December 2025

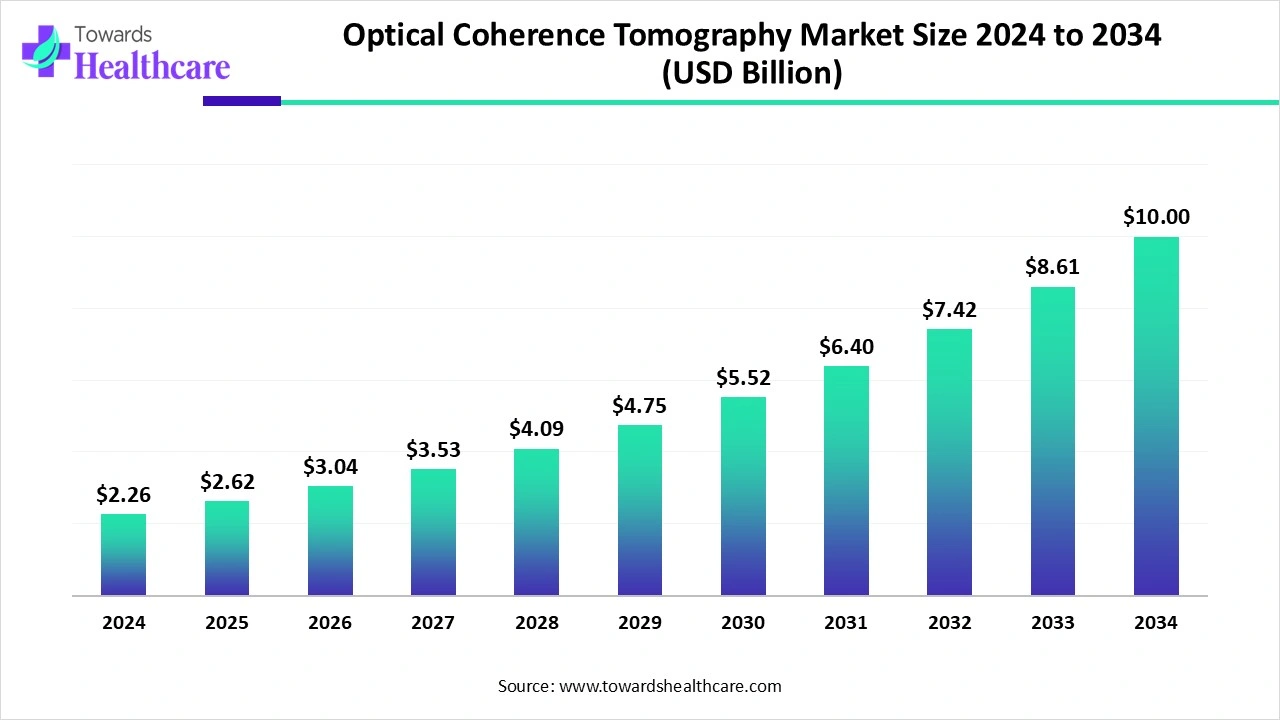

The global optical coherence tomography market size was estimated at US$ 2.26 billion in 2024, projected to increase to US$ 2.62 billion in 2025 and reach US$ 10 billion by 2034, showing a healthy CAGR of 15.97% across the forecast years.

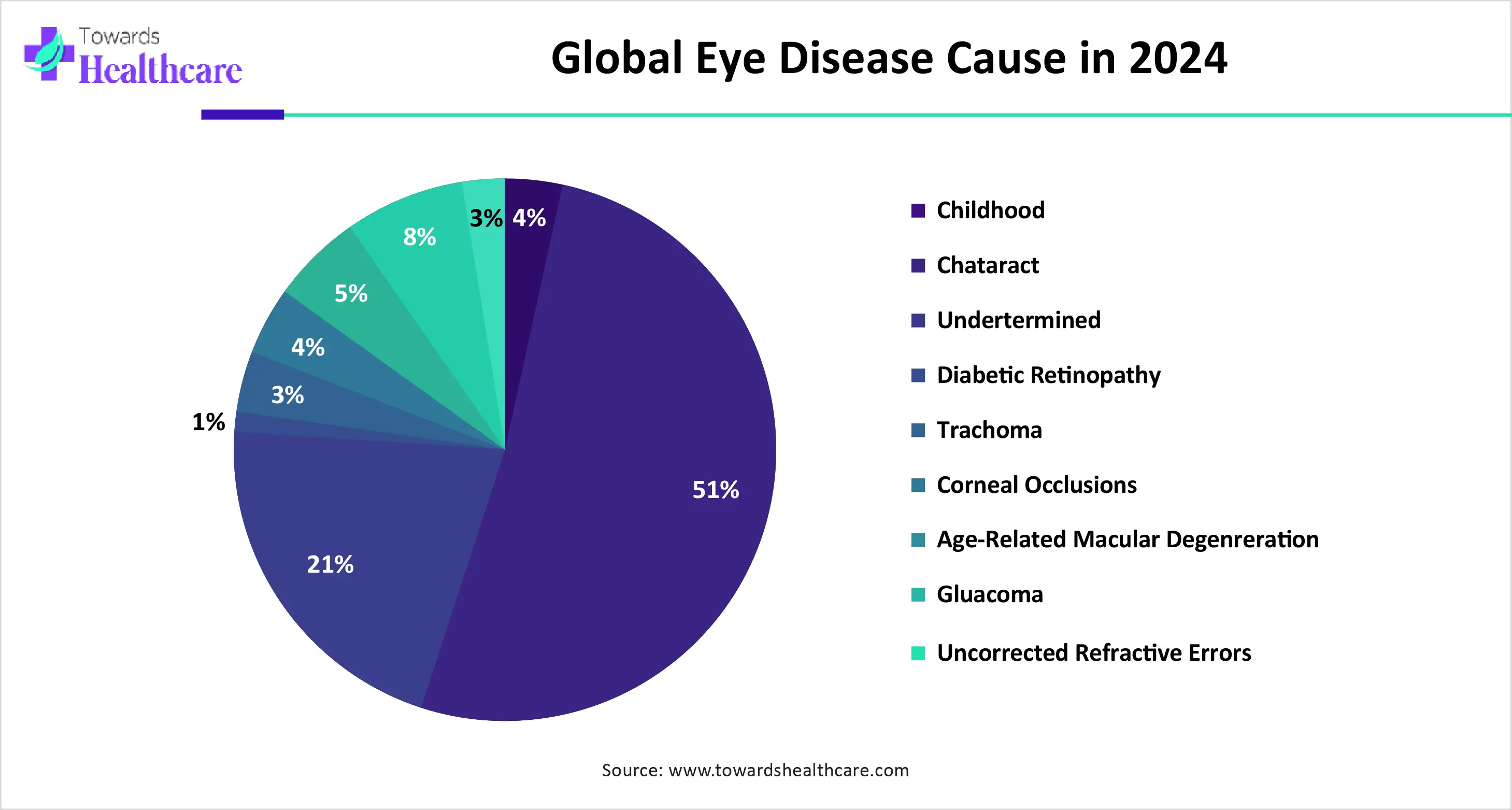

The optical coherence tomography market is experiencing strong growth driven by the rising prevalence of eye disorders such as glaucoma, age-related macular degeneration, and diabetic retinopathy, which are fueling the demand for advanced imaging solutions. Continuous technological advancements, including portable OCT devices, higher-resolution imaging, and AI-based diagnostic integration, are enhancing clinical efficiency and broadening applications beyond ophthalmology into cardiology, dermatology, and oncology. Increasing awareness about early disease detection, coupled with expanding healthcare infrastructure and specialist availability, is boosting adoption. Additionally, supportive reimbursement policies and strong research and development activities are further supports North America’s dominance in the market.

| Table | Scope |

| Market Size in 2025 | USD 2.62 Billion |

| Projected Market Size in 2034 | USD 10 Billion |

| CAGR (2025 - 2034) | 15.97% |

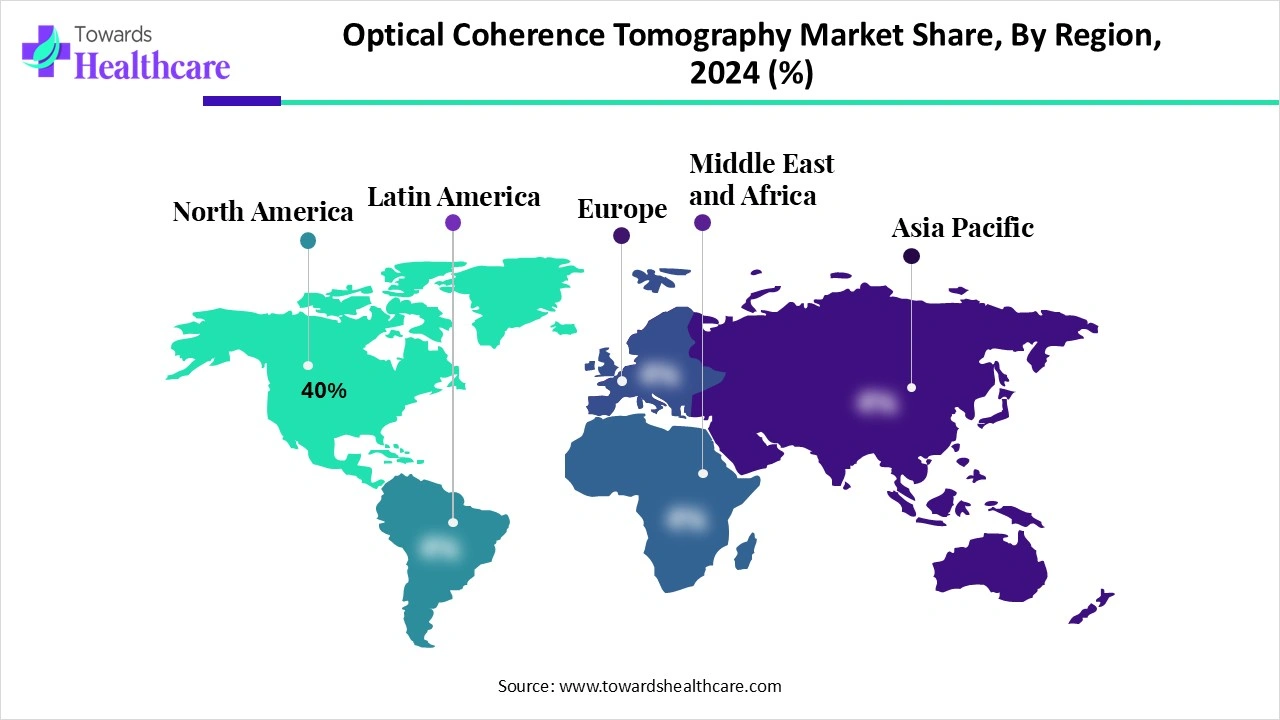

| Leading Region | North America Share 40% |

| Market Segmentation | By Clinical Application, By Product Type / Form Factor, By Technology / Imaging Modality, By End User / Buyer, By Component / Revenue Stream, By Deployment / Business Model, By Region |

| Top Key Players | Carl Zeiss Meditec, Heidelberg Engineering, Topcon Healthcare, Canon Medical Systems / Canon (Tomey & Canon ophthalmic units), NIDEK, Optovue, Haag-Streit, Leica Microsystems / Leica Ophthalmic, Thorlabs, Santec, Lumedica, Wasatch Photonics / OCT component suppliers, Abbott, Terumo, Boston Scientific, Philips |

Optical Coherence Tomography (OCT) is a non-invasive imaging technique that uses light waves to capture high-resolution, cross-sectional images of biological tissues. It is primarily used in ophthalmology to examine the retina and other structures of the eye, helping in the diagnosis and monitoring of conditions like glaucoma, age-related macular degeneration, and diabetic retinopathy. OCT works similarly to ultrasound imaging, but instead of sound, it uses light to measure the reflection from different tissue layers, producing detailed images that allow clinicians to detect abnormalities and track disease progression with precision.

Integration of AI and advancement in the tomography has driven the market. AI algorithms are increasingly being incorporated into OCT systems to enhance diagnostic accuracy, automate image analysis, and assist in disease detection, particularly in ophthalmology.

OCT technology is being explored for applications beyond ophthalmology, including dermatology, cardiology, and oncology, broadening its utility in medical diagnostics.

For instance,

The integration of Artificial Intelligence (AI) in the market is significantly enhancing diagnostic accuracy, efficiency, and clinical decision-making. AI-powered algorithms can automatically analyze OCT images, detecting subtle structural changes in the retina and other ocular tissues that may be missed by manual evaluation. This enables early diagnosis and timely intervention for conditions such as glaucoma, diabetic retinopathy, and age-related macular degeneration, improving patient outcomes. Moreover, AI integration reduces the workload of ophthalmologists by streamlining image interpretation, enabling faster results and more efficient clinic workflows.

Advanced AI tools can also predict disease progression and personalize treatment plans, supporting proactive healthcare strategies. Beyond ophthalmology, AI-enhanced OCT is being explored for applications in dermatology, cardiology, and oncology, further expanding its utility. Overall, AI integration is driving market growth by improving accuracy, workflow efficiency, and the potential for broader clinical applications in medical diagnostics.

Growing Prevalence of Ophthalmic & Chronic Disorders

Rising prevalence of ophthalmic and chronic disorders significantly fuels the growth of the optical coherence tomography market. As conditions like glaucoma and diabetic retinopathy become more widespread, the demand for early, precise, and non-invasive imaging systems such as OCT surges.

Meanwhile, in India, experts are sounding the alarm over a growing public health crisis: soaring rates of diabetic retinopathy tied to the rapid spread of diabetes, signaling an urgent need for regular screening and early diagnosis to avert irreversible vision loss.

As more patients develop conditions like glaucoma and DR, clinics increasingly adopt OCT systems for early detection and monitoring, bolstering demand.

The above graph shows that how growing prevalence of ophthalmic and chronic diseases are responsible for driving the growth of the optical coherence tomography market. Clinicians prefer OCT for its non-invasive, high-resolution imaging, making it a cornerstone in managing chronic eye diseases.

Need for Skilled Personnel & Limited Reimbursement Policies

The key players operating in the market are facing issue due to limited reimbursement policies and need for skilled personnel. Operation and interpretation require trained professionals, which may be scarce in some areas. Inadequate insurance coverage for OCT procedures reduces demand in certain countries. Challenges in imaging deeper tissues or specific ocular conditions restrict applicability.

Favorable Regulatory & Reimbursement Environment

A favorable regulatory and reimbursement environment plays a vital role in driving the growth of the optical coherence tomography market. Regulatory approvals from agencies such as the FDA or CE marking ensure that OCT devices meet safety and efficacy standards, fostering clinician trust and faster adoption. Additionally, the introduction of new CPT codes and reimbursement coverage for advanced OCT modalities, including OCT angiography, significantly reduces the financial burden on patients and encourages healthcare providers to integrate these technologies into routine practice. Broader insurance support also expands accessibility in both developed and emerging markets. Together, streamlined approval pathways and supportive reimbursement policies accelerate innovation, promote wider clinical adoption, and strengthen the overall market growth.

The ophthalmology segment dominates the optical coherence tomography market due to the high prevalence of eye disorders such as glaucoma, diabetic retinopathy, and age-related macular degeneration, which require accurate and early diagnosis. OCT provides non-invasive, high-resolution imaging of the retina, optic nerve, and other ocular structures, making it an essential diagnostic tool for ophthalmologists. Increasing awareness among patients and healthcare providers about the importance of early detection further drives adoption. Additionally, technological advancements in OCT devices, such as AI-assisted analysis and portable systems, enhance diagnostic efficiency and accuracy, solidifying ophthalmology as the leading clinical application segment in the market.

The cardiology segment is estimated to be the fastest-growing in the optical coherence tomography market due to the rising prevalence of cardiovascular diseases, including coronary artery disease and atherosclerosis, which require precise imaging for diagnosis and treatment planning. IV OCT provides high-resolution, cross-sectional images of blood vessels, enabling cardiologists to assess plaque composition, stent placement, and vessel morphology with greater accuracy than traditional imaging techniques. Technological advancements, such as real-time imaging and integration with interventional procedures, are enhancing clinical adoption. Additionally, increasing awareness of minimally invasive cardiovascular interventions and the benefits of early detection are fueling the rapid growth of this segment.

The desktop/table-top clinical OCT systems segment dominate the optical coherence tomography market due to their widespread use in hospitals, eye clinics, and specialized diagnostic centers. These systems offer high-resolution imaging, reliable performance, and the ability to handle a wide range of ophthalmic examinations, making them ideal for routine clinical diagnostics. Their ease of integration into existing clinical workflows and compatibility with various imaging modalities further enhance adoption. Additionally, healthcare providers prefer these systems for their durability, stability, and ability to support multiple patients efficiently. The combination of proven accuracy, versatility, and established clinical trust solidifies the dominance of desktop OCT systems.

The portable/handheld OCT devices segment is anticipated to be fastest-growing in the optical coherence tomography market due to its flexibility, mobility, and suitability for diverse clinical settings, including outpatient clinics, emergency departments, and remote or underserved areas. These devices support point-of-care diagnostics, offering rapid, high-resolution imaging for retinal, corneal, and anterior segment assessments, which enables timely intervention. Technological advancements, such as miniaturized optics, AI-assisted analysis, and wireless connectivity, enhance performance and usability. Rising prevalence of eye disorders, increasing patient awareness, and integration with teleophthalmology and digital health solutions further drive adoption, making handheld OCT devices essential for efficient, accessible, and versatile diagnostic care.

The spectral-domain OCT (SD-OCT) segment dominates the optical coherence tomography market due to its superior imaging speed, high resolution, and ability to capture detailed cross-sectional images of retinal and ocular structures. SD-OCT enables precise assessment of eye conditions such as glaucoma, diabetic retinopathy, and age-related macular degeneration, supporting early diagnosis and effective treatment monitoring. Its advanced technology allows for faster image acquisition and reduced motion artifacts compared to earlier time-domain systems, improving workflow efficiency in clinical settings. Widespread adoption in ophthalmology, combined with ongoing technological enhancements and reliable performance, solidifies SD-OCT as the leading segment in the market.

The swept-source OCT (SS-OCT) segment is anticipated to be the fastest-growing in the optical coherence tomography market due to its advanced imaging capabilities, including deeper tissue penetration and faster scan speeds compared to traditional OCT systems. This enables more accurate and efficient diagnosis of ocular conditions such as glaucoma, diabetic retinopathy, and age-related macular degeneration. Technological advancements, such as higher resolution imaging and integration with artificial intelligence, further enhance the diagnostic capabilities of SS-OCT systems. Additionally, the increasing prevalence of eye disorders and the demand for non-invasive diagnostic procedures are driving the adoption of SS-OCT technology in clinical settings.

The ophthalmology clinics & eye hospitals segment dominate the optical coherence tomography market due to their specialized focus on diagnosing and managing eye disorders. These facilities require advanced imaging technologies to accurately detect conditions such as glaucoma, diabetic retinopathy, and age-related macular degeneration, making OCT systems an essential tool. The high patient volume in these centers, coupled with the need for routine monitoring and follow-up, drives consistent demand. Additionally, the adoption of cutting-edge OCT devices enhances diagnostic accuracy, workflow efficiency, and patient care quality. Their central role in eye healthcare ensures that ophthalmology clinics and hospitals remain the primary end-users of OCT technology.

The cardiac cath labs & interventional cardiology departments segment is estimated to grow at fastest rate in the optical coherence tomography market due to the increasing prevalence of cardiovascular diseases, such as coronary artery disease and atherosclerosis, which require precise intravascular imaging for diagnosis and intervention. OCT enables high-resolution, cross-sectional visualization of blood vessels, aiding in accurate stent placement, plaque characterization, and procedural planning. Technological advancements, including faster imaging speeds and real-time integration with interventional procedures, enhance clinical efficiency. Rising awareness of minimally invasive cardiac interventions and the demand for improved patient outcomes further drive the adoption of OCT in these specialized cardiac care settings.

The hardware systems segment dominates the optical coherence tomography market due to its critical role in delivering high-resolution imaging and accurate diagnostics across ophthalmology and cardiology applications. These systems, including OCT scanners, light sources, detectors, and interferometers, form the foundation of all OCT operations, ensuring precise image acquisition and analysis. Their reliability, durability, and compatibility with various clinical workflows make them essential for hospitals, eye clinics, and research centers. Continuous technological advancements, such as improved imaging speed, miniaturization, and enhanced integration with software analytics, further strengthen the adoption of hardware systems, solidifying their position as the dominant segment in the optical coherence tomography market.

The software, AI & cloud image analysis segment is estimated to be the fastest-growing in the optical coherence tomography market due to the increasing demand for automated, accurate, and efficient diagnostic tools. AI-driven algorithms enhance image interpretation, enabling early detection of ocular and cardiovascular conditions, reducing human error, and improving clinical decision-making. Cloud-based platforms allow seamless storage, sharing, and remote analysis of high-resolution OCT images, supporting teleophthalmology and collaborative care. Integration of advanced software with OCT hardware improves workflow efficiency and patient management. Rising adoption of digital healthcare solutions and growing awareness of AI benefits in diagnostics are driving the rapid growth of this segment.

The on-premise device ownership segment dominates the optical coherence tomography market because it provides healthcare facilities with full control over their imaging equipment, ensuring immediate availability, consistent performance, and secure handling of sensitive patient data. Owning OCT devices allows clinics, hospitals, and specialty eye centers to integrate the technology directly into their workflows, supporting routine diagnostics, follow-ups, and high patient throughput. Additionally, on-premise systems offer long-term cost efficiency by eliminating recurring rental or subscription fees and enabling customization to specific clinical needs. The reliability, accessibility, and operational autonomy of on-premise OCT systems make this segment the preferred choice among healthcare providers.

The managed service/device leasing & subscription imaging-as-a-service segment is anticipated to be the fastest-growing in the optical coherence tomography market due to its flexibility, affordability, and accessibility. This model allows healthcare providers, particularly small clinics and emerging markets, to access advanced OCT technology without heavy upfront investment. It typically includes maintenance, software updates, and remote technical support, reducing operational challenges. Subscription-based services also enable scalable usage based on patient demand and technological advancements. The combination of lower costs, operational convenience, and easy adoption is driving the rapid expansion of this segment in the market.

North America dominates the optical coherence tomography (OCT) market share 40% due to its advanced healthcare infrastructure, high adoption of innovative diagnostic technologies, and strong presence of leading market players. The region has a large aging population with a high prevalence of ophthalmic and chronic diseases such as age-related macular degeneration, diabetic retinopathy, and glaucoma, which drives consistent demand for OCT.

The U.S. represents the largest share of the North American optical coherence tomography market, driven by advanced healthcare facilities, rapid adoption of cutting-edge imaging technologies, and a strong presence of key OCT manufacturers and distributors. A high prevalence of ophthalmic disorders such as diabetic retinopathy and glaucoma, combined with an aging population, creates sustained demand. Favorable reimbursement policies, robust clinical research, and early FDA approvals for innovative OCT devices further boost market penetration. The U.S. also leads in AI-based OCT integration, with several academic institutions and private companies driving innovation in automated diagnostics and precision imaging.

Canada’s optical coherence tomography market growth is supported by a growing elderly population, rising incidence of eye diseases, and increasing awareness about early diagnosis. The country benefits from its universal healthcare system, which provides coverage for many diagnostic imaging services, facilitating wider adoption of OCT. Canadian ophthalmology clinics and hospitals are progressively adopting spectral-domain and swept-source OCT technologies for advanced imaging.

The Asia-Pacific region is the fastest-growing market for optical coherence tomography (OCT) due to several interlinked factors. A rapidly aging population and rising prevalence of chronic conditions such as diabetes and age-related eye disorders are driving the demand for advanced diagnostic imaging. Expanding healthcare infrastructure and increasing investments in hospitals and specialty clinics enhance accessibility to OCT systems. Governments across countries like China, India, and Japan are implementing initiatives to improve eye care services, further boosting adoption. Additionally, growing awareness of early disease detection, increasing healthcare expenditure, and collaborations between global OCT manufacturers and local distributors accelerate market penetration in this region.

Japan is a leading optical coherence tomography market in Asia-Pacific, driven by its advanced healthcare infrastructure, high healthcare spending, and strong emphasis on early disease detection. The country has one of the fastest-aging populations globally, leading to rising cases of glaucoma, age-related macular degeneration, and diabetic retinopathy. Japanese universities and research institutions also play a crucial role in OCT innovation, with companies like Topcon and Canon Medical pioneering advanced systems. Widespread clinical adoption, favorable government policies, and technological leadership make Japan a key driver of OCT growth in the region.

China is emerging as the fastest-growing optical coherence tomography market, fueled by its large patient pool, high prevalence of diabetes, and rising cases of vision-related disorders. Rapid healthcare infrastructure development, expanding hospital networks, and government initiatives to improve ophthalmic care are major growth enablers. Domestic companies are increasingly collaborating with international OCT manufacturers, making advanced imaging technologies more accessible and affordable. The country is also witnessing a rise in AI-enabled diagnostics, with OCT integration in large-scale screening programs for early eye disease detection.

Development of advanced OCT technologies (e.g., Spectral-Domain OCT, Swept-Source OCT, OCT Angiography), AI-based image analysis, and miniaturized portable devices. Universities, research institutes, and medical device companies focus on innovation and prototyping.

Companies: Topcon Corporation (Japan), Carl Zeiss Meditec (Germany), Canon Medical Systems (Japan), Heidelberg Engineering (Germany).

Institutions: Massachusetts Institute of Technology (MIT), University of Tsukuba (Japan), Stanford University (USA).

Large-scale production of optical coherence tomography hardware, software, and consumables; quality control; distribution via direct sales, local distributors, and global channels. Companies also partner with regional suppliers to expand presence in emerging markets.

Manufacturers: Nidek (Japan), Optovue (USA, now part of Zeiss), Abbott (USA – intravascular OCT), Thorlabs (USA).

Distributors: Henry Schein (USA), local medical equipment distributors in China & India.

Deployment of OCT systems in hospitals, ophthalmic clinics, cardiology labs, dermatology centers, and research institutes. Includes physician training, patient support, and integration with AI diagnostic software for improved outcomes.

Healthcare Providers: Mayo Clinic (USA), Aravind Eye Care (India), Seoul National University Hospital (South Korea), Peking Union Medical College Hospital (China).

Patient Support Programs: American Academy of Ophthalmology (AAO), International Agency for the Prevention of Blindness (IAPB).

In July 2024, the U.S. Food and Drug Administration announced the approval of the Heidelberg Engineering company’s OCTA (Spectralis CT angiography) module with SHIFT technology. This technology cuts acquisition time by 50%. The 125kHz preset OCTA speed is intended to improve clinical efficiencies, expedite workflow, and preserve image quality from Heidelberg.

By Clinical Application

By Product Type / Form Factor

By Technology / Imaging Modality

By End User / Buyer

By Component / Revenue Stream

By Deployment / Business Model

By Region

December 2025

November 2025

November 2025

November 2025