January 2026

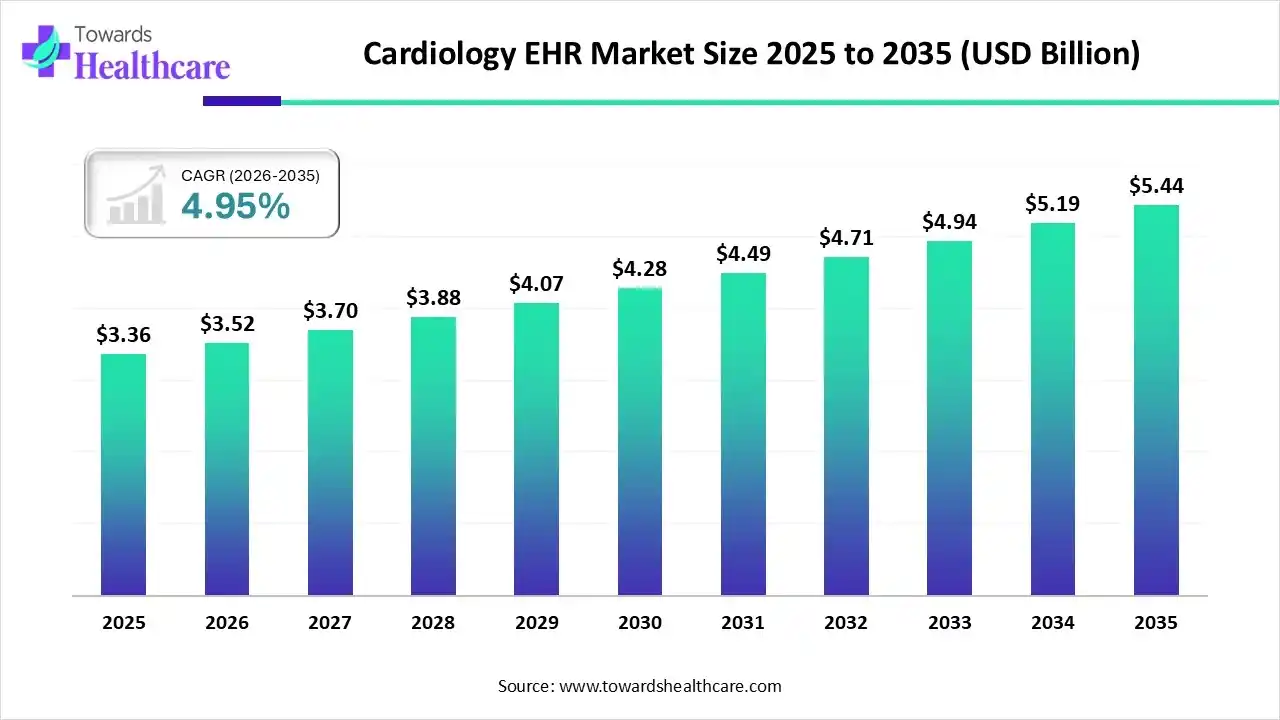

The global cardiology EHR market size was estimated at USD 3.36 billion in 2025 and is predicted to increase from USD 3.52 billion in 2026 to approximately USD 5.44 billion by 2035, expanding at a CAGR of 4.95% from 2026 to 2035.

The global cardiology EHR market is driven by this technology provides features like integration with diagnostic devices, specialty-driven templates, and clinical decision support equipment. They aim to enhance data access and interoperability. The cardiology electronic health record (EHR) sector includes particular digital systems intended to manage and optimize patient health data for cardiovascular care.

| Key Elements | Scope |

| Market Size in 2026 | USD 3.52 Billion |

| Projected Market Size in 2035 | USD 5.44 Billion |

| CAGR (2026 - 2035) | 4.95% |

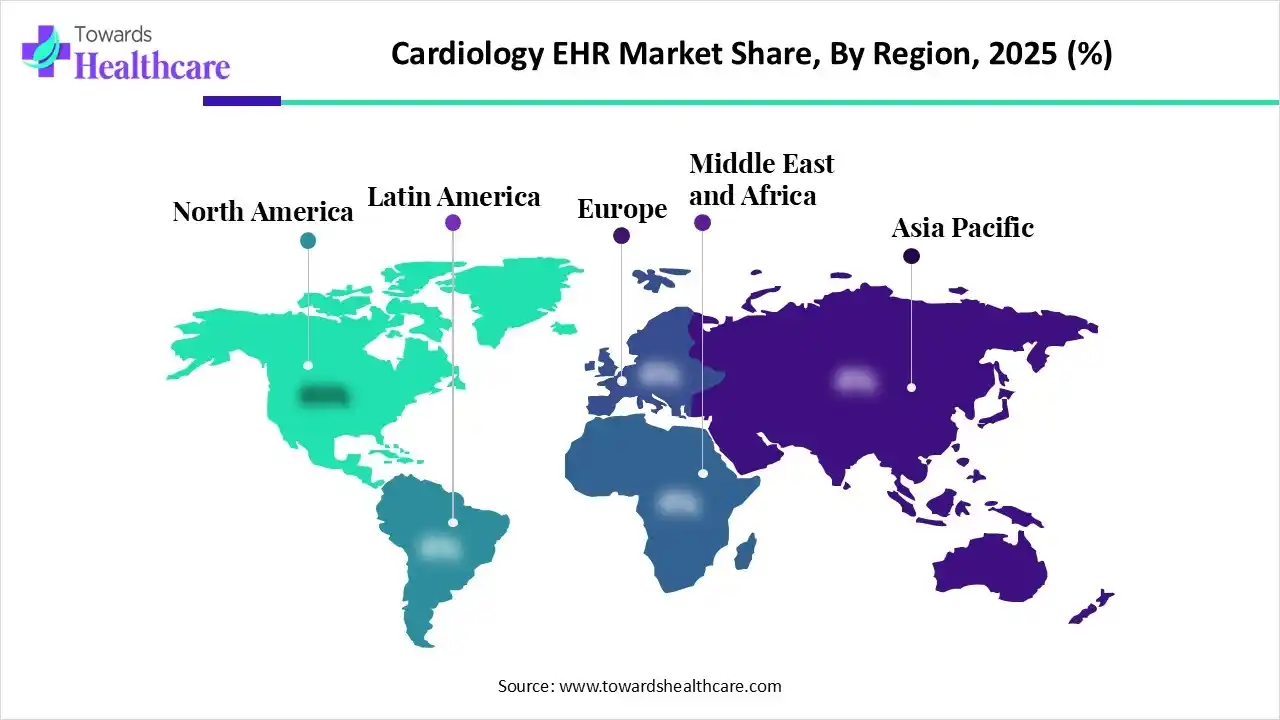

| Leading Region | North America |

| Market Segmentation | By Product, By Business Model, By End Use, By Region |

| Top Key Players | HeartX, Auxira Health, Philips, PendraCare, Epic Systems Corporation, Oracle, GE HealthCare |

An electronic health records service for cardiologists allows a secure and consistent storage and transfer of patient health information beyond the general healthcare records. EHR software is a revolution in the medical care industry, game-changing cardiology practice workflows, and lowering administrative errors. The development of cardiology EHR software has focused on improving CDS functionalities tailored precisely to cardiology practices. These tools leverage evidence-based strategies, integrate challenge calculators, and provide real-time alerts for potential drug interactions or contraindications. Cardiology EHR software has kept pace with the emerging demands of medical care by incorporating features that allow telecardiology consultations and remote cardiac patient monitoring.

The incorporation of AI-driven technology in cardiology EHR has the latent to improve early disease identification, optimize treatment approaches, and enhance patient outcomes. AI has made significant strides in renovating cardiology, providing advancements in diagnostic imaging, extrapolative analytics, personalized treatment plans, long-term disease management, and medical assistance. AI-based technology's ability to analyze wide data sets and detect complex patterns provides significant potential to improve patient results. This technology enables precise prediction of cardiovascular outcomes, non-invasive diagnosis of coronary artery disease, and identification of malignant arrhythmias.

Wearable device incorporation with EHR systems simplifies automatic transfer of real-time data on healthcare measurements and behaviour measures from a wearable device to an EHR system within the healthcare ecosystem.

Rising PACS incorporation connects cardiology, radiology, and other imaging departments with EHR and RIS systems using standardized protocols such as DICOM and HL7.

Seamless incorporation with cardiology tools like ECG machines, echocardiograms (ECHO), cardiac catheterization labs, Holter monitors, and treadmill test (TMT) devices. Real-time import of results helps to avoid manual mistakes and speed up diagnosis.

Which Product Led the Cardiology EHR Market in 2025?

In 2024, the web/cloud-based EHR segment held the dominating share of the market, as Web-based EHRs are exempt from the need for hardware or software installation, ensuring a quicker and sincere implementation method. Quicker implementation reduces interruptions in cash flow, increasing a faster return on spending in comparison to conventional structures. Cloud-based EHRs provide sturdy security features, ensuring HIPAA compliance through bank-level safety and high-degree encryption.

Whereas, the on-premise EHR segment is estimated to witness significant growth in the market as EHR systems and imaging software are hosted on local servers, confirming high-speed performance when opening large files, like patient histories or radiology scans. On-premises EHR has high upfront costs, including IT infrastructure, Installation, hardware, and software costs.

Why did the Professional Services Segment Dominate the Market in 2025?

The professional services segment captured the biggest revenue share of the cardiology EHR market in 2025, as medical care professionals who use cardiology EHR/EMR and practice management software admit enhanced productivity, lower expenses, and more time to focus on patient engagement in place of tedious documentation tasks. Integration of EMR cardiology software enables medical authorities to access and save patient reports and electrocardiogram charts rapidly.

Whereas, the subscriptions segment is estimated to witness significant growth in the market, as subscription-driven cardiology EHR provides significant advantages, including lower upfront costs, automatic software updates and maintenance by the vendor, enhanced accessibility and scalability, and robust data security and disaster recovery protocols.

Why is the Hospitals Segment Dominant in the Market in 2025?

In 2025, the hospitals segment held the dominating share of the cardiology EHR market, as EHR systems offer rapid and easy access to patient data, which supports healthcare providers in making more informed decisions related to patient care. EHRs offer proximately accessible data pertaining to significant data, like a life-threatening allergy, to emergency staff. EHRs help healthcare providers avoid potentially serious problems by alerting them to possible safety issues, ultimately leading to improved patient results.

Whereas, the ambulatory surgery centers (ASCs) segment is the fastest growing in the market as modernized medical workflows, improved diagnostic precision, and better financial effectiveness by integrating particular cardiology data and administrative functions. Patient portals let people access their health records, lab results, and educational materials, also schedule appointments, and securely interconnect with their care team.

In 2024, North America dominated the cardiology EHR market by capturing a significant share, driven by robust government initiatives and economic incentives, a robust and advanced healthcare organization, high rates of cardiovascular disease cases, and the presence of major health IT organizations. There is an increasing acceptance rate of novel technologies such as cloud-based systems and artificial intelligence (AI) in North America.

For Instance,

The U.S. possesses an extremely developed healthcare organization with high digital literacy and a strong emphasis on digital revolution. This environment drives the integration of complex cardiology-specific EHR services that can handle massive amounts of data from different diagnostic tools such as ECGs and echocardiograms, which drives the growth of the market.

For Instance,

Asia Pacific is expected to grow at the fastest CAGR in the market as the region is rapidly adopting cloud-based and web-based EHR technology, which is attractive because it lowers the necessity for significant upfront spending in hardware and IT infrastructure, making it accessible to a massive range of healthcare services, including smaller clinics and rural areas. There is an enhancing trend of integrating AI-based analytics and telemedicine platforms in the EHR systems, specifically in countries such as Japan and South Korea.

India has a substantial and rising number of persons affected by CVDs, often being referred to as the cardiac capital of the world, which drives the growth of the market. The Indian regulation has actively promoted the acceptance of digital health technologies by flagship programs such as the Ayushman Bharat Digital Mission (ABDM). Healthcare workers in India are progressively emphasizing better patient outcomes, safety, and operational efficiency.

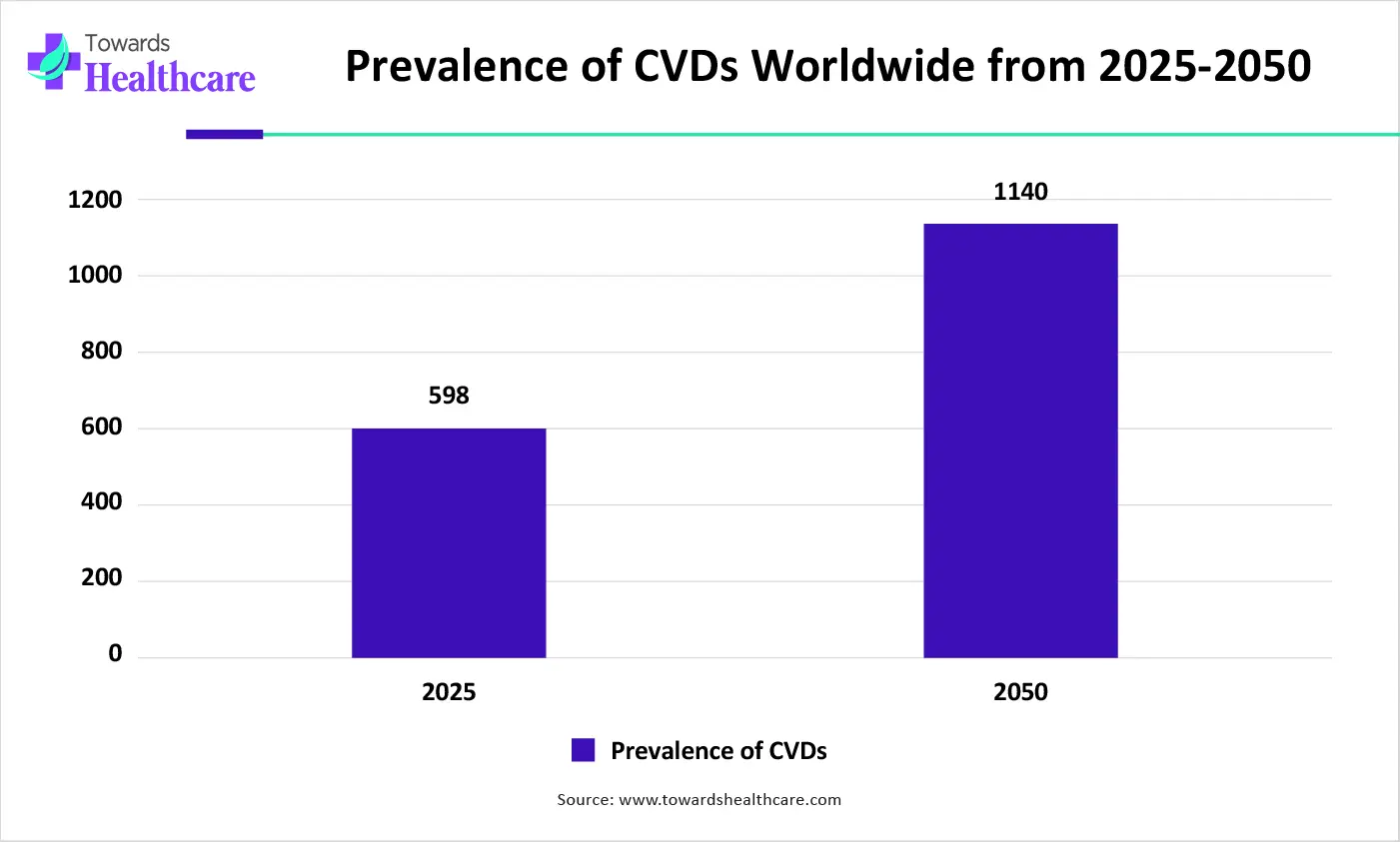

Europe is poised for rapid growth in the cardiology EHR market, as Europe has a large and aging demographic and an increasing prevalence of cardiovascular diseases, which are the leading cause of death in the region. This creates an increasing demand for advanced, specialized EHR services that manage multifaceted, long-term conditions, help with continuous monitoring, and coordinate care among multiple specialists.

The UK has a proactive regulatory environment that promotes secure data storage and restricted access, which increases trust in digital systems and encourages vendors to provide compliant services. The UK has advanced, linked primary care EHR data resources, like those used by the British Heart Foundation (BHF) Data Science Centre and Health Data Research UK.

| Metric | Value |

| People living with CVD | 7.6 million+ |

| Annual CVD deaths | 174,693 |

| Daily CVD deaths | 480/day |

| Under-75 CVD deaths | 48,697 |

| Estimated adults with high blood pressure | 16 million |

| Diagnosed with high blood pressure | 11 million |

| Undiagnosed/poorly controlled high BP | 8 million |

| Economic cost of CVD | £30 billion/year |

| The NHS cost of CVD | £12 billion/year |

| Company | Headquarters | Latest Update |

| HeartX | United States | In October 2025, HeartX, powered by HealthTech Arkansas and MedAxiom, along with dozens of leading cardiovascular programs around the country, selected the seven startup healthcare companies that will participate in the 2025 accelerator program. |

| Auxira Health | Chicago | In May 2025, Auxira Health, a virtual cardiology model that supports practices thrive, today announced its official launch, bringing to market a new approach to clinical support purpose-built for cardiology. |

| Philips | Netherlands | In November 2025, Philips announced the introduction of a novel generation of AI-enabled Cardiac MR (CMR) innovations designed to make cardiac MR faster, easier, and more accessible for clinicians and patients. The new AI-powered CMR solutions simplify workflows, expand access to advanced imaging, and deliver diagnostic precision for a wider range of patients. |

| PendraCare | Netherlands | In September 2025, PendraCare’s product portfolio includes interventional cardiology devices, particularly guiding and diagnostic catheters, which are sold under its own brand as well as supplied to major global medical devices companies. |

| Epic Systems Corporation | United States | In 2025, Epic announced new artificial intelligence (AI)-enabled capabilities to improve its EHR system and the overall patient experience. |

| Oracle | United States | In 2025, Oracle Health announced plans to introduce a next-generation electronic health record (EHR) platform 2025, aiming to modernize healthcare with embedded artificial intelligence (AI) and data analytics. |

| Veradigm Network | Illinois | In March 2025, Veradigm Network EHR Data is one of the largest EHR data products designed exclusively for research, with more than 154 million deidentified patients with clinical activity and more than 246,000 providers. |

| GE HealthCare. | United States | GE Healthcare's cardiology portfolio provides precision care for the entire clinical pathway from early detection to intervention. |

By Product

By Business Model

By End Use

By Region

North America

Europe

Asia Pacific

Latin America

Middle East and Africa (MEA)

January 2026

January 2026

January 2026

January 2026