February 2026

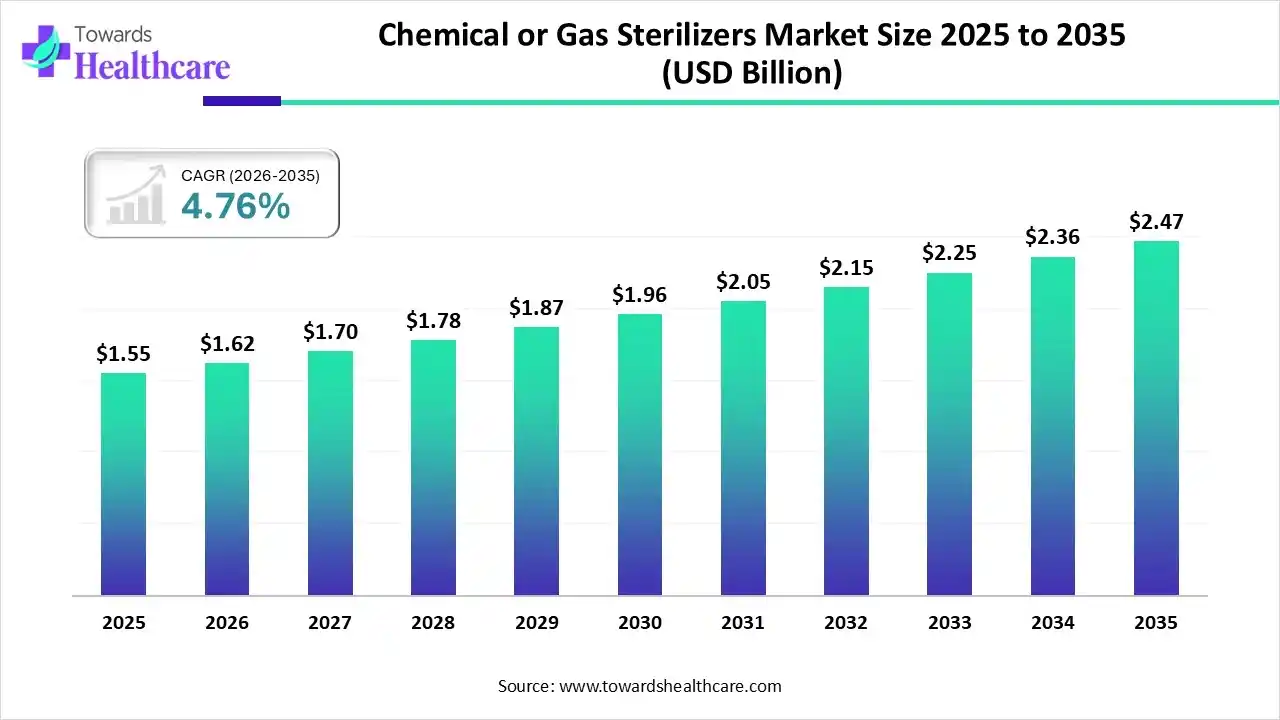

The global chemical/gas sterilizers market size was estimated at USD 1.55 billion in 2025 and is predicted to increase from USD 1.62 billion in 2026 to approximately USD 2.47 billion by 2035, expanding at a CAGR of 4.76% from 2026 to 2035.

The growing disease burden and surgical procedures globally are increasing the demand for chemical/gas sterilizers, where AI technologies are being used to enhance their optimization and ensure effectiveness and safety. Expanding healthcare, advanced hospitals, and stringent regulations are also encouraging their use. At the same time, the companies are also investing and launching new chemical/gas sterilizer products, which is promoting the market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.62 Billion |

| Projected Market Size in 2035 | USD 2.47 Billion |

| CAGR (2026 - 2035) | 4.76% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By End-user, By Region |

| Top Key Players | STERIS plc, Getinge AB, Advanced Sterilization Products (ASP), MMM Group GmbH, 3M Company, Belimed AG, Matachana Group, Sotera Health, Shinva Medical, Cistron System |

The chemical/gas sterilizers market is driven by the rising volume of surgical procedures and the global burden of hospital-acquired infections (HAIs). The chemical/gas sterilizers refer to the products that utilize chemical agents and sterilizing gases for eliminating all forms of microorganisms present on the laboratory equipment and medical, industrial. They are being used to sterilize heat-sensitive medical instruments, packed items, laboratory equipment, and infection control.

The use of AI in the optimization of the chemical/gas sterilizer is increasing, where they analyze the sterilization cycle and adjust parameters to offer fast and effective sterilization. It also helps in detecting the sterilizers' leaks and unusual chemical usage and automatically adjusts the process, reducing their degradation and ensuring safety. It is also used for quality control and monitoring the effectiveness of the sterilization.

The hospital, clinics, and surgical centres globally are increasing, which is driving the demand for chemical/gas sterilizers, especially during surgical procedures and instrument sterilization.

The growing focus on infection control is increasing the use of chemical/gas sterilization, which in turn is also driving the development of eco-friendly and safer sterilizers.

The companies are using various sterilization systems for faster sterilization and lower residues, where they are also utilizing advanced technologies for their automated sterilizations.

| Hospitals Systems | No. of Hospitals in Systems |

| Total U.S. hospitals in systems | 4,159 |

| Total U.S. hospitals | 6,095 |

Which Product Type Segment Held the Dominating Share of the Chemical/Gas Sterilizers Market in 2025?

The hydrogen peroxide sterilization segment held the dominating share in the market in 2025, due to its broad-spectrum efficacy. At the same time, they were used in the sterilization of heat-sensitive medical devices, where their material compatibility also increased the acceptance rates. Additionally, no toxic residues and faster sterilization cycles also increased their use.

Ethylene Oxide Sterilization

The ethylene oxide sterilization segment is expected to show the fastest growth rate during the predicted time, due to its high penetration ability. This is increasing their use for complex and multi-layered medical devices, along with temperature-sensitive products. Furthermore, their high scalability is also increasing their use for the sterilization of implants.

What Made Hospital & Specialty Clinics the Dominant Segment in the Chemical/Gas Sterilizers Market in 2025?

The hospital & specialty clinics segment led the market in 2025, due to frequent use of surgical instruments, which increased the demand for chemical/gas sterilizers. At the same time, stringent infection control and growth in the patient volume also increased their use for the sterilization of various equipment and devices.

Pharmaceutical & Medical Device Manufacturers

The pharmaceutical & medical device manufacturers segment is expected to show the highest growth during the upcoming years, due to stringent sterility standards, which increased the use of chemical/gas sterilizers. Moreover, the growth in single-use medical devices, implants, and advanced therapies is also increasing their use. Additionally, the growth in the manufacturing and R&D activities is also increasing the demand.

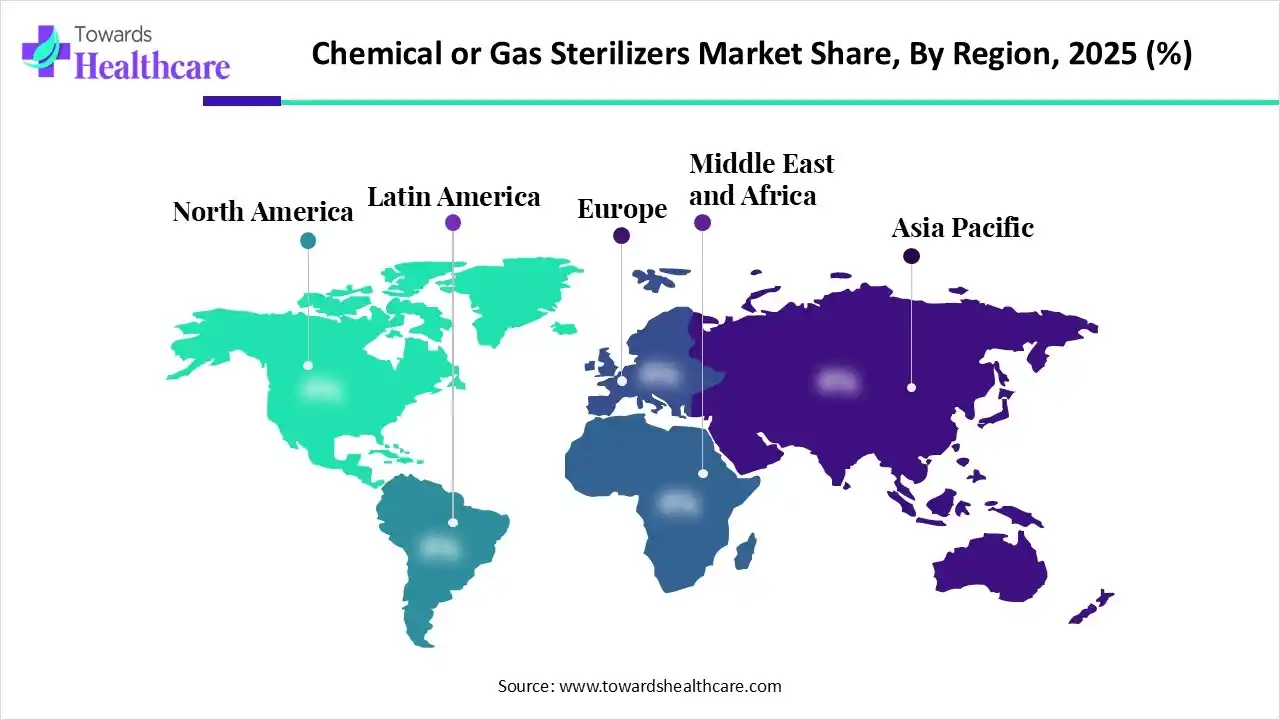

North America dominated the chemical/gas sterilizers market in 2025, due to the presence of advanced healthcare infrastructure, as they were used for infection control. At the same time, the growth in the surgical procedures and stringent regulations also increased their use. Furthermore, the industries also utilized them due to the growth in medical devices, which contributed to the market growth.

The presence of well-developed hospitals, surgical centers, and clinics across the U.S. is increasing the use of chemical/gas sterilizers. The growing number of surgeries and complex diseases is increasing their demand, where the growing development of medical devices and advanced sterilization technologies is also increasing their use.

Asia Pacific is expected to host the fastest-growing chemical/gas sterilizers market during the forecast period, due to expanding healthcare, where the growing surgical procedures and chronic diseases are also increasing their use. The growing development of advanced therapies and medical devices is also increasing their use, where the demand for low-temperature sterilization is also enhancing the market growth.

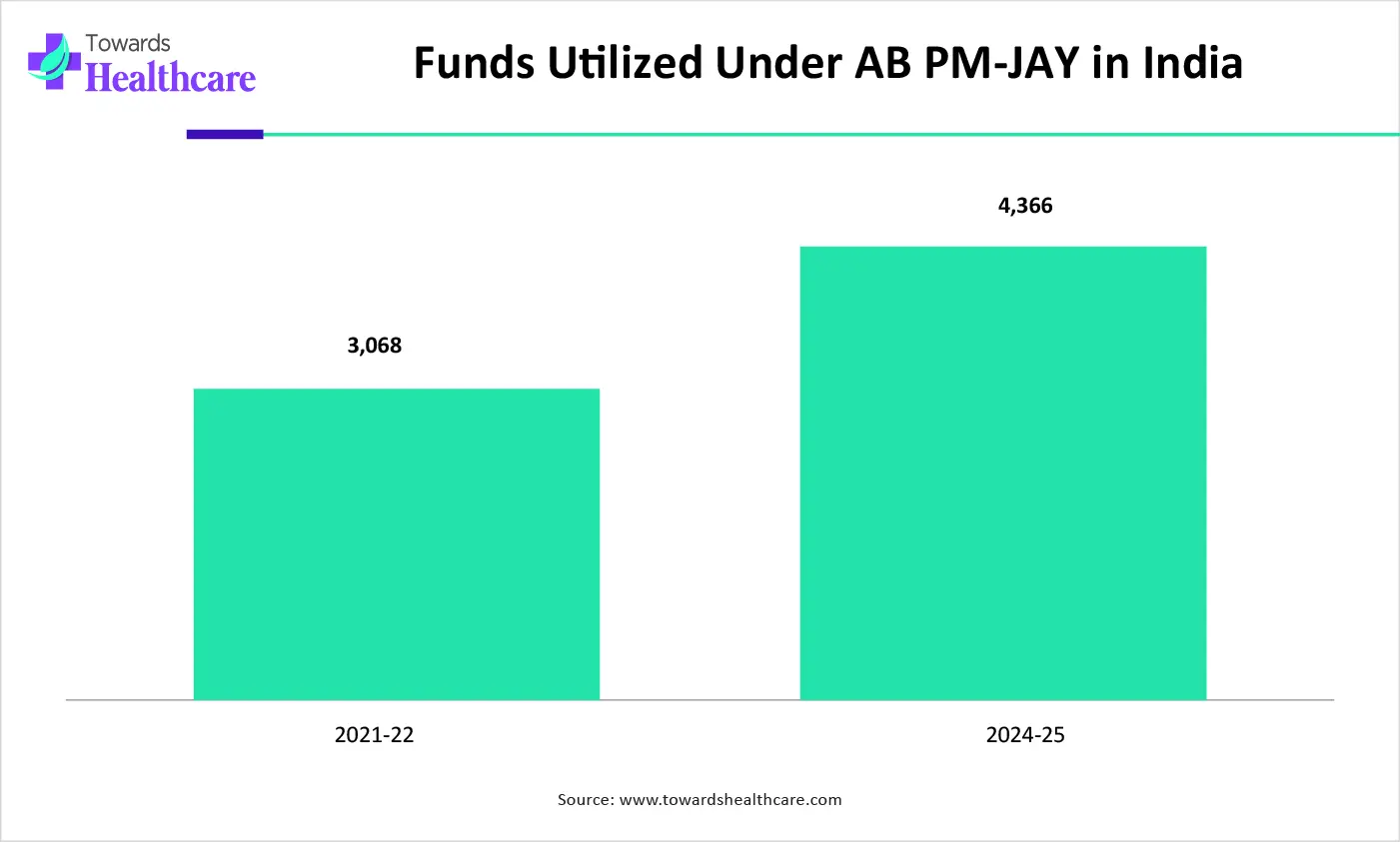

India is experiencing a rapid healthcare expansion, which is increasing the demand for chemical/gas sterilizers. At the same time, the growing diseases and surgical volumes are also increasing their use, where rising infection control measures are also increasing their demand. Furthermore, the growing innovation and government initiatives are also increasing their use.

| Years | Funds Utilized |

| 2021-22 | 3,067 |

| 2024-25 | 4,369 |

Europe is expected to grow significantly in the chemical/gas sterilizers market during the forecast period, due to stringent regulatory standards. This is increasing the use of chemical/gas sterilizers across the advanced healthcare system, where the focus on patient safety is also increasing their demand. Additionally, the growing innovations and diseases are also promoting the market growth.

The UK consists of well-established healthcare systems that utilize chemical/gas sterilizers to ensure sterility and regulatory compliance. They are also focusing on infection control, where the growing advanced therapies are also increasing their use. Furthermore, the companies are also developing eco-friendly sterilizers along with technological advancements.

| Companies | Headquarters | Solutions |

| STERIS plc | Ohio, U.S. | V-PRO Low Temperature Sterilization System and EtO gas sterilization |

| Getinge AB | Gothenburg, Sweden | Getinge GSS67H |

| Advanced Sterilization Products (ASP) | California, U.S. | STERRAD System |

| MMM Group GmbH | Planegg, Germany | Selectomat PL |

| 3M Company | Minnesota, U.S. | 3M Steri-Vac Sterilizer/Aerator GS Series |

| Tuttnauer | Breda, Netherlands | PlazMax H2O2 plasma sterilizer and EtO chambers |

| Belimed AG | Zug, Switzerland | EtO sterilization systems |

| Steelco S.p.A. | Riese Pio X, Italy | PL Series |

| Steri Techni Fab | Ahmedabad, India | EtO gas sterilizers |

| Andersen Sterilizers | North Carolina, U.S. | EtO gas sterilizers and EOGas 4 |

| Noxilizer, Inc. | Maryland, U.S. | NOX FLEX |

| Matachana Group | Barcelona, Spain | 100% EO Sterilizers |

| Sotera Health | Ohio, U.S. | Offers Ethylene Oxide |

| Shinva Medical | Zibo, China | XG1.U and XG2.C |

| Cistron System | Hyderabad, India | EO-matic and Stream-cum-EO hybrid sterilizers |

By Product Type

By End-user

By Region

February 2026

February 2026

February 2026

February 2026