February 2026

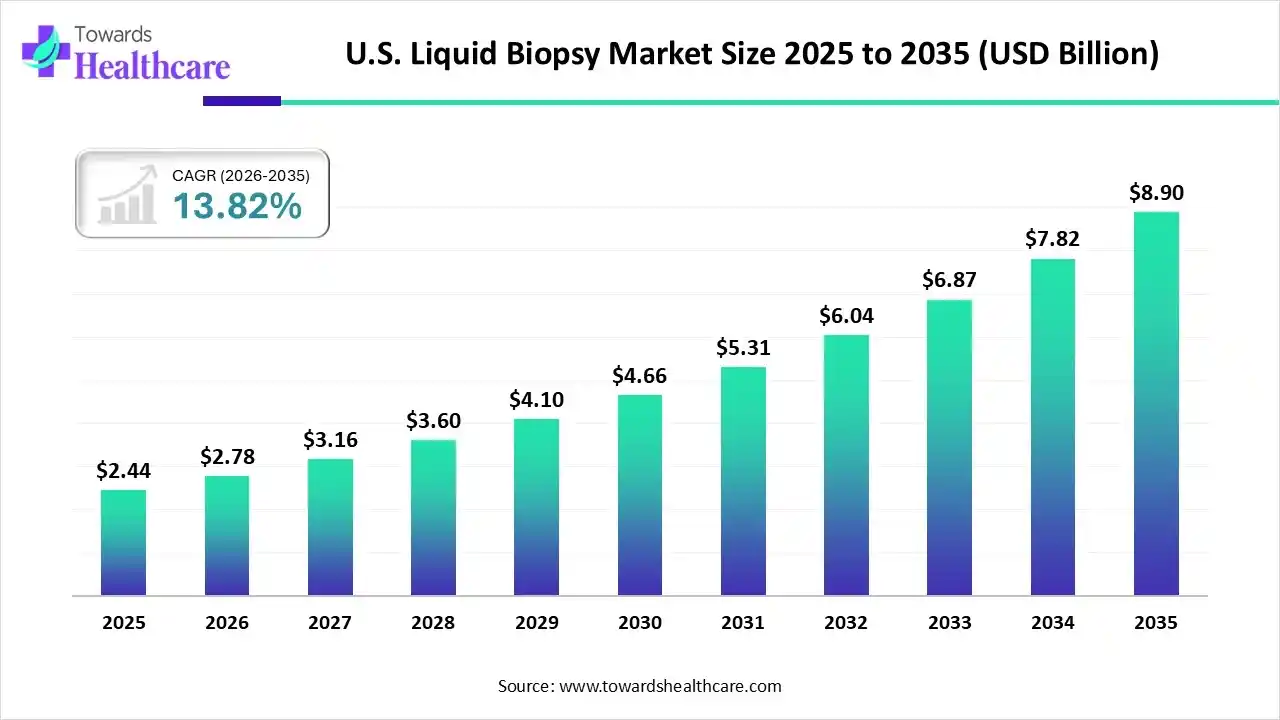

The U.S. liquid biopsy market size was estimated at USD 2.44 billion in 2025 and is predicted to increase from USD 2.78 billion in 2026 to approximately USD 8.90 billion by 2035, expanding at a CAGR of 13.82% from 2026 to 2035.

The U.S. liquid biopsy market is rapidly evolving, driven by rising demand for non-invasive cancer diagnostics and advancements in genomic technologies. Increasing adoption of precision medicine, coupled with growing awareness of early cancer detection benefits, is fueling market growth. Continuous innovations in circulating tumor DNA (ctDNA) and circulating tumor cell (CTC) assays, along with strong research collaborations, are shaping the competitive landscape.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.78 Billion |

| Projected Market Size in 2035 | USD 8.90 Billion |

| CAGR (2026 - 2035) | 13.82% |

| Market Segmentation | By Biomarker Type, By Technology/Platform, By Test Type / Application Stage, By Cancer Type (Indication Area), By Product & Service Type, By Clinical Setting / End-User, By Sample Type, By Business Model |

| Top Key Players | Guardant Health, Foundation Medicine (Roche), Exact Sciences, Illumina, BioRad Laboratories, Natera, Inc., Thermo Fisher Scientific, QIAGEN, LabCorp, NeoGenomics Laboratories |

Liquid biopsy is a non-invasive diagnostic technique that detects cancer-related biomarkers, such as circulating tumor DNA (ctDNA) and circulating tumor cells (CTCs), from blood or other body fluids. The U.S. liquid biopsy market is driven by factors including rising cancer prevalence, increasing demand for early detection, advancements in genomic and molecular technologies, growing adoption of precision medicine, and supportive government initiatives promoting cancer research and diagnostic innovation, which collectively fuel market growth and enhance patient outcomes through timely and accurate diagnostics.

AI integration can significantly enhance the U.S. liquid biopsy industry by improving the accuracy, speed, and efficiency of cancer detection. Machine learning algorithms can analyze complex genomic and molecular data from circulating tumor DNA (ctDNA) and circulating tumor cells (CTCs), identifying patterns that might be missed by traditional methods. AI-powered tools enable predictive analytics for disease progression, personalized treatment planning, and early detection of relapse. Additionally, automation of data interpretation reduces human error, accelerates clinical decision-making, and optimizes research and development. Overall, AI fosters more precise, cost-effective, and scalable liquid biopsy solutions, advancing patient care and outcomes.

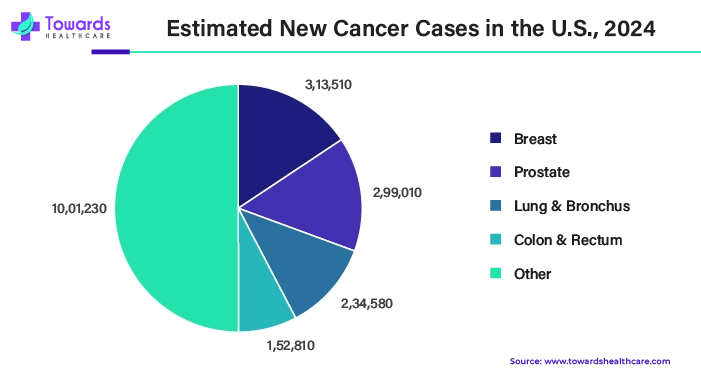

Rising cases of cancer have driven the growth of the liquid biopsy market in the U.S.

| Cancer Type | Estimated New Cases in 2025 |

| All cancer (Total) | 2,041,910 |

| Breast (female) | ~ 319,750 |

| Prostate | ~313,780 |

| Lung & Bronchus | ~226,650 |

| Colon & Rectum | ~154,270 |

| Melanoma of Skin | ~107,240 |

In 2025, the U.S. government continued supporting the advancement of liquid biopsy technologies, especially through federally backed research consortia and funding programs. The Liquid Biopsy Consortium, backed by the National Cancer Institute, funds academic-industry collaboration to validate early cancer detection methods using circulating tumor DNA, RNA, and exosomes.

Which Biomarker Type Segment Dominated the U.S. Liquid Biopsy Market?

The circulating tumor DNA (ctDNA) segment dominates the U.S. market due to its high sensitivity for early cancer detection, ability to monitor minimal residual disease, and suitability for guiding personalized therapy. Technological advancements in next-generation sequencing, non-invasive sample collection, and increasing clinical adoption further accelerate its growth and widespread application.

Circulating Tumor DNA (ctDNA)

The RNA (microRNA, mRNA) segment is estimated to be the fastest-growing in the U.S. liquid biopsy market due to its high stability in blood, ability to reflect real-time gene expression changes, and strong potential for early cancer detection and prognosis. Advances in RNA sequencing technologies, growing research on RNA-based biomarkers, and their utility in personalized medicine further drive adoption and clinical relevance.

Why Did the Next-Generation Sequencing (NGS) Segment Dominate the U.S. Liquid Biopsy Market?

The next-generation sequencing (NGS) segment dominates the U.S. market due to its high accuracy, ability to analyze multiple genetic mutations simultaneously, and suitability for comprehensive genomic profiling. Growing adoption in precision medicine, technological advancements reducing costs, and increasing use in early cancer detection, treatment monitoring, and research applications further strengthen its leading position.

Epigenetic Analysis

The epigenetic analysis segment is anticipated to be the fastest-growing in the U.S. market due to its ability to detect cancer-specific DNA methylation patterns and other epigenetic modifications with high sensitivity. Advancements in sequencing technologies, growing research on epigenetic biomarkers, and their potential for early cancer detection and personalized therapy are driving rapid adoption in clinical and research settings.

Why Did Therapy Selection/Companion Diagnostics Segment Dominate the U.S. Liquid Biopsy Market?

The therapy selection/companion diagnostics segment dominates the U.S. market due to its critical role in guiding personalized cancer treatment. By identifying specific genetic mutations and biomarkers, it enables targeted therapy decisions, improves treatment outcomes, and is increasingly integrated into precision medicine, driving widespread clinical adoption.

Minimal Residual Disease (MRD) Detection

The minimal residual disease (MRD) detection segment is estimated to be the fastest-growing in the U.S. market due to its ability to detect tiny amounts of cancer cells remaining post-treatment. High sensitivity, early relapse detection, and guidance for therapy adjustments drive adoption, making it a critical tool in precision oncology and patient monitoring.

Which Technology/Mode of Action Segment Led the U.S. Liquid Biopsy Market?

The lung cancer segment dominates the U.S. market due to the high prevalence of lung cancer, the critical need for early detection, and the availability of targeted therapies. Liquid biopsies enable non-invasive mutation profiling, treatment monitoring, and personalized therapy selection, driving widespread adoption in clinical oncology for lung cancer patients.

Pancreatic Cancer

The pancreatic cancer segment is anticipated to be the fastest-growing in the U.S. liquid biopsy market due to the disease’s typically late diagnosis and poor prognosis. Liquid biopsies enable early detection, monitoring of treatment response, and identification of actionable biomarkers, driving increasing adoption in research and clinical settings for improved patient outcomes.

Why Did the Services Segment Dominate the U.S. Liquid Biopsy Market?

The services segment dominates the U.S. market due to the high demand for specialized testing, clinical support, and diagnostic interpretation. Outsourced laboratory services, customized analysis, and growing adoption of precision medicine contribute to its prominence, as healthcare providers increasingly rely on service-based solutions for accurate and efficient liquid biopsy testing.

Software & Bioinformatics Tools

The software & bioinformatics tools segment is estimated to be the fastest-growing in the U.S. liquid biopsy market due to increasing data complexity from genomic analyses, the need for accurate interpretation of ctDNA and CTC results, and integration with AI-driven analytics. These tools enhance diagnostic precision, enable personalized therapy decisions, and accelerate research applications.

Which Reference Laboratories Segment Led the U.S. Liquid Biopsy Market?

The reference laboratories segment dominates the market due to their advanced infrastructure, specialized expertise, and ability to process high volumes of complex tests. Strong partnerships with healthcare providers, extensive quality control measures, and the growing demand for outsourced, reliable diagnostic services further reinforce their leading position in the market.

Biopharmaceutical & Biotechnology Companies

The biopharmaceutical & biotechnology companies segment is anticipated to be the fastest-growing in the U.S. liquid biopsy market due to increased investment in R&D, focus on developing targeted therapies, and partnerships for diagnostic innovation. Rising demand for precision medicine and advanced biomarker-driven drug development further drives the rapid adoption of liquid biopsy solutions in this segment.

Why Did the Blood (Plasma/Serum) Segment Dominate the U.S. Liquid Biopsy Market?

The blood (plasma/serum) segment dominates the U.S. market due to its non-invasive collection, high concentration of circulating tumor DNA (ctDNA) and cell-free nucleic acids, and compatibility with advanced molecular and genomic assays. Its reliability, widespread clinical adoption, and ability to provide accurate, real-time cancer monitoring make it the preferred sample type.

Cerebrospinal Fluid (CSF)

The cerebrospinal fluid (CSF) segment is estimated to be the fastest-growing in the U.S. liquid biopsy market due to its ability to detect central nervous system (CNS) tumors and metastases with high sensitivity. CSF provides direct access to tumor-derived biomarkers, enabling early diagnosis, monitoring of disease progression, and personalized therapy, driving increasing adoption in neuro-oncology.

Which Treatment Line / Usage Segment Led the U.S. Liquid Biopsy Market?

The centralized testing lab segment dominates the U.S. market due to its advanced infrastructure, high-throughput capabilities, and specialized expertise in processing complex genomic and molecular tests. Strong quality control, regulatory compliance, and established partnerships with healthcare providers make centralized labs the preferred choice for accurate and reliable liquid biopsy testing.

Direct-To-Consumer (DTC) Testing Model

The direct-to-consumer (DTC) testing model segment is anticipated to be the fastest-growing in the U.S. liquid biopsy market due to increasing consumer awareness, demand for convenient and non-invasive testing, and the rise of personalized health monitoring. Easy access, rapid results, and growing adoption of at-home diagnostic solutions drive its rapid market growth.

| Cancer Type | % Total New Cases (2025) |

| Breast (female) | ~15.7% |

| Prostate | ~15.4% |

| Lung & bronchus | ~11.1% |

| Colon & Rectum | ~7.6% |

| Other Cancers | ~50.2% |

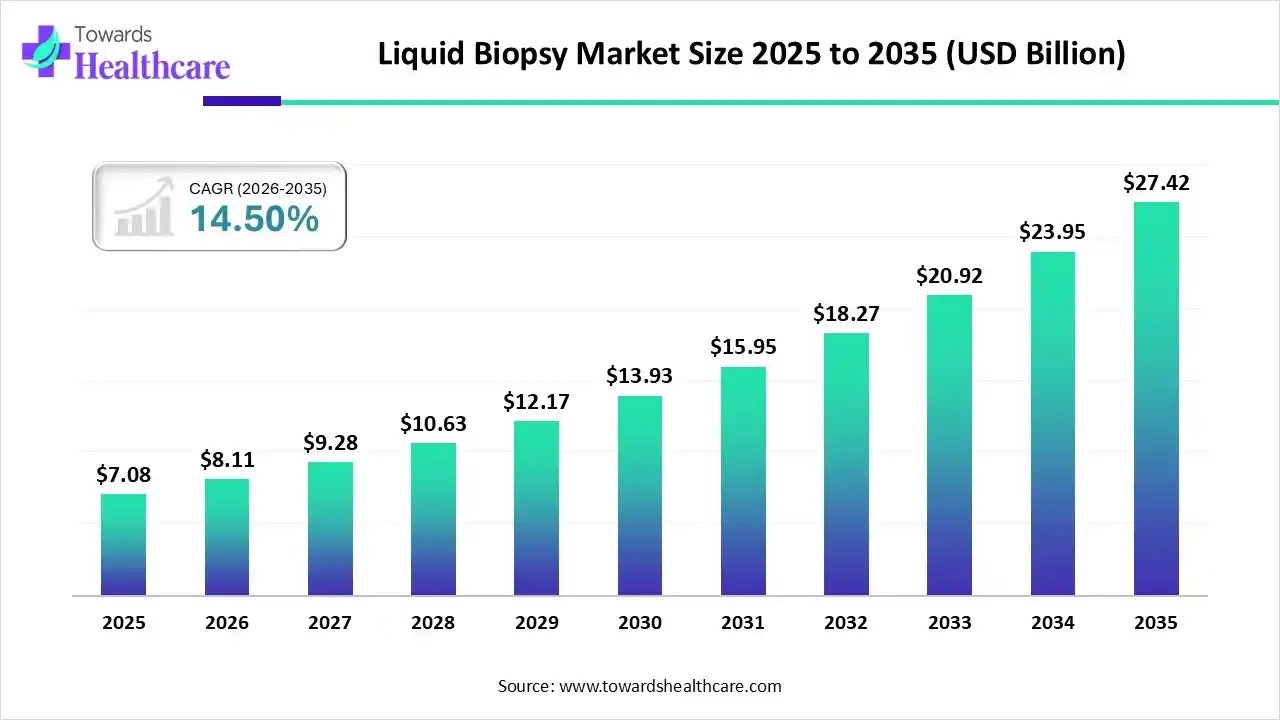

The global liquid biopsy market size is projected to reach USD 27.42 billion by 2035, growing from USD 7.08 billion in 2025, at a CAGR of 14.5% during the forecast period from 2026 to 2035, as a result of technological advancements in cancer diagnostics, and rising preference for minimally invasive cancer diagnostics.

| Company | Primary Offerings / Focus |

| Guardant Health | ctDNA-based liquid biopsy tests, including Guardant360 for genomic profiling and Guardant Revealfor minimal residual disease monitoring. |

| Foundation Medicine (Roche) | FoundationOne Liquid CDx and other genomic profiling assays for comprehensive circulating tumor DNA analysis. |

| Exact Sciences | Cancerguard multi-cancer early detection and molecular residual disease tests. |

| Illumina | Next-generation sequencing platforms and panels (e.g., TruSight Oncology ctDNA panel) are powering liquid biopsy assays. |

| BioRad Laboratories | Digital PCR systems and CTC analysis solutions, such as Droplet Digital™ PCR and CTC isolation tools. |

| Natera, Inc. | Cell-free DNA-based testing, including oncology and transplant care liquid biopsy assays. |

| Thermo Fisher Scientific | Molecular diagnostics and sequencing instruments used in liquid biopsy workflows (e.g., Ion Torrent systems). |

| QIAGEN | cfDNA/CTC extraction and sequencing panels, such as QIAseq Targeted cfDNA panels. |

| Labcorp | Clinical liquid biopsy tests (e.g., Labcorp Plasma Detect) and precision oncology service offerings. |

| NeoGenomics Laboratories | Oncology genetic testing and liquid biopsy services through its network of diagnostic labs. |

By Biomarker Type

By Technology/Platform

By Test Type / Application Stage

By Cancer Type (Indication Area)

By Product & Service Type

By Clinical Setting / End-User

By Sample Type

By Business Model

February 2026

February 2026

February 2026

February 2026