January 2026

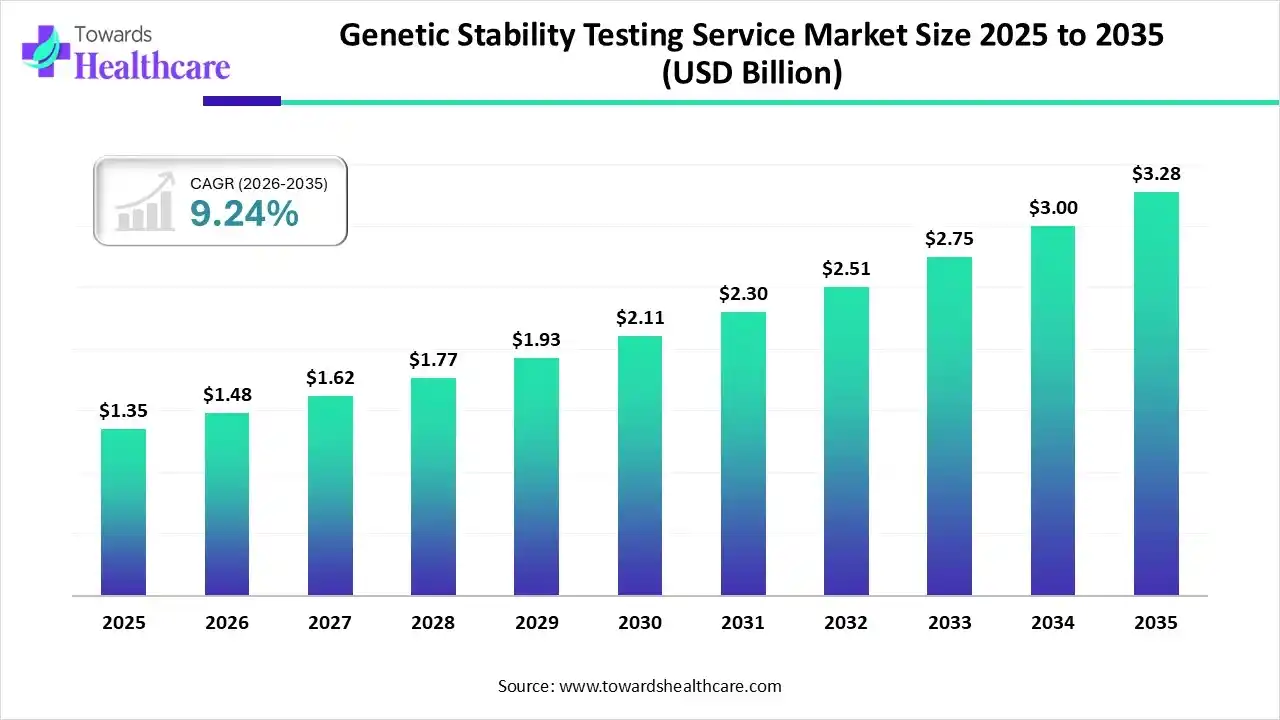

The global genetic stability testing service market size was estimated at USD 1.35 billion in 2025 and is predicted to increase from USD 1.48 billion in 2026 to approximately USD 3.28 billion by 2035, expanding at a CAGR of 9.24% from 2026 to 2035.

The growing R&D activities and increasing demand for personalized medicines are increasing the use of genetic stability testing services. The growing AI integration, applications, and new technology launches are also promoting the market growth.

The genetic stability testing service market is driven by the massive expansion of the cell and gene therapy pipeline. The genetic stability testing services encompass specialized tests utilized to maintain the stability and consistency of the genetic materials throughout their production and clinical applications. These tests help in maintaining the integrated genetic properties of the products and reducing the chances of unwanted mutations or other changes.

The use of AI in the genetic stability testing service market is increasing as it offers high throughput and automated data analysis, promoting the faster detection of abnormalities in genetic sequences and drug development. Its predictive modelling predicts genetic stability and prevents genetic changes, where its enhanced quality control also reduces the risk of deviations, maintaining the consistency and quality of the products.

The growing health awareness and shift towards personalized medicine are increasing their development driving the demand for genetic stability testing services to ensure their consistency.

The growing drug development, R&D activities, investments, and applications across the biotechnology, pharmaceutical, and agriculture industries are increasing the adoption of genetic stability testing services.

In order to provide more accurate, affordable, and faster genetic stability testing services, new next-generation technologies are being developed by companies, which are further supported by healthcare investments.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.48 Billion |

| Projected Market Size in 2035 | USD 3.28 Billion |

| CAGR (2026 - 2035) | 9.24% |

| Leading Region | North America |

| Market Segmentation | By Technology, By Application, By Sample Type, By Region |

| Top Key Players | Charles River Laboratories, Eurofins BioPharma Product Testing, Merck KGaA, Thermo Fisher Scientific, Sartorius AG, WuXi Advanced Therapies, SGS S.A., QIAGEN N.V., LabCorp, Illumina, Inc. |

Which Technology Type Segment Held the Dominating Share of the Market in 2025?

The cytogenetic techniques segment held the dominating share in the genetic stability testing service market in 2025, due to well-established methodologies. This provided reliable results, where their direct visual observation also offered detection of genetic changes. Additionally, their high sensitivity and affordability also increased their use.

Flow Cytometry

The flow cytometry segment is expected to show the highest growth during the predicted time, due to its rapid analysis. They also help in the measurement of numerous genetic markers in a single test, where they also support the detection of variability and genetic change is cell population. Moreover, their quantitative and qualitative results are also increasing their use.

Why Did the Clinical Diagnostics Segment Dominate in the Market in 2025?

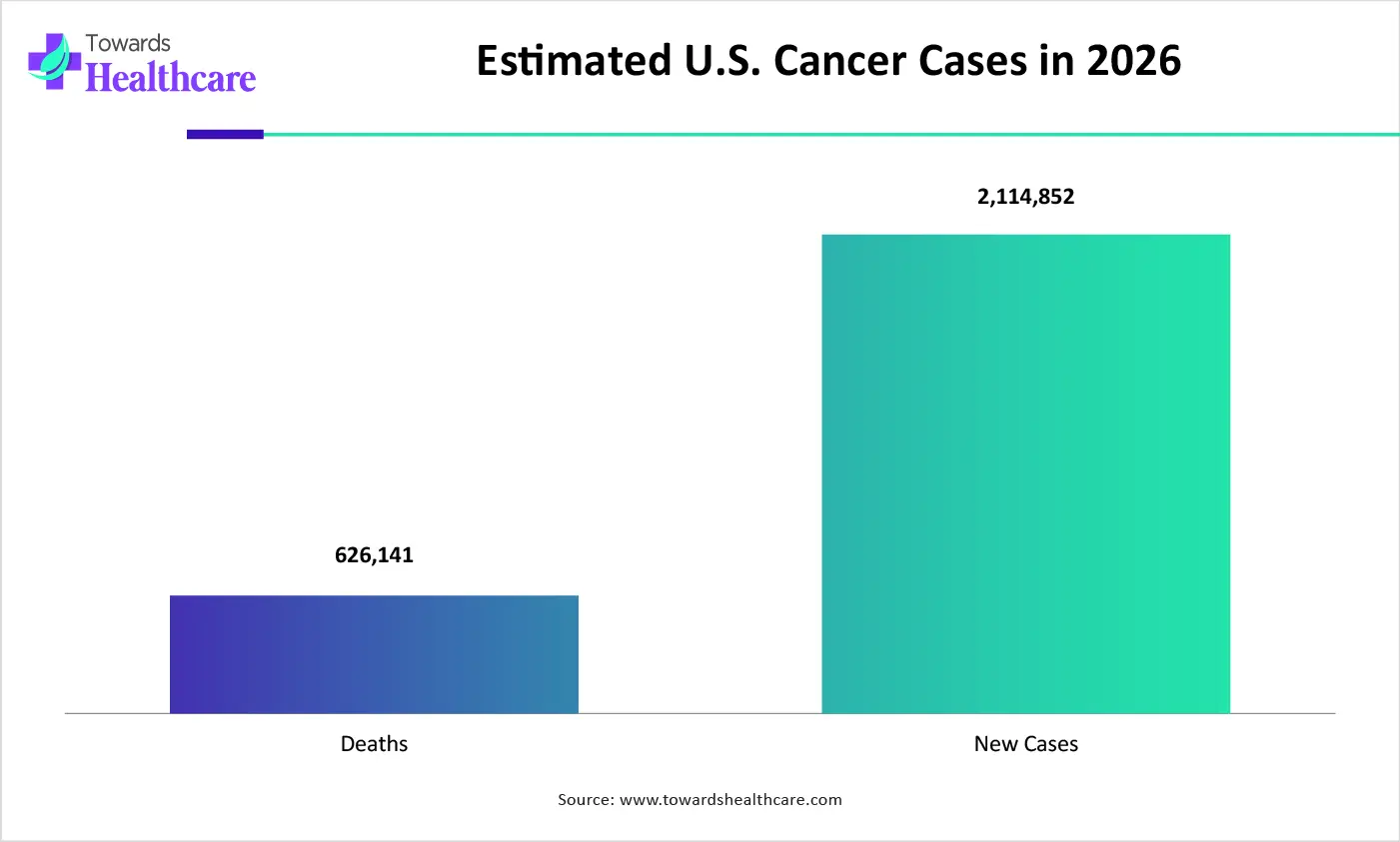

The clinical diagnostics segment led the genetic stability testing service market in 2025, as they are essential for the detection of various genetic diseases. The growth in health awareness also increased their use in early diagnosis of cancer. Furthermore, growth in the genetic screening program and reimbursement policies also encouraged their use.

Biopharmaceutical Manufacturing

The biopharmaceutical manufacturing segment is expected to show the fastest growth rate during the predicted time, due to increased biologics development. At the same time, the increasing interest in the development of new cell and gene therapies is also increasing the use of genetic stability testing services, where a growing shift towards personalization is also increasing their demand.

What Made Blood Samples the Dominant Segment in the Market in 2025?

The blood samples segment held the largest share in the genetic stability testing service market in 2025, due to its wide range of applications. They also consisted of DNA samples, which increased their use in the detection of various genetic markers, abnormalities, and mutations. Moreover, the presence of well-established techniques to collect and isolate blood and DNA also increased their use.

Primary Cells

The primary cells segment is expected to show the highest growth during the upcoming years, due to growing R&D activities. The increasing development of advanced therapies and personalized medicines is also increasing their use for genetic stability testing. Furthermore, their low risk of contamination and better disease modelling are also increasing their use.

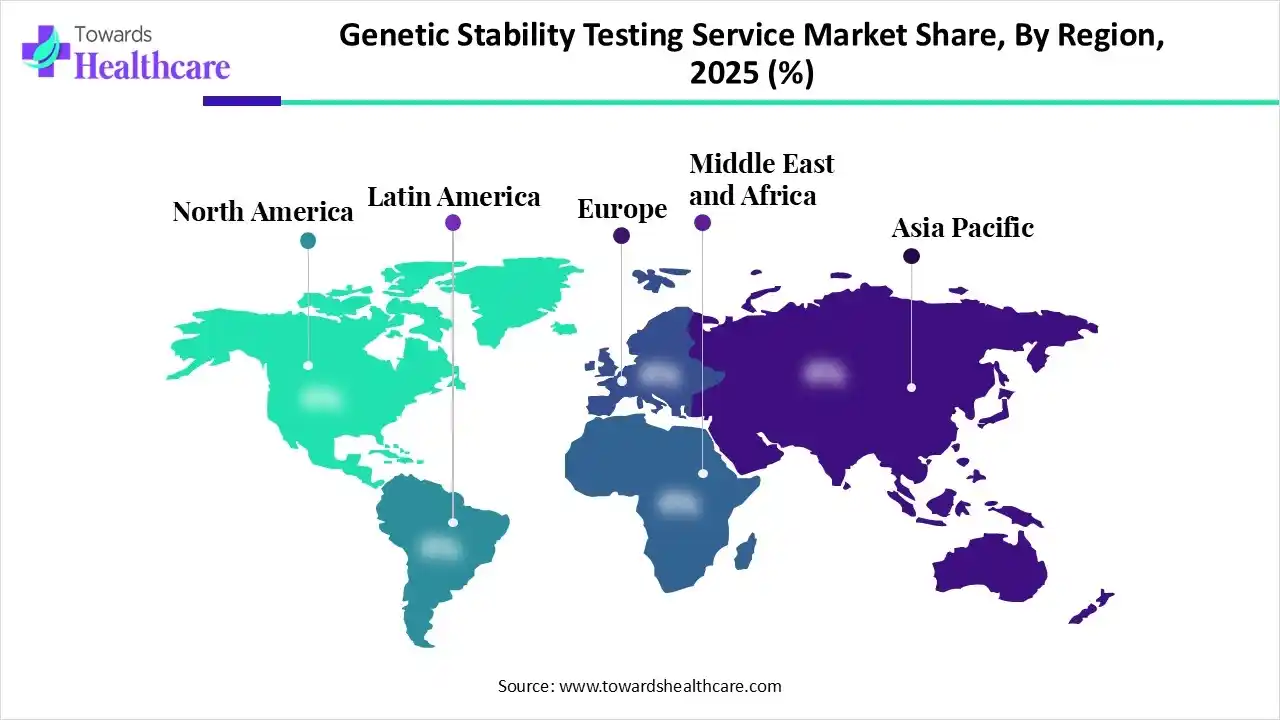

North America dominated the genetic stability testing service market in 2025, due to the presence of robust industries, which increased the use of these services for the development of biologics and advanced therapies. The growth in the R&D activities and healthcare investments also increased their adoption rates. The increasing health awareness and growth in the development of genetically engineered crops also contributed to the market growth.

U.S. Market Trends

The U.S. consists of robust regulations and industries, which are encouraging the use of genetic stability testing services to ensure product consistency, safety, efficacy, and quality. Additionally, the growing R&D activities focused on genomics medicine and the development of next-generation testing techniques are also increasing the use of these services.

Asia Pacific is expected to host the fastest-growing genetic stability testing service market during the forecast period, due to expanding pharmaceutical and biotechnology companies, which are increasing the outsourcing trends and drug development, driving the demand for these services. Increasing interest in the development of personalized medications and growing genetic diseases are also increasing their use, enhancing the market growth.

China Market Trends

China is experiencing a rapid expansion in the biotechnology and pharmaceutical industries, due to growing development of biologics and cell and gene therapies, which is increasing the use of genetic stability testing services. The growing government initiatives and shift towards the development of personalized medicines are also increasing their demand.

Europe is expected to grow significantly in the genetic stability testing service market during the forecast period, due to the presence of robust regulatory standards, which are increasing their use to ensure the product safety, quality, and efficacy. The presence of advanced industries are also increasing their use due to growing innovations, where the increasing outsourcing trends, growing investments, and technological advancements are also increasing their use, promoting the market growth.

UK Market Trends

The presence of well-developed pharmaceutical and biotechnology industries in the UK is increasing the use of genetic stability testing services to accelerate the development of gene therapies, biologics, and regenerative medicines. Moreover, their healthcare system is also utilizing them for effective and early detection of various genetic diseases.

| Companies | Headquarters | Genetic Stability Testing Services |

| Charles River Laboratories | Massachusetts, U.S. | DNA/RNA sequencing, qPCR, and blotting techniques |

| Eurofins BioPharma Product Testing | Luxembourg City, Luxembourg | Comprehensive cell line characterization techniques |

| Merck KGaA | Dermstadt, Germany | Aptegra CHO Genetic Stability Assay |

| Thermo Fisher Scientific | Massachusetts, U.S. | Ion Torrent and Applied Biosystems |

| Sartorius AG | Gottingen, Germany | Bioanalytical services |

| WuXi Advanced Therapies | Shanghai, China | Stability testing and cell line characterization techniques |

| SGS S.A. | Geneva, Switzerland | Specialized genotoxicity and genetic toxicology testing |

| QIAGEN N.V. | Venlo, Netherlands | Molecular testing solutions and sample preparation kits |

| LabCorp | North Carolina, U.S. | Comprehensive non-clinical genetic toxicology and stability studies |

| Illumina, Inc | California, U.S. | High-throughput NGS technology |

By Technology

By Application

By Sample Type

By Region

January 2026

January 2026

January 2026

January 2026