January 2026

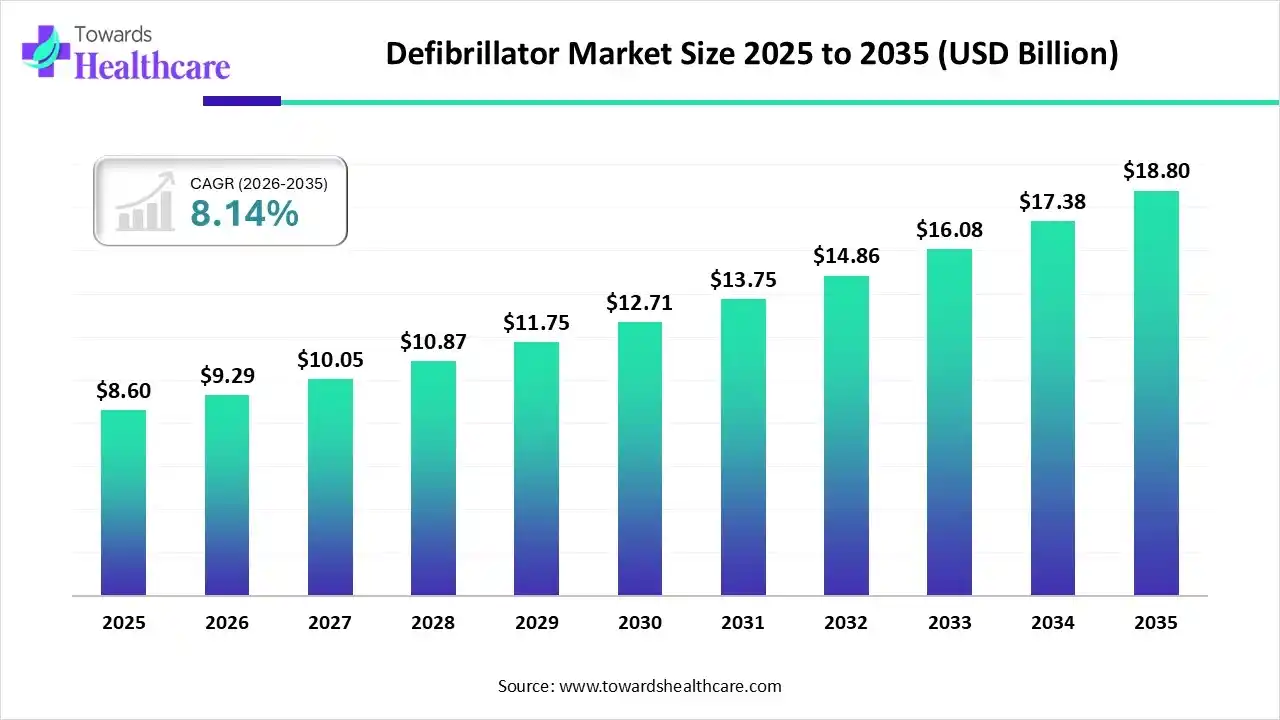

The global defibrillator market size was estimated at USD 8.6 billion in 2025 and is predicted to increase from USD 9.29 billion in 2026 to approximately USD 18.8 billion by 2035, expanding at a CAGR of 8.14% from 2026 to 2035.

The defibrillator market is growing due to the increasing applications in sudden cardiac arrest (SCA), ventricular fibrillation (VF), pulseless ventricular tachycardia (VT), and wearable cardioverter defibrillators (WCDs)

Defibrillators are devices that apply an electric current or charge to the heart to restore a standard heartbeat. Some implantable or wearable defibrillators fix certain dangerous arrhythmias, which are difficulties with the rhythm of the heartbeat. Defibrillators have various applications, based on the type. Automated external defibrillators (AEDs) are found in major public spaces. They save the lives of people who are in heart attack.

| Diseases | Percentages |

| CVD | 30% |

| Infections | 19% |

| Cancer | 13% |

| Injuries | 9% |

| Respiratory Diseases | 6% |

| Maternal | 6% |

| Others | 17% |

The integration of AI-driven technology into defibrillators drives the growth of the market, as AI-driven technology is used to calculate optimal geographical location and possible patrols to allow high access to automated external defibrillators. AI-based technology is enhancing the precision of heart rhythm readings, improving decision-making processes, and offering real-time feedback. AI-based systems offer immediate guidance on chest compression rate, depth, and recoil, enhancing resuscitation quality and consistency.

The incorporation of AI and advanced algorithms is modernizing defibrillator devices monitor and respond to asymmetrical cardiac rhythms. These novelties not only improve device efficacy but also enhance patient outcomes by reducing unnecessary interventions.

Innovation in battery technology and deep miniaturisation of electronics present the opportunity to implant the whole pacemaker system in the ventricle.

The development in defibrillator design shows significant progress in the management of cardiac arrhythmias and the prevention of SCA. By focusing on improving safety and efficacy, these new strategies address the challenges of conventional tools and prioritize patient compliance.

| Key Elements | Scope |

| Market Size in 2026 | USD 9.29 Billion |

| Projected Market Size in 2035 | USD 18.8 Billion |

| CAGR (2026 - 2035) | 8.14% |

| Leading Region | North America |

| Market Segmentation | By Product, By End User, Regional Outlook |

| Top Key Players | Medtronic, Abbott, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, MicroPort Scientific Corporation, Koninklijke Philips N.V. |

Which Product Led the Defibrillator Market in 2025?

In 2025, the implantable cardioverter defibrillators (ICDs) segment held the dominant market share, as ICDs avoid arrhythmic deaths, but they also affect quality of life (QOL) due to device-associated challenges. An ICD lowers the challenges of sudden death from cardiac arrest more than medicine. It is intended to treat dangerously rapid heart rates. It incessantly monitors the heart and restores it to its normal heart rate.

External Defibrillators

Whereas the external defibrillators segment is the fastest-growing in the market, as this device provides a fully robotic life-saving emergency therapy rapidly and is operable by any layperson. An automated exterior defibrillator increases the chance of saving the life of an SCA victim by 75%. The machineries are completely automated, portable, and analyzes the heart for shock rhythms. They are intended to give shocks robotically, and the rescuer does not press any button.

Why did the Hospitals Segment Dominate the Market in 2025?

The hospitals segment is dominant in the defibrillator market in 2025, as defibrillators reduce the challenges of sudden death in people who have a known arrhythmia or a high risk of a life-threatening arrhythmia from causes like genetic diseases, cardiac failure, or a prior cardiac arrest. Major hospitals and medical clinics employ the use of defibrillators on a routine basis as they strengthen an patients chance of survival.

Public Access Market

Whereas the public access market segment is the fastest growing in the market, as public automated external defibrillator (AED) defibrillation has increased survival rates as compared with defibrillation by EMS; this was most probably attributable to a much lower time to defibrillation. Public access defibrillation is specifically significant in witnessed cardiac arrests that happen in public places.

In 2025, North America led the defibrillator market, as growing cases of cardiac diseases driven by continuing rises in high blood pressure, obesity, and other major complicating factors, cardiac disease continues to kill more people, according to the American Heart Association. In the United States, people have a heart attack each 40 seconds; each year, around 805,000 people in the United States have a heart attack. The presence of industry leaders like Medtronic, Abbott, Boston Scientific Corporation, and Stryker, which drives the growth of the market.

For Instance,

U.S. Market Trends

Increasing cases of cardiovascular diseases (CVD) are largely attributed to unhealthy lifestyle factors like alcohol consumption, physical inactivity, smoking, and unhealthy food habits. U.S. and international sites are to make and bolster the guideline infrastructure to help population-based heart disease prevention, which drives the growth of the market.

Asia Pacific is set to experience rapid growth in the defibrillator market due to the rapidly increasing burden of cardiovascular disease (CVD) in this region. The number of aging people in the Asia-Pacific will triple, reaching 1.3 billion by 2050, which increases the demand of defibrillator. Growing disposable incomes are driving healthcare investment, also increasing the burgeoning pow middle class in this region, which contributes to the growth of the market.

For Instance,

India Market Trends

In India, increasing Government initiatives and growing public awareness campaigns support bridging the gap and encourage preventive care. India's increasing cardiac cases highlight an emergency requirement for better medical care approaches, preventive awareness, and accessible treatment. Cardiac health awareness supports lowering disease rates and enhancing treatment achievement. Early identification and better lifestyle habits prevent severe conditions, which drives the growth of the market.

Europe is experiencing substantial growth in the defibrillator market, as heart diseases are the leading cause of death in Europe, accounting for over 42.5% of all deaths per year, which increases the demand of defibrillator. The growing installation of automated external defibrillators (AEDs) in the workplace in Europe, which drives the growth of the market.

UK Market Trends

Cardiovascular disease (CVD) is the most usual causes of death in the UK, and more than 6 million people live with CVD. Medical care expenses relating to CVD are estimated at £7.4 billion per year, which drives the growth of the market.

| Company | Headquarters | Latest Update |

| Medtronic | United States | In April 2025, Medtronic plc, a global leader in healthcare technology, received U.S. Food and Drug Administration (FDA) approval for the OmniaSecure defibrillation lead for placement within the right ventricle. |

| Abbott | United States | In January 2025, Abbott entered into a strategic collaboration with AtaCor Medical to develop an investigational extravascular implantable cardioverter defibrillator (EV-ICD) system, with the goal to enhance the safety and effectiveness of therapy for patients at risk of sudden cardiac death. |

| Boston Scientific Corporation | United States | In July 2025, Boston Scientific Corporation (BSC) began informing clinicians of the potential for significantly increasing low-voltage shock impedance (LVSI) associated with shock coil calcification in RELIANCE™ defibrillation leads coated with expanded polytetrafluoroethylene. |

| BIOTRONIK SE & Co. KG | Germany | Recent research suggested shorter-than-expected battery life for BIOTRONIK tools, prompting a significant internal analysis. |

| MicroPort Scientific Corporation | China | In December 2025, MicroPort Scientific Corporation announced that the strategic merger between its subsidiaries MicroPort CardioFlow Medtech Corporation and MicroPort Cardiac Rhythm Management had been approved by MicroPort CardioFlow’s shareholders. |

| Koninklijke Philips N.V. | Netherlands | In January 2025, Royal Philips, a worldwide leader in health technology, announced that it had signed an agreement to sell its Emergency Care business. |

By Product

By End User

Regional Outlook

January 2026

January 2026

January 2026

January 2026