February 2026

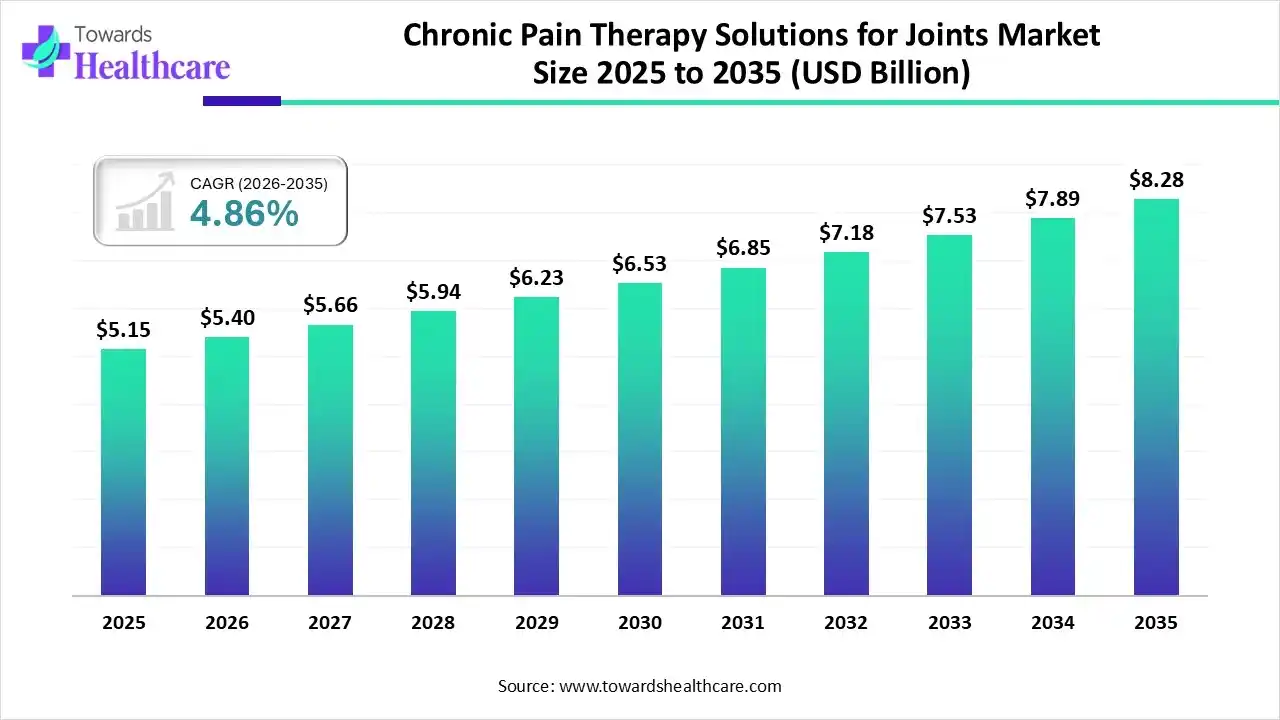

The global chronic pain therapy solutions for joints market size was estimated at USD 5.15 billion in 2025 and is predicted to increase from USD 5.4 billion in 2026 to approximately USD 8.28 billion by 2035, expanding at a CAGR of 4.86% from 2026 to 2035.

Around the globe, regions are facing a greater burden of a geriatric population, who are highly prone to various joint issues, like arthritis and chronic back pain. Also, to overcome the adverse effects of NSAIDs & opioids, companies are exploring advanced therapies, like PRP, stem cells, and also neuromodulation solutions.

Chronic pain therapy solutions for joints involve a multidisciplinary range of medical interventions, including pharmacological agents, minimally invasive injections, and neuromodulation devices. These solutions aim to alleviate persistent discomfort, reduce inflammation, and restore mobility in joints affected by degenerative conditions like osteoarthritis, rheumatoid arthritis, or long-term traumatic injuries.

The era is highly using AI solutions for different healthcare concerns, including wearable devices to monitor movement and adjust therapy parameters. For example, recently NXTSTIM EcoAI was rolled out by integrating Transcutaneous Electrical Nerve Stimulation (TENS) and Electrical Muscle Stimulation (EMS) with AI to facilitate adaptive pain relief. Also, AI algorithms assist in detecting clear earlier signs of joint erosion, cartilage thinning, or structural abnormalities (such as osteoarthritis) on X-rays and MRIs, as in DeepKnee.

Ongoing emergence of cytokine inhibitors & novel biologics is extensively targeting specific pain pathways, which provides excellent management of arthritis with minimal side effects.

The market is widely implementing advanced minimally invasive interventions, such as genicular artery embolization (GAE) to manage chronic knee osteoarthritis pain, & radiofrequency ablation used to read joint pain signals.

In the future, researchers will focus on peptide-siRNA conjugates, which are created to transfer small interfering RNAs (siRNAs) directly to joint cells to silence genes causing inflammation and pain.

| Key Elements | Scope |

| Market Size in 2026 | USD 5.4 Billion |

| Projected Market Size in 2035 | USD 8.28 Billion |

| CAGR (2026 - 2035) | 4.86% |

| Leading Region | North America |

| Market Segmentation | By Therapy Type, By Product, By Joint Type, By End-User, By Region |

| Top Key Players | Abbott Laboratories, Medtronic plc, Boston Scientific Corporation, Johnson & Johnson, Zimmer Biomet Holdings, Inc., Stryker Corporation, Sanofi S.A., Anika Therapeutics, Inc., Bioventus Inc., Pacira BioSciences, Inc. |

How did the Pharmacological (NSAIDs/Opioids) Segment Lead the Market in 2025?

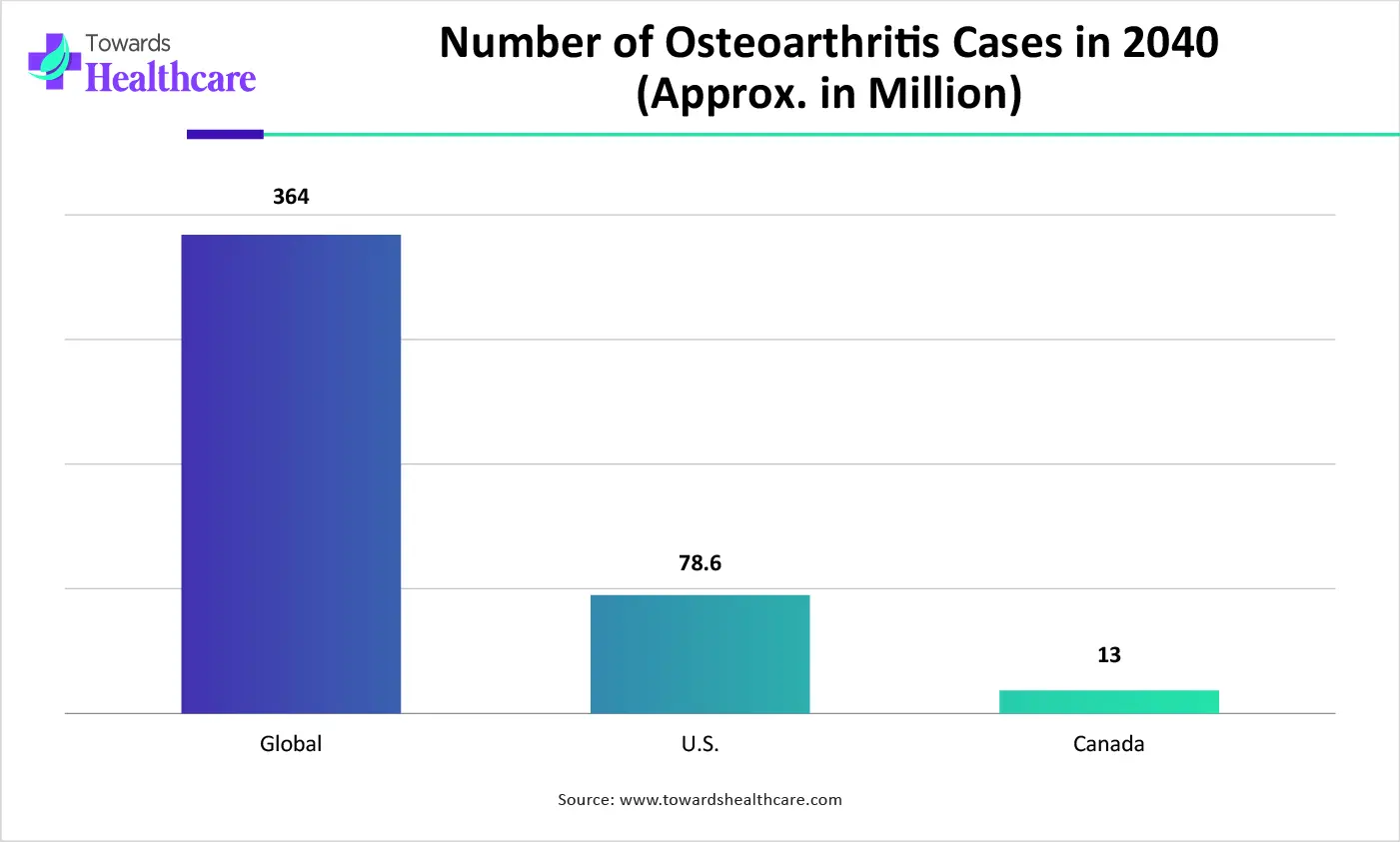

In 2025, the pharmacological (NSAIDs/opioids) segment captured nearly 53% share of the chronic pain therapy solutions for joints market. Its dominance is driven by a rise in the geriatric population and prevalence of various musculoskeletal disorders, like osteoarthritis & chronic back pain. Recent studies have shown that topical NSAIDs are as efficacious as oral NSAIDs for enhancing function in knee osteoarthritis.

Neuromodulation & Devices

The neuromodulation & devices segment will expand rapidly. The global adoption is primarily fueled by the surging preference for non-addictive, drug-free options. Emerging solutions in closed-loop systems, such as Medtronic’s Inceptiv is assisting in automatic adjustment of simulation based on real-time feedback. Recently, the FDA approved the SetPoint system for moderate-to-severe Rheumatoid Arthritis (RA), which is a small, implantable stimulator that functions on the vagus nerve in the neck.

Which Product Dominated the Chronic Pain Therapy Solutions for Joints Market in 2025?

The hyaluronic acid injections segment held nearly 42% share of the market in 2025. These products play a major role in mild to moderate osteoarthritis as a lubricant and shock absorber in the joint, finally lowering pain and boosting mobility. Firms are promoting high concentration & long-term solutions, like Linear HA, such as Biolevox HA ONE and advanced hybrid formulation, like Sinovial HL1. Researchers are stepping towards HA + corticosteroid combinations, HA + Platelet-Rich Plasma and new additives.

Regenerative Biologics (PRP/Stem Cell)

The regenerative biologics (PRP/stem cell) segment is predicted to expand fastest. Specifically, Leukocyte-poor PRP (LP-PRP) is often used for osteoarthritis, & Leukocyte-rich (LR-PRP) is preferred for tendon injuries. They facilitate longer-lasting pain relief (12–24 months) and raise functional results. Alongside, the globe is fostering stem cell-derived exosomes therapy, which modulates inflammation and bolsters tissue healing, & acts as a "cell-free" regenerative alternative. Certain companies are unveiling protein-enriched filtered PRP formulations and the broader adoption of allogeneic MSCs.

Why did the Knee Joints Segment Dominate the Market in 2025?

In 2025, the knee joints segment held approximately 55% share of the chronic pain therapy solutions for joints market. Key drivers are a booming ageing population & greater obesity rate, which leads to knee osteoarthritis and related joint injuries. These cases are highly shifting towards minimally invasive, joint-preserving, and regenerative solutions. Subchondroplasty is another solution, which targets bone marrow lesions & inject calcium phosphate to strengthen the bone and stimulate natural healing.

Shoulder & Small Joints

Moreover, the shoulder & small joints segment will witness rapid growth. The number of rotator cuff injuries, adhesive capsulitis, and dislocation/instability cases is boosting demand for new and advanced therapy solutions. A robust solution is 60-day peripheral nerve stimulation (PNS), which includes the use of a small, temporary wire to target the nerve to record pain signals. A recent innovation is Nav1.8 sodium channel blockers, like Journavx, which are non-opioid medication prominently block pain signals at peripheral nerves.

How did the Hospitals Segment Lead the Market in 2025?

The hospitals segment captured approximately 62% share of the market in 2025. They widely facilitate an integration of interventional procedures, advanced physical therapy, medication management, and, if required, surgical alternatives. Alongside, they possess trained pain specialists, rheumatologists, & orthopediststo to manage complex, long-term medication regimens. Alongside, hospitals are highly adopting advanced arthroscopy, arthroplasty and osteotomy.

Specialty Orthopedic Clinics

The specialty orthopedic clinics segment is estimated to expand rapidly. Clinics, like My Pain Clinic Global (Mumbai) is increasingly providing a multidisciplinary approach, which unites physiotherapy, rehabilitation, hyperbaric oxygen therapy (HBOT), & red-light therapy. Whereas, Max Healthcare & Axis Clinics are exploring robotic-assisted technologies for high-precision joint replacements and arthroscopy.

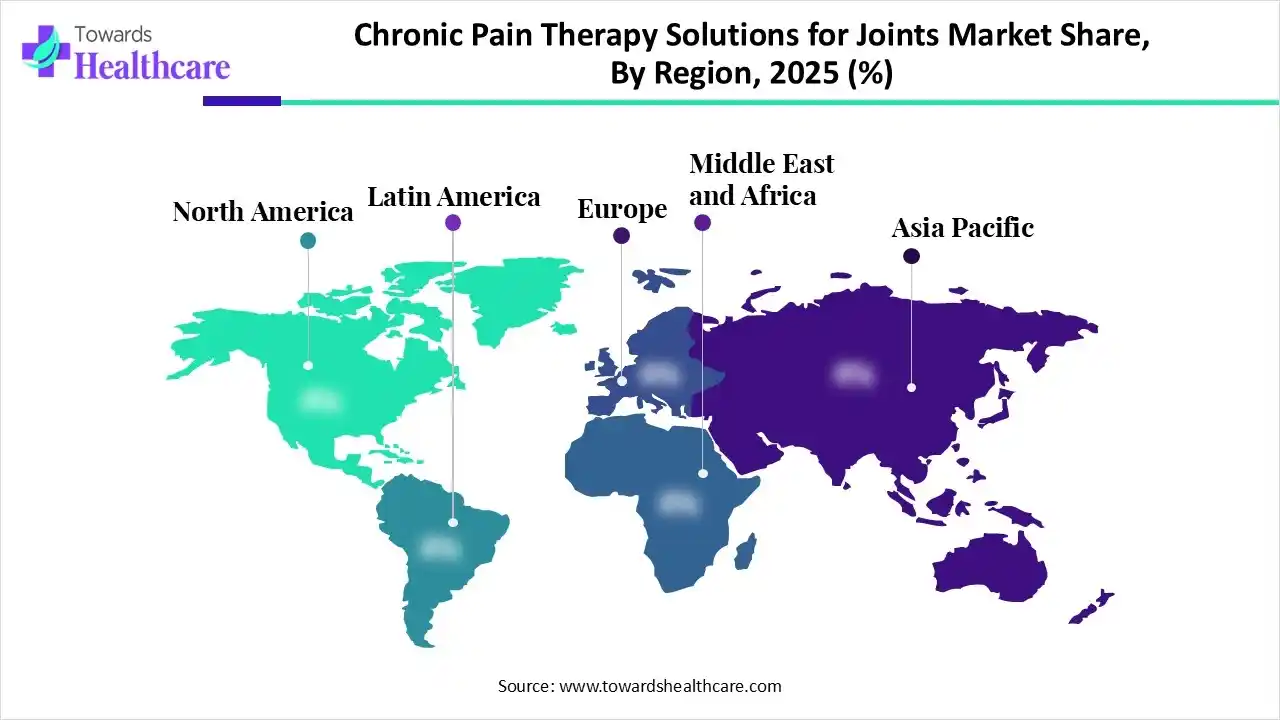

North America registered dominance with approximately 45% – 47% share of the market in 2025, due to increased prevalence of arthritis, advanced reimbursement frameworks for injectable therapies, and early adoption of neuromodulation for joint pain.

For instance,

U.S. Market Trends

The U.S. has been bolstering novel solutions, such as squishy artificial cartilage that releases anti-inflammatory drugs only when it senses raised acidity in the joint. Additionally, the FDA cleared the MISHA knee system, which helps the knee joint to keep the natural joint intact.

Asia Pacific is anticipated to witness rapid expansion in the chronic pain therapy solutions for joints market. APAC countries are widely fostering advancements in healthcare infrastructure, and the region is highly demanding hyaluronic acid injections for knee osteoarthritis, which are developed by firms like LG Chem, Seikagaku Corporation, and Bioventus LLC.

For instance,

China Market Trends

Chinese researchers are putting efforts into the progression of new drug delivery systems, which comprise dual drug hydrogel. This has been designed by Northwest University, which unites anti-inflammatory drugs, like dexamethasone & tissue-repair agents, such as kartogenin, to treat knee osteoarthritis.

| Company | Description |

| Abbott Laboratories | They usually explore various advanced implantable neuromodulation devices, as well as topical and oral pharmaceutical products. |

| Medtronic plc | It unveiled variations in Sacroiliac (SI) Joint Fusion, Kyphoplasty, and Radiofrequency (RF) Ablation, etc. |

| Boston Scientific Corporation | This mainly provides specialized interventional therapies to treat chronic joint pain. |

| Johnson & Johnson | It facilitates solutions through its DePuy Synthes MedTech division and novel medicine portfolio. |

| Zimmer Biomet Holdings, Inc. | This specialises in non-surgical to robotic-assisted surgical solutions, including restorative therapies, biologics, and surgical reconstruction |

| Stryker Corporation | A firm focuses on radiofrequency ablation, vertebral augmentation, and joint reconstruction technologies. |

| Sanofi S.A. | It plays a major role in developing viscosupplementation for knee osteoarthritis (OA). |

| Anika Therapeutics, Inc. | This company offers solutions for chronic joint pain through its proprietary hyaluronic acid (HA) technology. |

| Bioventus Inc. | It facilitates non-surgical hyaluronic acid (HA) injections for osteoarthritis (OA) & peripheral nerve stimulation (PNS) for nerve-related chronic pain. |

| Pacira BioSciences, Inc | This introduced several non-opioid, targeted therapies to manage chronic joint pain, like ZILRETTA, iovera, etc. |

By Therapy Type

By Product

By Joint Type

By End-User

By Region

February 2026

January 2026

January 2026

January 2026