December 2025

The consumption-type vaccine market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

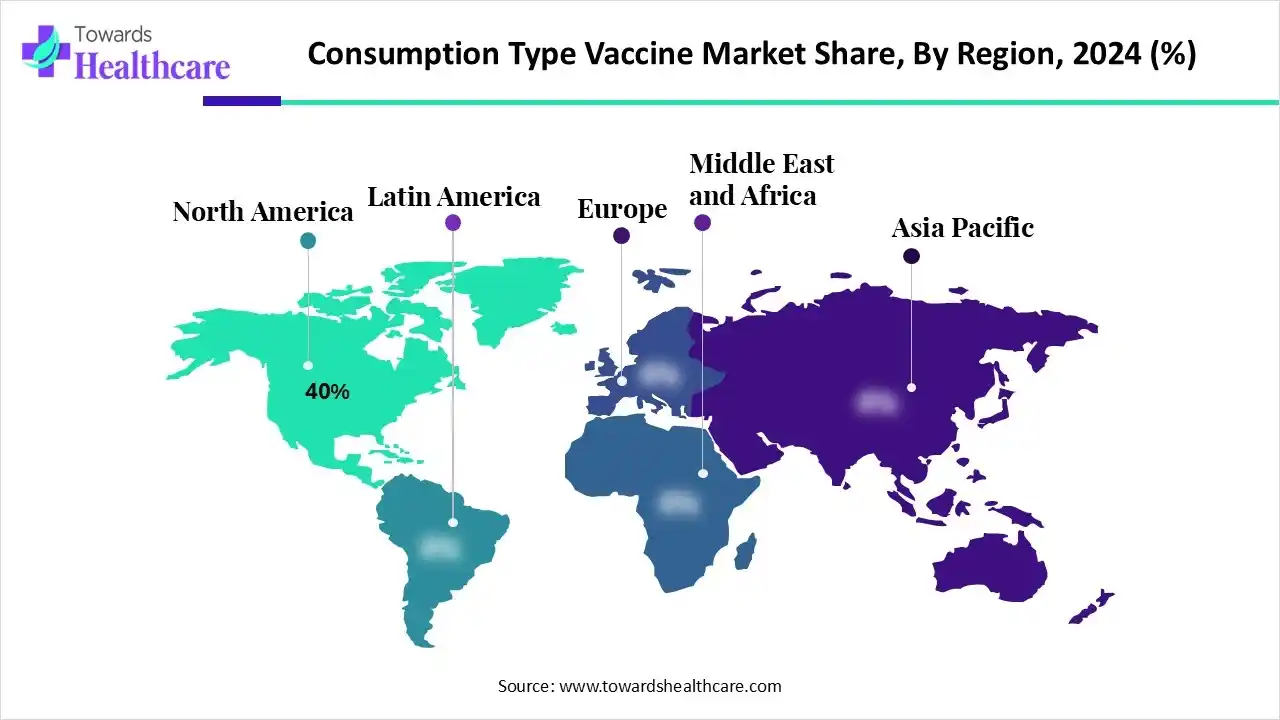

The consumption-type vaccine market is witnessing significant growth driven by the increasing prevalence of infectious diseases, rising awareness about preventive healthcare, and expanding immunization programs worldwide. Advancements in vaccine technology, government initiatives, and higher healthcare spending further boost demand. North America leads the market due to its robust healthcare infrastructure, strong regulatory framework, and high vaccination coverage among the population.

The market is growing due to increasing infectious disease cases, greater vaccine awareness, and expanding global immunization programs. Strong government support and advancements support and advancements in vaccine technology further drive market demand. The Consumption Type Vaccine Market refers to vaccines classified based on consumption patterns, formulation stability, and end-use behavior across human and veterinary applications. It encompasses preventive, therapeutic, and booster vaccines consumed seasonally, routinely, or in emergency campaigns. These vaccines vary by dosage type (single vs. multi-dose), storage temperature, and distribution format to meet population-scale immunization demands.

The market spans live-attenuated, inactivated, subunit, vector, and nucleic-acid vaccine platforms administered through public health programs, hospitals, and retail networks. It emphasizes consumption frequency, route, and demographic use rather than disease type, supporting efficient production, procurement, and stock management for large-scale immunization strategies globally.

AI can significantly impact the consumption type vaccine market by accelerating vaccine research and development, predicting disease outbreaks, and optimizing clinical trial designs. It enables faster identification of potential antigens, improves formulation efficiency, and reduces production timelines. Additionally, AI-driven data analytics enhance supply chain management, ensuring timely distribution and minimizing wastage. Personalized vaccination strategies and real-time monitoring of vaccine effectiveness can also be achieved, boosting public health outcomes and overall market growth.

| Vaccine Name | Manufacturers | Diseases | Approved Date |

| Comirnaty | Pfizer-BioNTech | Covid-19 | August 22, 2024 |

| Spikevax | Moderma TX Inc. | Covid-19 | August 22, 2024 |

| mNexspike | Moderma TX Inc. | Covid-19 | August 22, 2024 |

| FluMist | AstraZeneca | Influenza (seasonal flu) | September 20, 2024 |

| MRESVIA | Moderma TX Inc. | Respiratory Syncytial Virus | July 13, 2024 |

The intramuscular segment dominates the market, with a revenue of approximately 65% due to its proven efficacy, established safety profile, and widespread acceptance among healthcare providers. IM vaccines, such as those for influenza and COVID-19, are typically administered in the deltoid muscle, allowing for rapid absorption and a robust immune response. This method is preferred in both high- and low-income countries, aligning with global immunization strategies. While specific revenue shares are not publicly detailed by government sources, the IM route's prominence is evident in national immunization programs and global health initiatives.

The transdermal/microneedle patch segment is projected to experience rapid growth in the vaccine delivery market due to its innovative design and patient-centric benefits. These patches are minimally invasive, pain-free, and can be self-administered, enhancing patient compliance. They also offer advantages in distribution, as they do not require refrigeration, making them suitable for resource-limited settings. While specific growth rates are not detailed in government sources, these attributes position microneedle patches as a promising alternative to traditional vaccine delivery methods.

In 2024, the hospitals & clinics segment led the market with the largest revenue share of approximately 40%, primarily due to their central role in national immunization programs. Government initiatives like the Ayushman Bharat Health and Wellness Centers (AB-HWCs) have expanded access to healthcare services, including vaccinations, across India. On March 31, 2024, over 1.32 crore vaccination sessions were held, highlighting the significant contribution of these facilities to vaccine administration.

The retail pharmacies & immunization centers segment is expected to grow at the fastest CAGR in the vaccine market during the forecast period due to increased accessibility and convenience. Government initiatives like Ayushman Bharat Health and Wellness Centers (AB-HWCs) support private sector participation in vaccination programs, expanding reach in urban and semi-urban areas. Retail pharmacies offer extended hours and easier access, encouraging higher vaccine uptake. These factors, combined with rising awareness and demand for preventive healthcare, are driving rapid growth in this segment.

In 2024, the preventive vaccines segment held the largest market share of approximately 60%, driven by sustained global demand for immunization against infectious diseases. According to the WHO Global Vaccine Market Report 2024, the market size was valued at US$77 billion, with preventive vaccines comprising a significant portion of this figure. This dominance is attributed to ongoing vaccination programs targeting diseases such as influenza, hepatitis, and human papillomavirus (HPV), which continue to be prioritized by governments worldwide. The consistent allocation of resources and public health initiatives has reinforced the prominence of preventive vaccines in the global market.

The booster vaccines segment is expected to grow at the fastest CAGR in the consumption type vaccine market during the forecast period due to rising demand for maintaining immunity as protection from primary vaccinations wanes. Governments and global health organizations, including WHO and Gavi, are prioritizing booster campaigns for diseases such as COVID-19, influenza, and RSV. Aging populations, particularly adults above 60, are targeted to reduce severe disease risk. Increasing awareness, combined with public health initiatives and expanded vaccination programs, is driving the rapid adoption of booster vaccines worldwide.

In 2024, the single-dose segment held the highest market share of approximately 50% due to its enhanced patient compliance and cost-effectiveness. For instance, the single-dose Janssen COVID-19 vaccine demonstrated significant efficacy and safety, leading to its widespread adoption. Additionally, the U.S. Centers for Disease Control and Prevention (CDC) recommended a single-dose regimen for certain vaccines, such as the RSV vaccine for adults aged 75 and older, further driving the preference for single-dose formats. These factors collectively contributed to the dominant market position of single-dose vaccines.

The multi-dose segment is expected to grow at the fastest CAGR in the consumption type vaccine market during the forecast period due to its ability to simplify immunization schedules and improve patient compliance. Combining multiple vaccines into a single injection reduces the number of clinic visits and associated healthcare costs. Government immunization programs, such as India’s Universal Immunization Program, increasingly promote combination vaccines to enhance coverage and efficiency. These factors, along with rising awareness and demand for convenient vaccination options, are driving rapid market growth.

In 2024, the inactivated vaccines segment dominated the market with the largest revenue share of approximately 35% due to their proven efficacy and long-standing role in global immunization programs. These vaccines, such as those for measles, mumps, rubella (MMR), and oral polio, are administered globally through national immunization programs. Their ability to elicit both humoral and cellular immunity, along with cost-effectiveness, has led to their widespread use and sustained demand, solidifying their market leadership.

The mRNA-based vaccines segment is expected to grow at the fastest CAGR in the consumption type vaccine market during the forecast period due to its proven efficacy, safety, and adaptability. mRNA technology allows rapid development and large-scale production, enabling swift responses to emerging infectious diseases like COVID-19. Government initiatives, including funding from the U.S. Biomedical Advanced Research and Development Authority (BARDA), support research, distribution, and accessibility. The platform’s ability to target multiple pathogens and generate strong immune responses is driving increasing adoption and market growth worldwide.

In 2024, North America dominated the market share by 40% due to high immunization rates, advanced healthcare infrastructure, and strong government initiatives that ensure widespread vaccine accessibility. Countries like the U.S. and Canada benefit from well-established healthcare systems that support efficient distribution and administration of vaccines. Additionally, effective public awareness campaigns and communication strategies have increased trust and participation in vaccination programs. These factors collectively reinforced North America’s leading position in the global vaccine market.

The U.S. government has taken several initiatives to strengthen the market. Investments of $10–$39.5 billion supported the development of COVID-19 vaccines, including mRNA and protein-based platforms. Efforts to expand vaccine access include increasing the number of administration sites and eligible providers, improving uptake across populations. Additionally, funding for flexible vaccine manufacturing capacity ensures rapid production of novel vaccines during health emergencies. These measures collectively enhance vaccine availability, accessibility, and preparedness, reinforcing the U.S. role in the global vaccine market.

Canada is strengthening its market through strategic investments and national initiatives. Over $1.8 billion has been allocated to rebuild domestic vaccine and biomanufacturing capacity. The 2025–2030 Interim National Immunization Strategy focuses on improving equitable access and strengthening immunization programs nationwide. Additionally, coordinated vaccine supply management with provinces and territories ensures steady distribution and addresses potential gaps or delays. These efforts enhance Canada’s vaccine infrastructure, increase accessibility, and support public health preparedness across the country.

The Asia Pacific vaccine market is expected to grow at the fastest CAGR during the forecast period due to high infectious disease prevalence in countries like India, China, and Indonesia. Strengthened national immunization programs and public health campaigns are increasing vaccine coverage, while rising incomes and healthcare spending improve accessibility. Technological advancements in vaccine development and distribution further enhance efficiency. These factors, combined with government initiatives to expand immunization infrastructure, are driving rapid market growth and positioning the region as a key contributor to global vaccine demand.

In 2024, South Asia achieved a record-high immunization coverage, yet 2.9 million children remained unprotected. India significantly reduced its number of "zero-dose" children. Dengue and other outbreaks persisted.

In 2025, China continues to be a major player in the development of "consumption-type vaccines," which refers to non-injectable options, primarily oral and inhaled varieties. Building on its experience with an inhaled COVID-19 booster, the country is expanding research and regulatory support for novel vaccine technologies.

Europe is expected to grow at a significant CAGR in the consumption type vaccine market during the forecast period. Vaccine consumption growth in Europe in 2025 is driven by the aging population, the resurgence of infectious diseases, and innovation in vaccine technology. Demand is increasing for adult and travel vaccines, while pediatric vaccination rates are struggling to recover to pre-pandemic levels.

Consumption-type vaccine growth in Germany for 2025 is driven by routine viral and bacterial immunizations, with a declining but still significant market for COVID-19 boosters. The overall vaccine market is experiencing substantial growth due to a strong healthcare infrastructure, increased public health awareness, and advances in vaccine technology.

By Vaccine Consumption Type

By Dosage Format

By Technology Platform

By Route of Administration

By End-User

By Region

December 2025

December 2025

December 2025

November 2025