February 2026

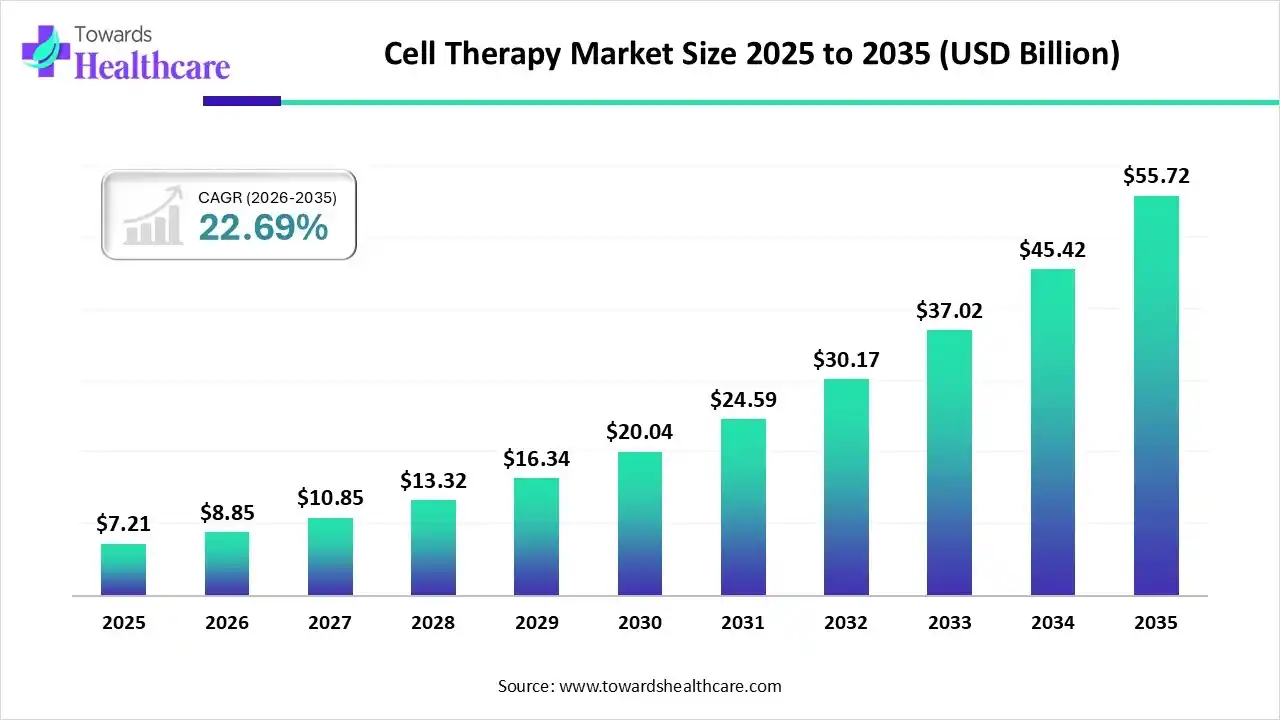

The global cell therapy market size was estimated at US$ 7.21 billion in 2025 and is projected to grow to US$ 55.72 billion by 2035, rising at a compound annual growth rate (CAGR) of 22.69% from 2026 to 2035.

| Metric | Details |

| Market Size in 2026 | USD 8.85 Billion |

| Projected Market Size in 2035 | USD 55.72 Billion |

| CAGR (2026 - 2035) | 22.69% |

| Leading Region | North America by 59% |

| Market Segmentation | By Therapy Type, By Therapeutic Area and By Region |

| Top Key Players | Novartis AG, 2seventy Bio Inc., Anterogen Co., Ltd., Johnson & Johnson Services, Inc., Astellas Pharma Inc., M Aurion Biotech, EDIPOST, Atara Biotherapeutics, JCR Pharmaceuticals Co., Ltd., S. BIOMEDICS, Holostem Terapie Avanzate S.r.l, Bristol-Myers Squibb Company, JW Therapeutics, Nkarta, Inc., Gilead Sciences, Inc. |

The delivery of chosen, modified, or changed cells outside of the body for the purpose of treating or preventing illness is known as cell therapy. With intriguing and developing potential for therapeutic use, cell therapy is a field on the rise. The manufacturing and culturing procedures must develop before these medicines may be used commercially, which usually entails drastically scaling up and automating to match the clinical demand. Over the past twenty years, research at government and university institutions throughout the globe has substantially advanced our knowledge of cell treatments. Different cell types will be researched for possible uses and developed into treatments as innovative cell therapies while the study is still in its early stages.

There are benefits and drawbacks to using AI in cell therapy. AI technology integration may save costs, streamline logistics, and increase production accuracy and efficiency. AI may also be used to forecast treatment outcomes, track the course of therapy, and identify people who would benefit from it. Furthermore, work is still to be done on the validation of AI-based judgments and the integration of AI systems into current production workflows.

For instance,

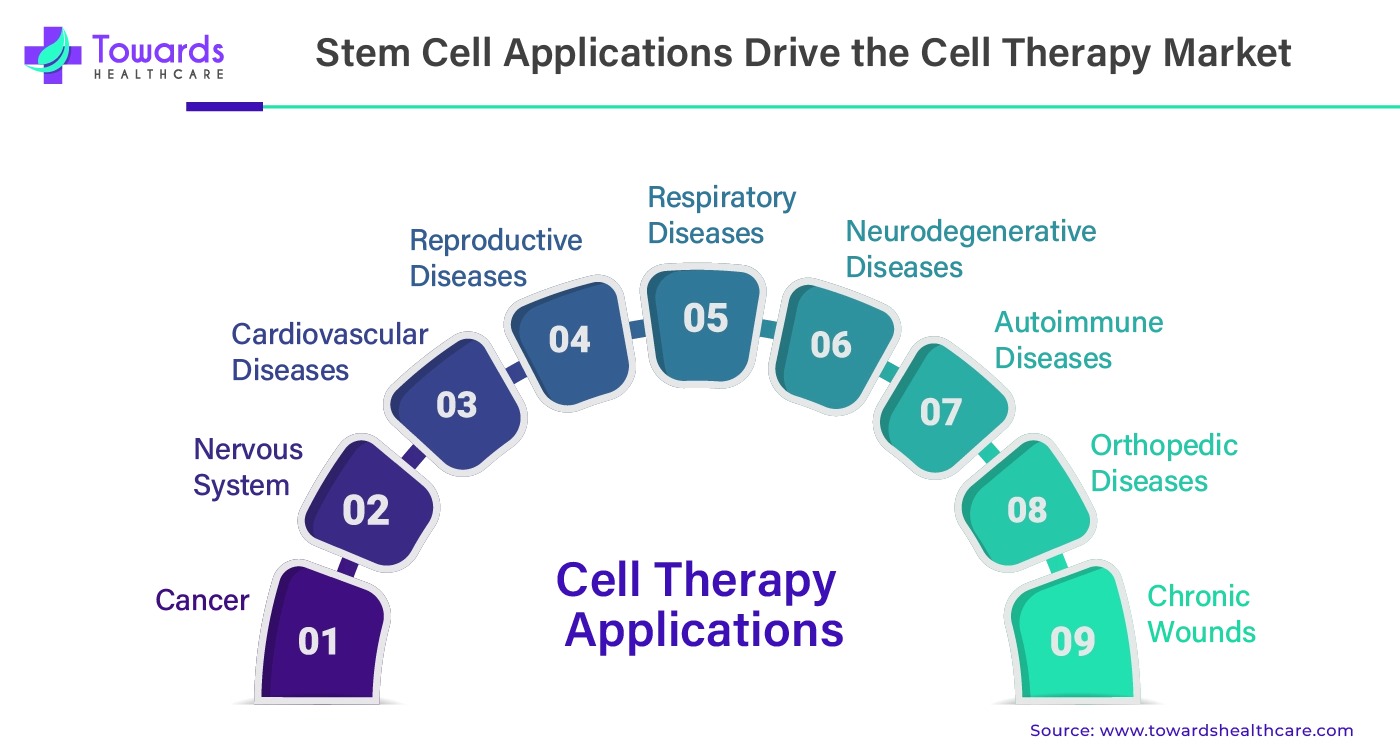

Adult bone marrow stem cells produce a variety of growth factors that enable them to differentiate into the kind of cells required for heart and blood vessel repair. With the use of stem cells, it is possible to stimulate the production of new, healthy skin tissue, boost collagen synthesis, hasten the growth of hair after haircuts or hair loss, and replace damaged or scarred tissue with freshly produced, healthy tissue. Adult stem cells injected into the brain can help regenerate new brain synapses, neurons, and cells after brain damage or cognitive impairment in illnesses such as Parkinson's and Huntington's. The use of stem cells in treating severe and debilitating autoimmune illnesses gives new hope. This therapy may be beneficial for patients with pain related to spinal diseases, orthopedic concerns, and sports injuries.

Cellular and gene therapy are two of the priciest therapies currently offered. Cell treatments are expensive, usually costing more than $400,000 USD and often more than $1 million USD per patient, and there are technological issues that raise questions about their accessibility and affordability for patients, payers, and healthcare systems both domestically and abroad. Budgets for healthcare may also be strained by the expense of cell treatment, forcing governments and insurance companies to make tough decisions about how best to distribute funds and cover different products. The costs involved in producing and administering cell therapy are one factor contributing to its high cost. Specialized equipment, trained personnel, and strict quality control systems could be required for each of these processes.

One of the newest and most promising treatments for blood cancer is CAR-T cell therapy. Through the activation of the immune system, these medicines support the fight against cancer. Future cancer treatments might greatly benefit from CAR T-cell therapy because of its many advantages. CAR T cells have proven to be a successful treatment for several cancers, particularly blood cancers like leukemia and lymphoma. The specific antigen that is present in malignant cells is the target of CAR T cells. This modification reduces harmful effects and harm to healthy tissues to a minimum. The purpose of CAR T cells is to multiply and persist throughout the body. This suggests that they could offer long-term protection against the cancer coming back.

For instance,

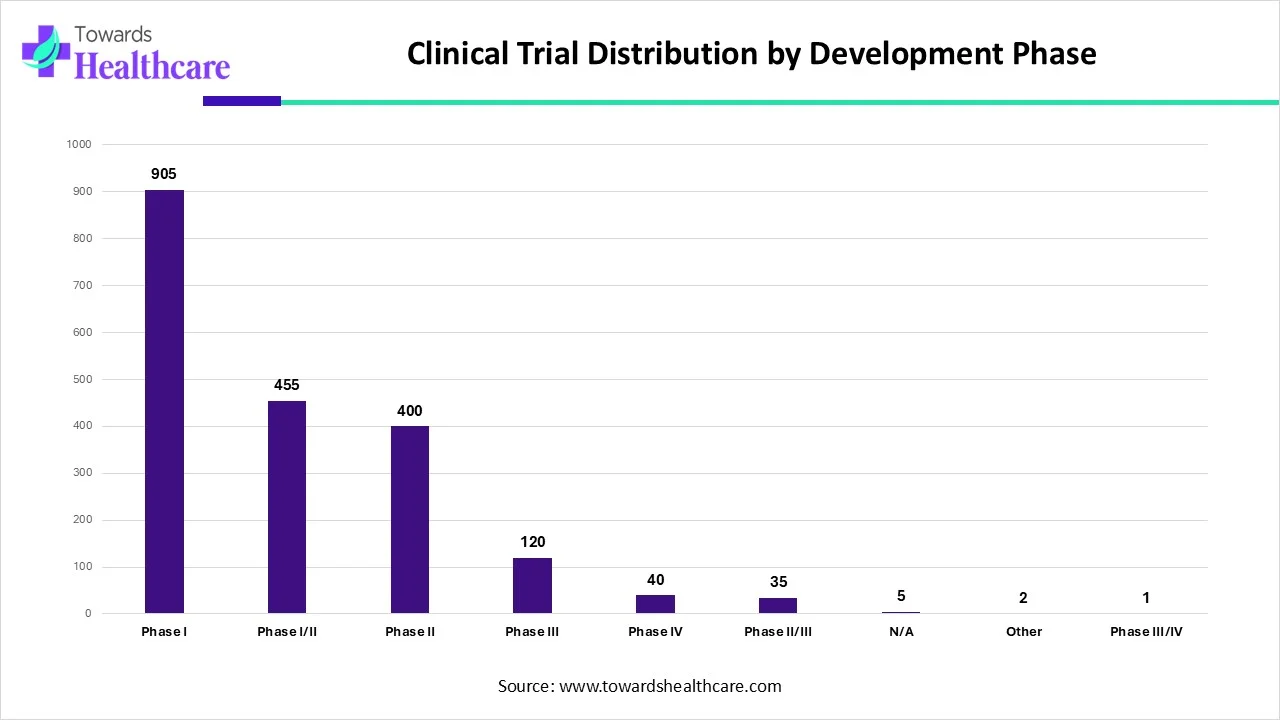

| Trial Phase | Number of Trials |

| Phase I | 905 |

| Phase I/II | 455 |

| Phase II | 400 |

| Phase III | 120 |

| Phase IV | 40 |

| Phase II/III | 35 |

| N/A | 5 |

| Other | 2 |

| Phase III/IV | 1 |

This data clearly shows how clinical trials concentrate across different stages of drug development. Phase I trials dominate the landscape with 905 studies, highlighting a strong focus on early-stage safety and dosage evaluation. Researchers actively invest in understanding how new therapies behave in humans before advancing them further.

Phase I/II and Phase II trials follow closely, with 455 and 400 studies respectively. This indicates steady momentum as developers transition promising candidates from initial safety assessments into efficacy testing. These phases play a critical role in refining therapeutic potential and reducing development risks. Later-stage trials appear in smaller numbers. Phase III accounts for 120 trials, reflecting the high cost, complexity, and regulatory rigor involved in large-scale validation. Phase IV trials remain limited at 40, as only approved therapies move into post-marketing surveillance.

Combined phases such as Phase II/III and Phase III/IV show minimal counts, suggesting that most sponsors prefer clearly defined trial stages rather than hybrid designs. The very small number of N/A and “Other” trials confirms that most studies follow standard regulatory pathways. Overall, this distribution emphasizes an innovation-driven pipeline, where the majority of activity centers on early and mid-stage development, ensuring a continuous flow of new therapies toward clinical and commercial maturity.

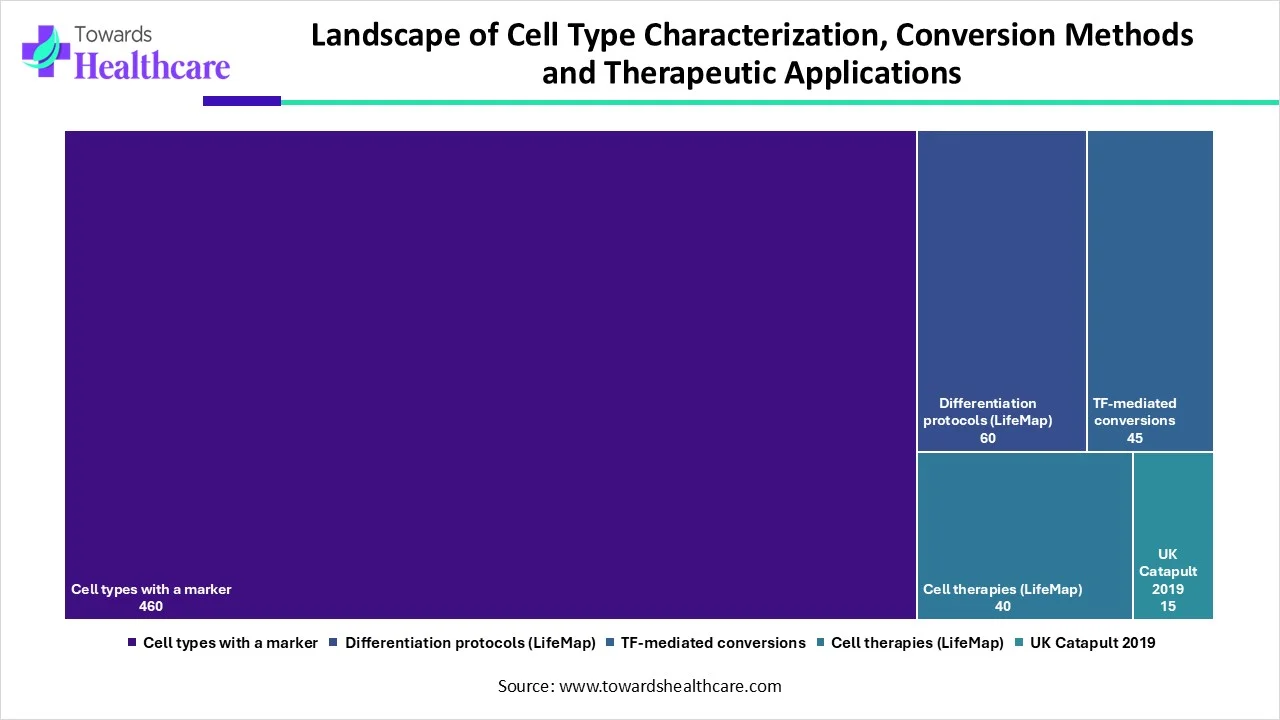

| Category | Total Number |

| Cell types with a marker | 460 |

| Differentiation protocols (LifeMap) | 60 |

| TF-mediated conversions | 45 |

| Cell therapies (LifeMap) | 40 |

| UK Catapult 2019 | 15 |

This table presents a concise snapshot of key resources and methodologies shaping modern cell biology and regenerative medicine. Researchers have identified 460 distinct cell types with specific markers, highlighting the depth of cellular characterization achieved so far. In parallel, 60 differentiation protocols documented by LifeMap actively guide scientists in directing cell fate under controlled conditions.

The field also advances through 45 transcription factor (TF)–mediated conversion methods, which enable direct reprogramming of one cell type into another, bypassing intermediate stages. Additionally, 40 cell therapies listed by LifeMap demonstrate how these scientific advances translate into real-world clinical applications. Complementing this global perspective, 15 initiatives supported by the UK Catapult in 2019 reflect focused national efforts to accelerate innovation, scale-up, and commercialization in cell and gene therapy.

Together, these figures clearly illustrate the breadth of ongoing research, the maturity of conversion technologies, and the growing momentum toward clinical and translational impact in the cell therapy ecosystem.

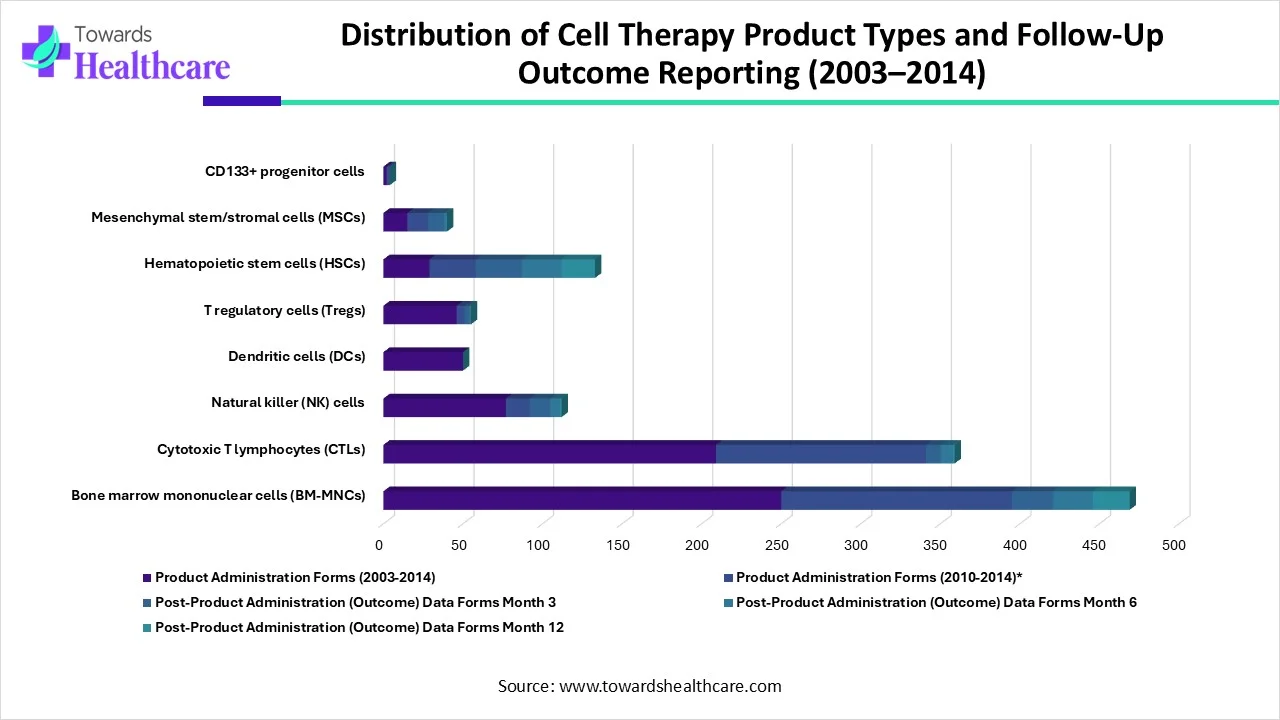

| Cell Product Type | Product Administration Forms (2003-2014) | Product Administration Forms (2010-2014)* | Post-Product Administration (Outcome) Data Forms | ||

| Month 3 | Month 6 | Month 12 | |||

| Bone marrow mononuclear cells (BM-MNCs) | 250 | 145 | 26 | 25 | 23 |

| Cytotoxic T lymphocytes (CTLs) | 209 | 132 | 9 | 8 | 1 |

| Natural killer (NK) cells | 77 | 15 | 13 | 6 | 1 |

| Dendritic cells (DCs) | 50 | 0 | 0 | 0 | 0 |

| T regulatory cells (Tregs) | 46 | 5 | 3 | 1 | 0 |

| Hematopoietic stem cells (HSCs) | 29 | 29 | 29 | 25 | 21 |

| Mesenchymal stem/stromal cells (MSCs) | 15 | 13 | 10 | 2 | 0 |

| CD133+ progenitor cells | 2 | 2 | 0 | 0 | 0 |

| Total forms collected | 678 | 341 | 90 | 67 | 46 |

This table presents a clear overview of cell therapy product types, the number of product administration forms collected over time, and the extent of post-administration outcome reporting at defined follow-up intervals. Between 2003 and 2014, researchers collected 678 product administration forms across multiple cell product categories, reflecting the breadth of clinical activity in this field.

Bone marrow mononuclear cells (BM-MNCs) dominated data collection, with 250 administration forms reported between 2003 and 2014 and 145 forms specifically from 2010 to 2014. Investigators also reported post-administration outcomes for BM-MNCs at Month 3, Month 6, and Month 12, demonstrating consistent long-term follow-up. Cytotoxic T lymphocytes (CTLs) and natural killer (NK) cells also showed substantial early reporting, although outcome data declined sharply by Month 12, indicating reduced long-term follow-up.

Hematopoietic stem cells (HSCs) stood out for their strong continuity in outcome reporting. All 29 administered cases included Month 3 data, and most continued through Month 12, highlighting robust follow-up practices for this cell type. In contrast, dendritic cells, T regulatory cells, mesenchymal stem/stromal cells, and CD133+ progenitor cells showed limited or no outcome data beyond early time points, suggesting gaps in longitudinal reporting.

Overall, the table highlights both the concentration of clinical activity around a few major cell therapy types and the uneven depth of post-product outcome monitoring. While early administration data appear comprehensive, long-term outcome reporting decreases notably across several cell categories, underscoring the need for more consistent follow-up in cell therapy studies.

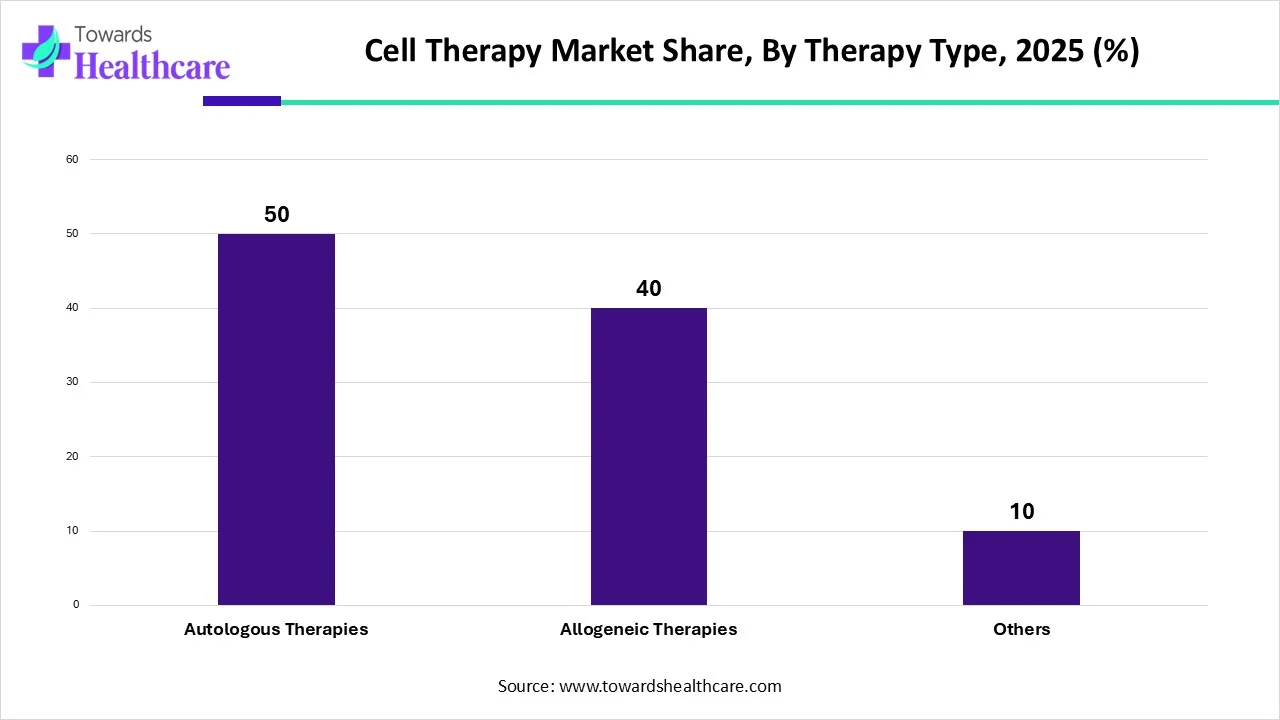

Which Therapy Type Segment Dominated the Cell Therapy Market?

By therapy type, the autologous therapy segment dominated the cell therapy market share by 50% in 2025. Autologous cell therapy, with applications in immuno-oncology and regenerative medicine, is a fast-expanding therapeutic method. Autologous methods have the important benefit of reducing the danger of immunological rejection in patients and fostering long-term recovery. The ability to tailor autologous cell treatment to the specific requirements of each patient is an additional advantage. Thus far, this type of treatment has shown effective in treating burns and pressure ulcers, promoting wound healing, reducing chronic inflammation, and improving postoperative healing all while bioengineering skin replacements.

For instance,

| Therapeutic Area Segment | 2025 Share (%) |

| Oncology | 45 |

| Musculoskeletal Disorders | 15 |

| Cardiovascular Diseases | 15 |

| Dermatology | 10 |

| Others | 15 |

Why Did the Oncology Segment Dominate the Cell Therapy Market?

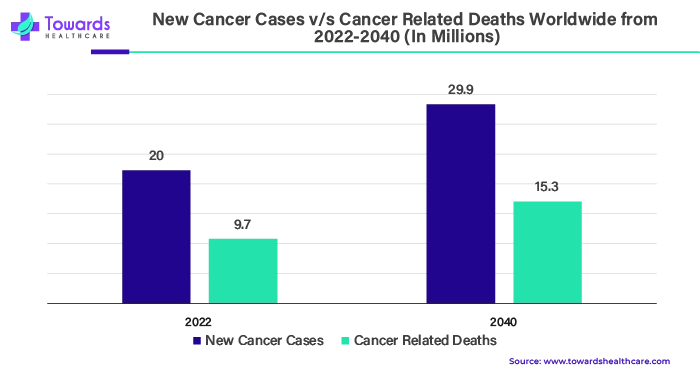

By therapeutic area, the oncology segment held the largest share by 45% of the cell therapy market. Cell therapy is essential to our goal of making cancer no longer a leading cause of death due to the disease's rising incidence. In cell-mediated immunity and T-cell genetic modification techniques, T-cells are crucial. Therapeutic promise for preventing tumor formation has been demonstrated by CAR-T cell and TCR-T cell treatments, which have shown promising clinical outcomes in clinical studies.

For instance,

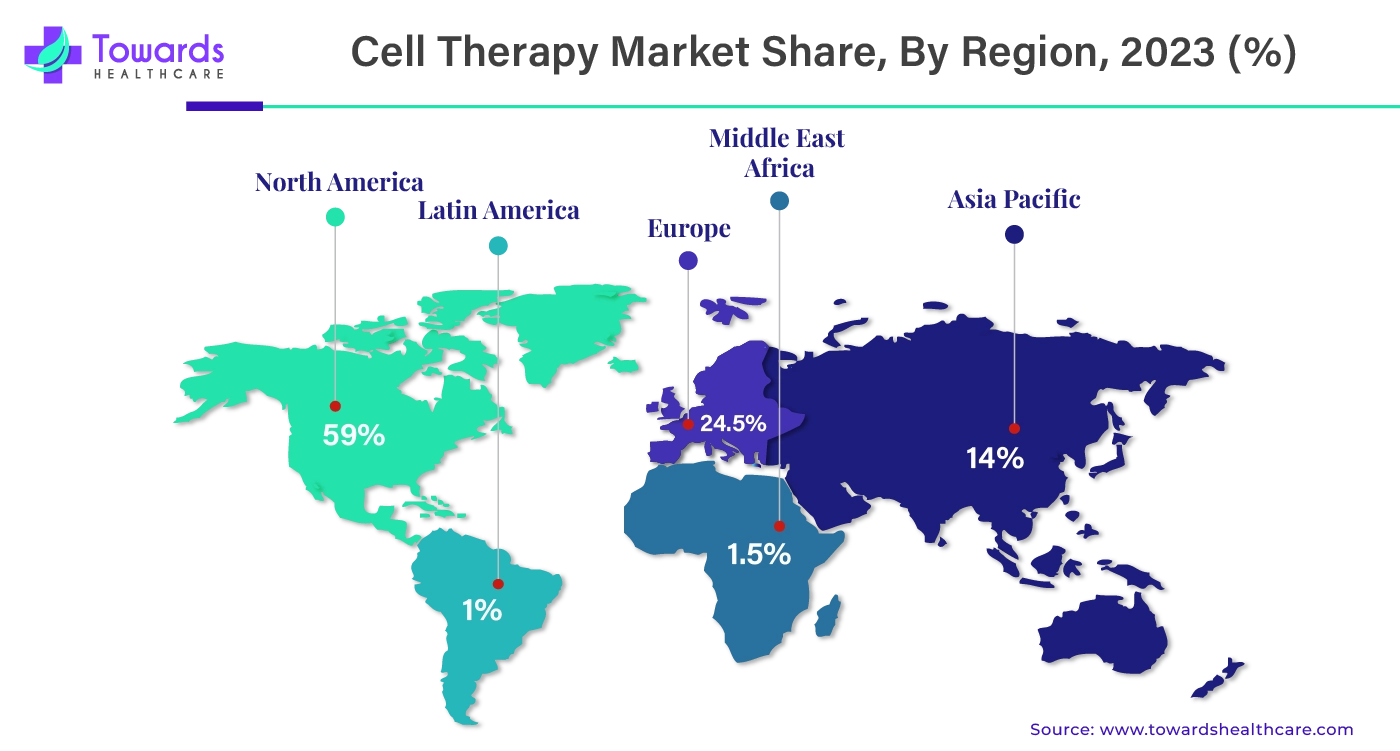

By region, North America dominated the cell therapy market share by 59% in 2023. North America is considered technologically advanced, with advanced healthcare infrastructure and research centers equipped with advanced systems. With time, the region has focused on providing better therapeutics and medicines to treat illness with the help of key organizations and governments. These factors have significantly contributed to the growth of the market in this region. The major countries that have contributed to this growth are the U.S. and Canada.

The U.S. holds the largest share of the cell therapy market in North America, and one of the main reasons for that is the growing prevalence of cancer. The U.S. is among the top countries with a large number of cancer cases. Cell therapy has proven to be highly useful in conducting cancer research and cancer therapeutics. With the growing number of cancer cases, the country is heavily focused on cancer research.

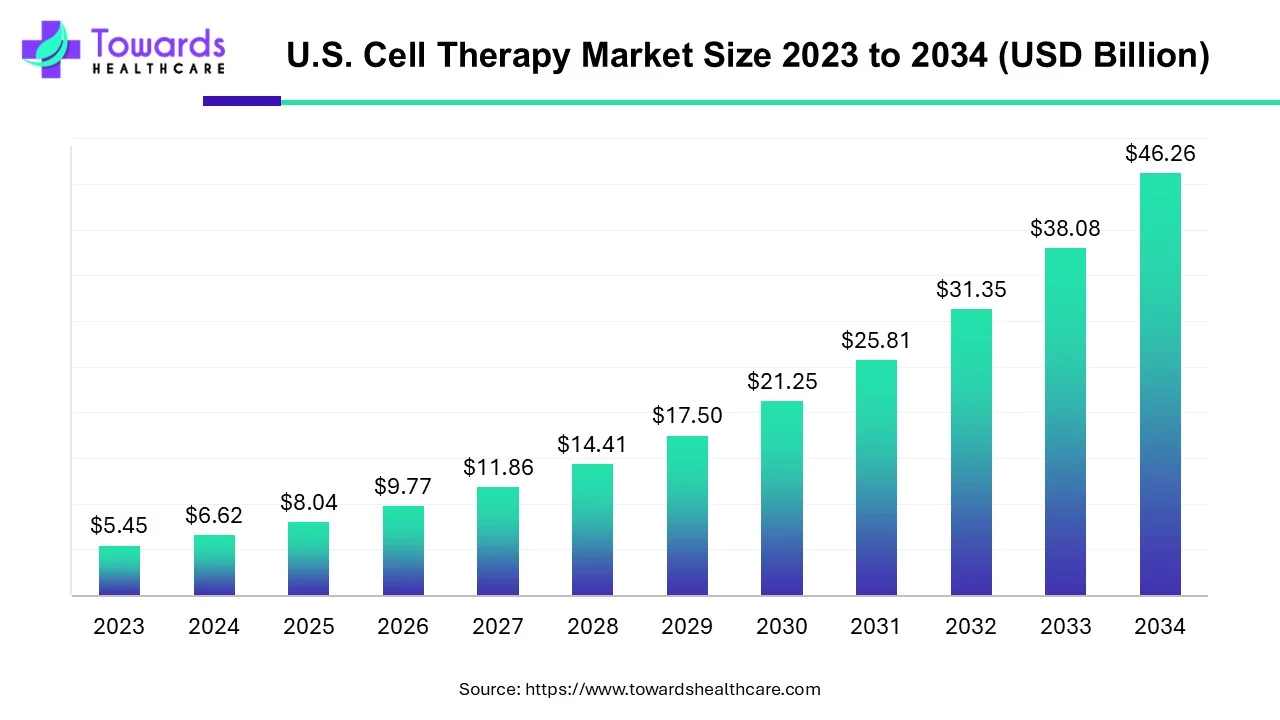

U.S. Cell Therapy Market Forecast

The U.S. cell therapy market size is expected to grow at a compound annual growth rate (CAGR) of 21.46%, increasing from USD 8.04 billion in 2025 to USD 46.26 billion by 2034.

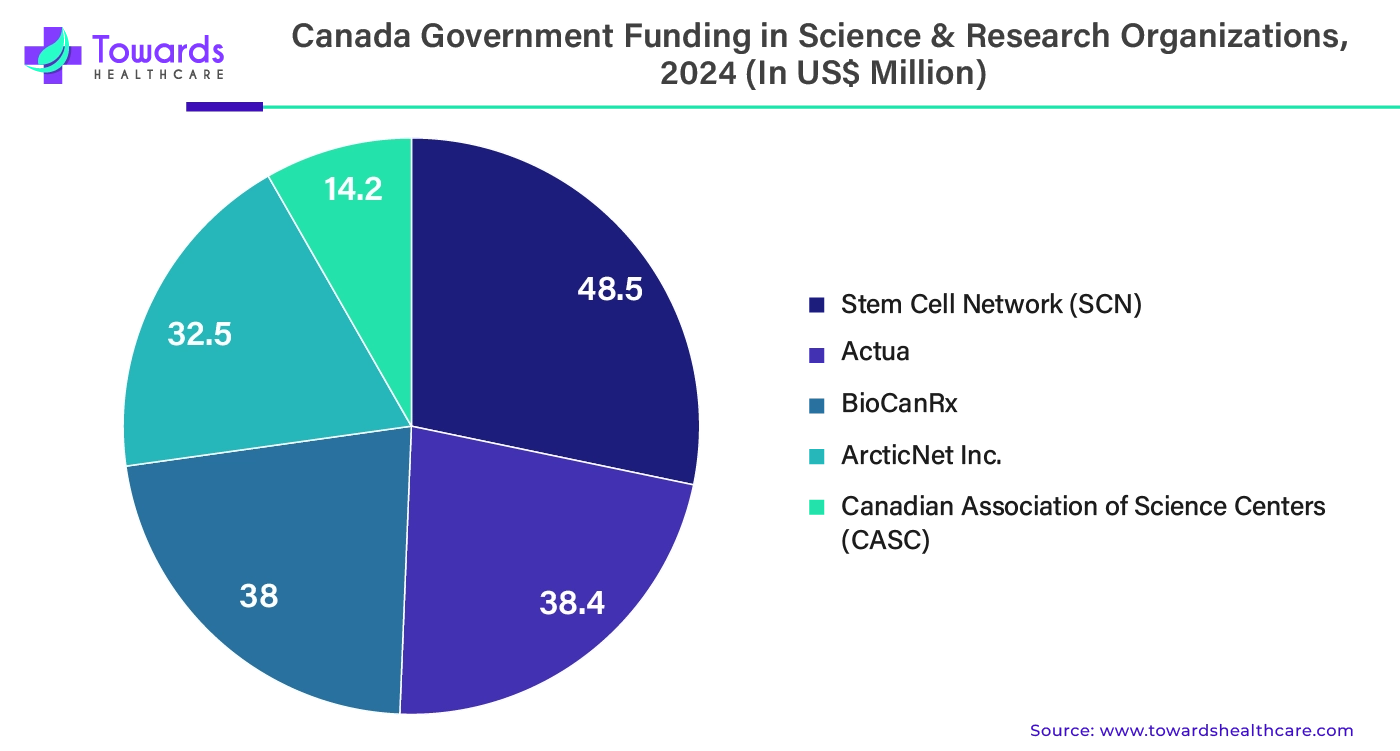

In order to guarantee that Canada stays at the forefront of innovation and research into new technologies, the government of Canada is committed to investing in these areas. The Strategic Science Fund provides up to $171.6 million in support for independent scientific and research institutions, as announced by the Minister of Health. As announced in December 2023, the money will assist five groups in Ottawa and was granted following a new open, merit-based, competitive procedure that was guided by the recommendations of an impartial expert review panel.

By region, Asia Pacific is expected to grow at a significant rate during the forecast period. Asia Pacific’s cell therapy market is growing due to multiple factors. One of the major factors is government initiatives. The governments of China, India, and Japan are majorly contributing to the market. To this date, various cell therapies have been approved in the Asia Pacific, which are listed in the table, and more research is going on to develop new cell therapies.

For instance,

Cell Therapy Market Trends in China

China is emerging as the fastest-growing market for cell therapy in the Asia-Pacific region, due to government support for developing local manufacturing capabilities and research infrastructure. Furthermore, China has launched several regulatory measures to facilitate the development of cell therapy products, including a dual-track regulatory framework, which has accelerated the growth of its cell therapy pipeline.

Cell Therapy Market Trends in India

The cell therapy market of India is experiencing strong growth due to a large patient pool, increasing awareness about the benefits of cell therapies, and rising healthcare expenditure. India has a growing number of advanced therapy centers, such as Tata Memorial Hospital, Rajiv Gandhi Cancer Institute and Research Centre, and clinical trials, demonstrating the potential for growth in the cell therapy market. For Instance, in May 2023, a U.S.-based company, StemCures, announced plans to set up a manufacturing lab focused on stem cell therapy in India.

| CAR-T Cell Therapies Approved in Asia | |||

| Brand | Manufacturer | Country | Year of Approval |

| Carvykti | Legend Biotech, J&J | Japan & South Korea | 2023 |

| Yuanruida (CNCT19) | JUVENTAS | China | 2023 |

| Carteyva | JW Therapeutics | China | 2021 |

| Fucaso | IASO BIO, Innovent | China | 2023 |

| Saikaize (Zevor-cel) | Carsgen Therapeutics | China | 2024 |

| Abecma | BMS, bluebird bio | Japan | 2022 |

| Breyanzi | BMS | Japan | 2021 |

| Yescarta | Kite Pharma, Fosun Kite | Japan & China | 2021 |

| Kymriah | Novartis | Japan, South Korea and Taiwan | 2021 |

India is becoming a hub of cancer due to smoking, environmental factors, and consumption of carcinogens. The lack of treatment options is leading to numerous cancer-related deaths. To Mitigate this, the Indian Government has taken various initiatives to utilize cell therapies for the treatment of cancer.

For instance,

| Cell and Gene Therapy R&D Projects Supported by Indian DBT from 2020-2024 | |

| Output | Number |

| Scientists Supported | 228 |

| Projects Supported | 144 |

| Manpower Supported | 307 |

| Publications | 105 |

| Patents Filed/Granted | 7 |

| Technologies/Products Developed | 6 |

| Workshop/Training Programs Organized | 5 |

Europe is considered to be a significantly growing area, due to the rising adoption of advanced technologies, increasing demand for personalized medicines, and favorable government support. Government bodies launch initiatives to promote the development and use of cell therapy. The burgeoning healthcare sector and the increasing healthcare expenditure contribute to market growth. The presence of key players and the rising investments by government and private organizations augment the market.

Cell Therapy Market Trends in the UK

In June 2025, the Royal Marsden Private Care became the first center in the UK to provide CAR-T cell therapy for the treatment of multiple myeloma. The UK government has established the UK Stem Cell Foundation to expedite the progress of promising stem cell research and technology.

The Middle East & Africa are expected to grow at a notable CAGR in the foreseeable future. The rising prevalence of genetic and rare disorders, growing awareness of innovative therapeutics, and evolving regulatory landscapes govern market growth. Ongoing efforts are made to establish a suitable research and clinical trial infrastructure, supporting the development of cell therapy. Government and private bodies provide reimbursement for advanced treatment in the region.

Cell Therapy Market Trends in the UAE

The Center of Arab Genomic Studies estimates that about 2.8 million people are suffering from rare diseases in the UAE. In January 2025, the United Arab Emirates University inaugurated the Stem Cells Research Center in support of a nationwide effort to advance cutting-edge healthcare.

| Company Name | 2seventy Bio, Inc. |

| Headquarters | Massachusetts, U.S., North America |

| Recent Development | In April 2024, Regeneron Pharmaceuticals, Inc. completed the asset purchase agreement ("APA"), according to 2seventy Bio, Inc. As part of their recently created cell therapies business, Regeneron employed over 160 workers from 2seventy Bio and acquired all of their research and development initiatives related to autoimmune and cancer under the provisions of the American Psychological Association. Moving ahead, 2seventy Bio will work in tandem with their partner Bristol Myers Squibb (BMS) to exclusively concentrate on the marketing and development of Abecma (idecabtagene vicleucel), their BCMA-targeted CAR T cell treatment for multiple myeloma. |

| Company Name | Astellas Pharma Inc. |

| Headquarters | Tokyo, Japan, North America |

| Recent Development | In May 2024, to create unique convertibleCAR® projects by merging the state-of-the-art cell therapy platforms from both businesses, Astellas Pharma Inc. and Poseida Therapeutics, Inc. have formed a research partnership and licensing agreement. Poseida and Xyphos Biosciences, Inc., a fully owned subsidiary of Astellas, or "Xyphos," have established this arrangement. |

By Therapy Type

By Therapeutic Area

By Region

February 2026

February 2026

February 2026

January 2026