March 2026

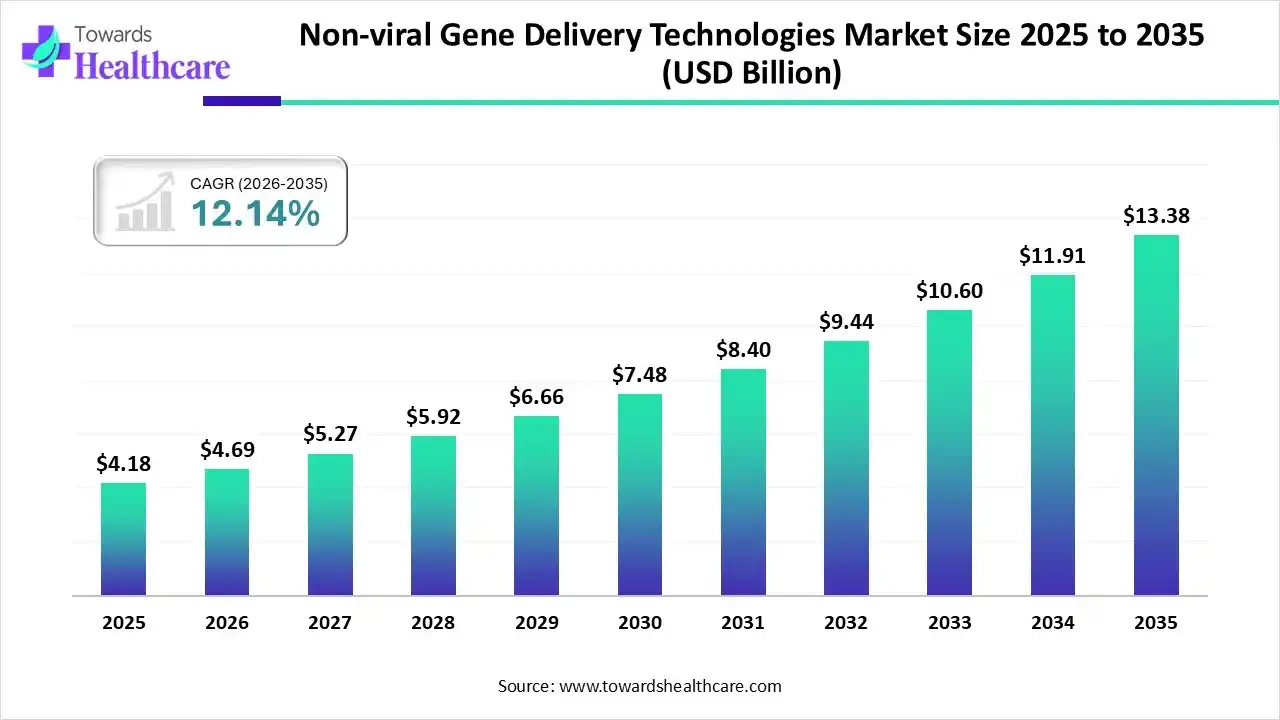

The global non-viral gene delivery technologies market size was estimated at USD 4.18 billion in 2025 and is predicted to increase from USD 4.69 billion in 2026 to approximately USD 13.38 billion by 2035, expanding at a CAGR of 12.34% from 2026 to 2035.

The non-viral gene delivery technologies market is growing due to non-viral technology providing major advantages such as lower immunogenicity, simple production, and great strength for repeat administration. They are versatile, able of delivering a wide range of genetic materials, such as plasmid DNA, mRNA, and gene-editing tools like CRISPR-Cas9.

| Key Elements | Scope |

| Market Size in 2026 | USD 4.69 Billion |

| Projected Market Size in 2035 | USD 13.38 Billion |

| CAGR (2026 - 2035) | 12.34% |

| Leading Region | North America |

| Market Segmentation | By Mode, By Application, By End-use, Regional Outlook |

| Top Key Players | Thermo Fisher Scientific Inc., GenScript, Danaher, Merck KGaA, Bio-Rad Laboratories, Altogen Biosystems, Lonza |

The integration of AI-driven technology into non-viral gene therapy drives the growth of the market, as AI-driven technology is used to develop actively targeted gene delivery vehicles with insignificant off-target properties, by not only simulating cellular structures and offering a better understanding of their characteristics using AI-driven imaging strategies, but also discovering new targeting peptides present in viruses. AI-based optimization of non-viral delivery vectors supports overcoming long-standing challenges associated with vector capacity, immunogenicity, and tissue-precise targeting. AI-driven platforms allow real-time processing of patient-specific information, involving targeted gene therapy regimens that are tailored to the exclusive genomic makeup of specific patients.

Which Mode Led the Non-viral Gene Delivery Technologies Market in 2024?

In 2025, the chemical segment held the dominant position and is projected to witness the fastest CAGR over the forecast period as chemical vectors for non-viral gene delivery are based on engineered DNA nanoparticles produced with different range of macromolecules appropriate to reduce some viral functions needed for gene transfer. Chemical strategies include polymers and lipids, whereas physical methods apply physical qualities and pressures to carry the genetic code in the cells. Chemical non-viral gene delivery processes employ synthetic or natural materials to form vectors that drive gene transfer through endocytosis.

Why did the Research Segment Dominate the Market in 2024?

The research segment is dominant in the non-viral gene delivery technologies market in 2025, as non-viral strategies, as a substitute for gene transfer vehicles to the popular viral vectors, have gained significant attention because of their favorable characteristics, including lack of immunogenicity, reduced toxicity, and massive strength for tissue specificity. Non-viral vectors have major advantages in efficiency, safety, and easy manufacturing, possessing potential medical care application value when compared with viral vectors.

Therapeutics

Whereas the therapeutics segment is the fastest growing in the market, as nonviral gene vectors are progressively favoured in healthcare applications given their outstanding safety profile, low immunogenicity. Non-viral delivery technology, like gene guns, microinjection, nonoperation, and electroporation, drives the direct introduction of genetic material into the cells. Non-viral vectors improve the efficiency of cargos, extend the circulation time, enhance therapeutic effectiveness, and offer intended delivery.

Why did the Research and Academic Institutes Segment Dominate the Market in 2024?

The research and academic institutes segment is dominant in the non-viral gene delivery technologies market in 2025, as significant non-viral strategies include simplicity in manufacturing and have huge strength for repeat administration. Scientists simply modify chemical structures to enhance targeting specificity and allow stimuli-responsive release, making them standard for exact personalized medicine research.

In 2025, North America led the non-viral gene delivery technologies market as increasing biotech start-ups are driving growth and innovation in the region's healthcare sector, creating the way for advanced medical care solutions. NIH-funded research helps the foundation for manufacturing to grow vaccines and therapies, demonstrating deep public-private R&D complementarity. Large biotech sectors have developed a disproportionate number of biological drugs, which drives the demand for non-viral gene delivery technologies.

For Instance,

U.S. Market Trends

In the U.S., increasing partnerships among academic institutions and biotech companies drive industry novelty. Major universities contribute advanced research, dedicated facilities, and scientific findings. Presence of world-class academic institutions such as Harvard, MIT, Tufts, and Boston University, which offer leading research and skilled talent to drive revolution.

Europe is set to experience rapid growth in the non-viral gene delivery technologies market, as Europe is quickly positioning itself as the worldwide leader in biologics production, driven by strategic spending, a combined regulatory framework, and a growth in biopharma novelty. With over €55 billion invested in R&D and an increasing network of progressive CDMOs, the region provides supreme end-to-end capabilities for biologic drug manufacturing.

For Instance,

UK Market Trends

In the UK, government spending supports the boldest ideas in UK life sciences, a realism from putting robots to work in factories making medicines, to reusing spent nuclear fuel in the next generation of cancer therapies. The UK’s global leading status as a life sciences hub increased by £800 million, with Barts Life Sciences Cluster plans and the British Business Bank promise of a novel nine-figure Venture Capital (VC) fund. The UK’s life sciences field is a force for advance and for growth, creating a turnover of £150 billion yearly.

Asia Pacific is experiencing substantial health growth in the non-viral gene delivery technologies market, as growing health awareness leading to amplified health demand has pressured the ruling administrations in the region to invest in the sector. Increasing middle-class income levels, a growing ageing population, and rising prevalence of long term diseases are contributing to the increasing demand for non-viral gene delivery technology.

India Market Trends

The Indian government improves its medical care system by increasing similar partnerships to enlarge hospital capacity, renovate facilities, and enhance the quality of care, particularly in rural and underserved regions. India incorporate with advance digital systems to improve efficiency, enhance patient care management, and lower administrative expenses.

| Company | Headquarters | Latest Update |

| Thermo Fisher Scientific Inc. | United States | In November 2024, Thermo Fisher Scientific announced the launch of the Invitrogen Vivofectamine Delivery Solutions, an advanced lipid nanoparticle (LNP) technology intended to transform non-viral nucleic acid delivery. |

| GenScript | China | GenScript Biotech continues to advance open partnerships and supports to accelerate the translation of scientific breakthroughs into practical applications, with a significant focus on enhancing patient results. |

| Danaher | Japan | Danaher focused on advancing non-viral gene delivery technologies, specifically via collaborations involving lipid nanoparticles (LNPs). |

| Merck KGaA | Germany | In October 2025, Merck entered into a partnership with Promega Corporation, a global life science solutions and service leader based in Madison, Wisconsin, in the US, to co-develop novel technologies that advance drug screening and discovery. |

| Bio-Rad Laboratories | United States | In November 2025, Bio-Rad Laboratories, Inc. announced that its Nuvia wPrime 2A Media has received a 2025 Innovation Award from The Analytical Scientist. |

| Altogen Biosystems | Nevada | Altogen endures to market tissue-targeted in vivo transfection kits intended for particular organs, with the lungs, heart, kidney, and tumors. |

| Lonza | Switzerland | In October 2025, Lonza announced the operational readiness of its new aseptic drug product filling line in Stein (CH). |

Physicomechanical barriers, which limit the design of delivery devices, physicochemical barriers that influence self-assembly of colloidal particulate formulations, and biological barriers that compromise delivery of the DNA to its target site.

By Mode

By Application

By End-use

By Region

March 2026

February 2026

February 2026

February 2026