January 2026

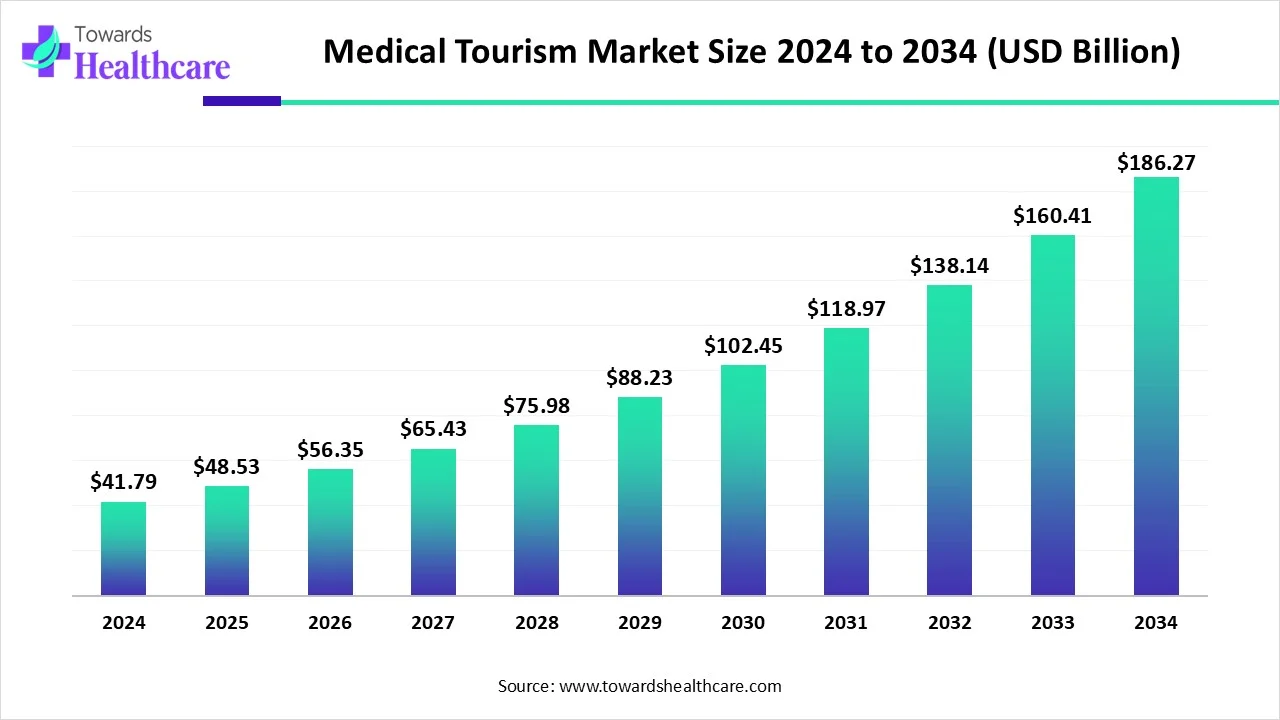

The global medical tourism market size is calculated at USD 41.79 in 2024, grew to USD 48.53 billion in 2025, and is projected to reach around USD 186.27 billion by 2034. The market is expanding at a CAGR of 16.12% between 2025 and 2034.

Around the world, medical tourism, also known as health tourism, is a massive and rapidly expanding industry. People who travel abroad for medical treatment are referred to as medical tourists, or health tourists. Due to the recent exponential rise in healthcare costs, medical tourism—the practice of people in rich nations traveling to less developed nations to acquire affordable medical treatment—has begun to gain traction. Indeed, medical tourism is a desirable alternative for those who lack insurance or have inadequate insurance, as well as for those who have reached their home country's insurance coverage limit, since patients from nations without universal health care can frequently save thousands of dollars on medical treatments by traveling overseas.

| Metric | Details |

| Market Size in 2024 | USD 41.79 Billion |

| Projected Market Size in 2034 | USD 186.27 Billion |

| CAGR (2025 - 2034) | 16.12% |

| Leading Region | North America |

| Market Segmentation | By Treatment Type, By Service Provider, By Region |

| Top Key Players | MOHW Hengchun Tourism Hospital, Apollo Hospitals Enterprise Ltd., Bumrungrad International Hospital, Mount Elizabeth Hospitals, Raffles Medical Group, Dr. B. L. Kapur Memorial Hospital, Kasemrad Hospital International Rattanathibet, Mission Hospital, Bangkok Hospital, Miot Hospital, Penang Adventist Hospital |

Among the main advantages of incorporating AI into the medical tourism sector is the potential to optimize administrative procedures. Conventional administrative duties like making appointments, billing, and filing insurance claims may frequently be laborious and prone to mistakes made by people. Medical tourism providers may automate these procedures and achieve faster and more accurate transactions by leveraging AI-powered platforms. Because AI algorithms can handle and analyze vast volumes of data fast, there is less chance of errors or delays, and all relevant paperwork is in order.

Rising Healthcare Costs

It is believed that the expense of healthcare in wealthy countries has been rising recently. More people feel compelled to get their medical treatments done abroad when the cost of these operations and treatments rises in their own countries. As a result, they embark on a quest to find locations with more dependable and affordable operations. Here, medical tourism contributes to the provision of an alluring alternative with effective services that are quite costly in many of these industrialized nations.

Legal and Ethical Issues

The laws and moral principles governing medical operations differ from one nation to the next. The legality of clinical malpractice allegations, the availability of legal redress, and recipient rights can all provide challenges. In certain cases, treatments that are safe and acceptable in one country could be prohibited or viewed as immoral in another.

Technological Advancements

The medical tourism market is undergoing a transformation due to technological developments. Significant advancements have been made in the industry in recent years in fields including virtual reality, robotic surgery, and telemedicine. By using telemedicine, patients may consult with doctors from a distance, doing away with the need to physically go. Surgeons may now execute intricate treatments with more accuracy and less invasiveness thanks to robotic surgery. Because it offers a more engaging and dynamic experience, virtual reality is being used for patient education and pre-operative preparation.

By treatment type, the cosmetic segment held the largest share of the medical tourism market in 2024. The phenomenon of cosmetic surgery tourism is driven by cost and has grown more rapidly in the last ten years. Companies that provide all-inclusive holiday packages that involve cosmetic surgery are becoming more and more common worldwide, and they are easily found online. The Dominican Republic, Malaysia, Mexico, the Philippines, South Africa, Poland, Argentina, Brazil, Costa Rica, and Thailand are also well-liked travel locations for cosmetic surgery.

By treatment type, the infertility segment is estimated to grow at the fastest CAGR in the medical tourism market during the forecast period. According to a new WHO research released today, many people will experience infertility at some point in their lives. Infertility affects around 1 in 6 adults globally, or 17.5% of the total population. India is a popular destination for IVF tourism because of its top-notch facilities, reasonably priced treatments, state-of-the-art equipment administered by skilled professionals, and excellent success rates.

By service provider, the private segment held the major share of the medical tourism market and is estimated to grow at the fastest rate during 2025-2034. In mixed health systems, the private health sector is becoming more and more recognized. The patient-centric approach to care is also being emphasized by private service providers. This enhances the entire patient experience by providing more individualized services, cutting down on wait times for appointments, and paying closer attention to each patient's needs. Luxurious lodgings and services are also offered by a number of private medical institutions in medical tourism locations. For medical tourists undergoing treatments, this emphasis on comfort and a cheerful atmosphere is also making the experience more enjoyable.

North America dominated the medical tourism market in 2024 due in significant part to aesthetic tastes, beauty standards, and lifestyle choices, the area has a strong demand for elective and cosmetic operations. In order to obtain reasonably priced and excellent care overseas, patients pursuing dental work, reproductive treatments, cosmetic surgery, or weight reduction surgery may choose medical tourism. Patients looking for elective operations or aesthetic upgrades are drawn to medical tourism locations because they provide full cosmetic packages, cutting-edge facilities, and skilled doctors.

In comparison to December 2023, foreign visitors spent a record $22.3 billion in December on travel to and tourism-related activities in the United States, an almost 10 percent increase. Together with all spending by border, seasonal, and other temporary workers in the United States, educational and health-related tourism expenditures came to $6.3 billion in December 2024 (up from $5.7 billion in December 2023), a more than 10-percent increase over the previous year. In December 2024, 28 percent of U.S. travel and tourism exports were related to medical tourism, education, and short-term worker spending.

Canada, a country renowned for its breathtaking scenery and excellent quality of life, has been quietly making a name for itself as a respectable medical tourism destination. With one of the greatest healthcare systems in the world, Canada promises medical tourists cutting-edge, high-quality services frequently for a fraction of the price of other industrialized nations. In addition to its medical accomplishments, Canada is renowned for its strict healthcare laws, cutting-edge medical facilities, and highly qualified medical personnel.

Asia Pacific is estimated to host the fastest-growing medical tourism market during the forecast period, driven by a number of elements that make the area a desirable location for medical treatment. Cost-benefit is one of the main motivators since medical care in places like Malaysia, Thailand, and India is far less expensive than in Western countries without sacrificing quality. The area also has top-notch healthcare facilities approved by international organizations and highly qualified medical personnel. The attractiveness is further increased by cutting-edge medical treatments and technology, as well as decreased procedure wait times. Government programs and regulations that increase the revenue from the medical tourism industry, such as expedited visa procedures and marketing campaigns, are also quite important.

The second-largest economy and most populous nation in the world, China, has been causing a stir in the global healthcare sector. The country has made significant investments in medical technology and infrastructure over the last few decades, making it a rising star in the medical tourism industry. China draws people from all over the world who are looking for a range of therapies because of its distinctive fusion of modern medical technology and traditional Chinese medicine. China provides a wide range of healthcare services at affordable costs, including cutting-edge cancer treatments and holistic wellness initiatives.

According to UNWTO forecasts, foreign arrivals reached 1,300 million in 2023, a 33.3% increase from 2022, indicating a substantial revival in global tourism. As the recovery progresses, 9.52 million FTAs were recorded in 2023, up 47.89% from 2022 (6.44 million) and reaching 87.09% of prepandemic levels. Additionally, the number of non-resident Indian (NRI) arrivals increased to 9.38 million in 2023, up 18.9% from 2022 and 34.38% above pre-pandemic levels. The highest percentage of FTAs came from South Asia (29.02%), followed by Western Europe (20.40%) and North America (21.82%). Bangladesh, the United States, the United Kingdom, Australia, Canada, Sri Lanka, Malaysia, Germany, Nepal, and France were the top 10 source markets, making up 70.06% of all free trade agreements.

December saw the highest number of arrivals (1.10 million, 11.5%), showing a high demand for winter vacations. Following the start of the recovery, 9.52 million FTAs were registered in 2023, up 47.89% from 2022 (6.44 million) and reaching 87.09% of prepandemic levels. In 2023, non-resident Indian (NRI) arrivals also increased to 9.38 million, up 18.9% from 2022 and 34.38% over pre-pandemic levels. FTAs were mostly supplied by South Asia (29.02%), North America (21.82%), and Western Europe (20.40%). Bangladesh, the US, the UK, Australia, Canada, Sri Lanka, Malaysia, Germany, Nepal, and France were the top 10 source markets, constituting 70.06% of all free trade agreements. December saw the highest number of arrivals (1.10 million, 11.5%), showing a high demand for winter vacations.

Europe is expected to grow significantly in the medical tourism market during the forecast period. It is already well-known for being a prestigious destination for medical tourism. The region's strong medical standards, affordable airfares, stable governments, and competitive treatment costs have all contributed to the growth of the medical tourism industry. The medical facilities in this area have an exceptional and extensive portfolio that provides the market with a wealth of possibilities at affordable costs. Furthermore, the growing healthcare infrastructure in nations like the UK and France for medical tourists has made Europe the industry leader.

Estimates range from 150,000 to 250,000 each year for medical/surgical procedures or health and wellness-related reasons in Germany. There is no doubt among experts that the number of medical tourists is increasing. High-end spas, wellness resorts, and rehabilitation facilities may be found in Germany; many of these establishments have been providing care and healing for hundreds of years. Therefore, it should come as no surprise that a large number of the millions of visitors who go to Germany each year would make use of the wellness resorts, health spas, and therapeutic baths that provide a wide range of services.

England, Scotland, Wales, and Northern Ireland make up the United Kingdom (UK), which is renowned across the world for its excellent healthcare. The UK has established itself as a top medical tourism destination thanks to its extensive history of medical research, innovation, and a strong National Health Service (NHS). Although the NHS mostly provides care for citizens of the United Kingdom, the private healthcare industry has attracted a lot of interest because of its high-end services, state-of-the-art equipment, and highly qualified medical personnel. Medical tourists frequently go to the UK in search of specialist surgeries and treatments that are either unavailable or have lengthy waiting lists back home.

Latin America is considered to be a significantly growing area, due to robust healthcare infrastructure and the presence of skilled professionals. The availability of low-cost treatment options also attracts numerous tourists from around the globe. Countries like Costa Rica, Colombia, Panama, Brazil, and Mexico are major tourist destinations for medical tourism. Some countries are near the U.S., thereby reducing the time and costs for Americans. Advancements in medical technologies through medical research and innovation also support the market.

It is estimated that the medical tourism cost accounts for 30% to 70% less in Mexico, compared to the U.S. and Canada. More than 1.4 to 3 million people travel every year to Mexico for advanced treatments at lower prices, making it the second most popular destination for medical tourism globally. Mexico primarily offers expertise in dental and cosmetic surgery.

Brazil offers state-of-the-art treatments for plastic surgery, dentistry, and wellness therapies. It is considered to be the cosmetic surgery capital of Latin America, due to the presence of skilled professionals and advanced equipment. Apart from this, it also provides medical services in cardiology and oncology.

The Middle East & Africa are expected to grow at a considerable rate in the medical tourism market in the upcoming period. The increasing awareness among the people of the burgeoning medical tourism sector in the Middle East & Africa boosts the market. Middle Eastern countries like Bahrain, Cyprus, Egypt, Iran, and Israel are some of the emerging countries offering advanced medical services. The availability of cost-effective medical treatments compared to Western countries has gained people’s attention.

The UAE has positioned itself as a global hub for medical tourism. The UAE has launched several medical tourism portals to enable international medical tourists to book procedures and access tourism services, such as direct contact with healthcare providers, visa issuance, booking appointments, and other recreational activities.

Medical and wellness tourism in Saudi Arabia is rapidly expanding with favorable government initiatives and support. Projects like the Red Sea Project and AMAALA aim to support medical and wellness tourism in Saudi Arabia, which also includes specialized healthcare centers. AMAALA creates a new concept of luxury domestic and international tourism focused on relaxation, health, and wellness.

In August 2024, acting Assistant Undersecretary for Support Services Sector, Chief Innovation Officer at the Ministry of Finance, and MBRIF representative Fatima Yousif Alnaqbi commented on the launch, saying, We are happy to support innovative initiatives that help to solidify the UAE's position as a global center of excellence. The success of an idea backed by our idea Accelerator program always fills us with immense joy. In addition to highlighting the significance of such programs, the launch of HealthStay.io, which provides solutions to improve the medical tourism experience in our nation, also highlights the priceless contribution a customized accelerator can make to our innovation ecosystem to boost our economy.

By Treatment Type

By Service Provider

By Region

January 2026

January 2026

January 2026

December 2025