January 2026

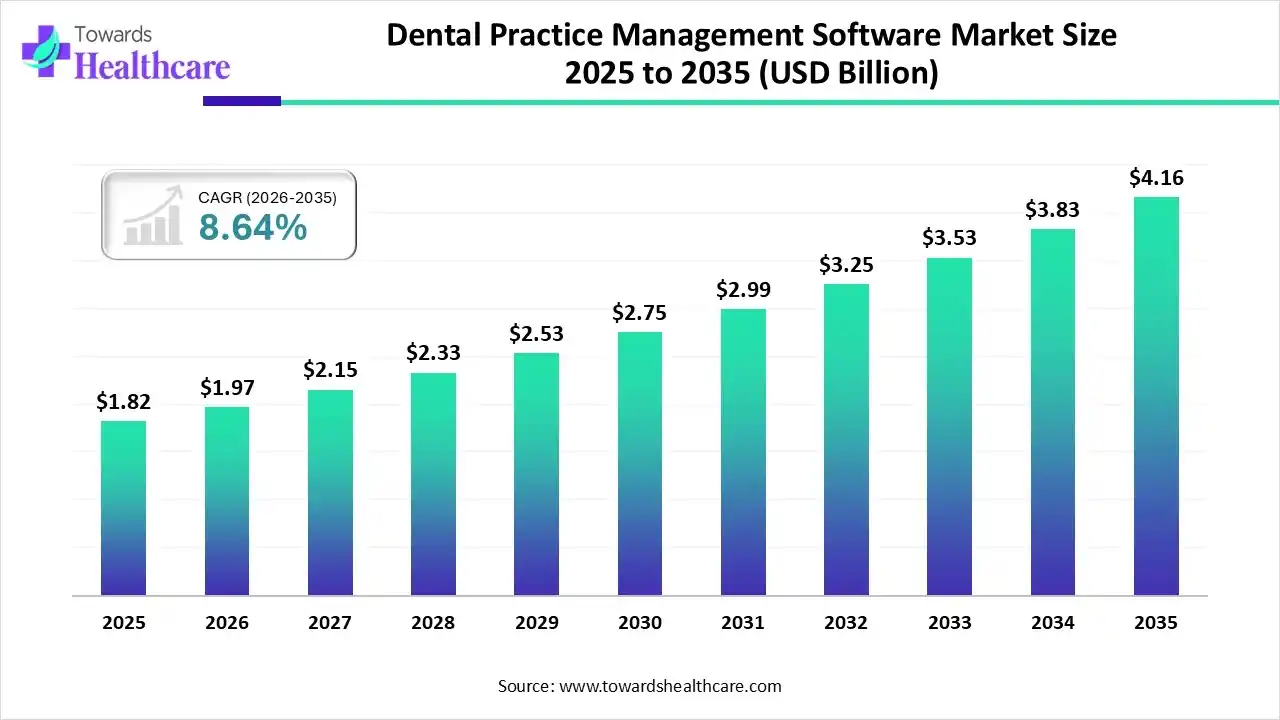

The global dental practice management software market size was estimated at USD 1.82 billion in 2025 and is predicted to increase from USD 1.97 billion in 2026 to approximately USD 4.16 billion by 2035, expanding at a CAGR of 8.64% from 2026 to 2035.

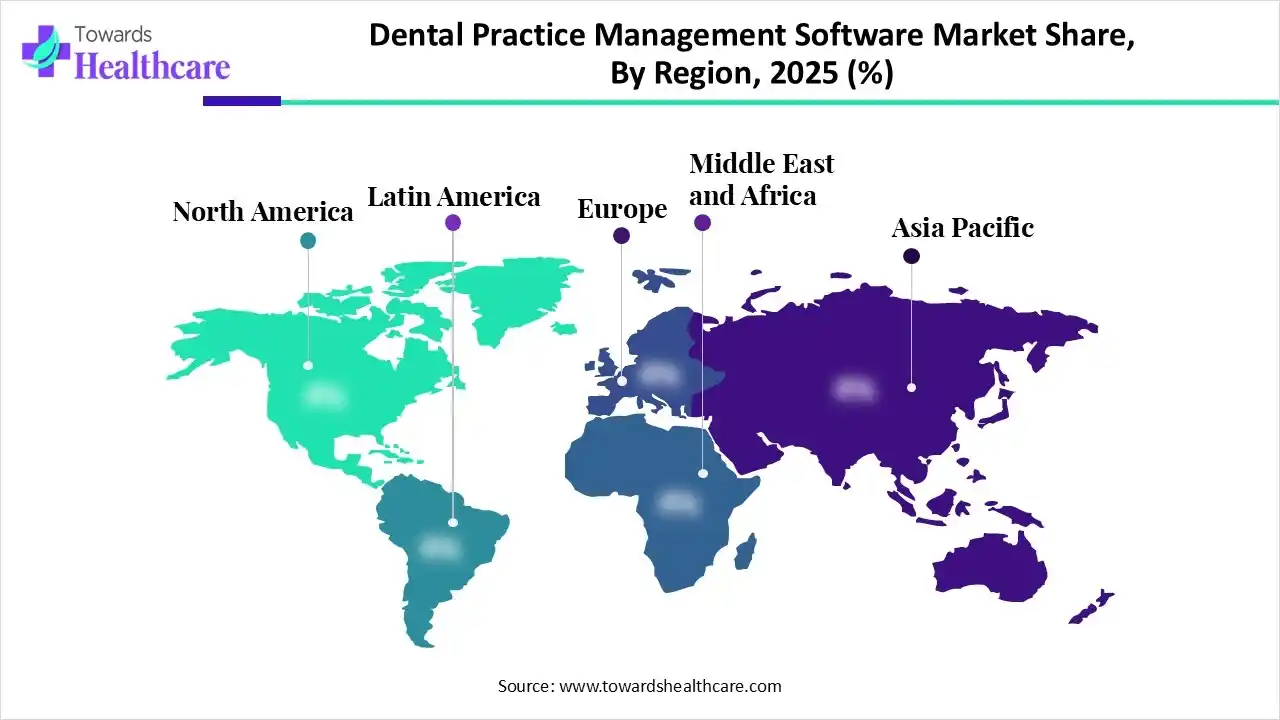

The dental practice management software market is growing steadily as clinics adopt digital solutions for scheduling, billing, patient records, and workflow automation. Rising demand for cloud-based platforms, improved patient engagement, and integration with imaging and diagnostic tools further support adoption. North America dominates the market due to advanced healthcare IT infrastructure, high digitalization rates, and the strong presence of leading software providers.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.97 Billion |

| Projected Market Size in 2035 | USD 4.16 Billion |

| CAGR (2026 - 2035) | 8.64% |

| Leading Region | North America |

| Market Segmentation | By Type, By Deployment Mode, By Application, By End Use, By Region |

| Top Key Players | Henry Schein, Inc., Carestream Dental LLC, Planet DDS Inc., Patterson Companies, Inc., Curve Dental, LLC, Open Dental Software, Inc., DentiMax, Inc. |

Dental practice management software is driven by the growing need for digitalization, improved patient experience, and streamlined clinic operations. Rising adoption of cloud-based solutions, AI integration, and an increasing focus on automated scheduling, billing, and records management further accelerate market growth. Dental practice management software is specialized digital software designed to support the administrative, clinical, and operational activities of dental clinics. It helps manage appointments, patient records, billing, insurance claims, treatment planning, and communication, all within a centralized system. By improving accuracy, workflow efficiency, and patient engagement, it enables dental practices to operate more effectively and deliver higher-quality care.

AI integration enhances dental practice management software by automating routine tasks, improving clinical accuracy, and enabling data-driven decision-making. It streamlines scheduling through predictive patient flow analysis, reduces no-shows with intelligent reminders, and automates billing and insurance verification. AI-powered diagnostics assist dentists with faster assessments by analyzing X-rays and imaging data. Natural language processing enables voice-based charting, while personalized treatment recommendations improve patient engagement. Overall, AI makes practice operations more efficient, accurate, and patient-centric.

Cloud deployment continues to dominate as more clinics, especially multi-location practices and DSOs, seek scalable, remotely accessible systems. Cloud PMS offers real-time syncing, automatic updates, and lower infrastructure costs.

Tele-dentistry tools and remote monitoring capabilities are being built into PMS platforms, allowing virtual consultations, remote follow-ups, and hybrid care models, improving access and convenience.

There’s growing demand for PMS platforms that integrate seamlessly with diagnostic imaging, electronic health records (EHR), treatment planning, and reporting tools. This integration supports comprehensive, end-to-end patient care workflows.

Practices are increasingly using built-in analytics and reporting tools inside PMS to monitor performance indicators like appointment adherence, financial metrics, treatment outcomes, and patient retention, enabling data-driven practice management.

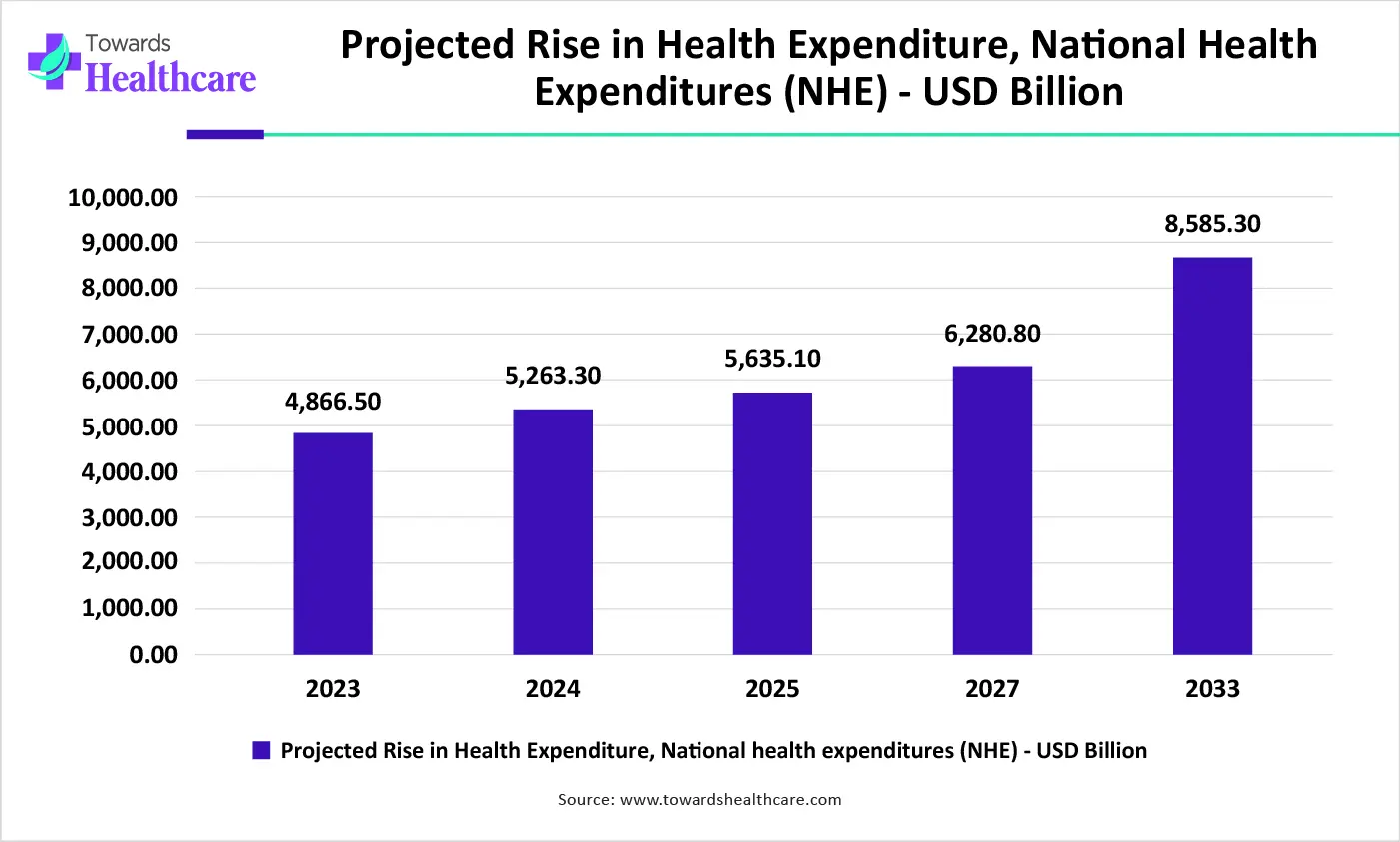

A rise in healthcare expenditure improves the dental practice management software market by enabling clinics to invest in advanced digital tools, streamline operations, enhance patient experience, and adopt integrated solutions that boost overall practice efficiency.

How Pureplay PMS Dominated the Dental Practice Management Software Market in 2025?

The PurePlay PMS segment dominates the market because it offers comprehensive, end-to-end solutions for scheduling, billing, patient records, treatment planning, and reporting within a single platform. Its unified functionality reduces workflow complexity, improves operational efficiency, and enhances patient management, making it the preferred choice for dental practices and large dental service organizations seeking all-in-one, integrated software solutions.

Dental PMS Add-Ons

The dental PMS add-ons segment is estimated to be the fastest-growing in the market due to increasing demand for modular, customizable solutions that enhance existing practice management systems. Clinics prefer add-ons for specific functions like AI-driven scheduling, automated reminders, patient engagement, tele-dentistry integration, and reporting tools. This flexibility allows practices to upgrade capabilities without replacing their entire software, driving rapid adoption.

Why Did the Web-Based Segment Dominate the Dental Practice Management Software Market?

The web-based segment dominates the market due to its ease of access, real-time updates, and multi-location connectivity. Cloud-hosted platforms enable seamless scheduling, billing, and patient record management while reducing IT infrastructure costs. High scalability, automatic software updates, and secure data storage make web-based deployment the preferred choice for both small clinics and large dental service organizations.

Cloud-Based

The cloud-based segment is anticipated to be the fastest-growing in the market due to increasing demand for remote access, real-time collaboration, and scalable solutions. Cloud platforms offer automatic updates, data backup, enhanced security, and integration with AI and tele-dentistry tools. These benefits enable practices to streamline operations, reduce IT overhead, and improve patient management efficiency, driving rapid adoption.

Why Did Patient Communication Software Hold a Dominant Segment in the Dental Practice Management Software Market?

The patient communication software segment dominates the market due to its ability to streamline appointment scheduling, reminders, follow-ups, and patient engagement. By improving communication efficiency, reducing no-shows, and enhancing patient satisfaction, dental practices can maintain stronger relationships, optimize workflow, and ensure better care coordination, making this application the most widely adopted in PMS solutions.

Insurance Management Software

The insurance management software segment is anticipated to be the fastest-growing segment in the dental practice management software market due to rising complexity in dental insurance claims, growing patient volumes, and the need for accurate, automated claim processing. It streamlines verification, reduces errors, accelerates reimbursements, and ensures compliance, enabling dental practices to optimize revenue cycle management and focus on delivering efficient, patient-centric care.

Which Application Segment Led the Dental Practice Management Software Market?

The dental clinics segment dominates the market due to its high adoption of comprehensive PMS solutions for scheduling, billing, patient records, and treatment planning. Clinics prioritize operational efficiency, patient engagement, and regulatory compliance, making integrated software essential for managing daily workflows, improving service quality, and supporting both solo and multi-dentist practices.

Hospitals

The hospitals segment is estimated to be the fastest-growing market due to the increasing integration of dental services within multi-specialty hospitals. Hospitals require advanced PMS solutions to manage high patient volumes, streamline billing, coordinate interdisciplinary care, and maintain digital health records. The need for efficient, scalable, and AI-enabled systems drives rapid adoption in this segment.

North America dominates the dental practice management software market due to its advanced healthcare IT infrastructure, high adoption of digital dental workflows, and strong presence of leading PMS providers. The region benefits from widespread use of cloud solutions, supportive government initiatives for digitization, and high investment by dental service organizations seeking automation, improved patient management, and integrated clinical administrative systems.

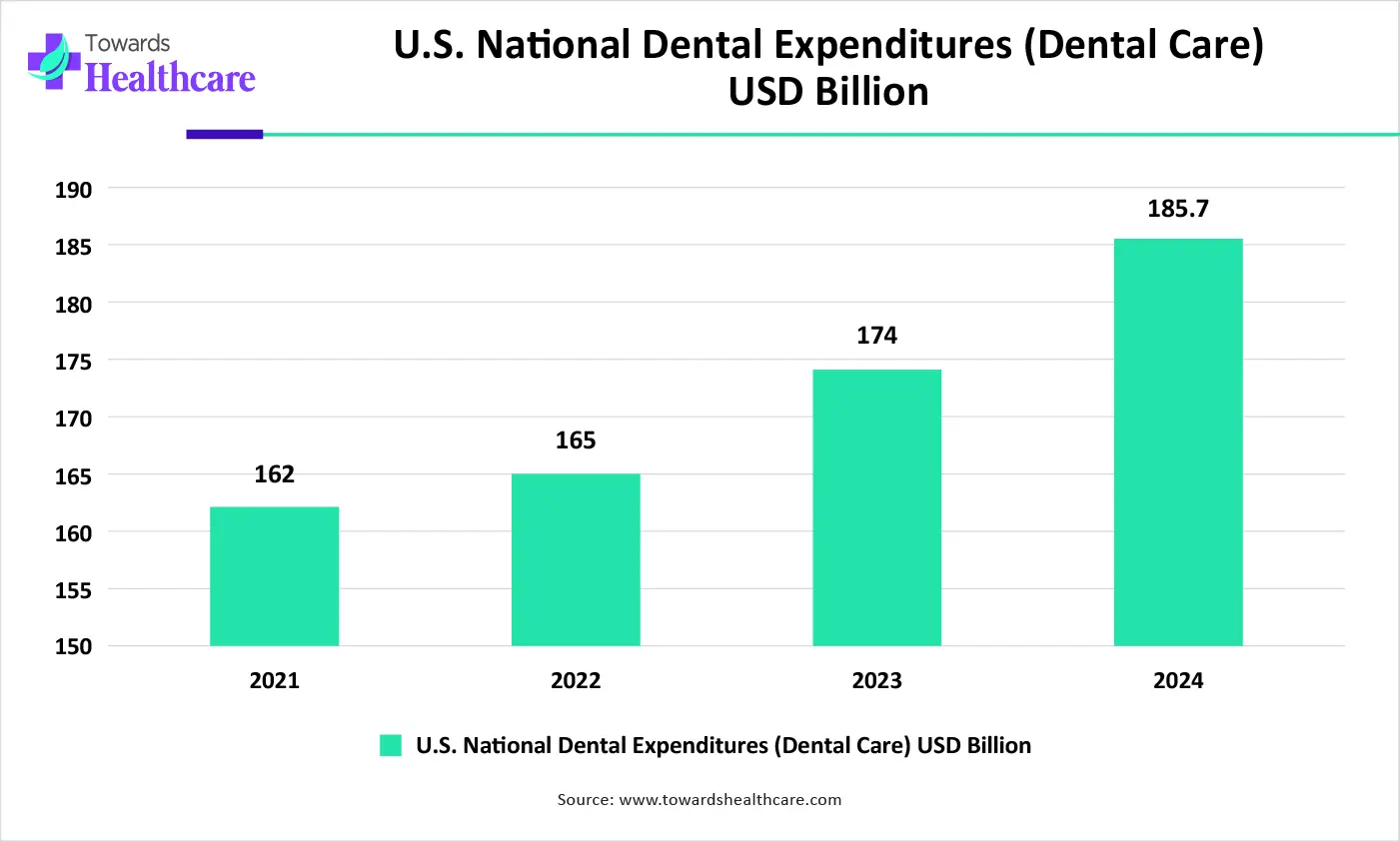

The U.S. dominates the North America market due to its strong network of dental service organizations, early adoption of cloud-based PMS, and high demand for integrated scheduling, billing, and patient engagement tools. Robust investments in digital health, a large dental practice base, and continuous innovation by major U.S.-based vendors further reinforce the country’s leading position.

Asia-Pacific is the fastest-growing region in the dental practice management software market due to the rapid digitization of healthcare, rising dental awareness, and expanding private dental clinics. Increasing investment in cloud-based solutions, growing medical tourism, and government support for healthcare IT adoption further accelerate PMS uptake. Countries like China, India, and South Korea are increasingly prioritizing workflow automation and patient management efficiency, fueling strong market growth.

China dominates the Asia-Pacific dental practice management software market due to its rapidly expanding dental clinic network, strong government push for healthcare digitalization, and increasing investment in cloud-based practice systems. The country’s large patient population, rising demand for cosmetic dentistry, and growing preference for AI-driven appointment, billing, and records management tools further strengthen its leadership in the regional PMS market.

Europe is growing notably in the dental practice management software market due to increasing adoption of digital health solutions, strong regulatory emphasis on accurate patient data management, and rising demand for automated scheduling and billing systems. Expansion of private dental clinics, rapid shift toward cloud-based platforms, and growing investments in AI-enabled dental technologies further support the region’s steady market growth.

The UK dominates the Europe market due to its advanced healthcare IT ecosystem, strong regulatory focus on digital patient record management, and high adoption of cloud-based PMS solutions. Widespread use of integrated scheduling, billing, and compliance tools, along with significant investments in AI-enabled dental technologies, strengthens the country’s leadership. Growing private dental chains further accelerate demand.

| Vendor (Company) | Headquarters | Key Offerings / Products |

| Henry Schein, Inc. | Melville, New York, USA | PMS software line including Dentrix (also Dentrix Ascend), scheduling, billing, EHR/charting, imaging integration, and a fullsuite of practice management. |

| Carestream Dental LLC | Rochester, New York, USA (or USA-based) | PMS solutions like SoftDent, imaging integration, patient records, scheduling, and billing tools. |

| Planet DDS Inc. | Salt Lake City, Utah, USA (or US-based) | Cloud-native PMS Denticon scalable solution for multi-location practices and DSOs, centralized data, remote access, and enterprise-level practice management. |

| Patterson Companies, Inc. | St. Paul, Minnesota, USA (Patterson Dental) | PMS software such as Eaglesoft scheduling, billing/insurance management, charts, and integration with dental equipment & supplies. |

| Curve Dental, LLC | Provo, Utah, USA | Cloud-based PMS emphasizing mobility scheduling, charting, imaging integration, billing, patient communication, and analytics for small-to-mid practices. |

| Open Dental Software, Inc. | Eugene, Oregon, USA | Flexible PMS platform (Open Dental) patient records, scheduling, billing, and charting; popular among small practices for affordability and extensibility. |

| DentiMax, Inc. | Salt Lake City, Utah, USA (or USA-based) | PMS and imaging software tailored to both clinical and admin workflows charting, scheduling, billing, and imaging integration. |

| PracticeWeb, Inc. | United States (US-based) | Dental PMS offering scheduling, patient records, billing, and insurance management, ideal for small clinics seeking cost-effective, customizable solutions. |

| CareStack (Good Methods Global Inc.) | California, USA (US-based) | Cloud-based all-in-one PMS practice management, patient communication, revenue cycle management, analytics, and support for small to large practices. |

| NextGen Healthcare, Inc. | Atlanta, Georgia, USA (US-based; NextGen is a major healthIT firm) | Offers dental PMS modules as part of broader health IT/EHR platforms, useful for practices or institutions needing integrated dental-medical record management. |

By Type

By Deployment Mode

By Application

By End Use

By Region

North America

South America

Europe

Asia Pacific

MEA

January 2026

January 2026

January 2026

January 2026