Modular Medical, Inc. is a development enthusiast medical device company who marketise/sell simple and sober patch pump for diabetes (Type1 and 2). The company’s crown is its 3-day patch pump, which highlights the reusable, convenient, simple 2-part design. Commercialising affordable and user-friendly patch pumps is the main motive of Modular.

Modular bang on entry in the newyear with its new production of validation to its bulk of Pivot™ tubeless patch pump’s infusion set and disposable cartridge has begun. This is one of the crucial manufacturing areas that Modular has won in first place. Following this, the confidence of the commercial launch this year is high, along with the FDA’s 510(k) clearance for the same.

The comprehensive Pivot system, a first-ever removable 3ml tubeless patch pump, encouraged to serve affordability with a simple and gentle appearance. The patch pump fills the gap between the patients and traditional pumps by fighting all odds, stepping in between them.

As many other pumps are costly, the pivotal patch pump is affordable for an infinite number of pumpers, an adult population that depends on MDI. The company’s smart and kind low-cost manufacturing approach and action help the company to secure a large share of the growing diabetes tech market. The pump is on the FDA’s submission track, and confident production will soon meet massive demand. The company is ready to get into action.

The pumpers' population has been coming down since the price or quality issues. The shortage of alternatives can also be the reason for pumpers. Learning the need, the modular comes to the forefront. This patch pump will alleviate implementation risk for the marketing plan. This will improve and relax the launch scenario. This is a patient-focused product, so it got the FDA’s positive review. The Pivot Insulin Delivery System is yet to get a clear signal for sale from the FDA’s end.

CEO of Modular Medical, Jeb Besser, said, “We are thrilled to line up the pivotal manufacturing validation, which takes us closer to our responsibility to serve our simple commitment of the Pivot pump to reach the needs of the patients who are out of options or have no access to the pump. This is an ease to our plan of marketing with the FDA response proof to our recent 510(k) application.”

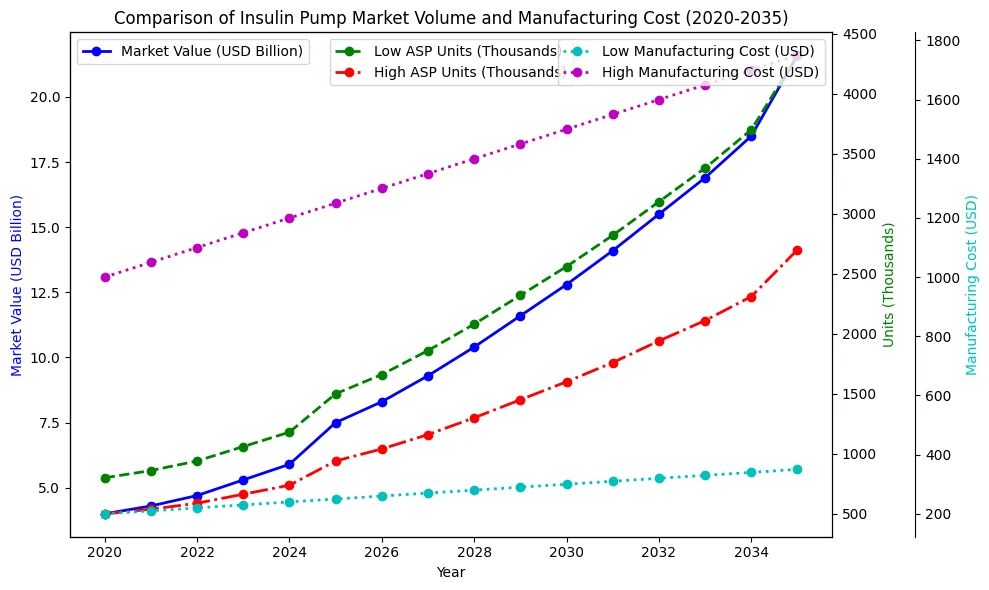

Over the past few years, the insulin pump market has experienced impressive growth, thanks to improvements in diabetes management technology and the rising number of people affected by diabetes. Insulin pumps, which offer a more consistent and accurate way to deliver insulin, have become essential for many living with Type 1 and Type 2 diabetes. As the market evolves, it’s important to understand how insulin pumps are priced, how they’re manufactured, and how sales are projected to grow. In this article, we’ll explore these key aspects, breaking down the expected sales volume, manufacturing costs, and price ranges from 2020 to 2035. By looking at these trends, we’ll get a clearer picture of where the insulin pump industry is headed and its growing role in diabetes.

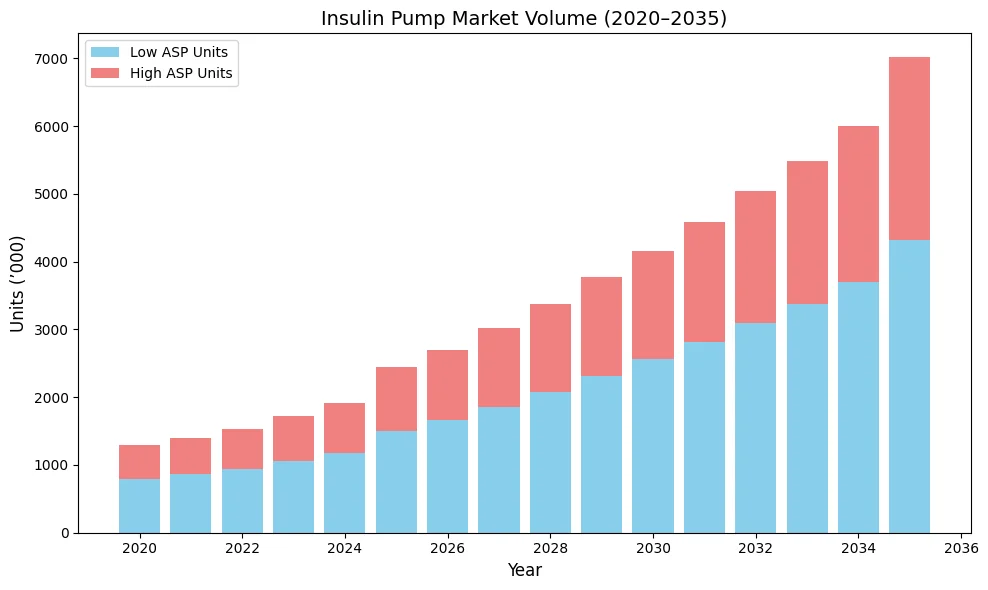

The volume table shows how many insulin pumps are expected to be sold globally each year, from 2020 to 2035. The sales volume is projected based on how much the insulin pumps cost on average. For example, if an insulin pump costs around $6,000 on average and the market value is $7.5 billion, we estimate around 1.5 million pumps are sold in that year. Over the next decade, as the market grows, more pumps are expected to be sold, with the market growing at a healthy pace.

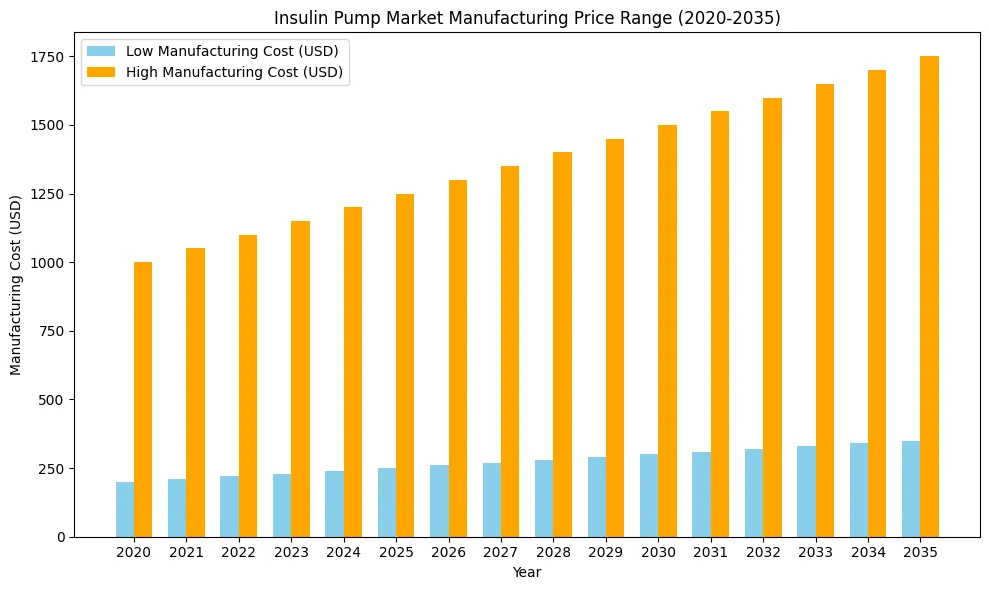

Manufacturing cost refers to what it takes to actually build an insulin pump, including the parts and labor required. The table shows the expected low cost for basic models and the high cost for advanced models. For example, a basic insulin pump might cost around $250 to manufacture, while a high-end model could cost up to $1,750. These values gradually increase over time because of inflation, technology upgrades, and better safety features.

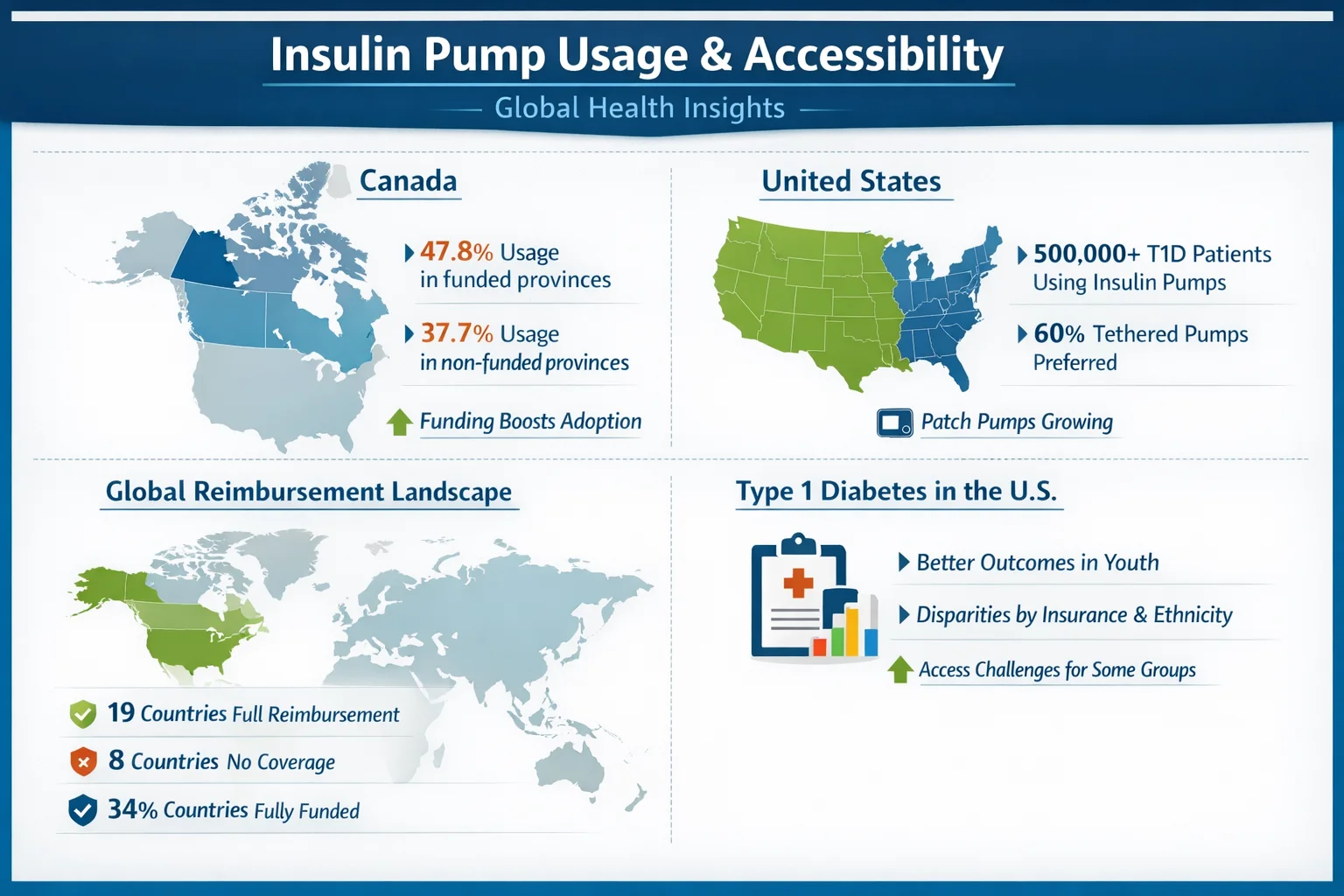

Beyond company data, government and health authority reports offer valuable insights into how insulin pumps are being adopted and reimbursed globally. These figures often reflect broader trends in diabetes care, accessibility to medical technology, and the evolution of healthcare reimbursement policies.

Canada

United States

Type 1 Diabetes Usage Trends in the U.S.

Company Insights: