February 2026

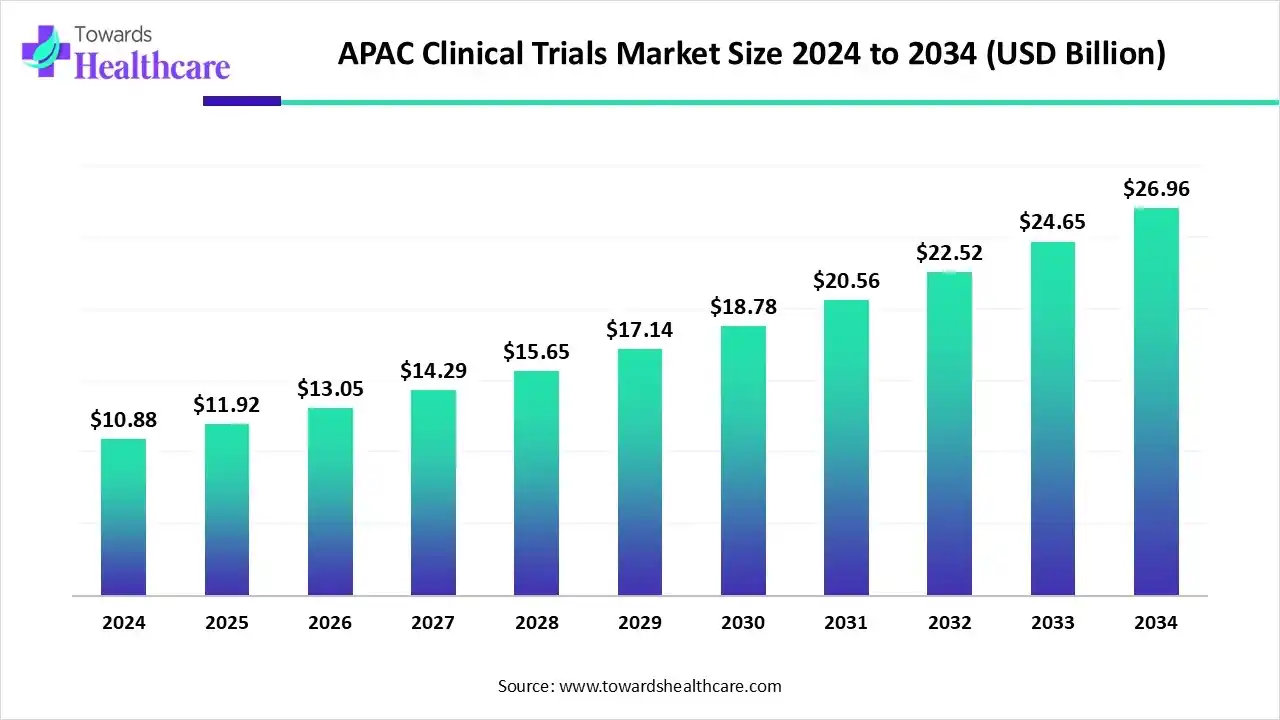

The APAC clinical trials market size was estimated at US$ 18.87 billion in 2025, projected to increase to US$ 20.42 billion in 2026 and reach US$ 41.33 billion by 2035, showing a healthy CAGR of 7.16% across the forecast years.

The APAC clinical trials market is expanding rapidly due to growing investment in life sciences research, increasing outsourcing of trials from Western countries, and supportive government policies. China and India are emerging as key hubs, driven by large, diverse patient populations and skilled medical professionals. Rising prevalence of chronic diseases and demand for innovative therapies further boost trial activities, positioning the region as a critical contributor to the global clinical research landscape.

| Table | Scope |

| Market Size in 2025 | USD 18.87 billion |

| Projected Market Size in 2035 | USD 41.33 billion |

| CAGR (2026 - 2035) | 7.16% |

| Market Segmentation | By Phase, By Study Design, By Indication, By Region |

| Top Key Players | LabCorp, Syneos Health, Novotech, Avance Clinical, AbbVie, Merck Sharp & Dohme LLC |

The market is growing rapidly due to increasing R&D activities, large patient populations, and supportive government policies. The APAC clinical trials are research studies conducted in the region to evaluate the safety, efficacy, and outcomes of new drugs or medical treatments in local populations. The APAC clinical trials market is experiencing rapid growth due to increasing investments in healthcare infrastructure, a surge in demand for personalized medicine, and advancements in digital health technologies.

Countries like China and India are emerging as key hubs for clinical research, driven by their large and diverse patient population, cost-effective operations, and supportive regulatory environments. This expansion is further fueled by the rise of Contract research organizations (CROs) and the adoption of decentralized clinical trial models, enhancing efficiency and accessibility in the region.

AI can significantly impact the APAC clinical trials market by accelerating patient recruitment, optimizing trial design, and improving data analysis. It enables predictive modeling, real-time monitoring, and personalized treatment strategies, reducing costs and timelines. AI-driven automation enhances accuracy in trial operations, while machine learning identifies patient cohorts and potential adverse effects more efficiently. Overall, AI adoption increases trial efficiency, supports decentralized models, and strengthens the region’s competitiveness in global clinical research.

| Year | Number of New Clinical Trials | % of Total Trials |

| 2023 | 12,000 | 40% |

| 2024 | 18,000 | 60% |

The phase 3 segment led the market with the largest revenue share in 2024 due to its critical role in confirming drug efficacy, monitoring side effects, and comparing new treatments with existing standards. These trials require a large patient population, longer duration, and greater investments. Additionally, increasing demand for late-stage clinical validation and prevalence of chronic diseases further the dominance of phase 3 trials in the market.

The phase 2 segment is projected to grow at the fastest CAGR during the forecast period due to the rising number of investigator-led and institution-based trials across the Asia-Pacific region. Favorable regulatory reforms, growing emphasis on targeted therapies, and increasing funding for early-stage research are accelerating phase 2 activities. Sponsors prefer this phase to assess drug efficacy and refine dosing before large-scale trials, making it a crucial step in advancing innovative treatment development efficiently.

The interventional study segment dominated the market in 2024 and is expected to grow at the fastest CAGR due to its critical role in testing new treatments through controlled clinical settings. These studies provide reliable safety and efficacy data required for regulatory approvals. Increasing R&D investments, the rise of precision medicine, and advancements in digital trial technologies have further boosted interventional research. Additionally, growing patient enrollment and government support for innovative therapies are driving the market's continued expansion.

The oncology segment led the market in 2024 and is projected to grow fastest because of the increasing number of treatment-naïve cancer patients and expanding oncology research infrastructure across the Asia-Pacific. Supportive regulatory reforms, rising domestic biotech innovation, and growing participation in multinational cancer trials are driving the growth. Additionally, the focus on novel therapies, such as cell and gene treatment, continues to strengthen the region's position in global oncology clinical development.

China dominated the market in 2024 due to its well-developed clinical research infrastructure, large pool of treatment-naïve patients, and growing expertise in biopharmaceutical innovation. Supportive government policies and streamlined regulatory processes have made the country a preferred hub for both domestic and international sponsors. Additionally, the adoption of advanced technologies, a skilled workforce, and collaboration between research institutes and pharmaceutical companies have strengthened China’s position as a leading center for clinical trials in the region.

In 2024, China registered 4,900 clinical trials (up 13.9% vs 2023). Of these, 2,539 (51.8%) were for new drug development, and 2,361 (48.2%) were bioequivalence studies.

The Japan APAC clinical trials market is expanding due to its advanced healthcare infrastructure, strong regulatory support, and growing focus on innovative therapies. The country has a well-established network of hospitals and research centers, enabling efficient patient recruitment and high-quality data collection. Additionally, government initiatives encourage collaboration between pharmaceutical companies and academic institutions, while increasing investment in biotechnology and precision medicine drives the development of novel treatments, making Japan a key contributor to the growth of clinical research in the region.

About 1,500 clinical trials are active at any time in Japan. Credevo The clinical trials support services market earned USD 1,030.8 million in 2024, with Phase III trials generating the highest revenue.

India’s market is increasing due to its large and diverse patient population, which enables faster recruitment for both early- and late-phase studies. The country offers cost-effective trial operations, skilled medical professionals, and an improved clinical research infrastructure. Supportive government policies, such as streamlined regulatory approvals and incentives for foreign sponsors, encourage more multinational and domestic trials. Additionally, growing focus on innovative therapies and increasing healthcare investments are driving India’s rising role in the regional clinical trials landscape.

India registered approximately 18,000 new clinical trials in 2024, a 50% rise from the previous year. Of 94,730+ trials registered since 2000 in CTRI, 79% focus on non-communicable diseases.

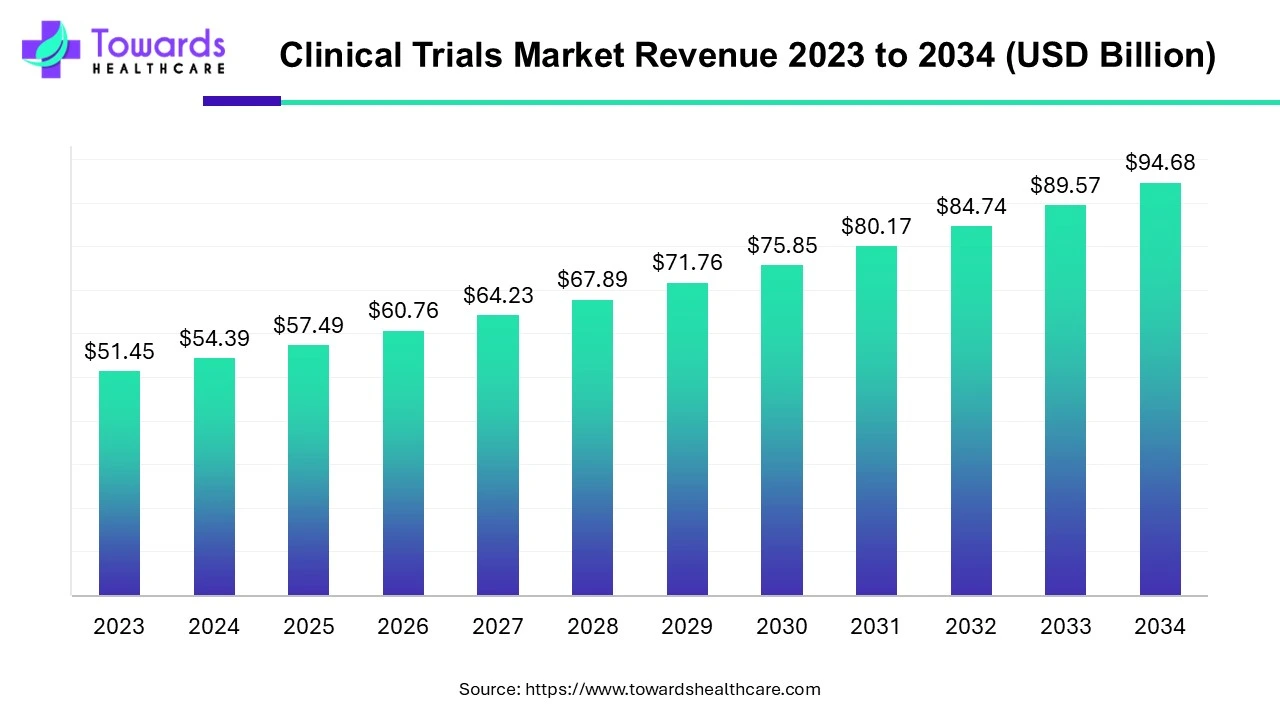

The global clinical trials market is valued at USD 98.91 billion in 2026 and is projected to reach USD 174.18 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.7% over the forecast period from 2026 to 2035.

By Phase

By Study Design

By Indication

By Region

February 2026

February 2026

February 2026

February 2026