February 2026

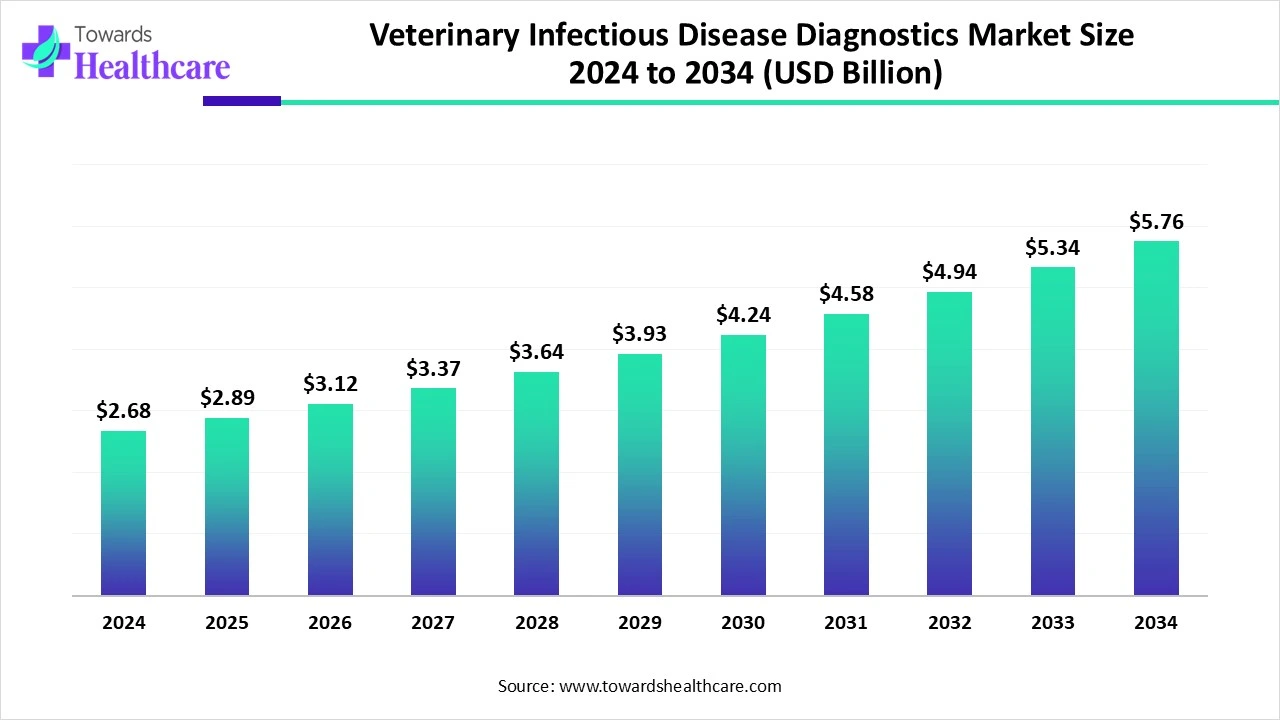

The global veterinary infectious disease diagnostics market size is calculated at US$ 2.68 in 2024, grew to US$ 2.89 billion in 2025, and is projected to reach around US$ 5.76 billion by 2034. The market is expanding at a CAGR of 7.95% between 2025 and 2034.

In developed and developing regions, the market has been experiencing major growth due to the emergence of infectious zoonotic diseases between animals. Alongside various products, technologies, and services employed in the detection of infectious diseases in animals, mainly in livestock, companion animals, and wildlife. Moreover, the global veterinary infectious disease diagnostics market comprises the adoption of highly sophisticated techniques, such as molecular diagnostics, like PCR and qPCR, immunoassays such as ELISA and lateral flow assays, and biosensor-based systems. This approach offers highly sensitive, faster, and user-friendly solutions in the veterinary diagnosis sector.

| Table | Scope |

| Market Size in 2025 | USD 2.89 Billion |

| Projected Market Size in 2034 | USD 5.76 Billion |

| CAGR (2025 - 2034) | 7.95% |

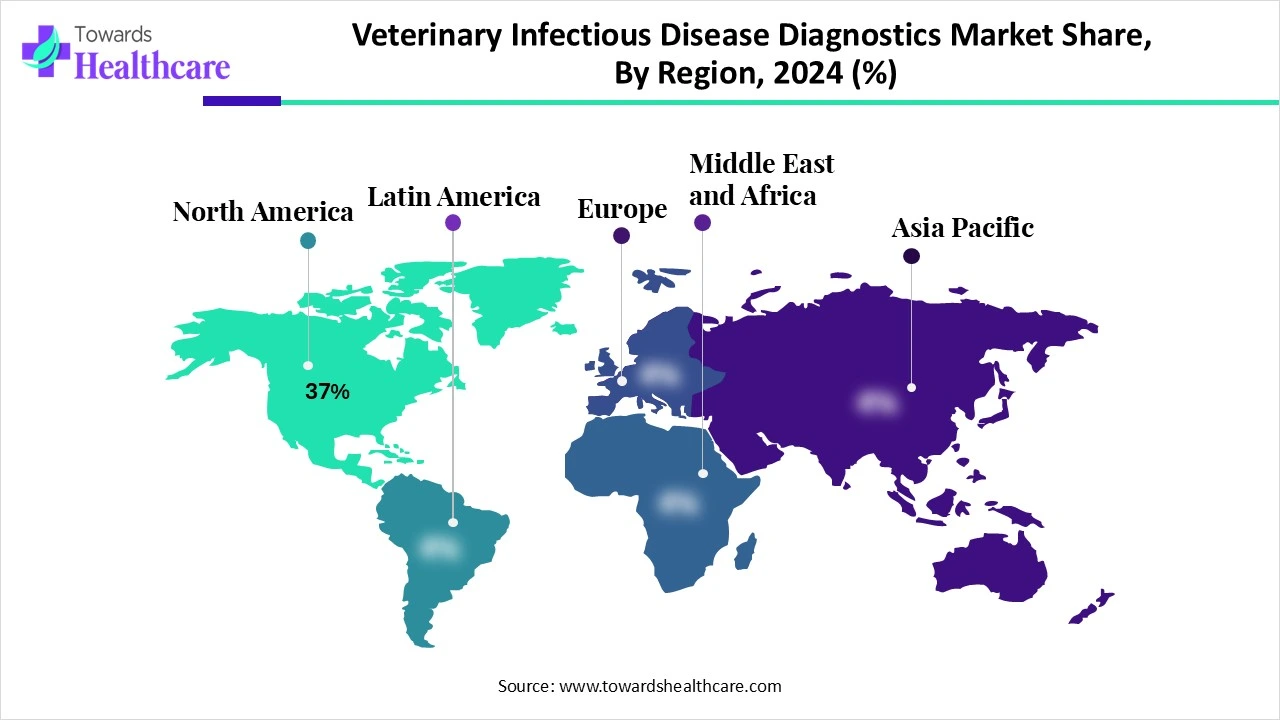

| Leading Region | North America Share 37% |

| Market Segmentation | By Product Type, By Animal Type, By Disease Type, By End User, By Region |

| Top Key Players | IDEXX Laboratories, Inc., Zoetis Inc., Thermo Fisher Scientific Inc., Heska Corporation, Bio-Rad Laboratories, Inc., Neogen Corporation, Virbac, BioMérieux SA, Bionote Inc., Randox Laboratories, Agrolabo S.p.A., IDvet, Abaxis, Indical Bioscience GmbH, Qiagen N.V., VMRD Inc., MEGACOR Diagnostik GmbH, Fujifilm Wako Pure Chemical Corporation, Creative Diagnostics, Biogal – Galed Labs |

The veterinary infectious disease diagnostics market refers to the global market dedicated to products, technologies, and services used to detect infectious diseases in animals, including livestock, companion animals, and wildlife. It encompasses a wide array of diagnostic tools such as immunoassays, molecular diagnostics, and clinical biochemistry, which are employed for early disease detection, disease surveillance, treatment guidance, and control of disease outbreaks. This market plays a crucial role in animal health management, food safety, zoonotic disease prevention, and regulatory disease monitoring programs.

In the respective market, the growing awareness about animal health and escalating government and private funding in the veterinary sector are widely impacting market expansion.

Currently, around the world, an enhancing trend regarding the widespread adoption of AI and relevant tools in diverse areas, including the veterinary domain. Eventually, consistent advances in AI, ML, and digital health technologies are allowing the progression of advanced and robust diagnostic tools for veterinary medicine. Additionally, increasing investments in veterinary healthcare are facilitating the adoption of AI-driven diagnostic approaches to enhance diagnosis accuracy and support veterinarians in early and precise disease detection. Primarily, X-rays, MRIs, and ultrasound are highly used in conjunction with AI in the detection of tumors, fractures, and other abnormalities. Whereas, SignalPET and Radimal are AI-based tools that help veterinarians in interpreting radiographs.

A Combination of Factors in Animal Health

The veterinary infectious disease diagnostics market is mainly driven by different combined factors such as accelerating cases of infectious diseases in both companion animals and livestock, which occur due to globalization and climate change, requiring better diagnostic solutions. Moreover, greater pet ownership rates, especially in developed countries, resulting in enhanced expenditure on veterinary care, are fueling overall market growth. As well as emerging awareness and issues related to the transmission of zoonotic diseases from animals to humans, mainly with diseases called avian influenza and African swine fever, are fostering for optimized diagnostic capabilities.

Competitive Landscape and Concerns About ROI

Ongoing emergence and evolution of infectious diseases and their pathogens necessitate consistent research and development efforts to develop diagnostic tools that are both sensitive and specific is acting as a major hurdle in the market. Alongside developing competition required balance among speed and research, as well as automation with human insights, and ensuring ROI to clients in this era, is creating barriers for market research players.

Enhanced Innovations and Collaborations

In 2025-2034, the veterinary infectious disease diagnostics market will encompass major opportunities, particularly in diagnostic technologies. In this area, the rising innovations like PCR and qPCR, immunoassays such as ELISA and lateral flow assays, and biosensor-based systems are empowering rapid, more sensitive, and user-friendly testing solutions. Besides this, emerging strategic collaborations and alliances among companies, research institutions, and veterinary professionals are increasingly assisting market growth and the development of advanced diagnostic solutions. Also, this will boost the development of novel solutions in a variety of diseases, like endocrinology, cardiology, ophthalmology, oncology, neurology, and dermatology etc.

In 2024, the immunodiagnostics segment led the veterinary infectious disease diagnostics market. These types of products offer the detection of pathogens or the animal's immune response to them. Also, these techniques are necessary in various disease identification, monitoring their expansion, and analyzing the efficacy of treatments or preventative measures.

However, under this segment, the ELISA sub-segment held the largest share. This is one of the reliable and fastest diagnostic tools, which is employed in different infectious concerns in animals to replace other approaches like agar gel immunodiffusion (AGID) tests. Several kinds of ELISA are widely used in diverse diseases, such as Equine Infectious Anemia (EIA), Infectious Bovine Rhinotracheitis (IBR), Feline Immunodeficiency Virus (FIV), and Porcine Reproductive and Respiratory Syndrome (PRRS), etc.

The molecular diagnostics segment is anticipated to expand rapidly during 2025-2034 in the veterinary infectious disease diagnostics market. The advantages of this diagnostic involved are high sensitivity and specificity, allowing speedy and accurate diagnosis of many viral, bacterial, and parasitic infections. They are widely applied in antimicrobial susceptibility testing, which further supports treatment decisions. Moreover, in the case of vaccine development, molecular techniques have also emerged.

Whereas, in molecular diagnostics, the PCR sub-segment is estimated to grow at the fastest CAGR. A well-known, faster, versatile, and highly sensitive approach is a PCR, which further helps in the detection of non-culturable organisms in the laboratory. It is increasingly used in various livestock, companion animals, and exotic & wild animals.

The livestock animals segment was dominant in the market in 2024. A huge population in the world is greatly demanding of meat, milk, and other livestock-derived products, and escalating infectious disease cases are fueling the adoption of advanced diagnostics. Inclusion of the determination of pathogens like bacteria, viruses, fungi, and parasites in these animals is driving the demand for control and mitigation of disease outbreaks.

And, under this segment, the cattle sub-segment held a major share of the market. As many bacterial issues, including leptospirosis, tuberculosis, and Salmonella, are also widespread in cattle, prompting the need for advanced diagnostic tools for strong management and control. Certain common diagnostic approaches are used in cattle diagnosis, such as bacterial culture and serology, to more advanced techniques like PCR and biosensors.

On the other hand, the companion animals segment is predicted to expand fastest in the veterinary infectious disease diagnostics market. Due to accelerating pet ownership, rising prevalence of specific diseases, and the broad adoption of pet insurance are impacting this segment is experiencing growth. Additionally, a wider range of bacteria, viruses, fungi, and parasites in cats and dogs is propelling demand for timely treatment, disease control, and preventing the spread of zoonotic diseases.

Under this segment, the dogs sub-segment will grow at a rapid CAGR during 2025-2034. The large population of the world possesses dogs as a pet animal, which is highly susceptible to many infectious diseases, like Canine Distemper, Infectious Canine Hepatitis, Canine Parvovirus, Leptospirosis, and Lyme Disease etc. Whereas several diagnostic methods are employed, such as cytology and bacteriological culture, to serological assays and nucleic acid amplification techniques.

In the veterinary infectious disease diagnostics market, the viral infections segment accounted for the largest revenue share in 2024. The growing diversity of infectious diseases, especially canine parvovirus, avian influenza, and bovine tuberculosis, is boosting the need for accurate and timely diagnostics. Also, the developing veterinary clinics, laboratories, and diagnostic facilities, particularly in developing regions, are supporting these cases and overall market development.

Under viral infections, the avian influenza sub-segment led the market with a major share. This infection is commonly found in birds having respiratory signs (coughing, sneezing, nasal discharge), neurological signs (ataxia, tremors), and decreased egg production. Alongside, different regions’ governments and international organizations are heavily invested in disease surveillance and control programs, particularly the execution of regulations for mandatory testing and reporting of avian influenza cases.

Although the zoonotic diseases segment will expand rapidly in the veterinary infectious disease diagnostics market. The emergence of various zoonotic concerns, like bacterial (e.g., salmonellosis, brucellosis), viral (such as rabies, avian influenza), parasitic (like toxoplasmosis), and fungal (mainly ringworm) infections, is fueling demand for highly sophisticated diagnostic solutions. Furthermore, the field focused on a One Health approach, which assists in the understanding of the interconnectedness of human, animal, and environmental health.

Under this segment, the leptospirosis sub-segment is predicted to witness the fastest expansion. These prevalences are mainly dependent on a combination of clinical signs, laboratory tests, and epidemiological factors. For this, rapid in-clinic tests are applied, including lateral flow immunoassays, which are the quickest approach to diagnose leptospirosis at the point-of-care. And, to omit limitations involved in the above tests, the microscopic agglutination testing (MAT), PCR are widely employed.

In 2024, the veterinary hospitals & clinics segment registered dominance in the veterinary infectious disease diagnostics market. Because of the increasing awareness regarding the significance of preventive care and early disease detection among pet owners, the result is broad and often essential for veterinary check-ups and diagnostic tests. In addition, ongoing technological innovations in diagnostic solutions, like PCR, next-generation sequencing, and immunodiagnostics, enable speedy, more accurate, and affordable solutions for identifying infectious diseases.

Whereas, the point-of-care/in-house testing facilities segment will grow at the highest CAGR. As they comprise various benefits, like faster, convenient diagnostics for infectious diseases, as well as eliminating the need for sending samples to external laboratories. Moreover, dipsticks or lateral flow assays offer results within minutes, with speedy treatment decisions and potentially mitigating disease spread. Also, portable nucleic acid detection technologies are widely used with quicker detection of pathogen DNA or RNA, which provides high sensitivity and specificity.

North America was dominant in the veterinary infectious disease diagnostics market share by 37% in 2024. Due to expanded pet ownership and an accelerating emphasis on pet healthcare expenses are fueling the market. Also, this region consists of several technological advances in molecular diagnostics, rapid testing methods, and automated analyzers that are enhancing the accuracy, speed, and efficiency of diagnostic processes.

For this market,

The presence of well-equipped veterinary hospitals and research infrastructure is mainly involved in this region’s veterinary infectious disease diagnostics market. Along with this, the US government’s raised focus on managing zoonotic diseases and promoting animal health also contributes to market growth.

For instance,

In Canada, the veterinary infectious disease diagnostics market is fueled by the increasing awareness about zoonotic diseases and rising focus on public health. And, also, growing R&D activities in veterinary are boosting ultimate diagnostic approaches.

For instance,

Around the world, the ASAP is anticipated to register the fastest growth in the veterinary infectious disease diagnostics market. As this region is facing the expansion of zoonotic disease, and other major concerns among animals are proliferating, demand for highly effective and rapid testing approaches is increasing. Primarily, this region’s market contributed to the wide range of products and technologies, such as conventional methods like ELISA and bacterial culture, as well as advanced molecular diagnostics like PCR and next-generation sequencing.

China encompasses the world's huge livestock population, such as millions of pigs and millions of cattle, are generates a crucial need for disease diagnostics to mitigate risks like African swine fever (ASF) and foot-and-mouth disease (FMD).

For instance,

India’s veterinary infectious disease diagnostics market is driven by the escalating number of companion animals, leading to a wider demand for diagnostic services. As well as in India growing demand for dairy, poultry, and meat production, needs diagnostics for disease prevention and productivity enhancement.

For this market,

In Europe, the presence of robust veterinary-focused companies and growing technological expansion is fueling the veterinary infectious disease diagnostics market. Primarily, this region is highly reliant on technologies like Polymerase Chain Reaction (PCR), Enzyme-Linked Immunosorbent Assay (ELISA), and immunofluorescence assays (IFA) for diagnosis in livestock and companion animals, which assist in managing and controlling the spread of diseases.

In Germany, the growing number of companion animals, particularly dogs and cats, propels the demand for diagnostic services to ensure their health and well-being. Besides this, this region is focused on early and precise diagnosis of infectious diseases to detect outbreaks and enhance treatment outcomes.

For instance,

The veterinary infectious disease diagnostics market in the UK is influenced by expanding awareness related to animal health. As well as increased veterinary reference laboratories are due to their capacity for high-volume testing and advanced diagnostic capabilities.

For instance,

By Product Type

By Animal Type

By Disease Type

By End User

By Region

February 2026

February 2026

February 2026

February 2026