February 2026

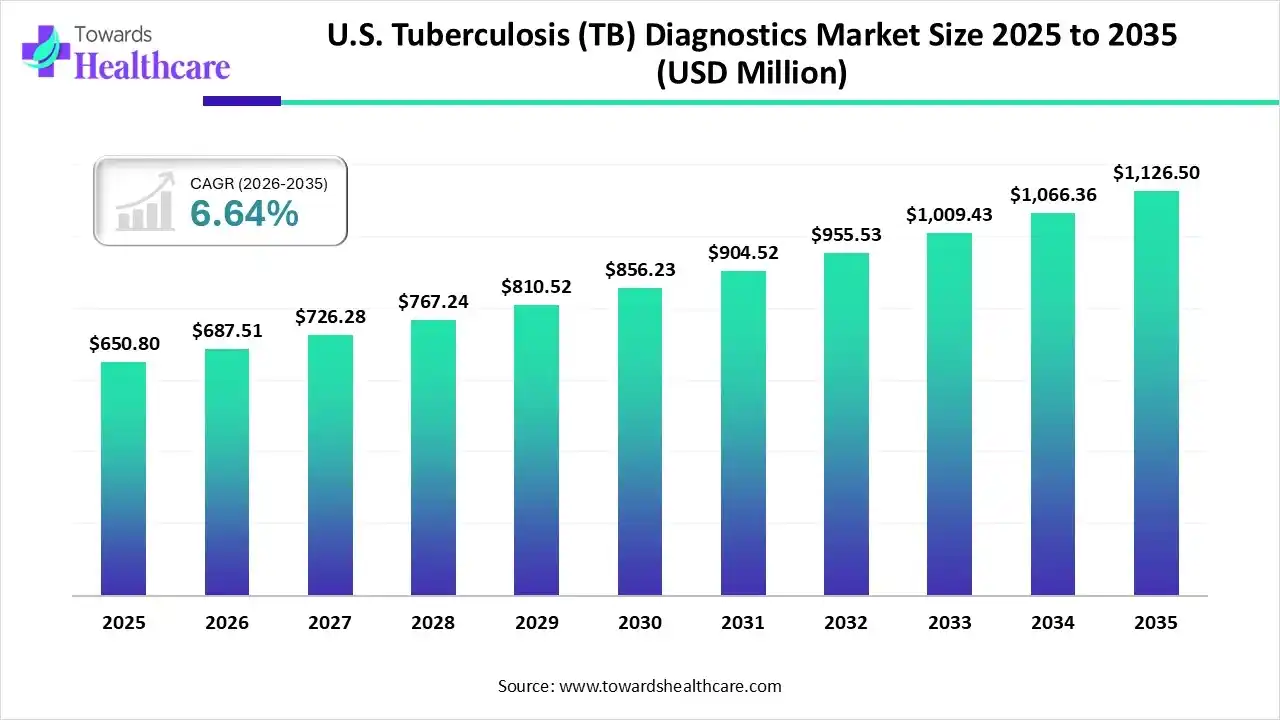

The U.S. tuberculosis (TB) diagnostics market size was estimated at USD 650.8 million in 2025 and is predicted to increase from USD 687.51 million in 2026 to approximately USD 1126.5 million by 2035, expanding at a CAGR of 5.64% from 2026 to 2035.

The U.S. tuberculosis diagnostics market is shaped by strong public health surveillance systems, early screening programs, and the growing use of molecular and rapid diagnostic technologies. Rising focus on latent TB detection, government funding initiatives, and hospital-based testing drives adoption. Continuous innovation, AI integration, and expanded access through reference laboratories further strengthen diagnostic accuracy, speed, and nationwide disease monitoring efforts.

| Key Elements | Scope |

| Market Size in 2026 | USD 687.51 Million |

| Projected Market Size in 2035 | USD 1126.5 Million |

| CAGR (2026 - 2035) | 5.64% |

| Market Segmentation | By Test Type, By Disease Type, By End-User, By Sample Type |

| Top Key Players | F. Hoffmann-La Roche Ltd., QIAGEN, Abbott Laboratories, Danaher (Cepheid), Thermo Fisher Scientific Inc., Becton Dickinson & Co (BD), Hologic Inc., BioRad Laboratories, bioMérieux SA, Oxford Immunotec |

The U.S. tuberculosis (TB) diagnostics market is driven by increasing TB screening programs, rising awareness of early disease detection, government-led public health initiatives, technological advancements in molecular testing, and the growing need for rapid, accurate diagnosis to control transmission and improve treatment outcomes. Tuberculosis diagnostics refers to the range of laboratory tests, tools, and technologies used to detect Mycobacterium tuberculosis infection in individuals. Common methods include sputum smear microscopy, culture tests, nucleic acid amplification tests, molecular assays, chest imaging, and immunological tests such as interferon-gamma release assays.

The U.S. market is increasingly adopting molecular diagnostics such as nucleic acid amplification tests due to their high accuracy and faster turnaround times. These technologies support early detection, drug-resistance identification, and improved clinical decision-making across hospitals and public health laboratories.

Growing emphasis on identifying latent tuberculosis infection among high-risk populations, including immigrants, healthcare workers, and immunocompromised individuals, is driving demand for advanced immunological tests such as interferon-gamma release assays across the U.S. healthcare system.

Federal and state-level TB control programs continue to fund screening, surveillance, and diagnostic infrastructure. Sustained policy support and funding initiatives strengthen laboratory networks and ensure widespread access to advanced tuberculosis diagnostic solutions nationwide.

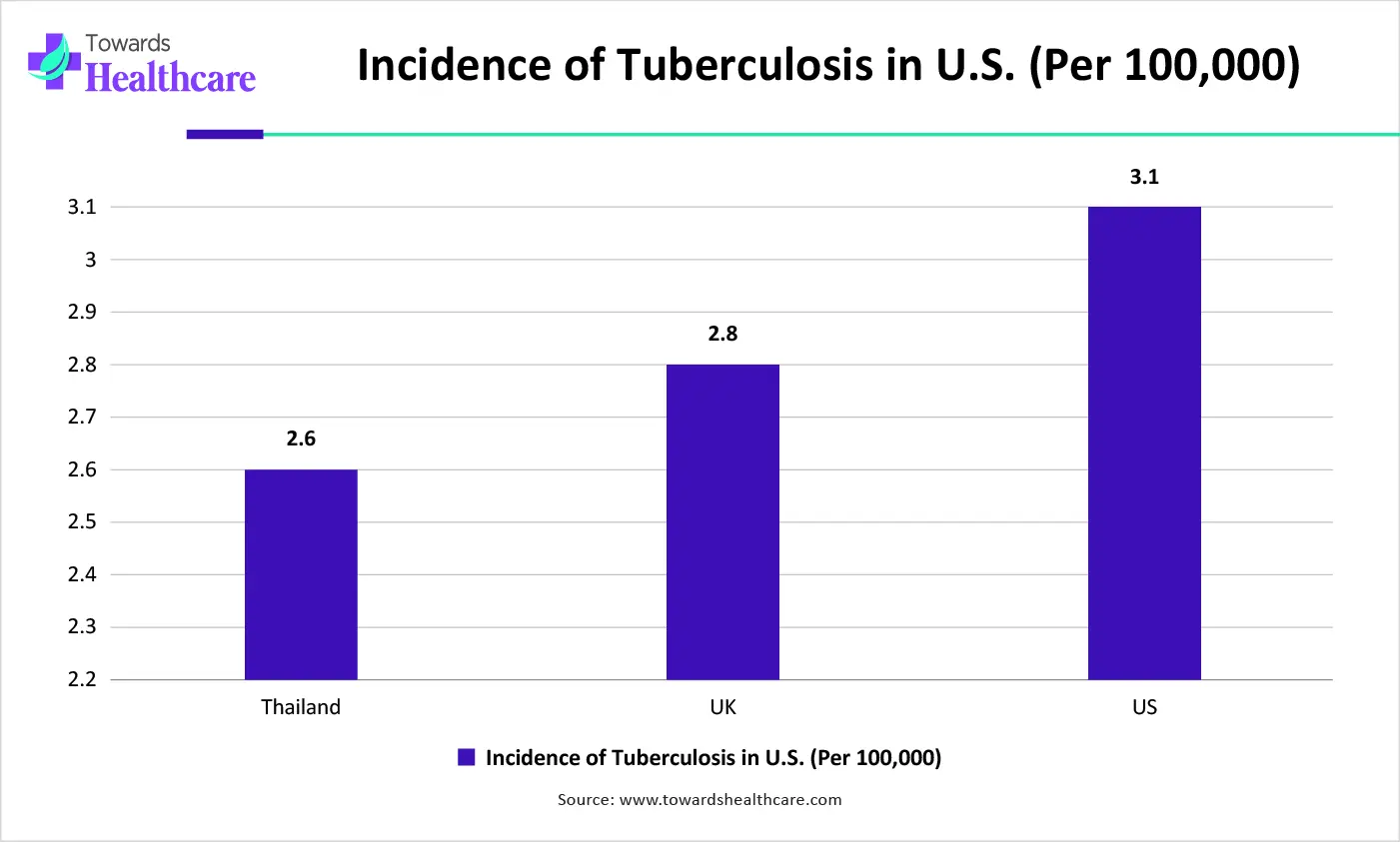

| Year | U.S. Tuberculosis Cases (Incidence Rate per 100,00) |

| 2022 | 2.5 cases per 100,000 |

| 2023 | 2.9 cases per 100,000 |

| 2024 | 3.0 cases per 100,000 |

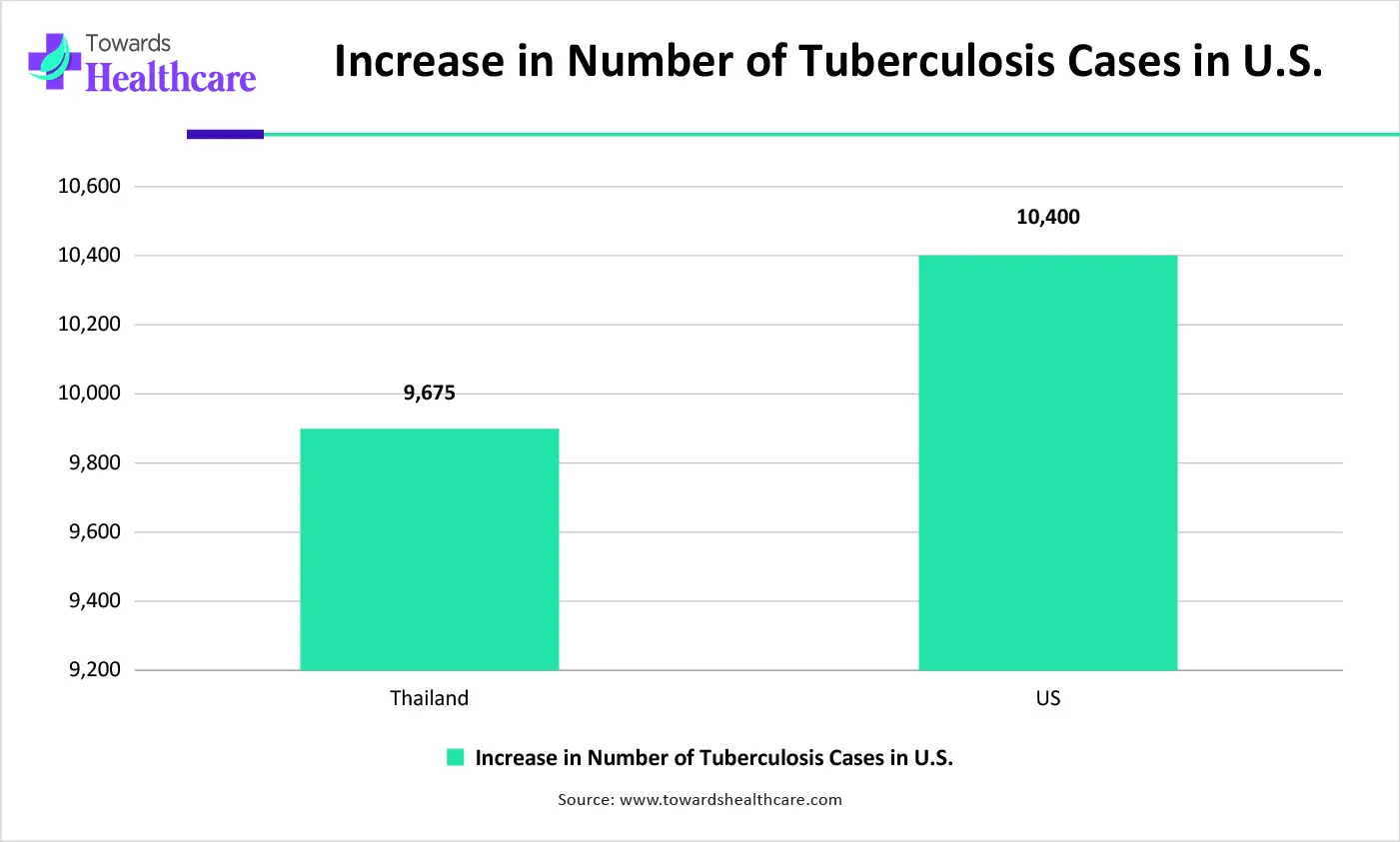

| Year | No. of Tuberculosis Cases |

| 2023 | 9,622 |

| 2024 | 10,347 |

Which Test Type Segment Dominated the U.S. Tuberculosis (TB) Diagnostics Market?

The immunological tests segment is the dominant segment in the market due to its high diagnostic specificity and sensitivity, strong CDC and clinical guideline support, absence of BCG-vaccine cross-reactivity, single-visit blood-based testing convenience, rapid turnaround times, automation compatibility, and widespread adoption across hospitals, public health labs, and screening programs.

Molecular Diagnostics (NAATs / PCR)

The molecular diagnostics segment is estimated to be the fastest-growing segment in the market due to rapid adoption of NAAT/PCR tests that deliver highly sensitive, specific results far quicker than traditional methods, strong preference for rapid drug-resistance detection, ongoing technological innovation, and increased use in clinical settings for early, accurate tuberculosis diagnosis.

Why Did the Latent Tuberculosis Infection (LTBI) Segment Dominate the Market?

The Latent Tuberculosis Infection (LTBI) segment is the dominant segment in the U.S. tuberculosis (TB) diagnostics market due to widespread screening needs driven by a large population with latent infection, strong public-health emphasis on early detection to prevent active disease, routine use of skin tests and IGRAs in high-risk groups, and established clinical protocols prioritizing LTBI detection.

Active Tuberculosis

The active tuberculosis segment is anticipated to be the fastest-growing segment in the U.S. tuberculosis diagnostics market during the forecast period due to increasing focus on early and accurate detection of symptomatic disease, rising awareness and screening initiatives, broad use of rapid molecular and culture-based tests in clinical settings, and expanded public health efforts to identify and treat active TB infections promptly.

Which End User Segment Led the U.S. Tuberculosis (TB) Diagnostics Market?

The public health laboratories segment is the dominant segment in the market due to its role as the primary reference and specialized testing hubs for TB control, handling complex culture, drug-susceptibility and confirmatory testing, supporting state and federal surveillance programs, and partnering with health departments to ensure standardized, quality diagnostics nationwide.

Reference & Independent Diagnostic Laboratories

The reference & independent diagnostic laboratories segment is estimated to be the fastest-growing in the U.S. TB diagnostics market due to rising outsourcing of TB testing, expansion of centralized high-throughput lab networks, growing demand for advanced molecular and specialized assays, and increased partnerships with public health agencies to manage larger test volumes efficiently.

Why Did the Sputum Samples Segment Dominate the U.S. Tuberculosis (TB) Diagnostics Market?

The sputum samples segment is dominant in the U.S. market in 2025 because sputum specimens provide the highest diagnostic yield and remain the mainstay for detecting pulmonary Mycobacterium tuberculosis, are routinely collected for microscopy, culture, and molecular tests, and are widely accepted clinically for accurate active TB diagnosis.

Blood Samples

The blood samples segment is anticipated to be the fastest‑growing in the U.S. tuberculosis diagnostics market due to increased adoption of less invasive blood tests like IGRAs, quicker result availability, strong clinical preference for single‑visit testing, reduced cross‑reactivity with BCG vaccination, and expanding use in both latent and active TB screening settings.

The U.S. is considered a dominant country in the tuberculosis (TB) diagnostics market, not because of high TB prevalence, but due to several strategic and systemic factors:

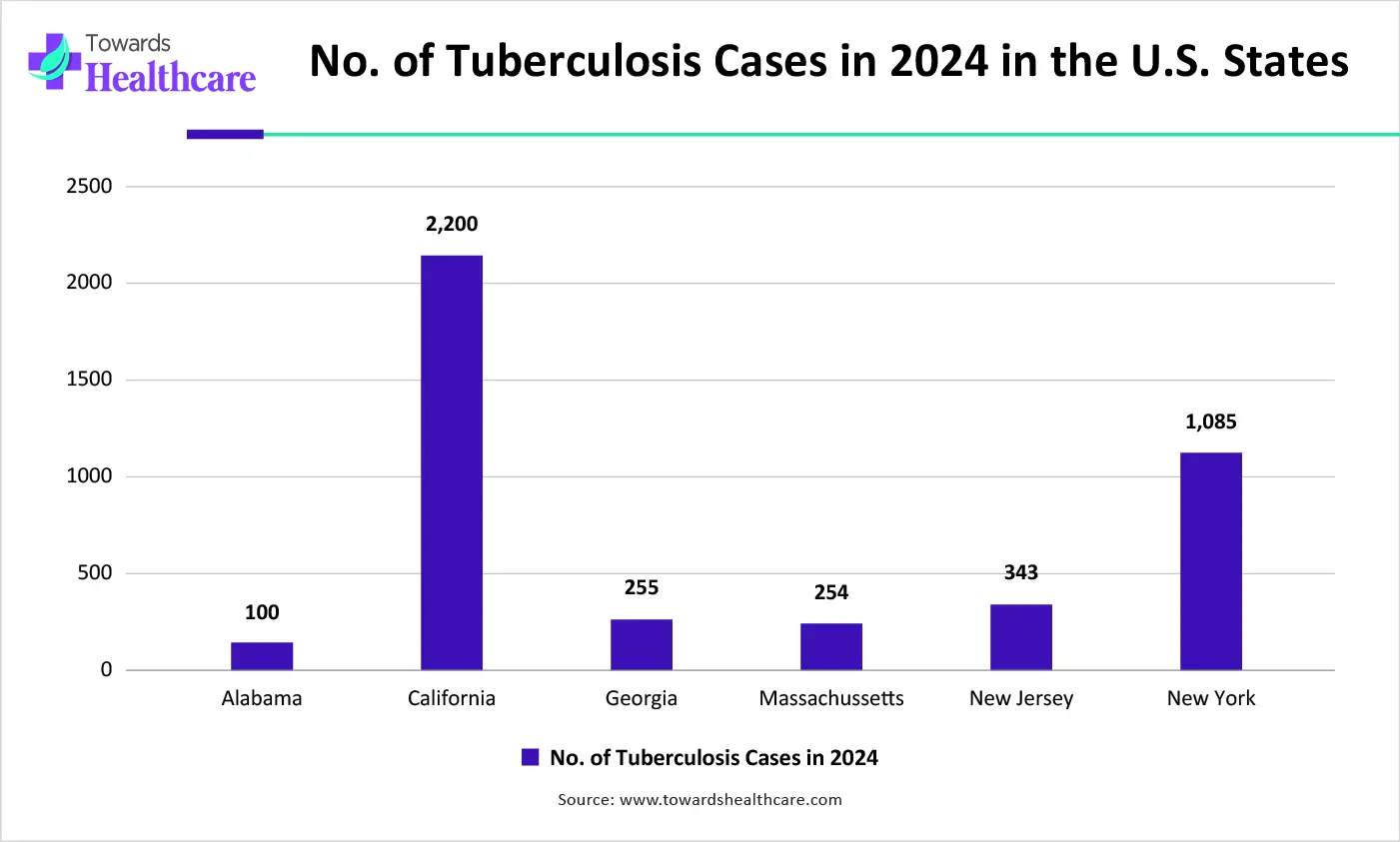

| Cities | Cases in 2024 |

| Alabama | 90 |

| California | 2,100 |

| Georgia | 253 |

| Massachusetts | 252 |

| New Jersey | 342 |

| New York | 1,083 |

| Company | Key TB Diagnostics Offerings |

| F. Hoffmann-La Roche Ltd. | COBAS MTB and COBAS MTBRIF molecular assays for rapid TB and drug resistance detection. |

| Abbott Laboratories | NAAT and immunoassay solutions, including Determine TB LAM and RealTime MTB assays. |

| QIAGEN | QuantiFERONTB Gold Plus IGRA for latent TB and molecular assay panels. |

| Danaher (Cepheid) | GeneXpert MTB/RIF and related cartridge-based molecular tests. |

| Thermo Fisher Scientific Inc. | TaqMan TB panels and high-throughput PCR platforms for TB detection. |

| Becton Dickinson & Co (BD) | BD MGIT/BACTEC culture systems and supporting immuno/molecular tools. |

| Hologic Inc. | Panther Fusion and related molecular TB assays. |

| BioRad Laboratories | Droplet digital PCR TB assays and mutation panels. |

| bioMérieux SA | VIDAS TBIGRA immunoassays and BacT/ALERT culture systems. |

| Oxford Immunotec | TSPOT.TB: Tcell-based latent TB diagnostic test. |

By Test Type

By Disease Type

By End-User

By Sample Type

February 2026

February 2026

February 2026

February 2026