January 2026

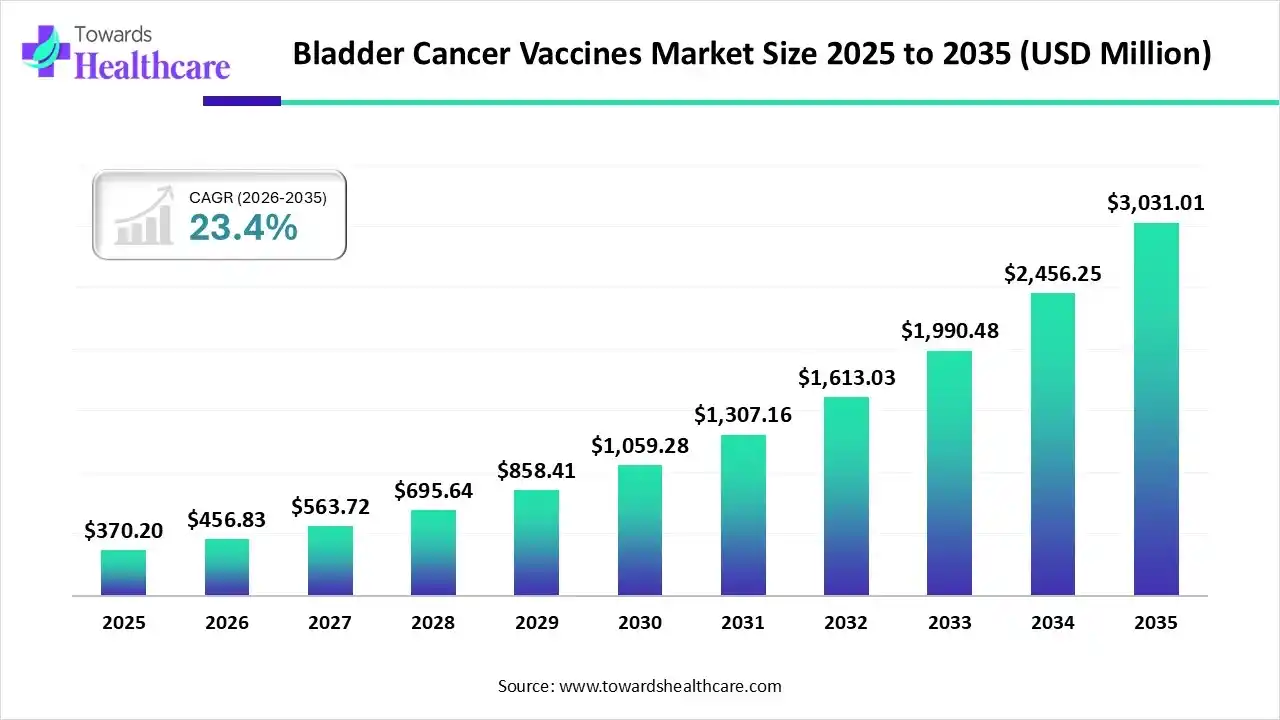

The global bladder cancer vaccines market size was estimated at USD 370.2 million in 2025 and is predicted to increase from USD 456.83 million in 2026 to approximately USD 3031.01 million by 2035, expanding at a CAGR of 23.4% from 2026 to 2035.

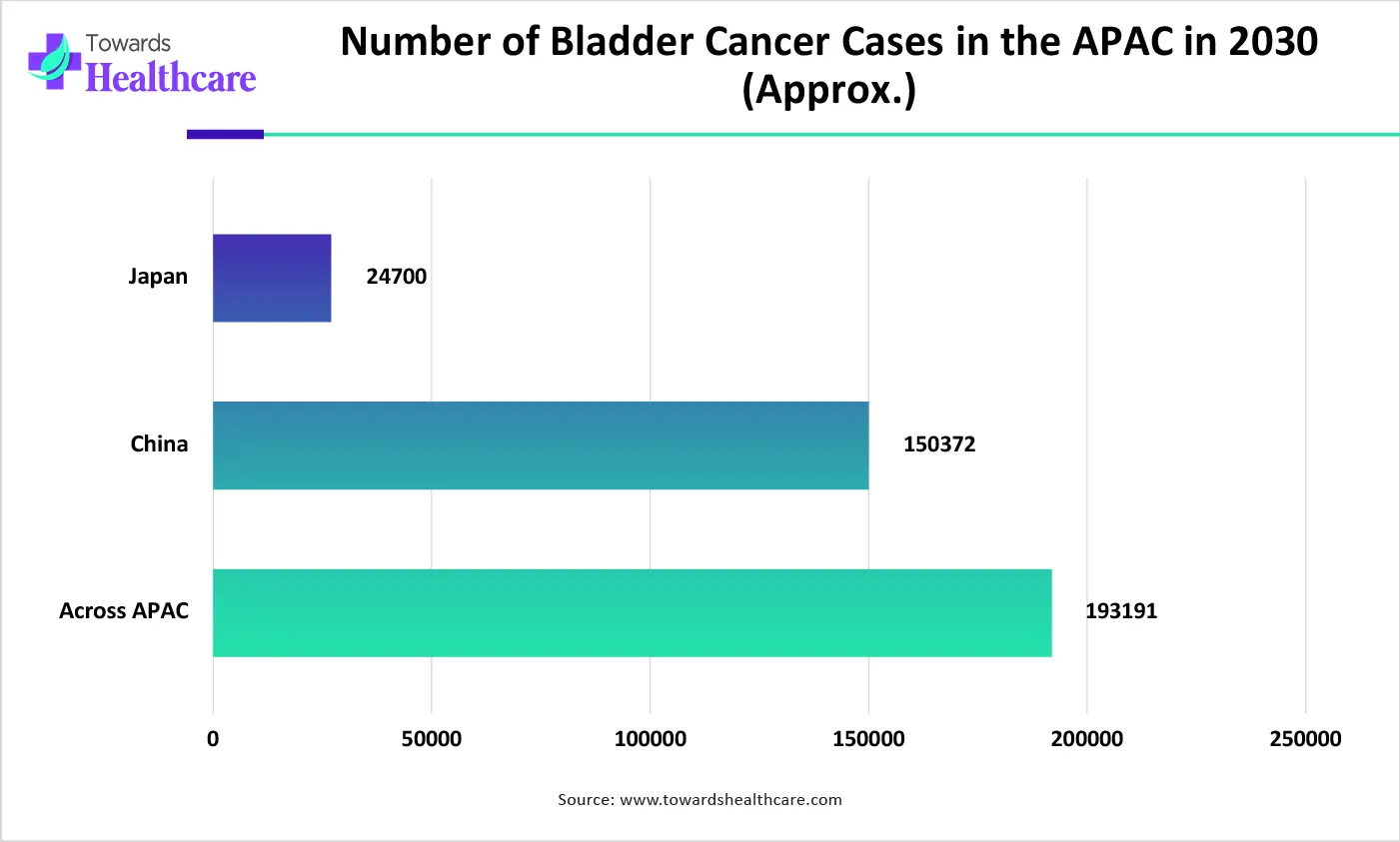

A specific growth in bladder cancer cases, mainly in the Asia Pacific countries, like China, & Japan, is bolstering the prospective demand and research development activities in the bladder cancer vaccines. This further accelerates through the adoption of a variety of immunotherapies, mRNA vaccines, and other combinations of therapies. Whereas, many regions are substantially putting efforts into clinical trials to raise the progression and revolution of these vaccines through the numerous collaborations, investments, and initiatives.

| Key Elements | Scope |

| Market Size in 2026 | USD 456.83 Million |

| Projected Market Size in 2035 | USD 3031.01 Million |

| CAGR (2026 - 2035) | 23.4% |

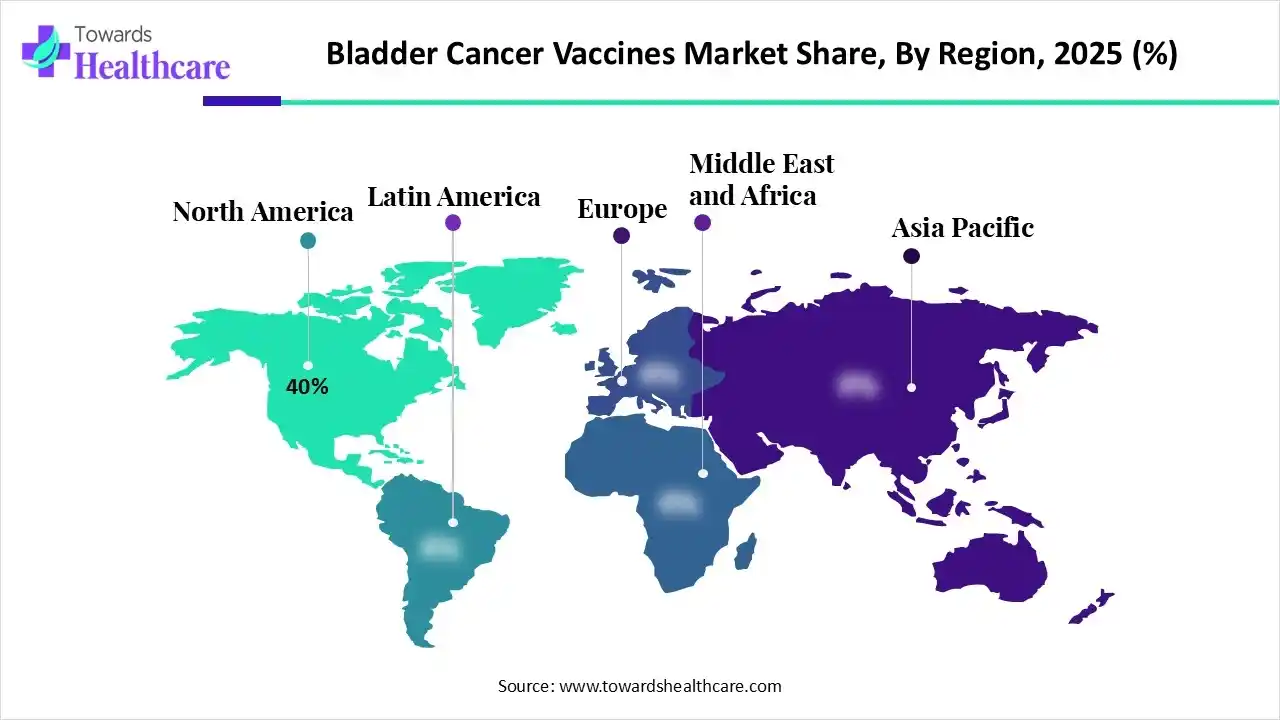

| Leading Region | North America by 40% |

| Market Segmentation | By Product Type, By Deployment Type, By Application, By End-User, By Region |

| Top Key Players | Merck & Co., Inc., Pfizer Inc., Bristol-Myers Squibb Company, Roche Holding AG, GlaxoSmithKline plc, Novartis AG, AstraZeneca plc, Johnson & Johnson, Eli Lilly and Company, BioNTech SE |

The bladder cancer vaccines market refers to the segment of oncology therapeutics focused on developing and commercializing vaccines specifically designed to prevent or treat bladder cancer by stimulating the body’s immune response against cancerous cells. The market encompasses clinical development, production, and commercialization of these vaccines, with increasing adoption driven by rising bladder cancer incidence, growing interest in immunotherapy, and advances in biotechnology and personalized medicine.

These vaccines include live attenuated bacteria-based therapies, peptide-based vaccines, dendritic cell-based vaccines, and other immunotherapeutic approaches aimed at improving survival, reducing recurrence, and enhancing quality of life for bladder cancer patients.

2025 is the era where the diverse applications of AI are assisting the global developments in different cases, such as bladder cancer vaccines. In this case, AI supports the prediction of tumour-specific antigens (neoantigens) by the patient’s unique genetic data, for example, PGV001. Alongside AI tools, including NetMHCpan, which enables improvements in the accuracy of epitope prediction, while ensuring the most effective targets are selected for incorporation into vaccines.

The recent RUTIVAC-1 trial presented a TB vaccine (RUTI) that enhances BCG's efficacy in preventing recurrence, with 100% tumour-free rates at 5 years in a pilot study, and highlighted a boosted immune response.

Nowadays, companies are investing in R&D for mRNA technologies and personalised immunotherapies that focus on high targeting, safety, and minimal recurrence.

Day by day, researchers are studying genetically modified BCG strains, like VPM1002BC, which are developed to be safer or more potent by escalating antigen presentation or expressing additional cytokines, such as IL-2 or GM-CSF.

Specifically, oncolytic viruses, such as CG0070, selectively replicate in tumor cells and leverage immune-stimulating factors in clinical trials, with promising results, mainly in combination with checkpoint inhibitors.

| Sponsor | Study Title |

| Merck Sharp & Dohme LLC | A Clinical Study of Intismeran Autogene (V940) and BCG in People With Bladder Cancer (V940-011/INTerpath-011) |

| University College, London | DURvalumab in Combination With S-488210/S-488211 vAccine in Non-muscle Invasive Bladder CancEr (DURANCE) |

| ECOG-ACRIN Cancer Research Group | Intravesical BCG vs GEMDOCE in NMIBC (BRIDGE) |

| Verity Pharmaceuticals Inc. | Evaluating Safety and Efficacy of Verity-BCG in BCG-naïve Patients with Intermediate and High-risk Non-muscle Invasive Bladder (NMIBC) (EVER) |

Which Product Type Dominated the Bladder Cancer Vaccines Market in 2025?

In 2025, the live attenuated vaccines segment led with a 40% revenue share of the market. This vaccine is known as the Bacillus Calmette-Guérin (BCG) vaccine, which is used for non-muscle-invasive bladder cancer (NMIBC). Recently, researchers have demonstrated that the approaches to strengthen BCG's interaction with bladder cells, especially genetic modification to express adhesive proteins (FimH), are further assisting in optimising retention and immune activation.

Peptide-Based Vaccines

During 2026-2035, the peptide-based vaccines segment will expand rapidly. Mainly, they offer wider advantages in bladder cancer by triggering T-cell responses against tumour antigens. In the last few days, PGV_001, a personalized peptide genome vaccine, was developed and tested in urothelial carcinoma using computational tools to predict neoantigens, and another example is NCI-2025-00334, which is in a phase I trial fostering evaluation with up to 20 peptides from patient-specific tumor mutations, along with an adjuvant, in muscle-invasive bladder cancer following surgery.

Why did the Hospital/Clinical Administration Segment Lead the Market in 2025?

The hospital/clinical administration segment dominated with a 55% share of the bladder cancer vaccines market in 2025. It is prominently considered the primary treatment center for most patients and the main site for administering complex therapies, such as intravesical BCG. Primarily, they insert a catheter into the urethra and inject the liquid BCG solution directly into the bladder. However, for the participation of these hospitals in clinical trials the administration contributes to the extensive data collection, reporting, and protocol adherence.

Outpatient/Ambulatory Centers

The outpatient/ambulatory centers segment is anticipated to expand fastest. Numerous diagnostic, surveillance, and initial treatment procedures for non-muscle-invasive bladder cancer (NMIBC), including cystoscopy and intravesical immunotherapy, are increasingly performed in an outpatient setting. Alongside, ASCs provide minimally invasive procedures, resulting in shorter recovery times and minimal post-operative complications, which are promising for patient outcomes and satisfaction. It also leverages a non-hospital setting, which inherently lowers the exposure time and risk of acquiring hospital-acquired infections.

Which Application Led the Bladder Cancer Vaccines Market in 2025?

In 2025, the bladder cancer treatment segment captured a 60% share of the market. The emergence of vector-based vaccines, such as ADSTILADRIN (nadofaragene firadenovec), uses a viral vector for NMIBC. Nowadays, research firms are exploring mRNA vaccines, which demonstrate probable combinations with immunotherapies like pembrolizumab.

In July 2025, the UK MHRA approved ImmunityBio’s ANKTIVA Plus BCG for BCG-unresponsive non-muscle invasive bladder cancer carcinoma in situ.

Research & Clinical Trials

In the coming era, the research & clinical trials segment is anticipated to witness rapid expansion. Ongoing research activities and clinical trials are focusing on the development of tailored mRNA vaccines, oncolytic viruses, and peptide-based vaccines.

Cretostimogene grenadenorepvec is currently in a Phase III trial (PIVOT-006) for NMIBC patients and has achieved complete response rates in early data, possibly providing a novel alternative for patients with an urgent need for treatment options to BCG due to shortages or unresponsiveness.

How did the Hospitals & Cancer Treatment Centers Segment Dominate the Market in 2025?

The hospitals & cancer treatment centers segment led with a 50% share of the bladder cancer vaccines market in 2025. Especially, the University of Texas MD Anderson Cancer Center (Houston, TX) and Memorial Sloan Kettering Cancer Center (New York, NY) are top oncology hospitals across the globe, with raised innovations in research in AI and robotics for cancer treatment. They also facilitated access to a variety of treatments, like surgery, chemotherapy (intravesical and systemic), radiation therapy, immunotherapy (BCG therapy, checkpoint inhibitors), and targeted therapy.

Specialty Clinics/Urology Centers

In the future, the specialty clinics/urology centers segment is predicted to expand at a rapid CAGR. They widely offer a multidisciplinary uro-oncology program, resulting in more accurate diagnoses, tailored treatment plans, and enhanced outcomes. Also, they possess uro-oncologists with specific training and extensive experience in treating urological cancers, and more sophisticated diagnostic tools, particularly advanced MRI, CT, and PET scans, along with innovative techniques, such as narrow-band imaging and molecular profiling. Currently, they are emphasising the "one-stop shop" model of many multispecialty clinics, which simplifies the patient journey and lowers the need for multiple visits.

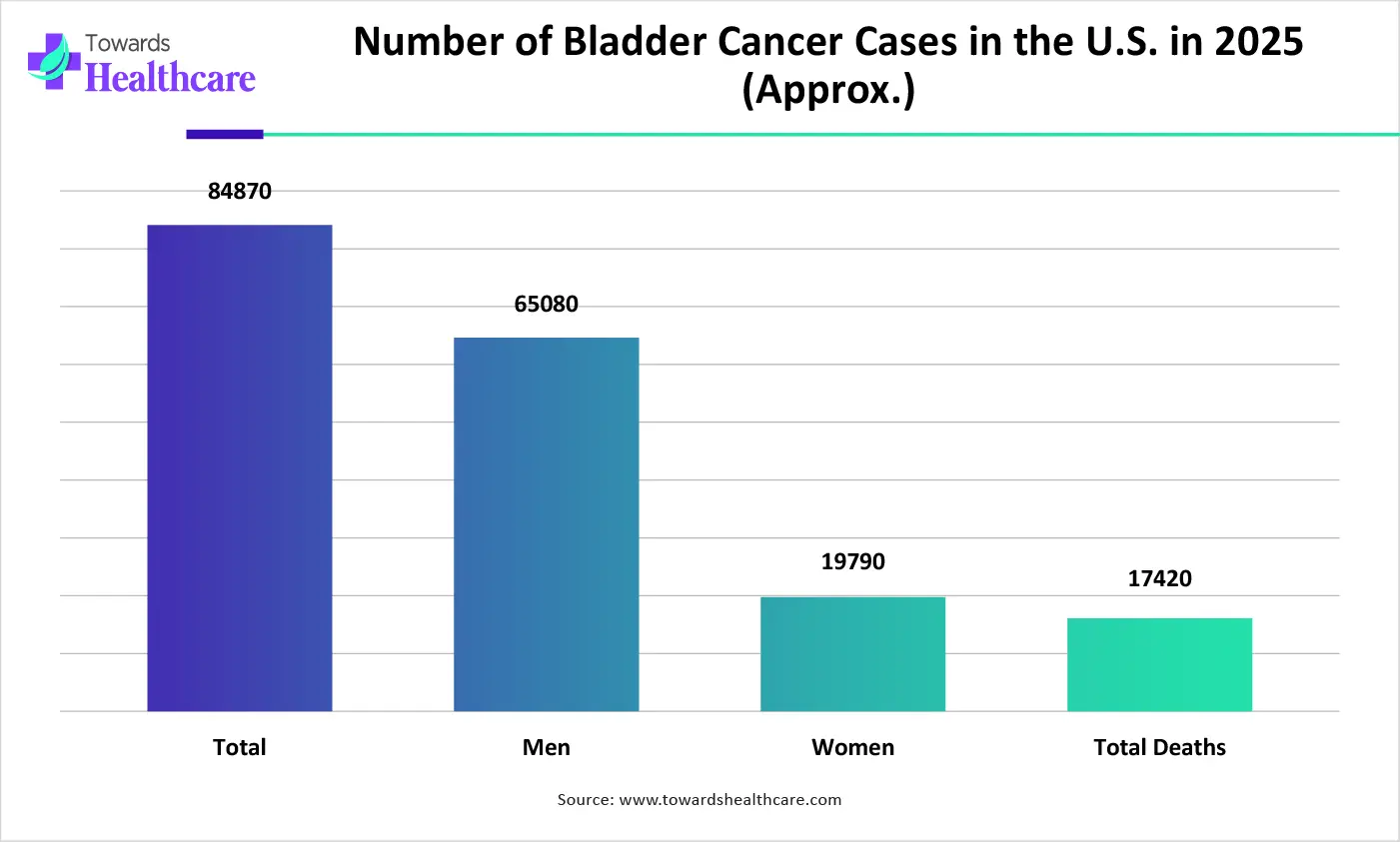

In 2025, North America dominated with a 40% share of the bladder cancer vaccines market, due to the accelerating cancer cases, major investment in immunotherapy innovation, especially in mRNA & BCG combos, government support, and strong biotech ecosystems, such as Merck, Pfizer, etc. Recently, the FDA approved the gemcitabine intravesical system, with a brand name Inlexzo, also known as TAR-200, created by Janssen Biotech/Johnson & Johnson for BCG-unresponsive NMIBC.

Whereas, the U.S. is exploring many new immunotherapy combinations, novel drug delivery systems, such as Durvalumab (Imfinzi), approved in combination with chemotherapy (gemcitabine and cisplatin) as neoadjuvant and adjuvant treatment for muscle-invasive bladder cancer (MIBC).

The prospective highest growth of the bladder cancer vaccines market in the Asia Pacific is mainly fueled by a rise in cancer cases, due to the expanded smoking rates, and is further fueled by the high demand for more efficacious solutions, especially in China, Japan, India, and South Korea. Recently, AstraZeneca Pharma India received approval from the Central Drugs Standard Control Organisation (CDSCO) for the use of durvalumab (Imfinzi) in a perioperative regimen (before and after surgery) for muscle-invasive bladder cancer (MIBC).

On the other hand, China will expand at the fastest CAGR, with raised approvals by China's National Medical Products Administration (NMPA) for the use of enfortumab vedotin (PADCEV) in combination with pembrolizumab (Keytruda) for adult patients with locally advanced or metastatic urothelial cancer.

With a lucrative growth, Europe will transform the bladder cancer vaccines market, as recently AstraZeneca's Imfinzi (durvalumab) was approved in the EU as the first and only perioperative immunotherapy for resectable muscle-invasive bladder cancer (MIBC). It has substantial uses with chemotherapy before surgery and as a monotherapy afterwards, which has presented a 25% reduction in the risk of death in the Phase III NIAGARA trial.

Moreover, Germany is immensely leveraging diverse trial in the era, with the exploration of combined ICIs (e.g., pembrolizumab, atezolizumab, enfortumab vedotin) with existing treatments, especially the KEYNOTE-905/EV-303 and IMvigor011 studies presented at ESMO 2025 in Berlin, for muscle-invasive bladder cancer (MIBC) patients.

| Merck & Co., Inc. | A company significantly explored advanced immunotherapies, such as its flagship drug Keytruda (pembrolizumab), for bladder cancer. |

| Pfizer Inc. | It mainly specializes in combination therapies consisting of existing immunotherapies and a potential novel agent being studied with the standard-of-care Bacillus Calmette-Guérin (BCG) vaccine. |

| Bristol-Myers Squibb Company | This specifically leverages the immunotherapy Opdivo (nivolumab), which is a checkpoint inhibitor. |

| Roche Holding AG | A vital player offers an experimental personalized mRNA cancer vaccine called autogene cevumeran (BNT122/RO7198457), which is in a Phase II clinical trial. |

| GlaxoSmithKline plc | It facilitates Pacis, a Bacillus Calmette-Guérin (BCG) vaccine used for the treatment of superficial bladder cancer. |

| Novartis AG | This particularly unveils diverse other cancer immunotherapy and treatment areas, encompassing some in the bladder cancer space through collaborations. |

| AstraZeneca plc | Its prominent offering is the immuno-oncology treatment Imfinzi (durvalumab). |

| Johnson & Johnson | It has a significant new intravesical (into the bladder) treatment called INLEXZO (gemcitabine intravesical system), approved in late 2025 for BCG-unresponsive bladder cancer. |

| Eli Lilly and Company | This is involved in numerous clinical trials, such as (NCT07218380), which is testing vepugratinib (LY3866288). |

| BioNTech SE | A firm is studying mRNA-based personalized cancer vaccines for the treatment of bladder cancer through a notable collaboration on the autogene cevumeran (BNT122) program with Roche/Genentech. |

By Product Type

By Deployment Type

By Application

By End-User

By Region

January 2026

December 2025

December 2025

December 2025