December 2025

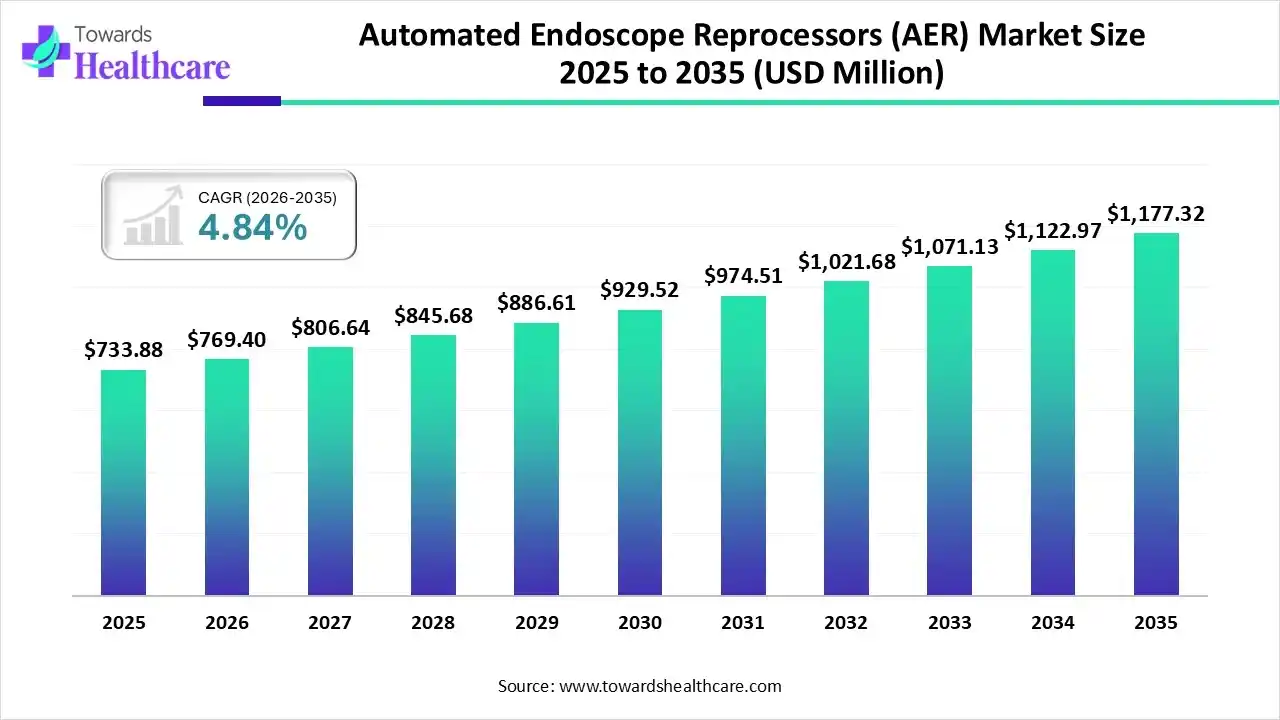

The global automated endoscope reprocessors (AER) market size is expected to be worth around USD 1177.32 million by 2035, from USD 733.88 million in 2025, growing at a CAGR of 4.84% during the forecast period from 2026 to 2035.

The automated endoscope reprocessors (AER) market is primarily driven by the increasing endoscopic procedures and an enhanced focus on patient safety. AERs are used in healthcare settings to reprocess endoscopes and their accessories. The demand for AERs is increasing, particularly in emerging economies, driven by the rapid expansion of healthcare infrastructure. Regulatory agencies establish stringent regulations on infection control, necessitating healthcare professionals to use AERs.

| Key Elements | Scope |

| Market Size in 2026 | USD 769.4 Million |

| Projected Market Size in 2035 | USD 1177.32 Million |

| CAGR (2026 - 2035) | 4.84% |

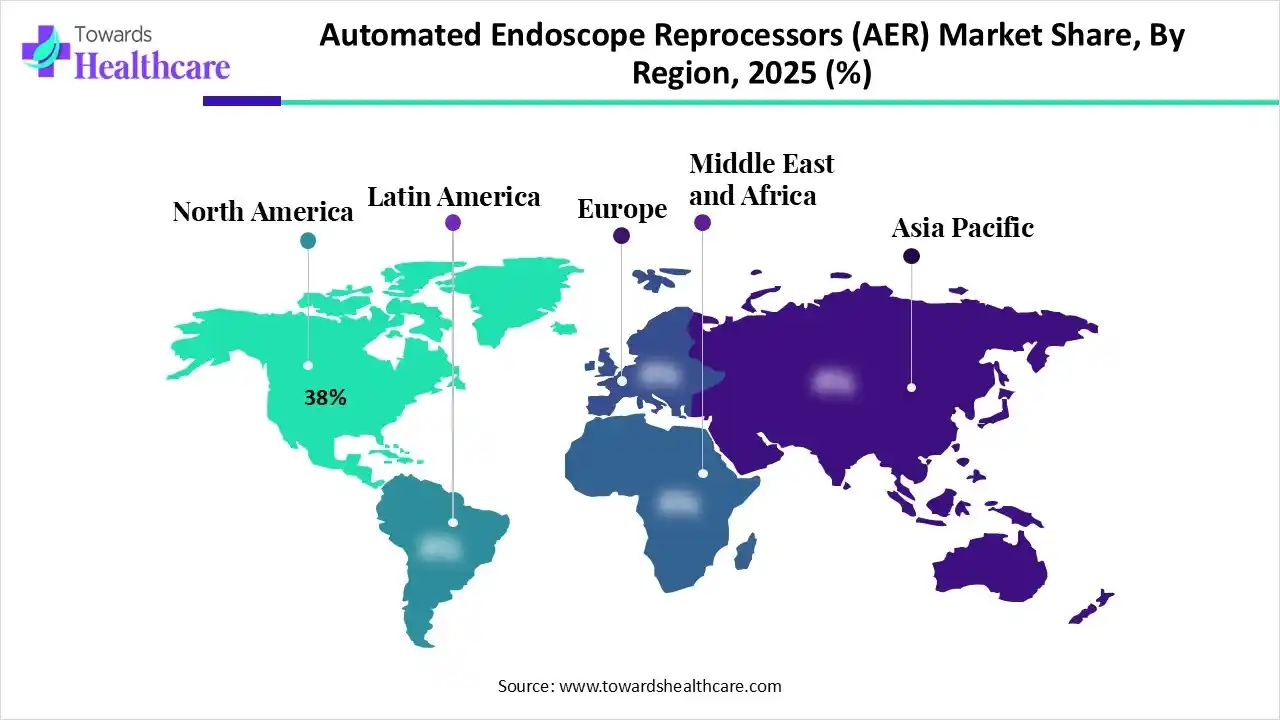

| Leading Region | North America by 38% |

| Market Segmentation | By Product Type, By Disinfection Technology, By End-User/Healthcare Setting, By Workflow Integration, By Service & Support, By Distribution Channel, By Region |

| Top Key Players | Advanced Sterilization Products, Custom Ultrasonics, Inc., STERIS Corporation, Olympus Corporation, Wassenburg Medical, Inc., Getinge AB, Ecolab, Steelco, MMM Group |

The automated endoscope reprocessors (AER) market comprises automated systems designed to clean, disinfect, and reprocess flexible and rigid endoscopes used in medical diagnostic and surgical procedures. AERs standardize and automate high-level disinfection (HLD), reducing manual handling, enhancing infection control, improving turnaround times, and ensuring compliance with healthcare sterilization standards. The market includes standalone AERs, integrated washer-disinfector systems, and accessory products (trays, connectors, disinfectants) used across hospitals, ambulatory surgical centers, specialty clinics, and endoscopy units.

Artificial intelligence (AI) plays a crucial role in introducing automation in AERs, thereby minimizing manual errors and enhancing operational efficiency. AI-based robotic systems are used for cleaning endoscopic systems. AI can detect the level of cleanliness in endoscopes and suggest a repeat reprocessing cycle. The robotic system is configured under lab conditions to grab, lift, and position a special cleaning tray with high accuracy. AI can avoid action against a given resistance through forced feedback control.

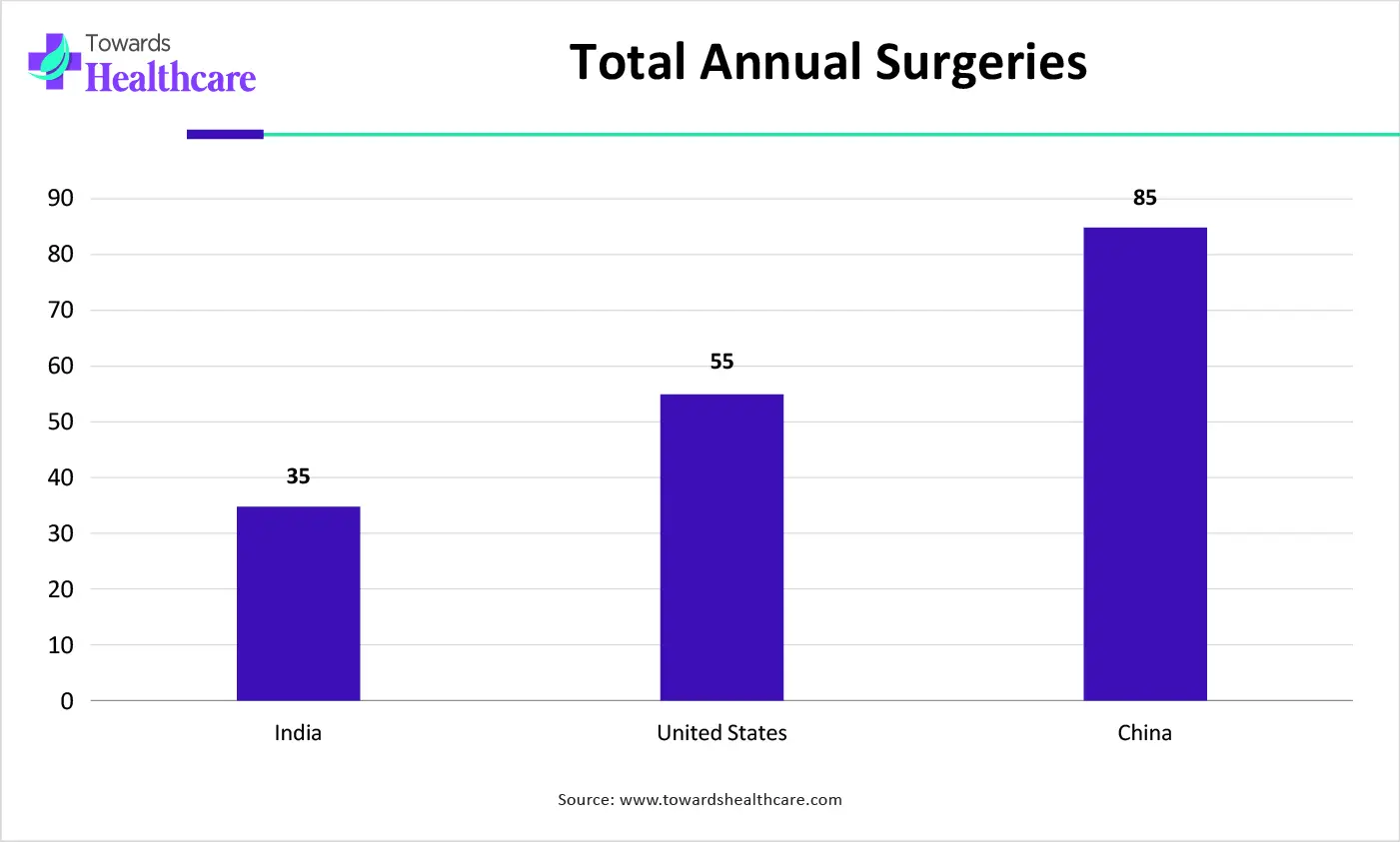

| Countries | Total Annual Surgeries |

| India | 35 |

| United States | 55 |

| China | 85 |

Why Did the Standalone AER Systems Segment Dominate the Automated Endoscope Reprocessors (AER) Market?

The standalone AER systems segment held a dominant position with a share of approximately 45% in the market in 2025, due to their widespread availability and the ability to reprocess endoscopes efficiently. Standalone systems are easy to install in a healthcare facility and have a compact design. They are comparatively easy to use by healthcare professionals. They are adopted by smaller facilities, such as hospitals and ambulatory surgery centers, which have space constraints.

High-Throughput/Multi-Scope AERs

The high-throughput/multi-scope AERs segment is expected to grow at the fastest CAGR of approximately 14% in the market during the forecast period. Multi-scope AERs can be used to clean multiple endoscopes simultaneously. The dual basin system is most widely preferred as it improves workflow flexibility with two independent basins. It is highly consistent and enhances compliance with endoscope reprocessing.

Which Disinfection Technology Segment Dominated the Automated Endoscope Reprocessors (AER) Market?

The high-level chemical disinfection systems segment held the largest revenue share of approximately 60% in the market in 2025, due to the need for reprocessing of thermolabile endoscopes. Chemical sterilant processing systems circulate the disinfectant solution around the exterior and through the device channels for a limited exposure period after cleaning. They eliminate all viable microbial life, including bacterial spores.

Hybrid (Chemical + Thermal) Systems

The hybrid (chemical + thermal) systems segment is expected to grow with the highest CAGR of approximately 16% in the market during the studied years. Hybrid systems offer numerous combined benefits of both chemical and thermal systems. They can be used for a wide range of endoscopes, including those that are heat-sensitive and heat-resistant. They perform multiple functions, such as leak testing and high-level disinfection.

How the Hospitals Segment Dominated the Automated Endoscope Reprocessors (AER) Market?

The hospitals segment contributed the biggest revenue share of approximately 50% in the market in 2025, due to favorable infrastructure and the increasing number of inpatient admissions. Patients prefer visiting hospitals for their treatment due to reimbursement policies and the presence of skilled professionals. Hospitals have professionals from various disciplines, providing multidisciplinary expertise to patients.

Ambulatory Surgical Centers (ASCs)

The ambulatory surgical centers (ASCs) segment is expected to expand rapidly with a CAGR of approximately 14% in the market in the coming years. The shifting trend towards ASCs encourages them to adopt AERs for endoscopic reprocessing. ASCs prefer outpatient services, eliminating the need for patients to stay overnight. They save exorbitant costs and time for patients and providers. They possess specialized equipment and infrastructure to provide outpatient services.

Which Workflow Integration Segment Led the Automated Endoscope Reprocessors (AER) Market?

The integrated with central sterile services department (CSSD) segment led the market with a share of approximately 48% in the market in 2025, due to the need to deliver safe medical equipment and devices for surgery and patient care services. CSSD plays a pivotal role in patient safety through incorporating infection prevention and control principles with validated decontamination processes. The segmental growth is also attributed to stringent regulatory guidelines by regulatory agencies or the WHO.

Networked/IoT-Enabled Workflows

The networked/IoT-enabled workflows segment is expected to witness the fastest growth with a CAGR of approximately 18% in the market over the forecast period. AERs are increasingly connected with IoT-enabled technology to enhance safety, efficiency, and compliance in healthcare settings. IoT-enabled technologies facilitate automated documentation and connectivity around the healthcare ecosystem. The increasing integration of digitization in healthcare organizations boosts the segment’s growth.

What Made Preventive Maintenance the Dominant Segment in the Automated Endoscope Reprocessors (AER) Market?

The preventive maintenance segment accounted for the highest revenue share of approximately 42% in the market in 2025. Preventive maintenance enables healthcare professionals to maintain high-quality endoscopes before any surgery, reducing delays in patient treatment. Regulatory agencies release guidelines to conduct annual maintenance or cleaning procedures of AERs. Concerned authorities maintain records of preventive maintenance and reprocessing equipment, such as leak testers.

Remote Diagnostics & Monitoring

The remote diagnostics & monitoring segment is expected to show the fastest growth with a CAGR of 19% over the forecast period. Service providers offer remote diagnostics & monitoring services of endoscopes to check for the desired maintenance. This eliminates the need for healthcare professionals to visit the service center. They have skilled professionals to provide relevant expertise and solutions to complex problems.

Why Did the Direct OEM/Manufacturer Sales Segment Dominate the Automated Endoscope Reprocessors (AER) Market?

The direct OEM/manufacturer sales segment registered its dominance over the global market with a share of approximately 55% in 2025. Providers can directly purchase AERs from manufacturers or original equipment manufacturers (OEMs) at affordable rates. This reduces the extra costs associated with wholesalers or distributors. The increasing awareness of local/indigenous manufacturing of AERs favors the segment’s growth.

Online/E-commerce Channels

The online/e-commerce channels segment is expected to account for the highest growth with a CAGR of approximately 15% over the forecast period. The advent of online platforms, the burgeoning e-commerce sector, and the increasing adoption of smartphones propel the segment’s growth. Online platforms enable professionals to purchase high-quality AERs from anywhere across diverse geographical locations. The rapidly evolving supply chain infrastructure also potentiates the demand for online platforms for purchasing medical devices.

North America dominated the global market in 2025. The presence of key players, a robust healthcare infrastructure, and favorable regulatory support are factors that contribute to market growth in North America. The increasing number of inpatient surgeries and the rising adoption of advanced technologies favor market growth. North American hospitals also drive the demand for efficient and compliant disinfection.

The U.S. recorded over 34 million hospital admissions in 2023, according to the AHA Survey 2025. This is due to the increasing chronic disease prevalence among Americans. Key players, such as Custom Ultrasonics, Inc., Ecolab, and STERIS Corporation, are major contributors to the market in the U.S. The Food and Drug Administration (FDA) regulates the approval of AERs in the U.S.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The rising prevalence of chronic disorders, the growing geriatric population, and the increasing hospital admissions boost the market. Government organizations of various countries, like China and India, provide funding to adopt advanced technological products in healthcare organizations. Government bodies promote the indigenous manufacturing of medical devices, encouraging foreign companies to set up their manufacturing facilities in the region.

China’s national prevalence of chronic disorders is approximately 81.1%, representing 179.9 million Chinese older adults. The Chinese government has launched the “Action Plan for Promoting Large-Scale Equipment Renewal and the Trade-in of Consumer Goods” to boost equipment investments in the healthcare sector by over 25% by 2027 from 2023.

Europe is expected to grow at a notable CAGR in the foreseeable future. Favorable government support and the growing demand for digitization in the healthcare sector propel the market. The presence of key players and the increasing investments and collaborations among companies augment market growth. European nations are becoming hubs for advanced treatment owing to the burgeoning healthcare sector. The growing awareness of infection risks boosts the adoption of AER for patient safety.

Companies like STERIS Corporation, Olympus Corporation, and PFE Medical provide high-quality AER machines in the UK. The increasing number of laparoscopic surgeries potentiates the demand for AERs. It is estimated that over 60,000 laparoscopic cholecystectomies (LC) are performed annually in the UK.

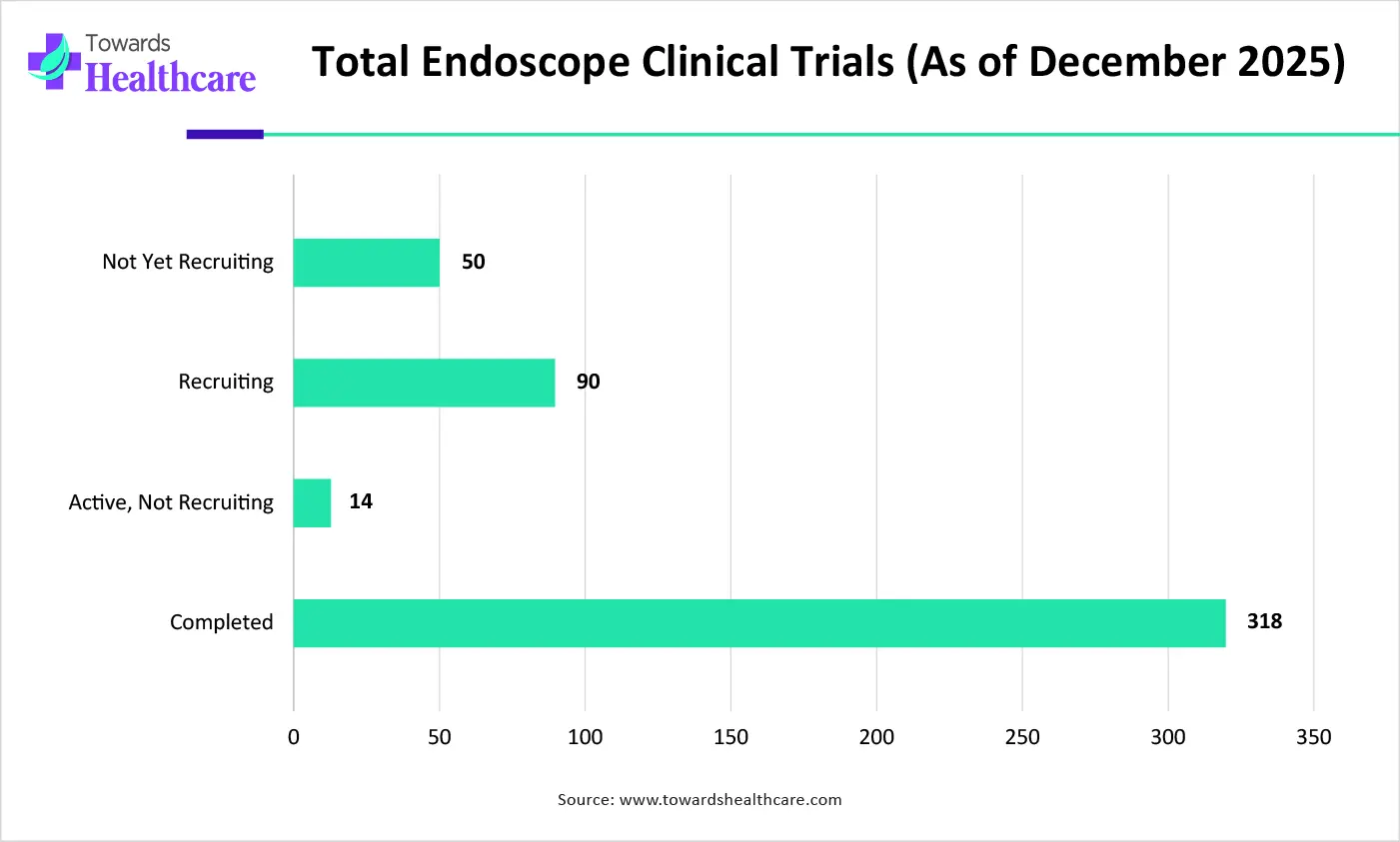

| Stages of Clinical Trials | Total Number of Endoscope Clinical Trials (as of December 2025) |

| Not Yet Recruiting | 50 |

| Recruiting | 90 |

| Active, Not Recruiting | 14 |

| Completed | 318 |

| Companies | Headquarters | Offerings |

| Advanced Sterilization Products | California, United States | ASP Aeroflex AER is a cost-effective, single basin system that automates the washing and high-level disinfection cycle of flexible semi-critical endoscopes. |

| Custom Ultrasonics, Inc. | Pennsylvania, United States | It offers stand-alone AER machines that wash and disinfect immersible heat-sensitive endoscopes and components. |

| STERIS Corporation | Massachusetts, United States | It provides MEDIVATORS ADVANTAGE PLUS AER, which features a no-touch workflow to reduce cross-contamination in the single-sided system. |

| Olympus Corporation | Tokyo, Japan | It offers an AER and three chemicals for cleaning and reprocessing endoscopy equipment to keep patients and staff safe. |

| Wassenburg Medical, Inc. | The Netherlands | The company aims to provide infection-free patient treatment and a safe, user-friendly, efficient, and innovative endoscope reprocessing process at every hospital. |

| Getinge AB | Gothenburg, Sweden | It offers two models of AERs that efficiently perform leak testing, cleaning, and high-level disinfection of flexible endoscopes. |

| Ecolab | Minnesota, United States | The Soluscope AER offer outstanding value and innovation, with quick cycle times and patented enhanced pre-cleaning functions. |

| Steelco | Riese Pio X, Italy | It offers a broad portfolios of AERs, ensuring reprocessing efficiency, infection control, and cost-effective operation. |

| MMM Group | Barcelona | The Uniclean PLE 3 washer-disinfector is designed for the automated cleaning and disinfection of reusable, flexible, thermolabile endoscopes. |

Opportunities

By Product Type

By Disinfection Technology

By End-User/Healthcare Setting

By Workflow Integration

By Service & Support

By Distribution Channel

By Region

December 2025

January 2026

November 2025

November 2025