October 2025

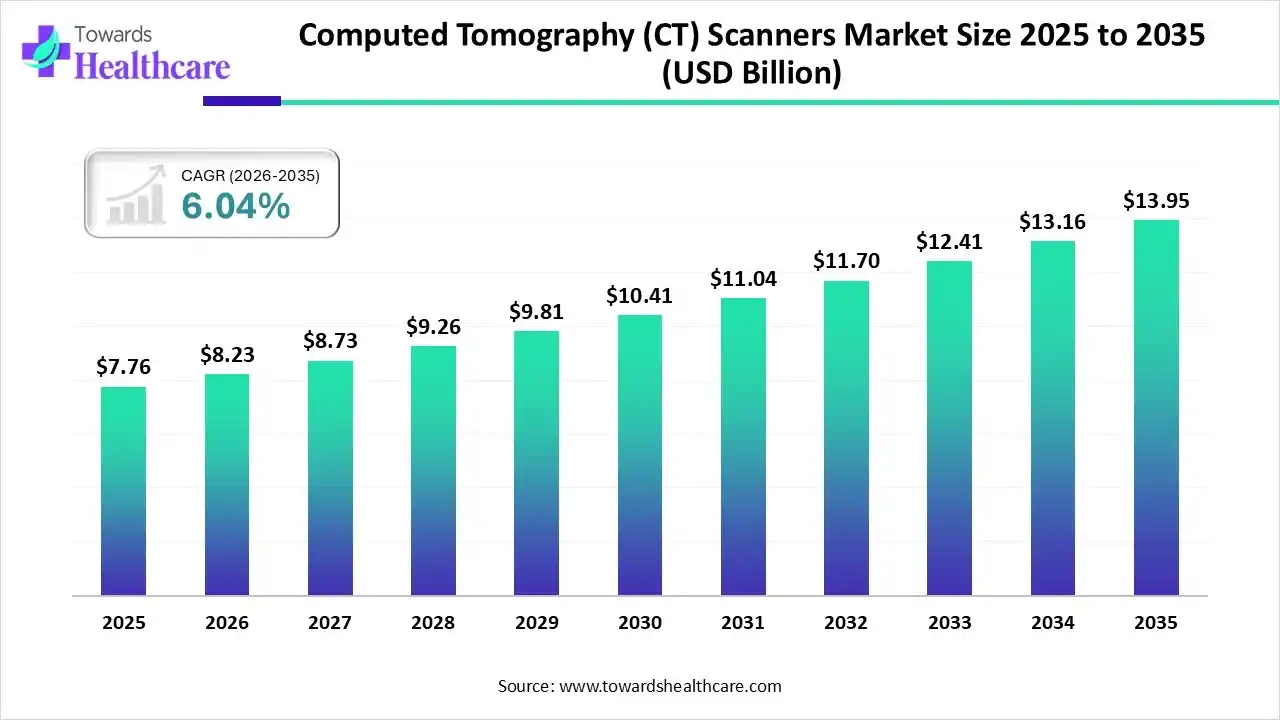

The global computed tomography (CT) scanners market size was estimated at USD 7.76 billion in 2025 and is predicted to increase from USD 8.23 billion in 2026 to approximately USD 13.95 billion by 2035, expanding at a CAGR of 6.04% from 2026 to 2035.

The growing chronic disease burden globally is increasing the demand for CT scanners for their early and accurate detection. The companies are also focusing on integrating AI technologies to enhance their features, where the growing funding and investments are leading to new launches. The expanding healthcare, growing health awareness, and innovations are driving their demand across various regions, promoting the market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 8.23 Billion |

| Projected Market Size in 2035 | USD 13.95 Billion |

| CAGR (2026 - 2035) | 6.04% |

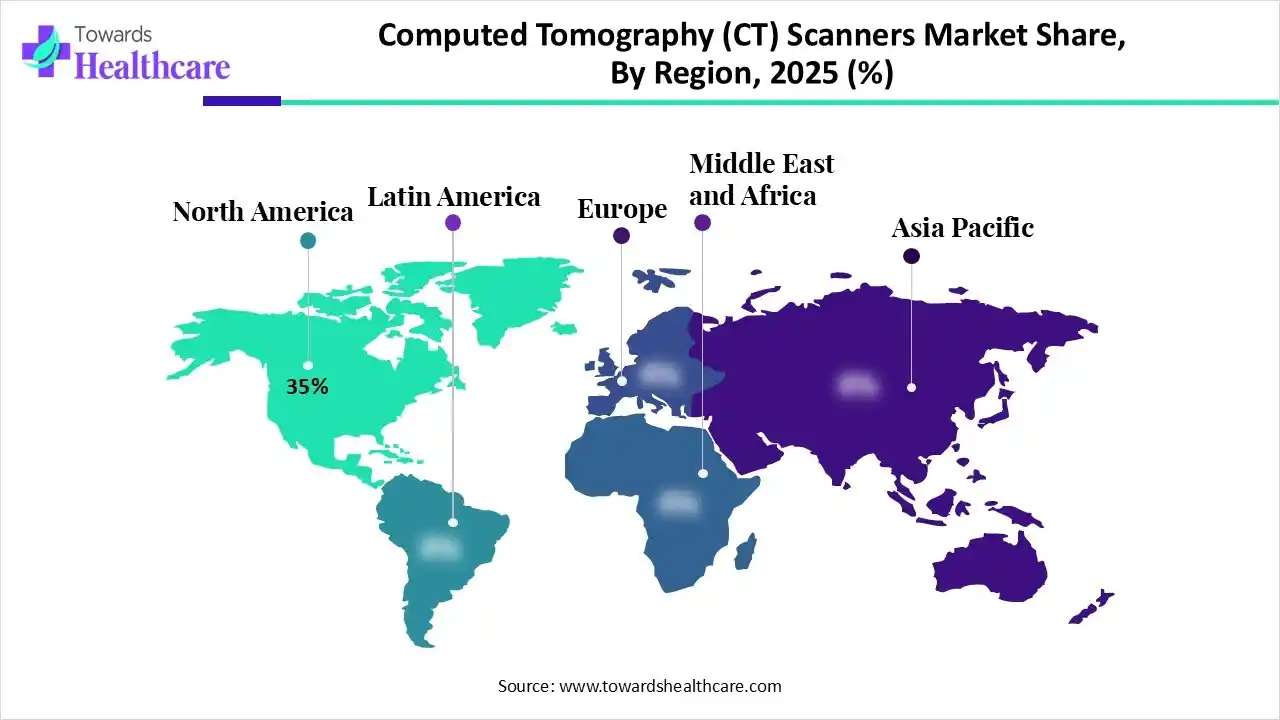

| Leading Region | North America by 35% |

| Market Segmentation | By Product Type, By Deployment Type, By Application, By End-User, By Region |

| Top Key Players | Siemens Healthineers, GE Healthcare, Philips Healthcare, Hitachi Medical Corporation, Fujifilm Holdings Corporation, Samsung Medison, Shimadzu Corporation, Neusoft Medical Systems, United Imaging Healthcare, Planmeca Oy |

The computed tomography (CT) scanners market is driven by increasing chronic diseases and technological advancements. The computed tomography (CT) scanners refer to medical imaging systems that use X-ray technology to produce cross-sectional and 3D images of the body for diagnostic purposes. CT scanners are widely used in hospitals, diagnostic centers, and research institutes for detecting and monitoring diseases, including cancer, cardiovascular disorders, neurological conditions, and musculoskeletal injuries.

The use of AI in the computed tomography (CT) scanners market is increasing as it is being integrated with the CT scanners to enhance the imaging quality and resolution. They also offer faster imaging, which helps in providing quantitative analysis, which increases their use in the treatment planning and personalized medicine development. Moreover, their automated and accurate imaging decreases human errors, which encourages their use.

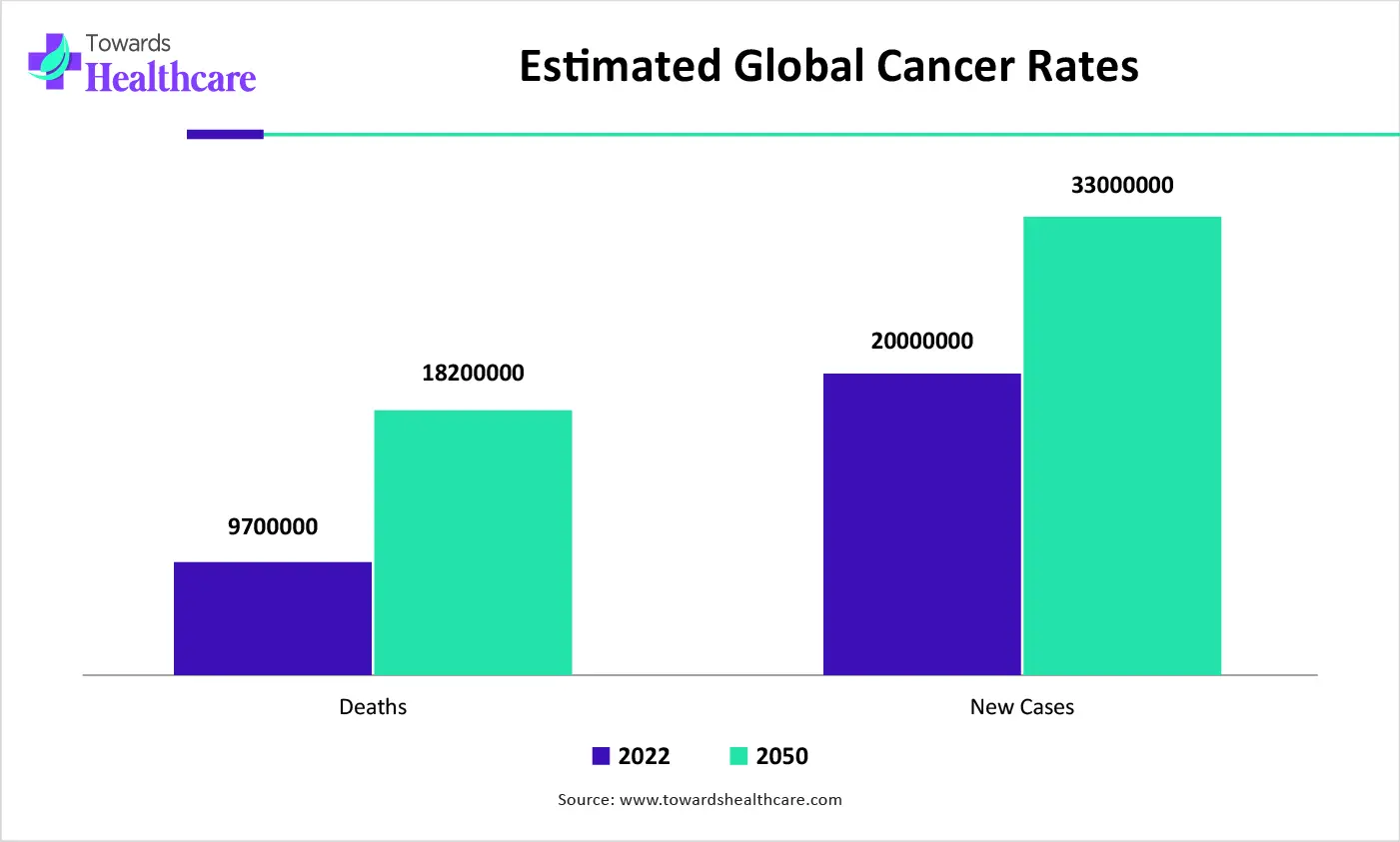

The growing incidence of diseases like cancer, Alzheimer’s disease, and cardiovascular diseases acts as the major factor driving the computed tomography (CT) scanners market, for their early and accurate detection.

The companies are focused on enhancing various features and applications of the CT scanners, which are promoting the development of the AI-assisted imaging solutions, spectral CT scanners, portable scanners, and cloud-based platforms.

The growing demand for personalized therapeutics is increasing the use of CT scanners for treatment planning or monitoring the response to the therapies.

| Years | Cancer deaths worldwide | Cancer new cases worldwide |

| 2022 | 9.7 million | 20 million |

| 2050 | 18.2 million | 33 million |

Why Did the Conventional CT Scanners Segment Dominate in the Market in 2025?

The conventional CT scanners segment held the largest share of 40% in the computed tomography (CT) scanners market in 2025, due to their established technology, which provided reliable results. Moreover, their enhanced availability and ease of use also increased their use in a wide range of applications.

Cone Beam CT (CBCT)

The cone beam CT (CBCT) segment is expected to show the highest growth during the predicted time, driven by its lower radiation dose. They also offer faster scans and are portable, which is increasing their demand. Furthermore, their high-resolution 3D imaging is also increasing their adoption rates.

How the On-Premise Segment Dominated the Market in 2025?

The on-premise segment led the computed tomography (CT) scanners market with a 65% share in 2025, as they offered data security. This, in turn, increased their use across various hospitals and clinics. Additionally, their regular updates and integration with other systems also promoted their use.

Cloud-Based/Remote Viewing Platforms

The cloud-based/remote viewing platforms segment is expected to show the fastest growth rate during the predicted time, as they offer remote monitoring. At the same time, they also provide enhanced scalability and affordability, where their advanced analytics feature and security are also increasing their demand.

Which Application Type Segment Held the Dominating Share of the Market in 2025?

The oncology/cancer diagnostics segment held the dominating share of 25% in the computed tomography (CT) scanners market in 2025, due to growth in cancer incidence rates. This increased the use of CT scanners for early diagnosis. Moreover, they were also used during their treatment planning.

Neurological Imaging

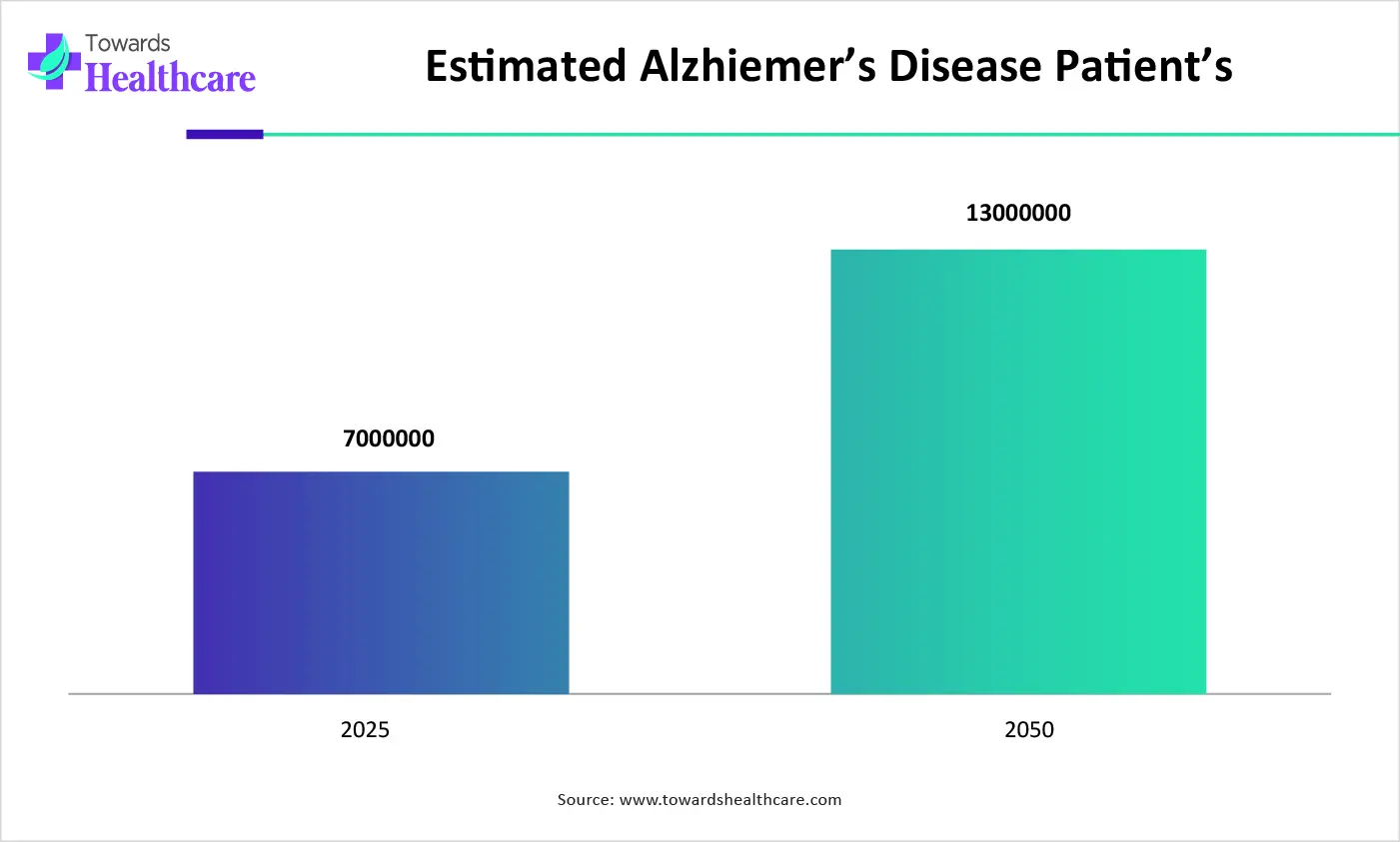

The neurological imaging segment is expected to show the highest growth during the upcoming years, due to the growing geriatric population and increasing incidences of brain injuries and Alzheimer’s disease. This is increasing the demand for CT scanners for their accurate and faster detection.

What Made Hospitals & Medical Centers the Dominant Segment in the Market in 2025?

The hospitals & medical centers segment led the computed tomography (CT) scanners market with a 60% share in 2025, due to the high patient volumes. The presence of specialized staff also increased the use of CT scanners for various applications, which enhanced the patient outcomes.

Diagnostic Imaging Centers

The diagnostic imaging centers segment is expected to show the fastest growth rate during the upcoming years, due to growing outpatient imaging. They also offer advanced CT scanners, which are attracting patients. Similarly, their lower wait time and affordable services are also increasing their preference.

North America dominated the computed tomography (CT) scanners market with 35% in 2025, due to the presence of advanced industries. At the same time, the growth in healthcare investments and the presence of advanced healthcare infrastructure also increased their use. Moreover, the growing cancer cases and neurological diseases also increased their adoption rate, which contributed to the market growth.

| Years | American Alzheimer's Patients |

| 2025 | 7 million |

| 2050 | 13 million |

The U.S. consists of high healthcare investments, which are being used in the adoption of advanced CT scanners. The companies are also developing multi-slice and AI-powered CT scanners, which are promoting their clinical trials. Furthermore, the presence of reimbursement policies and growing diseases is also increasing their use.

Asia Pacific is expected to host the fastest-growing computed tomography (CT) scanners market during the forecast period, due to the expanding healthcare sector. The growing incidence of chronic diseases is also increasing the adoption of CT scanners for early diagnosis. Furthermore, the industries are developing advanced solutions, which are leading to new collaborations among them, enhancing the market growth.

Due to growth in healthcare investments, the adoption of advanced CT scanners is increasing in China. Moreover, it also consists of a large population, which increases the risk of disease incidence, driving the demand for these scanners. Additionally, increasing medical tourism is also increasing the adoption of advanced CT scanners.

Europe is expected to grow significantly in the computed tomography (CT) scanners market during the forecast period, due to the presence of robust healthcare systems. This, in turn, increased the use of CT scanners for the detection of various chronic diseases. Moreover, the growing geriatric population and innovations are also increasing their use and availability, which is promoting the market growth.

The growing health awareness in the UK is increasing the use of CT scanners for early disease diagnosis. At the same time, the hospital and clinics, along with diagnostic centres, are utilizing their services for the detection of a wide range of diseases. The growing government support is also increasing their use, as well as innovations.

| Companies | Headquarters | CT Scanners |

| Siemens Healthineers | Erlangen, Germany | Somatom go. Top, Somatom Go Now, and Definition AS |

| GE Healthcare | Chicago, U.S. | Optima 520, Brivo 325 Dual Slice, etc. |

| Philips Healthcare | Amsterdam, Netherlands | Ingenuity CT, Incisive CT, and Access CT |

| Canon Medical Systems | Tochigi, Japan | Aquilion ONE series, Aquilion Prime SP, and Aquilion Precision |

| Hitachi Medical Corporation | Tokyo, Japan | Primus, SCENARIA series, and Supria series |

| Fujifilm Holdings Corporation | Tokyo, Japan | FCT Speedia and FCT iStream |

| Samsung Medison | Gyeonggi-do, South Korea | BodyTom and NExCT 700 |

| Shimadzu Corporation | Kyoto, Japan | MobileDaRt Evolution MX8 and FLEXAVISION |

| Neusoft Medical Systems | Shenyang, China | NeuViz series and NeuSight PET/CT systems |

| United Imaging Healthcare | Shanghai, China | uCT 780, uMI 550, and uCT 710 |

| Planmeca Oy | Helsinki, Finland | Cone Beam CT systems |

By Product Type

By Deployment Type

By Application

By End-User

By Region

October 2025

November 2025

November 2025