January 2026

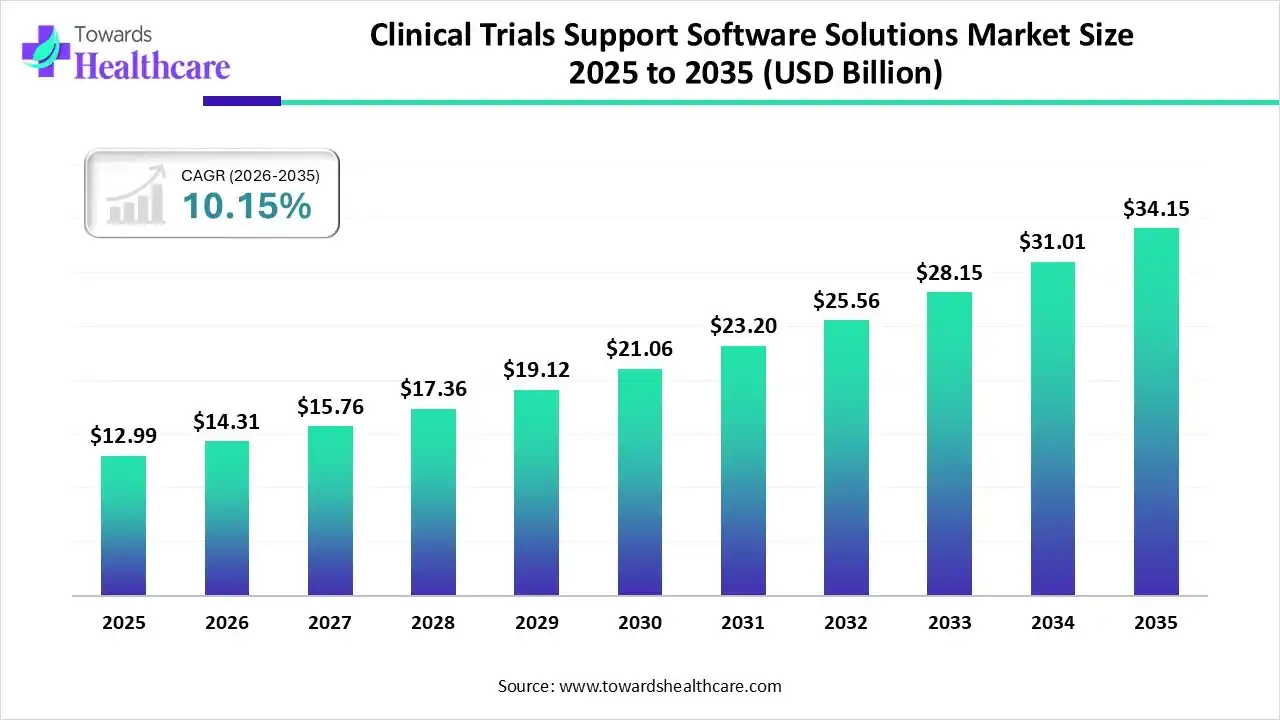

The global clinical trials support software solutions market size was estimated at USD 12.99 billion in 2025 and is predicted to increase from USD 14.31 billion in 2026 to approximately USD 34.15 billion by 2035, expanding at a CAGR of 10.15% from 2026 to 2035.

The global clinical trials support software solutions market is driven by these software services are specialized digital platforms intended to streamline the whole clinical trial lifecycle, from planning and implementation to analysis and reporting. These services enhance effectiveness, ensure government compliance, improve data accuracy and security, and lower operational expenses by replacing physical, paper-based processes.

| Key Elements | Scope |

| Market Size in 2026 | USD 14.31 Billion |

| Projected Market Size in 2035 | USD 34.15 Billion |

| CAGR (2026 - 2035) | 10.15% |

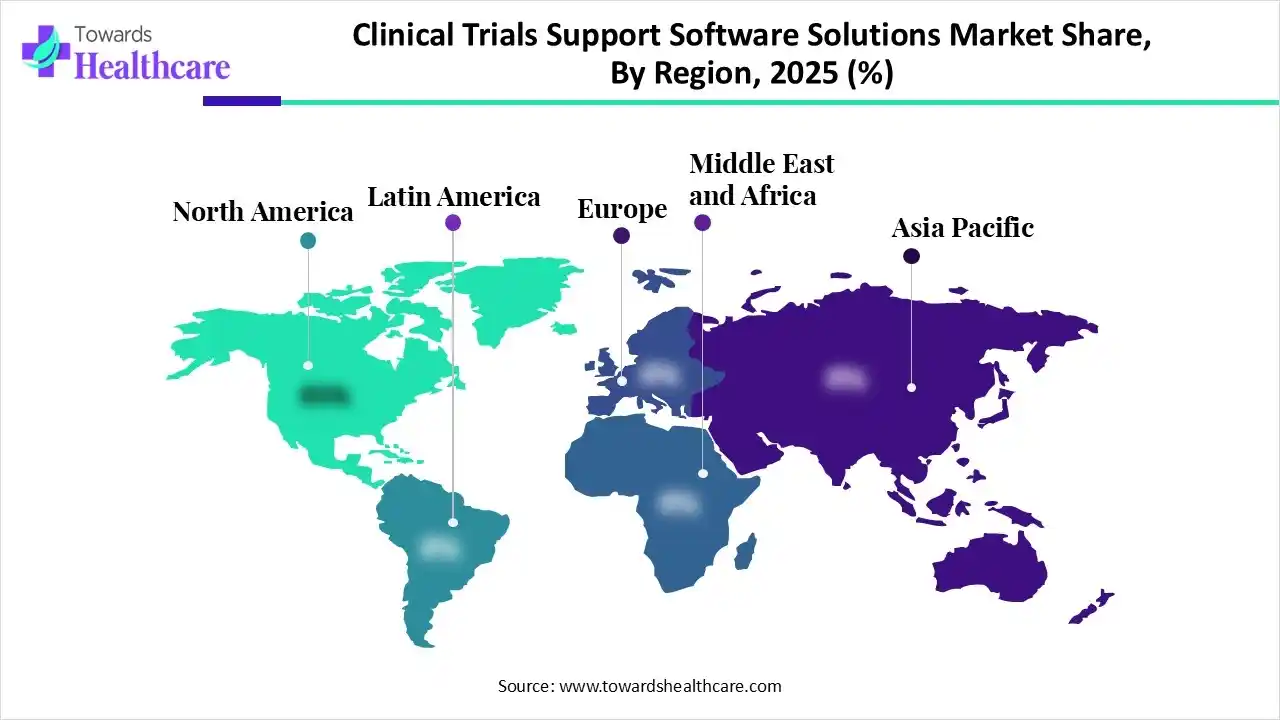

| Leading Region | North America |

| Market Segmentation | By Product Outlook, By Phase Outlook, By End Use Outlook, By Regional Outlook |

| Top Key Players | IQVIA, Anju Software, QIAGEN, Advarra, Avetra, Oracle, Parexel, Syneos, ICON |

AI-driven technology has revolutionised ground-breaking ways of gathering data, biosimulation, and early disease diagnosis for clinical trials. AI-driven technology offers wide utility options through structured, standardised, and digitally driven elements in healthcare research. AI-driven technology authorizes trials to take proactive and decisive actions to enhance patient results and clinical trial outcomes. AI plays a significant role in automating processes that have conventionally been time-consuming and error-prone. It supports scientists to streamline trial design, match patients more efficiently, and analyze wide datasets with greater precision.

Which Product Led the Clinical Trials Support Software Solutions Market in 2025?

In 2025, the CTMS segment held the dominating share of the market as CTMS, constructed on a unified data architecture, allows data to be entered once and used across all applications. A cloud-based CTMS service is a necessity to optimize clinical trial management by centralizing clinical and operational data, rationalization activities, and offering continuous oversight and visibility.

Payments/Investigator Payment Solutions

Whereas, the payments/investigator payment solutions segment is the fastest growing in the market as streamlined payment procedures improve the workload on trial sites, enabling staff to focus additional attention on participant care and research. By eliminating financial barriers, trials attract a more diverse pool of participants, resulting in more representative and comprehensive research results.

Why did the Cloud and Web-based Segment Dominate the Market in 2025?

The cloud and web-based segment captured the biggest revenue share of the clinical trials support software solutions market in 2025, as it lowers paperwork, reduces data entry challenges, and streamlines workflows. This helps cut down the overall expenses of running clinical trials. Investigators, sponsors, and regulators access trial data from anywhere, enabling them to track progress and adjust without postponement.

On-Premise

Whereas, the on-premise segment is estimated to grow significantly in the market during 2026-2035, as an on-premises CTMS offers complete control it provides over data management. It is highly modified to meet the specific requirements of an organization. From complex workflows to exclusive reporting features, on-premises systems are tailored in ways that cloud services may not allow.

Why is Phase III Segment Dominant in the Market?

In 2025, the phase III segment held the dominating share of the clinical trials support software solutions market, as phase III trials offer a massive amount of data required for the package insert and labeling of a drug, after it has been FDA-approved. Phase III trials offer the highest level of indication for showing the effectiveness of novel interventions or treatments.

Phase I

Whereas, the phase I segment is the fastest growing in the market as phase 1 clinical trials are an important component of assessing products and solutions, including novel drugs, drug combinations. Phase 1 clinical trials enable novel treatments to progress further in drug development or halt that process altogether.

What Made the CROs Segment Dominant in the Clinical Trials Support Software Solutions Market in 2025?

In 2025, the CROs segment captured the largest revenue share of the market as CROs use advanced technologies and software stages to drive efficient communication, document sharing, and task tracking. By allowing more effective trial execution, CROs support patients in gaining earlier access to novel therapies. CROs support complex pre-clinical requirements such as toxicology programs followed by IND applications.

Biopharmaceutical Companies

Whereas the biopharmaceutical companies segment is the fastest growing in the clinical trials support software solutions market, as a flexible clinical trials platform has reduced running expenses and basic data management, enabling more creative trial designs and simple updates throughout a study. Clinical trial software corporations create tools that allow the well-organized planning, management, and tracking of clinical study information.

In 2025, North America dominated the clinical trials support software solutions market by capturing a significant share, driven by its extremely advanced healthcare IT infrastructure, significant R&D spending, a supportive government environment, specifically from the FDA, and the presence of leading technology and pharmaceutical companies. Government bodies such as the U.S. Food and Drug Administration (FDA) and Health Canada offer clear guidelines and actively encourage the use of advanced technologies, like Artificial Intelligence (AI) and decentralized trial models.

For Instance,

The U.S. is a focus of technological novelty, with various tech organizations and startups focusing on clinical trial solutions. There is a high rate of initial acceptance and implementation of advanced technologies such as AI, machine learning, cloud-based platforms, and remote patient monitoring equipment, which improves trial design, patient needs, and data monitoring.

For Instance,

Asia Pacific is expected to grow at the fastest CAGR in the clinical trials support software solutions market, as the Asia Pacific is a hub to over half the world's population, offering a large and genetically varied pool of potential clinical trial participants. This increases the patient recruitment procedure, which is often a major bottleneck in other regions such as North America and Europe, meaningfully lowering trial timelines. Major countries in the region, such as China, Japan, South Korea, and India, have applied streamlined and effective government approval processes, aligning their standards with international guidelines such as Good Clinical Practice (GCP).

In India, conducting clinical trials is 50% more affordable than in countries such as the U.S. or Europe due to lower operational costs and a competitive labor force. This expense advantage enables sponsors (pharmaceutical organizations) to exploit their research and development (R&D) funds while maintaining high-quality standards that meet international programmes (ICH-GCP).

Europe is poised for significant growth in the clinical trials support software solutions market, with an integration of an advanced healthcare infrastructure, a helpful government environment, major R&D spending, and the early acceptance of advanced digital technologies. Strict regulations set by the European Medicines Agency (EMA) and national bodies, like the Clinical Trials Regulation (CTR) and the General Data Protection Regulation (GDPR), drive the demand for compliant, reliable digital platforms.

In the UK, proactive digital alteration, a unified healthcare system (NHS), a supportive government environment, and a focus on high-quality data and innovation. The National Health Service (NHS) offers a unique, national infrastructure with well-characterised and diverse patient populations, easing the collection of high-quality, real-world data vital for research

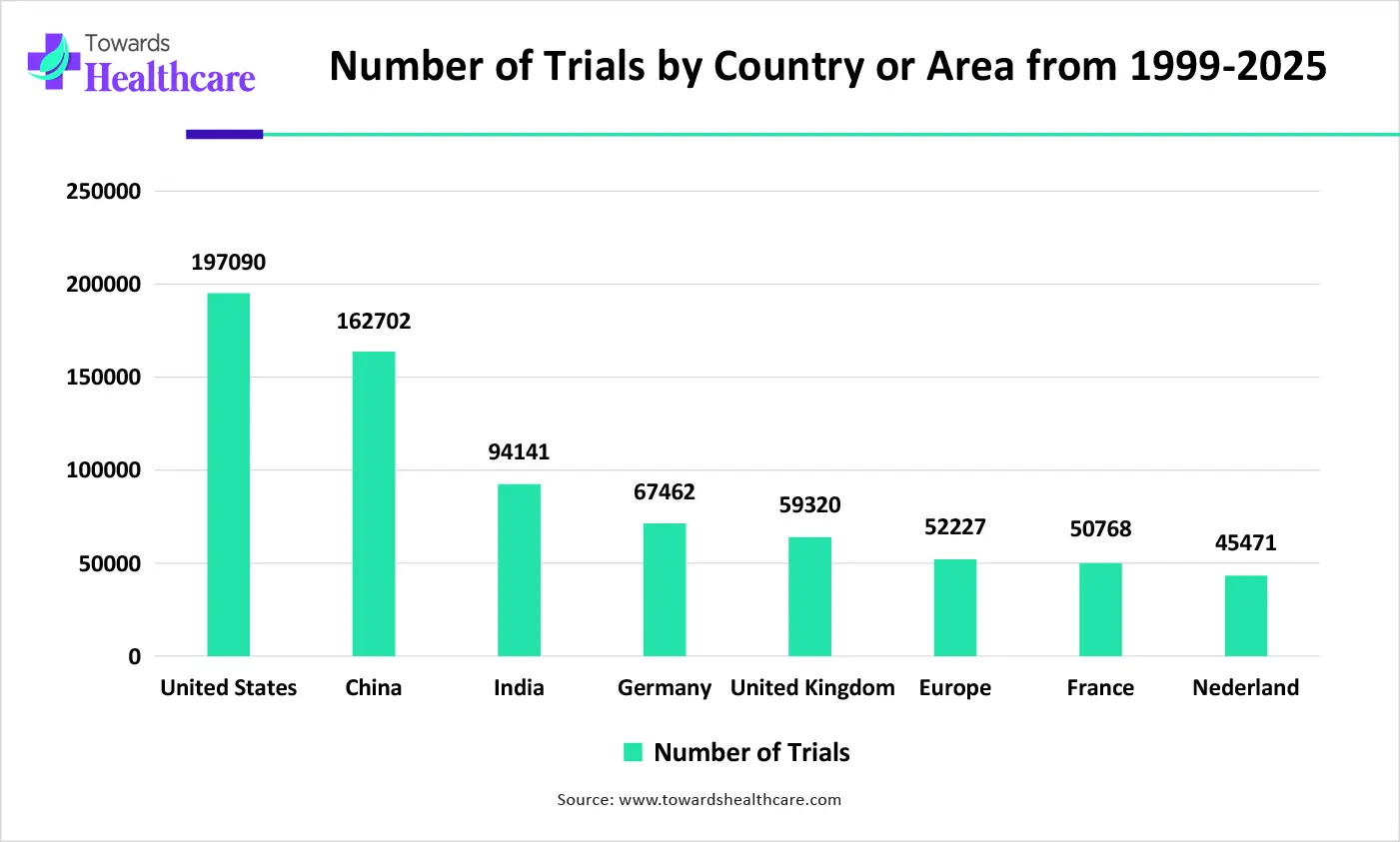

| Region | Number of trials from 1999-2025 |

| United States | 197090 |

| China | 162702 |

| India | 94141 |

| Japan | 67462 |

| Germany | 59320 |

| United Kingdom | 52227 |

| France | 50768 |

| Nederland | 45471 |

| Company | Headquarters | Latest Update |

| IQVIA | United States | In September 2025, IQVIA, a leading global provider of clinical research services, commercial insights, and healthcare intelligence to the life sciences and healthcare industries, announced the launch of its Clinical Trial Financial Suite (CTFS), an AI-enabled platform orchestrating all financial aspects of clinical trials. |

| Anju Software | Canada | In September 2025, Anju Software announced Clinexa, an AI ecosystem of virtual assistants that transforms clinical protocols into trial-ready databases in days. The initial release focuses on compressing the study build timeline by automating protocol ingestion and generating casebooks, edit checks, and auditable validation materials. |

| QIAGEN | Germany | In May 2025, QIAGEN announced it had signed a definitive agreement to acquire Genoox, a provider of AI-powered software that enables clinical labs to scale and accelerate the processing of complex genetic tests. |

| Advarra | Columbia, Maryland | In January 2025, Advarra, the market leader in regulatory review solutions and clinical research technology, unveiled its Study Collaboration solution to accelerate study startup by automating workflows, improving real-time visibility, and fostering seamless collaboration and engagement among research stakeholders. |

| Avetra | United States | In December 2025, Avetra, a next-generation Contract Research Organization (CRO), announced its official launch, introducing a modern, site-centric operating model designed to realign the relationship between sponsors, CROs, and investigative sites. |

| Veeva | Pleasanton, CA, USA | Veeva Vault Clinical Suite: EDC, CTMS, eTMF, RTSM, MyVeeva (eConsent, ePRO) |

| Oracle | Austin, TX, USA | Oracle Health Sciences: Clinical One Cloud (EDC, RTSM, ePRO), CTMS, DMW |

| Parexel | Waltham, MA, USA | Parexel Biotech Solutions, Clinical Informatics, regulatory consulting, logistics |

| Syneos | Morrisville, NC, USA | Data & Analytics, clinical monitoring, RWE services, commercialization support |

| ICON | Dublin, Ireland | ICONIK data platform, a full suite of clinical development and commercialization services |

By Product Outlook

By Phase Outlook

By End Use Outlook

By Regional Outlook (Revenue, USD Million, 2021 - 2033)

North America

Europe

Asia Pacific

Latin America

Middle East and Africa (MEA)

January 2026

January 2026

January 2026

January 2026