U.S. Clinical Trials Market Size, Company Landscape with Segmental Insights

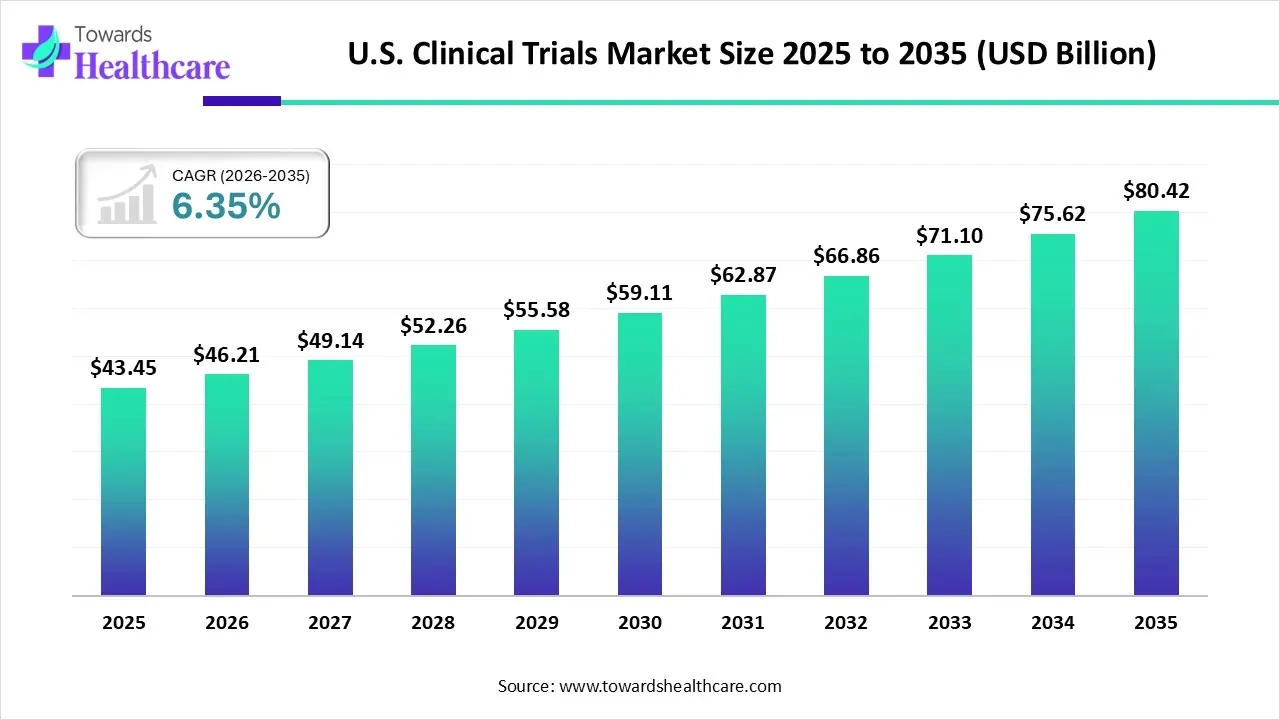

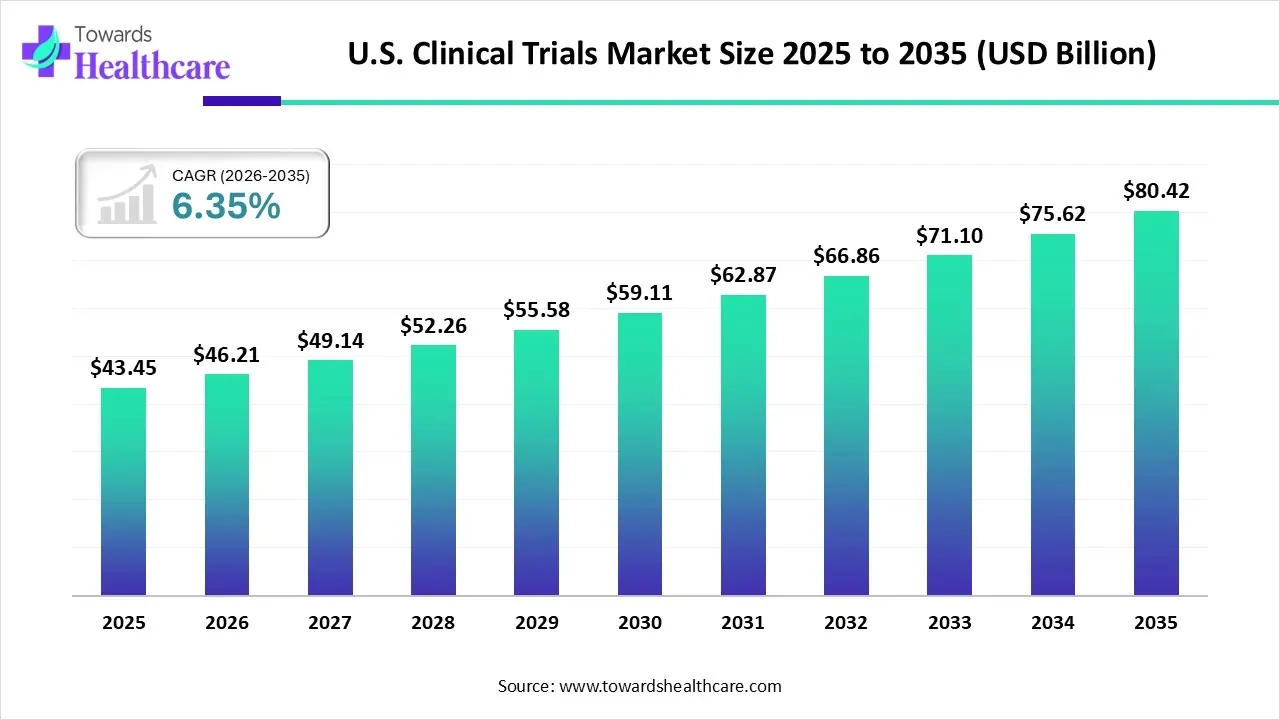

The U.S. clinical trials market size is calculated at US$ 43.45 billion in 2025, grew to US$ 46.21 billion in 2026, and is projected to reach around US$ 80.42 billion by 2035. The market is expanding at a CAGR of 6.35% between 2026 and 2035.

The U.S. clinical trials market is expanding as a result of the growing need for novel therapies as well as developments in biotechnology and personalized medicine. This market is distinguished by its strong infrastructure, comprehensive regulatory frameworks, and expanding cooperation between government agencies, research institutions, and pharmaceutical companies. The growing prevalence of chronic illnesses, the growing need for personalized medicine, and technological developments in clinical research techniques are the main factors propelling market expansion.

Key Takeaways

- The U.S. clinical trials market will likely exceed USD 43.45 billion by 2025.

- Valuation is projected to hit USD 80.42 billion by 2035.

- Estimated to grow at a CAGR of 6.35% starting from 2026 to 2035.

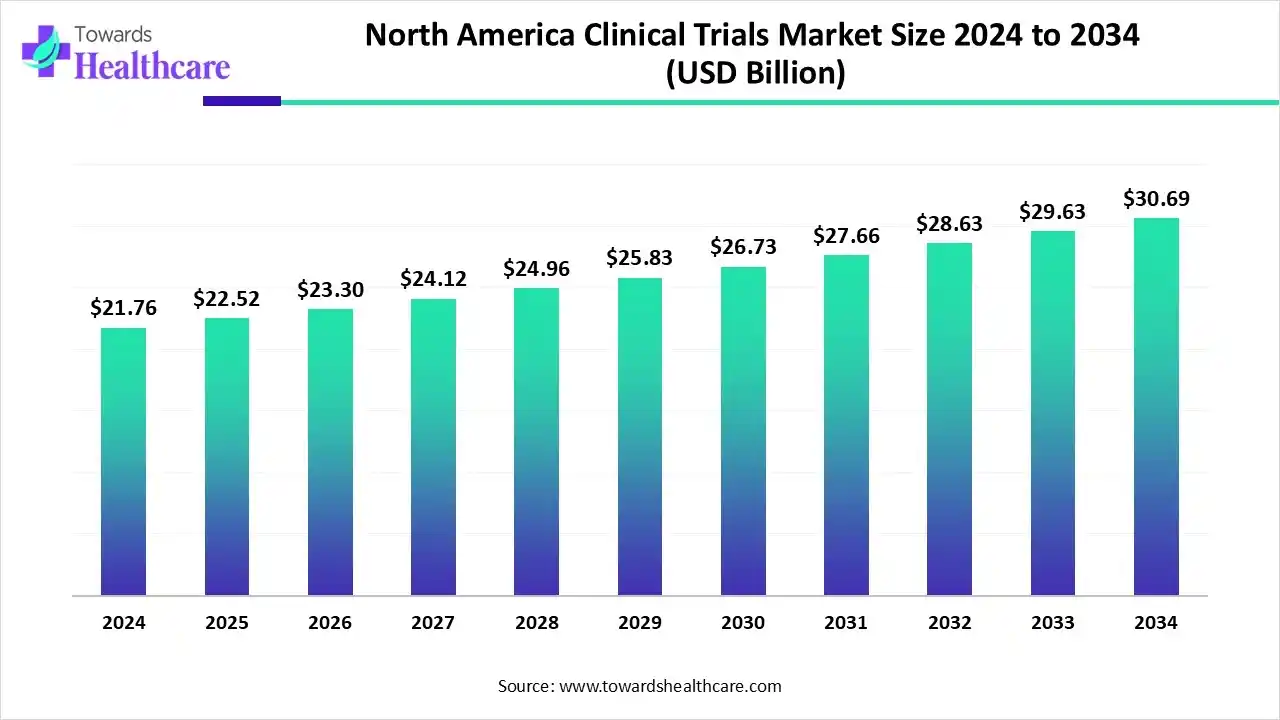

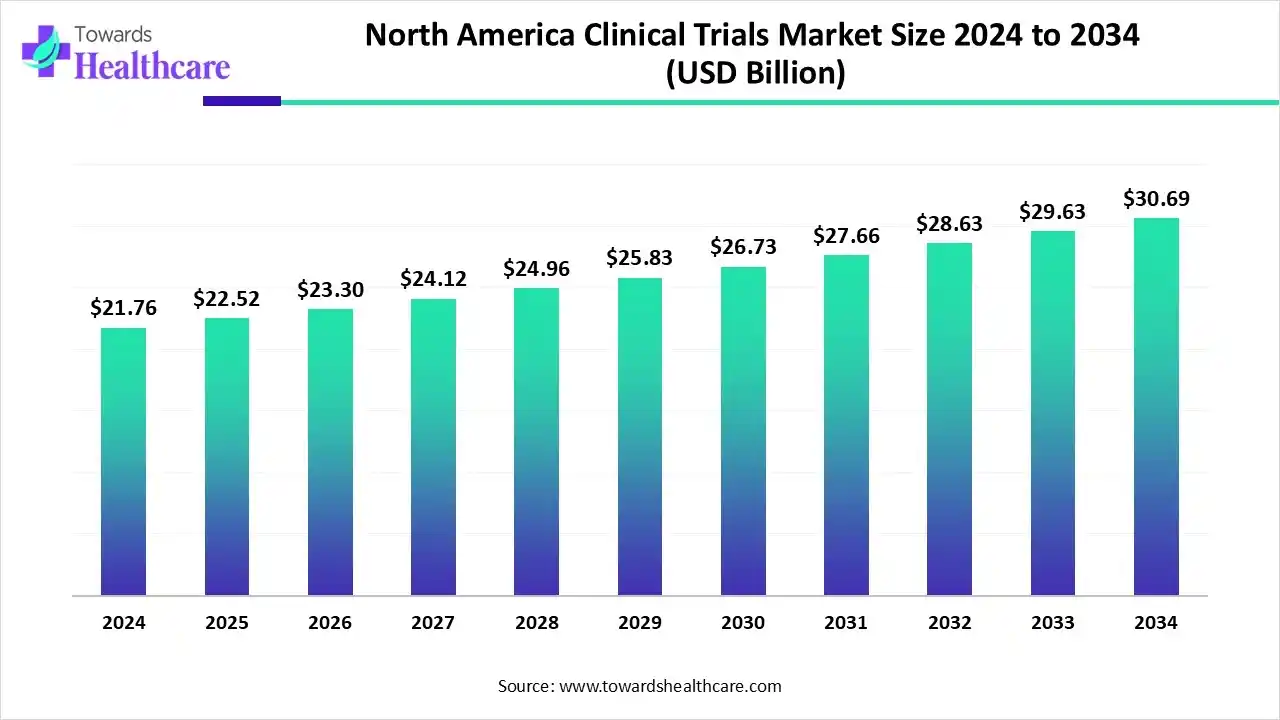

- The North America clinical trials market is US$ 55.48 billion in 2025, projected to reach US$ 99.10 billion by 2035 at a 5.40% CAGR.

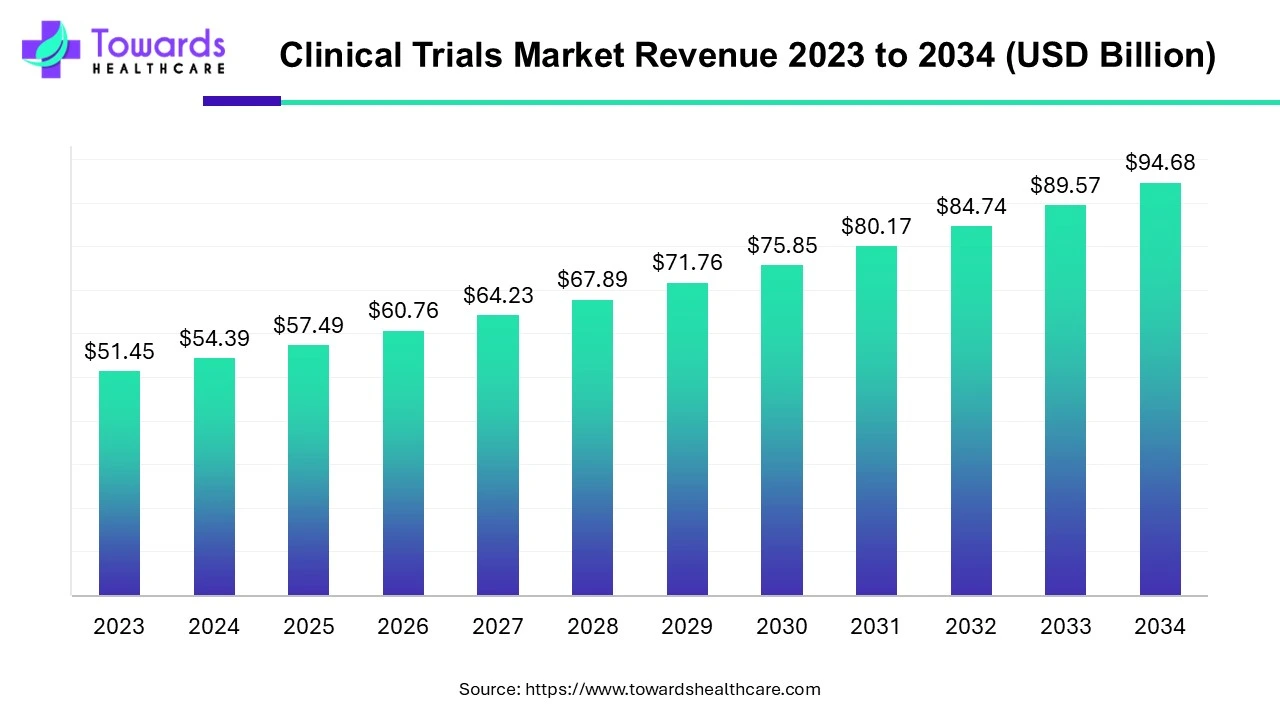

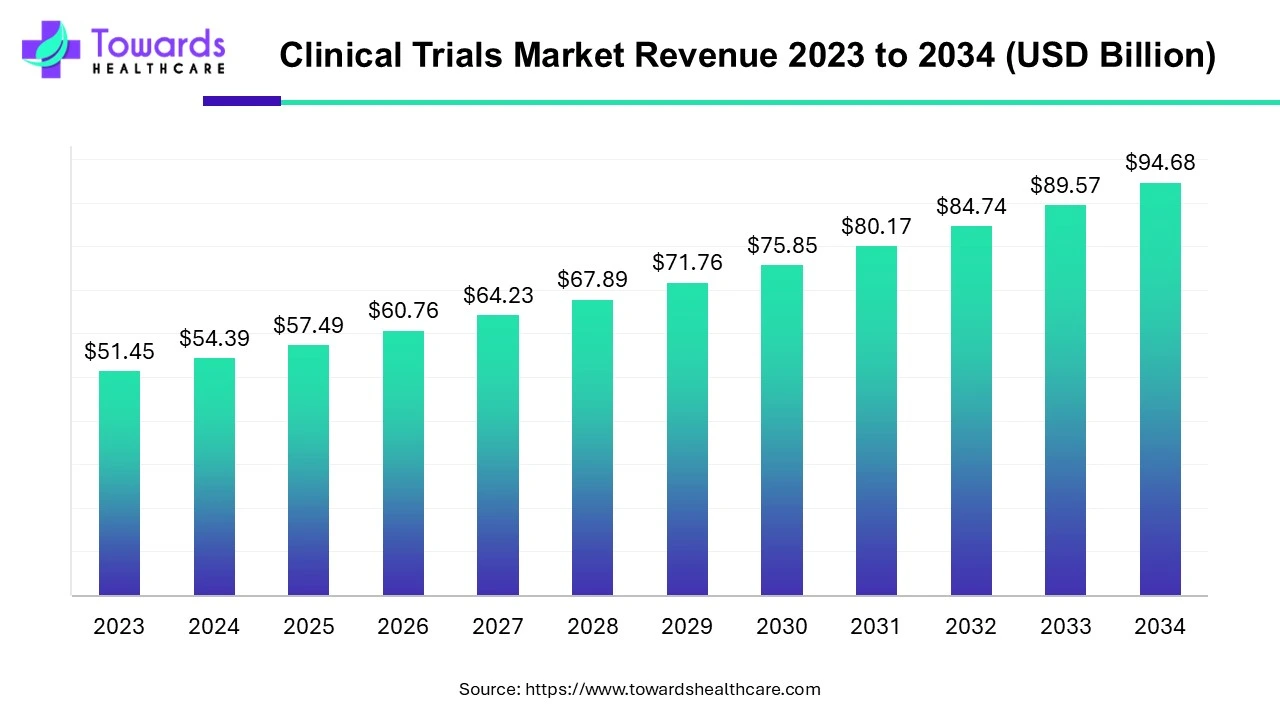

- The clinical trials market will grow from USD 54.39 billion in 2024 to USD 94.68 billion by 2034, at a 5.7% CAGR.

- By phase, the phase 3 segment dominated the U.S. clinical trials market in 2024.

- By phase, the phase 2 segment is expected to grow at the fastest CAGR during 2025-2034.

- By study design, the interventional study segment dominated the market in 2024 and is expected to grow at the fastest CAGR during 2025-2035.

- By intervention, the oncology segment dominated the market in 2024 and is expected to grow the fastest CAGR during 2025-2034

Executive Summary Table

| Key Elements |

Scope |

| Market Size in 2025 |

USD 43.45 billion |

| Projected Market Size in 2035 |

USD 80.42 billion |

| CAGR (2025 - 2035) |

6.35% |

| Market Segmentation |

By Phase, By Study Design, By Indication |

| Top Key Players |

IQVIA, Thermo Fisher Scientific (PPD), LabCorp (Covance), ICON plc, Parexel, Syneos Health, Charles River Laboratories, Medpace, Worldwide Clinical Trials, Eurofins Scientific, WuXi AppTec, PSI CRO, Premier Research, Caidya (formerly Clinipace), Precision for Medicine, Inotiv, Curia Global, Ergomed, TFS HealthScience |

An Overview of the U.S. Clinical Trials Landscape

A key component of the development of pharmaceuticals and biotechnology worldwide is the U.S. clinical trials market. The U.S. is one of the most developed and intricate markets for clinical trials due to its strong regulatory framework, substantial R&D investment, and rising incidence of chronic diseases. A thriving life sciences ecosystem, substantial healthcare spending, and scientific excellence characterize this area, all of which contribute to the rising number and complexity of clinical studies carried out each year.

U.S. Clinical Trials Market Outlook

- Industry Growth Overview: Increased investments in pharmaceutical research, biotech advancements, and the rise in chronic diseases are the main drivers of this growth. A favorable growth outlook is further enhanced by government programs and regulatory assistance.

- Sustainability Trends: Sustainability trends emphasize patient-centered strategies that boost efficiency and accessibility, like decentralized and virtual trials. By developing more targeted treatments and lowering the need for extensive trials, the expanding applications of pharmacogenetics and personalized medicine also support sustainability.

- Major Investors: The U.S. clinical trials market is heavily funded by major investors, including angel and venture capital firms. These investors are contributing a substantial amount of money to help the industry grow and innovate.

- Startup Ecosystem: The startup ecosystem is thriving, and many businesses are using big data and artificial intelligence (AI) to increase trial efficiency. AI patient recruitment tools and decentralized trial platforms are recent innovations that are expanding the U.S. clinical trials market and generating new opportunities.

What is the Role of AI in the U.S. Clinical Trials Market?

Clinical trials are being revolutionized by artificial intelligence (AI), which is addressing issues in patient monitoring, the burden of manual labor, and data limitations. AI makes trials quicker and more effective by automating data management, accelerating patient recruitment, and enabling remote monitoring. Through biosimulation, early diagnosis, and personalized medicine, it enhances drug development, cutting expenses and time while improving research output and accuracy. Clinical trials will increasingly rely on AI in the future to achieve more efficient procedures and better results.

Segmental Insights

Phase Insights

How Phase 3 Dominated the U.S. Clinical Trials Market in 2024?

The phase 3 segment held the largest share of the market in 2024. Phase 3 is the last stage of testing before the drug's specifics and clinical trial findings are sent to regulatory bodies for approval of its commercial release. Therefore, phase 3 is an essential stage of drug development, and advancing the medication to a phase 3 trial may cost billions.

Phase 2

The phase 2 segment is estimated to achieve the fastest growth in the U.S. clinical trials market during the forecast period. A crucial step in the drug development process, phase II clinical trials offer vital information about a medication's safety and effectiveness. Through these trials, researchers and stakeholders can make well-informed decisions about advancing promising candidates to the next stage of development, optimizing dosage schedules, and identifying which patient populations will benefit from the treatment.

Phase 1

The phase 1 segment is expected to grow at a lucrative CAGR in the U.S. clinical trials market during the forecast period. To test new medical treatments in humans, phase 1 clinical trials are the initial stage. Phase 1's main objective is to evaluate a new drug's safety. These investigations aid in identifying any adverse effects at different dosages as well as the drug's pharmacokinetics, the way it is absorbed, distributed, metabolized, and excreted in the body, and pharmacodynamics, its effects on the body.

Study Design Insights

How did the Interventional Study dominate the U.S. clinical trials market in 2024?

The interventional study segment held the largest share of the market in 2024 and is estimated to achieve the fastest growth during the forecast period. For medical progress, interventional clinical trials are essential. They offer solid scientific proof of whether novel treatments are safer or more effective than existing ones. In order to guarantee that patients have access to improved care, this evidence serves as the foundation for the regulatory approval of novel treatments. These trials may also reveal novel applications for current therapies, expanding the range of available treatments.

Observational Study

The observational study is expected to grow at a lucrative CAGR in the U.S. clinical trials market during the forecast period. When examining treatment outcomes, observational studies are crucial. The tolerability profile of commercially available medications can be better understood using data from extensive observational studies. Large, diverse patient populations with complicated, long-term conditions like diabetes mellitus can benefit greatly from observational research.

Intervention Insights

What Factors Made Oncology Dominant in the U.S. clinical trials market in 2024?

The oncology segment held the largest share of the market in 2024 and is estimated to achieve the fastest growth during the forecast period. In the U.S., there were over 18.1 million cancer survivors in 2022, and by 2040, there are expected to be 26.1 million. In the U.S., about 7% of cancer patients take part in cancer treatment trials. There were sixty oncology drug approvals in 2024, representing a broad range of indications, including the treatment of common and uncommon cancers.

Pain Management

The pain management is expected to grow at a lucrative CAGR in the U.S. clinical trials market during the forecast period. The adult population in the U.S. has a high disease burden of chronic pain. According to the 2021 National Health Interview Survey, more than 20% of American adults said they had chronic pain. It is estimated that the annual cost of pain-related multimorbidity and disability in the U.S. is between US$560 and US$635 billion, which is more than the combined cost of care for diabetes, cancer, and heart disease.

Regional Insights

What Factors Support the U.S. Clinical Trials Market’s Growth?

The U.S. clinical trials market is growing rapidly due to the rising prevalence of clinical trials. Involvement of a government organization and efforts taken by academic and research institutions. Apart from this, the U.S. is in a dominant position in pharmaceuticals, biotechnology, and other life sciences sectors, which are heavily involved in clinical trials. Furthermore, the strong presence of major players competing in the region to develop novel, advanced therapeutics to stand out in the market and expand their global presence.

Clinical Trials Statistics in the U.S.

- Statistics for 2024: During the year, 43,674 new studies were posted on ClinicalTrials.gov Trends and Charts, with oncology being the most popular category.

- 2025 statistics: Over 36,700 studies have been published so far this year, indicating a robust recovery in research activity. By mid-2025, phase I–III trial starts had increased by 20% year over year.

North America Clinical Trials Market Growth

The North America clinical trials market size is calculated at US$ 55.48 billion in 2025, grew to US$ 58.82 billion in 2026, and is projected to reach around US$ 99.10 billion by 2035. The market is expanding at a CAGR of 5.40% between 2026 and 2035.

Global Clinical Trials Market Growth

The global clinical trials market size is calculated at USD 54.39 billion in 2024 and is expected to be worth USD 94.68 billion by 2034, expanding at a CAGR of 5.7% from 2024 to 2034, as a result of growing demand for personalized medicines, rising investment in R&D and adoption of decentralized clinical trials.

Company Landscape

1. Company: IQVIA

Company Overview:

- Company Overview: A leading global provider of advanced analytics, technology solutions, and contract research services (CRO) to the life sciences industry. It uses human data science—the intersection of data, science, and human ingenuity—to help customers accelerate clinical development and commercialization.

Corporate Information:

- Headquarters: Research Triangle Park, North Carolina, U.S.

- Year Founded: 2016 (Formed through the merger of Quintiles and IMS Health)

- Ownership Type: Publicly Traded (NYSE: IQV) (As of late 2024/early 2025)

History and Background:

- History and Background: Formed by the 2016 merger of Quintiles Transnational Holdings Inc. (a leading clinical trials service provider) and IMS Health Holdings, Inc. (a leading provider of healthcare data and analytics). The combined entity rebranded as IQVIA in 2017 to emphasize the integration of clinical research, data, and technology.

Key Milestones/Timeline:

- Key Milestones/Timeline:

- 2016: Quintiles and IMS Health merge.

- 2017: Rebrands to IQVIA.

- 2020/2021: Significant role in COVID-19 vaccine and therapeutic trials, leveraging integrated data/tech capabilities.

- 2024 (Q4): Reported full-year 2024 revenue of $15.405 billion.

- 2024 (Late): Continued focus on advancing obesity and cardiometabolic trials.

Business Overview:

- Business Overview: Provides end-to-end solutions for pharmaceutical, biotechnology, medical device, and healthcare payers/providers. Offers services from early-phase R&D to commercialization and post-market surveillance. Full-year 2024 revenue was $15.405 billion.

Business Segments/Divisions:

- Business Segments/Divisions:

- Technology & Analytics Solutions (TAS): Provides proprietary software, real-world data and analytics, and consulting services (Revenue: $6.160 billion in FY 2024).

- Research & Development Solutions (R&DS): Full-service clinical trial outsourcing (CRO), covering Phases I-IV (Revenue: $8.527 billion in FY 2024).

- Contract Sales & Medical Solutions (CSMS): Commercialization, medical affairs, and outsourced sales services (Revenue: $718 million in FY 2024).

Geographic Presence:

- Geographic Presence: Operates in more than 100 countries globally, with a significant presence in North America, Europe, and Asia-Pacific. Employs over 85,000 people worldwide.

Key Offerings:

- Key Offerings:

- Clinical Trial Services (Full-service CRO, Functional Service Provider (FSP))

- Real World Evidence (RWE) generation and data sets

- Advanced analytics and proprietary software (e.g., Orchestrated Clinical Trials, IQVIA Connected Intelligence)

- Commercialization and medical affairs services

- Regulatory and safety compliance (Pharmacovigilance)

End-Use Industries Served:

- End-Use Industries Served:

- Pharmaceutical and Biopharmaceutical Companies (Large Pharma, Mid-size, and Biotech)

- Medical Device and Diagnostics Companies

- Government Agencies

- Healthcare Providers and Payers

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Continues to execute strategic, smaller-scale technology and data acquisitions to enhance platform capabilities.

- Partnerships & Collaborations: Continuously forms alliances with biopharma companies for strategic R&D and commercial initiatives.

- Product Launches/Innovations:

- June 2024: Launched One Home for Sites, a platform for trial sites providing a single sign-on and dashboard for key systems.

- Capacity Expansions/Investments: Invests heavily in technology and AI platforms to support decentralized and hybrid clinical trial models.

- Regulatory Approvals: Supports customers in achieving regulatory approvals (e.g., FDA, EMA) through its R&DS and compliance services.

Distribution Channel Strategy:

- Distribution channel strategy: Direct sales model through a large global commercial and R&D team; Technology solutions often sold via subscription and integrated into CRO service contracts.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: IQVIA Connected Intelligence™ platform, Orchestrated Clinical Trials (OCT) platform, and proprietary healthcare-grade AI solutions.

- Research & Development Infrastructure: Global network of clinical sites, labs, data centers, and therapeutic experts across 17 major areas.

- Innovation Focus Areas: Decentralized Clinical Trials (DCT), AI and Machine Learning for trial design/patient recruitment, Real World Evidence (RWE), and cardiometabolic/obesity research.

Competitive Positioning:

- Strengths & Differentiators: Unmatched scale and integration of clinical services (CRO) with proprietary, real-world data and technology/analytics capabilities. Leading position in the global CRO market by revenue.

- Market presence & ecosystem role: A critical hub in the life sciences ecosystem, connecting pharma, providers, payers, and patients through data and technology. Dominant position in the CRO market (Source: IQVIA analyses widely used in the industry).

SWOT Analysis:

- Strengths: Deep, proprietary data assets and analytics; integrated R&D and commercial services; global scale and reach.

- Weaknesses: High reliance on complex IT integration; competitive pressure in traditional CRO services.

- Opportunities: Expansion of Decentralized Clinical Trials (DCT); growing demand for Real World Evidence (RWE); applying AI to drug discovery/development.

- Threats: Data privacy regulations; increased competition from specialized tech/data companies.

Recent News and Updates:

- Press Releases (Feb 2025): Reported strong full-year 2024 results, with R&DS contracted backlog of $31.1 billion as of December 31, 2024.

- Industry Recognitions/Awards (Sept 2024): Awarded the 2024 Global Customer Value Leadership Award for excellence in AI quality and regulatory solutions for the healthcare industry by Frost & Sullivan.

2. Company: Syneos Health

Company Overview:

- Company Overview: A fully integrated biopharmaceutical solutions organization offering clinical development, medical affairs, and commercialization services. Known for its "Biopharma Services" model, which integrates clinical and commercial strategies.

Corporate Information:

- Headquarters: Morrisville, North Carolina, U.S.

- Year Founded: 2017 (Result of the merger between INC Research and inVentiv Health)

- Ownership Type: Private (Taken private in September 2023 by an investor consortium including Elliott Investment Management, Patient Square Capital, and Veritas Capital).

- Key People: Costa Panagos (CEO, appointed October 2024).

History and Background:

- History and Background: Formed by the combination of INC Research (a clinical CRO) and inVentiv Health (a commercialization specialist). The merger aimed to create a full-service, end-to-end partner for biopharma companies, connecting clinical insights directly to commercial strategy.

Key Milestones/Timeline:

- Key Milestones/Timeline:

- 2017: INC Research and inVentiv Health merge and rebrand as Syneos Health.

- 2022: Reported revenue of $5.39 billion.

- May 2023: Investment consortium agrees to take the company private for $4.46 billion ($7.1 billion including debt).

- September 2023: Completion of the acquisition, making Syneos Health a private company.

- September 2025: Released its 2024 Impact Report, noting it reached 345,000+ patients in 2,700+ clinical trials.

- October 2024: Costa Panagos appointed CEO.

Business Overview:

- Business Overview: Provides integrated clinical and commercial services. Clinical services handle Phases I–IV, while Commercial Services offer sales teams, marketing, and medical affairs. The integrated model is designed to optimize development-to-launch pathways.

Business Segments/Divisions:

- Business Segments/Divisions:

- Clinical Solutions: Full-service clinical trial execution (75% of 2022 revenue).

- Commercial Solutions: Commercialization, consulting, medical affairs, and communications (25% of 2022 revenue).

Geographic Presence:

- Geographic Presence: Global operations in approximately 110 countries, with over 25,000 colleagues worldwide.

Key Offerings:

- Key Offerings:

- Full-service Clinical Development (Phase I–IV)

- Integrated Commercialization Services (Sales, Marketing, Patient Solutions)

- Medical Affairs and Consulting

- Site and Patient Recruitment

- Functional Service Provider (FSP) models

End-Use Industries Served:

- End-Use Industries Served:

- Biopharmaceutical Companies (particularly mid-sized and emerging biotech)

- Large Pharmaceutical Companies

- Medical Device Companies

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Shifted focus post-privatization in 2023 to operational optimization and integration of past acquisitions.

- Partnerships & Collaborations:

- March 2023: Signed a multi-year deal with Microsoft Research to develop an AI/machine learning platform for optimizing clinical trials.

- Continues to expand its Catalyst Site program globally to enhance site capabilities.

- Product Launches/Innovations: Focus on leveraging technology and data insights to accelerate trial delivery and commercial launch planning.

- Capacity Expansions/Investments: Investment in digital tools and AI to support its integrated clinical/commercial model.

- Regulatory Approvals: Supports customer submissions to regulatory bodies like the FDA.

Distribution Channel Strategy:

- Distribution channel strategy: Direct sales model emphasizing the integrated clinical-to-commercial offering. Uses its global network of sites and decentralized capabilities for trial delivery.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Proprietary data, analytics, and AI/ML platforms developed through partnerships (e.g., with Microsoft) to optimize trial and launch planning (Kinetic strategy).

- Research & Development Infrastructure: Global clinical operations, medical experts, and therapeutic-area specialized teams.

- Innovation Focus Areas: AI in clinical trial design, decentralized and hybrid trials, diversity in clinical trials, and enhancing the role of Medical Affairs in trials (Source: 2025 Health Trends Report).

Competitive Positioning:

- Strengths & Differentiators: Unique integrated approach that unifies clinical development and commercialization strategy from the start. Strong expertise in therapeutic areas like oncology and rare diseases.

- Market presence & ecosystem role: A top-tier global CRO, particularly strong in the emerging biotech sector and recognized for its commercialization services (Source: Competitor in the top five global CROs by revenue).

SWOT Analysis:

- Strengths: Fully integrated clinical and commercial model (unique selling proposition); strong presence in the high-growth biotech segment; deep expertise in global regulatory/commercial strategy.

- Weaknesses: Recent transition to private ownership can cause short-term strategic adjustments; smaller scale compared to IQVIA and ICON plc in pure clinical volume.

- Opportunities: Capitalizing on the complexity of cell/gene therapies and niche diseases that require integrated expertise; growth in patient-centric models and decentralized trials.

- Threats: Intense competition in the CRO market; need to continuously adapt its unique integrated model to rapid biopharma shifts.

Recent News and Updates:

- Press Releases (Sept 2025): Released 2024 Impact Report, highlighting work on over 2,700 trials and a focus on expanding AI and patient inclusion criteria.

- Industry Recognitions/Awards: Frequently recognized in industry reports for its leadership in the CRO and commercial services sectors.

Top Vendors in the U.S. Clinical Trials Market & Their Offerings

| Company |

Core Offerings |

Special Strengths / Niche |

Clinical Phases Served |

Contributions to U.S. Trials |

| Parexel |

Full service CRO + regulatory consulting, adaptive designs, decentralized trials |

Rare disease, hematology, oncology, precision medicine |

Phase I-IV |

Accelerates complex and innovative trials; strong regulatory insight and patient-centric approaches |

| Syneos Health |

Clinical development, biostatistics, early-phase, commercialization, and field operations |

Deep therapeutic expertise, AI-driven insights, integrated commercial + clinical model |

Phase I through post-approval |

Speeds development via tech-enabled design, recruitment, and commercialization; supports nearly all FDA novel drug categories. |

| Charles River Laboratories |

Preclinical research, safety assessment, bioanalytical services |

Toxicology, pharmacology, and large molecule support |

Preclinical to early clinical |

Enables clinical readiness by bridging preclinical to first-in-human studies via rigorous in vivo/in vitro platforms |

| Medpace |

Integrated clinical trial management, central labs, bioanalytics, imaging, regulatory & safety |

High-science, full-service model with embedded medical/regulatory expert |

Phase I-IV, devices |

Provides seamless execution through one cross-functional team; reduces complexity and accelerates timelines |

| Worldwide Clinical Trials |

Protocol development, clinical monitoring, data management, pharmacology, and bioanalytical lab |

Neuroscience, cardiometabolic, inflammatory; rare disease, cell/gene therapy |

Phase I-III |

Contributes deep therapeutic focus and flexible CRO services; supports efficient site management and data integrity. |

Top Companies in the U.S. Clinical Trials Market

- IQVIA

- Thermo Fisher Scientific (PPD)

- LabCorp (Covance)

- ICON plc

- Parexel

- Syneos Health

- Charles River Laboratories

- Medpace

- Worldwide Clinical Trials

- Eurofins Scientific

- WuXi AppTec

- PSI CRO

- Premier Research

- Caidya (formerly Clinipace)

- Precision for Medicine

- Inotiv

- Curia Global

- Ergomed

- TFS HealthScience

- Advanced Clinical

Recent Developments in the U.S. Clinical Trials Market

- In November 2025, ACS ACTS (Access to Clinical Trials and Support), a comprehensive clinical trial matching service designed to improve equitable access to clinical trials, was expanded nationwide, according to the American Cancer Society. To help caregivers, individuals with cancer, and healthcare professionals understand how clinical trials may fit into a treatment journey, explore individualized clinical trial options tailored to specific needs, and easily access American Cancer Society services and resources to overcome participation barriers, the program provides trained American Cancer Society cancer information specialists.

- In August 2025, the U.S. Department of Defense granted a $7.3 million grant to a multidisciplinary team of researchers at VCU Massey Comprehensive Cancer Center and MD Anderson Cancer Center to support a novel clinical trial aimed at metastatic triple-negative breast cancer (TNBC), one of the most aggressive and challenging types of breast cancer.

Segments Covered in the Report

By Phase

- Phase 1

- Phase 2

- Phase 3

- Phase 4

By Study Design

- Observational Study

- Interventional Study

- Expanded Access Study

By Indication

- Autoimmune/Inflammation

- Rheumatoid arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome (IBS)

- Others

- Pain Management

- Chronic Pain

- Acute Pain

- Oncology

- Blood Cancer

- Solid Tumors

- Other

- CNS Condition

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle Regeneration

- Others

- Diabetes

- Obesity

- Cardiovascular

- Others