Siemens Healthineers | Erlangen, Germany | Clinical information systems and EHR solutions integrated with diagnostics and imaging for hospital environments. |

By Deployment

By Type

By Business Model

By Product

By Hospital

By Application

By Region

North America

South America

Europe

Asia Pacific

MEA

January 2026

January 2026

January 2026

January 2026