Agricultural Biotechnology Market Size, Trends and Key Players with Insights

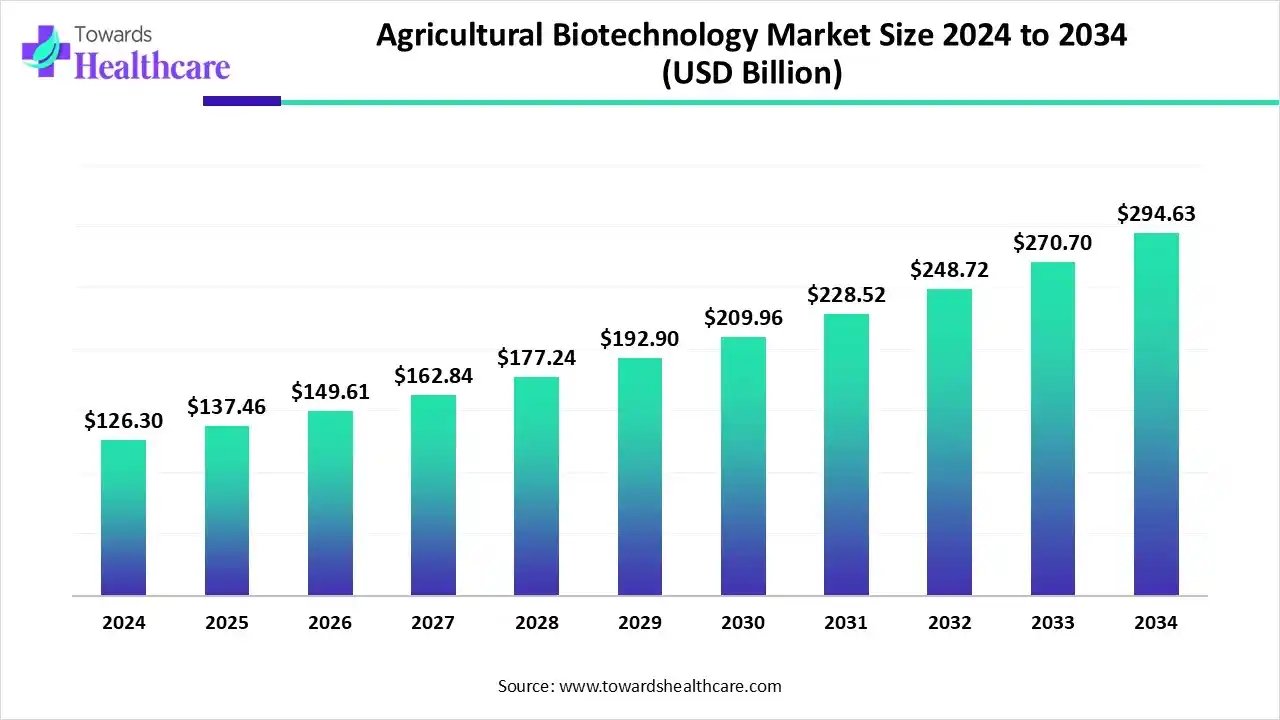

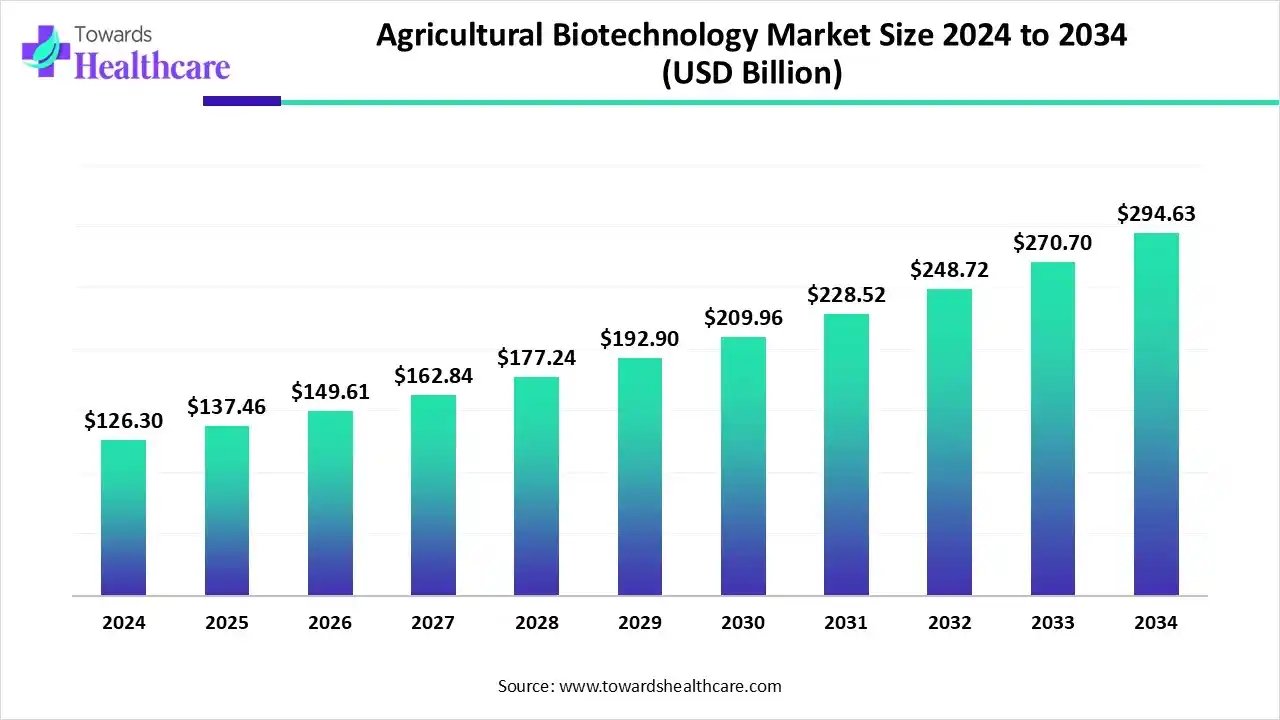

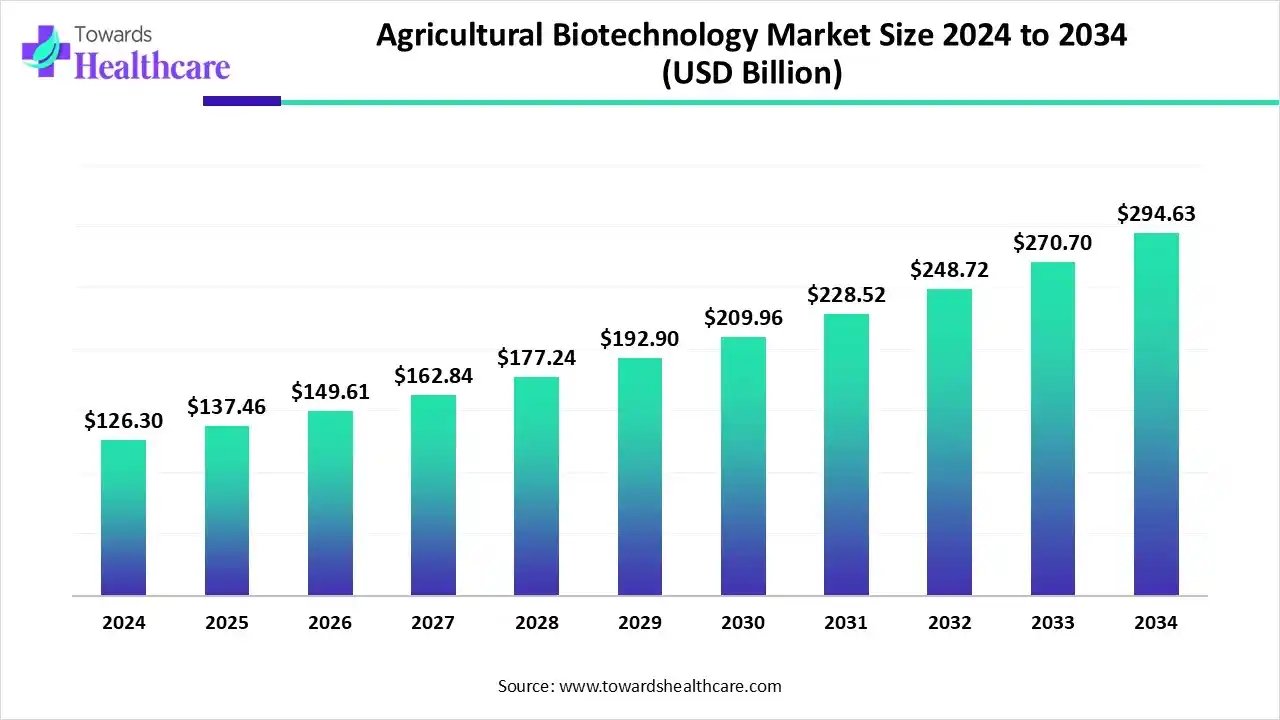

The agricultural biotechnology market size in 2024 was US$ 126.3 billion, expected to grow to US$ 137.46 billion in 2025 and further to US$ 294.63 billion by 2034, backed by a robust CAGR of 8.84% between 2025 and 2034.

The agricultural biotechnology market is witnessing significant growth driven by the increasing demand for sustainable agriculture, improved crop yields, and enhanced food security. Advancements in genetically modified seeds, biofertilizers, and pest-resistant crops are transforming modern farming practices. Favorable government policies, rising investments in research and development, and growing awareness among farmers about innovative biotech solutions are further propelling market expansion. The Asia-Pacific region leads the market, supported by rapid population growth, strong agricultural infrastructure, and the adoption of cost-effective biotechnology solutions, making it the key hub for agricultural biotech advancements globally.

Key Takeaways

- The agricultural biotechnology market will likely exceed USD 126.3 billion by 2024.

- Valuation is projected to hit USD 294.63 billion by 2034.

- Estimated to grow at a CAGR of 8.84% starting from 2025 to 2034.

- Asia Pacific held a major revenue share in the agricultural biotechnology market in 2024.

- North America is expected to witness the fastest growth during the predicted timeframe.

- By organism, the plants segment registered its dominance over the global market with a share in 2024.

- By organism, the animals segment is expected to grow with the highest CAGR in the market during the studied years.

- By application, the transgenic crops & animals segment held the largest revenue share of in the market in 2024.

- By application, the vaccine development segment is expected to show the fastest growth over the forecast period.

Key Indicators and Highlights

| Table |

Scope |

| Market Size in 2025 |

USD 137.46 Billion |

| Projected Market Size in 2034 |

USD 294.63 Billion |

| CAGR (2025 - 2034) |

8.84% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Organism, By Application, By Region

|

| Top Key Players |

BASF SE, Bayer AG, ADAMA Agriculture Solution, Corteva, Syngenta, Evogene, DuPont, Vilmorin, Isagro SPA, Benson Hil

|

What is meant by Agricultural Biotechnology?

The main factor driving the growth of the agricultural biotechnology market is the increasing need for higher crop yields to ensure food security for a growing global population. Agricultural biotechnology involves the use of scientific techniques, such as genetic modification, tissue culture, and molecular markers, to enhance plants, animals, and microorganisms. It aims to develop pest-resistant crops, improve nutritional content, and create sustainable farming solutions, ultimately increasing productivity while reducing environmental impact.

Market Outlook

- Industry Growth Overview -The Agricultural Biotechnology Market has experienced robust growth due to rising global food demand and the need for sustainable farming practices. Innovations in genetically modified crops, biofertilizers, and pest-resistant seeds are transforming agriculture. Supportive government policies, increased R&D investments, and growing farmer awareness are accelerating adoption. Asia-Pacific leads the market, driven by rapid population growth, strong agricultural infrastructure, and widespread implementation of advanced biotech solutions.

- Global Expansion -The global expansion of the agricultural biotechnology market is driven by increasing demand for sustainable and high-yielding crops worldwide. Adoption of genetically modified seeds, biofertilizers, and advanced farming technologies is rising across North America, Europe, and the Asia-Pacific. Strategic collaborations, government support, and growing investments in R&D are facilitating market penetration in emerging economies. This expansion is further supported by heightened awareness of food security, environmental sustainability, and the need for efficient agricultural practices globally.

- Major Investors -: Major investors in the market include a mix of venture capital firms, private equity investors, and leading agribusiness corporations actively funding innovation and expansion. Key players such as Bayer Crop Science, Corteva Agriscience, Syngenta, and BASF have made significant investments in research and development of genetically modified seeds, biofertilizers, and pest-resistant crops. Additionally, governments and international organizations are providing grants and funding to support sustainable agriculture and advanced biotechnology adoption globally.

- Startup Ecosystem -The startup ecosystem in the agricultural biotechnology market is rapidly growing, driven by innovations in genetically modified crops, biofertilizers, and precision farming technologies. Startups are leveraging advanced research, AI, and biotechnology to develop sustainable and high-yield solutions. Support from venture capital, incubators, and government grants is fueling their growth, enabling new players to address global food security challenges and transform modern agriculture.

Agricultural Biotechnology Market Trends

- Bioengineered Microbes: The use of engineered microbes is enhancing soil health and reducing the need for synthetic fertilizers, contributing to more sustainable farming practices.

- Investment and funding play a pivotal role in accelerating the growth of the agricultural biotechnology market by enabling research and development, scaling innovations, and facilitating market entry. In 2025, significant investments have been made to advance agricultural biotech initiatives.

- For instance, in April 2025, the Department of Biotechnology in India launched a joint call for proposals on 'Climate Resilient Agriculture' under the BioE3 Policy, aiming to foster high-performance biomanufacturing. These investments support the development of innovative solutions that address global agricultural challenges.

How can AI integration Drive the Agricultural Biotechnology Market?

Artificial Intelligence (AI) is revolutionizing agricultural biotechnology by enhancing precision, efficiency, and sustainability in farming practices. In 2025, AI integration has led to significant advancements in various areas. AI integration is transforming agricultural biotechnology by providing innovative solutions for disease management, weed control, and crop improvement, thereby contributing to more sustainable and efficient farming practices.

Various Agriculture Biotechnology Techniques

| Technique |

Year Introduced |

Procedure |

Application |

| CRISPR-Cas9 Gene Editing |

2024 |

Utilizes the CRISPR-Cas9 system to make precise alterations in plant DNA, enhancing traits like disease resistance and drought tolerance |

Development of climate-resilient crops such as Swarna-Sub1 rice, capable of surviving flash floods |

| RNA Interference (RNAi) |

2025 |

Employs RNA molecules to silence specific genes in pests, reducing their impact on crops. |

Targeted pest and disease management in crops. |

| Synthetic Biology |

2025 |

Designs and constructs new biological parts, devices, and systems by re-engineering existing biological systems |

Creation of engineered microbes for enhanced nitrogen fixation, reducing the need for synthetic fertilizers |

| Marker-Assisted Selection (MAS) |

2025 |

Identifies specific DNA sequences associated with desirable traits and uses them to select plants with those traits |

Accelerated breeding of guava with improved fruit quality and shelf life. |

| AI-Powered Bioinformatics |

2025 |

Integrates artificial intelligence with bioinformatics to analyze large datasets, predicting gene functions and interactions |

Enhanced precision in crop improvement programs, reducing breeding cycles. |

| Microbial Inoculants |

2024 |

Introduces beneficial microorganisms into the soil to promote plant growth and health |

Development of biofertilizers and biopesticides for sustainable agriculture. |

| Gene Editing in Sugarcane |

2024 |

Modifies sugarcane DNA to introduce genes that confer drought resistance. |

Creation of drought-resistant sugarcane varieties like NXI-4T. |

Segmental Insights

Which Organism Segment Dominated the Agricultural Biotechnology Market?

The plants segment dominates the market as it forms the core focus of most biotech innovations aimed at enhancing crop yield, quality, and resilience. Advanced techniques such as genetic modification, CRISPR gene editing, RNA interference, and marker-assisted selection are primarily applied to plants to develop pest-resistant, drought-tolerant, and nutrient-enriched crops. Increasing global food demand, supportive government policies, and greater farmer awareness of sustainable practices drive the adoption of plant-based biotech solutions, making this segment the leading contributor to market growth.

The animals segment is estimated to be the fastest-growing in the agricultural biotechnology market due to rising demand for high-quality animal protein and the need for healthier livestock. Advancements in genetic engineering, cloning, and recombinant vaccines are improving disease resistance, growth rates, and overall productivity in livestock. Increasing adoption of biotechnology in animal feed, breeding programs, and veterinary care enhances efficiency and profitability for farmers. Additionally, growing awareness of sustainable livestock practices and government initiatives supporting animal health and biotechnology adoption are accelerating growth in this segment.

Why Did the Transgenic Crops & Animals Segment Dominate the Agricultural Biotechnology Market?

The transgenic crops & animals segment dominates the market due to its ability to deliver significant improvements in yield, quality, and resistance to pests, diseases, and environmental stresses. Genetic modification techniques enable the development of crops and livestock with desirable traits, such as drought tolerance, enhanced nutrition, and faster growth. Strong adoption in key regions, supportive government policies, and growing awareness among farmers and breeders about the benefits of transgenic organisms further reinforce this segment’s leadership in advancing sustainable and efficient agricultural practices globally.

The vaccine development segment is anticipated to be the fastest-growing segment in the agricultural biotechnology market due to increasing concerns over livestock diseases and the rising demand for safe, high-quality animal protein. Advances in recombinant DNA technology and RNA-based vaccines are enabling faster and more effective immunization of animals. Supportive government initiatives, growing awareness of animal health, and the need to prevent disease outbreaks in livestock are accelerating the adoption of biotechnology-driven vaccines, driving rapid growth in this segment.

Regional Analysis

Which Factors Contribute to Asia Pacific’s Dominance in the Agricultural Biotechnology Market?

The Asia-Pacific region dominates the market due to a combination of demographic, economic, and technological factors. Rapid population growth in countries like China and India drives the need for higher crop yields and enhanced food security. Governments actively promote biotechnology through favorable policies, subsidies, and investment in research and development.

The region benefits from extensive arable land, strong agricultural infrastructure, and increasing adoption of genetically modified seeds, biofertilizers, and pest-resistant crops. Growing farmer awareness about sustainable practices, coupled with rising demand for high-quality agricultural products, further reinforces Asia-Pacific’s leadership in advancing agricultural biotechnology globally.

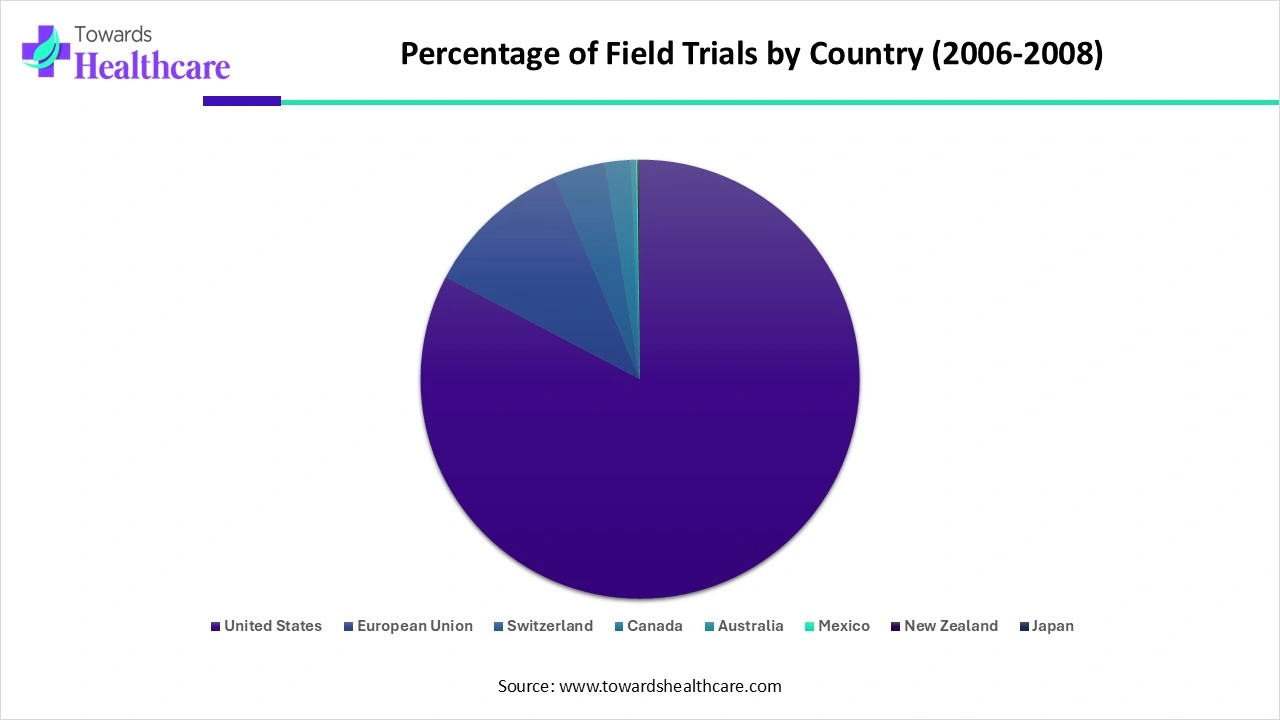

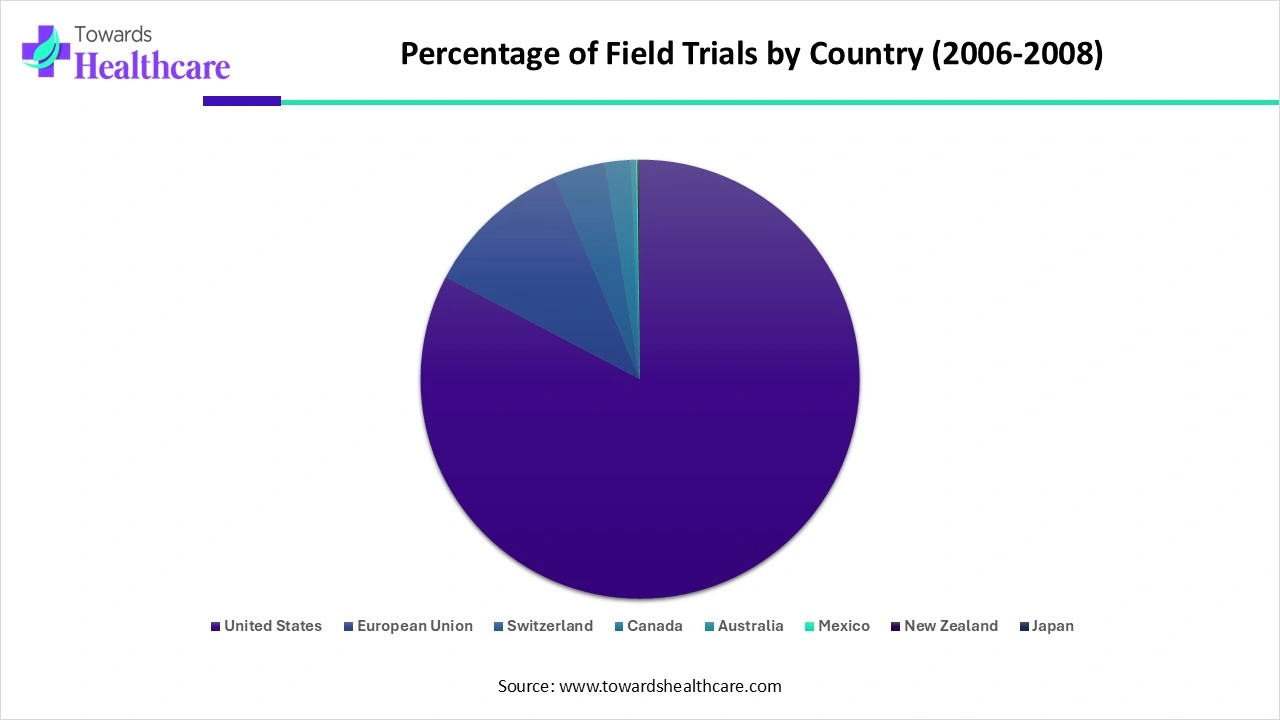

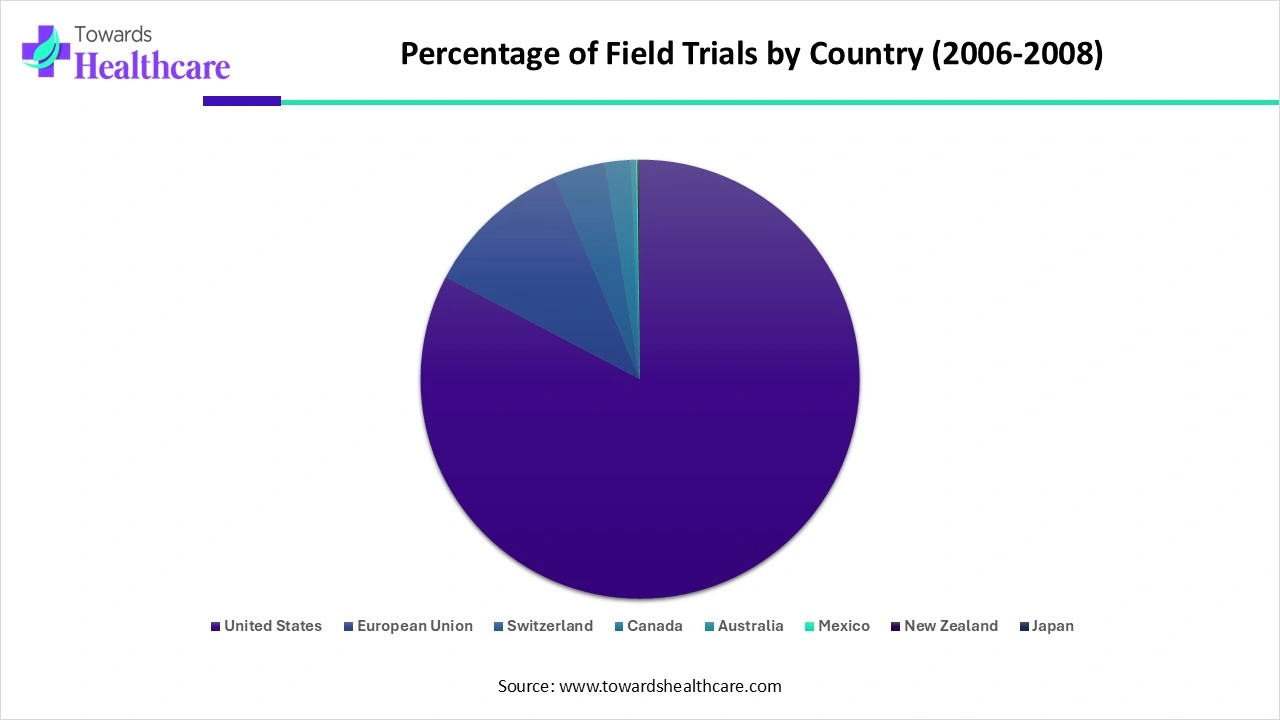

Percentage of Field Trials by Country (2006-2008)

This table shows the percentage distribution of a total of 3,849 field trials conducted between 2006 and 2008, broken down by country of head office. The United States leads with a dominant share of 82.7% of all trials, followed by the European Union with 10.9%. Other countries, including Switzerland, Canada, Australia, and others, have much smaller shares, with Japan, New Zealand, and Mexico each contributing less than 1% to the overall trials.

India Market Trends

India's agricultural biotechnology sector is experiencing significant growth, driven by government support and increasing adoption of biotech solutions. Key players include Agriland Biotech, Ajay Biotech, IPL Biologicals, Microsun Bioplants, Nuviqo, Organica Biotech, Padmatech Industries, Sheel Biotech, Sun Agro Biotech Research Centre, Titan Biotech, and Viyen Biotech. These companies are involved in developing genetically modified seeds, biofertilizers, and biopesticides. Notably, Punjab Agricultural University (PAU) secured a ₹4 crore project from the Department of Biotechnology for predictive breeding of guava, focusing on enhancing fruit quality and shelf life.

Japan Market Trends

Japan's agricultural biotechnology market is characterized by advanced research and cautious regulatory approaches. As of October 2024, the Government of Japan had approved 205 products for environmental safety, including 157 approvals for domestic cultivation. Despite these approvals, Japanese farmers do not cultivate genetically engineered food or feed products domestically. However, Japan remains one of the world's largest per-capita importers of food and feed produced using modern biotechnologies.

China Market Trends

China is a global leader in the adoption of genetically engineered (GE) crops, with approximately 3.5 million hectares of GE crops planted in 2024, including 2.8 million hectares of GE cotton, 667,000 hectares of GE corn and soybean, and 10,000 hectares of GE papaya. Leading companies in China's agricultural biotechnology sector include Beijing Dabeinong Biotechnology, Longping Biology, and Hangzhou Ruifeng, which are developing new traits and genes for various crops. Additionally, WuXi AppTec, a prominent biotechnology company, plans to raise approximately US$980 million to support global expansion, indicating strong investor confidence in China's biotech sector.

How Big is the Opportunity for the Growth of the North America Region?

The North American region is estimated to experience the fastest growth in the agricultural biotechnology market due to several key factors. Advanced research and development infrastructure, combined with high adoption of modern farming technologies, accelerates the deployment of genetically modified crops, biofertilizers, and biopesticides. Strong regulatory support from agencies like the USDA and FDA facilitates the commercialization of innovative biotech solutions. Additionally, rising demand for high-yield, climate-resilient crops and sustainable farming practices drives investment in biotechnology. The presence of major agribusiness companies, along with extensive farmer awareness and access to cutting-edge precision agriculture tools, further fuels rapid market expansion in North America.

Number of Agronomic Trait Field Trials by Region (2000–2008)

| Year |

United States |

Canada |

All Other Countries |

Total Trials |

| 2000 |

97 |

79 |

30 |

206 |

| 2001 |

169 |

81 |

30 |

280 |

| 2002 |

133 |

86 |

30 |

249 |

| 2003 |

152 |

70 |

51 |

273 |

| 2004 |

181 |

78 |

51 |

310 |

| 2005 |

230 |

87 |

60 |

377 |

| 2006 |

317 |

131 |

60 |

508 |

| 2007 |

411 |

240 |

51 |

702 |

| 2008 |

212 |

264 |

51 |

527 |

The table shows a steady increase in agricultural biotechnology field trials across the world between 2000 and 2008. The United States consistently led in the number of agronomic trait trials, followed by Canada, which experienced rapid growth after 2006. Other countries also contributed steadily, supporting global expansion in biotech crop development.

The total number of trials peaked in 2007, indicating a strong global push toward genetically modified (GM) and advanced agronomic traits such as pest resistance, drought tolerance, and improved crop yield. This trend highlights increasing investment and adoption of agricultural biotechnology technologies worldwide.

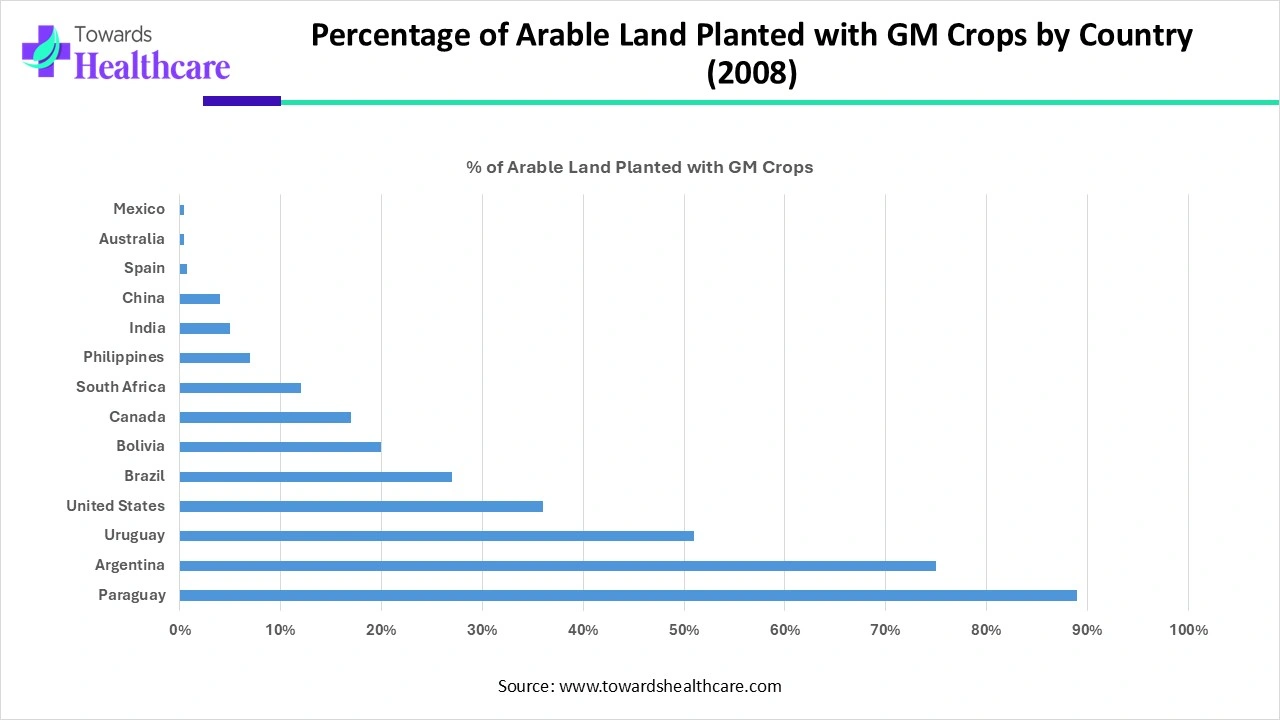

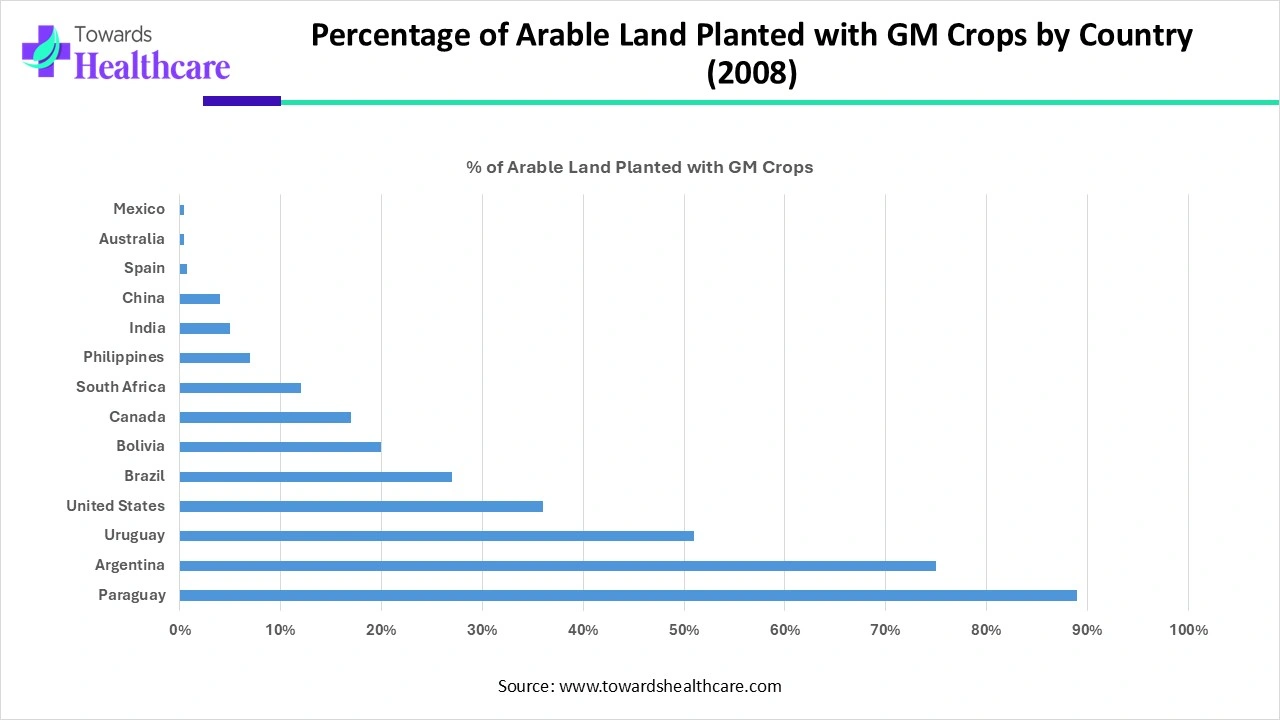

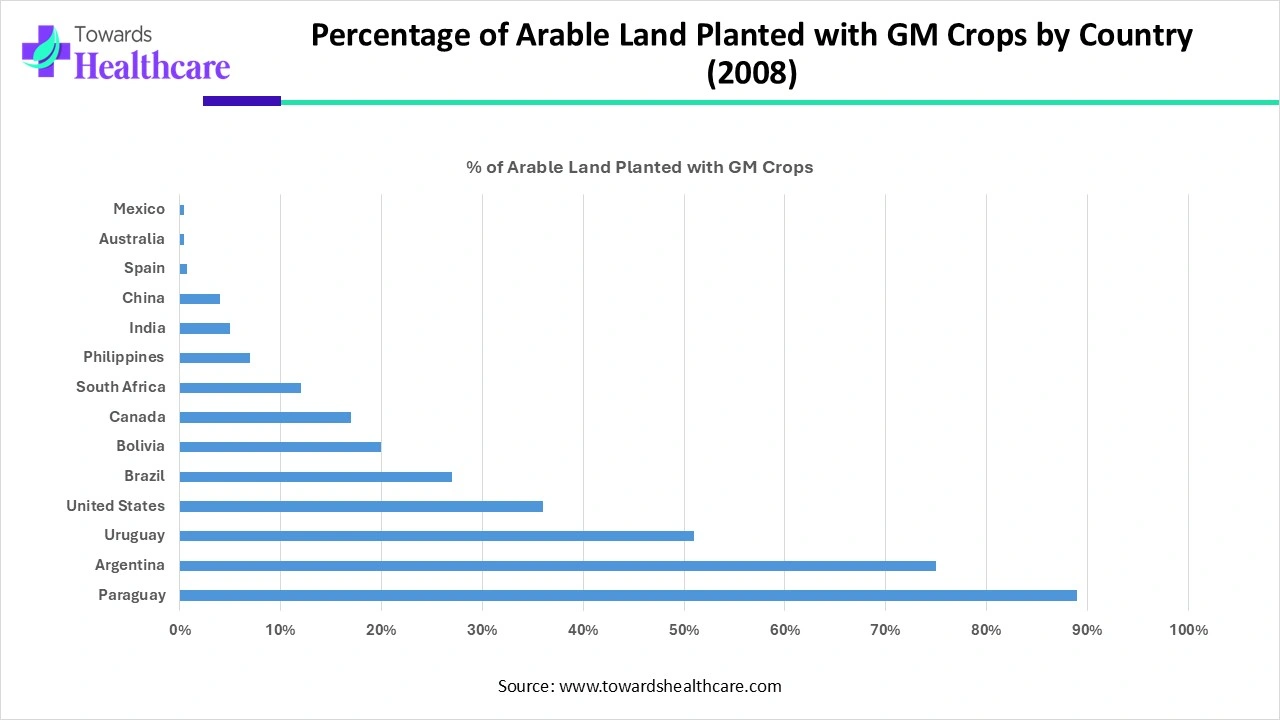

Percentage of Arable Land Planted with GM Crops by Country (2008)

This image shows the percentage of arable land planted with genetically modified (GM) crops by country in 2008. It highlights a range of countries, with the United States and Argentina being among the leaders in GM crop adoption. Countries like Mexico, Australia, and Spain also show significant adoption, while others, like Paraguay, Uruguay, and Canada, have lower percentages. This graph underscores the global variation in the use of GM crops on arable land.

U.S. Market Trends

The United States dominates the North American agricultural biotechnology market due to its advanced research and development infrastructure, supportive regulatory framework, and strong presence of leading agribusiness companies such as Corteva Agriscience, Bayer Crop Science, and Syngenta. High adoption of genetically modified crops, biofertilizers, and precision agriculture technologies enhances productivity and sustainability. Additionally, substantial government funding, widespread farmer awareness, and the country’s focus on innovation-driven agriculture contribute to its leadership, making the U.S. the primary driver of growth in North America’s agricultural biotechnology sector.

Value Chain Analysis

Research & Development (R&D)

- Target identification (traits, genes, or microbes)

- Laboratory research (gene editing, marker-assisted selection, microbial formulation)

- Pilot-scale testing in controlled environments

- Field trials for efficacy and safety

Organizations Involved:

- Universities and research institutes (e.g., Punjab Agricultural University, IIIT-Allahabad)

- Biotech startups (e.g., Agriland Biotech, BioConsortia)

- Government-funded R&D agencies (e.g., Department of Biotechnology, India; USDA, U.S.)

Clinical Trial & Regulatory Approval

- Small-scale field trials for environmental and biological safety

- Large-scale multi-location trials to assess efficacy

- Submission of safety, quality, and environmental impact data to regulatory bodies

- Approval for commercial cultivation or use

Organizations Involved:

- Regulatory authorities (e.g., USDA, FDA, EFSA, CFDA/China)

- Independent testing laboratories

- Biotechnology companies conducting trials (e.g., Syngenta, Corteva, Longping Biology)

Product Deployment & Farmer Support (Patient Support Equivalent)

- Distribution of seeds, biofertilizers, or biopesticides to farmers

- Training and technical support for proper usage

- Monitoring crop performance and providing advisory services

- Feedback collection for product improvement

Organizations Involved:

- Agricultural extension services (e.g., Krishi Vigyan Kendras in India)

- Biotech companies’ field support teams

- NGOs and government programs promoting biotech adoption

Top Vendors in the Agricultural Biotechnology Market & Their Offerings:

Bayer AG (Germany)

Offerings: Bayer's Crop Science division focuses on developing genetically modified seeds, herbicides, and fungicides. Notably, their herbicide 'Roundup' and corn seeds have seen strong demand in markets like India. The company aims to launch ten major agricultural products within the next decade, targeting over €5 billion in sales.

Corteva Agriscience (USA)

Offerings: Corteva specializes in seeds and crop protection solutions, including herbicides, insecticides, fungicides, and biologicals. Their products are sold in over 110 countries, with a strong presence in North America.

Syngenta Group (Switzerland)

Offerings: Syngenta provides a range of agricultural solutions, including genetically modified seeds, crop protection products, and digital farming tools. Their research areas encompass molecular biology, plant transformation, and applied genomics.

BASF SE (Germany)

Offerings: BASF offers a diverse portfolio in plant biotechnology, including seed treatments, crop protection chemicals, and digital farming solutions. They focus on sustainable agriculture practices and innovation in ingredient formulations.

UPL Limited (India)

Offerings: UPL's Natural Plant Protection (NPP) division focuses on biological and botanical agro products, offering organic fertilizers, bio-fertilizers, and pest management solutions. Their NPP division generated $365 million in revenue in 2024.

Indigo Ag (USA)

Offerings: Indigo Ag specializes in microbial solutions for agriculture, aiming to improve soil health and crop resilience. They utilize data analytics and digital platforms to enhance farming practices.

Ginkgo Bioworks (USA)

Offerings: Ginkgo Bioworks is a cell programming company that designs custom organisms for applications in agriculture, pharmaceuticals, and other industries. They partner with companies to develop solutions like nitrogen-fixing microbes and vaccine adjuvants.

Top Companies in the Agricultural Biotechnology Market

Recent Developments in the Agricultural Biotechnology Market

- In July 2025, AI Integration in Agriculture: The agtech industry witnessed a surge in AI-powered solutions, enhancing rural development and reshaping global food systems. AI-Biotech Framework Proposal: Scientists proposed an integrated framework combining biotechnology and artificial intelligence to revolutionize crop breeding, aiming to improve productivity and sustainability.

- In July 2025, Flagship Pioneering unveiled Terrana Biosciences, a new company focused on delivering adaptive, targeted agricultural solutions using a novel RNA technology platform. This approach aims to enhance crop resilience and protect yields without altering the plant genome. Terrana is backed by a US$50 million investment to advance RNA-based crop solutions.

- August 2025, UPL Brazil achieved a historic milestone by launching ten new agricultural biotechnology products, simultaneously the largest annual volume since its establishment. These products aim to enhance crop protection and productivity across various agricultural sectors.

- In September 2025, JH Biotech Partners with Sun Fresh Vegetable: In early September, JH Biotech Inc. partnered with Sun Fresh Vegetable to pioneer a new model integrating preventive agriculture and smart cold chain logistics. This collaboration focuses on enhancing the shelf life and quality of produce through innovative agricultural biotechnology solutions.

Segments Covered in the Report

By Organism

- Plants

- Conventional Techniques

- Established Genetic Modification

- New Breeding Techniques

- Animals

- Conventional Techniques

- Established Genetic Modification

- New Breeding Techniques

- Microbes

- Conventional Techniques

- Established Genetic Modification

- New Breeding Techniques

By Application

- Vaccine Development

- Transgenic Crops & Animals

- Antibiotic Development

- Nutritional Supplements

- Flower Culturing

- Bio-Fuels

By Region

- North America

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait