February 2026

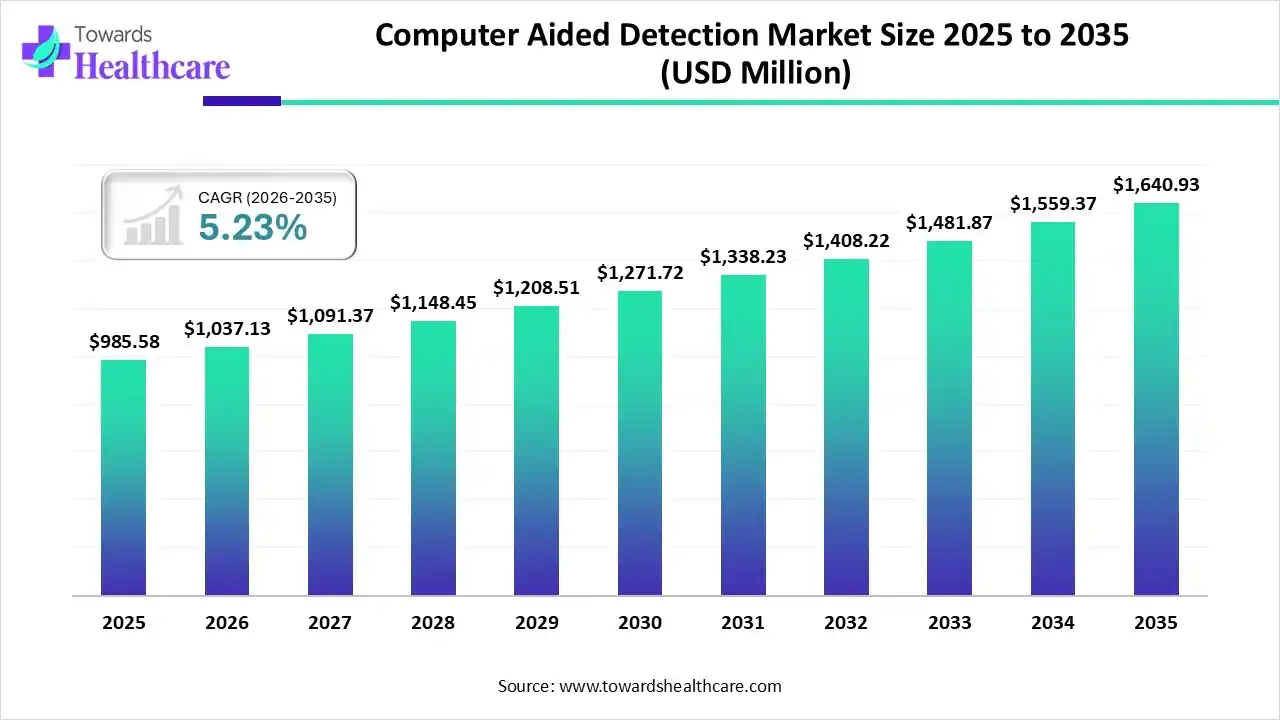

The global computer-aided detection market size is calculated at USD 985.58 million in 2025, grew to USD 1037.13 million in 2026, and is projected to reach around USD 1640.93 million by 2035. The market is expanding at a CAGR of 5.23% between 2026 and 2035.

| Key Elements | Scope |

| Market Size in 2026 | USD 1037.13 Million |

| Projected Market Size in 2035 | USD 1640.93 Million |

| CAGR (2026 - 2035) | 5.23% |

| Leading Region | North America |

| Market Segmentation | By Application, By Imaging Modalities, By End-User, By Region |

| Top Key Players | DeepTek AI, Delft Imaging, VinBrain, Infervision, JLK Group, Qure.ai, Kromek Group, Dassault Systèmes, Align Technology, Inc. |

The computer-aided detection market is primarily driven by the rising prevalence of chronic disorders, such as cancer, musculoskeletal disorders, and infectious diseases. Healthcare professionals leverage advanced computer tools to enhance diagnostic accuracy and reduce false negative rates. Integrating artificial intelligence (AI) in computer-aided detection (CAD) automates image identification and disease classification, thereby highlighting potential abnormalities.

The computer-aided detection market is experiencing robust growth, driven by the rising prevalence of chronic diseases, growing demand for early diagnosis and screening, and the increasing need for personalized care. It encompasses the development, manufacturing, and supply of CAD tools and software in healthcare organizations. CAD systems assess signs of chronic diseases from radiology images, enabling healthcare professionals to make informed clinical decisions. They are used with various types of imaging systems, such as mammography, X-ray, CT, and MRI.

AI and machine learning (ML) algorithms are increasingly utilized and integrated into medical practice, assisting healthcare professionals/radiologists in the early detection of chronic diseases. They improve efficiency, diagnostic accuracy, and standardization, decreasing the workload on radiologists. AI and ML allow radiologists to focus on their core tasks, such as reporting, consultations, and direct patient interaction. They analyze vast amounts of data and assist in feature extraction and image classification.

Which Application Segment Dominated the Computer-Aided Detection Market?

The breast cancer segment held a dominant position in the market in 2024, due to the rising prevalence of breast cancer and the availability of licensed devices. Breast cancer is the most common cancer, especially among women, accounting for 2.3 million new cases annually. Digital mammography tools are preferred to detect and classify breast cancer lesions and identify subtle abnormalities. They can detect minute changes in the breast that are difficult to view by a human.

Lung Cancer

The lung cancer segment is expected to grow at the fastest CAGR in the computer-aided detection market during the forecast period. CAD has a highly sensitive ability to detect early lung cancer to find small nodular lesions that are missed in daily image reading. The increasing prevalence of lung cancer potentiates the need for early detection. The American Cancer Society estimated about 226,650 new lung cancer cases in the U.S. in 2025.

Colon/Rectal Cancer

The colon/rectal cancer segment is expected to show lucrative growth, driven by the increasing incidence of colorectal cancer. AI-based CAD can improve colonoscopy and can be used for screening of colorectal cancer. It is a non-invasive method for predicting deeply invasive colorectal cancer. Since colon cancer develops from precursor adenomatous polyps, early detection and removal of polyps can reduce the chance of developing cancer.

Why Did the X-Ray Imaging Segment Dominate the Computer-Aided Detection Market?

The X-ray imaging segment held the largest revenue share of the market in 2024, due to the widespread availability of X-ray tools in healthcare organizations and high affordability. X-ray systems provide accurate, rapid detection of various diseases. Advanced digital X-ray systems are designed to reduce patient radiation exposure and associated risks. The availability of portable X-ray systems also contributes to the segment’s growth. CAD results in a more streamlined, effective healthcare process, improving the quality of patient care.

Computed Tomography (CT)

The computed tomography (CT) segment is expected to grow with the highest CAGR in the computer-aided detection market during the studied years. A CT scan is one of the most advanced diagnostic tools, offering multiple benefits, such as high speed, reduced hospital stay, and improved patient placement into appropriate areas of care. AI-based CT scans help radiologists predict and detect factors that are responsible for disease progression in the near future.

Ultrasound Imaging

The ultrasound imaging segment is expected to grow in the coming years, due to higher safety, no radiation exposure, and easy operability. Portable ultrasound systems are available that can be used bedside, eliminating the need to transport patients to medical laboratories. CAD-based ultrasound imaging systems generate clearer, high-quality images, allowing providers to view hidden changes.

How the Hospitals Segment Dominated the Computer-Aided Detection Market?

The hospitals segment contributed the biggest revenue share of the market in 2024, due to favorable infrastructure and increasing patient volumes. Hospitals receive funding from the government and private organizations, enabling them to adopt advanced detection tools. People prefer visiting hospitals due to favorable reimbursement policies and the presence of multidisciplinary experts.

Diagnostic Centers

The diagnostic centers segment is expected to expand rapidly in the computer-aided detection market in the coming years. Diagnostic centers possess specialized equipment for detecting numerous disorders. They have skilled professionals to provide personalized care and generate detailed reports of patients’ diagnoses. They offer an array of benefits from early detection and prevention to specialized testing and comprehensive health assessments.

Research Centers

The research centers segment is expected to grow at a notable CAGR, driven by growing research activities and increasing R&D investments. Research centers adopt advanced CAD tools and software to help researchers study the disease progression. This enables them to design novel drug candidates. CAD simplifies a researcher’s task, allowing them to focus on data interpretation.

North America dominated the global market in 2024. The presence of a robust healthcare infrastructure, the increasing adoption of advanced technologies, and favorable regulatory support are the major factors driving market growth in North America. The growing demand for personalized care and advanced diagnostic tools propels the market. The increasing investments and collaborations contribute to market growth.

The Food and Drug Administration (FDA) regulates the approval of CAD systems in the U.S. As of July 2025, the U.S. FDA has approved a total of 1,247 AI/ML-based medical devices. The increasing number of diagnostic laboratories also fosters the demand for CAD tools. As of 2024, there were approximately 32,828 diagnostic & medical laboratories in the U.S.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The rising prevalence of chronic disorders, the growing geriatric population, and the increasing awareness of advanced CAD tools foster market growth. The presence of key players and favorable research and clinical trial infrastructure facilitates the development of innovative CAD systems. Countries like China, India, and Japan host conferences and workshops to share the latest updates on innovative diagnostic techniques.

China is set to host the 12th OMIA Workshop on MICCAI 2025 to bring together scientists, clinicians, and students from multiple disciplines to address key challenges related to the application of advanced computer vision and ML technologies. The nation is also establishing its clinical trial infrastructure to support trials on CAD. A total of 7 studies were registered in China as of November 2025.

Europe is expected to grow at a considerable CAGR in the upcoming period. Government organizations provide funding to research institutions and medical devices to support the development of CAD systems. Increasing collaborations among key players, along with public-private partnerships, foster the market. People are becoming aware of the screening and early diagnosis of several chronic disorders, potentiating the demand for CAD. The rising prevalence of chronic disorders and the burgeoning healthcare sector bolster market growth.

The Medicines and Healthcare Products Regulatory Agency (MHRA) recently established an “AI Airlock programme” to support the manufacturing of AI-powered healthcare technologies. The NHS England invested nearly £6 million to facilitate the development of AIR-SP, an AI screening platform, to help expedite diagnosis.

The South American Computer-Aided Detection market, particularly in Brazil, is experiencing significant growth. This upward trend is primarily driven by the increasing incidence of chronic diseases like cancer. The region is actively adopting AI-powered diagnostic tools to enhance early detection and improve patient outcomes across healthcare facilities.

Brazil remains a key driver in the South American CAD market. Government and private sector initiatives are increasingly focusing on preventive healthcare and screening programs. This is boosting the adoption of advanced imaging solutions, specifically those for breast and lung cancer detection, pushing market value higher.

The Middle East and Africa (MEA) region presents a burgeoning market for CAD systems. Growth is supported by substantial government investments aimed at modernizing healthcare infrastructure. Rising awareness about early diagnosis and the increasing availability of sophisticated diagnostic imaging technologies contribute to market expansion across the region.

GCC countries are at the forefront of CAD adoption in the MEA, showing a strong focus on artificial intelligence integration. National digital transformation strategies and high per capita healthcare spending are major growth factors. The demand for advanced diagnostic accuracy in oncology and other critical areas fuels this rapid market growth.

| Companies | Headquarters | Offerings | Revenue |

| Fujifilm Corporation | Tokyo, Japan | Fujifilm Digital Mammography CAD | JPY 3,195 billion (FY 2025) |

| Olympus Corporation | Tokyo, Japan | ENDO-AID CADe | 997.3 billion yen (FY 2025) |

| Samsung Healthcare | South Korea | Lunit AI solutions and Auto Lung Nodule Detection | KRW 1,660.2 billion (Q3 2025) |

| Riverain Technologies | Ohio, United States | Chest X-ray CAD | - |

| iCAD, Inc. | New Hampshire, United States | Profound AI d]Detection | $9.8 million (Q4 2024) |

Company Overview:

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview:

Business Segments/Divisions:

Geographic Presence:

Global operations, with the U.S. accounting for the largest portion of revenue ($sim69%)$, followed by Europe ($ sim20%$)$, and Asia ($sim8%$).

Key Offerings (CAD/AI):

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

Partnerships & Collaborations

Continues collaboration with organizations like the WTA (Women’s Tennis Association) to promote women's health awareness.

Product Launches/Innovations:

November 2024: Launched the Envision Mammography Platform with a 2.5-second scan time for 3D mammograms.

Capacity Expansions/Investments:

Ongoing significant R&D investment, contributing to a $sim4.8%$ Compound Annual Growth Rate (CAGR) in total sales over the decade leading up to 2024.

Regulatory Approvals:

Technological Capabilities/R&D Focus:

Competitive Positioning:

Strengths & Differentiators: Strong global installed base in breast health, robust recurring revenue from diagnostic assays, deep integration of proprietary AI (Genius AI) into its 3D mammography platform, and a comprehensive portfolio focused on women's health.

Market presence & ecosystem role: Leader in the global breast imaging market; its Panther molecular system is a core driver in the Diagnostics segment.

SWOT Analysis:

Recent News and Updates:

Press Releases:

Industry Recognitions/Awards:

Included in the Dow Jones Sustainability North America Composite Index in the past, reflecting strong ESG performance.

Company Overview:

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview:

Business Segments/Divisions:

Detection: Includes AI-powered CAD and workflow solutions for breast and other cancers, utilizing the ProFound AI suite. (Post-2023 divestiture of the Xoft therapy business, this is the sole focus.)

Geographic Presence:

Key Offerings (CAD/AI):

ProFound Suite:

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

July 2025: Acquired by RadNet Inc.

Partnerships & Collaborations:

Product Launches/Innovations:

Continued enhancement of the ProFound AI platform with new features like Heart Health applications (currently not available in all geographies).

Capacity Expansions/Investments:

Focusing on expanding its AI solutions via a strong direct and indirect channel strategy.

Regulatory Approvals:

Technological Capabilities/R&D Focus:

Competitive Positioning:

SWOT Analysis:

Recent News and Updates:

Press Releases:

The latest focus is on the successful execution of the management-led transformation plan, leading to significantly reduced cash burn (Q2 2024).

Industry Recognitions/Awards:

Cited in multiple clinical studies for the performance of its ProFound AI platform, demonstrating enhanced clinical performance compared to other platforms.

By Application

By Imaging Modalities

By End-User

By Region

February 2026

February 2026

February 2026

February 2026