February 2026

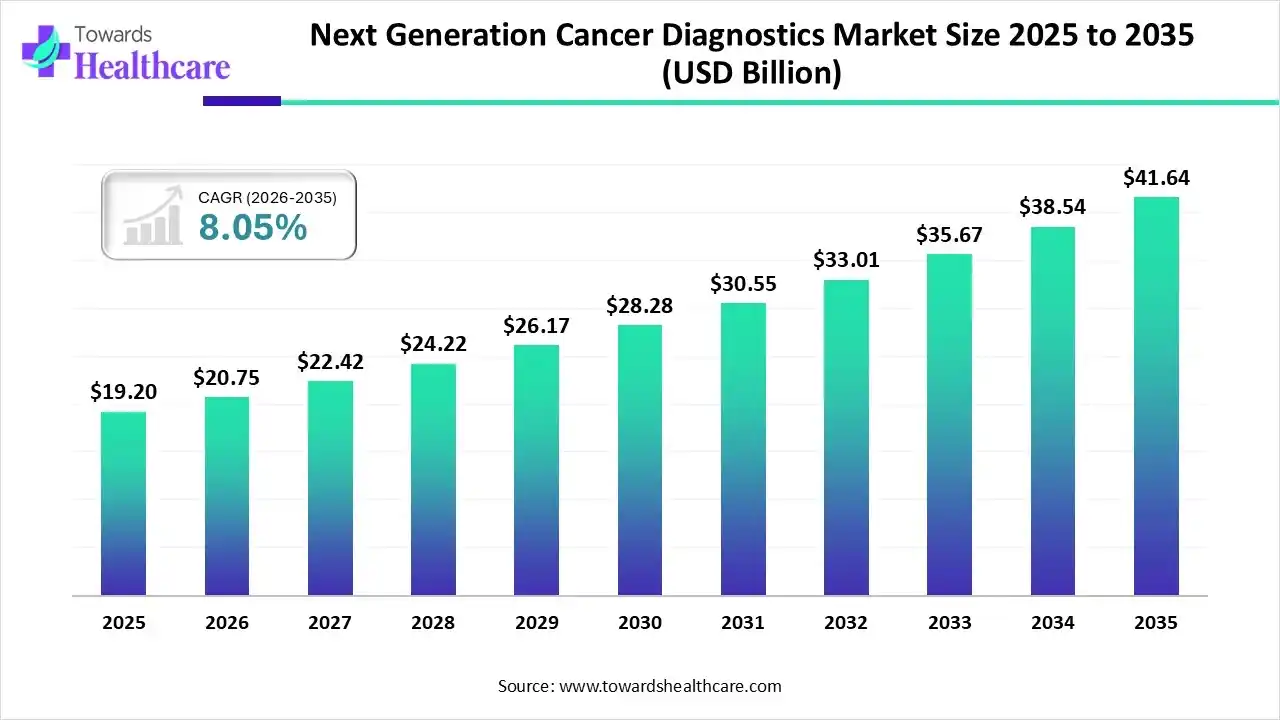

The global next generation cancer diagnostics market size is estimated at USD 19.20 billion in 2025, grew to USD 20.75 billion in 2026, and is projected to reach around USD 41.64 billion by 2035. The market is expected to expand at a CAGR of 8.05% between 2026 and 2035.

| Key Elements | Scope |

| Market Size in 2026 | USD 20.75 Billion |

| Projected Market Size in 2035 | USD 41.64 Billion |

| CAGR (2026 - 2035) | 8.05% |

| Leading Region | North America |

| Market Segmentation | By Technology, By Application, By Cancer Type, By Function, By Region |

| Top Key Players | F. Hoffmann La Roche Ltd. (Roche Diagnostics), QIAGEN N.V., Agilent Technologies, Inc., Abbott Laboratories, GE Healthcare, Koninklijke Philips N.V. (Philips), PerkinElmer, Inc., Myriad Genetics, Inc., Hologic, Inc, Novartis AG |

The next generation cancer diagnostics market is experiencing strong growth driven by advances in genomics, liquid biopsy, and AI-based diagnostic tools. North America leads the market because of its advanced healthcare infrastructure, high awareness, and prominent diagnostic companies. The rising incidence of cancer, increasing demand for personalized medicine, and government support for precision oncology research further promote adoption. Additionally, ongoing innovations and collaborations across the biotech and healthcare sectors continue to enhance diagnostic accuracy and early cancer detection.

The next generation cancer diagnostics market is driven by a strong focus on the early detection of cancer at its molecular roots before it advances. Next-generation cancer diagnostics is an innovative approach that combines cutting-edge technologies such as genomic sequencing, liquid biopsy, digital pathology, and AI-powered analytics to provide deeper insights into tumor behavior. By integrating molecular profiling with big data, next-generation diagnostics enables clinicians to customize treatment plans for each patient’s genetic profile. This approach represents a transformative shift from reactive cancer management to proactive, data-driven, and patient-specific diagnosis and treatment planning.

AI integration is transforming the next generation cancer diagnostics market by improving accuracy, speed, and personalization in cancer detection and treatment planning. Machine learning algorithms analyze large amounts of genomic, imaging, and clinical data to spot subtle cancer patterns often missed by traditional diagnostics. AI-powered tools help pathologists automate image analysis, enhance diagnostic accuracy, and reduce human errors. Predictive analytics also support early detection and risk assessment, enabling timely interventions. Additionally, AI aids in developing personalized treatment plans by linking genetic mutations with targeted therapies. Combining with big data platforms speeds up biomarker discovery and clinical decision-making. Overall, AI enables healthcare professionals to provide faster, more reliable, and patient-specific cancer care, greatly improving outcomes and operational efficiency in oncology diagnostics.

Which Technology Dominates the Next Generation Cancer Diagnostics Market?

The next generation sequencing segment dominated the market while holding the largest share in 2024. This is primarily due to its high accuracy, scalability, and ability to analyze multiple genetic alterations simultaneously. Its efficiency in identifying mutations, guiding personalized therapies, and enabling comprehensive tumor profiling makes it a preferred technology in precision oncology and clinical diagnostics. Additionally, NGS supports liquid biopsy and targeted therapy approaches, further strengthening its dominance in the next-generation cancer diagnostics landscape.

The qPCR & multiplexing segment is expected to grow at the fastest CAGR in the upcoming period due to its ability to detect multiple cancer biomarkers simultaneously with high sensitivity and specificity. It offers rapid results, cost efficiency, and scalability, making it ideal for clinical applications and large-scale cancer screening programs. The technology is widely adopted in clinical laboratories and research settings because it supports both tissue and liquid biopsy applications, enabling personalized treatment decisions.

The protein microarrays segment is expected to expand at a notable rate over the forecast period, as these arrays enable high-throughput, simultaneous analysis of thousands of proteins, require minimal sample volume, and deliver exceptional sensitivity for biomarker detection. These capabilities support early cancer detection, personalized treatment strategies, and streamlined clinical workflows.

Why Did the Lung Cancer Segment Dominate the Next Generation Cancer Diagnostics Market?

The lung cancer segment led the market in 2024 because lung cancer has a high worldwide incidence and death rate, fueling strong demand for early detection. Advanced diagnostics, including liquid biopsies and genomic profiling, enable identification of actionable mutations and biomarkers, supporting targeted therapies and personalized treatment plans. Additionally, the increasing awareness of lung cancer screening programs and the integration of precision medicine in oncology further boost the adoption of next-generation diagnostic tools in this segment.

The breast cancer segment is projected to grow at the highest CAGR in the near future due to rising global incidence, increased awareness and screening efforts, and the quick adoption of advanced molecular testing technologies. These factors collectively drive greater demand and the deployment of next-generation diagnostics in breast oncology. Next-generation diagnostics, including genomic profiling, liquid biopsies, and advanced imaging technologies, enable precise identification of tumor subtypes and actionable genetic mutations, facilitating personalized treatment strategies.

The cervical cancer segment is expected to grow at a significant rate in the market due to increasing global incidence of cervical malignancies, widespread HPV screening initiatives, and greater public and governmental focus on women’s health. Technological advances in molecular and digital testing enhance early detection and diagnostic precision, supporting segmental growth.

What Made Therapeutic Monitoring the Dominant Segment in the Next Generation Cancer Diagnostics Market?

The therapeutic monitoring segment led the market in 2024 because it provides real-time evaluation of treatment effectiveness and tumor response, especially with targeted and immunotherapy treatments. Advanced diagnostics such as liquid biopsy, genomic profiling, and AI-driven analytics allow clinicians to track tumor progression, detect minimal residual disease, and adjust therapies promptly, improving patient outcomes. Increasing adoption of personalized medicine and targeted therapies has further amplified the demand for precise therapeutic monitoring.

The prognostics segment is expected to grow at the fastest rate in the market over the projection period because it enables clinicians to predict tumor behavior, recurrence risk, and survival outcomes. With increasing demand for precision medicine and treatment stratification, prognostic tools help tailor therapies and improve patient-centric care and long-term management. The increasing emphasis on precision medicine and outcome-driven care further bolsters segmental growth.

The companion diagnostics segment is likely to grow at a notable rate in the coming years because it plays a pivotal role in enabling personalized cancer therapy. By identifying specific biomarkers and genetic mutations, these diagnostics guide clinicians in selecting the most effective targeted treatments for individual patients. The integration of companion diagnostics with targeted therapies improves treatment efficacy, minimizes adverse effects, and enhances overall patient outcomes.

Why Did the Biomarker Development Segment Led the Next Generation Cancer Diagnostics Market?

The biomarker development segment dominated the market with the largest share in 2024 due to its critical role in identifying molecular targets for early detection and personalized treatment. Advancements in genomics, proteomics, and bioinformatics have enhanced biomarker discovery, enabling precise cancer profiling, improving diagnostic accuracy, and advancing prognosis assessment and therapy selection across oncology applications.

The genetic analysis segment is expected to grow at the fastest rate during the forecast period because it allows for comprehensive detection of cancer-causing mutations, hereditary risks, and tumor-specific genomic profiles, which are essential for early detection and personalized treatment. Clinicians and researchers increasingly rely on genetic insights to tailor therapies, predict treatment response, and monitor disease progression. The growing emphasis on precision medicine and targeted oncology therapies further drives the adoption and prominence of genetic analysis in cancer diagnostics.

The proteomic analysis segment is expected to grow significantly in the coming years because it allows high-throughput detection of protein biomarkers, uncovers tumor-specific protein expression and post-translational modifications, and supports personalized and early diagnostics by integrating multi-omics data and advanced bioinformatics for better patient stratification. Proteomic analysis also helps monitor therapeutic efficacy and resistance mechanisms, providing actionable insights for clinical decision-making.

The next generation cancer diagnostics market is poised for substantial expansion, underpinned by the convergence of molecular genomics, high-throughput sequencing technologies, and AI-driven bioinformatics platforms. The global rise in cancer prevalence, coupled with an urgent need for early-stage detection and personalized therapeutic regimens, has catalyzed investment in precision oncology. Market incumbents and emerging players alike are leveraging technological innovation in liquid biopsies, multiplexed qPCR assays, and NGS-based profiling to create scalable, clinically actionable solutions that can transform diagnostic workflows and patient stratification models.

From an investment and opportunity standpoint, the market offers pronounced upside potential in the companion diagnostics and prognostic segments, where linking biomarkers to targeted therapies can significantly de-risk clinical outcomes. Integration of predictive analytics and real-world evidence datasets into diagnostic pipelines enables pharmaceutical partners and healthcare providers to optimize treatment protocols, reduce downstream costs, and unlock value in underserved oncology indications. Moreover, the convergence of genomics and proteomics, supported by regulatory alignment toward precision medicine frameworks, offers fertile ground for cross-sector partnerships and platform-driven commercialization strategies.

Geographically, North America remains the epicenter of innovation and capital deployment, yet Europe and select APAC markets are emerging as fertile growth corridors driven by expanding healthcare infrastructure, greater reimbursement coverage, and rising adoption of minimally invasive diagnostics. The market trajectory is further reinforced by policy-level emphasis on population-level screening programs and digital health integration, suggesting a sustainable growth horizon for players capable of combining technological sophistication with scalable delivery models. Strategic early-mover advantages in these geographies will likely determine long-term market dominance, particularly for companies integrating AI-guided interpretation, high-sensitivity assays, and real-time clinical decision support capabilities.

North America led the next generation cancer diagnostics market by capturing the largest share in 2024. This is due to advanced healthcare infrastructure, significant investment in R&D, especially in precision oncology, and early adoption of cutting-edge diagnostic technologies. High awareness of early cancer detection, significant government funding, and robust research and development initiatives further drive market growth. Additionally, supportive regulatory frameworks, widespread screening programs, and the strong presence of biotech firms further reinforce its leadership position.

The U.S. is a major contributor to the North American next generation cancer diagnostics market because it has one of the highest cancer burdens worldwide, with about 2,041,910 new cases expected in 2025 alone. This increasing prevalence is boosting demand for advanced diagnostic technologies. Furthermore, the U.S. benefits from a robust healthcare infrastructure, leading diagnostic technology companies based domestically, and supportive regulatory and reimbursement policies, all of which help accelerate the adoption of next-generation diagnostics.

Asia Pacific is expected to experience the fastest growth in the market throughout the forecast period, driven by expanding healthcare infrastructure, rising awareness of cancer, and increased investment in precision medicine. In particular, in India, cancer incidence is expected to rise from about 1.46 million in 2022 to roughly 1.57 million by 2025, driving demand for advanced diagnostics. The increasing cancer burden, combined with governmental focus on early detection and greater access to technology, is accelerating the adoption of next-generation diagnostic solutions across the region.

China leads the market in Asia-Pacific because of its huge cancer burden. in 2024, the country reported an estimated 4.9 million new cases and 2.59 million deaths. Its large population, rising rates of lung and digestive system cancers, extensive government screening programs, and strong investment in diagnostic infrastructure position China as the dominant player in the region. Government initiatives such as Healthy China 2030, rapid development of healthcare infrastructure, and innovations from companies such as BGI Genomics further strengthen the country’s position. Rising healthcare spending, AI adoption, widespread cancer screening, and supportive NMPA regulations further reinforce its leadership in precision oncology diagnostics.

The Middle East & Africa (MEA) presents substantial growth opportunities for the expansion of the next generation cancer diagnostics market, driven by increasing cancer rates, expanding healthcare infrastructure, and rising investments in precision diagnostics. Public-private screening programs, adoption of molecular testing technologies, and collaborations with international diagnostic companies all support market growth across MEA.

The UAE's next generation cancer diagnostics market is rapidly advancing as healthcare infrastructure broadens and the adoption of precision medicine increases. Higher cancer rates and national screening programs drive demand for molecular diagnostics like NGS and liquid biopsy. Government investments, strategic partnerships with global companies, and AI-powered imaging deployments boost market growth and innovation in oncology testing.

Europe is witnessing an opportunistic rise in the market driven by strong government support for precision medicine and early cancer detection initiatives. The region’s emphasis on genomic research, favorable reimbursement policies, and collaborations between research institutions and biotech companies are accelerating innovation. Additionally, the growing adoption of liquid biopsies and AI-integrated diagnostic tools across major countries like Germany, the U.K., and France is enhancing Europe’s position as a key player in next-generation oncology diagnostics.

Germany is a major contributor to the market in Europe due to its strong healthcare infrastructure, advanced research capabilities, and emphasis on precision medicine. The country’s extensive investment in genomic research, biotechnology, and digital health integration supports the rapid adoption of next-generation sequencing and molecular diagnostic technologies. Additionally, collaborations between academic institutions, healthcare providers, and diagnostic companies position Germany as a leader in innovation and implementation within Europe’s cancer diagnostics landscape.

The growth of the market is supported by rising cancer prevalence, increasing awareness of early detection, and improving access to advanced healthcare technologies. Government initiatives promoting cancer screening programs and the expansion of diagnostic infrastructure are also driving market adoption. Additionally, partnerships between local healthcare providers and global biotech companies are accelerating the availability of innovative diagnostic tools across countries like Brazil and Argentina.

Brazil is the major contributor to the South American next generation cancer diagnostics market due to its expanding healthcare infrastructure, large patient population, and growing investments in cancer research. The country has been actively integrating advanced diagnostic technologies such as genomic sequencing and liquid biopsies into its oncology care framework. Furthermore, government-led cancer awareness initiatives and collaborations with international biotech firms have strengthened Brazil’s position as the regional hub for next-generation cancer diagnostics.

| Vendor | Key Offerings/Contribution |

| F. Hoffmann La Roche Ltd. (Roche Diagnostics) | Focuses on personalized healthcare solutions: biomarker-based testing, companion diagnostics, liquid-biopsy platforms, and partnerships in immuno-oncology diagnostics. |

| QIAGEN N.V. | Specializes in sample preparation, molecular assays, and NGS-based panels geared toward precision oncology and target biomarker detection. |

| Agilent Technologies, Inc. | Delivers laboratory instrumentation, reagents, and NGS target-enrichment kits optimized for high-throughput cancer diagnostics workflows. |

| Abbott Laboratories | Provides diagnostic platforms for oncology, including both point-of-care and laboratory systems aimed at cancer biomarker testing and early detection. |

| GE Healthcare | Leverages imaging and diagnostic equipment and is integrating next-generation cancer detection technologies (e.g., liquid biopsy, imaging analytics) into healthcare workflows. |

| Koninklijke Philips N.V. (Philips) | Integrates diagnostic imaging, digital pathology, and AI-based analytics to support early cancer detection and personalized oncology care. |

| PerkinElmer, Inc. | Offers molecular diagnostic reagents, instruments, and NGS workflows for biomarker discovery, tumor profiling, and oncology testing. |

| Myriad Genetics, Inc. | Provides genetic and genomic testing solutions for hereditary cancer risk assessment, tumor profiling, and personalized therapy selection. |

| Hologic, Inc. | Specializes in women’s health diagnostics, including advanced molecular assays for breast and cervical cancer screening and precision oncology applications. |

| Novartis AG | Develops companion diagnostics in collaboration with diagnostic firms to support targeted cancer therapies and personalized medicine initiatives. |

Corporate Information

Headquarters: San Diego, California, U.S. | Year Founded: 1998

Business Overview

Illumina is a global leader in genomics and life sciences, offering integrated systems and consumables for DNA sequencing, genotyping, and molecular diagnostics. In cancer diagnostics, the company’s platforms support tumor genomic profiling, companion diagnostic development, and liquid biopsy workflows, all advancing precision oncology strategies.

Business Segments / Divisions

Geographic Presence

Illumina serves customers globally across major regions: the Americas, Europe/Middle East/Africa (EMEA), China, and Asia-Pacific. The company has a major installed base of sequencers worldwide, providing a broad footprint across clinical and research markets.

Key Offerings

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Recent News

Corporate Information

Headquarters: Waltham, Massachusetts, U.S. | Year Founded: 1956

Business Overview

Thermo Fisher Scientific is a global leader in life sciences tools, clinical diagnostics, laboratory equipment, consumables, and services, helping researchers and clinicians accelerate discovery, diagnostics, and manufacturing of therapies. In the cancer diagnostics space, Thermo Fisher supports precision oncology through next-generation sequencing (NGS) workflows, companion diagnostics, and other molecular oncology solutions that help identify and monitor tumor biomarkers.

Business Segments / Divisions

Thermo Fisher’s broad operations is grouped into several major segments relevant to cancer diagnostics:

Geographic Presence

Thermo Fisher operates globally, serving customers across the Americas, Europe, the Middle East & Africa (EMEA), Asia Pacific, and Latin America through numerous offices, manufacturing sites, distribution centers, and R&D facilities. Its global reach enables the deployment of diagnostic and sequencing technologies across diverse markets, aiding the adoption of precision oncology worldwide.

Key Offerings

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Recent News

In August 2025, Thermo Fisher Scientific received FDA approval for its Oncomine Dx Target Test as a companion diagnostic for HERNEXEOS® (zongertinib), enabling clinicians to identify NSCLC patients with HER2/ERBB2 TKD mutations.

By Technology

By Application

By Cancer Type

By Function

By Region

February 2026

February 2026

February 2026

February 2026