January 2026

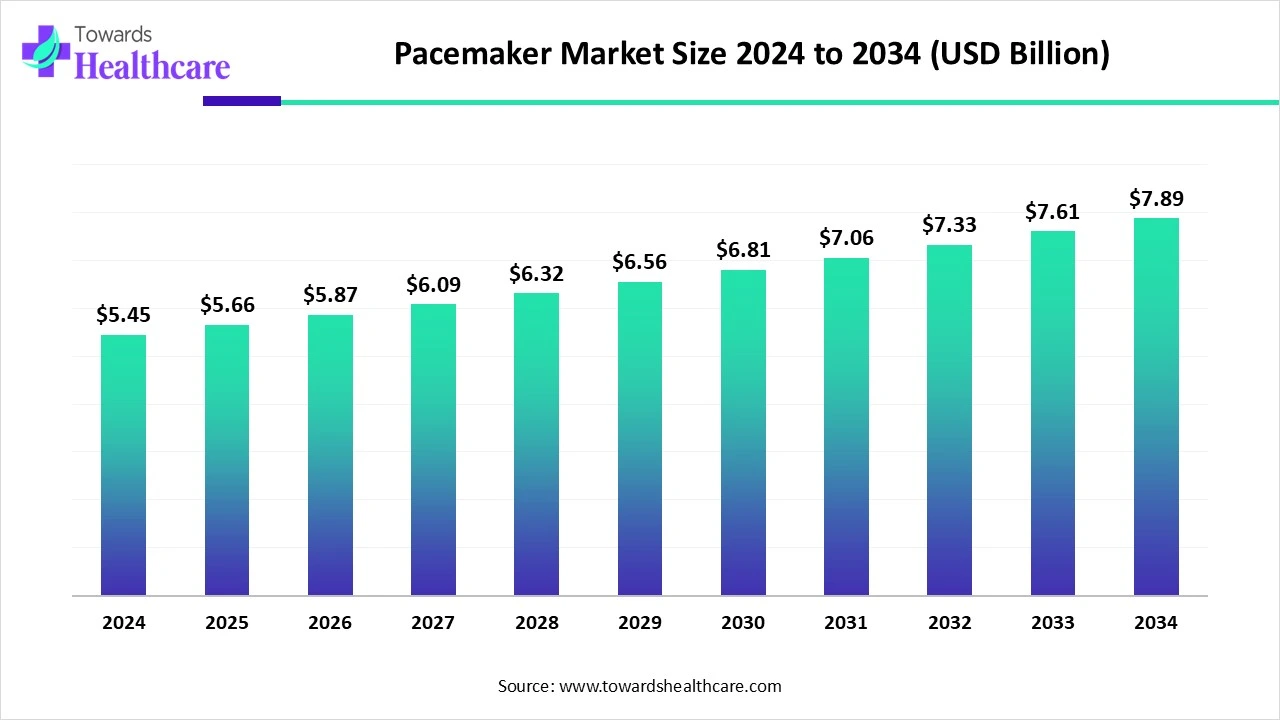

The global pacemaker market size is calculated at USD 5.45 billion in 2024, grow to USD 5.66 billion in 2025, and is projected to reach around USD 7.89 billion by 2034. The market is expanding at a CAGR of 3.75% between 2025 and 2034.

The pacemaker market is witnessing steady growth driven by the rising prevalence of cardiovascular diseases, particularly among the elderly. Advancements in technology, such as leadless pacemakers, remote monitoring, and MRI compatibility, are enhancing device performance and patient comfort. Increasing healthcare awareness, improved diagnosis, and expanding access to cardiac care in emerging economies are also contributing to market expansion. Additionally, supportive government initiatives and growing adoption of minimally invasive procedures are fueling further demand for pacemakers globally.

| Metric | Details |

| Market Size in 2025 | USD 5.66 Billion |

| Projected Market Size in 2034 | USD 7.89 Billion |

| CAGR (2025 - 2034) | 3.75% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Technology, By Application, By Implant Site, By End User, By Sales Channel, By Region |

| Top Key Players | Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, BIOTRONIK SE & Co. KG, MicroPort Scientific Corporation, LivaNova PLC, Osypka Medical GmbH, Lepu Medical Technology, Shree Pacetronix Ltd., ZOLL Medical Corporation (Asahi Kasei), MEDICO S.p.A., Sorin Group (now part of LivaNova), Pacetronix, Cordis (Cardinal Health), Oscor Inc., EDWARDS Lifesciences, Fukuda Denshi, IMPLANET, Stryker (external cardiac pacing devices), Cook Medical |

The Pacemaker Market refers to the global industry involved in the design, manufacturing, and distribution of implantable and external medical devices that use electrical impulses to regulate abnormal heart rhythms (arrhythmias). Pacemakers are primarily used in patients suffering from bradycardia, atrial fibrillation, and heart block. The market is driven by rising cardiovascular disease prevalence, an aging global population, technological advancements such as MRI-compatible and leadless pacemakers, and increased healthcare access in emerging regions.

The pacemaker market is evolving with advancements like leadless design, remote monitoring, and MRI-safe technology. These innovations are improving patient comfort, enhancing device performance, and enabling more personalized, minimally invasive treatment options for heart rhythm disorders.

For Instance,

AI is transforming the market by enabling smarter, real-time monitoring and personalized treatment through data-driven insights. It helps predict arrhythmia risks, optimize pacing algorithms, and improve device programming for individual patient needs.

AI also enhances remote patient management by analyzing data trends and alerting clinicians to potential issues early. These capabilities improve patient outcomes, reduce hospital visits, and support the development of next-generation pacemakers with adaptive, self-learning features, ultimately driving innovation and market growth.

Rising Prevalence of Cardiovascular Diseases

The growing burden of cardiovascular conditions, including conduction disorders and irregular heartbeats, has significantly increased the need for pacing devices. As heart-related issues become more common due to aging stress, and lifestyle habits, more patients are requiring consistent heart rhythm regulation. This rising clinical need is encouraging broader adoption of pacemakers, pushing manufacturers to innovate and meet demand, thus positioning cardiovascular disease prevalence as a key factor driving the market growth.

High Cost of Pacemaker Devices and Procedures

The rising prices of advanced pacemakers technologies and implantations procedures have emerged as a growing concern in the market. Innovation like leadless and remote-monitoring-enabled devices, thought beneficial involve higher production and operational costs. This makes them less accessible to patients in cost-sensitive or underinsured regions, potentially restricting the market growth. The financial burden on both healthcare systems and patients is becoming a major barrier, especially in developing countries with limited reimbursement support.

Technological Advancement

The pacemaker market is set to benefit from rapid technological progress, as innovations are making devices smaller, smarter, and more adaptable to patient needs. Features such as rechargeable batteries, improved biocompatibility, and remote connectivity are transforming cardia care.

These advancements support quicker recover, fever hospital visits, and long-term monitoring, making treatment more effective and convenient. As healthcare system prioritize digital and minimally invasive solutions, these technologies open new growth avenues for manufactures and providers alike.

For Instance,

In 2024, the implantable pacemakers segment led the pacemaker market in revenue due to their higher reliability, long-term functionality, and growing preference for minimally invasive procedures. These devices offer continuous heart rhythm management, making them suitable for patients with chronic cardiac conditions. Their ability to reduce hospitalization and improve patient quality of life also contributed to their dominance. Moreover, advancements in battery life and device miniaturization further boosted their adoption across both developed and emerging healthcare markets.

For Instance,

The conventional segment dominated the pacemaker market in 2024 largely due to physician familiarity, streamlined surgical procedures, and consistent clinical outcomes. These devices have trust among healthcare providers and patients. Moreover, established reimbursement policies and widespread clinical guidelines continue to favour conventional models. Their compatibility with existing infrastructure and ease of integration into routine care also contributed to their market presence during the year.

The bradycardia segment led the pacemaker market in 2024 primarily because of its clear clinical indications and consistent demand for pacing therapy. As bradycardia often results in fatigue, dizziness, and fainting, timely intervention with pacemakers becomes essential. Physicians widely recognize and treat this condition using standard pacing techniques, contributing to high device utilization. Moreover, routine cardiac screening and the number of patients with conduction system disorders further reinforced the market-leading position.

For Instance,

In 2024, the endocardial segment led the pacemaker market by implant site due to its clinical efficiency, longer device lifespan, and lower complication rates. This approach allows direct placement of the pacemaker lead into the heart’s inner lining, ensuring accurate signal delivery and better rhythm control. Its familiarity among surgeons and compatibility with conventional pacemaker systems further supported widespread adoption, especially in patients requiring long-term pacing therapy across various healthcare settings.

The hospital segment held the highest market share in 2024, largely because of rising inpatient procedures and the integration of cardiac care units within hospitals. These facilities often serve as referral centers for complex cardiac cases, ensuring a steady flow of patients needing pacemaker implants. Moreover, hospitals are more likely to participate in clinical trials and adopt new pacemaker technologies early, which enhances patient trust and drives higher procedure volumes compared to other healthcare settings.

For Instance,

In 2024, the direct sales segment dominated the market as it allowed manufacturers to offer tailored product solutions and gather real-time feedback form end-users. This approach helped streamline communication, improve services quality, and address clinical needs more effectively. Direct sales also facilitated faster adoption of new technologies, as companies could directly educate healthcare professionals and demonstrate product benefits, leading to stronger engagement and higher sales volumes compared to indirect distribution methods.

In 2024, North America dominated the market in terms of revenue due to its advanced healthcare infrastructure, high prevalence of cardiac disorders, and early adoption of innovative medical technologies. The region also benefited from strong reimbursement systems, increased awareness about heart health, and a growing elderly population.

Additionally, the presence of leading pacemaker manufacturers and ongoing clinical research activities contributed to higher procedure volumes and device uptake across hospitals and specialized cardiac centers.

For Instance,

The U.S. pacemaker market is growing due to a rising number of cardiovascular cases, especially among the aging population. Increased adoption of advanced technologies like leadless and MRI-compatible pacemakers is also driving demand. Supportive reimbursement policies, strong healthcare infrastructure, and greater awareness about heart rhythm disorders further contribute to market expansion, making the U.S. a key region for pacemaker adoption and innovation.

For Instance,

Canada’s market is expanding due to a rapidly aging population and a high prevalence of cardiovascular disease, which significantly increases demand for cardiac rhythm management. Strong public healthcare and reimbursement support boost access to implantable devices. Moreover, ongoing innovation such as MRI-safe and leadless pacemakers combined with growing awareness of heart rhythm disorders and rising minimally invasive implant procedures, continues to drive device adoption and market growth.

Asia-Pacific is expected to grow at the fastest pace in the market during the forecast period due to increasing cases of cardiac disorders and a rapidly aging population. Improvements in healthcare infrastructure, growing awareness of heart health, and the rising availability of advanced pacemaker technologies are boosting demand. Additionally, increasing healthcare spending and greater access to minimally invasive procedures are encouraging more patients in the region to opt for pacemaker implantation.

For Instance,

China’s market is expanding rapidly, driven by a surging number of older adults and an escalating burden of cardiovascular diseases (about 330 million patients suffering from CVDs). Rising healthcare spending and improvements in medical infrastructure boost access to implantable cardiac devices across urban centers. Growing awareness about arrhythmia treatment and increasing pacemaker adoption, especially for advanced technologies, further supports market growth in China.

For Instance,

India’s market is expanding due to a growing aging population and a rising incidence of cardiovascular disease, which drives demand for implantable devices. Government initiatives like Ayushman Bharat and NPCDCS are improving healthcare access and reimbursement, enabling broader pacemaker adoption.

Concurrently, technological advancements such as leadless, MRI-compatible, and remotemonitoring pacemakers, along with medical tourism and local device manufacturing, are boosting affordability and uptake across both urban and rural regions.

For Instance,

Europe is accelerating the market by leveraging its well-established public healthcare systems and high reimbursement coverage. many countries fund over 85% of device implantation costs, easing patient access. A rapidly aging population, especially in Germany, France, and the UK, has increased arrhythmia cases and demand for pacemakers. Regulatory standards like the EU Medical Device Regulation ensure safety and quality, while early adoption of MRI-compatible, Bluetooth-enabled, and AI-supported pacemakers drives innovation and uptake across the region.

For Instance,

The UK market is expanding due to an aging population and the associated rise in heart rhythm disorders. The National Health Service (NHS) supports widespread device adoption by funding pacemaker implantation and prioritizing cardiovascular care. Increasing use of advanced technologies such as leadless and dual-chamber pacemakers further fuels growth. New product launches, including FDA-approved systems introduced in the UK, enhance access to modern treatments and reinforce market momentum.

For Instance,

Germany’s market is growing due to its aging population and rising cases of heart rhythm disorders. The country’s advanced healthcare infrastructure, high procedural volume, and strong reimbursement support make pacemaker treatments more accessible. Additionally, collaborations between hospitals and medical device companies, along with early adoption of innovative technologies like leadless and MRI-compatible pacemakers, continue to drive growth and enhance patient outcomes across the country.

In November 2024, Abbott, a global leader in healthcare, introduced the AVEIR VR leadless pacemaker in India to treat patients with slow heart rhythms. Approved by both CDSCO and the USFDA, this next-generation device offers a less invasive alternative to traditional pacemakers by eliminating the need for chest incisions, leads, or generator pockets. Ajay Singh Chauhan, General Manager of Abbott’s Cardiac Rhythm Management division, stated that the AVEIR VR is designed to simplify implantation and retrieval while delivering advanced performance benefits. (Source - E Health)

By Product Type

By Technology

By Application

By Implant Site

By End User

By Sales Channel

By Region

January 2026

January 2026

January 2026

January 2026