January 2026

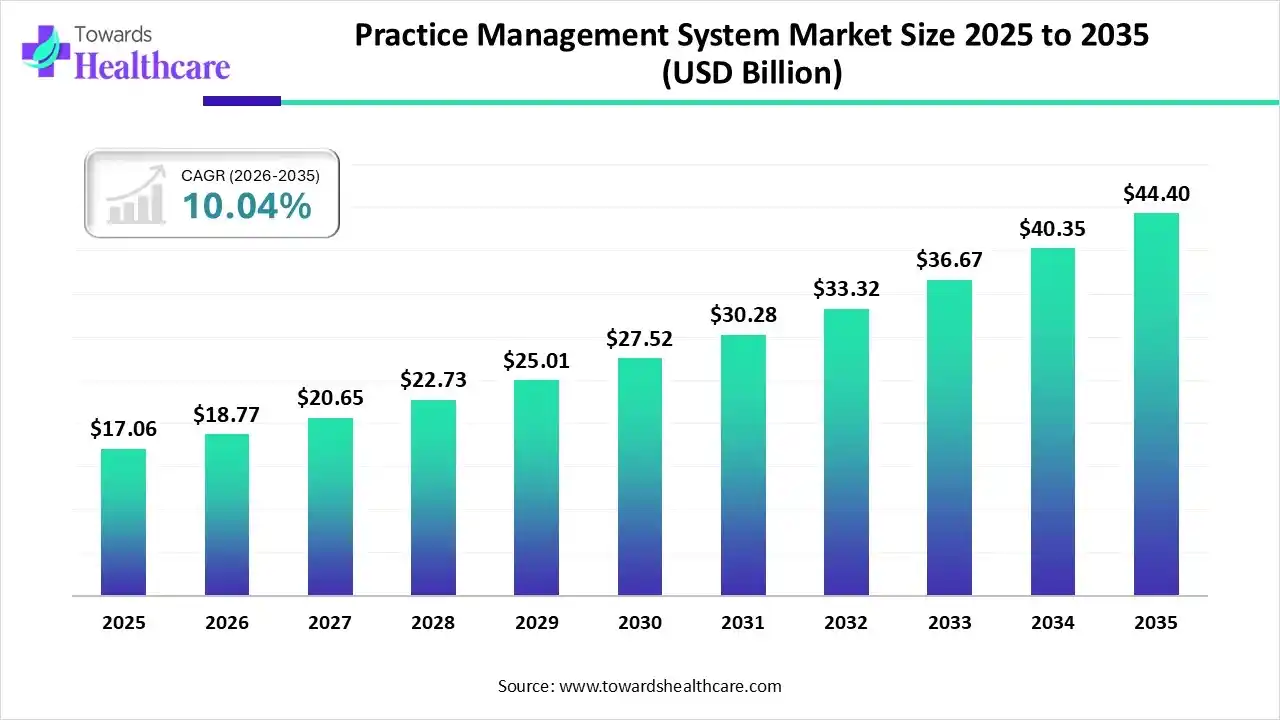

The global practice management system market size was estimated at USD 17.06 billion in 2025 and is predicted to increase from USD 18.77 billion in 2026 to approximately USD 44.40 billion by 2035, expanding at a CAGR of 10.04% from 2026 to 2035.

The market is growing as healthcare providers focus on streamlining scheduling, billing, and administrative workflows. Rising patient loads, digital transformation, and the shift toward cloud-based and interoperable solutions are key drivers. Automation, regulatory compliance needs, and the demand for integrated practice and electronic health record tools continue to accelerate adoption across hospitals and clinics.

| Key Elements | Scope |

| Market Size in 2026 | USD 18.77 Billion |

| Projected Market Size in 2035 | USD 44.40 Billion |

| CAGR (2026 - 2035) | 10.04% |

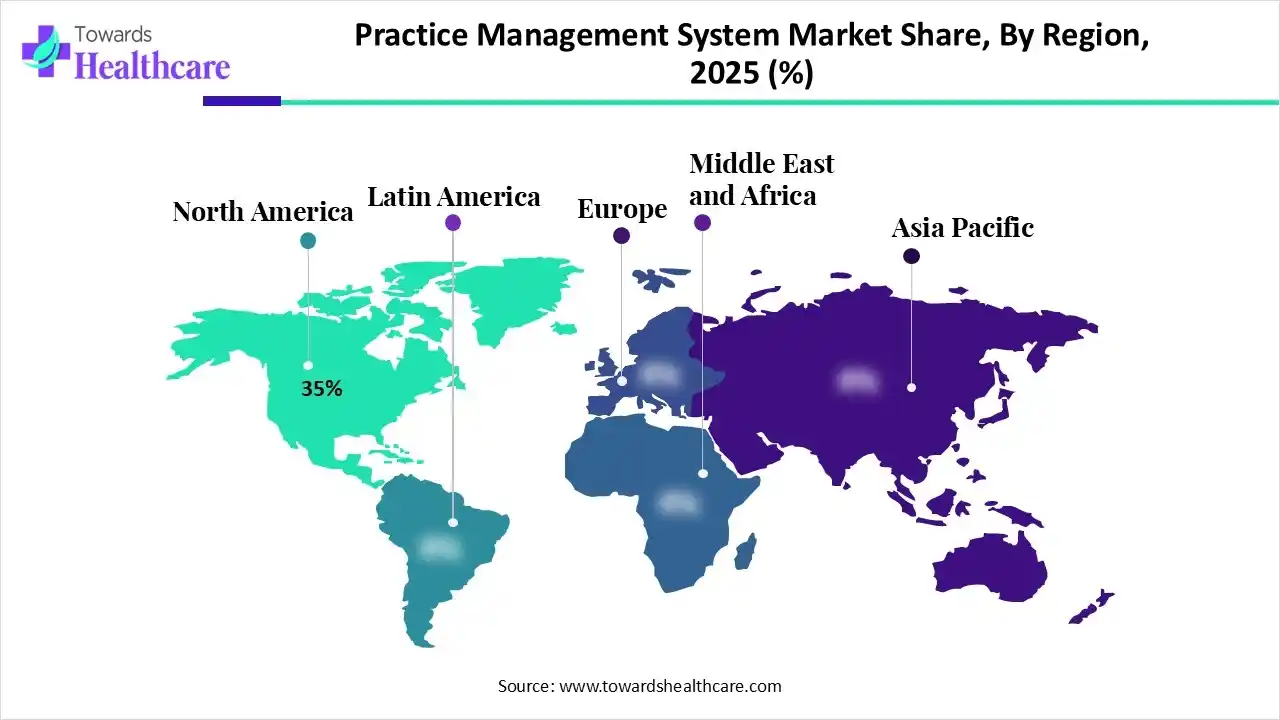

| Leading Region | North America 35% |

| Market Segmentation | By Product Type, By Deployment Type, By Application, By End-User, By Region |

| Top Key Players | Veradigam (Allscripts), OmniMD, Henry Schein, Inc., AdvantEdge Healthcare Solutions, athrnahealth, Oracle Health (Cerner), Epic Systems Corporation, GE HealthCare, McKesson Corporation |

AI is transforming the market by automating routine administrative tasks such as scheduling, claims processing, and billing. It enhances accuracy, reduces manual errors, and speeds up decision-making. AI-driven analytics help providers predict patient demand, optimize workflows, and improve revenue cycles. Additionally, AI-powered chatbots and virtual assistants support better patient communication, making PMS platforms more efficient and proactive.

| Year | Adoption/ Digital-Health Metric | Percentage |

| 2023 | Availability of online digital health services | 79% |

| 2024 | Availability of online digital health services | 82% |

| 2023 | Hospitals using predictive AI integrated with EHR | 66% |

| 2024 | Hospitals using predictive AI integrated with EHR | 71% |

Why Did the Practice Management Software Suites Segment Dominate in the Market in 2025?

The practice management software suites segment leads the practice management system market with revenue shares of 40% due to its comprehensive functionality, integrating scheduling, billing, EHR, patient engagement, and reporting in a single platform. Healthcare providers prefer all-in-one solutions for streamlined operations, reduced administrative errors, improved efficiency, and enhanced patient experience, making software suites the most widely adopted product type in the practice management market.

Integrated EHR-PMS Solutions

The integrated EHR-PMS solutions segment is expected to grow fastest due to rising demand for seamless healthcare workflows. By combining electronic health records with practice management functions, these solutions enhance data interoperability, reduce manual tasks, improve patient care, and support regulatory compliance. Increasing adoption of digital health and cloud-based platforms further drives the segment’s rapid growth.

What Made the Cloud-based Segment Dominant in the Market in 2025?

The cloud-based segment dominated the practice management system market with revenue shares of 55% and is projected to grow at the fastest rate due to its scalability, cost-effectiveness, and remote accessibility. Cloud solutions enable seamless data storage, easy software updates, and integration with EHR and telehealth systems. Healthcare providers prefer cloud-based PMS for improved workflow efficiency, secure data management, and the ability to access patient information anytime, supporting better clinical decision-making and operational performance.

How will the Practice Administration & Scheduling Segment dominate the Market in 2025?

The practice administration & scheduling segment led the practice management system market with revenue shares of 40% due to its critical role in managing appointments, patient flow, and staff allocation. Efficient scheduling reduces wait times, optimizes resource utilization, and enhances patient satisfaction. Healthcare providers prioritize these tools to streamline daily operations, improve clinics' efficiency, and support overall practice management, making this segment the most widely adopted.

Patient Engagement & Communication

The patient engagement & communication segment is expected to grow at the fastest CAGR due to increasing focus on improving patient experience, adherence, and satisfaction. Tools like automated reminders, portals, and mobile apps enhance communication between providers and patients, streamline care coordination, and support telehealth services. Rising demand for personalized, connected healthcare is driving rapid adoption of these solutions.

Why Did the Hospitals & Health Systems Segment Dominate the Market in 2025?

The hospitals & health systems segment dominated the practice management system market with revenue shares of 40% due to high patient volumes, complex workflows, and the need for efficient administrative and clinical operations. Hospitals require comprehensive PMS solutions to manage scheduling, billing, EHR integration, and regulatory compliance. Their large-scale operations and focus on improving patient care drive widespread adoption of practice management systems in this segment.

Physician Groups & Clinics

The physician groups & clinics segment is expected to grow fastest due to increasing adoption of digital solutions for small to mid-sized practices. These providers seek efficient tools for scheduling, billing, EHR integration, and patient engagement. Rising demand for streamlined workflows, cost-effective cloud-based PMS, and improved patient care is driving rapid growth in this segment.

North America dominates the practice management system market with revenue shares of 35% due to advanced healthcare infrastructure, high adoption of digital health technologies, and favorable government initiatives supporting EHR and telehealth integration. The region’s focus on improving operational efficiency, patient care, and regulatory compliance drives widespread adoption of PMS solutions across hospitals, clinics, and physician practices.

The U.S. led the market due to advanced healthcare infrastructure, high digital health adoption, and supportive government policies promoting EHR and telehealth integration. Widespread use of cloud-based and AI-enabled PMS solutions, combined with rising demand for operational efficiency and improved patient care, has driven the country’s dominant market position.

Asia Pacific is expected to grow at the fastest CAGR due to increasing healthcare digitization, rising demand for efficient practice management, and growing adoption of cloud-based and integrated PMS solutions. Expanding healthcare infrastructure, government initiatives promoting digital health, and rising awareness among providers and patients are accelerating market growth across the region.

India is anticipated to grow rapidly in the practice management system market due to increasing healthcare digitization, expansion of private hospitals and clinics, and rising adoption of cloud-based and integrated PMS solutions. Government initiatives supporting digital health, growing patient awareness, and the need for efficient workflow and billing management further drive market growth in the country.

Europe is expected to grow at a notable CAGR in the practice management system market due to increasing adoption of digital health technologies, supportive government regulations, and the shift toward integrated EHR-PMS solutions. Rising demand for efficient clinical workflows, patient engagement, and telehealth services across hospitals and clinics is driving the region’s market growth.

The UK is anticipated to grow at a rapid CAGR due to strong government support for digital health, widespread EHR adoption, and increasing demand for integrated PMS solutions. Growing emphasis on efficiency within the NHS and private practices, along with the rising use of cloud-based and patient-engagement tools, is accelerating practice management system adoption across the country.

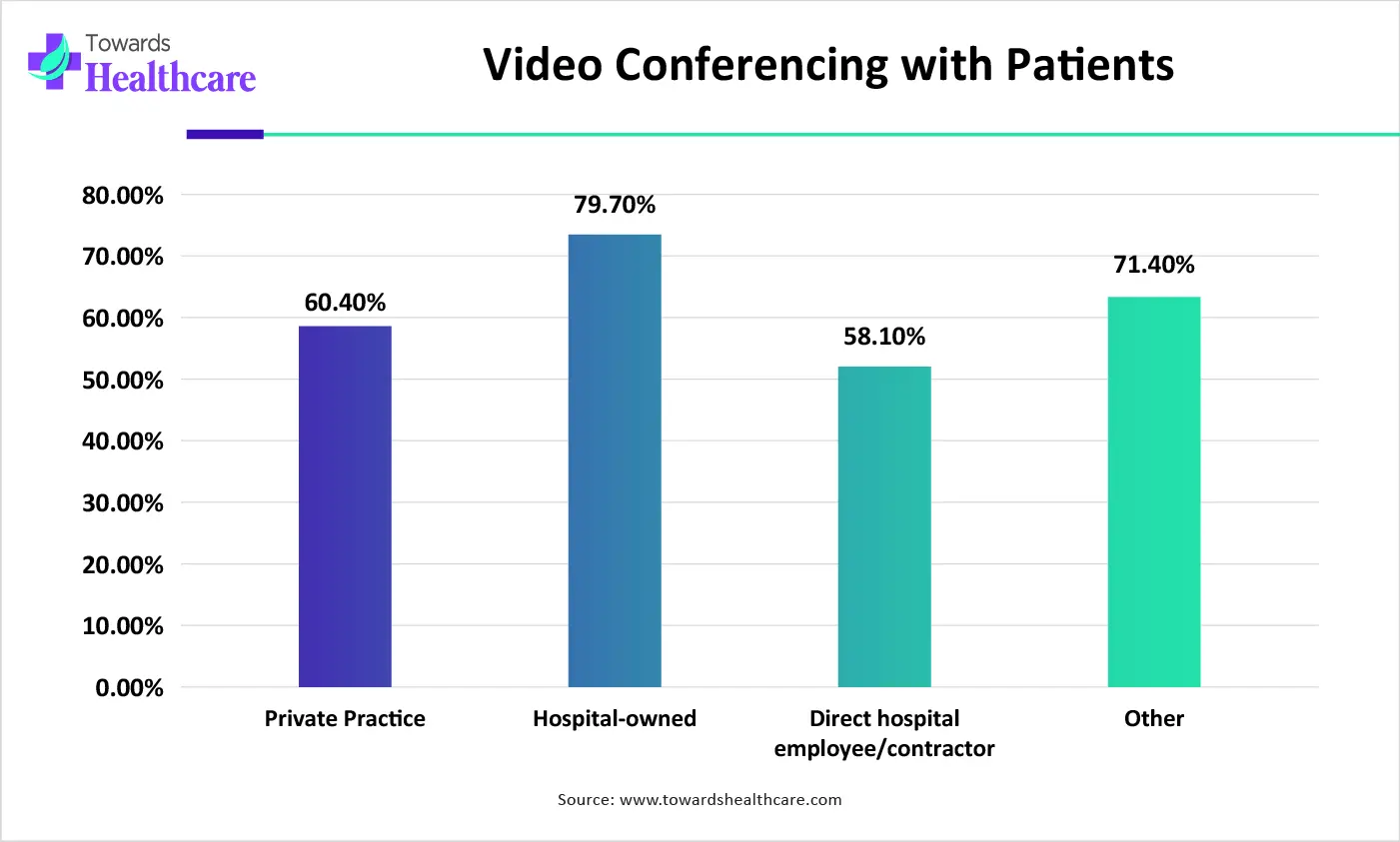

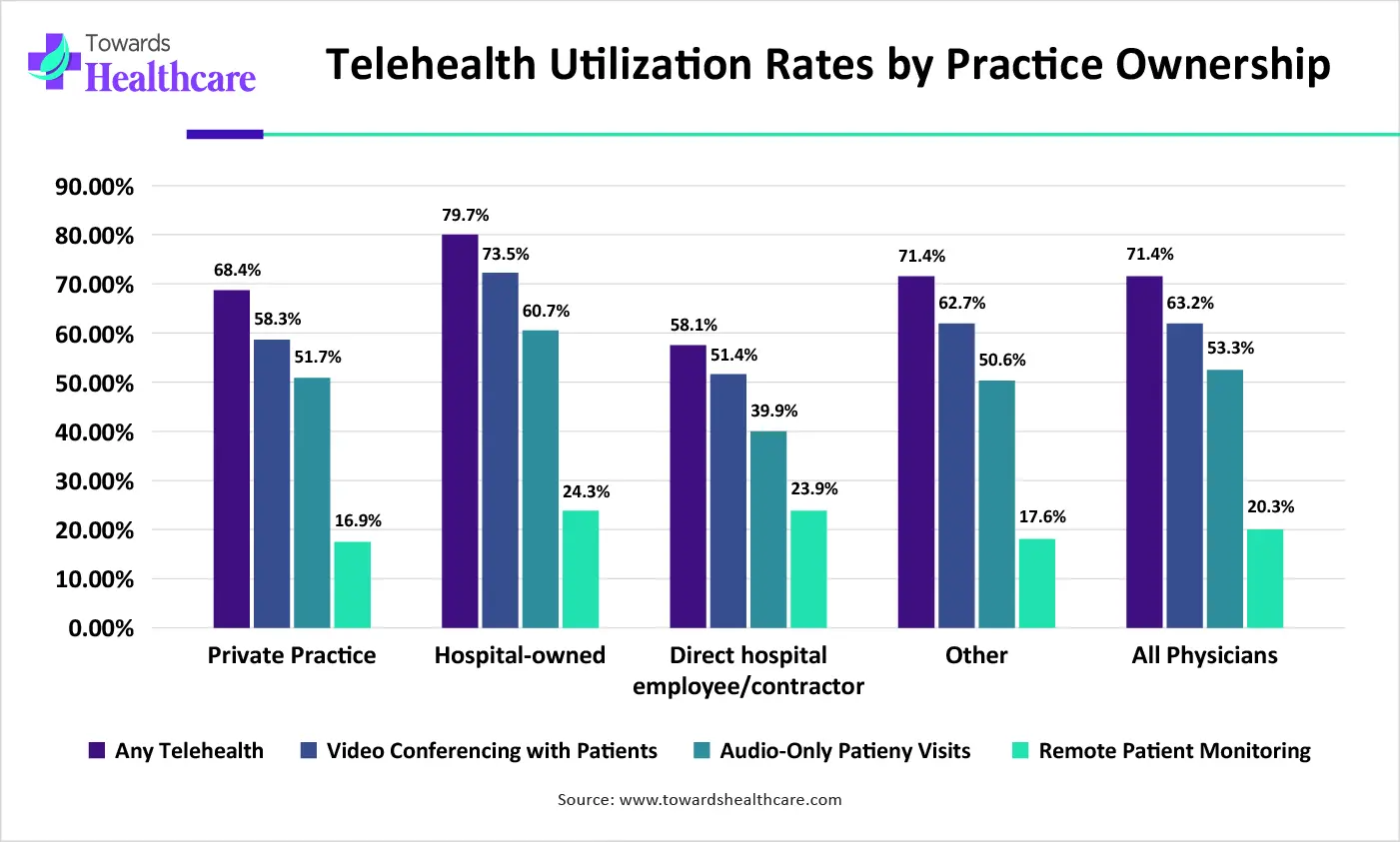

| Practice Ownership | Any Telehealth | Video conferencing with Patients | Audio-only Patient Visits | Remote Patient Monitoring |

| Private Practice | 68.4% | 58.3% | 51.7% | 16.9% |

| Hospital-owned | 79.7% | 73.5% | 60.7% | 24.3% |

| Direct hospital employee/contractor | 58.1% | 51.4% | 39.9% | 23.9% |

| Other | 71.4% | 62.7% | 50.6% | 17.6% |

| All Physicians | 71.4% | 63.2% | 53.3% | 20.3% |

| Company | Headquaters | Offerings |

| Veradigam (Allscripts) | Chicago, IL, USA | Veradigm (Allscripts) practice-management suite scheduling, billing/RCM, claims, reporting, and integrations with EHR/EHR-adjacent products. |

| OmniMD | Hawthorne,NY | Cloud-based EHR + Practice Management + RCM; appointment scheduling, claims management, patient intake, and analytics. |

| Henry Schein, Inc. | Melville,NY | Dental & medical PMS: Dentrix (dental practice management), MicroMD PM (medical practice management) scheduling, billing, imaging integration, patient communications. |

| AdvantEdge Healthcare Solutions | Warren, NJ, USA | Practice management & RCM services, medical billing, coding/audits, managed services for physician practices (outsourced billing + software integrations). |

| athrnahealth | Watertown/Boston Area, USA | athenaOne (integrated EHR + practice management + athenaCollector RCM, patient engagement) cloud SaaS for ambulatory practices. |

| Oracle Health (Cerner) | North Kansas City | Cerner Millennium / Oracle Health EHR with integrated practice-management and revenue/care workflows (scheduling, billing interfaces, clinical/administrative integration). |

| Epic Systems Corporation | Verona,WI,USA | Enterprise EHR with practice-management capabilities for large hospitals and ambulatory networks scheduling, registration, billing integrations, and patient portal. |

| GE HealthCare | Chicago, IL, USA | Offers practice management/reporting tools within its digital software portfolio (enCORE/Practice Management Tool), clinical workflow & integration solutions for outpatient and specialty practices. |

| McKesson Corporation | Irving, TX, USA | Healthcare IT & practice solutions (RCM, practice management modules, inventory & pharmacy integrations) delivered as part of its business/technology services for providers. |

By Product Type

By Deployment Type

By Application

By End-User

By Region

January 2026

January 2026

December 2025

December 2025