January 2026

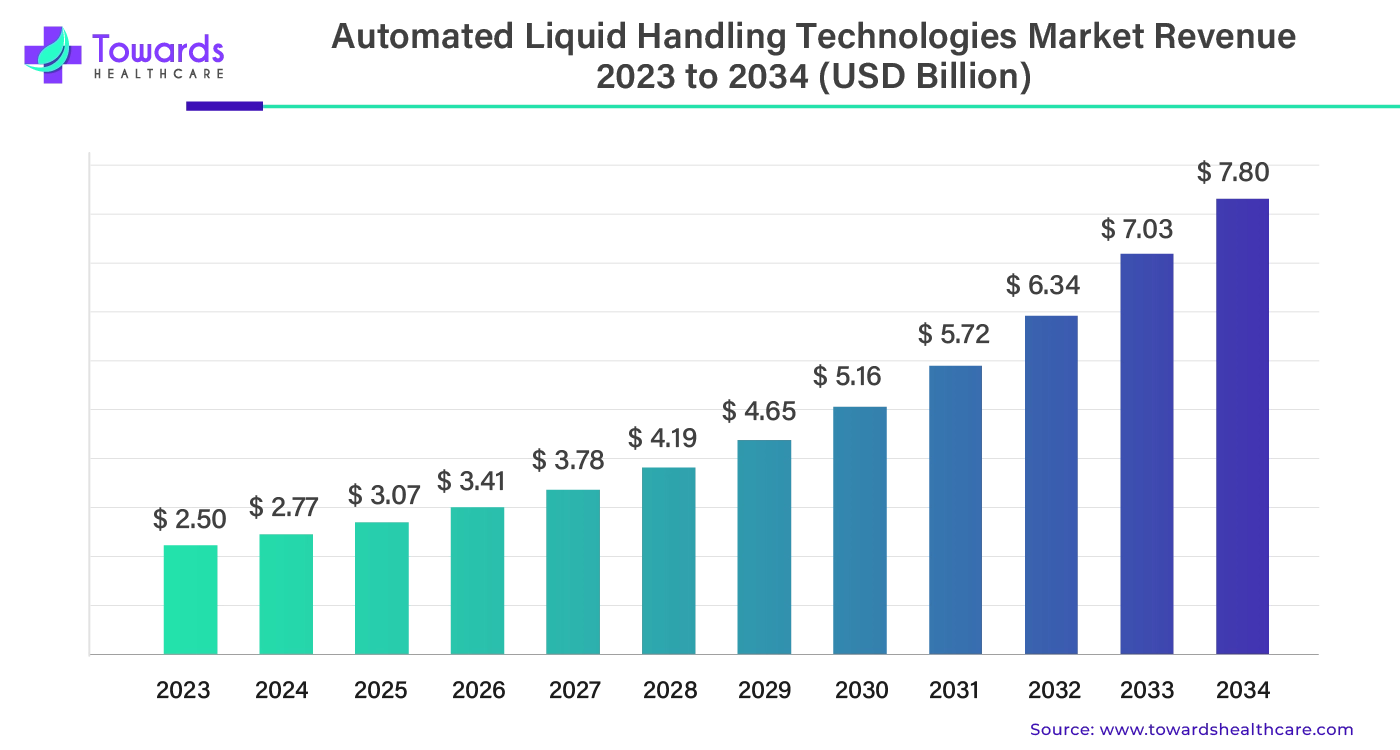

The global automated liquid handling technologies market size was estimated at US$ 3.4 billion in 2026 and is projected to grow to US$ 8.64 billion by 2035, rising at a compound annual growth rate (CAGR) of 10.90% from 2026 to 2035.

| Key Elements | Scope |

| Market Size in 2025 | USD 3.07 billion |

| Projected Market Size in 2035 | USD 8.64 |

| CAGR (2025 - 2035) | 10.9% |

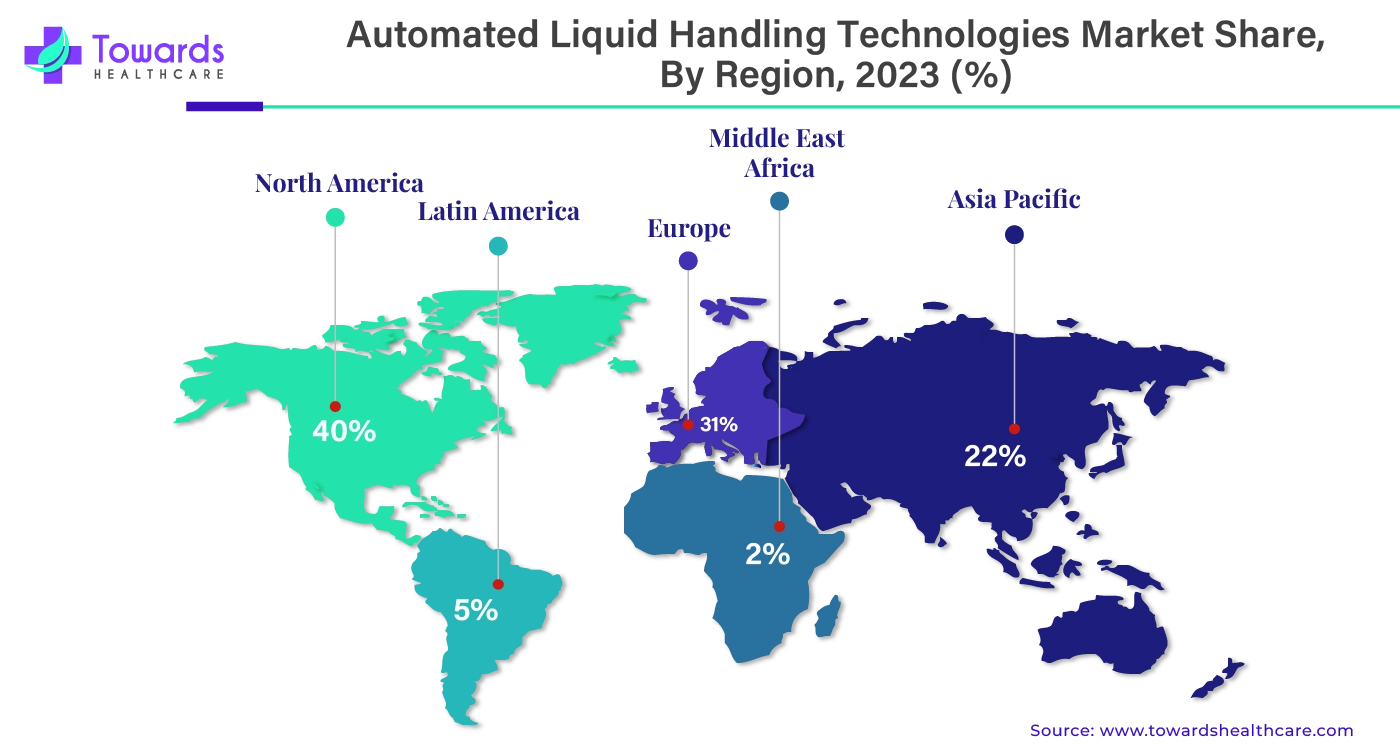

| Leading Region | North America by 40% |

| Market Segmentation | By Product, By Application, By End-User, By Region |

| Top Key Players | Agilent Technologies, Inc., AUTOGEN, INC., Corning Incorporated, Danaher, Hamilton Company, Aurora Biomed, Inc., Eppendorf AG, Thermo Fisher Scientific, Inc., Hudson Robotics, BioTek Instruments, Inc., Analytik Jena AG, Gilson, Inc., QIAGEN, LABCYTE INC., Formulatrix, Inc., METTLER TOLEDO, Lonza, Tecan Trading AG, PerkinElmer, Inc. |

In high-throughput applications where absolute removal of human movement is necessary, complete automation is very helpful. These circumstances lend themselves to the use of liquid handling platforms, which have the capacity to handle hundreds of samples simultaneously. Automated liquid handling equipment is available in a wide variety of sizes and designs for use in various contexts. These devices deliver a specified volume of liquid or sample into a predefined container with the assistance of a motorized pipette or syringe coupled to a robotic arm. Certain versions have extra lab equipment and may do additional functions, including heater-cooler plates (link), to satisfy certain needs. With these modifications, it is guaranteed that the liquid handling procedure will be as comprehensive, effective, and accurate as it is practical.

For instance,

It appears that automated liquid handling equipment will have a bright future in light of the anticipated impact of various breakthroughs on the biotechnology industry. An important development in liquid handling systems is the increasing use of machine learning (ML) and artificial intelligence (AI). Intelligent and efficient laboratory operations might be facilitated by the potential of AI and ML to enhance data analysis, forecast maintenance requirements for systems, and optimize liquid handling techniques.

Automated liquid handling systems, one type of high throughput screening (HTS) technology, are crucial for accelerating research and guaranteeing optimal workflow efficiency. High-throughput liquid handling systems are used in drug development laboratories to discover target genes, active chemicals, and antibodies. The components needed to create more focused studies and, eventually, create novel medications and treatments are provided by the results to scientists. These machines are capable of being programmed to execute millions of tests and repeatable jobs without human oversight. Finding this preliminary data might take years in the absence of high-capacity liquid handling devices.

The growth of the automated liquid handling technologies market is limited because these automated technologies cannot be applied in all the liquid handling processes. Various steps need human interaction and human logic, which cannot be performed by robots or any automated tools.

When it comes to development, sustainability is beginning to take precedence in the field of liquid handling systems. Producers are devising strategies to reduce the ecological footprint of their products. For instance, they may improve energy efficiency and lessen the trash produced by plastic. This is consistent with the larger biotechnology trend toward sustainability, which places an increasing emphasis on environmentally beneficial practices.

Which Product Segment Dominated the Market?

By product, the automated liquid handling workstations segment dominated the automated liquid handling technologies market. Automated workstations for multipurpose liquid handling are instruments made to do most of the liquid sample mixing, combining, and sampling tasks automatically. Using a multifunctional liquid-handling automated workstation reduces sample contamination and frees up staff to focus on other projects in laboratories doing biology research and medication development, among other things. The workstations are capable of measuring samples, adding reagents, and ensuring that liquids are added to bioassays consistently.

For instance,

Which Application Segment Led the Market?

By application, the drug discovery & ADME-Tox research segment held the largest share of the automated liquid handling technologies market. Automated liquid handling has emerged as a key technique in drug research, particularly for campaigns comprising millions of molecules in screening. The pace at which drug candidates and chemical probes for investigating biological systems are identified is directly impacted by the quick development of assay downsizing and the intense invention of these devices.

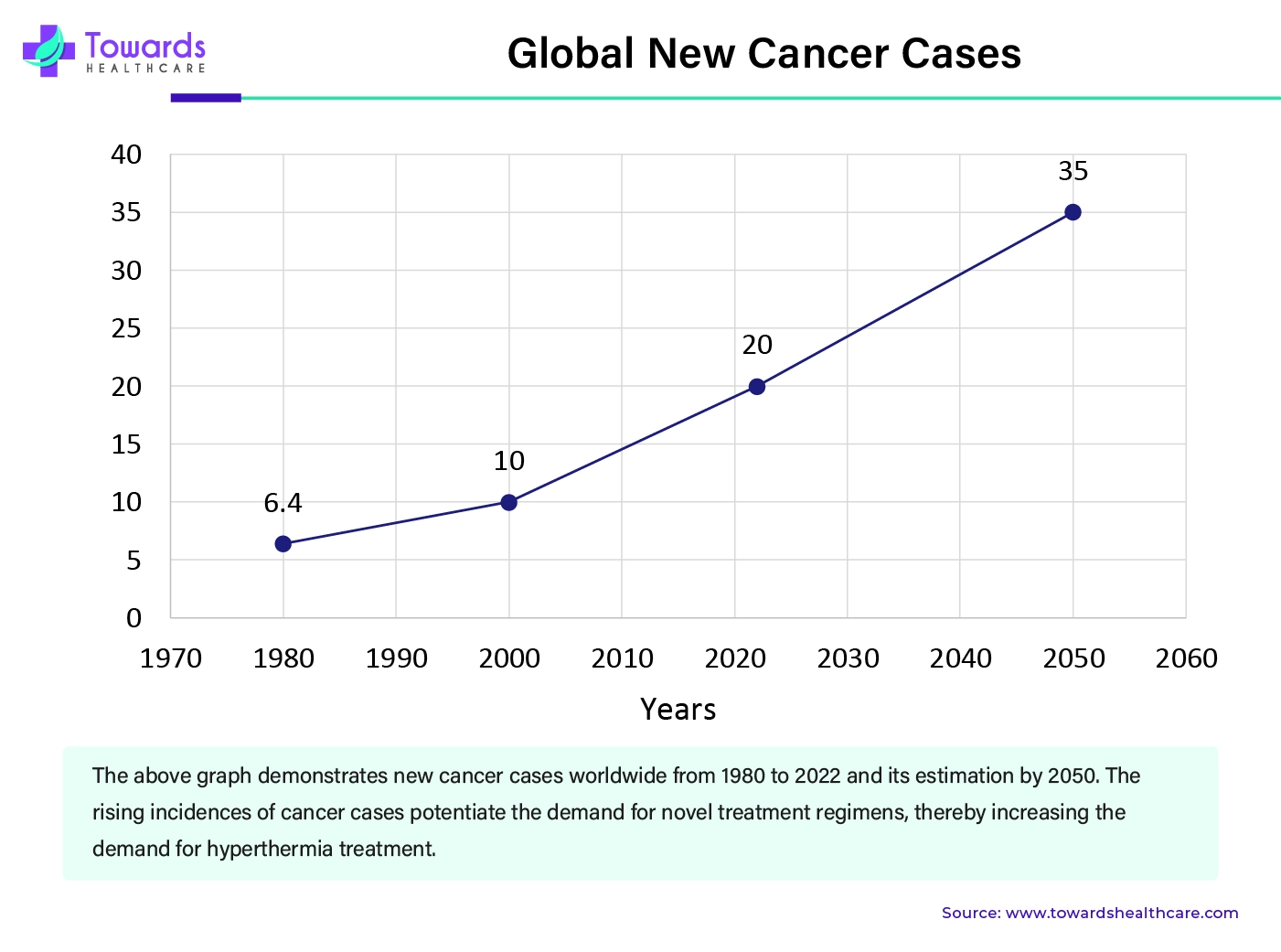

By application, the cancer & genomic research segment is estimated to grow at the fastest rate in the automated liquid handling technologies market during the forecast period. The cancer & genomic research is growing due to growing cancer cases. Accuracy and efficiency are critical in the field of cancer research. The outcomes and advancement of a research project can be greatly impacted by each sample, measurement, and liquid transfer. Liquid handling systems are, therefore, becoming a vital tool in labs that are devoted to the monitoring and diagnosis of cancer. Robots that manage liquids have completely changed how scientists handle materials and carry out tests. Scientists can handle several samples at once with minimum human error thanks to these advanced pieces of equipment that are intended to execute accurate and automatic liquid transfers.

How the Pharmaceutical & Biotechnology Companies Segment Dominated the Market?

By end-use, the pharmaceutical & biotechnology companies segment dominated the automated liquid handling technologies market in 2023. These companies conduct various R&D, develop a lot of products, and conduct experiments for the betterment of healthcare and other sectors associated with biotechnology and pharmaceuticals. During these processes, different types of liquid reagents, liquid agents, liquid bioproducts, and solutions are used, which should be utilized in accurate amounts. The work associated with genetics, sequencing, NGS, and genomics requires reagents and enzymes in highly specific amounts. Many reagents are used in microliters, which cannot be dispensed without automation. Therefore, automated liquid handling tools are used on a large scale by pharmaceutical and biotechnology companies.

By region, North America dominated the automated liquid handling technologies market share by 40% in 2023 because of the booming biotechnology and pharmaceutical industries, which demand advanced laboratory automation solutions for the procedures involved in drug research and discovery. Large investments in research and development, along with the rising significance of precision medicine and customized healthcare, are driving the use of these technologies.

The automated liquid handling technologies market in the U.S. is expanding as a result of the rising cancer incidence and the availability of advantageous reimbursement programs. Furthermore, organizations such as the American Cancer Society, the American Breast Cancer Foundation (ABCF), and the Esophageal Cancer Awareness Association (ECAA) are launching programs to assist patients, caregivers, survivors, and anyone else who could be vulnerable to the disease. As a result, growth in the local market is predicted over the duration of the projection.

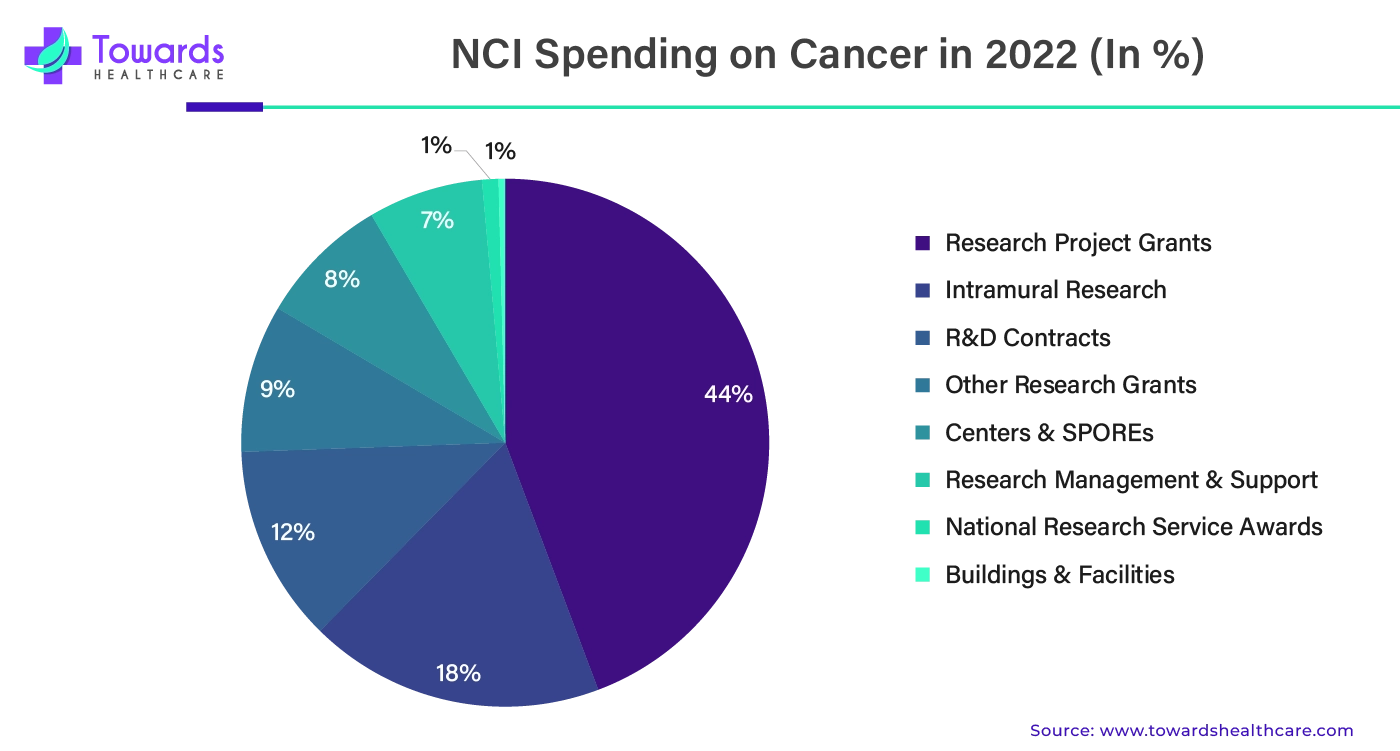

The Further Consolidated Appropriations Act, 2024 (H.R.2882) gave NCI a total of $7.22 billion, an increase of $120 million over the interim budget allotted under the Continuing Resolution. The National Cancer Institute (NCI) of the Cancer Moonshot will get an additional $216 million in funding in 2023, which is the final year of such financing. Compared to FY 2023, there would be a net decrease of $96 million in NCI funding for FY 2024.

By region, Asia Pacific is expected to grow at the fastest rate during the forecast period. In addition to Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) in nations like China, India, and Japan, the industries with the quickest growth have been biopharma and biotechnology. The fields in which these industries operate have seen tremendous breakthroughs. The expansion of the automated liquid handling technologies market is also anticipated to be fueled by China, Japan, and India making significant investments in the life science domains of omics research, advanced healthcare, microbiology, drug discovery, and clinical diagnostics.

DBT funded nine biotech parks, whereas BIRAC funded sixty bio-incubators. In the Interim Budget 2024–25, the Department of Biotechnology (DBT) was given Rs. 2,251.52 crore (US$ 271 million). The National Biopharma Mission is sponsoring 101 activities, including 30 MSMEs and more than 150 NGOs. The government is provided with a framework by the National Biotechnology Development Strategy 2020–25 for improving innovation, resource management, and talent development, all of which work together to create a strong ecosystem for information sharing.

The bioeconomy sector in India has grown from US$ 10 billion in 2015 to US$ 130 billion in 2024. By 2021, the bioeconomy in India will account for 2.6% of the GDP of the nation. India is expected to reach the $300 billion US bioeconomy threshold by 2030. The vast bulk of India's bioeconomy is still made up of biopharma. Biopharma accounted for 49% of the bioeconomy, with a predicted total economic impact of US$ 39.4 billion. By 2025, it is projected that the Indian vaccine market will be worth Rs. 252 billion, or $3.04 billion USD. DCGI approved the marketing of the first-ever locally made quadrivalent Human Papilloma Virus (qHPV) vaccine against cervical cancer in India in July 2022. It was supported by BIRAC and DBT.

Europe is expected to grow at a notable CAGR in the foreseeable future. Government organizations of European nations launch initiatives to expand their biologics manufacturing infrastructure. This potentiates the demand for automated liquid handling technologies. The rising adoption of advanced technologies and increasing investments foster market growth. The presence of key players and favorable regulatory policies also contributes to the market.

Germany Market Trends

Key players, such as Brand GmbH + Co KG, Eppendorf AG, and Beckman Coulter, are major contributors to the market in Germany that provide automated liquid handling systems. In September 2025, the German regulatory authority granted biologic drugs production approval to a manufacturing facility.

| Company Name | Hamilton Company |

| Headquarters | Nevada, U.S., North America |

| Recent Development | In May 2024, with great pleasure, Hamilton announces the release of ZEUS X1, its most recent creation. Precision measuring tools, sample management systems, and automated liquid handling workstations are all offered by Hamilton, a top global supplier. The innovative CO-RE®II technology from Hamilton and state-of-the-art air displacement pipetting technology are combined in the ZEUS X1 for seamless OEM integration. Our automated pipetting module eliminates the challenges of pipetting and ensures process security all along the way with a range of active monitoring and corrective strategies. |

| Company Name | SLS |

| Headquarters | Galveston, U.S., North America |

| Recent Development | In September 2023, with the launch of the Eppendorf epMotion series for Automated Liquid Handling Systems, SLS announced a noteworthy development in liquid handling technology. SLS has acquired the extraordinary honor of being the only distributor of this highly anticipated product line by way of a historic decision. The excellent rapport and long-lasting partnership that has grown over time are demonstrated by the cooperation between SLS and Eppendorf. This achievement demonstrates the commitment to providing cutting-edge laboratory solutions that support customers in realizing their aspirations to study science. |

By Product

By Application

By End-User

By Region

January 2026

January 2026

December 2025

December 2025