January 2026

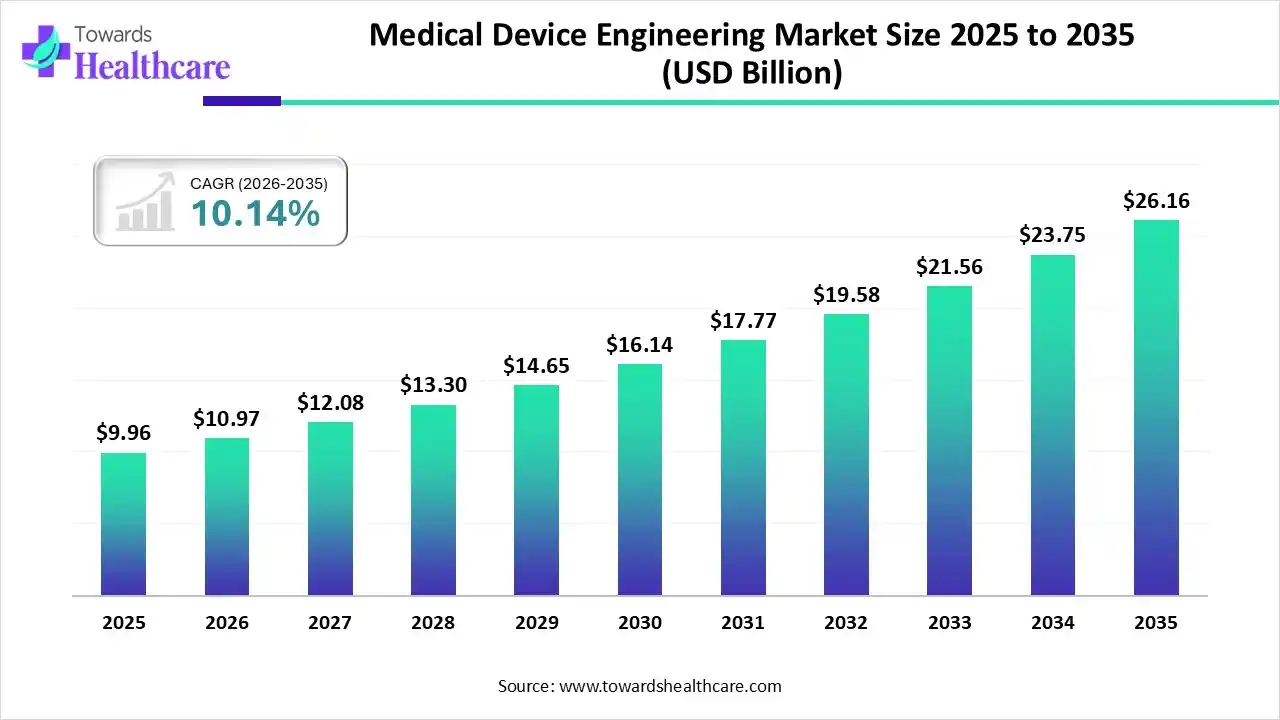

The global medical device engineering market size was estimated at USD 9.96 billion in 2025 and is predicted to increase from USD 10.97 billion in 2026 to approximately USD 26.16 billion by 2035, expanding at a CAGR of 10.14% from 2026 to 2035.

Many medical device OEMs are increasingly focusing on AI integration, diagnostic imaging equipment and other software progression.

Primarily, the medical device engineering market involves the application of engineering principles, such as mechanical, electrical, software, and biomedical, to design, establish, test, & produce technologies for healthcare, like pacemakers, imaging systems, and surgical tools. This has been progressing through the integrated AI and Gen AI into device design, which lowers R&D cycles by up to 30%. Also, the globe is promoting home-based care & real-time surgical AI, including Proprio’s Paradigm, which offers AI-assisted, radiation-free, real-time 3D surgical guidance.

Specifically, AI has been playing a vital role across the market by expanding diagnostic accuracy in imaging, reinforcing real-time, remote patient monitoring (RPM) wearables, and improving robotic surgery. Ongoing breakthroughs include AI-enabled digital twins for surgical planning, AI-driven predictive maintenance of devices, & generative AI for quicker prototyping.

Day by day, leading firms are developing advanced devices with boosted sensors for consistent, real-time monitoring & perfect data unification into electronic health records (EHR) for remote patient care.

Substantial advances in BCIs are allowing for direct communication between the brain & external devices, which provides robust, novel treatments for neurological disorders, paralysis, & neurorehabilitation.

Researchers are emphasizing implants, especially for orthopaedic and cardiac applications, with embedded sensors for monitoring healing, finding infection, and communicating with external devices to proactively adjust treatments.

| Key Elements | Scope |

| Market Size in 2026 | USD 10.97 Billion |

| Projected Market Size in 2035 | USD 26.16 Billion |

| CAGR (2026 - 2035) | 10.14% |

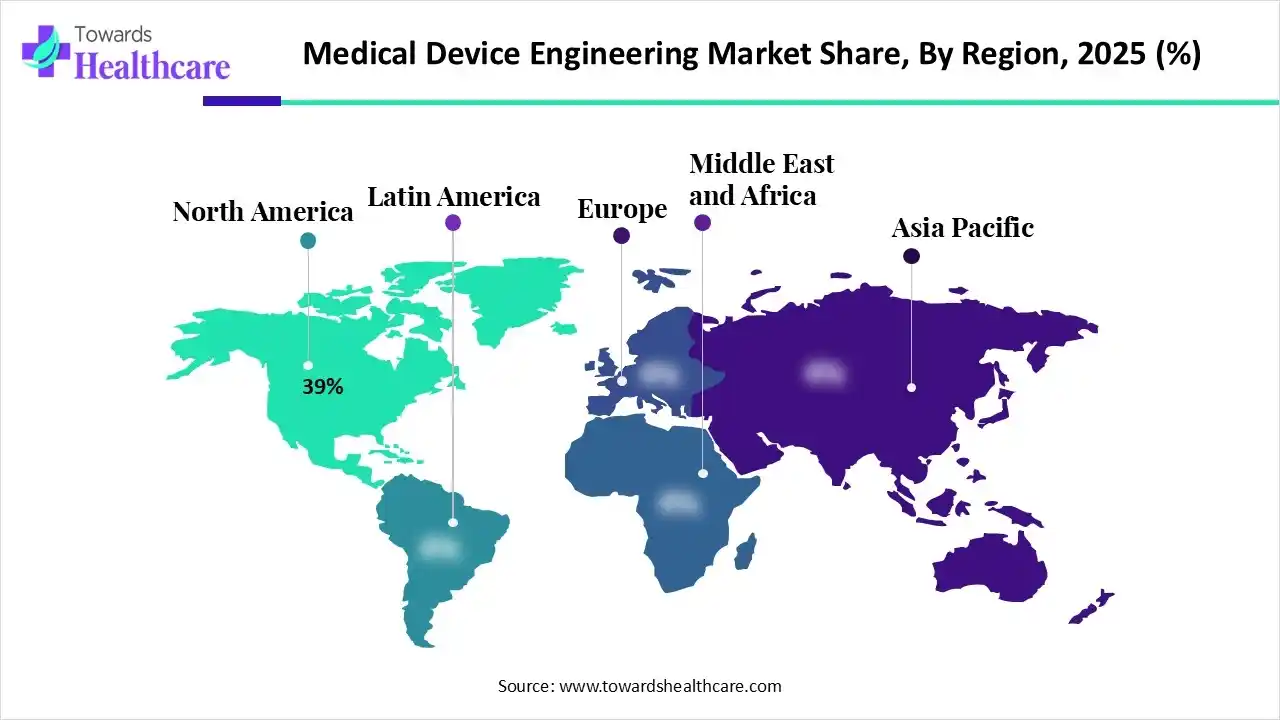

| Leading Region | North America by 39% |

| Market Segmentation | By Service Type, By Device Type, By Technology, By End User, By Region |

| Top Key Players | L&T Technology Services (LTTS), Infosys Limited, HCL Technologies, Cyient, Wipro Limited, TATA Consultancy Services (TCS), Capgemini (Altran), Flex Ltd., Jabil Inc., Accenture |

Which Service Type Led the Medical Device Engineering Market in 2025?

In 2025, the product design & engineering segment dominated with nearly 34% share of the market. This is prominently driven by the growing outsourcing for affordable & specialized expertise, with higher adoption of AI, IoT, and smart connectivity in devices. The era is extensively focusing on AI-integrated diagnostics, real-time data monitoring, & sustainable, user-friendly innovations. The latest example is CergenX, which designed an AI-enabled EEG neurotech platform for early brain injury detection in newborns.

Software Development & Testing

The software development & testing segment will expand rapidly. A significant driver is a rise in the need for complete validation and documentation for standards, especially the FDA and EU MDR, and demands for specialized testing services. Besides this, several firms are boosting standalone software applications for diagnosis and monitoring, which further demand these services. Also, researchers are widely fostering cloud-native to enable real-time algorithm updates & connectivity with the Internet of Medical Things (IoMT).

How did the In-Vitro Diagnostic (IVD) Devices Segment Dominate the Market in 2025?

The in-vitro diagnostic (IVD) devices segment captured nearly 20% share of the medical device engineering market in 2025. Escalating cases of cancer, cardiovascular disease, diabetes and infectious diseases, like COVID-19, TB, and HIV is fueling the demand for more frequent, extensive testing and monitoring. The market is transforming integrated hematology systems by employing digital imaging, cell classifiers, and AI for automatic analysis of blood slides, counting, & classification of white blood cells, red blood cells, and platelets instantly.

Diagnostic Imaging Equipment

The diagnostic imaging equipment segment is estimated to expand fastest. Booming chronic illnesses and widespread demand for minimally invasive surgeries & diagnostic techniques are bolstering the demand for specialized imaging systems. Many leading players are shifting towards software-defined, vendor-neutral PACS and preferring sustainability through "helium-free" & portable technology. Freelium was developed as a next-generation, helium-free magnetic resonance imaging (MRI) platform to combat the need for large, expensive, and resource-intensive helium supplies.

Which Technology Led the Medical Device Engineering Market in 2025?

In 2025, the traditional mechanical engineering segment was dominant with approximately 42% share of the market. This is significant for the physical design, functionality, and production of devices, i.e. from simple tools to complex, life-saving equipment. This technology mainly works on kinematics, material strength, and fluid mechanics, with smart technology, AI, & modern production.

AI & Machine Learning Integration

In the future, the AI & machine learning integration segment will witness rapid expansion. Specifically, deep learning assists in the analysis of complex, large-scale medical data with increased accuracy than manual interpretation, minimal misdiagnosis & reducing waiting times. The FDA is emerging with pathways for AI-powered, "continuously learning" algorithms, & VC funding for digital health AI startups has been bolstered.

Why did the Medical Device OEMs Segment Dominate the Market in 2025?

In 2025, the medical device OEMs segment held nearly 65% share of the market. Major OEMs, like Medtronic, Siemens Healthineers, & Stryker Corporation, are highly dependent on engineering companies for R&D, design, and regulatory compliance. This market is allowing them to employ Computer-Aided Engineering (CAE), model-based design, & 3D printing for their faster iteration and minimal physical testing. The emergence of stricter regulations necessitates specialized expertise in quality assurance, validation, and compliance, which pushes OEMs to join with specialized engineers.

Pharmaceutical & Biotech Companies

Moreover, the pharmaceutical & biotech companies segment is anticipated to grow fastest. They significantly provide combination products, i.e. drug-device combos, which fuel major innovation by uniting therapeutic chemistry with precise delivery hardware. Nowadays, these firms are fostering a "software-first" approach, where connected, intelligent devices are leveraged to strengthen drug delivery & allowing for tailored medicine, with raised clinical trial effectiveness.

In 2025, North America registered dominance in the medical device engineering market by 39% due to the concentration of major MedTech OEMs (Medtronic, J&J), high R&D spending, and a complex regulatory landscape requiring specialized engineering. Whereas Canada has been surging with funding and an effort toward implanting AI, sophisticated materials, and nanotechnology into diagnostic & therapeutic tools.

U.S. Market Trends

However, the U.S. market captured a dominant share, with accelerating steps from isolated hardware to intelligent, adaptive systems. Recently, the FDA approved the first closed-loop DBS system for Parkinson’s disease, known as BrainSense Adaptive Deep Brain Stimulation.

During the prospective period, the Asia Pacific is predicted to witness rapid growth in the medical device engineering market. This is led by the continuous digital transformation, including integrated AI, robotics, & Big Data Analytics, which evolves smarter, connected, and software-defined devices. Alongside, China’s NMPA and India’s Medical Devices Policy 2023 are executed by respective governments for simplifying regulatory approvals, with raised safety and local production.

China Market Trends

China will expand rapidly, with robust regulatory upgradation, whereas the NMPA published a revised GMP for medical devices. This mainly focuses on the latest, risk-managed manufacturing, which will be effective from Nov 1, 2026. Additionally, Chinese leaders are looking for international market access, especially Peijia Medical's 510(k) submission to the U.S. FDA for its DCwire Micro Guidewire.

| Company | Description |

| L&T Technology Services (LTTS) | This mainly offers comprehensive end-to-end engineering solutions for the medical device & life sciences industry. |

| Infosys Limited | It specializes in various services from initial concept and design to regulatory compliance and post-market support. |

| HCL Technologies | It explored diverse IoT & connected devices, CARE™ Orchestration Platform & other AI-assisted solutions. |

| Cyient | This primarily covers comprehensive, ISO 13485-certified medical device engineering, including the complete product lifecycle. |

| Wipro Limited | A firm emphasizes R&D, software, mechanical, & electronic design for connected health, imaging, and diagnostic devices. |

| TATA Consultancy Services (TCS) | This company integrates domain expertise with digital technologies & cloud to assist product development in areas like orthopedics, cardiology, and diagnostics. |

| Capgemini (Altran) | It usually facilitates end-to-end medical device development, with the aim of connected health, Software as a Medical Device (SaMD), and regulatory compliance (MDR/IVDR). |

| Flex Ltd. | A company specialises in developing smart, connected, and complex devices from concept to scalable production. |

| Jabil Inc. | This offers different solutions in digital health, diagnostics, orthopedic implants, and drug delivery systems. |

| Accenture | Its offerings encompass digital twin simulation, smart connected device design, cloud-based infrastructure, & regulatory compliance support. |

By Service Type

By Device Type

By Technology

By End User

By Region

January 2026

January 2026

January 2026

January 2026