January 2026

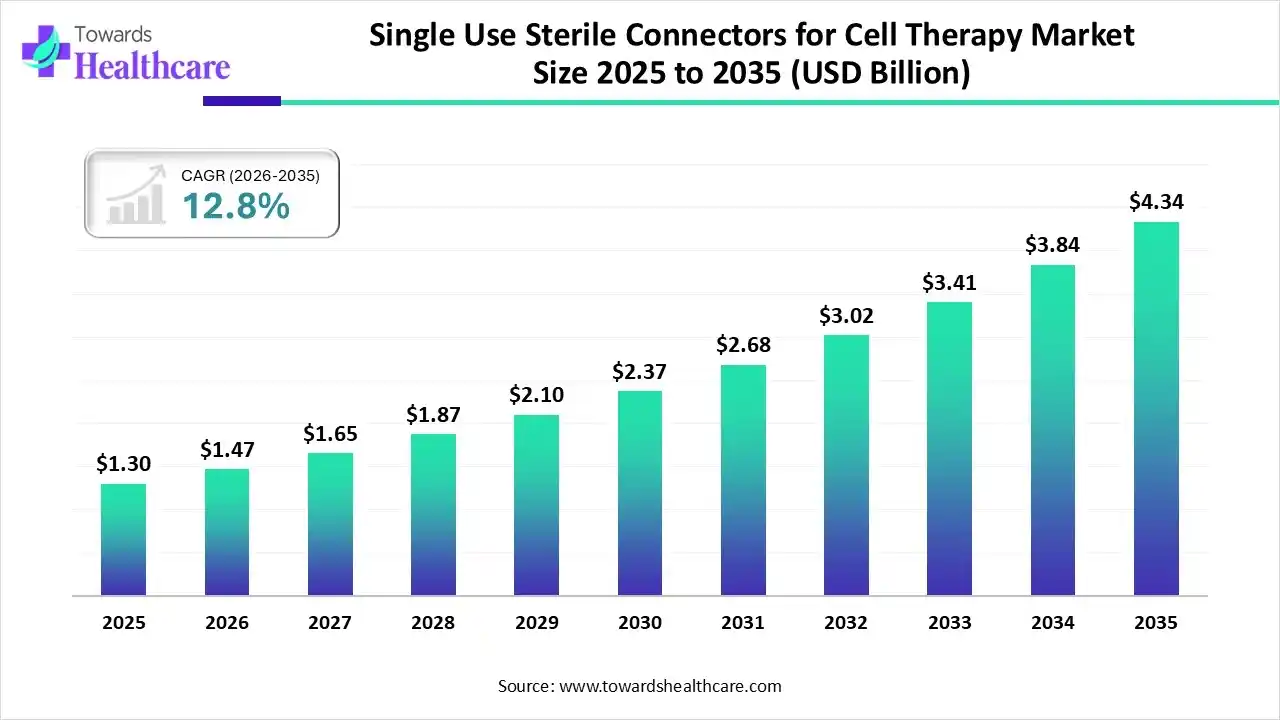

The global single-use sterile connectors for cell therapy market size is expected to be worth around USD 4.34 Billion by 2035, from USD 1.30 billion in 2025, growing at a CAGR of 12.8% during the forecast period from 2026 to 2035.

The single-use sterile connectors for cell therapy market is experiencing robust growth, driven by the increasing development of cell therapy (CT) products and growing demand for single-use manufacturing equipment. Manufacturers aim to fulfill patient needs by delivering high-quality CT products developed in a sterile environment. The increasing investments and collaborations with contract development and manufacturing organizations (CDMOs) contribute to market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.47 Billion |

| Projected Market Size in 2035 | USD 4.34 Billion |

| CAGR (2026 - 2035) | 12.8% |

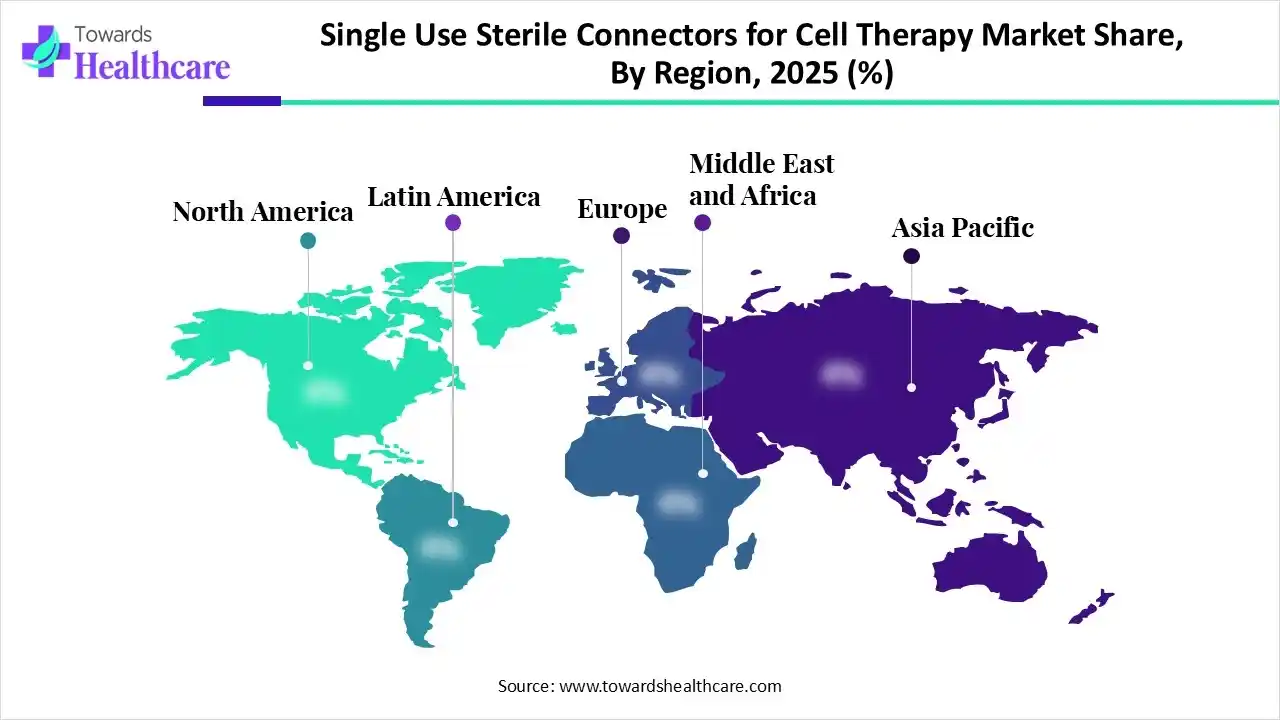

| Leading Region | North America |

| Market Segmentation | By Connector Type, By Material Type, By Application/Process Stage, By End-User, By Region |

| Top Key Players | Colder Products Company, Cytiva Life Sciences, Sentinel Process Systems, Sartorius Group, Pall Corporation, Merck Millipore, Hangzhou Cobetter Filtration Equipment Co., Ltd., Ami Polymer |

The single-use sterile connectors for cell therapy market involves the development and distribution of single-use connectors for fluid transfer across manufacturing equipment. Integrated sterile connectors help reduce the sterilization steps needed to return an opened system to a functionally closed system. These connectors minimize the risk of cross-contamination and facilitate sterile media transfer in a non-sterile environment.

Artificial intelligence (AI) is increasingly adopted in manufacturing techniques to automate cell therapy development, enhancing efficiency and accuracy. AI-enabled robots are used to streamline manufacturing operations. AI and machine learning (ML) algorithms analyze vast amounts of data and suggest an appropriate connector type to the manufacturers based on their products. AI and ML can also assess sterility and detect the presence of microorganisms. Moreover, AI-based predictive analytics enable manufacturers to detect potential errors and take necessary measures.

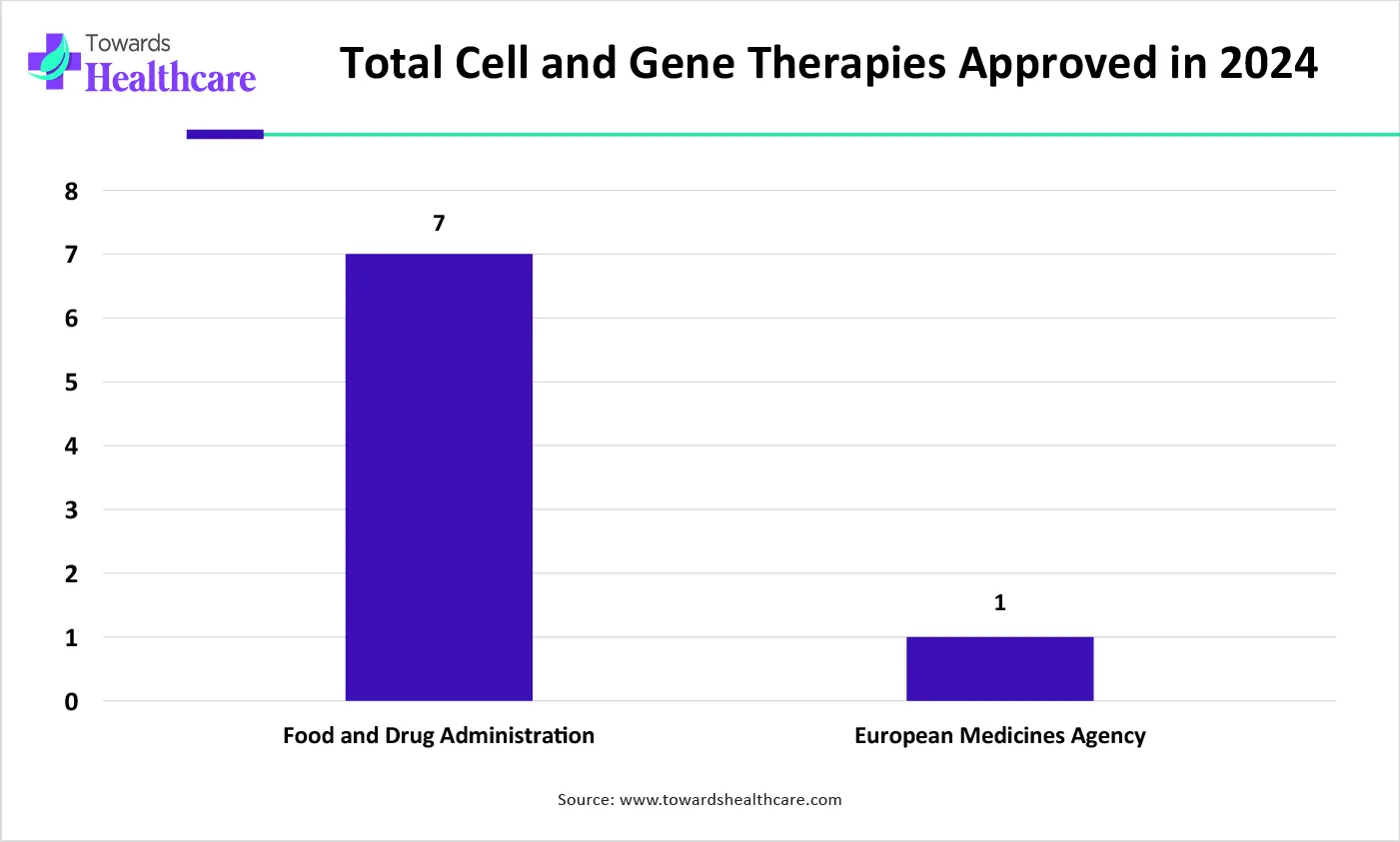

| Regulatory Agencies | Total Cell and Gene Therapies Approved |

| Food and Drug Administration | 7 |

| European Medicines Agency | 1 |

Which Connector Type Segment Dominated the Market?

The aseptic sterile connectors segment held a dominant position in the single-use sterile connectors for cell therapy market in 2025, due to the need to prevent microbial contamination. Single-use aseptic sterile connectors prevent contamination during fluid transfer and system integration by maintaining a sterile, closed barrier until a secure connection is formed. Aseptic connectors ensure that operators can safely connect lines, perform transfers, and disconnect without introducing risk. They provide fast and secure solutions and are compliant with stringent biopharma standards.

Genderless Connectors

The genderless connectors segment is expected to grow at the fastest CAGR in the market during the forecast period. Genderless connectors have identical connector halves, eliminating the need for different male and female halves to make the connection. They offer superior advantages over gendered connectors, such as connecting equipment from different OEMs and a reduced inventory. Manufacturers can minimize the risk of ordering the wrong components or assemblies.

How the Polycarbonate Segment Dominated the Market?

The polycarbonate segment held the largest revenue share of the single-use sterile connectors for cell therapy market in 2025, due to the high strength and durability of polycarbonate. Polycarbonate meets the stringent standards and regulations of the biopharma industry, ensuring high quality and purity. It ensures heat resistance and ease of sterilization. Connectors made from polycarbonate have inherent toughness, impact resistance, and maintain integrity and functionality for long periods of time.

High-Purity Elastomers

The high-purity elastomers segment is expected to grow with the highest CAGR in the market during the studied years. High-purity elastomers offer enhanced flexibility and elasticity to connectors. Developers can easily mold elastomers to the desired shape, designing customized connectors based on manufacturers’ equipment. High-purity elastomers provide sterile sealing and chemical compatibility for fluid transfer and electrical connections.

Why Did the Upstream Processing Segment Dominate the Market?

The upstream processing segment contributed the biggest revenue share of the single-use sterile connectors for cell therapy market in 2025, due to the need for maintaining sterility during upstream bioprocessing. Upstream processing is the first phase of the bioprocess, from cell line development and cultivation to culture expansion of the cells through harvest. Connectors offer a closed, sterile environment for upstream processing, reducing the risk of contamination in the later stages of manufacturing.

Fill & Finish Operations

The fill & finish operations segment is expected to expand rapidly in the market in the coming years. Fill & finish operations are the final step in downstream processing, which require special equipment to ensure product integrity during storage, transportation, and delivery to patients. Single-use connectors reduce sterilization time and lower costs, eliminating the need for cleaning validation and maintenance.

Which End-User Segment Led the Market?

The biopharmaceutical & biotechnology companies segment led the single-use sterile connectors for cell therapy market in 2025, due to the presence of a favorable manufacturing infrastructure and suitable capital investment. Biopharmaceutical & biotech companies receive funding from the government or private organizations to adopt advanced manufacturing equipment. The increasing competition among key players necessitates them to expand their product pipelines with innovative CTs, potentiating the demand for single-use sterile connectors.

CMOs/CDMOs

The CMOs/CDMOs segment is expected to witness the fastest growth in the market over the forecast period. CMOs/CDMOs possess specialized manufacturing equipment and skilled professionals to perform complex operations. Skilled professionals provide tailored solutions to complex manufacturing problems. Large companies outsource their CT manufacturing activities to CMOs/CDMOs, enabling them to focus on their core competencies. Small- and medium-sized companies collaborate with CMOs/CDMOs as they lack sufficient infrastructure.

North America dominated the global single-use sterile connectors for cell therapy market in 2025. A strong presence of major biopharma companies, growing demand for personalized medicines, and favorable regulatory support are the major factors that contribute to market growth in North America. Countries like the U.S. and Canada have a well-established research and clinical trial infrastructure for assessing several CT products.

The U.S. is home to over 3,000 biotechnology companies as of 2024, representing an increase of 4.2% in 2023. Key players, such as Colder Products Company, Cytiva Life Sciences, and Pall Corporation, are the major contributors to the market in the U.S. As of November 2025, the U.S. FDA has approved a total of 46 cell and gene therapies.

Asia-Pacific is expected to host the fastest-growing single-use sterile connectors for cell therapy market in the coming years. Countries like China, India, Japan, and South Korea are at the forefront of supporting the indigenous development of CT products, providing high-quality products at affordable prices to the local population. The demand for CT products in Asia-Pacific is increasing due to growing patient demand and a thriving ecosystem of innovation. The rising prevalence of chronic disorders and growing research and development activities augment the market.

Companies like TCRCure Biopharma Corp., Gracell, and Fosun Kite Biotechnology Co., Ltd. are major companies that manufacture CT products in China. The Chinese government has launched new pilot programs, allowing foreign companies to invest in the CGT sector in selected free-trade zones (FTZs). In the future, China will lift the ban on other cities, including Tianjin, to promote investment in CGT.

Europe is expected to grow at a notable CAGR in the single-use sterile connectors for cell therapy market in the foreseeable future. Government organizations launch initiatives and provide funding to support the development of CT products. Cell therapy manufacturing in Europe is booming, with strong investment, a growing pipeline of innovative therapeutics, and a robust network of CDMOs. Evolving regulatory landscapes in niche markets also foster market growth. Additionally, increasing collaborations among key players and public-private partnerships contribute to market growth.

The UK’s Medicines and Healthcare products Regulatory Agency (MHRA) has recently introduced new regulations to allow personalized medicines to be prepared in small or individual batches. This helps strengthen the UK’s leadership in safe, decentralized manufacturing, boost research and trials, and improve patient access to cutting-edge treatments.

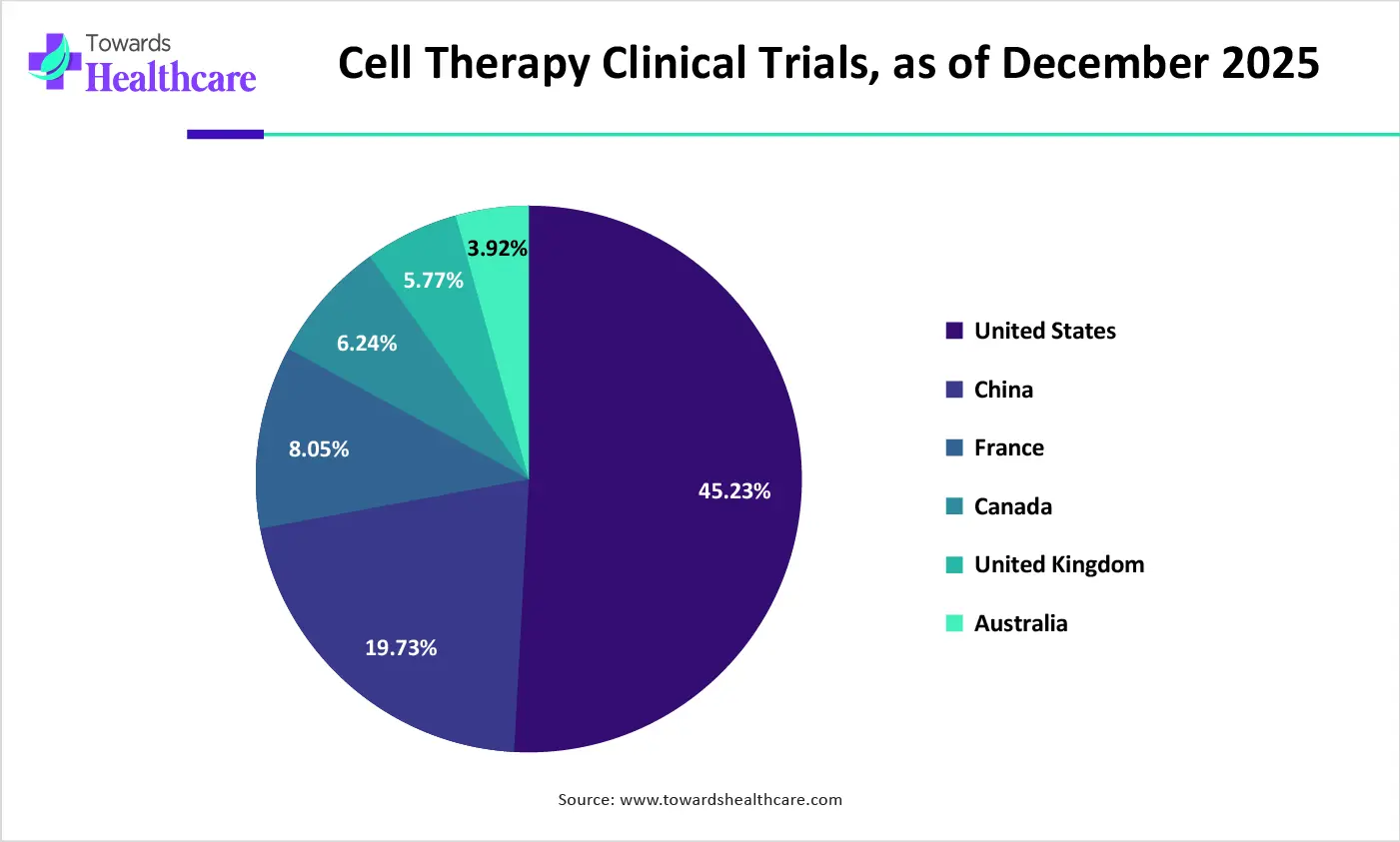

| Countries | No. of Clinical Trials (as of December 2025) | % of Clinical Trials |

| Global | 26,396 | 100% |

| United States | 11,940 | 45.23% |

| China | 5,209 | 19.73% |

| France | 2,124 | 8.05% |

| Canada | 1,646 | 6.24% |

| United Kingdom | 1,523 | 5.77% |

| Australia | 1,035 | 3.92% |

| Companies | Headquarters | Offerings |

| Colder Products Company | Minneapolis, United States | It provides specifically engineered single-use connectors to maximize design flexibility and minimize risk in bioprocess manufacturing. |

| Cytiva Life Sciences | Massachusetts, United States | ReadyMate single-use connectors are used to connect unit operations and single-use bag assemblies. |

| Sentinel Process Systems | Pennsylvania, United States | The company designs single-use connectors, fittings, and disconnects for optimal efficiency and safety in bioprocessing. |

| Sartorius Group | Göttingen, Germany | OPTA SFT Sterile Connector guarantees smooth fluid transfer, which is sterile, fast, and reliable. |

| Pall Corporation | New York, United States | Kleenpak Presto sterile connectors are available in different sizes and offer intuitive and easy handling. |

| Merck Millipore | Massachusetts, United States | Lynx CDR connectors provide ergonomic, fast, and simple connections and multiple uses. |

| Hangzhou Cobetter Filtration Equipment Co., Ltd. | Hangzhou, China | Cobetter Lifecube single-use tubing assemblies are used for the interconnection of different unit operations. |

| Ami Polymer | Mumbai, India | The company offers a range of single-use systems, from simple tubing with a connector to a complex manifold with several connections. |

By Connector Type

By Material Type

By Application/Process Stage

By End-User

By Region

January 2026

January 2026

January 2026

January 2026