January 2026

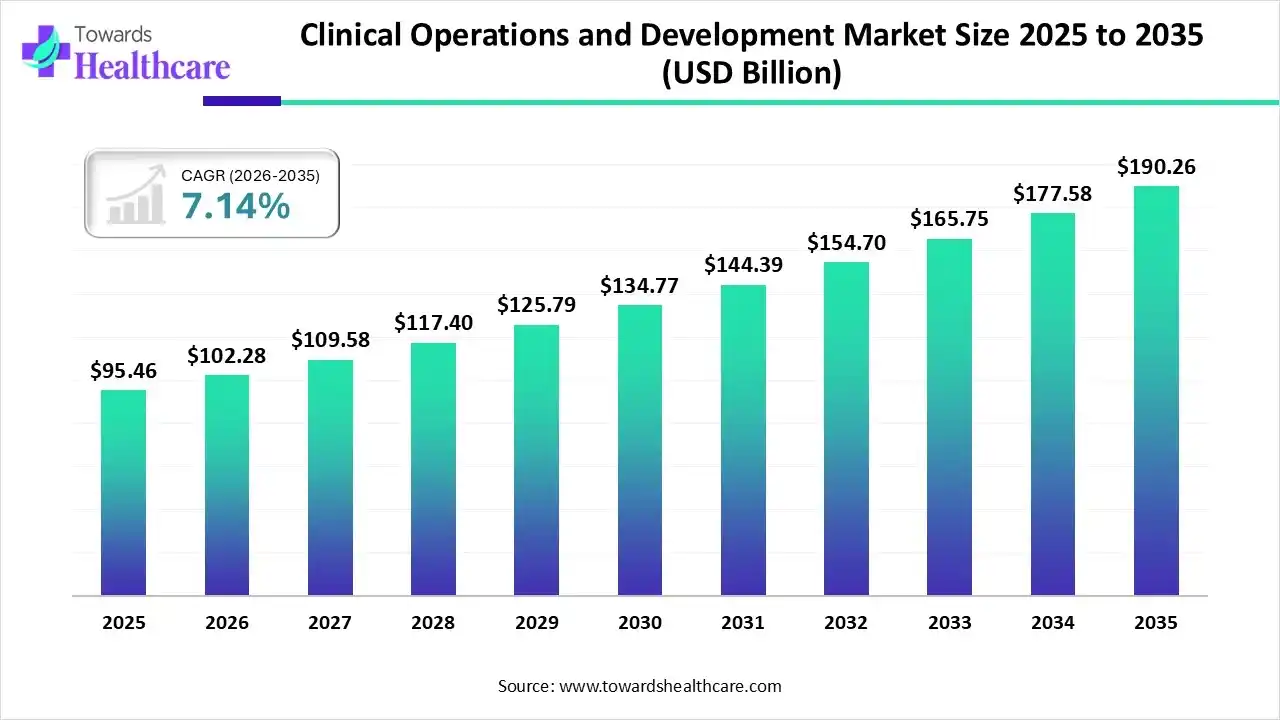

The global clinical operations and development market size is expected to be worth around USD 190.26 Billion by 2035, from USD 95.46 billion in 2025, growing at a CAGR of 7.14% during the forecast period from 2026 to 2035.

The clinical operations and development market is experiencing robust growth driven by the increasing complexity in clinical trials and the growing demand for decentralized clinical trials. The growing collaboration among professionals across clinical trials facilitates coherent clinical operations and development. This ensures the conduct of safe, efficient, and compliant trials, integrating innovations effectively. Digital tools are leveraged to simplify operations and streamline large-scale clinical trials.

| Key Elements | Scope |

| Market Size in 2026 | USD 102.28 Billion |

| Projected Market Size in 2035 | USD 190.26 Billion |

| CAGR (2026 - 2035) | 7.14% |

| Leading Region | North America |

| Market Segmentation | By Phase, By Service Type, By Indication, By Region |

| Top Key Players | Caidya, IQVIA, ICON plc, ClinChoice, Novotech CRO, Tata Consultancy Services, Syneos Health, Abiogenesis Clinpharm, ProPharma |

The clinical operations and development market refers to providing tailored services from clinical trial design to disclosure of trial results. Clinical operations and development services take ownership of the project to elevate the clinical development experience and advance healthcare opportunities for all. They drive innovative design strategies, operational efficiency, and effective integration of patient outcomes in trial design. They maintain flexibility and provide high-quality, personalized services.

Artificial intelligence (AI) and machine learning (ML) tools are increasingly leveraged across the clinical development landscape to deliver time and cost savings while minimizing risks. They can automate trial design, streamline complex operations, and improve data quality. They allow professionals to identify the most active molecules, find patient populations, and review scans, claims reports, and other healthcare data. AI and ML enable sponsors to gain the best insights to make the right decisions, increasing predictability, reducing time-to-market, and improving efficiency.

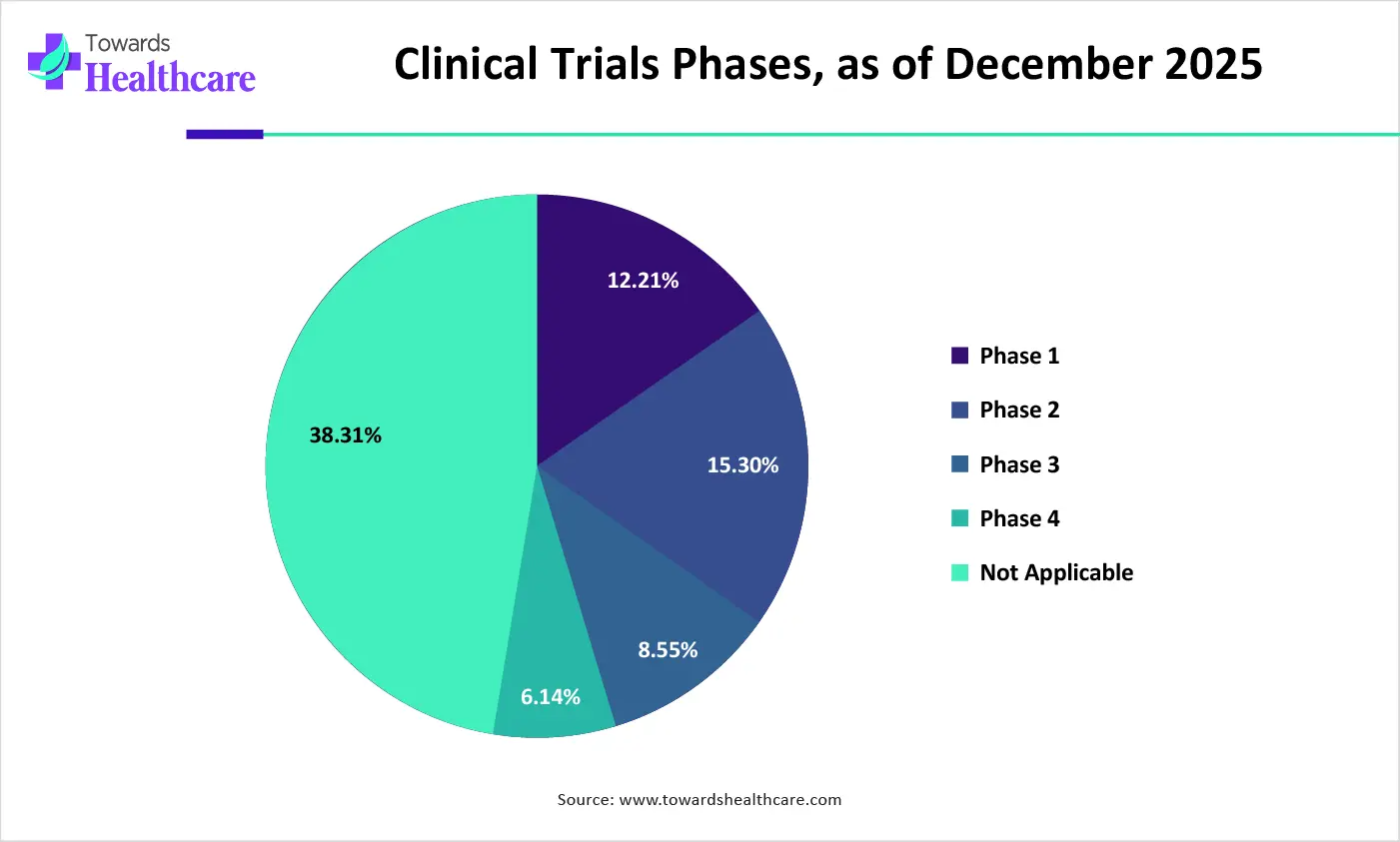

| Phases | Number of Trials | % of Trials |

| Phase 1 | 68,516 | 12.21% |

| Phase 2 | 85,852 | 15.30% |

| Phase 3 | 48,011 | 8.55% |

| Phase 4 | 34,427 | 6.14% |

| Not Applicable | 2,14,899 | 38.31% |

How the Phase III Segment Dominated the Clinical Operations and Development Market?

The phase III segment held a dominant position in the market in 2025 and is expected to expand rapidly in the market in coming years, due to the high complexity of Phase III trials. Phase III trials are conducted across multiple sites and involve a large subject population. This necessitates researchers to keep track of vast amounts of data and generate critical data for regulatory approval. Phase III trials are conducted to confirm and expand the safety and effectiveness results from Phase I/II trials.

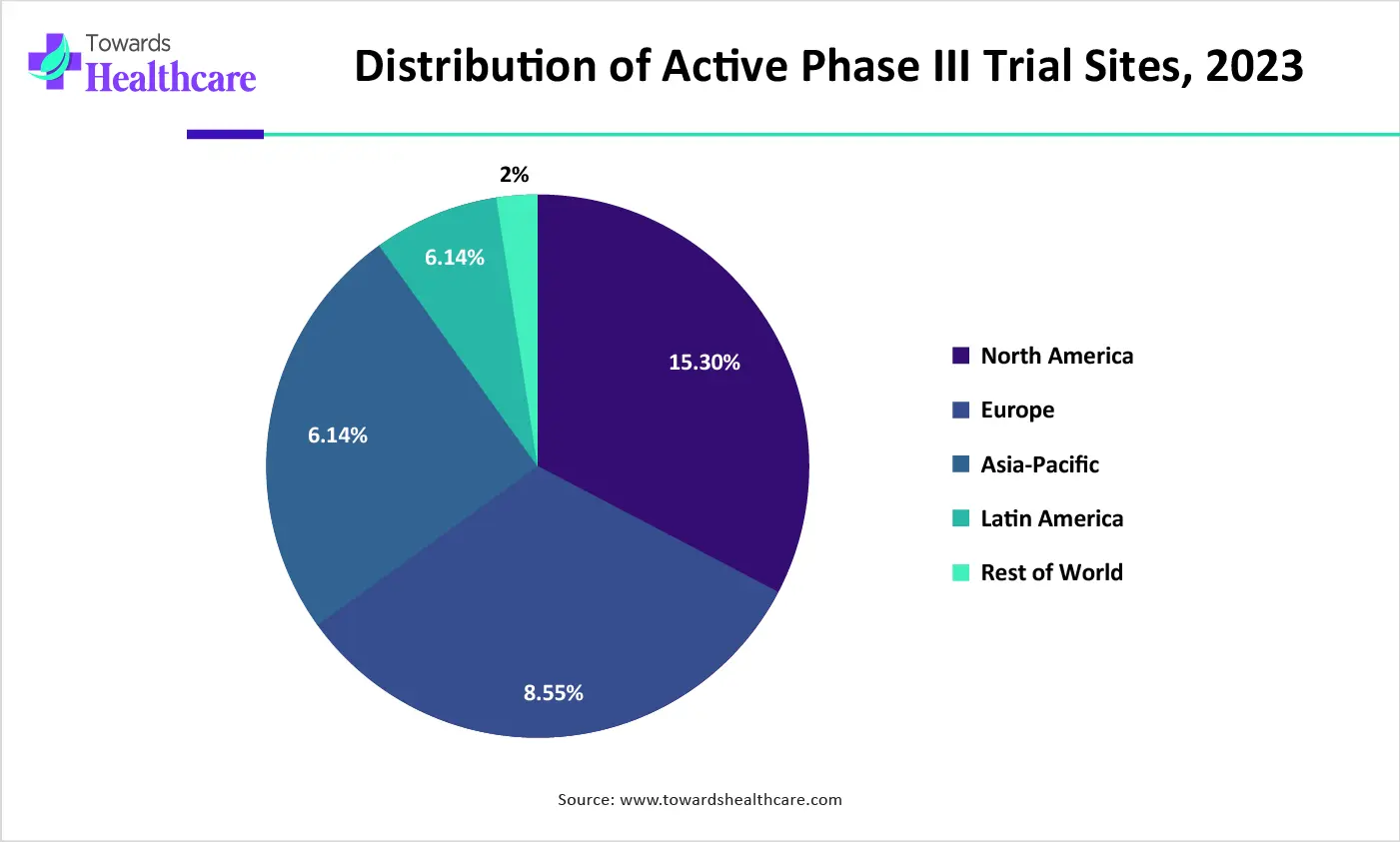

| Regions | Distribution of Phase III Clinical Trial Sites, 2023 |

| North America | 32% |

| Europe | 34% |

| APAC | 25% |

| Latin America | 7% |

| Rest of World | 2% |

Which Service Type Segment Dominated the Clinical Operations and Development Market?

The laboratory services & bioanalytical testing segment held the largest revenue share of the market in 2025, due to the need to evaluate trial results and the growing demand for biomarker analysis. Laboratory services include determining drug metabolism, pharmacokinetics, pharmacodynamics, immunogenicity, biomarkers, and diagnostic testing. Advances in genomic technologies allow researchers to study the disease progression, identify novel biomarkers, and assess the safety and efficacy of drug candidates.

Data Management & Biostatistics Services

The data management & biostatistics services segment is expected to grow at the fastest CAGR in the market during the forecast period. Data management services refer to data collection, validation, and cleaning, thereby reducing study risks and advancing clinical development with precision. Biostatistics allows researchers to analyze and interpret complex clinical data using statistical tools. Data management & biostatistics services are essential to support seamless data integration and accurate results.

Why Did the Oncology Segment Dominate the Clinical Operations and Development Market?

The oncology segment contributed the biggest revenue share of the market in 2025, due to the rising prevalence of cancer and growing research activity in the cancer field. The World Health Organization (WHO) predicts that more than 35 million new cancer cases will be reported in 2050. Out of the total 560,990 trials, about 115,630 trials are related to oncology on the clinicaltrials.gov website as of 11th December 2025. Scientists focus on developing personalized medicines and medical devices to prevent, diagnose, and treat different cancer types.

Central Nervous System (CNS) Disorders

The central nervous system (CNS) disorders segment is expected to witness the fastest growth in the market over the forecast period. The increasing prevalence of CNS disorders and the shifting trend towards non-oncology diseases augment the segment’s growth. According to the American Society of Gene + Cell Therapy, cell therapy trials are expanding beyond cancer, with 58% focusing on non-oncology applications. According to a recent McKinsey and Company report, the number of neurological phase III trials has increased 4.3 times from 2000 to 2024.

North America dominated the global market in 2025. The presence of key players, a robust clinical trial infrastructure, and constant healthcare innovations are the factors that govern market growth in North America. Government organizations support advanced research and clinical trials through funding programs and initiatives. Regulatory agencies approve a healthcare product based on the clinical trial data, necessitating effective trials across the region. Countries like the U.S. and Canada conduct the highest number of clinical trials in the world.

As of December 2025, 187,516 trials are registered from the U.S., accounting for 33.42% of all trials. This potentiates the demand for clinical operations and development. Key players, such as PPD, IQVIA, and ICON plc, are the major contributors to the market in the U.S. The Food and Drug Administration (FDA) regulates the design, conduct, analysis, and reporting of clinical trials.

Asia-Pacific is expected to host the fastest-growing market in the coming years. The burgeoning healthcare sector, increasing patient population, and evolving regulatory landscapes are reshaping the clinical trial landscape in the region. Pharma & biotech companies receive funding from government and private organizations to conduct clinical trials and outsource their clinical operations and development. Government bodies are making constant efforts to establish a suitable clinical trial infrastructure. The increasing adoption of advanced technologies, such as decentralized clinical trials and real-time data capture and analysis tools, propels the market.

China witnesses a continuous surge in clinical trials, accelerating its new drug development. The National Health Commission (NHC) has been supporting demonstration clinical trial research platforms for various diseases nationwide, and works with other government departments to continuously improve the regulatory system for clinical research. The Chinese Clinical Trial Registry reports registration of 112,322 trials as of 11th December 2025.

Europe is expected to grow at a considerable CAGR in the upcoming period. Amid the Trump Administration’s research funding cuts, more U.S.-based scientists are considering jumping ship, especially in European countries like France. European nations offer suitable research and clinical trial facilities, investments, and regulatory policies to support advanced clinical trials. The increasing number of clinical trials and rising collaboration among key players contribute to market growth. Several institutions conduct conferences and seminars to share the latest updates about scientific innovations in the region.

France has opened doors for foreign scientists through its Agence Nationale de la Recherche (ANR), enhancing visibility to French research capacity and attracting the best scientists in the world. The French government has allocated an additional funding of €100 million under the France 2030 program to attract foreign researchers. In April 2024, OSE Immunotherapeutics received €8.4 million ($9 million) in non-dilutive funding from the French government for the registration of a Phase III trial for a cancer vaccine.

| Companies | Headquarters | Offerings |

| Caidya | North Carolina, United States | The company possesses clinical development experts who shape a personalized solution, getting involved in the earliest stages of the project to map requirements. |

| IQVIA | North Carolina, United States | IQVIA’s research and development solutions enable researchers to reimagine clinical development by leveraging advances in technology and analytics. |

| ICON plc | Dublin, Ireland | ICON offers a wide range of services, including project management of clinical development programs, agile clinical monitoring, optimized balanced resourcing, and smart study start-up. |

| ClinChoice | Pennsylvania, United States | It ensures the efficient and effective execution of clinical trials, from planning and initiation through to study completion, across diverse sectors. |

| Novotech CRO | Sydney, Australia | It is a global full-service CRO and scientific advisory partner that accelerates clinical development programs. |

| Tata Consultancy Services | Mumbai, India | It offers clinical operations support services and standard-driven clinical data management (CDM) services. |

| PPD | North Carolina, United States | It provides bespoke clinical operations solutions in a flexible functional service provider (FSP) model to meet your unique needs. |

| Syneos Health | North Carolina, United States | It provides full-service development programs, as well as leadership, mentoring, and technical support to the clinical operations team, ensuring quality of deliverables and achievement of financial goals. |

| Abiogenesis Clinpharm | Hyderabad, India | The company’s comprehensive clinical operation services ensure seamless and efficient operations. |

| ProPharma | North Carolina, United States | Its expert clinical outsourcing services help design, conduct, and manage trials to ensure successful studies to meet regional and global regulations. |

By Phase

By Service Type

By Indication

By Region

January 2026

January 2026

January 2026

January 2026