February 2026

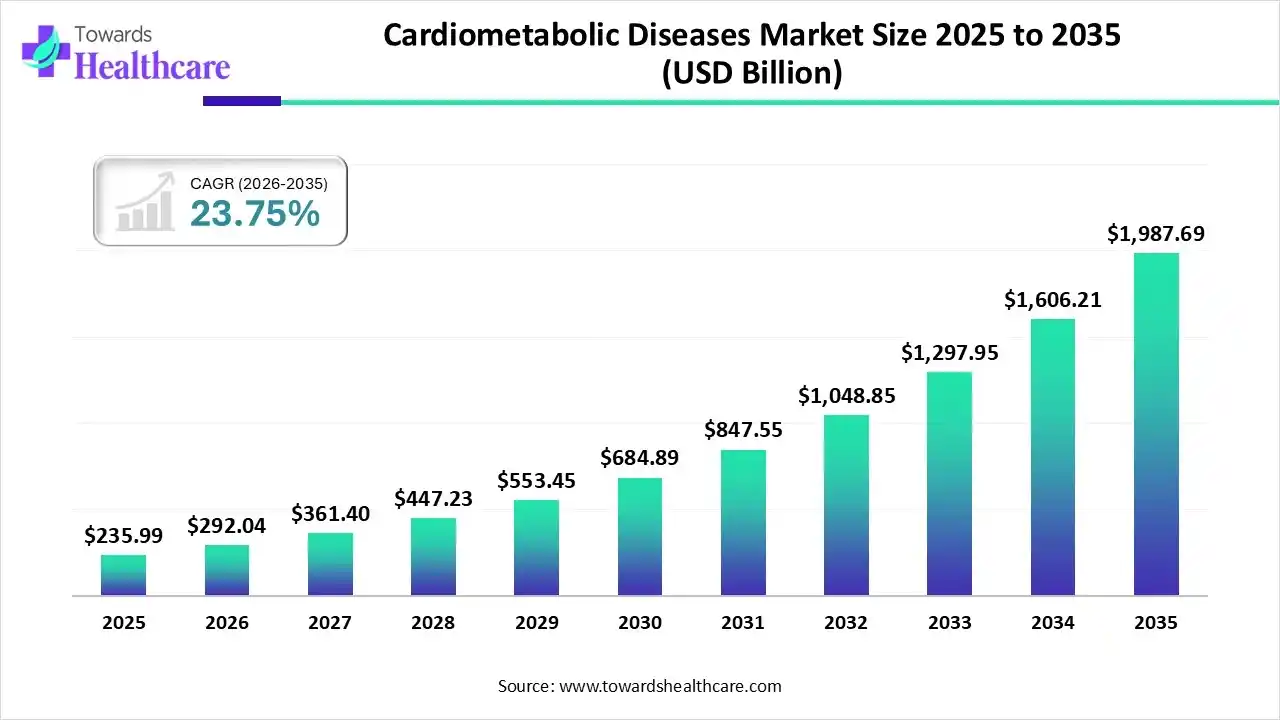

The global cardiometabolic diseases market size was estimated at USD 235.99 billion in 2025 and is predicted to increase from USD 292.04 billion in 2026 to approximately USD 1987.69 billion by 2035, expanding at a CAGR of 23.75% from 2026 to 2035.

The increasing incidence of cardiometabolic disease globally is increasing the demand for effective treatment and accurate diagnostic solutions, where the use of AI is driving their innovations. The robust healthcare, growing health awareness, and government initiatives are also increasing their use across various regions, where the companies are also investing and launching new products, promoting the market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 292.04 Billion |

| Projected Market Size in 2035 | USD 1987.69 Billion |

| CAGR (2026 - 2035) | 23.75% |

| Leading Region | North America by 37% |

| Market Segmentation | By Disease Type, By Therapeutic Class, By Treatment Modality, By End-User, By Region |

| Top Key Players | Novo Nordisk, Eli Lilly and Company, Novartis, AstraZeneca, Boehringer Ingelheim, Merck & Co., Amgen, Sanofi, Bayer, Pfizer |

The cardiometabolic diseases market is driven by increasing incidences of interconnected lifestyle-related conditions, an aging population, and advancements in diagnostic technology. The cardiometabolic diseases comprise the epidemiology, diagnosis, treatment, monitoring, and management of conditions that affect the heart and metabolic systems. Cardiometabolic diseases include cardiovascular diseases (e.g., coronary artery disease, heart failure, hypertension), metabolic disorders (e.g., type 2 diabetes, obesity, dyslipidemia), and overlapping syndromes like metabolic syndrome that increase risk of morbidity and mortality.

The use of AI for the early and accurate detection of diseases is increasing, as it analyzes medical records and lab data. Personalized treatment plans and drug development and optimization are also supported with the use of AI, where wearable devices and apps are also being developed with its use. It is also used in the design of clinical trials, which helps in reducing manual errors.

To deal with the growing incidence of cardiometabolic diseases, the healthcare sector is increasingly adopting various novel and personalized therapies along with other combination drugs.

The hospital and clinics are focused on integrating the therapeutic option with lifestyle modification for effective management of cardiometabolic disease and to reduce its complications.

The companies are developing various mobile apps, wearable devices, and telemedicine platforms for early disease detection and their continuous monitoring, which are backed by investments.

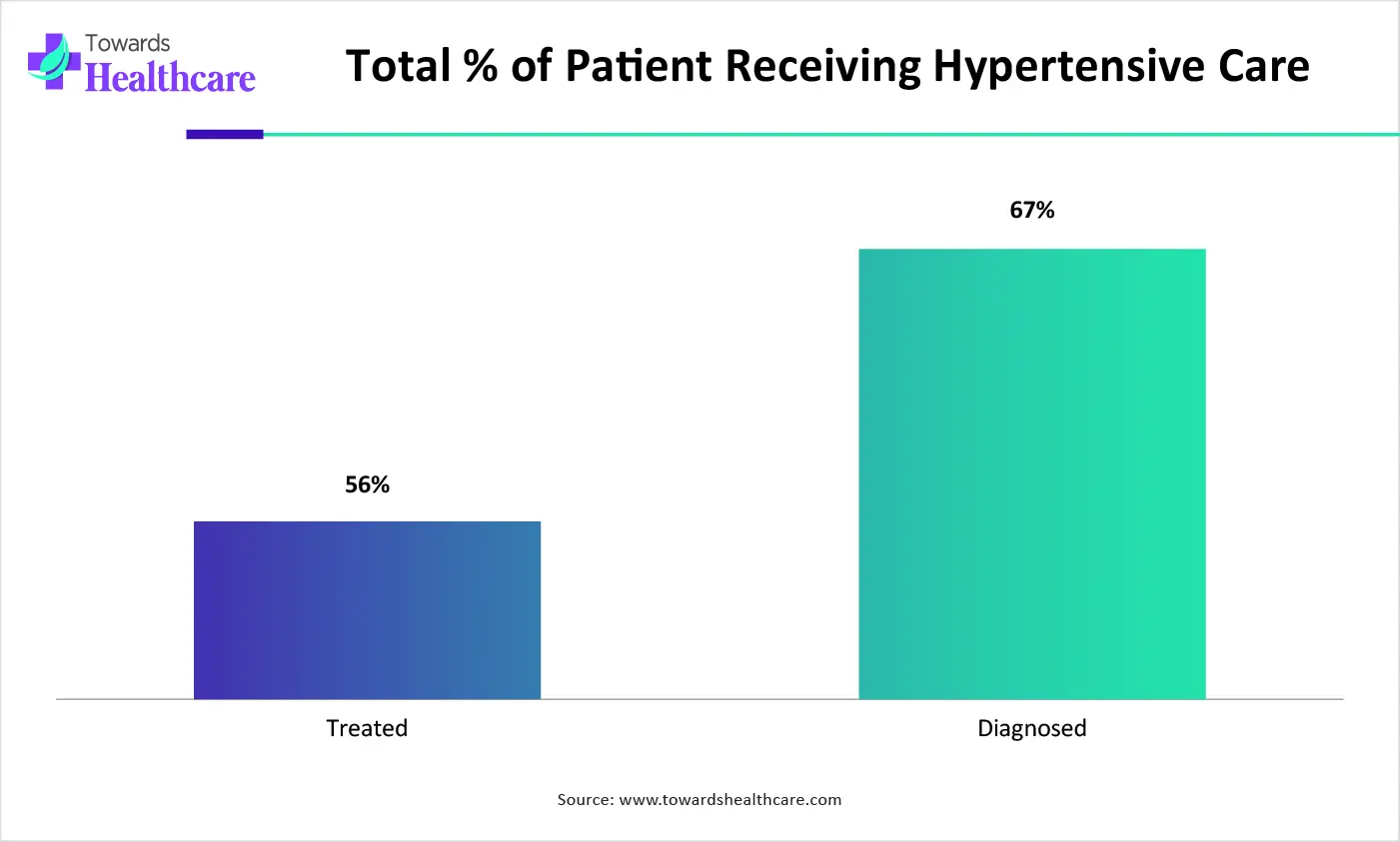

| Hypertension Management | Hypertensive Patients (%) |

| Treated | 56% |

| Diagnosed | 67% |

Why Did the Hypertension Segment Dominate in the Cardiometabolic Diseases Market in 2025?

The hypertension segment held the largest share of approximately 50% in the market in 2025, due to growth in stressful conditions. Moreover, their complications led to various heart diseases and diabetes. This, in turn, increased the demand for various accurate diagnostic and effective treatment options.

Obesity

The obesity segment is expected to show rapid growth with approximately a 13% CAGR during the predicted time, due to a growing sedentary lifestyle. At the same time, the growing processed food consumption and calorie intake are also increasing the obesity rates. The growing health awareness is also driving their early diagnosis.

How Antihypertensives Segment Dominated the Cardiometabolic Diseases Market in 2025?

The antihypertensives segment led the market with approximately 47% share in 2025, due to growth in the hypertension rates. This increased the use of various hypertensive drugs, where their long-term use increased their repeated demand. Additionally, the presence of generic products also increased their affordability.

Antidiabetics

The antidiabetics segment is expected to show the highest growth with approximately 17% CAGR during the predicted time, due to increasing diabetes cases. Furthermore, the sedentary lifestyles, genetic factors, and dietary changes are also increasing their incidences, driving the demand for antidiabetics.

GLP-1 RAs & SGLT2 Inhibitors

In the antidiabetics segment, the GLP-1 & SGLT2 inhibitors subsegment is expected to show the fastest growth rate, due to their enhanced efficacy. Moreover, their proven weight management and cardiovascular risk reduction are also increasing their acceptance rates, which is driving their innovations.

Which Treatment Modality Type Segment Held the Dominating Share of the Cardiometabolic Diseases Market in 2025?

The pharmaceuticals segment held the largest share of approximately 60% in the market in 2025, due to growth in the R&D activities. Additionally, the growth in cardiometabolic diseases also increased the use of various treatments and diagnostic options, which promoted their adoption rates and advancements.

Digital Health/Telemedicine

The digital health/telemedicine segment is expected to show rapid growth with approximately 19% CAGR during the upcoming years, due to growing focus on remote monitoring. This, in turn, is encouraging the development of wearable and personalized care options, which are attracting patients.

What Made Hospitals & Cardiology Centers the Dominant Segment in the Cardiometabolic Diseases Market in 2025?

The hospitals & cardiology centers segment led the market with approximately 48% share in 2025, due to growth in the patient volume. This increased the use of various diagnostics and treatment options. Moreover, their reimbursement policies and use of complex therapies also increased their acceptance rates.

Home Care & Remote Monitoring

The home care & remote monitoring segment is expected to show the highest growth with approximately 20% CAGR during the upcoming years, due to the early detection of disease complications. This increased their use for continuous disease monitoring, driving the demand for telemedicine and wearable devices.

North America dominated the cardiometabolic diseases market with approximately 37% share in 2025, due to the presence of an advanced healthcare infrastructure. At the same time, the growth in cardiometabolic diseases is also increasing the adoption of various treatments and diagnostic options, along with digital platforms, which contributed to the market growth.

The growing incidence of cardiovascular disease in the U.S. is increasing the demand for effective treatment and accurate diagnostic devices. This is driving the adoption of various advanced therapies and digital health platforms, where the growing investments and reimbursement policies are increasing their innovations and acceptance rates, respectively.

Asia Pacific is expected to host the fastest-growing cardiometabolic diseases market with approximately 15% CAGR during the forecast period, due to rapid urbanization, which is leading to lifestyle changes and increasing the incidence of various cardiometabolic diseases. The expanding healthcare and growing health awareness are also increasing the use of various disease management options, enhancing the market growth.

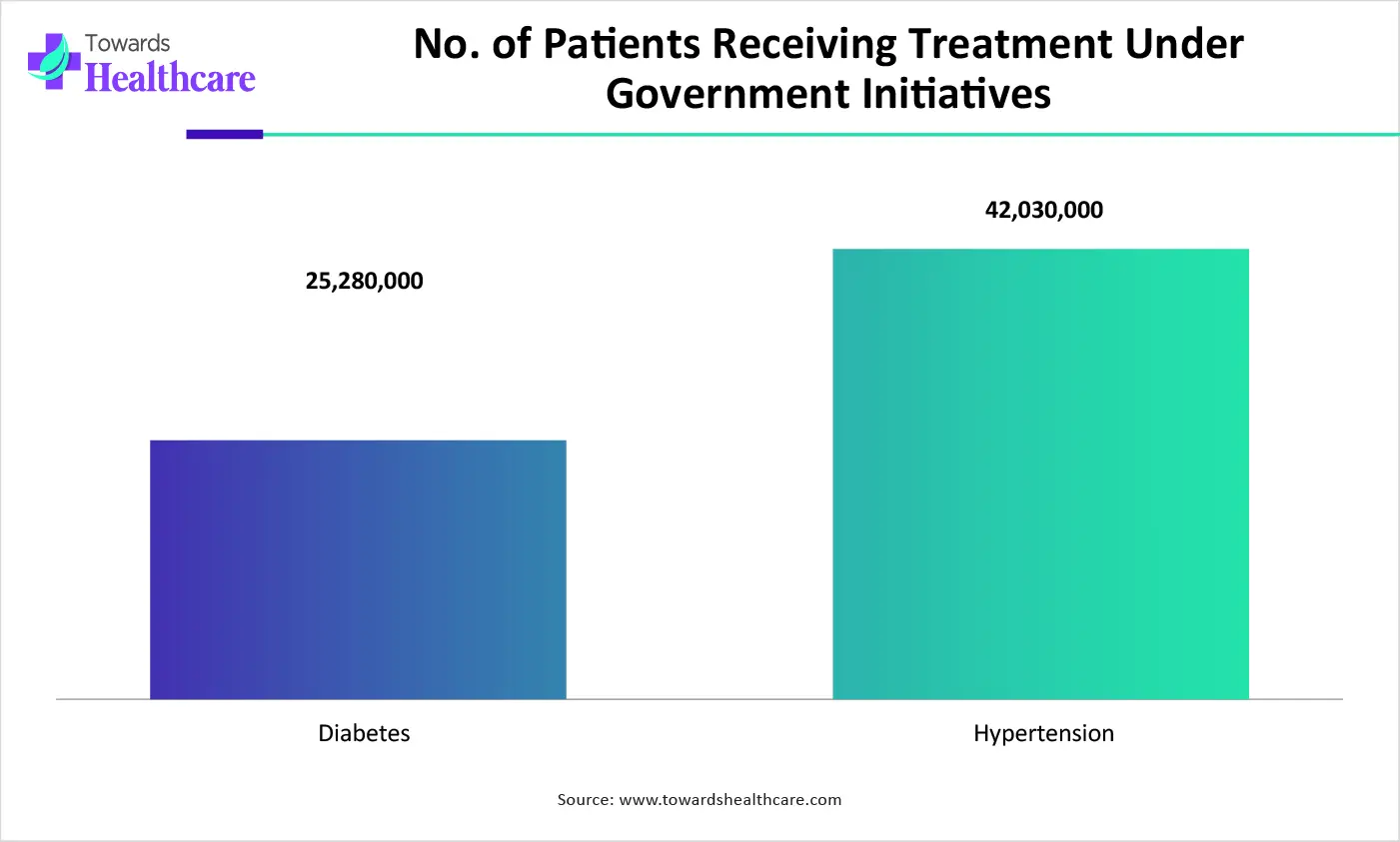

The growing incidence of diabetes and hypertension in India is increasing the demand for treatment options. The expanding healthcare is driving their adoption, where the growing health awareness is increasing their early diagnosis. The growing government initiatives are also increasing accessibility to their treatment options.

| Diseases | Treatment Received |

| Diabetes | 25.28 million |

| Hypertension | 42.03 million |

Europe is expected to grow significantly in the cardiometabolic diseases market during the forecast period, due to growing hypertension and diabetes cases. At the same time, the presence of advanced healthcare systems is increasing the use of various advanced therapies, supported by reimbursement policies, which is promoting the market growth.

The presence of advanced healthcare systems is increasing the accessibility to a wide range of treatment options for cardiometabolic disease to control its growing incidence. The industries are also developing various specialized therapies and digital health monitoring devices, where the government initiatives are also supporting these innovations.

| Companies | Headquarters | Solutions |

| Novo Nordisk | Bagsvaerd, Denmark | Ozempic and Wegovy |

| Eli Lilly and Company | Indiana, U.S. | Mounjaro and Zepbound |

| Novartis | Basel, Switzerland | Leqvio and Entresto |

| AstraZeneca | Cambridge, UK | Farxiga |

| Boehringer Ingelheim | Ingelheim, Germany | Jardiance |

| Merck & Co. | New Jersey, U.S. | Januvia and Winrevari |

| Amgen | California, U.S. | Repatha |

| Sanofi | Paris, France | Praluent and Lantus |

| Bayer | Leverkusen, Germany | Kerendia |

| Pfizer | New York, U.S. | Vyndaqel/Vyndamax |

By Disease Type

By Therapeutic Class

By Treatment Modality

By End-User

By Region

February 2026

February 2026

February 2026

February 2026