February 2026

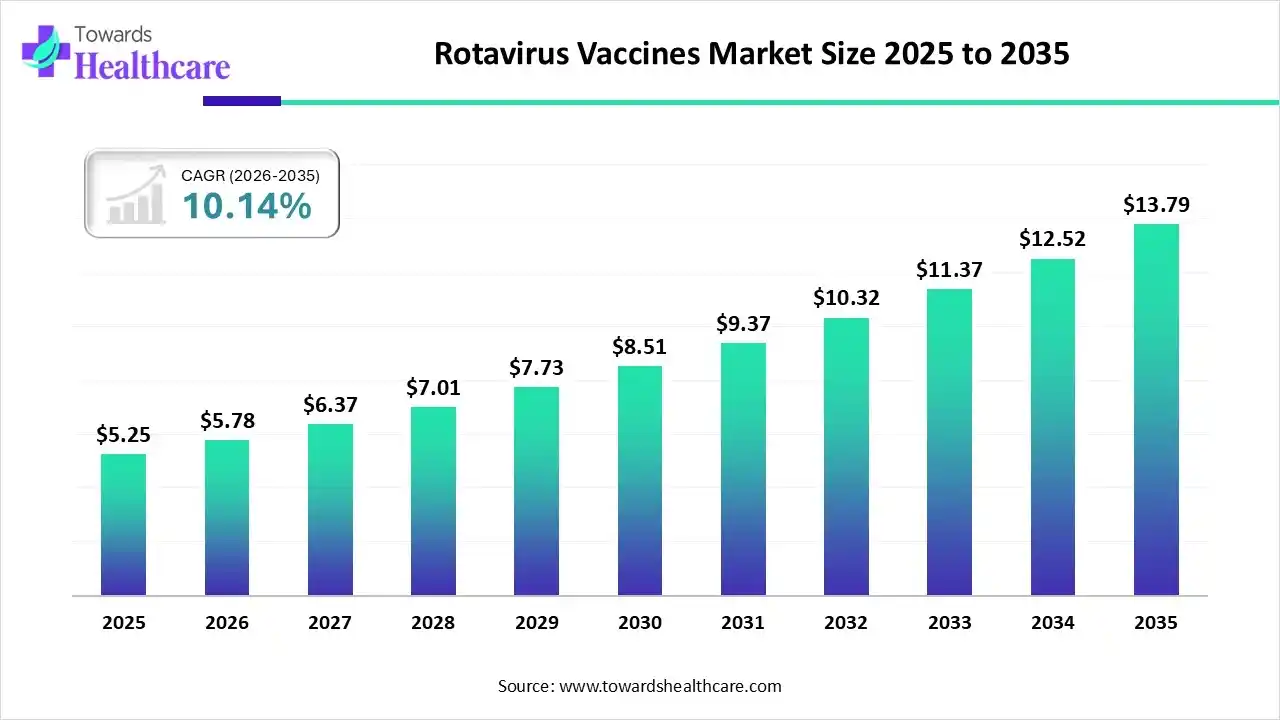

The global rotavirus vaccines market size was estimated at USD 5.25 billion in 2025 and is predicted to increase from USD 5.78 billion in 2026 to approximately USD 13.79 billion by 2035, expanding at a CAGR of 10.14% from 2026 to 2035.

The growing rotavirus infections globally are increasing the demand for their vaccines, where the growing adoption of AI technologies is accelerating their production. The growing population, health awareness, and robust healthcare are also increasing their use to control outbreaks, where companies are also developing and investing in advanced rotavirus vaccines, promoting the market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 5.78 Billion |

| Projected Market Size in 2035 | USD 13.79 Billion |

| CAGR (2026 - 2035) | 10.14% |

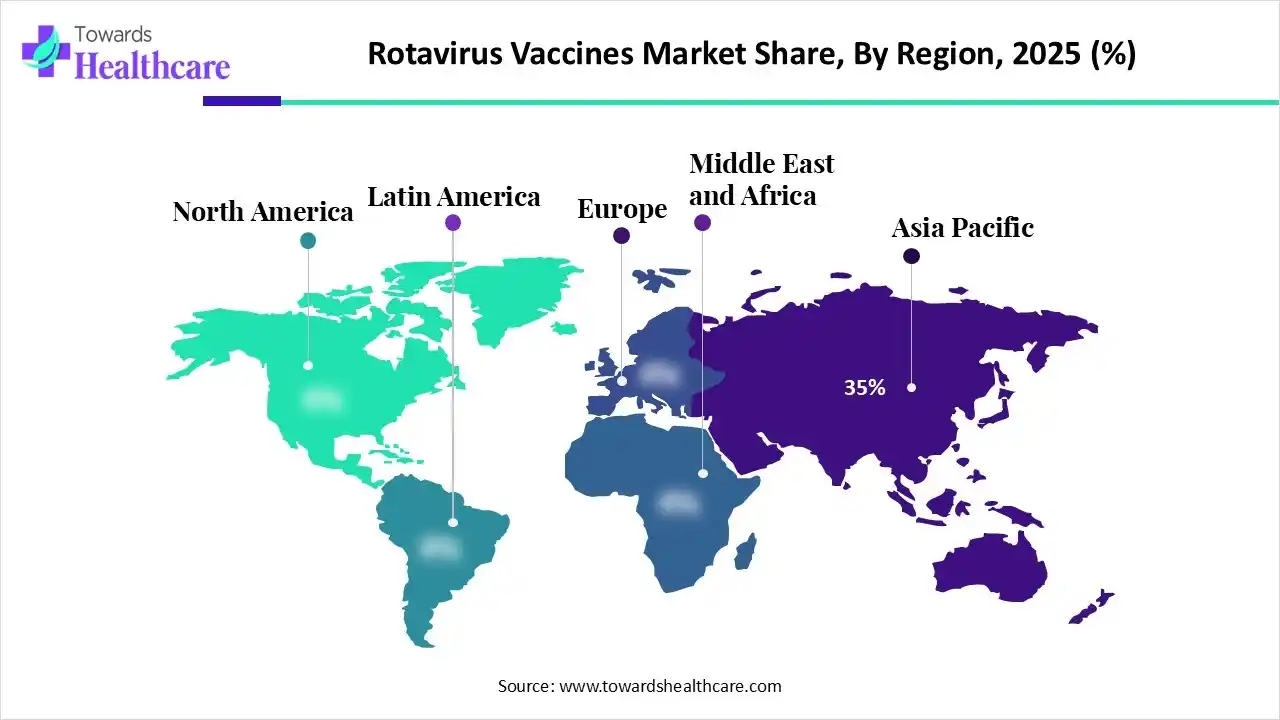

| Leading Region | Asia-Pacific by 35% |

| Market Segmentation | By Vaccine Type, By Route of Administration, By Immunization Program, By Distribution Channel, By End-User, By Region |

| Top Key Players | GlaxoSmithKline (GSK), Merck & Co., Serum Institute of India, Bharat Biotech, Lanzhou Institute of Biological Products (LIBP), Sinovac Biotech, Sanofi Pasteur, Biological E. Limited, POLYVAC |

The rotavirus vaccines market is driven by increasing immunization programs and infant health awareness. The rotavirus vaccines comprise vaccines developed to prevent rotavirus infection, which is a leading cause of severe gastroenteritis in infants and young children worldwide. These vaccines are administered orally and are designed to stimulate protective immunity against rotavirus strains to reduce morbidity, mortality, and healthcare burden.

AI plays an important role in the analysis and identification of viral gene sequences and vaccine targets, driving the development of target-specific vaccines. AI is also used to develop personalized vaccines depending on the patient's health profile, where the use of AI algorithms is promoting the development and identification of next-generation vaccine and their targets. It also helps in detecting disease outbreaks, as well as designing clinical trials.

Due to growing rotavirus disease outbreaks, the immunization programs conducted by the government are increasing, which is driving the adoption of stable and single-dose formulations.

In order to enhance the accessibility and control the disease outbreaks of rotavirus, the funding from the government, WHO, UNICEF, Gavi, and private bodies is increasing, leading to new collaborations and encouraging innovations.

The companies are focused on developing broad-spectrum rotavirus vaccines and novel platforms to enhance the safety and efficacy of the rotavirus vaccines, along with their stability.

| Viral Infections | Cumulative Number of Positive Laboratory Reports |

| Rotavirus | 962 |

| Norovirus | 2,802 |

In March 2025, a total $1.2 million grant was awarded by GIVAX, Inc. to Indiana University Bloomington researchers, where their collaboration led to the development of a groundbreaking rotavirus-norovirus combination vaccine to combat norovirus.

Why Did the Pentavalent Rotavirus Vaccines Segment Dominate in the Rotavirus Vaccines Market in 2025?

The pentavalent rotavirus vaccines segment held the largest share of approximately 48% in the market in 2025, due to their proven effectiveness against 5 rotavirus strains. This, in turn, increased their use in various immunization programs. Moreover, their stability and affordability also increased their use.

Next-Generation/Broad-Spectrum Rotavirus Vaccines

The next-generation/broad-spectrum rotavirus vaccines segment is expected to show the highest growth with approximately 14% CAGR during the predicted time, due to enhanced effectiveness. Additionally, their longer duration of action and growing innovations are also driving their acceptance rates.

How Oral Rotavirus Vaccines Segment Dominated the Rotavirus Vaccines Market in 2025?

The oral rotavirus vaccines segment led the market with approximately 95% in 2025, as they helped in enhancing gut immunity. At the same time, their non-invasive approach and ease of administration also increased their adoption rates. This, in turn, increased their adoption across the paediatric population.

Injectable (emerging formulation candidates)

The injectable (emerging formulation candidates) segment is expected to show rapid growth with approximately 16% CAGR during the predicted time, due to their rapid onset of action. They also provide an enhanced safety profile, which is increasing their use and driving the development of various combinations.

Which Immunization Program Type Segment Held the Dominating Share of the Rotavirus Vaccines Market in 2025?

The government national immunization programs segment held the dominating share of approximately 70% in the market in 2025, due to mandatory vaccination schedules. This, in turn, increased the adoption of rotavirus vaccines, where the growth in funding also increased their use.

NGO/Public Health Initiatives

The NGO/public health initiatives segment is expected to show the highest growth with approximately 13% CAGR during the upcoming years, due to growing focus on high-burden regions. Moreover, the growing health awareness, rotavirus outbreaks, and emergencies are also increasing their demand.

Why the Government Public Health Supplies Segment Dominated the Rotavirus Vaccines Market?

The government public health supplies segment led the market with approximately 60% share in 2025, driven by the growth in the immunization programs. This promoted the bulk procurement of different types of rotavirus vaccines. Moreover, the support from other global agencies also encouraged their use.

International Aid/Donor Supply Chains

The international aid/donor supply chains segment is expected to show rapid growth with approximately 14% CAGR during the upcoming years, due to growing funding. This is driving the donor-funded immunization campaigns across the high-burden region to control their outbreaks, which is increasing their adoption rates.

What Made Public Healthcare Facilities the Dominant Segment in the Rotavirus Vaccines Market in 2025?

The public healthcare facilities segment held the largest share of approximately 62% in the market in 2025, as they are the primary site for immunization. At the same time, the growth in the patient volume also increased their adoption rates. Furthermore, the growth of government and other health agencies' funding also increased their use.

Community Health Centers

The community health centers segment is expected to show the highest growth with approximately 13% CAGR during the upcoming years, due to growing decentralized immunization services. Moreover, the growing focus on underserved areas and preventive healthcare is also increasing their demand.

Asia Pacific dominated the rotavirus vaccines market with an approximate 35% share in 2025, due to the presence of a large population, which increased the incidence of rotavirus infections. At the same time, the growth in the immunization programs and government support also increased their use. Furthermore, the expanding healthcare sector also increased its manufacturing, which contributed to the market growth.

The growing paediatric population in China is increasing the demand and use of rotavirus vaccines in China. The growing incidence of rotavirus infections and government-funded immunization programs also increased their use. This is increasing rotavirus vaccine production and innovations.

MEA is expected to host the fastest-growing rotavirus vaccine market with approximately 17% CAGR during the forecast period, due to the growing rotavirus disease burden. Additionally, the growing paediatric populations and increasing government initiatives are also increasing their use. Moreover, the growing health awareness and expanding vaccination programs are also enhancing the market growth.

The demand for rotavirus vaccines across South Africa is increasing due to their high incidence rates. Moreover, the government and other health agencies are also launching new immunization programs backed by funds. Additionally, the expanding healthcare and health awareness are also increasing their use.

| Vaccines | Countries out of 54 Gavi-eligible countries |

| HPV vaccine | 28 |

| Rotavirus vaccines | 43 |

North America is expected to grow significantly in the rotavirus vaccines market during the forecast period, due to the presence of advanced healthcare infrastructure. The growing vaccination program and health awareness are also increasing their use. Moreover, the growing innovation of advanced vaccines is also promoting the market growth.

The U.S. consists of a robust healthcare sector, which is increasing the use of rotavirus vaccines. Similarly, the growing routine childhood immunization programs supported by the government and provincial funding are also increasing their adoption rates, where the companies are focusing on developing advanced retrovirus vaccines.

| Companies | Headquarters | Solutions |

| GlaxoSmithKline (GSK) | London, UK | ROTARIX |

| Merck & Co. | New Jersey, U.S. | RotaTeq |

| Serum Institute of India | Pune, India | ROTASIL |

| Bharat Biotech | Hyderabad, India | ROTAVAC & ROTAVAC 5D |

| Lanzhou Institute of Biological Products (LIBP) | Lanzhou, China | Provides Lanzhou Lamb Rotavirus (LLR) vaccines |

| Sinovac Biotech | Beijing, China | Offers live attenuated oral rotavirus vaccine |

| Sanofi Pasteur | Lyon, France | Provides rotavirus vaccine |

| Biological E. Limited | Hyderabad, India | Offers affordable rotavirus candidates |

| PT Bio Farma | Bandung, Indonesia | RV3-BB |

| POLYVAC | Hanoi, Vietnam | Rotavin-M1 |

By Vaccine Type

By Route of Administration

By Immunization Program

By Distribution Channel

By End-User

By Region

February 2026

February 2026

February 2026

February 2026