Image Credits: Baroda BNP Paribas

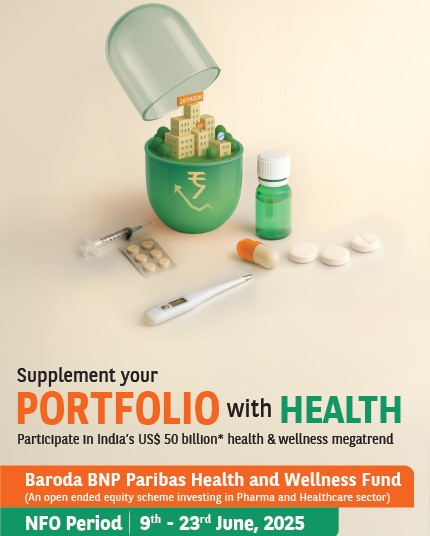

Baroda BNP Paribas Asset Management India has introduced a new thematic equity scheme. A scheme is known as ‘Baroda BNP Paribas health and wellness fund. This new fund offer is ready for subscription from 9th June to 23rd June 2025. Baroda BNP Paribas mutual fund is a joint venture between BNP Paribas Asset Management and Bank of Baroda. This partnership collaborates on finance and introduces a funding policy.

The open-ended equity scheme has been initiated to meet the increasing demand for healthcare and wellness. The fund invested in companies will be a crucial investment. The benefit from long-term structural growth will accelerate the healthcare market. India’s healthcare sector is a game changer. The per capita healthcare expenditure is low in comparison to global standards. It’s now accelerating due to increasing awareness, rising chronic disease cases, affordability, and extended life expectancy. The funding scheme will analyze a vast range of segments, including insurance, diagnostics, hospitals, medtech, healthcare, and pharmaceutical research. The investment consists of 100 listed companies with a merged market capitalization of $200 billion.

The scheme is mainly introduced for investors holding a minimum investment of three years, along with the risk. This scheme is an investment solution for the banking firm. The investment in large, mid, and small industries will enable an alignment with the scheme’s health and wellness theme and benefit both companies and patients.

CEO of Baroda BNP Paribas AMC, Suresh Soni, said the requirement for health and wellness is the same for all age groups. India’s healthcare has started from a low base the sector has long-term potential.

CIO equity, Sanjay Chawla, further highlighted India’s most prevalent chronic illnesses, such as cancer, heart disease, and diabetes. These illnesses accelerate demand for curative and preventive care, which leads to investment opportunities.