January 2026

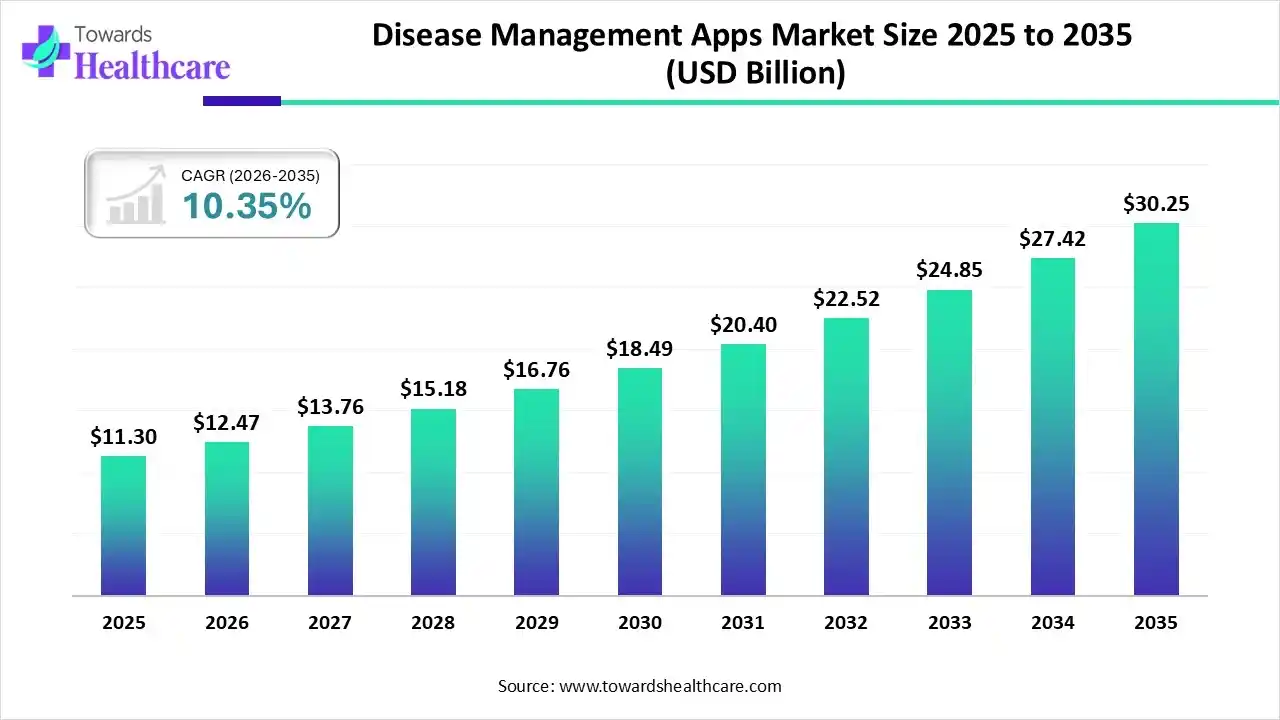

The global disease management apps market size was estimated at USD 11.30 billion in 2025 and is predicted to increase from USD 12.47 billion in 2026 to approximately USD 30.25 billion by 2035, expanding at a CAGR of 10.35% from 2026 to 2035.

The disease management apps market is primarily driven by the rising adoption of advanced technologies and the growing demand for patients to take part in the clinical decision-making process. The increasing smartphone and internet penetration and the rising healthcare consumerization favor market growth. Government bodies also support the use of telehealth through initiatives and funding.

| Key Elements | Scope |

| Market Size in 2026 | USD 12.47 Billion |

| Projected Market Size in 2035 | USD 30.25 Billion |

| CAGR (2026 - 2035) | 10.35% |

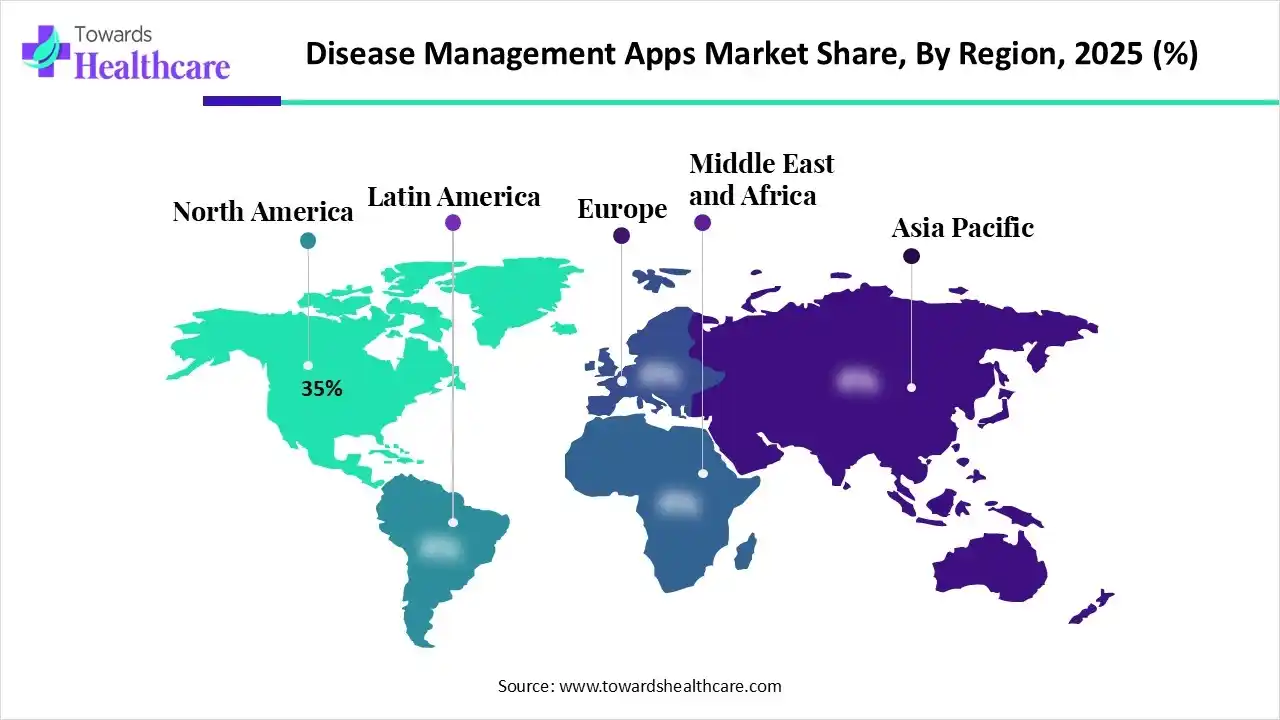

| Leading Region | North America by 35% |

| Market Segmentation | By Product Type, By Deployment Type, By Application, By End-User, By Region |

| Top Key Players | Omada Health, Inc., WellDoc, Teladoc Health, Glooko, Medtronic Care Management Services, Philips Healthcare, Proteus Digital Health, Dexcom, Inc., ADA Health, MyFitnessPal |

The disease management apps market refers to the global ecosystem of mobile and web-based digital health applications designed to help patients monitor, manage, and treat chronic and acute health conditions. These apps perform numerous functions, such as symptom tracking, medication reminders, remote monitoring of vitals, lifestyle and behavioral guidance, teleconsultation integration, and data sharing with healthcare providers. They aim to improve disease outcomes, patient adherence, and overall quality of care by enabling continuous health monitoring, self-management, and timely intervention.

AI plays a vital role in promoting and supporting self-management in patients with chronic conditions. AI and machine learning (ML) algorithms analyze vast amounts of patient data, enabling disease detection, improving diagnostic accuracy, and providing patient-centered care. They improve the quality and access to care, reduce costs, and optimize daily self-management by integrating with clinical information systems and patient-facing technologies. Natural language processing (NLP) helps identify patients’ conditions in real time through texts and voice-based agents.

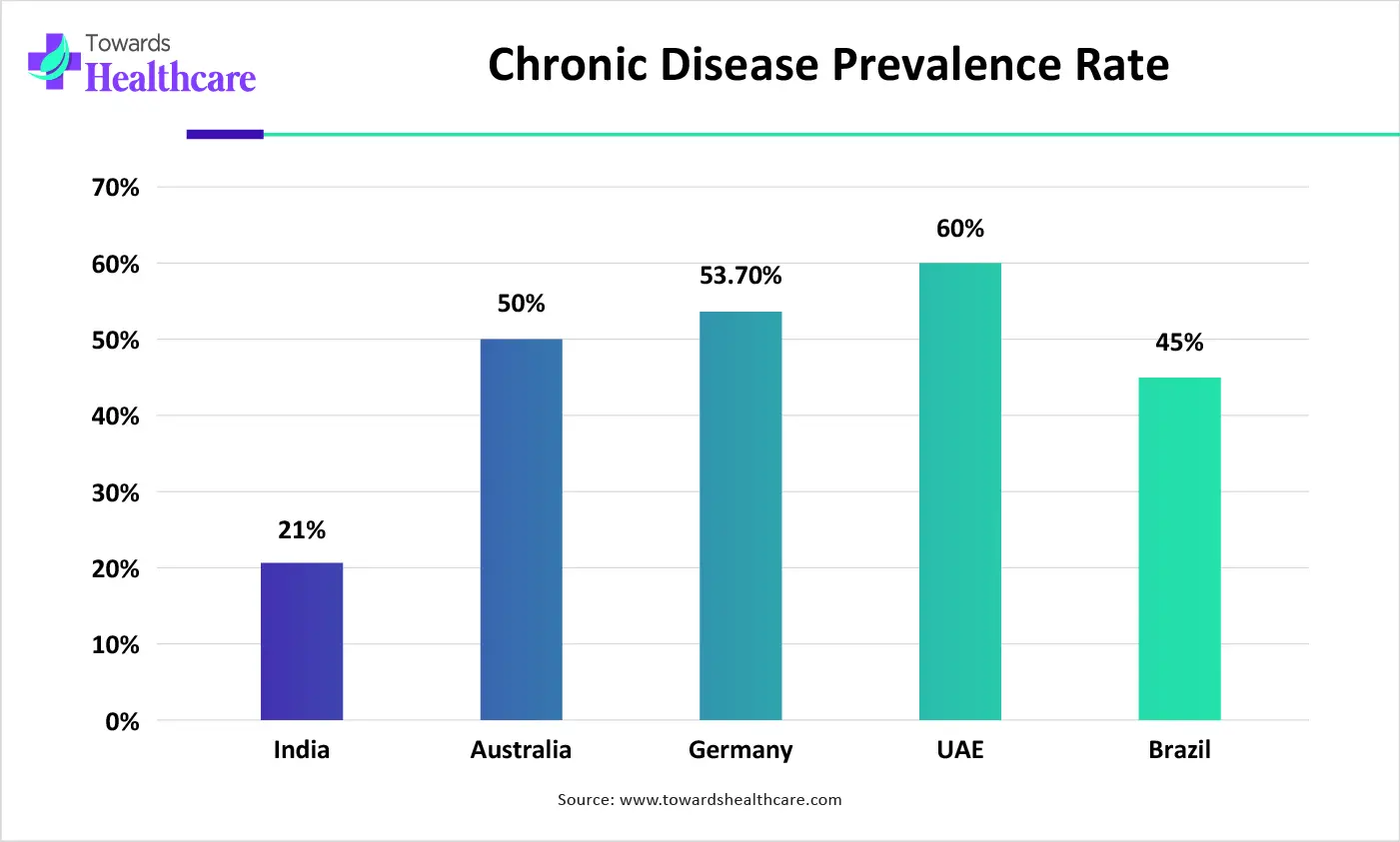

| Countries | Total Population Affected by Chronic Disease |

| India | 21% |

| Australia | 50% |

| Germany | 53.7% |

| UAE | 60% |

| Brazil | 45% |

Which Product Type Segment Dominated the Disease Management Apps Market?

The diabetes management apps segment held a dominant position in the market in 2025, with a revenue of 35% due to the rising prevalence of diabetes and growing awareness of preventive diabetes care. Diabetes management apps facilitate blood glucose tracking, insulin dose calculation, and diet and lifestyle management. They are widely preferred as people are aware of avoiding potential diabetes complications. The International Diabetes Federation (IDF) reported that 589 million people were suffering from diabetes in 2024.

Cardiovascular Disease Apps

The cardiovascular disease apps segment is expected to grow at the fastest CAGR in the market during the forecast period. Cardiovascular diseases (CVDs) are the most common causes of morbidity and mortality, especially among the geriatric population, globally. CVD apps enable patients and healthcare professionals to assess future risks and monitor vital parameters, such as blood pressure, heart rate, and oxygen saturation.

How the On-Premise/Local Installations Segment Dominated the Disease Management Apps Market?

The cloud-based segment held the largest revenue share of the market in 2025, with a revenue of 60%. Cloud-based tools can store large amounts of data and can be accessed by providers from anywhere and at any time. They offer superior advantages, such as high flexibility and scalability. They allow companies to pay on an as-needed basis and effectively scale up or down based on overall usage.

Hybrid (Cloud + Local)

The hybrid (cloud + local) segment is expected to grow with the highest CAGR in the market during the studied years. Hybrid systems blend the benefits of cloud-based and on-premise tools, providing high flexibility in a healthcare organization. They also offer high scalability and cost control for healthcare professionals. They provide more deployment options, security, compliance, and get more value from their existing infrastructure.

Which Application Segment Led the Disease Management Apps Market?

The remote patient monitoring segment led the market in 2025, with a revenue of 40% due to the burgeoning telehealth sector and the growing geriatric population. Disease management apps eliminate the need for patients to visit any healthcare organization physically and receive advanced care from the comfort of their homes. This saves a lot of time and costs for patients. Healthcare professionals also benefit from apps by providing tailored insights and serving a larger patient population.

Medication & Treatment Adherence

The medication & treatment adherence segment is expected to expand rapidly in the market in the coming years. Disease management apps are leveraged by AI-based sensors to continuously track patients. They provide real-time notifications of patients’ health status and send reminders for timely drug use. They enhance medication adherence through certain interventions, such as short message service and electronic pillboxes.

What Made Hospitals & Health Systems the Dominant Segment in the Disease Management Apps Market?

The hospitals & health systems segment contributed the biggest revenue share of 40% of the market in 2025, due to favorable infrastructure and rising patient volumes. Patients prefer hospitals due to the presence of multidisciplinary expertise and favorable reimbursement policies. Hospitals and health systems receive funding from the government and private organizations to adopt advanced digital health tools. They can help providers treat a vast patient population across diverse geographical locations.

Individual Patients/Consumers

The individual patients/consumers segment is expected to witness the fastest growth in the market over the forecast period. People are becoming more aware of disease management apps and their benefits. Patients are also aware of their health and fitness, necessitating them to continuously track their vital parameters. The increasing use of wearable devices also contributes to the segment’s growth.

North America dominated the global market in 2024, with a revenue of 35%. The presence of a robust healthcare infrastructure, the rising prevalence of chronic disorders, and favorable regulatory support are the major factors that govern market growth in North America. The increasing use of wearable devices and the presence of key players foster market growth. Additionally, government bodies in North America make constant efforts to create a more robust digital health ecosystem.

According to a recent consumer study in the U.S., approximately 50% of 8,000 U.S. internet households own and actively use wearable devices, underscoring the growing demand for health and safety features. There are a total of 261,500 digital health apps in the U.S. that focus on chronic disease management. Key players, such as Odama Health, Teladoc Health, and Philips Healthcare, are major contributors to the market in the U.S.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The growing geriatric population and the burgeoning healthcare sector propel the market. Government organizations launch initiatives to support the adoption of digital tools within the healthcare sector. They also provide funding to healthcare organizations and reimbursement to patients. The increasing use of mobile health apps and growing awareness of digital health apps in remote locations also boost market growth.

China’s digital healthcare ecosystem is booming, driven by government initiatives and the growing demand for personalized care. It is estimated that approximately 81.1% of the total Chinese population has at least one chronic disease, representing 179.9 million older adults. The nation spends around 7% of its GDP on health, promoting the adoption of digital tools.

Europe is expected to grow at a considerable CAGR in the upcoming period. The increasing adoption of advanced technologies and rising investments augment the market. The European Centre for Disease Prevention and Control offers surveillance and outbreak tools to support and guide outbreak preparedness, investigation, and response activities. Increasing collaborations among key players and public-private partnerships facilitate the development of innovative disease management apps in the region.

There are around 227,500 digital health apps in the UK. The UK government supports cutting-edge tech projects, leading to the development of digital tools. Innovate UK is supporting 17 businesses, including the development of light-weight smart glasses which use AI to address the impact of illnesses like depression, anxiety, and psychosis.

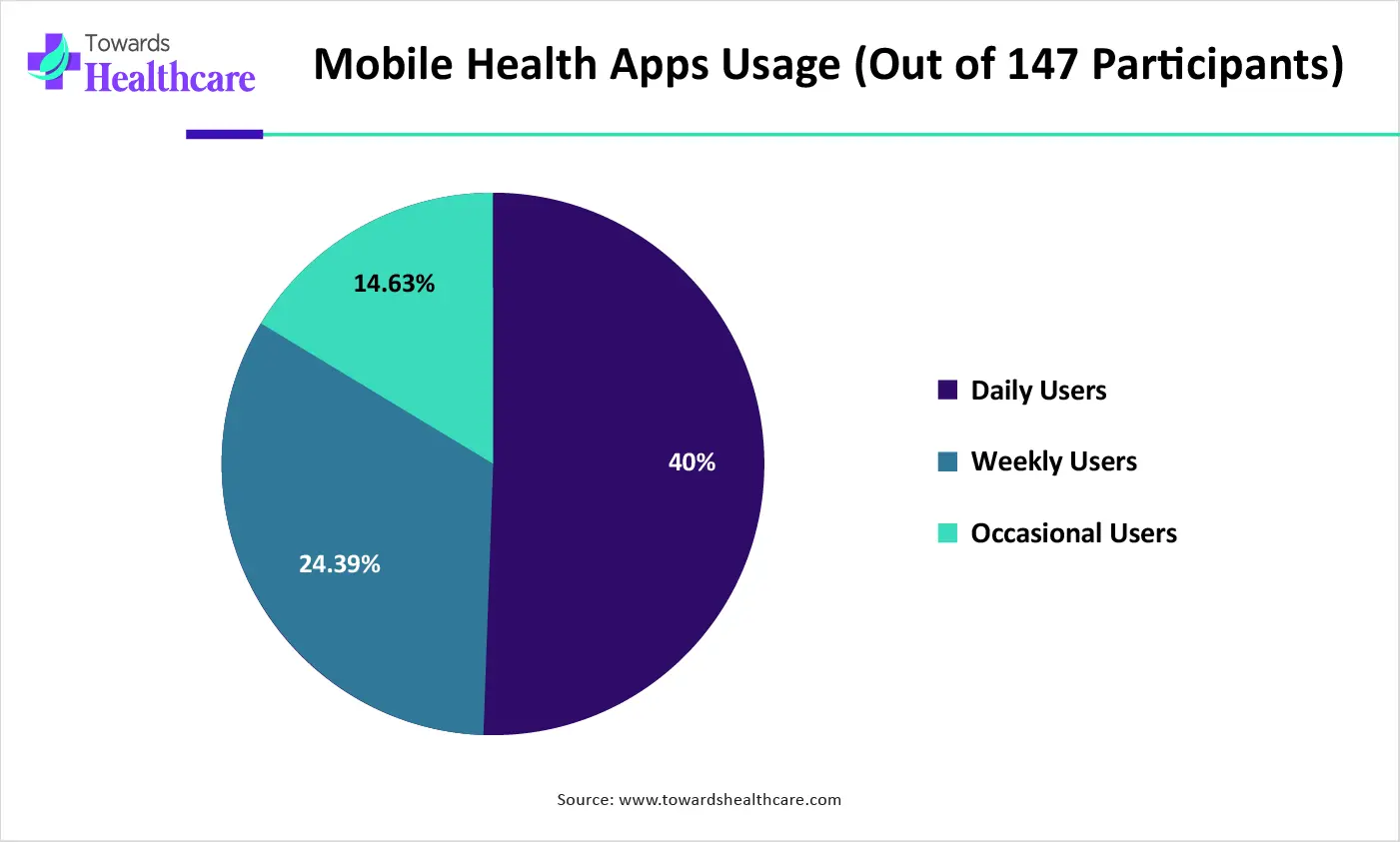

| Mobile Health App Usage | Percentage of Users (out of 147 participants) |

| Daily Users | 40% |

| Weekly Users | 24.39% |

| Occasional Users | 14.63% |

| Companies | Headquarters | Offerings |

| Omada Health, Inc. | California, United States | It offers virtual care solutions with personalized chronic disease management programs. |

| WellDoc | Maryland, United States | WellDoc App supports prediabetes, diabetes, heart failure, hypertension, and weight management. |

| Teladoc Health | New York, United States | Teladoc Health is a telemedicine platform that promotes physical, mental, and emotional well-being in a practical and safe way. |

| Glooko | California, United States | Glooko Mobile App helps users stay connected and collaborate with their care teams between visits, identify trends, and share reports remotely. |

| Medtronic Care Management Services | Minneapolis, United States | It offers Medtronic CareLink, MyCareLink, and MyCareLink Smart applications for remote patient monitoring. |

| Philips Healthcare | Massachusetts, United States | The Philips Care Assist mobile app transforms qualified smart devices into a powerful tool for caregivers working in fast-paced hospital environments. |

| Proteus Digital Health | California, United States | It offers apps that track medication use and health status from smartphones and help patients receive reminders and alerts. |

| Dexcom, Inc. | California, United States | The Dexcom Clarity App allows patients to measure their glucose trends and time in range, enabling them to track their progress. |

| ADA Health | Berlin, Germany | The app assesses answers against its medical dictionary of thousands of disorders and medical conditions and provides a personalized report to patients. |

| MyFitnessPal | Texas, United States | It is a nutrition tracking app that helps people reach their health, fitness, and weight goals. |

By Product Type

By Deployment Type

By Application

By End-User

By Region

January 2026

January 2026

January 2026

December 2025