January 2026

The mRNA vaccine raw materials market is experiencing significant expansion, with projections indicating a revenue increase reaching several hundred million dollars by the end of the forecast period, spanning 2026 to 2035. This growth is driven by emerging trends and strong demand across key sectors.

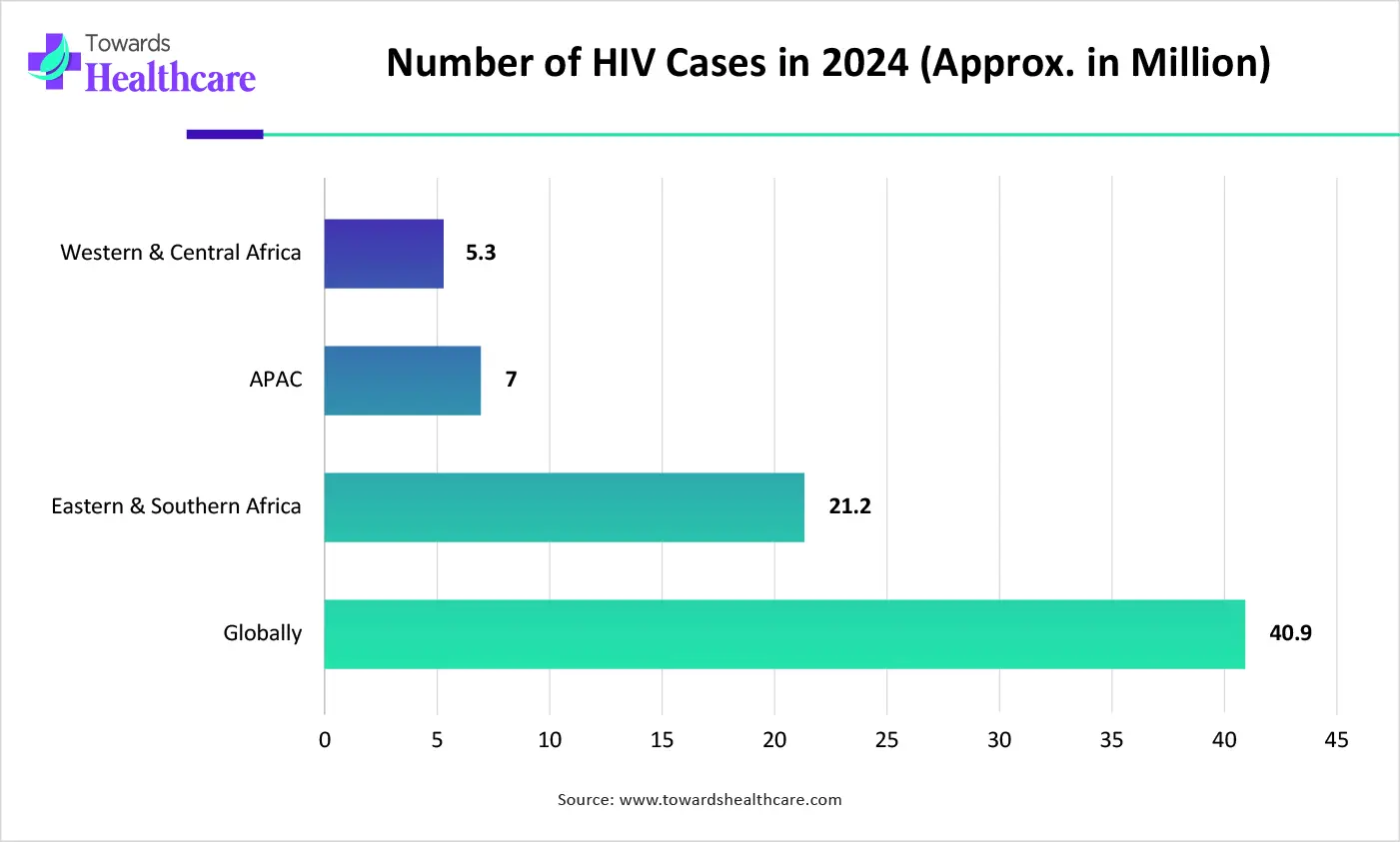

Nowadays, the world is facing a huge burden of diverse infectious diseases and cancer cases, which is highly demanding advanced mRNA vaccines & therapeutics. This further boost adoption of highly pure, scalable raw materials and the latest production technologies & component, like LNP technology, capping agents, and modified nucleotides.

The mRNA vaccine raw materials market includes nucleoside triphosphates (NTPs), RNA polymerase, capping agents, & specialized lipids. Moreover, the global expansion of the market is driven by a widening therapeutic pipeline, which mainly targets cancers, infectious diseases, and rare disorders. Alongside this, after COVID-19, the world is highly demanding vaccines, which in turn fosters demand for these raw materials. Whereas, leading companies are promoting in-house progression, GMP-compliant IVT kits, modern capping analogs, etc.

AI algorithms have a significant impact across the globe, including mRNA solutions. Whereas, MIT researchers and other institutions employed machine learning models for the evaluation of numerous existing delivery particles and estimated completely novel lipid structures. However, the emergence of novel AI-assisted landscapes, like those utilizing the LightGBM algorithm, is now anticipating two crucial properties of raw lipids, i.e., apparent pKa (acidity) and mRNA delivery efficiency.

LNP is the most important component of mRNA, which is experiencing greater demand, and players are also transforming with specialized, high-purity lipids with minimal adverse effects.

Researchers are stepping towards saRNA for its robustness in lower-dose applications, with rising demand for particular enzymes.

The globe is investigating polymeric nanoparticles, peptides, and protamine-based delivery systems to facilitate alternatives to conventional LNPs.

Which Product Type Led the mRNA Vaccine Raw Materials Market in 2025?

In 2025, the nucleotides (NTPs/modified nucleotides) segment held nearly 38% share of the market. This primarily comprises Adenine (A), guanine (G), cytosine (C), and uracil (U) & modified nucleotides, like pseudouridine and N1-methylpseudouridine, which offer greater mRNA stability and lower immune response. Researchers are widely leveraging sophisticated 5′-cap technology, like CleanCap, which is integrated with modified nucleotides to secure mRNA degradation by intracellular exonucleases.

Capping Agents (Cap Analogs)

Moreover, the capping agents (cap analogs) segment will witness rapid growth. Their adoption is propelled by increased efficiency of mRNA capping for greater translation, stability, and immune evasion. Also, co-transcriptional capping enables one-step synthesis, which crucially lowers production time and expenditures. Recently developed hydrophobic PureCap analogs are allowing for the separation of capped from uncapped mRNA using reversed-phase HPLC (RP-HPLC), omitting the requirement for enzymatic purification of byproducts.

How did the Vaccine Production Segment Dominate the Market in 2025?

The vaccine production segment captured nearly 81% share of the mRNA vaccine raw materials market in 2025. This is fueled by ongoing R&D investments, government encouragement for pandemic preparedness, and progressing vaccines for infectious diseases. The latest developments include BioNTech expanded it facilities to develop capping reagent modified nucleotides in-house, while Telesis Bio evolved its Gibson SOLA technology, allowing for faster, on-site synthesis of high-quality DNA and mRNA.

Therapeutic Production

The therapeutics production segment will expand rapidly. The worldwide rising demand for high-quality mRNA raw materials, breakthroughs in LNP technology, and groundbreakings in enzymatic capping, DNA-to-RNA transcription, and circular RNA (circRNA) technology are supporting therapeutic development. Many key players are spurring precision cancer vaccines, oncology antibody mRNA, and CRISPR mRNA therapies. Whereas, Ethris & Lonza developed mRNA vaccines stored at room temperature for nasal delivery.

Which End-User Segment Led the mRNA Vaccine Raw Materials Market in 2025?

In 2025, the pharmaceutical & biotech companies segment captured approximately 49% share of the market. Giant firms, like Thermo Fisher Scientific, Merck KGaA, and Maravai LifeSciences, are widely investing in the expedited production of infectious disease vaccines and cancer immunotherapies. Also, they are shifting towards synthetic components, including ionizable lipids and nucleoside-modified RNA (modRNA), which lower immunogenicity and mitigate genomic integration.

CROs & CDMOs

The CROs & CDMOs segment is anticipated to expand fastest. CROs &CDMOs, like Lonza, Wacker Biotech, WuXi Biologics, etc., are fostering GMP-grade manufacturing, lipid nanoparticle (LNP) formulation, and boosted development timelines. Alongside, they are seamlessly adopting advanced continuous-flow, microfluidic-based systems that are replacing traditional batch processes, minimizing reagent consumption and optimizing mRNA consistency.

Why did the Research-Grade Segment Dominate the Market in 2025?

The research-grade segment captured approximately 56% share of the mRNA vaccine raw materials market in 2025. A major driver is the ongoing preclinical and clinical development of over 500 mRNA-related drug candidates, which are increasingly demanding for RUO-grade nucleotides, capping analogs, and enzymes for early-stage synthesis. Companies are broadly focused on in vitro transcription (IVT) effectiveness, boosting stability, and newer lipid nanoparticle (LNP) formulations for robust endosomal escape and targeted delivery.

GMP-Grade

The GMP-grade segment is estimated to witness the fastest expansion. As the globe is moving towards commercialization, manufacturers need scalable raw materials. Manufacturers are exploring their facilities' progression, with variations in therapeutics, adoption of AI-assisted production, and bolstering vertical integration. Specifically, pharmaceutical companies and CDMOs (Contract Development and Manufacturing Organizations) in extensive, compliant manufacturing platforms are speeding up the adoption of GMP-grade materials.

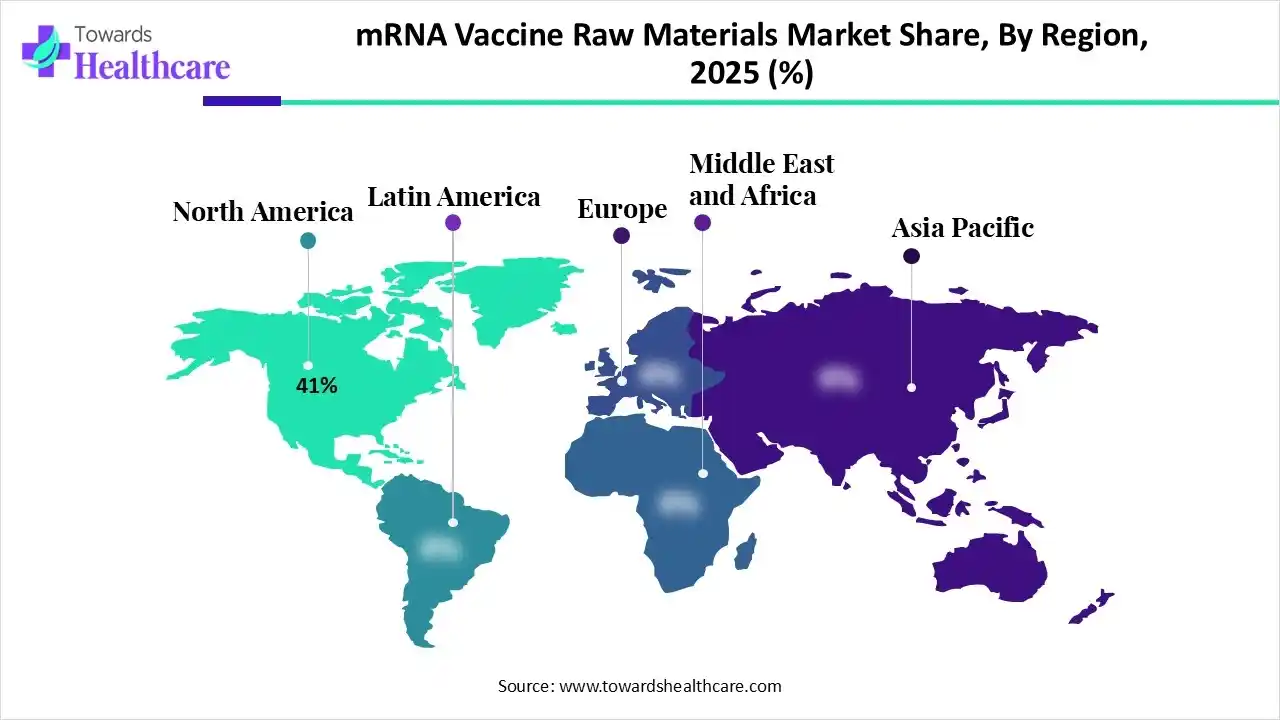

By capturing nearly 41% share, North America registered dominance in the mRNA vaccine raw materials market in 2025. The dominance is propelled by growing mRNA therapeutics, vaccine pipelines, and investments from both public & private sectors, allied with the presence of leading biotech firms and academic institutions.

U.S. Market Trends

However, the U.S. market is immensely leveraging local onshoring and technological refinement to assist a pipeline widening beyond COVID-19 into cancer and rare diseases.

For instance,

In the coming era, the Asia Pacific will expand rapidly, as many firms are highly emphasizing the localization of the supply chain for raw materials, like modified ribonucleoside triphosphate (NTPs). Additionally, certain governments, like in Korea & Japan, are robustly empowering mRNA vaccine and therapeutic research by covering funding for infrastructure.

India Market Trends

India is also increasingly emerging with a rigorous, indigenous, and localized ecosystem for mRNA vaccine raw materials. However, in the last two years, Aurigene reinforced its biomanufacturing capabilities in Genome Valley, Hyderabad, to provide advanced analytics and process development for mRNA, supporting the local supply chain.

Europe is predicted to witness notable growth in the mRNA vaccine raw materials market. Recently, the EMA updated guidelines related to the quality, safety, and characterisation of lipid nanoparticles (LNPs) and raw materials, which bolsters the need for testing to ensure stability & quality in the draft guideline on quality aspects for mRNA vaccines.

UK Market Trends

Whereas the UK is securely stepping towards raw materials, such as the UK-based CDMO Touchlight, which continued to supply its enzymatic doggybone DNA (dbDNA) technology to GSK for mRNA production, to offer a rapid, more scalable option to plasmid DNA.

| Company | Description |

| Thermo Fisher Scientific Inc. | This mainly explores a comprehensive, cGMP-compliant portfolio of raw materials for mRNA vaccine development, characterising their high-purity TheraPure reagents. |

| Merck KGaA (MilliporeSigma) | A firm facilitates a comprehensive, end-to-end portfolio of raw materials, reagents, and services for the complete mRNA vaccine manufacturing process, from pre-clinical development to commercial production. |

| Maravai LifeSciences (TriLink BioTechnologies) | This specifically offers GMP-grade raw materials for mRNA vaccines, specializing in proprietary CleanCap capping analogs. |

| Aldevron (Danaher Corporation) | It usually specializes in the production of high-quality plasmid DNA, mRNA, and proteins for vaccines and therapeutics |

| New England Biolabs (NEB) | A company provides a comprehensive portfolio of high-quality, research-grade, and GMP-grade reagents for the complete mRNA vaccine production process. |

| Jena Bioscience GmbH | This offers modified nucleoside triphosphates, high-concentration T7 RNA polymerases, and precision HighYield T7 synthesis kits. |

| Promega Corporation | It is prominently emphasizing high-quality, animal-origin-free (AOF) components, favourable for cGMP processes. |

| Hongene Biotech | A firm explores extensive nucleosides, nucleotides, phosphoramidites, cap analogs, and lipids. |

| Yeasen Biotechnology | Its offerings comprise T7 RNA polymerase, capping enzymes (Vaccinia Capping Enzyme, 2'-O-Methyltransferase), RNA cleaners, and modified nucleoside triphosphates (NTPs). |

| BOC Sciences | This majorly explores cGMP and non-GMP grade materials, which assist the full mRNA production workflow. |

By Product Type

By Application

By End-User

By Grade

By Region

January 2026

December 2025

December 2025

December 2025