February 2026

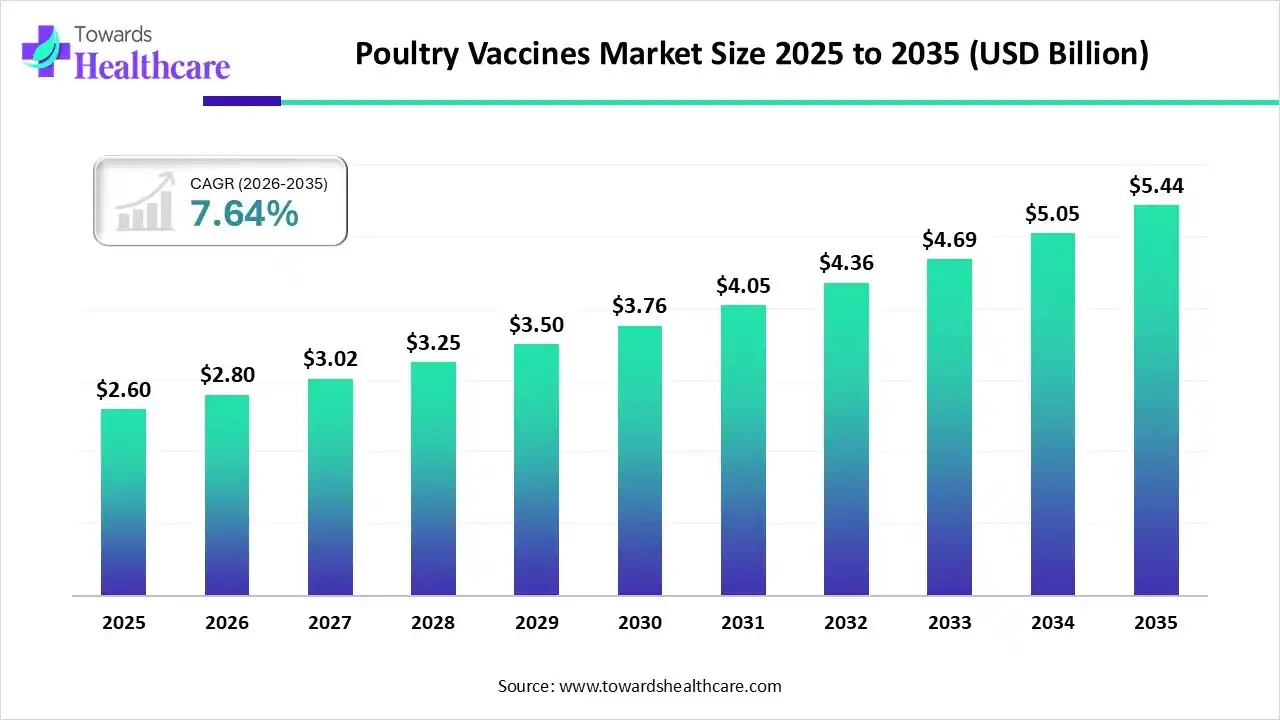

The global poultry vaccines market size was estimated at USD 2.6 billion in 2025 and is predicted to increase from USD 2.8 billion in 2026 to approximately USD 5.44 billion by 2035, expanding at a CAGR of 7.64% from 2026 to 2035.

The market is expanding due to rising avian disease outbreaks and the growing need for preventive flock health solutions. Increasing poultry consumption, strict biosecurity standards, and consumer demand for antibiotic-free products are driving broader adoption of vaccination programs globally. Technological innovations in delivery and vaccine platforms are enhancing effectiveness and simplifying administration for producers.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.8 Billion |

| Projected Market Size in 2035 | USD 5.44 Billion |

| CAGR (2026 - 2035) | 7.64% |

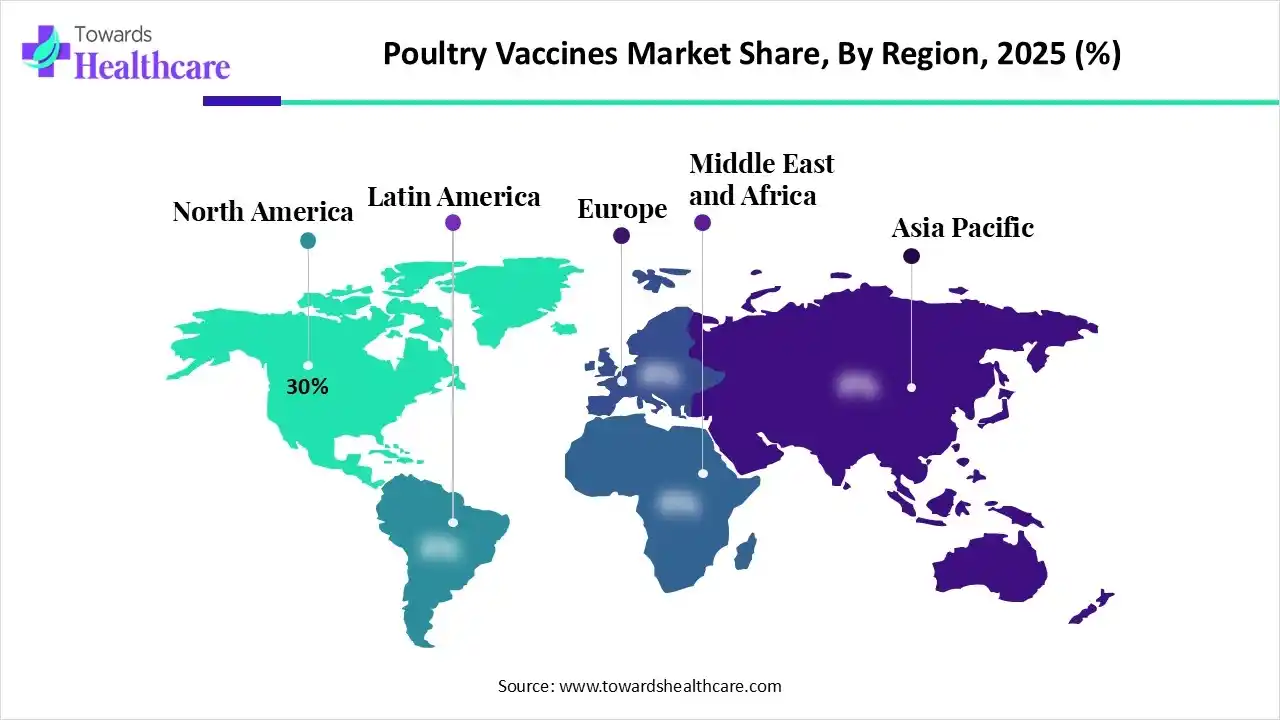

| Leading Region | North America by 30% |

| Market Segmentation | By Product Type, By Deployment Type, By Application, By End-User, By Region |

| Top Key Players | Merck Animal Health, Zoetis, Inc, Boehringer Ingelheim Animal Health, Elanco Animal Health, Vaxxinova, Hipra, Hendrix Genetics, Indian Immunological Limited, Shandong Longchang |

Poultry vaccines are biological preparations used to protect chickens, turkeys, and other birds from infectious diseases by stimulating their immune system to build resistance and prevent outbreaks. The poultry Vaccines market is expanding as producers prioritize flocks' immunity to reduce mortality and economic losses. Growing industrial poultry farming, tighter disease-control protocols, and increasing cross-border trade of live birds drive consistent vaccination needs. Innovation in recombinant and immune-boosting vaccines, along with government-supported health programs, continues to strengthen overall market demand.

In November 2024, Vaxxinova received European Commission approval for its Vaxxon ND Clone poultry vaccine, designed to help control and prevent Newcastle Disease infections in birds.

AI is transforming the market by improving early disease detection, predicting outbreak risks, and optimizing vaccination schedules. It enhances farm data analysis, supports precision dosing, and streamlines production processes. AI-driven surveillance and automation help reduce losses, improve flock health, and boost vaccine demand by enabling more efficient and proactive disease-management strategies.

AI, IoT sensors, and data analytics will transform poultry health management by enabling real-time disease detection, predictive outbreak alerts, and optimized vaccination schedules, reducing losses and improving flock performance significantly.

Recombinant, vector, and immune-enhancing vaccine technologies will deliver broader, faster, and longer-lasting protection. These innovations support easier administration, better cross-strain coverage, and stronger disease control as pathogens continue to evolve.

Growing demand for antibiotic-free, welfare-focused, and environmentally responsible poultry production will accelerate vaccine adoption, helping farmers prevent infections naturally, minimize drug use, and meet global sustainability and food-safety expectations.

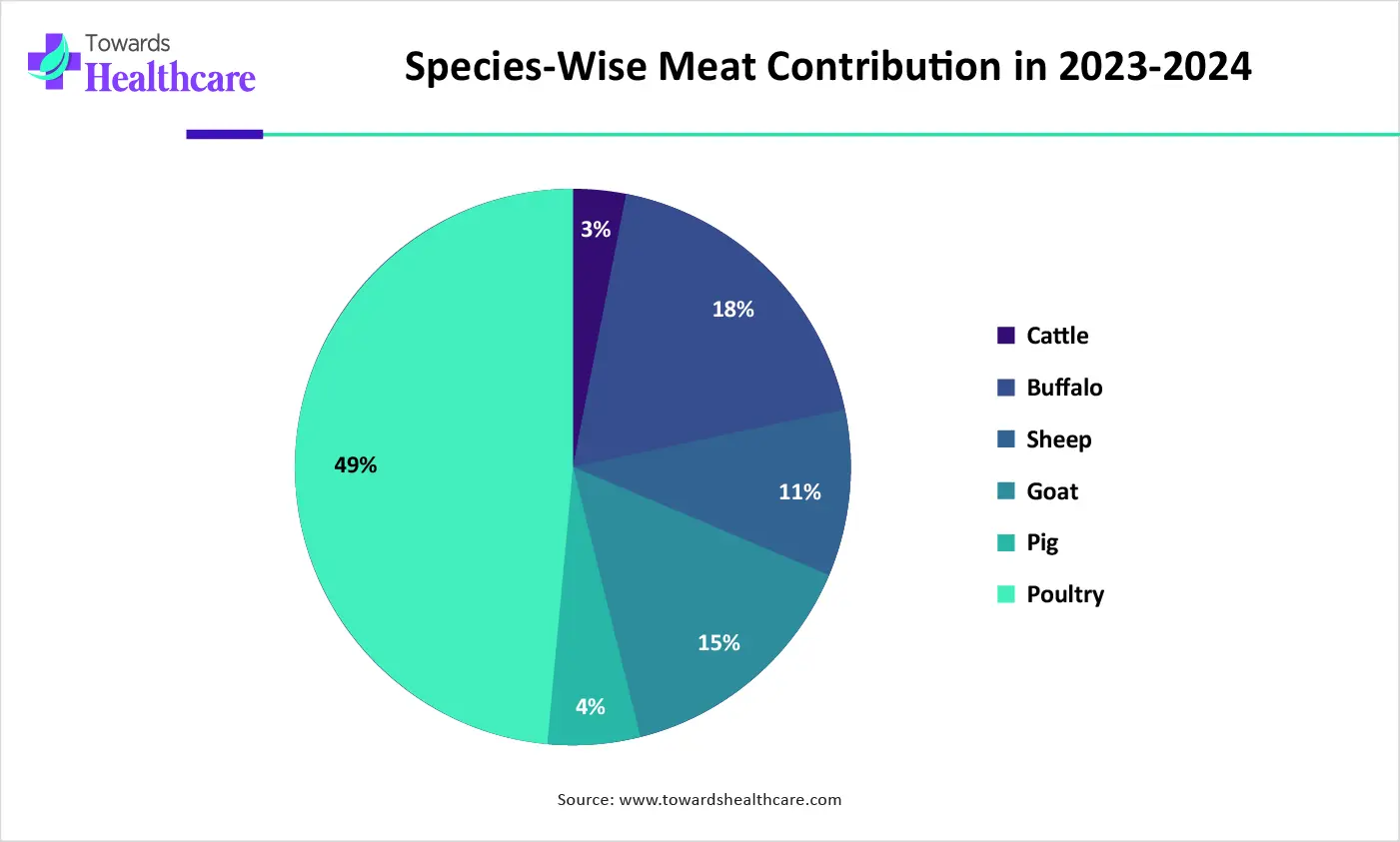

| Species | % |

| Cattle | 2.60 |

| Buffalo | 18.09 |

| Sheep | 11.13 |

| Goat | 15.50 |

| Pig | 3.72 |

| Poultry | 48.96 |

Why Did the Live Vaccines Segment Dominate in the Market in 2025?

The live vaccines segment led the poultry vaccines market in 2025, with a 50% revenue because these vaccines offer stronger, longer-lasting immunity and faster protection, making them ideal for high-risk poultry environments. They are widely used for major diseases like Newcastle and infectious Bronchitis, support mass administration methods, and help reduce overall disease burden, driving higher adoption among large commercial poultry producers.

Recombinant/Vector-based Vaccines

The recombinant/vector-based vaccines segment is projected to grow at the fastest because these vaccines provide targeted, highly safe immunity without using live pathogens. Their ability to deliver multiple antigens, reduce shedding, and address emerging viral strains makes them ideal for modern poultry health needs. Increasing focus on biosecurity, antibiotic-free production, and technologically advanced disease control further accelerates their adoption throughout the forecast period.

What Made the On-farm Administration Segment Dominant in the Market in 2025?

The on-farm administration segment dominated the poultry vaccines market, with a revenue of 70%, because it allows poultry producers to vaccinate birds directly at the farm, ensuring immediate, flexible, and large-scale immunization. This approach reduces transportation stress, lowers handling costs, and supports rapid response during outbreaks. Its compatibility with mass-delivery methods such as spray, drinking water, or in-ovo systems makes it highly efficient for commercial farms managing large flocks.

Hybrid/Contract Vaccination Services

The hybrid/contract vaccination services segment is set to grow the fastest because farms increasingly rely on specialized teams to ensure accurate dosing, consistent protocols, and compliance with evolving biosecurity standards. These services reduce labor burdens, minimize vaccination errors, and improve flock immunity outcomes. As large commercial farms scale operations and prioritize efficiency, outsourcing vaccination support becomes a cost-effective and reliable solution, driving strong demand during the forecast period.

How will the Newcastle Disease Segment dominate the Market in 2025?

The Newcastle disease segment led the poultry vaccines market, with 30% revenue share, because it is one of the most contagious and economically demanding poultry diseases worldwide. High morbidity and mortality rates make vaccination essential for flock protection. Widespread outbreaks in commercial and backyard poultry farms drive consistent vaccine demand. Additionally, government-mandated immunization programs and the availability of effective live and inactivated vaccines ensure broad adoption, solidifying Newcastle disease as the primary application segment in the market.

Other Diseases

The other diseases segment is expected to grow fastest as awareness of less common but impactful poultry diseases increases. Advances in combination and recombinant vaccines enable protection against multiple pathogens simultaneously, while preventive healthcare practices and stricter biosecurity in commercial farms drive higher adoption of vaccines for emerging and secondary poultry diseases.

How Does the Commercial Poultry Farms Segment Dominate the Market in 2024?

The commercial poultry farms segment held the highest poultry vaccines market share in 2025 because large-scale operations face greater risks of disease outbreaks due to high bird density. Vaccination is essential to protect flock health, ensure consistent production, and minimize economic losses. Additionally, these farms have better access to veterinary services, advanced vaccination technologies, and government-supported immunization programs, driving widespread and routine adoption of poultry vaccines.

Veterinary Clinics/Service Providers

The veterinary clinics/service providers segment is expected to grow fastest because increasing reliance on professional vaccination services ensures accurate dosing, proper handling, and adherence to biosecurity standards. Rising awareness among small-scale and backyard poultry owners, coupled with the expansion of veterinary networks and mobile vaccination services, drives demand. These providers also support advanced vaccine technologies and contribution treatment, making them a key growth driver during the forecast period.

North America dominated the market with a revenue of 30% due to rising focus on advanced disease prevention, strong adoption of recombinant and vector vaccines, and increasing poultry production. Frequent avian disease threats, supportive government policies, and improved farm biosecurity are driving higher vaccination rates. Growing investment in R&D and modern vaccination technologies further accelerates market expansion in the region.

The U.S. poultry vaccine market is growing due to rising cases of avian diseases, strong emphasis on biosecurity, and expanding commercial poultry production. Government support for vaccination strategies, advancements in recombinant and vector vaccines, and increasing demand for safe, antibiotic-free poultry products are further driving widespread vaccine adoption across farms.

Asia Pacific is expected to grow at the fastest CAGR due to its rapidly expanding poultry population, rising demand for affordable protein, and frequent disease outbreaks that increase reliance on vaccination. Growing commercial farming, government-led disease-control programs, and greater adoption of advanced vaccines further accelerate market growth. Improving veterinary infrastructure and higher investment in farm biosecurity also support this strong regional expansion.

India’s poultry vaccine market is growing due to expanding commercial poultry farming, frequent outbreaks of viral and bacterial diseases, and rising demand for healthier, antibiotic-free poultry products. Government vaccination programs, improved veterinary services, and growing awareness of preventive healthcare are boosting vaccine adoption. Increasing investments in advanced vaccines and better farm biosecurity also support strong market growth.

Europe is expected to grow at a notable CAGR in the poultry vaccine market due to strict government regulations, advanced poultry farming practices, and high adoption of preventive healthcare measures. Frequent outbreaks of avian diseases, strong biosecurity standards, and widespread use of live and recombinant vaccines further drive market growth. Additionally, technological advancements, well-established veterinary infrastructure, and growing consumer demand for safe, antibiotic-free poultry products contribute to Europe’s leading position in the global poultry vaccine market.

The UK market is growing due to rising concerns over avian diseases, stricter biosecurity standards, and a strong government focus on disease prevention. Expanding commercial poultry production, demand for antibiotic-free meat, and advancements in recombinant and vector vaccines are further driving adoption. Increased investment in farm health management also supports steady market growth.

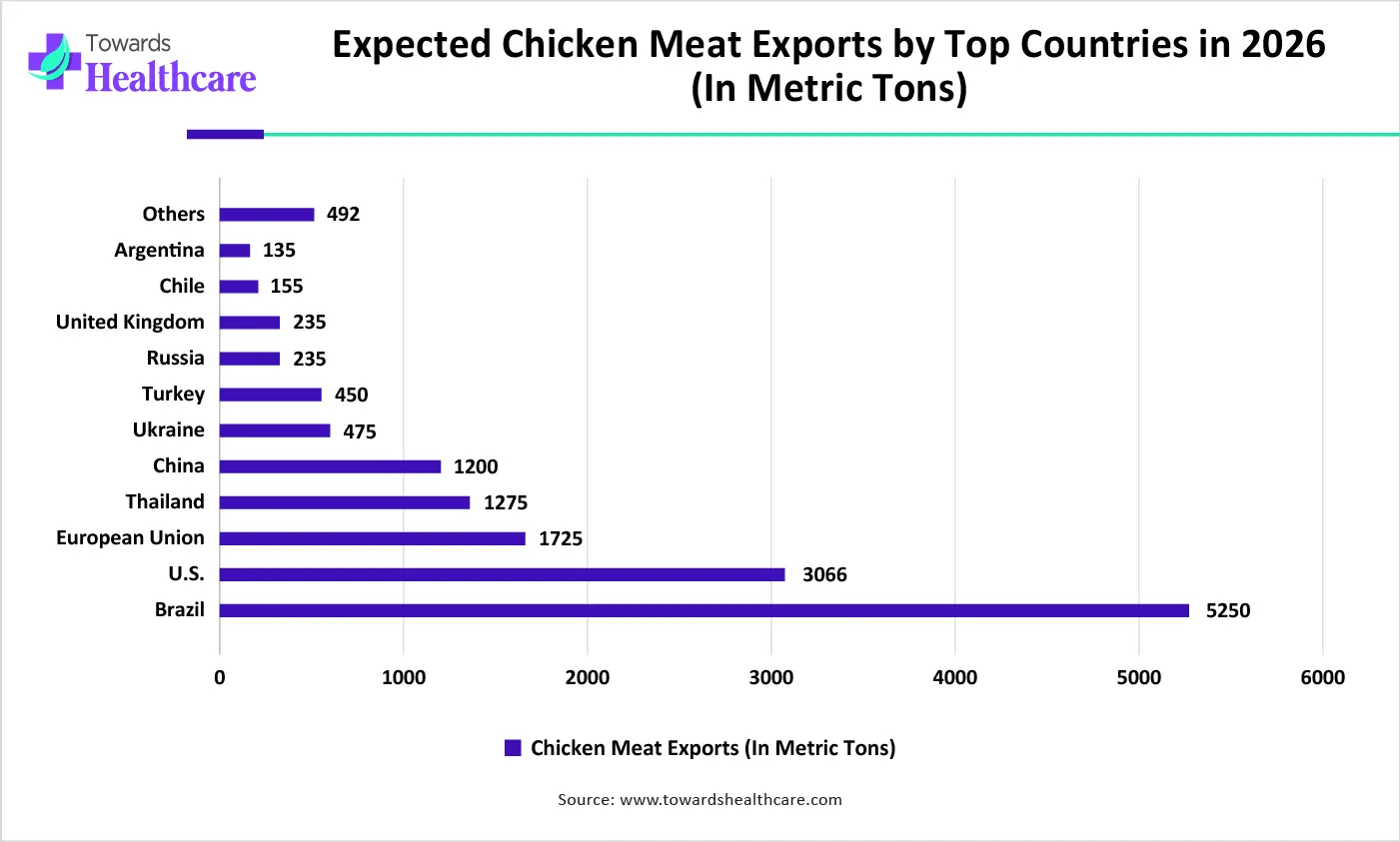

| Countries | 2026 |

| Brazil | 5,250 |

| U.S. | 3,066 |

| European Union | 1,725 |

| Thailand | 1, 275 |

| China | 1,200 |

| Ukraine | 475 |

| Turkey | 450 |

| Russia | 235 |

| United Kingdom | 235 |

| Chile | 155 |

| Argentina | 135 |

| Others | 492 |

| Companies | Headquarters | Offerings |

| Merck Animal Health | USA | Offers a broad poultry vaccine portfolio (live, inactivated, hatchery vaccines, and multivalent formulations) for diseases such as IBD, Marek’s, ILT, and Newcastle |

| Zoetis, Inc | USA | Provides comprehensive hatchery and field vaccines (including recombinant and vectored products) and diagnostic solutions for Newcastle, IBD, Marek’s, and avian influenza. |

| Boehringer Ingelheim Animal Health | Germany | Markets next-gen poultry vaccines and delivery systems (live, inactivated, and integrated hatchery solutions) targeting ND, IBD, Marek's, and multivalent protection. |

| Elanco Animal Health | USA | Supplies poultry vaccines and health-management solutions (inactivated, autogenous options, and supportive products) for ND, IBD, reovirus, fowl cholera, and more. |

| Ceva Sante Animal | France | Strong poultry portfolio including live and vectored vaccines (hatchery and field) for Newcastle, Infectious Bronchitis, Gumboro, coccidiosis, and other key diseases. |

| Vaxxinova | Netherlands | Specializes in bacterial and viral autogenous and commercial poultry vaccines, plus bespoke R&D and recently expanded commercial vaccine portfolios. |

| Hipra | Spain | Offers an extensive range of poultry vaccines (live, recombinant, hatchery-applied) covering coccidiosis, Newcastle, Gumboro, Salmonella, and digital vaccination support tools. |

| Hendrix Genetics | Netherlands | Primarily a genetics and breeding company, supports vaccination strategies and in-ovo/hatchery health programs in partnership with vaccine providers (focus: integrated flock health solutions). |

| Indian Immunological Limited | India | Major domestic animal-health manufacturer offering a range of livestock and poultry vaccines, formulations, and contract manufacturing for regional markets. |

| Shandong Longchang | China | Chinese animal-health company producing veterinary biologics and poultry products (vaccines/biologics and feed-additive solutions) for domestic and export markets. |

By Product Type

By Deployment Type

By Application

By End-User

By Region

February 2026

February 2026

February 2026

February 2026